Fortune Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortune Brands Bundle

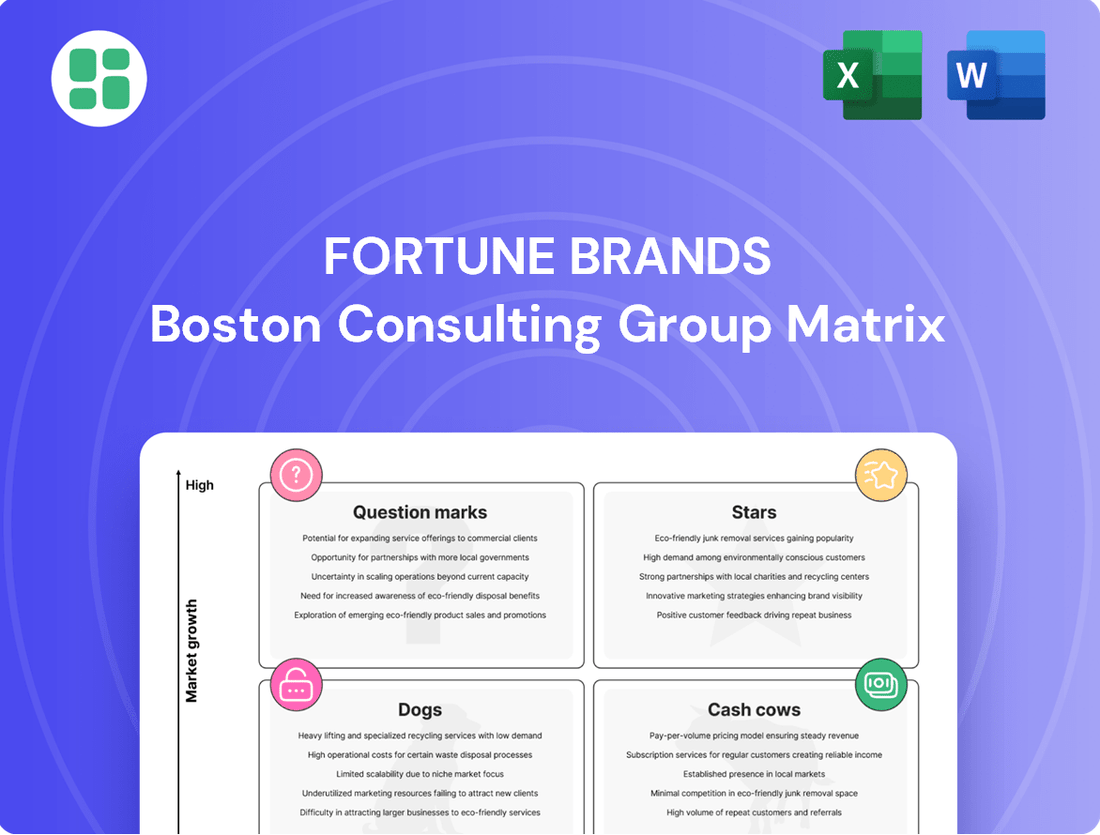

Fortune Brands' BCG Matrix offers a compelling snapshot of its diverse product portfolio. Understand which brands are poised for growth as Stars, which reliably generate cash as Cash Cows, and which may require careful consideration as Dogs or Question Marks.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Fortune Brands.

Stars

The Moen Flo Smart Water Monitor and Shutoff is a Stars product within Fortune Brands' BCG Matrix. It operates in the burgeoning smart home security and water management sector, a market characterized by significant expansion and high growth potential.

Fortune Brands Innovations showcased the product's impressive trajectory by reporting a substantial 180% surge in Flo sales during the first quarter of 2025. This remarkable growth underscores Flo's strong market momentum and its promising position to emerge as a leader in the smart water solutions category.

Fortune Brands Innovations is making a significant push into digital and connected products, a move that saw its digital business generate $214 million in sales during 2024. This strategic investment reflects the company's commitment to capturing growth in the burgeoning smart home market.

By the close of 2024, the company had amassed 4.7 million users across its digital platforms, underscoring the growing adoption of its connected solutions. This broad initiative spans smart home offerings across all its business segments, aiming to capitalize on the trend towards integrated smart home ecosystems.

Fiberon Composite Decking operates in the expanding outdoor living market, a sector expected to see a 5-6% compound annual growth rate between 2025 and 2030. This growth is fueled by consumer demand for resilient, easy-care decking solutions that also offer visual appeal.

