Enstar Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enstar Group Bundle

Enstar Group's SWOT analysis reveals a company with significant financial strength and a proven track record in niche markets. However, it also highlights potential vulnerabilities in regulatory changes and competitive pressures that could impact its growth trajectory.

Want the full story behind Enstar's robust financial footing and its strategic advantages in the insurance sector? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

Enstar Group stands as a preeminent global force in the run-off insurance sector, boasting a remarkable portfolio of over 120 acquisition transactions since its inception. This extensive history underscores a profound expertise in navigating and resolving complex legacy liabilities, a critical advantage in the industry.

Their deep understanding of intricate insurance portfolios and a proven history of successful claims management in challenging business lines solidify their market leadership. This specialization enables Enstar to efficiently manage discontinued insurance business, a service that liberates capital and mitigates risk for the original insurers.

Enstar Group boasts a robust financial position, underscored by its substantial asset base and carefully managed liabilities. This strong financial footing is further validated by its solid financial strength ratings, providing a clear indicator of its stability and operational capacity.

Key to this strength is Enstar's subsidiary, Cavello Bay Reinsurance Limited, which holds an 'A' Financial Strength Rating from both AM Best and S&P Global Ratings, both with a stable outlook as of late 2024. This rating reflects a strong capital position and a resilient business model.

This impressive financial standing empowers Enstar to confidently pursue and execute large legacy transactions, while also effectively managing its varied and complex portfolios. It's a testament to their disciplined approach to capital management and risk underwriting.

Enstar Group's strength lies in its highly diversified portfolio, encompassing non-life run-off, life and annuities, and investment management. This broad operational base, spread across key insurance markets like Bermuda, the US, London, Continental Europe, and Australia, significantly reduces reliance on any single segment or geography. This global reach, as of Q1 2024, allows Enstar to capitalize on opportunities in various economic cycles and regulatory environments, enhancing its resilience.

Effective Investment Management Capabilities

Enstar Group's robust investment management capabilities are a cornerstone of its financial strength. The company consistently generates significant net investment income, a key driver of its profitability. For instance, Enstar reported net investment income of $1.1 billion for the nine months ended September 30, 2023, a notable increase from the prior year, underscoring the effectiveness of its asset allocation and management strategies.

These strategies have translated into strong annualized total investment returns, vital for meeting its long-term liabilities and supporting ongoing operations. The ability to optimize the performance of its diverse investment portfolios directly contributes to Enstar's overall financial stability and its capacity for growth.

- Strong Net Investment Income: Enstar generated $1.1 billion in net investment income for the first nine months of 2023, highlighting successful asset management.

- Positive Total Investment Returns: The company consistently achieves strong annualized total investment returns, crucial for solvency and operational support.

- Profitability Enhancement: Effective portfolio optimization directly bolsters Enstar's overall profitability and financial resilience.

Strategic Acquisitions and Capital Release Solutions

Enstar Group has a strong history of making smart acquisitions, which consistently boosts its assets under management and broadens its reach in the market. For instance, in 2023, Enstar completed several significant transactions, adding approximately $5 billion in reserves to its portfolio, demonstrating its ongoing strategic growth.

The company's main business is offering creative capital release solutions to insurance companies by assuming their older, less desirable liabilities. This specialization positions Enstar as a sought-after partner for businesses aiming to improve their financial standing and lessen risk exposure.

- Proven Acquisition Strategy: Enstar's consistent success in acquiring and integrating new businesses has led to a steady increase in its total assets, reaching over $35 billion by the end of 2023.

- Capital Release Expertise: The company's core competency lies in efficiently managing and releasing capital tied up in legacy insurance liabilities, a service highly valued by insurers seeking balance sheet optimization.

- Risk Mitigation Partner: Enstar's ability to absorb and manage complex legacy risks makes it an attractive proposition for insurers looking to de-risk their operations and focus on core growth areas.

Enstar Group's core strength lies in its unparalleled expertise in the run-off insurance sector, demonstrated by over 120 successful acquisition transactions since its founding. This deep specialization allows them to efficiently manage complex legacy liabilities, a critical value proposition for insurers seeking to de-risk their balance sheets.

The company's robust financial health is a significant advantage, supported by strong financial strength ratings. For instance, its subsidiary Cavello Bay Reinsurance Limited holds an 'A' rating from AM Best and S&P Global Ratings with a stable outlook as of late 2024, reflecting substantial capital and a resilient business model.

