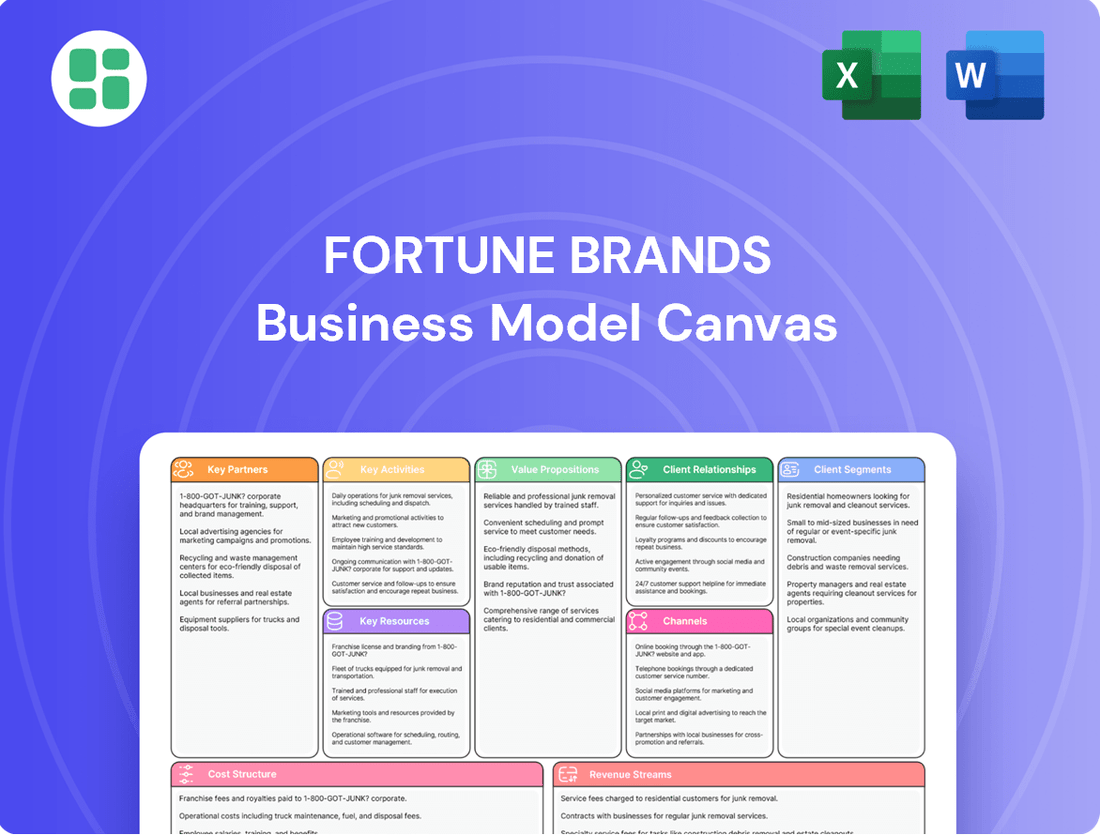

Fortune Brands Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortune Brands Bundle

Unlock the full strategic blueprint behind Fortune Brands's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Fortune Brands Innovations prioritizes strategic alliances with technology firms to bolster its digital product suite. A prime illustration is their investment in Value Hybrid Global, S.L., a move designed to fast-track connected lockout tagout (cLOTO) solutions for the Master Lock brand.

This partnership is pivotal for Fortune Brands' expansion into the growing sector of digital commercial safety solutions. In 2023, the company reported that its Water Innovation segment, which includes smart home technologies, saw a significant contribution to its overall revenue, underscoring the importance of these tech-focused collaborations.

Fortune Brands leverages extensive channel partner networks, including big-box retailers, wholesale distributors, and specialized dealers, to ensure broad product availability. For instance, in 2024, their focus on optimizing these relationships continued to be a cornerstone of their go-to-market strategy, aiming for seamless product access for consumers and trade alike.

These vital partnerships, such as those with major home improvement chains, are critical for reaching a wide customer base for brands like Moen and Therma-Tru. In 2024, Fortune Brands actively engaged with these partners, providing category insights and support to enhance sales performance and customer satisfaction, reflecting a commitment to collaborative growth.

Fortune Brands Innovations has forged strategic alliances with insurance providers, notably benefiting its Moen Flo Smart Water Monitor and Shutoff. These partnerships are crucial for expanding sales channels and generating ongoing revenue by offering homeowners enhanced protection and potential savings on water damage claims.

The robust performance of Moen Flo, which surpassed its 2024 sales projections, underscores the effectiveness of these insurance collaborations. By integrating Flo into insurance offerings, Fortune Brands taps into a market segment that values preventative measures and property protection.

Material and Component Suppliers

Fortune Brands relies on a global network of material and component suppliers to maintain its diverse product lines, including plumbing, outdoor living, and security. These relationships are vital for securing consistent quality and availability of essential inputs. For instance, in 2024, the company continued to navigate supply chain complexities, including managing the impact of potential tariffs on imported materials, which could affect cost structures for products like faucets and cabinetry.

- Supplier Diversification: To mitigate risks, Fortune Brands actively diversifies its supplier base for key components like brass, plastics, and electronic parts.

- Quality Assurance: Strong partnerships ensure suppliers meet stringent quality standards, crucial for the performance and durability of their products.

- Cost Management: Collaborative efforts with suppliers help optimize sourcing strategies and manage input costs, particularly in volatile commodity markets.

New Construction and Builder Relationships

Fortune Brands actively cultivates key partnerships with home builders, developers, and large-scale contractors for its new construction segment. These collaborations are crucial for embedding their product specifications into new residential and commercial projects from the initial stages. For instance, in 2024, the new construction market saw continued demand, with housing starts projected to remain robust, providing a fertile ground for these partnerships to flourish and secure early adoption of Fortune Brands' offerings.