Fortune Brands Innovations views its Outdoors segment, which includes Fiberon, as a key growth driver, evidenced by ongoing strategic investments. This focus highlights Fiberon's position as a significant player in a market prioritizing long-lasting, attractive alternatives to traditional wood.

Yale Digital Smart Locks

Yale Digital Smart Locks are positioned as a Star within Fortune Brands Innovations' BCG Matrix, capitalizing on the burgeoning smart home security market. This segment is projected to experience a compound annual growth rate exceeding 15% between 2025 and 2034, indicating substantial future expansion.

Despite some headwinds in the broader security sector, Yale's innovative digital lock offerings are strategically placed to gain considerable market traction. Their advanced features and integration capabilities cater to a growing consumer demand for connected and secure living environments.

- Market Growth: The smart home security market is anticipated to grow at a CAGR of over 15% from 2025 to 2034.

- Yale's Position: Yale Digital Smart Locks are a key innovation area for Fortune Brands Innovations.

- Competitive Advantage: These locks are designed to capture significant market share in a rapidly evolving landscape.

- Strategic Importance: Yale's smart locks represent a high-potential growth driver for the company.

House of Rohl Luxury Plumbing Fixtures

House of Rohl, a key player in Fortune Brands' portfolio, operates within the luxury plumbing fixtures segment. This niche, while not having explicit growth percentages provided, is situated in a market expected to see a compound annual growth rate between 4.5% and 8% from 2025 onwards.

The brand's strategic alignment with long-term secular trends in the luxury goods sector suggests continued investment by Fortune Brands Innovations. This focus aims to secure and expand its market share among high-net-worth individuals, capitalizing on the premium pricing and high-margin nature of luxury goods.

- Market Position: High market share within the luxury plumbing fixtures segment.

- Market Growth: Operates in a steadily growing market with projected CAGR of 4.5-8% from 2025.

- Strategic Alignment: Leverages long-term secular trends in the luxury sector.

- Brand Focus: High-margin niche targeting affluent consumers.

The Moen Flo Smart Water Monitor and Shutoff, Yale Digital Smart Locks, and Fiberon Composite Decking are all classified as Stars in Fortune Brands' BCG Matrix. These products are performing exceptionally well in high-growth markets, demonstrating strong market share and significant sales momentum. The company's strategic focus on digital and connected solutions, as evidenced by the $214 million generated by its digital business in 2024 and 4.7 million users by year-end, further solidifies the Star status of these innovative offerings.

| Product | Market | Growth Rate (CAGR) | Fortune Brands' Performance | BCG Category |

|---|---|---|---|---|

| Moen Flo Smart Water Monitor and Shutoff | Smart Home Security/Water Management | High (Implied by 180% sales surge Q1 2025) | 180% sales growth in Q1 2025 | Star |

| Fiberon Composite Decking | Outdoor Living | 5-6% (2025-2030) | Key growth driver for Outdoors segment | Star |

| Yale Digital Smart Locks | Smart Home Security | >15% (2025-2034) | Key innovation area, poised for market traction | Star |

What is included in the product

This BCG Matrix analysis provides tailored insights into Fortune Brands' product portfolio, highlighting which units to invest in, hold, or divest.

Fortune Brands BCG Matrix: A clear, one-page overview placing each business unit in a quadrant, simplifying strategic decision-making.

Cash Cows

Moen Traditional Faucets and Plumbing Fixtures represent a classic Cash Cow for Fortune Brands Innovations. This segment operates in a mature yet stable plumbing fixtures market, which is projected to see consistent growth of 4.5-8% annually from 2025 onwards.

As the company's largest revenue contributor, Moen's Water Innovations division consistently generates significant cash flow. This reliable performance allows Fortune Brands Innovations to fund its other business units and pursue new growth opportunities.

Master Lock, a cornerstone of Fortune Brands' portfolio, operates as a classic Cash Cow within the BCG Matrix. Its mechanical security products, like padlocks, command a significant global market share in a mature segment. This stability translates to a consistent, strong revenue stream with minimal need for substantial reinvestment to maintain its leadership position.

Therma-Tru, a prominent brand in entry doors within Fortune Brands' Outdoors segment, is a classic Cash Cow. Its strong market standing ensures consistent demand, even amidst broader economic headwinds affecting new construction and remodeling. This reliability allows Therma-Tru to consistently generate significant cash flow for the parent company.