Enstar benefits from a highly diversified portfolio spanning non-life run-off, life and annuities, and investment management across key global markets. This diversification, evident in its operations across Bermuda, the US, London, Continental Europe, and Australia as of Q1 2024, enhances its resilience against market fluctuations.

Furthermore, Enstar's strong investment management capabilities consistently generate significant net investment income, contributing substantially to profitability. The company reported $1.1 billion in net investment income for the first nine months of 2023, showcasing effective asset allocation and management.

| Key Strength Area | Supporting Data/Fact | Impact |

|---|---|---|

| Run-off Expertise | Over 120 acquisition transactions completed | Efficient management of complex legacy liabilities |

| Financial Strength | Cavello Bay Reinsurance Limited: 'A' rating (AM Best, S&P) as of late 2024 | Capacity for large legacy transactions, operational stability |

| Portfolio Diversification | Operations across Bermuda, US, London, Europe, Australia (Q1 2024) | Reduced reliance on single segments/geographies, enhanced resilience |

| Investment Management | $1.1 billion net investment income (9 months ended Sep 30, 2023) | Significant contribution to profitability and financial resilience |

What is included in the product

Offers a full breakdown of Enstar Group’s strategic business environment, detailing its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable roadmap for leveraging Enstar Group's strengths and mitigating weaknesses.

Weaknesses

Enstar's focus on the run-off insurance market means it takes on liabilities that can take many years to settle. This long-tail nature inherently creates uncertainty in predicting the final cost of claims, a core challenge in this sector.

The company is exposed to reserve development risk, where the actual cost of claims might turn out to be higher than the reserves initially set aside. For instance, in 2023, the insurance industry as a whole saw continued pressure on prior-year loss development across various lines, a trend Enstar actively manages through its specialized expertise.

Enstar's significant reliance on investment returns for profitability exposes it to considerable market volatility. For instance, in the first quarter of 2024, Enstar reported total investment income of $347 million, a figure that directly influences its overall financial performance.

Sharp fluctuations in interest rates and equity markets, as seen in the broader financial landscape throughout 2024, can directly impact Enstar's total investment return and, consequently, its net income. This dependence introduces a layer of market risk that extends beyond its primary insurance underwriting activities.

While Enstar has a proven track record of successful acquisitions, the sheer volume of these deals can lead to integration challenges. For instance, integrating multiple acquired portfolios, each with unique systems and claims handling processes, requires substantial operational resources and meticulous planning.

Successfully merging diverse company cultures and operational frameworks is crucial to unlocking the anticipated synergies and preventing potential disruptions to ongoing business. This complexity was evident in the integration of the Fidelis Insurance acquisition, which required careful alignment of IT systems and claims management protocols throughout 2024.

Limited Organic Growth in New Business

Enstar's core strategy as a run-off specialist means its growth isn't fueled by originating new insurance policies. This inherently caps its organic growth in terms of new premium income, unlike traditional insurers who actively seek new business. For instance, while Enstar's total revenue can grow significantly through acquisitions, the absence of new policy underwriting means a fundamental limitation on building new premium streams organically.

Consequently, Enstar's expansion is intrinsically tied to its ability to identify and successfully acquire new run-off portfolios. This reliance on external opportunities, rather than internal product development and sales, shapes its growth trajectory. The company's financial performance is therefore heavily influenced by deal flow and the successful integration of acquired liabilities, rather than the organic expansion of its underwriting book.

- Reliance on Acquisitions: Enstar's growth is primarily acquisition-driven, not from new policy sales.

- Limited Organic Premium Growth: The business model inherently restricts the generation of new insurance premiums.

- Deal Flow Dependency: Expansion hinges on the availability and successful closure of run-off portfolio acquisitions.

Impact of Delisting on Preferred Shareholders

The delisting of Enstar's ordinary shares from NASDAQ following its acquisition by Stone Point Capital and the Carlyle Group has created significant uncertainty for preferred shareholders. These preferred shares, which previously traded on the NASDAQ, are now effectively illiquid, with no public market for trading.

This lack of liquidity presents a considerable challenge for preferred shareholders seeking to sell their holdings. Without an exchange to facilitate transactions, finding a buyer and determining a fair market price becomes difficult, potentially leading to substantial discounts for any private sale. For instance, as of late 2024, preferred securities that have undergone similar delistings have often seen their market value drop by 15-25% due to the reduced accessibility and increased transaction friction.