These relationships ensure Fortune Brands' products are integrated into new homes and buildings as they are constructed, establishing a strong market presence. By working closely with these professional customers, they gain insights into upcoming project pipelines and evolving design preferences, allowing for tailored product development and supply chain management. This proactive engagement is key to winning specifications in a competitive market.

The strategic importance of these partnerships is underscored by the sheer volume of new construction. In the first half of 2024, the U.S. saw a significant number of new housing units authorized for construction, highlighting the substantial opportunity for brands that establish strong ties with builders. Fortune Brands leverages these relationships to become a preferred supplier, benefiting from predictable demand and large-volume orders.

- Builder Relationships: Direct engagement with builders secures product specifications early in the design and construction phases.

- Developer Partnerships: Collaborating with developers allows for integration into master-planned communities and large commercial developments.

- Contractor Alliances: Working with large-scale contractors ensures consistent product specification and installation across multiple projects.

- Market Access: These partnerships provide Fortune Brands with direct access to the burgeoning new construction market, driving significant revenue.

Fortune Brands Innovations cultivates key partnerships with technology companies to enhance its smart home offerings. Collaborations with firms like Value Hybrid Global are crucial for advancing connected safety solutions, as seen with the Master Lock brand.

The company also relies heavily on its extensive network of channel partners, including major retailers and distributors, to ensure widespread product availability. In 2024, Fortune Brands continued to focus on optimizing these relationships for seamless market access.

Strategic alliances with insurance providers, particularly for Moen’s Flo Smart Water Monitor, expand sales channels and offer homeowners protection, driving revenue. The strong performance of Flo in 2024 validated these valuable collaborations.

Furthermore, partnerships with home builders and developers are vital for securing product specifications in new construction projects, a segment that showed continued demand in 2024.

| Partnership Type | Example | Strategic Importance | 2024 Focus/Impact |

|---|---|---|---|

| Technology Firms | Value Hybrid Global (cLOTO) | Enhance digital product suite, connected safety | Fast-track cLOTO solutions |

| Channel Partners | Big-box retailers, wholesale distributors | Broad product availability, market reach | Optimize relationships for seamless access |

| Insurance Providers | Moen Flo integration | Expand sales, offer homeowner protection | Surpassed sales projections, tap preventative market |

| Home Builders/Developers | New construction projects | Secure specifications, early adoption | Leverage robust new construction demand |

What is included in the product

A comprehensive, pre-written business model tailored to Fortune Brands' strategy of acquiring and growing leading brands in the home and security markets, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of Fortune Brands, organized into 9 classic BMC blocks with full narrative and insights, ideal for presentations and funding discussions.

Fortune Brands' Business Model Canvas acts as a pain point reliever by offering a high-level, editable view of their core components, allowing for quick identification and strategic adaptation.

This concise, one-page snapshot of Fortune Brands' business model streamlines strategy, making it ideal for brainstorming and fast, digestible executive summaries.

Activities

Fortune Brands' key activities revolve around the meticulous design, engineering, and manufacturing of its diverse home and security product portfolio. This includes everything from stylish plumbing fixtures and functional cabinetry to advanced security systems, ensuring innovation and quality are embedded from concept to completion.

The company's manufacturing prowess is supported by a robust network of facilities, with a significant concentration of operations located across North America. This strategic placement allows for efficient production and distribution of their high-quality goods.

In 2023, Fortune Brands Innovations reported net sales of $2.20 billion, underscoring the scale of their product design and manufacturing operations. This figure reflects the substantial output and market reach of their extensive product lines.

Fortune Brands heavily invests in R&D to fuel product innovation, especially in digital and connected technologies. In 2023, the company continued to emphasize advancements in smart home integration, building on the success of products like the Moen Flo Smart Water Monitor and Master Lock's cLOTO system.

This strategic focus on R&D and innovation is critical for maintaining brand leadership and expanding into new, related markets. The company's commitment to developing cutting-edge solutions ensures its product portfolio remains competitive and appealing to evolving consumer demands for connected living.

Fortune Brands employs a robust sales and marketing strategy, utilizing an omnichannel approach. This includes leveraging e-commerce platforms, dedicated brand websites, physical retail presence, and direct sales teams to connect with a wide array of customers. In 2023, Fortune Brands reported net sales of $2.4 billion, demonstrating the reach of their promotional efforts.

Effective brand management is a cornerstone of Fortune Brands' success. By carefully cultivating and positioning its diverse portfolio of brands, the company aims to maintain a competitive edge in various market segments. This strategic focus on brand equity is vital for driving customer loyalty and market share.

Global Supply Chain and Operations Management

Fortune Brands' key activities revolve around meticulously managing its intricate global supply chain. This involves strategic sourcing of materials and components, alongside the integration of automation to drive efficiency and scale. The company leverages data-driven insights to optimize operations and achieve cost advantages across its diverse product lines.

The company is actively engaged in simplifying its workstreams and reorganizing its operational efforts. This strategic realignment aims to enhance the agility and overall efficiency of its business model, enabling quicker responses to market dynamics. A significant focus is placed on mitigating the financial impacts of tariffs through strategic pricing adjustments and ongoing efficiency improvements.

Key activities include:

- Strategic Sourcing and Procurement: Securing reliable and cost-effective supply of raw materials and components globally.

- Operational Efficiency and Automation: Implementing advanced manufacturing techniques and automation to improve productivity and reduce costs.

- Data Analytics for Optimization: Utilizing data to gain insights into supply chain performance, identify bottlenecks, and drive continuous improvement.

- Tariff Mitigation Strategies: Proactively managing the impact of tariffs through pricing strategies and operational efficiencies to maintain competitive pricing.