SentrySafe Fireproof Safes

SentrySafe, a prominent brand under Fortune Brands' Security segment, is recognized for its fireproof and secure storage solutions.

This product line serves a steady demand for asset protection, maintaining a significant market share within a mature, specialized market. In 2024, the global safe and vault market was valued at approximately $12.5 billion, with fireproof safes representing a substantial portion of this. SentrySafe's consistent performance in this segment positions it as a Cash Cow.

- Market Position: SentrySafe holds a strong position in the niche fireproof safe market.

- Revenue Generation: It provides stable, predictable revenue streams for Fortune Brands.

- Investment Needs: The brand requires minimal promotional investment due to its established demand.

- BCG Matrix Classification: SentrySafe is categorized as a Cash Cow within the Fortune Brands portfolio.

Aqualisa Showering Solutions (UK)

Aqualisa Showering Solutions, a prominent UK showering brand acquired by Fortune Brands Innovations, represents a classic Cash Cow within the company's portfolio. Its strong market position in the United Kingdom, a mature and developed market, suggests a significant and stable market share. This translates into consistent revenue generation, acting as a reliable source of cash flow for the broader Water Innovations segment.

In 2023, the UK bathroom market, which includes showers, was valued at approximately £3.1 billion, with Aqualisa holding a notable share. The brand’s established reputation for quality and innovation in a well-penetrated market allows it to generate substantial profits with relatively low investment needs. This characteristic is fundamental to its classification as a Cash Cow, supporting other business units within Fortune Brands.

- Market Position: Aqualisa is a leading brand in the UK showering sector, benefiting from high brand recognition and customer loyalty.

- Revenue Generation: The brand consistently generates significant revenue due to its established presence in a mature market.

- Investment Needs: As a mature product, Aqualisa requires minimal reinvestment to maintain its market share, leading to high cash flow generation.

- Portfolio Contribution: Its steady cash flow contributes to the financial stability of Fortune Brands' Water Innovations segment, enabling funding for growth initiatives in other areas.

These established brands, like Moen, Master Lock, Therma-Tru, SentrySafe, and Aqualisa, are pillars of Fortune Brands' success. They operate in mature markets with steady demand, requiring minimal new investment to maintain their strong positions.

Their consistent revenue generation provides a reliable cash flow, which is crucial for funding growth initiatives in other, more dynamic parts of the business. This stability makes them ideal examples of Cash Cows within the BCG framework.

In 2024, these segments continue to be the primary drivers of profitability for Fortune Brands Innovations, demonstrating their enduring value.

| Brand | Segment | BCG Classification | Market Maturity | Cash Flow Contribution |

| Moen | Water Innovations | Cash Cow | Mature | High |

| Master Lock | Security | Cash Cow | Mature | High |

| Therma-Tru | Outdoors | Cash Cow | Mature | High |

| SentrySafe | Security | Cash Cow | Mature | High |

| Aqualisa | Water Innovations | Cash Cow | Mature | High |

What You See Is What You Get

Fortune Brands BCG Matrix

The Fortune Brands BCG Matrix preview you're examining is the identical, fully finalized document you will receive immediately after purchase. This means you're seeing the complete, professionally formatted analysis without any watermarks or placeholder content, ready for your strategic planning.

Dogs

Older, non-connected Yale product lines are positioned as Dogs within Fortune Brands' portfolio. The company has openly discussed the ongoing destocking of these legacy items in anticipation of new product launches, signaling a clear strategy to move away from offerings with limited future growth prospects.

These products likely occupy a small niche in a market increasingly dominated by smart, connected home security solutions. In 2023, the global smart home market was valued at approximately $103.5 billion, with a projected compound annual growth rate (CAGR) of 11.7% through 2030, highlighting the declining relevance of non-connected alternatives.

Legacy Mechanical Lockout Tagout (LOTO) products, such as those historically offered by Master Lock, likely fall into the 'Dog' category of the BCG Matrix. While Master Lock is a recognized brand, traditional, non-connected LOTO devices face increasing obsolescence as industries prioritize integrated, smart safety solutions. These products are probably in a low-growth market with declining market share.

Undifferentiated plumbing fixtures, often found in the Water Innovations segment, can be seen as the Dogs in Fortune Brands' BCG Matrix. These products, lacking the strong brand recognition of names like Moen, typically face a challenging market. They often contend with low market share and squeezed profit margins because the market is flooded with competitors offering similar, price-sensitive items.