- Illiquidity: Preferred shares are no longer traded on a public exchange, hindering easy sale.

- Valuation Uncertainty: The absence of a market price makes it difficult to ascertain the current value of these holdings.

- Limited Exit Strategies: Investors have fewer options to divest their preferred share investments.

- Impact on Investor Confidence: Such delistings can erode trust in preferred stock as an investment vehicle.

Enstar's reliance on acquisitions for growth means its expansion is directly tied to the availability and successful integration of run-off portfolios, rather than organic premium generation.

This model inherently limits its ability to build new premium streams internally, making it dependent on external deal flow and the successful closure of acquisitions to fuel its growth trajectory.

The company's financial performance is therefore heavily influenced by the success of its acquisition strategy and the seamless integration of acquired liabilities, rather than the organic expansion of its underwriting book.

What You See Is What You Get

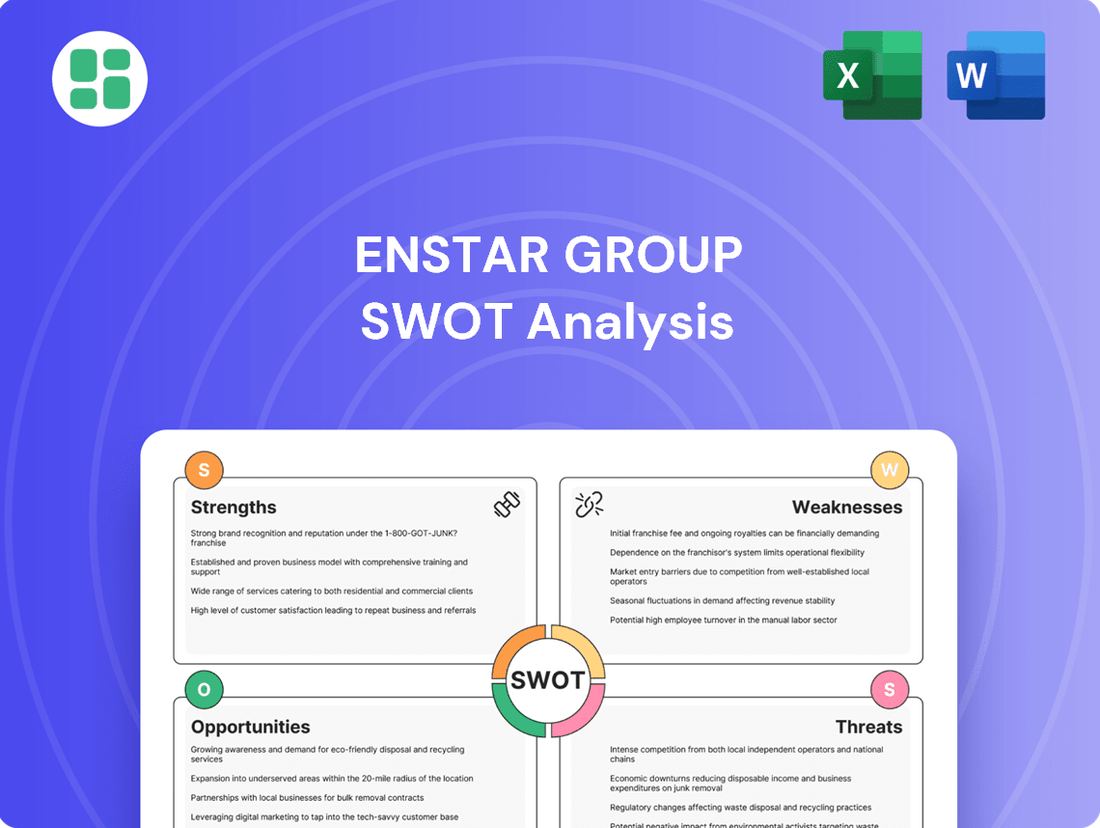

Enstar Group SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment. You'll gain access to a comprehensive breakdown of Enstar Group's Strengths, Weaknesses, Opportunities, and Threats, providing valuable strategic insights.

Opportunities

The global non-life run-off market is a massive opportunity, with estimated reserves surpassing US$1 trillion as of early 2024. This vast pool of dormant liabilities continues to present significant opportunities for companies like Enstar to acquire portfolios and businesses, thereby expanding their market presence and utilizing their specialized skills to unlock value.

Further consolidation within this substantial market is anticipated, offering Enstar ongoing avenues to secure new business. The increasing demand for a wider variety of run-off portfolios also opens up new avenues for growth and diversification.

