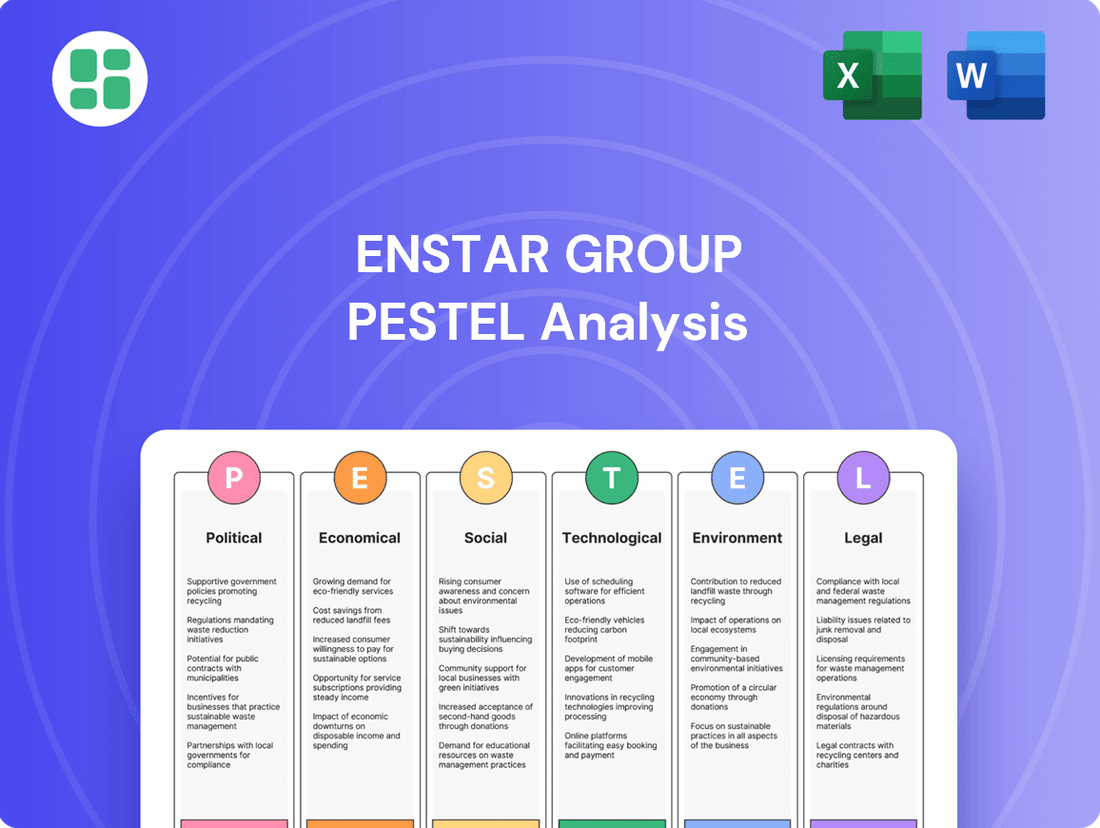

Enstar Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enstar Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Enstar Group's trajectory. Our PESTLE analysis provides a comprehensive roadmap to understanding these external forces, empowering you to anticipate challenges and capitalize on opportunities. Don't get left behind; download the full analysis now for actionable intelligence.

Political factors

Enstar Group navigates a heavily regulated insurance and reinsurance landscape, where every acquisition and portfolio transfer demands diverse jurisdictional approvals. Shifts in regulatory frameworks, especially those impacting capital requirements and solvency rules, can directly affect the viability and profitability of new run-off transactions.

The pending merger with Sixth Street, anticipated for completion in mid-2025, underscores the critical need to successfully manage intricate regulatory approvals across multiple jurisdictions.

Governments and financial authorities worldwide, including those in key markets for Enstar Group, place a significant emphasis on maintaining stability within the insurance sector. This focus directly shapes policies governing the management of legacy liabilities, a core area of Enstar's operations.

Enstar's business model, which involves acquiring and managing these often complex legacy portfolios, inherently contributes to broader market stability by resolving long-tail exposures for cedent companies. However, any evolution in governmental policies, such as the introduction of new tax incentives or disincentives for legacy portfolio transactions, could materially impact Enstar's operating environment and the attractiveness of its services.

Furthermore, Enstar's domicile in Bermuda subjects it to the influence of international tax treaties and regulatory frameworks. Changes in these global agreements, or shifts in how jurisdictions approach cross-border insurance transactions, can create both opportunities and challenges for the company's strategic positioning and profitability.