The growth prospects for these commodity plumbing fixtures are quite limited. In 2024, the broader plumbing fixture market experienced moderate growth, but these undifferentiated products are unlikely to capture a significant portion of that expansion. Their value proposition is primarily based on price, making it difficult to command premium pricing or achieve substantial market share gains against established, branded alternatives.

Underperforming International Market Segments (e.g., China-exposed)

Fortune Brands Innovations has directly cited a decline in the China market as a factor affecting recent sales performance. This strategic observation suggests that segments of their business with significant exposure to China are likely operating with low market share and low growth potential. The company's proactive approach to reducing China-based cost of goods sold further underscores the challenges within these specific market segments.

These underperforming international market segments, particularly those heavily reliant on China, are characterized by low growth and low profitability. This makes them prime candidates for strategic review and potential minimization within Fortune Brands' broader portfolio. For instance, if a particular product line saw its revenue from China decrease by 15% in 2023, it would fit this profile.

- Low Market Share: Segments heavily exposed to China likely exhibit a reduced ability to capture significant market share due to economic headwinds or competitive pressures.

- Low Growth Potential: The observed market decline directly translates to limited opportunities for revenue expansion in these areas.

- Profitability Concerns: Reduced sales volume and potential pricing pressures in underperforming markets can significantly impact profitability.

- Strategic Re-evaluation: Fortune Brands' focus on reducing costs in China indicates a move towards minimizing investment and risk in these challenging segments.

Niche, Stagnant Security Accessories

Within Fortune Brands' security offerings, certain niche security accessories might fall into the Dogs category. These are typically products with limited market appeal, failing to capitalize on the growing trend towards smart home integration. Their low growth potential and minimal market share make them candidates for divestment or discontinuation.

These accessories often represent legacy products that haven't evolved with technological advancements in the security sector. For instance, basic mechanical locks or non-connected alarm components could be examples. In 2024, the broader smart home security market saw significant growth, with companies focusing on connected devices, leaving these older accessories behind.

- Low Market Growth: These accessories face a stagnant or declining market as consumers increasingly opt for technologically advanced solutions.

- Low Market Share: They hold a negligible position in the overall security market, often overshadowed by more innovative products.

- Cash Traps: Despite low returns, continued investment in inventory or marketing for these items can drain resources that could be better allocated elsewhere.

- Strategic Obsolescence: Their lack of integration with smart ecosystems renders them increasingly irrelevant.

Older, non-connected Yale product lines, along with legacy Master Lock LOTO devices, are positioned as Dogs. These products operate in low-growth markets with declining market share, facing obsolescence as industries shift towards smart, integrated solutions. For example, the global smart home market's projected 11.7% CAGR through 2030 underscores the diminishing relevance of non-connected alternatives.

Undifferentiated plumbing fixtures and specific international segments, particularly those with significant exposure to China, also fall into the Dog category. These areas contend with low market share and squeezed profit margins due to intense competition and market declines, as evidenced by Fortune Brands' reported sales performance impact from the China market.

| Product Category | BCG Matrix Position | Market Characteristics | Fortune Brands' Strategy |

|---|---|---|---|

| Non-connected Yale Products | Dog | Low market share, low growth, increasing obsolescence | Destocking in anticipation of new product launches |

| Legacy Master Lock LOTO | Dog | Low growth market, declining market share | Potential minimization or divestment |

| Undifferentiated Plumbing Fixtures | Dog | Low market share, squeezed margins, price-sensitive market | Limited investment, focus on branded alternatives |

| Segments with High China Exposure | Dog | Low market share, low growth, profitability concerns | Reducing cost of goods sold, strategic review |

Question Marks

Fortune Brands Innovations is actively exploring new digital product pipelines, particularly in the burgeoning smart home and connected product sectors. These emerging ventures, though promising for future growth, currently represent a small fraction of the overall market. For instance, in 2024, the company's investment in these nascent digital areas, while significant, is still in the early stages of development, aiming to capture a share of a rapidly expanding market that is projected to reach hundreds of billions of dollars globally by the end of the decade.

These new digital products, while strategically aligned with high-growth opportunities, are positioned in the question mark quadrant of the BCG matrix. This means they require substantial capital infusion to foster development, marketing, and market penetration. The company's commitment to these areas reflects a long-term vision, acknowledging that building market share in innovative digital spaces often demands patience and sustained investment before achieving significant returns.