Enstar can leverage innovative technologies like Artificial Intelligence to significantly boost claims processing and settlement efficiency within the legacy sector. By investing in advanced solutions, Enstar can streamline operations, leading to reduced costs and improved profitability.

The adoption of AI in claims management can also enhance the accuracy of reserve estimations, a critical factor in the legacy insurance market. For instance, AI-powered analytics can analyze vast datasets to identify patterns and predict future claim costs more effectively than traditional methods.

A sustained favorable interest rate environment offers a significant tailwind for Enstar Group's investment income. As of mid-2024, benchmark interest rates remain elevated compared to recent years, allowing Enstar to generate higher yields on its substantial fixed-income portfolios. This directly bolsters its profitability and the overall financial performance of its managed assets.

Expansion into New Geographies and Lines of Business

Enstar Group can pursue growth by entering new geographic markets or expanding its service offerings within the insurance run-off sector. The increasing demand for external run-off solutions in Europe presents a significant avenue for expansion.

Specific lines of business, such as General Liability and Financial & Professional Liability, are experiencing heightened interest, offering targeted opportunities for Enstar's strategic development.

- Geographic Expansion: Targeting underserved European markets with tailored run-off solutions.

- Product Diversification: Focusing on high-demand lines like General Liability and Financial & Professional Liability.

- Strategic Acquisitions: Identifying and acquiring niche run-off portfolios in emerging regions.

- Partnership Development: Collaborating with European insurers to facilitate their capital management through run-off transactions.

Capital Management Solutions for Live Insurers

The growing recognition of the run-off market as a key capital management tool for active insurers presents a significant opportunity for Enstar. As companies increasingly seek to free up trapped capital and mitigate risk, Enstar is well-positioned to provide specialized legacy solutions. This trend is expected to fuel a steady stream of potential transactions.

This strategic shift in the insurance industry is driven by a desire for balance sheet optimization. For instance, in 2024, the global insurance industry continued to navigate evolving regulatory landscapes and economic uncertainties, prompting many to re-evaluate their capital allocation strategies. Enstar's ability to offer efficient and effective run-off solutions directly addresses this need.

The market for legacy insurance solutions is expanding, with estimates suggesting continued robust activity through 2025. Enstar can leverage this by:

- Developing tailored solutions: Offering bespoke run-off plans that meet the specific capital and risk management objectives of live insurers.

- Expanding service offerings: Broadening its capabilities to handle a wider range of insurance liabilities and complexities.

- Capitalizing on market momentum: Proactively engaging with insurers looking to de-risk and optimize their portfolios.

The global non-life run-off market, with reserves exceeding US$1 trillion in early 2024, offers vast opportunities for Enstar to acquire portfolios and expand its market presence. Continued market consolidation and increasing demand for diverse run-off portfolios provide ongoing avenues for new business and growth.

Enstar can enhance efficiency and profitability by adopting AI for claims processing and settlement in the legacy sector. AI-powered analytics also improve reserve estimation accuracy by identifying patterns and predicting future claim costs more effectively than traditional methods.

A sustained favorable interest rate environment, with elevated benchmark rates in mid-2024, boosts Enstar's investment income and profitability on its fixed-income portfolios. Geographic expansion into underserved European markets and diversification into high-demand lines like General Liability and Financial & Professional Liability are key growth strategies.

The growing recognition of run-off solutions as a capital management tool for active insurers, driven by a desire for balance sheet optimization, presents a steady stream of potential transactions for Enstar. This market momentum is expected to continue robustly through 2025.

Threats

A significant threat for Enstar is the potential for its insurance reserves to develop unfavorably, meaning the actual costs of claims could be higher than initially estimated. This is particularly concerning given the current inflationary environment, which is driving up the expenses associated with settling claims, especially those that take a long time to resolve, such as asbestos or workers' compensation cases.

For instance, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index (CPI) saw a notable increase throughout 2023 and into early 2024, impacting various cost components relevant to insurance claims. If Enstar's reserve estimates do not adequately account for these escalating costs, it could lead to a shortfall.

Furthermore, unexpected shifts in legal precedents or medical treatment costs can also create reserve deficiencies, adding another layer of risk to Enstar's operations. The company must continuously monitor these evolving trends to ensure its reserves remain robust and sufficient to cover future payouts.