Digital Transformation and Data Analytics

Fortune Brands actively pursues digital transformation, channeling resources into technology, data, and advanced analytics. This strategic focus is designed to uncover critical insights from both consumer behavior and internal business operations.

These investments directly fuel the expansion of their e-commerce channels and the development of connected products, simultaneously improving overall operational effectiveness. For instance, by Q1 2024, Fortune Brands reported a significant increase in digital engagement, with e-commerce sales contributing a larger percentage to their overall revenue compared to the previous year.

The company's commitment to digital leadership is evident in its ongoing efforts to enhance customer experience through data-driven personalization and streamline supply chain management. This digital acceleration is a cornerstone of their strategy to maintain a competitive edge in the market.

- Accelerated Digital Transformation: Investing in technology, data, and analytics to gain consumer and business insights.

- E-commerce and Connected Products Growth: Driving sales through digital platforms and innovative connected offerings.

- Operational Efficiency Enhancement: Utilizing data to optimize internal processes and supply chains.

- Digital Leadership Aspiration: Positioning Fortune Brands as a frontrunner in digital innovation within its sector.

Fortune Brands' key activities encompass strategic sourcing and procurement to secure materials, alongside operational efficiency improvements driven by automation. They leverage data analytics for supply chain optimization and implement tariff mitigation strategies to maintain competitive pricing.

The company actively pursues digital transformation, investing in technology and data to gain insights and enhance e-commerce channels. This digital acceleration also aims to improve operational effectiveness and customer experience.

| Key Activity | Description | 2023 Financial Impact/Data Point |

|---|---|---|

| Strategic Sourcing & Procurement | Securing cost-effective global supply of materials. | Net sales of $2.4 billion in 2023. |

| Operational Efficiency & Automation | Improving productivity and reducing costs through advanced manufacturing. | Focus on simplifying workstreams and reorganizing operations. |

| Data Analytics for Optimization | Using data to improve supply chain performance and identify bottlenecks. | Driving continuous improvement across product lines. |

| Tariff Mitigation Strategies | Managing tariff impacts through pricing and efficiency. | Mitigating financial impacts of tariffs. |

| Digital Transformation | Investing in technology, data, and analytics for insights and growth. | Increased digital engagement and e-commerce contribution in Q1 2024. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive analysis of Fortune Brands' operations, customer segments, value propositions, and revenue streams. You will gain full access to this professionally structured and detailed canvas, ready for your immediate use and strategic planning.

Resources

Fortune Brands Innovations’ strong brand portfolio, featuring names like Moen, Master Lock, and Therma-Tru, is a cornerstone of its business model. These brands hold significant consumer trust and recognition, directly contributing to market share across plumbing, outdoor living, and home security sectors. In 2023, the company continued to invest in brand equity, a strategy that underpins its competitive advantage.

Fortune Brands leverages a robust portfolio of intellectual property, including numerous patents, to safeguard its innovative product lines. This IP is particularly strong in emerging areas like smart home technology and connected solutions, giving them a distinct edge.

Key examples of this protected innovation include the Moen Flo Smart Water Monitor, which offers advanced leak detection, and the Master Lock cLOTO systems, enhancing security and convenience. These patents are crucial for maintaining their market position.

The company’s commitment to research and development, evidenced by consistent investment, continually expands this valuable intellectual asset base. This ongoing R&D ensures a pipeline of new, patentable technologies, reinforcing their competitive advantage.

Fortune Brands leverages a robust network of manufacturing plants and distribution centers strategically positioned across the United States, Canada, Mexico, Europe, and China. This extensive infrastructure is crucial for the efficient production, warehousing, and timely delivery of its broad product portfolio, bolstering its global sales and supply chain operations.

In 2024, the company continued its focus on operational efficiency by consolidating its U.S. office footprint. This move aims to foster greater collaboration and streamline internal processes, further enhancing its ability to manage its geographically dispersed manufacturing and distribution assets effectively.

Skilled Workforce and Management Expertise

Fortune Brands Innovations leverages a global team of over 11,000 associates, encompassing vital roles in production, research and development, sales, and corporate functions. This extensive workforce is a cornerstone of their operational capacity and innovation pipeline.

The company's management team possesses deep expertise in critical areas such as category management, driving strategic growth within specific product segments. Their proficiency in digital transformation and supply chain excellence are significant intangible assets, enabling efficiency and competitive advantage.

- Global Workforce: Over 11,000 associates worldwide.

- Key Expertise: Category management, digital transformation, supply chain excellence.

- Focus on People: Prioritization of employee well-being and development.

Financial Capital and Robust Balance Sheet

Fortune Brands' financial capital and robust balance sheet are foundational resources, enabling strategic growth and resilience. The company's strong cash flow generation, as evidenced by its consistent operating cash flow, allows for significant reinvestment in its core businesses and strategic initiatives. For instance, in 2023, Fortune Brands reported substantial operating cash flow, providing the fuel for its capital allocation strategy.

This financial strength is critical for pursuing strategic acquisitions, which have been a key component of the company's growth. Furthermore, it supports share repurchase programs, returning value to shareholders, and underpins ongoing investments in innovation and digital transformation. This financial flexibility is paramount in navigating the often-unpredictable economic landscape, allowing Fortune Brands to adapt and capitalize on opportunities.

- Strong Cash Flow Generation: Consistent positive operating cash flow provides the financial muscle for investment and strategic moves.

- Robust Balance Sheet: A healthy balance sheet offers stability and the capacity to undertake significant financial commitments.

- Strategic Investment Capability: Financial resources support acquisitions, R&D, and digital enhancements, driving future growth.

- Market Adaptability: Financial strength provides the flexibility to respond effectively to changing market dynamics and economic conditions.