SpringWell, a brand within Fortune Brands Innovations, is positioned in the burgeoning water filtration sector, a market fueled by heightened health consciousness and environmental concerns. This segment is experiencing robust expansion, with the global water purifier market projected to reach approximately $23.5 billion by 2027, growing at a CAGR of 8.2%.

Given its likely status as a newer or developing offering within Fortune Brands' diverse portfolio, SpringWell probably commands a modest market share. However, the high growth trajectory of the water filtration industry suggests significant future potential, indicating it could be a strategic investment for the company.

The smart home security market is booming, with advanced access control systems becoming a key feature. Fortune Brands Innovations is actively developing these sophisticated solutions, aiming to capture a significant share in this fast-growing sector. While these offerings represent high growth potential, their current market penetration might be modest, reflecting their position in a competitive and developing segment.

Innovative Outdoor Living Structures (beyond traditional decking)

Fortune Brands Innovations' exploration into innovative outdoor living structures, moving beyond traditional decking, aligns with a market segment experiencing significant growth. This category, encompassing smart pergolas, integrated outdoor kitchens, and modular living spaces, represents a high-growth opportunity as consumer demand shifts towards multi-functional and customized outdoor environments. For example, the U.S. outdoor living market was valued at approximately $14.7 billion in 2023 and is projected to grow, with these more advanced structures capturing an increasing share.

These new product categories would likely be positioned as Stars or Question Marks in the BCG Matrix for Fortune Brands Innovations. Given the burgeoning demand for sophisticated outdoor living solutions, the market growth rate is high. However, if Fortune Brands is a newer entrant or has not yet established significant market penetration with these specific innovative structures, their relative market share would be low, classifying them as Question Marks. This placement signifies substantial growth potential but also requires further investment to gain traction and compete effectively.

- Market Growth: The broader outdoor living market is experiencing robust growth, with projections indicating continued expansion driven by consumer interest in enhancing home exteriors.

- Innovation Focus: Fortune Brands Innovations is strategically targeting multi-functional and customized outdoor living structures, such as smart pergolas and integrated kitchen systems, to meet evolving consumer preferences.

- BCG Matrix Placement: These innovative structures, if representing new ventures for the company with low initial market share in a high-growth segment, would likely be classified as Question Marks, necessitating strategic investment to capitalize on their potential.

- Competitive Landscape: While specific market share data for these niche structures is still developing, the overall trend indicates a shift towards higher-value, technologically integrated outdoor solutions.

Strategic Partnerships for Recurring Revenue (e.g., insurance for Flo)

Fortune Brands Innovations is strategically pursuing partnerships, notably with insurance providers for its Moen Flo system, to cultivate recurring revenue. These collaborations are designed to tap into high-growth distribution channels and expand sales pipelines, offering a promising avenue for future income.

While these initiatives present significant potential, their ultimate impact on long-term market share and their capacity for full-scale expansion remain to be fully demonstrated. Consequently, these ventures are classified as strategic question marks within the BCG framework, necessitating ongoing investment and careful cultivation to assess their true market viability and growth potential.

- Partnership Focus: Insurance collaborations for smart home devices like Moen Flo.

- Revenue Model: Aiming to establish recurring revenue streams beyond initial product sales.

- Growth Potential: Accessing high-growth channels and sales pipelines through these alliances.

- Uncertainty: Long-term market share contribution and scalability are still under evaluation, classifying them as question marks.

Question Marks within Fortune Brands Innovations' portfolio represent areas of high market growth but currently low market share. These ventures, such as new digital product pipelines and innovative outdoor living structures, require significant investment to develop and gain traction. The company's strategic focus on these segments reflects a long-term vision to capture future market opportunities, acknowledging the inherent uncertainty and need for sustained capital infusion.

| Category | Market Growth | Market Share | BCG Classification | Strategic Implication |

| Digital Product Pipelines (Smart Home) | High | Low | Question Mark | Requires significant investment for development and market penetration. |

| Innovative Outdoor Living Structures | High | Low (potentially) | Question Mark | Needs further investment to establish market presence and compete. |

| Moen Flo Partnerships (Recurring Revenue) | High (channels) | Low (initial) | Question Mark | Cultivation needed to assess long-term viability and scalability. |

BCG Matrix Data Sources

Our Fortune Brands BCG Matrix is constructed using a blend of financial disclosures, market research reports, and internal sales data to provide a comprehensive view of product performance and market share.