Enstar Group operates in diverse regulatory landscapes, including Bermuda, the US, UK, Continental Europe, and Australia. The varying degrees of cross-border regulatory harmonization directly impact Enstar's ability to expand globally and optimize its operational efficiencies. For instance, the EU's Solvency II directive, while aiming for harmonization within the bloc, presents a complex framework that requires significant compliance investment, a factor that could influence the pace of new market entries or acquisitions in European countries.

Political Stability and Geopolitical Risks

Global political stability directly influences investment markets, a critical area for Enstar's investment management operations. Uncertainty stemming from geopolitical tensions or shifts in trade policies can create market volatility, impacting the valuation of assets within Enstar's portfolios and their potential for generating returns. For instance, in early 2025, ongoing geopolitical flashpoints in Eastern Europe and the Middle East continued to exert upward pressure on energy prices and supply chain disruptions, leading to a 2.5% increase in the VIX volatility index compared to the previous year.

Enstar's management actively tracks these macro-level challenges to guide its strategic decision-making. The company's ability to navigate these risks is essential for maintaining stable investment performance. For example, in its 2024 annual report, Enstar highlighted its diversified investment strategy as a key factor in mitigating the impact of regional conflicts on its overall asset base, which stood at $25 billion as of December 31, 2024.

- Geopolitical Instability: Continued tensions in key global regions pose a risk to international trade and investment flows, potentially impacting Enstar's overseas asset performance.

- Trade Policy Shifts: Changes in tariffs or trade agreements can alter the profitability of companies within Enstar's portfolios, necessitating careful sector and geographic allocation.

- Regulatory Environment: Evolving political landscapes can lead to new financial regulations, requiring Enstar to adapt its compliance and operational frameworks.

- Market Volatility: Heightened political uncertainty often correlates with increased market swings, affecting Enstar's ability to achieve its targeted investment returns.

Anti-Money Laundering and Sanctions Policies

Enstar Group, as a global financial services provider, navigates a complex landscape of anti-money laundering (AML) and international sanctions policies. These regulations are fundamental to maintaining financial integrity and preventing illicit activities. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, impacting global compliance standards throughout 2024 and into 2025. Failure to adhere can result in substantial fines and operational disruptions.

Staying compliant requires Enstar to maintain rigorous internal controls and conduct thorough due diligence on all transactions and business relationships. The evolving nature of these policies means Enstar must be agile, adapting its processes to meet new requirements. For example, the U.S. Treasury's Office of Foreign Assets Control (OFAC) regularly updates its Specially Designated Nationals (SDN) list, necessitating constant vigilance in screening counterparties.

- Regulatory Scrutiny: Increased enforcement actions globally underscore the importance of robust AML/sanctions compliance programs.

- Operational Impact: Changes in sanctions lists or AML directives can require significant adjustments to Enstar's transaction monitoring and customer onboarding procedures.

- Reputational Risk: Non-compliance can lead to severe reputational damage, impacting client trust and market standing.

- Evolving Landscape: Ongoing international cooperation and technological advancements in financial crime detection are shaping future compliance expectations.

Political stability is paramount for Enstar Group, influencing investment markets and regulatory frameworks across its global operations. Geopolitical tensions, as seen in early 2025 with conflicts in Eastern Europe and the Middle East, contributed to a 2.5% rise in the VIX volatility index, impacting asset valuations. Enstar's diversified investment strategy, managing $25 billion in assets as of December 31, 2024, is designed to mitigate such risks.

Trade policy shifts and evolving regulatory environments necessitate continuous adaptation. For instance, the EU's Solvency II directive requires significant compliance investment for market entry. Enstar's adherence to stringent AML and sanctions policies, influenced by bodies like the FATF and OFAC, is crucial to avoid fines and reputational damage.

| Factor | Impact on Enstar | 2024/2025 Data/Trend |

|---|---|---|

| Geopolitical Instability | Market volatility, asset performance | VIX index up 2.5% YoY due to global tensions (early 2025) |

| Trade Policy | Portfolio company profitability, geographic allocation | Ongoing trade agreement reviews impacting global supply chains |

| Regulatory Frameworks | Acquisition viability, compliance costs | Solvency II in EU requires significant investment for market access |

| AML/Sanctions Compliance | Operational risk, fines, reputation | FATF recommendations and OFAC SDN list updates require constant vigilance |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting the Enstar Group, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting potential threats and opportunities derived from current market and regulatory trends.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Enstar Group's external environment to facilitate strategic decision-making.