Fortune Brands Innovations' key resources are its powerful brand portfolio, extensive intellectual property, and a global operational infrastructure. These elements, supported by a skilled workforce and strong financial capital, enable the company to maintain market leadership and drive innovation across its diverse product categories.

| Resource Category | Key Assets | 2023/2024 Highlights |

| Brand Portfolio | Moen, Master Lock, Therma-Tru | Continued investment in brand equity, strong consumer trust. |

| Intellectual Property | Patents, smart home technology | Protection for innovative product lines like Moen Flo. |

| Operational Infrastructure | Global manufacturing & distribution network | Focus on efficiency, including U.S. office consolidation in 2024. |

| Human Capital | 11,000+ global associates | Expertise in category management, digital transformation. |

| Financial Capital | Strong cash flow, robust balance sheet | Enables reinvestment, acquisitions, and share repurchases. |

Value Propositions

Fortune Brands Innovations is recognized for delivering products that are built to last, a key reason customers choose them. Brands like Moen, known for its faucets, and Master Lock, famous for its security, consistently receive high marks for quality and durability. This commitment translates into fewer replacements and greater customer satisfaction.

In 2023, Fortune Brands Innovations reported net sales of $3.1 billion, with a significant portion attributed to its Water and Hardware segments, where reliability is paramount. This focus on enduring product quality fosters strong brand loyalty and reduces long-term costs for consumers and businesses alike.

Fortune Brands offers innovative and smart home solutions, including the Moen Flo Smart Water Monitor, which helps prevent water damage by detecting leaks and shutting off water automatically. This focus on connected devices enhances home safety and efficiency, positioning the company as a key player in the growing smart home market.

Master Lock’s cLOTO smart lock further exemplifies this value proposition, providing secure, keyless entry and remote access management. These digital products contribute to a more convenient and secure living environment for consumers.

The company's investment in digital technologies and connected products is crucial. In 2024, the global smart home market was projected to reach over $150 billion, highlighting the significant opportunity for companies like Fortune Brands to lead in this evolving sector.

Fortune Brands significantly bolsters safety and security across residential and commercial sectors. Their Master Lock and SentrySafe brands provide robust locks, safes, and commercial safety solutions, safeguarding both people and valuable assets. This commitment is further exemplified by cLOTO solutions, specifically engineered to mitigate severe workplace injuries.

Aesthetic Appeal and Design Variety

Fortune Brands Home & Security excels by offering a broad spectrum of products that marry functional superiority with striking aesthetic appeal and design diversity. This approach directly addresses the varied tastes of consumers involved in home improvement, renovations, and new builds.

Through its premium hardware and chic plumbing collections, the company empowers customers to curate personalized living environments. For instance, in 2024, the company reported that its Moen brand, a key player in stylish plumbing, continued to see strong demand, reflecting the consumer focus on both form and function in their homes.

- Premium Hardware and Stylish Plumbing: Brands like Moen and Master Lock provide both utility and visual enhancement.

- Design Variety: Catering to a wide range of interior design styles, from modern minimalist to classic traditional.

- Personalization: Enabling homeowners to express their individual style through fixture and hardware choices.

- Market Trend Alignment: Responding to the growing consumer desire for aesthetically pleasing and customizable home elements, a trend that saw significant growth in the 2024 housing market.

Commitment to Sustainability and ESG

Fortune Brands demonstrates a strong commitment to sustainability and Environmental, Social, and Governance (ESG) principles. This dedication resonates with a growing segment of consumers actively seeking products that minimize environmental impact and promote social responsibility.

The company’s portfolio includes innovative products designed for resource conservation. For instance, Moen’s Flo smart water monitor helps prevent water waste, while Fiberon’s composite decking often incorporates recycled materials. Therma-Tru’s energy-efficient doors also contribute to reduced household energy consumption, directly appealing to environmentally aware buyers.

Fortune Brands actively communicates its ESG initiatives through its reporting. In 2023, the company reported significant progress in areas such as reducing greenhouse gas emissions and increasing the use of recycled content across its product lines, reinforcing its value proposition to stakeholders who prioritize sustainability.

- Water Conservation: Moen Flo technology aims to reduce water waste in homes.

- Recycled Materials: Fiberon decking utilizes post-consumer and post-industrial recycled content.

- Energy Efficiency: Therma-Tru doors are designed to improve building envelope performance.

- ESG Reporting: Fortune Brands publicly discloses its progress on sustainability goals.

Fortune Brands Innovations offers products designed for longevity and reliability, a core draw for customers. Brands like Moen and Master Lock are recognized for their durable, high-quality items, leading to fewer replacements and greater customer satisfaction. This focus on lasting quality builds strong brand loyalty and ultimately saves consumers money over time.

The company also provides smart home solutions that enhance safety and convenience. Products such as the Moen Flo Smart Water Monitor and the Master Lock cLOTO smart lock integrate technology to offer features like leak detection and keyless entry, positioning Fortune Brands as a leader in the growing smart home market, which was projected to exceed $150 billion globally in 2024.

Furthermore, Fortune Brands prioritizes safety and security with brands like Master Lock and SentrySafe, offering robust solutions for both homes and businesses. Their commitment extends to innovative products like cLOTO, designed to reduce workplace injuries, underscoring a dedication to safeguarding people and assets.

Aesthetic appeal is another key value proposition, with a wide range of products offering both superior function and attractive design. This caters to diverse consumer tastes in home improvement and new builds, allowing customers to personalize their living spaces with stylish fixtures and hardware. In 2024, Moen continued to show strong demand, reflecting the consumer's focus on both form and function.