Enstar's substantial investment portfolio is directly susceptible to the unpredictable swings in global financial markets. For instance, a significant downturn in equity markets, such as the S&P 500 experiencing a 10% decline in a quarter, could materially reduce the value of its holdings.

Sudden and sharp increases in interest rates, a common occurrence in 2024 as central banks managed inflation, could also negatively impact bond valuations within Enstar's portfolio. This market risk directly translates into potential reductions in its investment income and could strain its capital reserves.

The run-off market is experiencing a surge in interest, drawing in more players eager to acquire legacy insurance portfolios. This heightened competition, a significant threat for Enstar, means that acquiring these portfolios might become more expensive. For instance, in 2024, the average price for legacy portfolios has seen an uptick due to this increased demand.

This intensified competition directly impacts potential returns for companies like Enstar. As more acquirers vie for the same deals, the profit margins on acquired portfolios are likely to shrink. Furthermore, the sheer number of new entrants could limit the availability of attractive acquisition opportunities, making it harder to find profitable transactions.

Regulatory and Compliance Changes

The insurance and reinsurance sectors operate within a stringent regulatory framework that is constantly adapting. Enstar Group, like its peers, must navigate these evolving compliance landscapes across its global operations. For instance, updates to solvency regulations, such as Solvency II in Europe, or new mandates around data privacy and cybersecurity disclosures, can significantly impact operational costs and capital allocation strategies. These changes can affect how Enstar structures its business and conducts cross-border transactions, potentially introducing new compliance burdens.

The financial impact of regulatory shifts can be substantial. For example, increased capital requirements stemming from new solvency rules could necessitate raising additional funds or adjusting investment strategies. Similarly, stricter data privacy laws might demand significant investment in IT infrastructure and compliance personnel. These evolving requirements present a continuous challenge, requiring proactive adaptation to maintain operational efficiency and financial stability.

- Increased Capital Requirements: Evolving solvency regulations can lead to higher mandated capital reserves, impacting liquidity and investment flexibility.

- Operational Burden: New compliance protocols, especially concerning data privacy and cybersecurity, necessitate ongoing investment in technology and personnel.

- Cross-Border Transaction Complexity: Divergent regulatory requirements across jurisdictions can complicate and increase the cost of international business operations.

Cybersecurity and Data Breaches

Enstar Group, heavily reliant on advanced IT systems for managing sensitive client and financial data, faces substantial cybersecurity threats. A significant data breach or cyberattack could result in considerable financial penalties, severe reputational harm, and extensive legal liabilities. The escalating complexity and frequency of these cyber risks demand ongoing, substantial investment in state-of-the-art cybersecurity defenses.

For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the pervasive nature of these threats. In 2023, the financial services sector was particularly targeted, with ransomware attacks and data theft posing significant challenges.

- Increased Sophistication of Attacks: Cybercriminals are constantly developing more advanced methods to infiltrate systems.

- Regulatory Scrutiny: Data privacy regulations, such as GDPR and CCPA, impose strict requirements and hefty fines for non-compliance.

- Reputational Damage: A successful breach can erode customer trust and significantly damage Enstar's brand image.

- Operational Disruption: Cyberattacks can halt business operations, leading to revenue loss and increased recovery costs.

The increasing competition in the run-off market, driven by more participants seeking legacy portfolios, poses a threat by potentially inflating acquisition costs and reducing profit margins for Enstar Group. This heightened demand, evident in 2024's rising acquisition prices, means Enstar may face higher expenses for acquiring new portfolios, impacting its ability to generate attractive returns. The intense competition also risks limiting the availability of profitable acquisition opportunities.

Enstar's significant investment portfolio is vulnerable to market volatility, with potential downturns in equity markets or sharp interest rate hikes, as seen in 2024, directly impacting asset valuations and investment income. For instance, a 10% decline in a major equity index could materially reduce the value of Enstar's holdings, while rising rates can devalue its bond portfolio. These market fluctuations can strain capital reserves and reduce overall profitability.

The evolving regulatory landscape presents a continuous challenge, requiring substantial investment in compliance and potentially increasing capital requirements. For example, updates to solvency regulations like Solvency II can mandate higher reserves, impacting liquidity. Furthermore, stricter data privacy and cybersecurity mandates can necessitate significant spending on IT infrastructure and personnel, adding to operational burdens and potentially complicating cross-border transactions.

SWOT Analysis Data Sources

This Enstar Group SWOT analysis is built upon robust data, including their official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded and accurate view of the company's current standing and future potential.