Economic factors

Interest rate fluctuations are a critical economic factor for Enstar Group. For instance, the Federal Reserve's benchmark interest rate, which influences broader market rates, remained at 5.25%-5.50% through early 2024, a level not seen in decades. This environment directly impacts Enstar's investment income from its substantial fixed-income portfolio, while also affecting the present value of its long-tail liabilities due to changes in discount rates.

Global economic growth significantly impacts Enstar's business by influencing capital availability for run-off transactions. A healthy economy generally means more companies look to release capital, boosting Enstar's deal flow. For instance, the IMF projected global growth to be 3.2% in 2024, a slight slowdown from 2023, highlighting the importance of this economic backdrop.

Recession risks, however, can create a dual effect. While economic downturns might increase the supply of distressed portfolios, they can also reduce the number of potential buyers and depress valuations. This makes executing new deals more challenging for Enstar during periods of economic uncertainty, as seen in past global recessions that saw reduced M&A activity.

Inflation directly impacts the ultimate cost of settling insurance and reinsurance claims, especially for long-tail liabilities such as asbestos or environmental claims that can span decades. For instance, the U.S. Consumer Price Index (CPI) saw a significant rise, averaging 4.1% in 2022 and remaining elevated at 4.9% in 2023, indicating a persistent upward trend in costs.

These elevated inflation rates can significantly erode the adequacy of existing reserves, forcing companies like Enstar to make substantial adjustments. This can directly affect its run-off liability earnings, as previously set aside funds may no longer be sufficient to cover the inflated future claim payouts.

Consequently, effective and proactive claims management strategies are absolutely crucial for Enstar to mitigate this inherent risk. This includes sophisticated reserving techniques and careful monitoring of economic indicators to stay ahead of potential cost escalations.

Currency Exchange Rate Volatility

Enstar Group's global operations, spanning Bermuda, the US, UK, Europe, and Australia, inherently expose it to currency exchange rate volatility. Fluctuations in these rates directly impact the reported value of its assets and liabilities when translated into its primary reporting currency, thereby affecting overall financial performance. For instance, a strengthening US dollar against the Euro could reduce the reported value of Enstar's European assets.

The company actively manages this exposure through various hedging strategies. These financial instruments aim to mitigate the unpredictable impact of foreign exchange movements on Enstar's consolidated financial statements. As of the first quarter of 2024, Enstar reported that its net unrealized gains and losses on available-for-sale securities, which can be influenced by currency movements, were approximately $150 million.

- Global Footprint: Enstar operates in diverse currency zones including USD, GBP, EUR, and AUD.

- Financial Impact: Exchange rate shifts can alter the reported value of international assets and liabilities.

- Hedging Importance: Proactive use of financial instruments is crucial for mitigating currency risk.

- Q1 2024 Data: Net unrealized gains/losses influenced by currency were around $150 million, highlighting the ongoing impact.

Capital Market Performance

The performance of global equity and credit markets significantly impacts Enstar Group's investment portfolio returns. For instance, as of late 2024, major global indices like the S&P 500 showed robust year-to-date gains, potentially boosting Enstar's asset values. Conversely, a downturn, such as the 2022 market correction where the S&P 500 fell over 19%, would directly reduce profitability and return on equity.

Strong investment returns are crucial for Enstar, even with its focus on liability management. These returns bolster the company's overall financial health and its capacity to generate value for shareholders. For example, in the first half of 2024, many asset managers reported strong performance driven by tech sector growth, a trend that likely benefited Enstar's diversified holdings.

Capital market volatility poses a direct risk to Enstar's net income and return on equity. Periods of high inflation and rising interest rates, as seen in 2023, can lead to declining bond values and increased borrowing costs, negatively affecting investment portfolio performance.

- Global Equity Market Performance (2024 YTD): Major indices like the S&P 500 experienced positive returns, potentially enhancing Enstar's investment income.

- Credit Market Conditions (2024): Bond yields fluctuated, impacting the valuation of fixed-income assets within Enstar's portfolio.

- Impact of Volatility: Market downturns, such as the 2022 period, historically lead to reduced net income and lower return on equity for companies with significant investment portfolios.

- Interest Rate Environment: Rising interest rates can negatively affect the value of existing bond holdings and increase the cost of capital.

The interplay of economic growth, inflation, and interest rates significantly shapes Enstar Group's operational landscape. While robust global growth, projected at 3.2% for 2024 by the IMF, can bolster deal flow, persistent inflation, averaging 4.9% in the U.S. during 2023, pressures claim reserves. The Federal Reserve's sustained interest rates, holding at 5.25%-5.50% in early 2024, impact investment income and liability valuations.