Sustainability is also a significant aspect of their offering, with products designed for resource conservation and a commitment to ESG principles. Innovations like Moen’s water-saving devices and Fiberon’s use of recycled materials appeal to environmentally conscious consumers. In 2023, the company reported progress in reducing emissions and increasing recycled content, reinforcing its sustainable practices.

| Value Proposition | Key Brands | 2024 Market Insight | Customer Benefit |

|---|---|---|---|

| Product Durability & Reliability | Moen, Master Lock | High customer satisfaction with long-lasting products. | Reduced replacement costs, increased trust. |

| Smart Home Innovation | Moen Flo, Master Lock cLOTO | Smart home market projected over $150 billion in 2024. | Enhanced safety, convenience, and efficiency. |

| Safety & Security Solutions | Master Lock, SentrySafe | Robust locks and safes for residential and commercial use. | Protection of assets and people. |

| Design & Aesthetics | Moen | Strong demand for stylish, functional home elements. | Personalized living spaces, enhanced home value. |

| Sustainability & ESG | Moen, Fiberon | Growing consumer preference for eco-friendly products. | Reduced environmental impact, alignment with social responsibility. |

Customer Relationships

Fortune Brands prioritizes direct customer service, offering dedicated support to address inquiries and resolve issues for consumers across its diverse product lines. This commitment is evident in their investment in specialized customer service teams for each brand, aiming to foster a positive post-purchase experience and build lasting loyalty.

Fortune Brands cultivates customer connections through robust digital channels, featuring detailed brand websites and user-friendly e-commerce platforms. These digital touchpoints provide customers with extensive product information and self-service capabilities, aligning with the growing trend of digital consumerism.

The company's online support infrastructure facilitates direct customer interaction, enabling quick resolutions and personalized assistance. This digital-first approach ensures a cohesive and convenient omnichannel experience, meeting modern consumer expectations for accessibility and responsiveness.

In 2024, Fortune Brands continued to invest in enhancing its digital engagement strategies, aiming to streamline the customer journey from product discovery to post-purchase support. This focus on digital interaction is crucial for maintaining brand loyalty and capturing market share in an increasingly online retail environment.

Fortune Brands cultivates collaborative relationships with its channel partners, aiming for mutual growth and outperforming the market. In 2023, the company reported net sales of $2.2 billion, underscoring the importance of these strong distribution networks.

To bolster these partnerships, Fortune Brands offers valuable category management insights and dedicated support. This assistance helps retailers and distributors refine their product assortments and better cater to end consumers, ensuring a robust presence at the crucial point of sale.

Professional and Builder Relationships

Fortune Brands cultivates deep connections with its professional clientele, primarily builders, contractors, and remodelers. These relationships are foundational, built on trust and consistent delivery of value. For instance, in 2024, the company continued to emphasize its direct sales force, which acts as a crucial touchpoint for these segments, fostering loyalty and understanding of evolving market demands in new construction and renovation projects.

The company provides robust technical support and develops customized solutions designed to seamlessly integrate Fortune Brands products into professional workflows and large-scale builds. This focus ensures that their offerings meet the rigorous specifications and performance expectations of the building industry, reinforcing their position as a reliable partner.

- Direct Sales Engagement: Dedicated sales teams work closely with builders and contractors to understand project needs and offer tailored product selections.

- Technical Expertise: Fortune Brands provides comprehensive technical support to ensure proper installation and optimal performance of their products in professional settings.

- Customized Solutions: The company develops specific product configurations and service packages to align with the unique requirements of large construction projects and remodeling businesses.

- Product Integration: Emphasis is placed on ensuring that Fortune Brands products are easily integrated into existing construction processes and professional applications, streamlining operations for their partners.

Community and ESG-driven Engagement

Fortune Brands' 'ONE Home' strategy actively fosters community engagement, prioritizing inclusivity and robust workplace safety protocols. This dedication to social responsibility not only cultivates stronger brand loyalty but also deeply connects with consumers who increasingly prioritize ethical corporate behavior.

These ESG-focused initiatives are instrumental in shaping a positive public perception and forging more meaningful relationships with stakeholders. For instance, in 2023, Fortune Brands reported a 9% reduction in recordable workplace incidents, underscoring their commitment to safety.

- Community Impact: Fortune Brands actively supports local communities through various outreach programs, aiming to create positive social change.

- ESG Integration: The 'ONE Home' approach embeds Environmental, Social, and Governance principles across all operations, driving sustainable practices.

- Brand Resonance: A strong emphasis on corporate citizenship enhances brand perception and attracts customers who align with these values.

- Employee Well-being: Investments in workplace safety and inclusivity contribute to a positive employee experience, fostering a culture of care and commitment.

Fortune Brands engages customers through direct support and digital channels, offering detailed product information and self-service options. In 2024, the company continued to enhance its digital engagement, focusing on a seamless customer journey. This digital-first approach aims to build loyalty and meet consumer expectations for accessibility.

Channels

Fortune Brands leverages major retail home improvement chains as a crucial distribution channel, ensuring widespread consumer access to its well-known brands such as Moen faucets, Master Lock security products, and Fiberon decking. These brick-and-mortar stores are vital for customers to physically interact with and purchase items for their home renovation and repair needs, representing a primary avenue for direct consumer sales.

Fortune Brands leverages a robust network of wholesale distributors and professional dealers to effectively reach contractors, builders, and a wide array of smaller independent retailers. This strategy is vital for driving substantial sales volumes and ensuring specialized product lines are readily accessible for professional projects and commercial endeavors.

These distribution partners are instrumental in broadening Fortune Brands' market share, providing crucial access to segments that might be challenging to penetrate directly. For instance, in 2023, the plumbing division, a significant user of this channel, reported net sales of $1.8 billion, underscoring the importance of these relationships in reaching the professional market.

Fortune Brands leverages both major e-commerce marketplaces and its own brand websites as critical digital channels. These platforms facilitate direct-to-consumer sales, enabling customers to research products online and purchase them conveniently, a key driver for connected product adoption.

The company is actively investing in and accelerating its digital strategy to enhance its e-commerce capabilities. This focus is designed to directly fuel continued growth in online sales and strengthen customer relationships through digital touchpoints.