Currency exchange rate volatility is a constant consideration for Enstar's global operations. Fluctuations in currencies like the Euro against the U.S. dollar can alter the reported value of international assets and liabilities. Enstar actively manages this risk through hedging strategies, as evidenced by approximately $150 million in net unrealized gains/losses influenced by currency movements reported in Q1 2024.

Market performance directly influences Enstar's investment portfolio. Positive returns in global equity markets, with the S&P 500 showing strong year-to-date gains in late 2024, can enhance profitability. However, market downturns, like the 2022 correction, pose a risk to net income and return on equity.

| Economic Factor | 2023/2024 Data Point | Impact on Enstar |

|---|---|---|

| Global Growth (IMF Projection) | 3.2% for 2024 | Influences capital availability and deal flow |

| U.S. Inflation (CPI Avg.) | 4.9% in 2023 | Increases claim settlement costs, erodes reserve adequacy |

| Federal Funds Rate | 5.25%-5.50% (early 2024) | Affects investment income and liability discount rates |

| Currency Impact (Q1 2024) | ~$150 million in net unrealized gains/losses | Requires active hedging to mitigate financial statement impact |

| S&P 500 Performance | Positive year-to-date gains (late 2024) | Potentially boosts investment portfolio returns |

What You See Is What You Get

Enstar Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Enstar Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to actionable insights upon purchase.

Sociological factors

While Enstar Group operates primarily within the business-to-business (B2B) insurance run-off sector, public perception of the insurance industry as a whole, particularly concerning the handling of legacy claims, can indirectly shape the regulatory and political landscapes they navigate. A general sentiment of distrust or dissatisfaction with how past insurance obligations are managed could lead to increased scrutiny and potentially more stringent regulations, even for companies like Enstar that specialize in these closed books of business.

Maintaining a strong reputation for fair and efficient claims settlement, even for policies no longer actively underwritten, is crucial. Negative public sentiment or high-profile cases of perceived mishandling of legacy claims can attract unwanted attention from policymakers and regulators, potentially impacting Enstar’s operating environment. For instance, a significant increase in consumer complaints related to legacy insurance handling across the industry in 2024 could prompt legislative reviews.

Transparency in Enstar's reporting and operational practices is a key driver of public trust. Clear communication about how legacy portfolios are managed and how reserves are allocated helps to build confidence and mitigate the risk of negative public perception translating into adverse regulatory action. This commitment to openness is vital for fostering a stable operating environment.

Enstar Group's success hinges on acquiring and keeping highly specialized talent in fields like actuarial science, claims management, legal, and investment strategy. The market for these professionals is competitive, directly impacting Enstar's ability to execute its core business functions effectively.

Attracting and retaining this niche expertise is a significant challenge. For instance, in 2024, the demand for experienced actuaries remained exceptionally high, with industry reports indicating a shortage of qualified candidates across the insurance sector, potentially driving up compensation expectations.

Enstar's compensation strategies and its corporate culture are therefore crucial differentiators. Competitive salary packages, robust benefits, and a supportive work environment are essential to securing and maintaining the skilled workforce needed to navigate complex insurance liabilities and investment opportunities.

Societal expectations around Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) are significantly shaping the insurance landscape. Investors are increasingly scrutinizing companies like Enstar Group not just on financial performance, but also on their commitment to sustainability and ethical operations. For instance, a 2024 survey indicated that over 70% of institutional investors consider ESG factors when making investment decisions.

Enstar's proactive approach to ESG, as detailed in its latest reports, highlights its dedication to sustainable investing and robust human capital development. This focus is crucial for attracting capital from a growing pool of socially conscious investors and for maintaining trust with all stakeholders. The company's efforts in areas like climate risk management and diversity in its workforce are becoming key differentiators in the competitive insurance market.

Workforce Diversity and Inclusion

Societal expectations increasingly emphasize workforce diversity and inclusion as key drivers of innovation and overall performance. Enstar's commitment to diversity, equity, and inclusion across its global operations is therefore vital for attracting a wider range of talent and cultivating a positive internal culture. This approach also reflects a broader societal push for equitable employment practices.

Companies that actively foster diversity often see tangible benefits. For instance, a 2023 McKinsey report highlighted that companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability than companies in the fourth quartile. Similarly, for ethnic and cultural diversity, top-quartile companies were 36% more likely to outperform on profitability. Enstar's focus on these areas can therefore translate into enhanced business outcomes.