Direct Sales to Builders and Commercial Accounts

Fortune Brands leverages dedicated direct sales teams to cultivate relationships with major builders, developers, and commercial entities. This direct approach is crucial for securing large volume orders for new construction projects and offering specialized solutions, like Master Lock's advanced connected lockout tagout systems for industrial safety.

By bypassing traditional retail channels, Fortune Brands ensures a more efficient and controlled sales process for these significant accounts. This allows for greater flexibility in pricing, product customization, and service delivery, directly addressing the unique needs of large-scale commercial operations. For instance, in 2023, Fortune Brands reported that its Water Innovation segment, which includes products often sold to builders, saw significant growth, underscoring the importance of these direct relationships.

- Direct Engagement: Sales teams directly interact with large builders and commercial clients.

- Project Focus: Facilitates procurement for new construction and large commercial projects.

- Tailored Solutions: Offers customized products, such as Master Lock's connected safety systems.

- Channel Efficiency: Bypasses retail intermediaries for streamlined sales.

Showrooms and Specialty Dealers

For its premium and luxury product lines, like those within the House of Rohl brand or unique design-focused plumbing fixtures, Fortune Brands strategically utilizes showrooms and specialty dealers. These channels are crucial for delivering a highly curated and personalized customer experience. This approach allows consumers and design professionals to intimately explore products, receive expert guidance, and visualize how these high-end items will integrate into their projects, directly supporting sales in the luxury segment.

These specialized retail environments are vital for showcasing the craftsmanship and design intricacies of Fortune Brands' higher-tier offerings. For instance, in 2024, brands like Moen and Kohler, both significant players in the premium home goods market, continued to invest in their showroom presence. These spaces facilitate a hands-on interaction with products that often feature advanced technology or unique materials, which is difficult to convey through online channels alone.

- Showrooms offer a tactile and visual experience essential for luxury goods.

- Specialty dealers provide expert advice, enhancing the value proposition for premium products.

- These channels are critical for demonstrating the quality and design nuances of brands like House of Rohl.

- Investment in these curated environments supports higher-margin sales and brand perception.

Fortune Brands utilizes a multi-faceted channel strategy, encompassing major home improvement retailers for broad consumer access and wholesale distributors for professional markets. E-commerce platforms and proprietary websites drive direct-to-consumer sales, while dedicated sales teams secure large builder and commercial accounts. Specialty showrooms and dealers cater to premium and luxury product lines, offering a curated customer experience.

| Channel Type | Key Segments Served | Examples of Brands/Products | Strategic Importance | 2023 Data/Insight |

|---|---|---|---|---|

| Major Retailers | Consumers, DIYers | Moen faucets, Master Lock | Broad reach, direct sales | Plumbing division net sales: $1.8 billion |

| Wholesale Distributors | Contractors, Builders, Independent Retailers | All product categories | Volume sales, professional access | Supports sales in professional market |

| E-commerce (Marketplaces & Own Sites) | Consumers | All product categories | Digital engagement, convenience | Key driver for connected product adoption |

| Direct Sales Teams | Large Builders, Developers, Commercial Entities | Master Lock connected safety systems | Large volume orders, custom solutions | Water Innovation segment growth |

| Showrooms & Specialty Dealers | Affluent Consumers, Design Professionals | House of Rohl, premium Moen fixtures | Curated experience, luxury sales | Continued investment in showroom presence |

Customer Segments

Residential homeowners, whether tackling projects themselves (DIY) or hiring professionals (DIFM), represent a core customer base for Fortune Brands. In 2024, the U.S. housing market saw continued activity in remodeling and new construction, with homeowners prioritizing upgrades that enhance comfort and value. These consumers are looking for durable, aesthetically pleasing, and functional home products, from plumbing fixtures to cabinetry.

Professional builders, remodelers, and general contractors represent a cornerstone customer segment for Fortune Brands. These are the individuals and companies actively engaged in both residential and commercial construction projects, from new home developments to large-scale renovations. They are inherently high-volume purchasers, consistently seeking dependable and often specialized building materials and components.

For this segment, product performance and consistent availability are paramount. They rely on suppliers to deliver materials that meet stringent building codes and project timelines. In 2023, the U.S. residential construction market saw significant activity, with over 1.4 million housing starts, underscoring the substantial demand from this professional segment. Fortune Brands' ability to provide reliable, high-quality products directly impacts their project success and profitability.

Commercial and industrial clients are businesses and facilities that need dependable security and safety products, especially for critical procedures like lockout tagout. Master Lock's connected solutions are built to handle the tough requirements of commercial safety and regulatory compliance.

These customers are focused on strong security measures and operational efficiency. For instance, in 2024, the global industrial safety market was valued at approximately $5.8 billion, with a projected compound annual growth rate (CAGR) of over 6% through 2030, highlighting the significant demand for these types of solutions.

Wholesale and Retail Partners

Wholesale and retail partners are a crucial customer segment for Fortune Brands, acting as intermediaries who purchase products for resale to the ultimate consumers. This segment includes a wide array of businesses, from major national retailers and regional chains to smaller, independent hardware stores and specialized distributors.

Fortune Brands' strategy relies heavily on cultivating robust relationships with these partners to guarantee widespread availability and accessibility of its product lines. For instance, in 2024, the company's focus on channel partnerships was evident in its efforts to support these entities through marketing initiatives and product training, aiming to boost sell-through rates.

These partners are not just sales channels but direct customers whose purchasing decisions significantly impact Fortune Brands' market penetration and overall sales volume. Their commitment to stocking and promoting Fortune Brands' products directly translates into broader consumer reach and brand visibility.

- Diverse Retail Footprint: Fortune Brands serves a broad spectrum of retail outlets, from big-box home improvement stores to independent hardware shops, ensuring comprehensive market coverage.

- Distribution Network Strength: The company leverages its relationships with distributors to reach a vast network of smaller retailers and contractors, amplifying product accessibility.

- Sales Performance in 2024: Fortune Brands reported that its wholesale and retail channels remained a primary driver of revenue, with specific segments showing mid-single-digit growth in the first half of 2024, bolstered by new product introductions and strong seasonal demand.

- Partner Support Programs: Investments in co-marketing funds and sales enablement tools for these partners are ongoing, aimed at enhancing their ability to sell Fortune Brands' products effectively.

International Markets

Fortune Brands actively engages with customers across key international markets, including Canada, Mexico, and various European nations, alongside a significant presence in China. This global reach diversifies its customer base, acknowledging distinct regional demands and consumer preferences.

The company strategically tailors its product portfolios and distribution networks to effectively serve these diverse international markets. For example, in 2024, Fortune Brands reported that its international segments contributed approximately 15% to its total net sales, highlighting the growing importance of these regions.

- Canada: A mature market with consistent demand for core product categories.

- Mexico: A growing market with increasing opportunities in new construction and renovation.

- Europe: Diverse demands across countries, with a focus on premium and sustainable offerings.

- China: A high-growth market with evolving consumer tastes and a strong emphasis on brand recognition.

Fortune Brands caters to a wide array of customers, from individual homeowners undertaking DIY projects to professional builders and contractors involved in large-scale construction. This dual focus ensures broad market penetration across both renovation and new build sectors. The company also serves commercial and industrial clients who prioritize security and safety solutions, particularly for operational compliance like lockout tagout procedures.

Wholesale and retail partners are indispensable, acting as key intermediaries that distribute Fortune Brands' products to end-users. These partners range from major retailers to smaller independent stores, and their engagement is vital for market reach. International customers in markets like Canada, Mexico, Europe, and China also represent a significant and growing segment, with tailored product offerings to meet diverse regional needs.

| Customer Segment | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| Residential Homeowners (DIY & DIFM) | Prioritize aesthetics, durability, and functionality in home upgrades. | U.S. housing market activity sustained remodeling and new construction efforts. |

| Professional Builders & Contractors | Require reliable, high-quality materials for timely project completion. | U.S. residential construction starts exceeded 1.4 million in 2023. |

| Commercial & Industrial Clients | Demand robust security and safety solutions for compliance and efficiency. | Global industrial safety market valued around $5.8 billion in 2024. |

| Wholesale & Retail Partners | Intermediaries crucial for product availability and market access. | Wholesale/retail channels drove revenue, with mid-single-digit growth in H1 2024. |

| International Customers | Exhibit diverse demands across Canada, Mexico, Europe, and China. | International segments contributed ~15% of total net sales in 2024. |

Cost Structure

Manufacturing and production costs represent a substantial segment of Fortune Brands' expenses. These direct costs encompass the price of raw materials, wages for production labor, and the general overhead required to run their global manufacturing operations. For instance, in 2023, the company reported cost of goods sold at approximately $2.7 billion, highlighting the scale of these expenditures.

Continuous efforts are made to streamline these manufacturing expenses. This involves implementing efficiency gains within production processes, investing in automation to reduce labor intensity, and engaging in strategic sourcing of materials to secure better pricing and reliable supply chains. These optimizations are crucial for maintaining competitive margins in the consumer products market.

Fortune Brands dedicates significant resources to research and development, a key component of its innovation strategy. These investments fuel the creation of new products and the enhancement of existing ones, particularly within the smart home technology sector.

In 2023, Fortune Brands reported R&D expenses of $245 million, reflecting a strong commitment to technological advancement and product differentiation. This expenditure is vital for staying ahead in a competitive market and meeting evolving consumer demands for smart and connected home solutions.

Fortune Brands invests significantly in sales, marketing, and distribution to reach its broad customer base. These expenses encompass advertising, promotional activities, and the upkeep of their sales force. In 2023, the company reported selling, general, and administrative expenses of $1.3 billion, a portion of which directly relates to these crucial functions.

Managing a diverse network of distribution channels, from retail partners to direct-to-consumer efforts, also adds to the cost structure. This includes the logistics and transportation expenses necessary to move products efficiently from manufacturing facilities to various points of sale and ultimately to the end customer.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Fortune Brands encompass operating costs tied to corporate functions, administrative overhead, IT infrastructure, and human resources. These are the essential costs of running the business behind the scenes, ensuring everything from payroll to IT systems functions smoothly.

Fortune Brands has actively pursued business simplification and office consolidation initiatives. These strategic moves are designed to streamline administrative processes, reduce inefficiencies, and ultimately lower overall G&A costs. For instance, in 2023, the company reported G&A expenses of $323 million, a decrease from $337 million in 2022, reflecting these ongoing efforts.

- Corporate Functions: Costs associated with executive management, legal, finance, and accounting departments.

- Administrative Overhead: Expenses related to office space, utilities, and general administrative support staff.

- IT Infrastructure: Investments in technology systems, software, and support necessary for business operations.

- Human Resources: Costs for employee recruitment, training, benefits administration, and HR management.

Acquisition and Restructuring Costs

Fortune Brands has strategically invested in its growth through acquisitions, which naturally involves associated costs. These expenses are part of their disciplined approach to expanding their brand portfolio. For instance, in 2023, the company reported acquisition-related costs, though specific figures for this category are often embedded within broader operating expenses or cash flow statements.

The company also incurs restructuring charges as it optimizes its operational footprint. These charges can stem from various initiatives, such as consolidating facilities or streamlining business processes to enhance efficiency and adapt to evolving market dynamics. In 2023, Fortune Brands reported $24 million in restructuring charges, primarily related to workforce reductions and facility consolidations.

- Acquisition Costs: Expenses tied to the integration of newly acquired businesses and brands into Fortune Brands' existing structure.

- Restructuring Charges: Costs incurred from operational optimizations like plant closures and office consolidations, totaling $24 million in 2023.

- Strategic Investments: These costs reflect Fortune Brands' commitment to disciplined M&A activity and operational efficiency improvements.

Fortune Brands' cost structure is heavily influenced by its manufacturing and R&D expenditures. In 2023, Cost of Goods Sold was approximately $2.7 billion, while R&D investments reached $245 million, underscoring the importance of product innovation and efficient production. Selling, General, and Administrative (SG&A) expenses totaled $1.3 billion in the same year, reflecting significant outlays in marketing, sales, and corporate operations.

The company also manages costs associated with strategic initiatives like acquisitions and restructuring. In 2023, restructuring charges amounted to $24 million, indicating efforts to optimize operations. These diverse cost categories are critical for maintaining competitiveness and driving future growth.

| Cost Category | 2023 Expense (Approx.) | Key Drivers |

|---|---|---|

| Cost of Goods Sold | $2.7 billion | Raw materials, labor, manufacturing overhead |

| Research & Development | $245 million | New product development, smart home technology |

| Selling, General & Administrative | $1.3 billion | Marketing, sales, distribution, corporate functions |

| Restructuring Charges | $24 million | Facility consolidation, workforce optimization |

Revenue Streams

Water Innovations Product Sales represent Fortune Brands' largest revenue stream, driven by the sale of plumbing fixtures. This includes a wide array of products like faucets, showers, kitchen sinks, and waste disposals, offered under well-recognized brands such as Moen, House of Rohl, Aqualisa, and SpringWell.

In 2023, this segment was a significant contributor to the company's financial performance, reflecting its dominant position in the market. For instance, the Plumbing segment, which encompasses these product sales, reported net sales of $2.1 billion for the full year 2023, showcasing its substantial impact on overall revenue.

Fortune Brands generates revenue from its Outdoors segment through the sale of a variety of products designed for outdoor living spaces. This includes popular brands like Therma-Tru entry doors and Fiberon composite decking, alongside railing, cladding, and urethane millwork.

This revenue stream serves both the new residential construction market and the home remodeling sector. For instance, in 2023, Fortune Brands reported that its Outdoors segment saw a notable increase in net sales, reflecting strong demand in these areas, even as it acknowledged sensitivity to economic cycles that can impact discretionary spending on home improvements.

Fortune Brands generates significant revenue from selling a wide range of security products. This includes physical items like locks and safes, as well as electronic security solutions and devices. For instance, in 2023, Master Lock and SentrySafe, key brands within this segment, continued to be strong performers, contributing to the company's overall sales growth.

The company's security product sales cater to a broad customer base, serving both individual consumers and commercial enterprises. Brands like Yale residential and August are particularly important for capturing the growing demand for smart home security and access control systems, reflecting a key trend in the market.

Digital and Connected Product Sales

Fortune Brands is increasingly seeing revenue from digital and connected products. This segment includes innovative items like the Moen Flo Smart Water Monitor and Shutoff, and Master Lock's connected lockout tagout (cLOTO) systems. These offerings are key to the company's strategy for future growth.

The company is positioning these connected products to potentially generate recurring revenue. This could come from associated services, software subscriptions, or strategic partnerships built around these smart devices. For instance, the Moen Flo system offers leak detection and automatic water shutoff, a feature consumers value for home protection.

- Digital and Connected Product Sales: Growing revenue from smart home devices and industrial connected solutions.

- Key Products: Moen Flo Smart Water Monitor and Shutoff, Master Lock's connected lockout tagout (cLOTO) solutions.

- Growth Strategy: These products are designed to be future growth drivers for Fortune Brands.

- Recurring Revenue Potential: Opportunities exist for ongoing revenue through associated services and partnerships.

International Sales

Fortune Brands generates revenue from international sales, with significant contributions from markets like Canada, Mexico, Europe, and China. While the United States is its primary market, these international operations are crucial for diversifying revenue streams and capturing global growth opportunities.

In 2023, Fortune Brands reported that its Water segment saw a notable increase in its international business, particularly in Europe, contributing to overall company performance. This international presence helps mitigate risks associated with over-reliance on a single market and allows the company to tap into varying economic cycles and consumer demands.

- Geographic Diversification: Revenue from Canada, Mexico, Europe, and China provides a buffer against domestic market fluctuations.

- Growth Opportunities: International markets offer avenues for expansion and increased market share, especially in developing economies.

- Market Challenges: Certain regions, such as China, have experienced recent market downturns, impacting sales performance in those specific areas.

- Segment Performance: The Water segment, for instance, demonstrated growth in its international operations in 2023, highlighting the potential of these markets.

Fortune Brands' revenue streams are primarily driven by product sales across its key segments: Water Innovations, Outdoors, and Security. The company also capitalizes on opportunities in digital and connected products, alongside its international market presence.

In 2023, the Water segment, dominated by plumbing fixtures, achieved net sales of $2.1 billion. The Outdoors segment, featuring brands like Therma-Tru and Fiberon, also contributed significantly to revenue, serving both new construction and remodeling markets.

The Security segment, including brands such as Master Lock and SentrySafe, generated substantial revenue from physical and electronic security solutions. Emerging digital and connected products, like the Moen Flo system, represent a strategic focus for future recurring revenue streams.

| Segment | 2023 Net Sales (USD Billions) | Key Brands |

|---|---|---|

| Water Innovations | 2.1 | Moen, House of Rohl, Aqualisa |

| Outdoors | N/A (Included in reporting) | Therma-Tru, Fiberon |

| Security | N/A (Included in reporting) | Master Lock, SentrySafe, Yale, August |

| Digital/Connected | N/A (Emerging) | Moen Flo, Master Lock cLOTO |

Business Model Canvas Data Sources

The Fortune Brands Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and competitor analysis. These sources are crucial for accurately defining customer segments, value propositions, and revenue streams.