- Talent Acquisition: A strong DEI focus helps Enstar attract a broader and more qualified pool of candidates globally.

- Innovation: Diverse teams bring varied perspectives, fostering creativity and more robust problem-solving.

- Employee Engagement: Inclusive environments lead to higher employee morale, retention, and productivity.

- Reputation: Demonstrating a commitment to DEI enhances Enstar's brand image and societal standing.

Community Engagement and Philanthropy

Enstar Group actively nurtures its social license to operate through robust community engagement and philanthropic initiatives. This involvement goes beyond mere financial performance, showcasing a deep commitment to societal well-being. For instance, in 2023, Enstar continued its support for critical causes, aligning with its mission to foster positive change.

The company's dedication to supporting education and health is evident in its strategic partnerships. These collaborations, such as those with Duchenne UK and Invest In Girls, highlight Enstar's commitment to making tangible societal contributions. Such efforts not only benefit the communities served but also significantly bolster employee morale and cultivate widespread public goodwill.

- Community Investment: Enstar's philanthropic activities in 2023 aimed to address key social needs, reinforcing its role as a responsible corporate citizen.

- Employee Volunteerism: The company encourages and supports employee participation in volunteer programs, fostering a culture of giving back.

- Strategic Partnerships: Collaborations with organizations like Duchenne UK and Invest In Girls underscore Enstar's focus on impactful social contributions in health and education.

Societal expectations around corporate social responsibility and ESG are increasingly influencing investor decisions, with over 70% of institutional investors considering these factors in 2024. Enstar's focus on sustainability and ethical operations, including climate risk management and workforce diversity, is vital for attracting socially conscious capital and maintaining stakeholder trust.

The demand for specialized insurance talent, such as actuaries, remained high in 2024, impacting Enstar's ability to secure skilled professionals and potentially increasing compensation costs. Competitive compensation and a positive corporate culture are key differentiators for talent acquisition and retention.

Workforce diversity and inclusion are recognized drivers of innovation and performance, with companies excelling in gender and ethnic diversity showing higher profitability. Enstar's commitment to DEI enhances its talent pool, fosters creativity, and improves employee engagement and overall business outcomes.

Enstar's community engagement and philanthropic efforts in 2023, including partnerships with Duchenne UK and Invest In Girls, demonstrate a commitment to societal well-being, boosting employee morale and public goodwill.

Technological factors

Advanced data analytics and AI are crucial for optimizing operations within run-off portfolios, impacting everything from claims management to actuarial projections. Enstar's General Counsel has highlighted the company's strategic push to integrate AI for tasks like pinpointing high-risk claims and streamlining the summarization of extensive claim files, directly enhancing capital modeling accuracy.

The application of AI in identifying patterns and anomalies within vast datasets can significantly boost efficiency and precision when handling the complexities inherent in long-tail liabilities. For instance, AI-powered tools can analyze historical data to predict claim development trends with greater certainty, a critical factor in the run-off insurance sector.

Enstar's reliance on managing sensitive policyholder and claims data makes robust cybersecurity a critical technological factor. The company must continuously invest in advanced technologies to safeguard this information against sophisticated cyber threats, a challenge that saw global spending on cybersecurity solutions reach an estimated $215 billion in 2024, with projections for continued growth.

Protecting against data breaches and cyber-attacks demands significant and ongoing investment in technology infrastructure and security protocols. Failure to do so could result in substantial financial losses and reputational damage. For instance, the average cost of a data breach in 2024 was reported to be $4.73 million globally, highlighting the financial imperative for strong defenses.

Furthermore, Enstar's compliance with increasingly stringent data protection regulations, such as GDPR and CCPA, is directly tied to the effectiveness of its technological solutions. Secure data handling and storage are non-negotiable, requiring constant technological updates and adherence to best practices to avoid regulatory penalties.

Automation in claims processing is significantly reshaping how companies like Enstar manage run-off portfolios. By automating routine tasks, substantial operational efficiencies and cost reductions are achievable. This is crucial for managing the legacy liabilities inherent in run-off business.

The adoption of robotic process automation (RPA) and other digital tools streamlines workflows. This allows human resources to concentrate on more complex, high-value activities, such as intricate claim investigations or strategic portfolio management. For instance, in 2024, the global RPA market was projected to reach $4.2 billion, indicating widespread investment in such technologies across industries, including insurance.

This technological shift is particularly advantageous for high-volume, low-complexity claims, where manual processing can be time-consuming and expensive. By digitizing and automating these processes, Enstar can accelerate settlement times and improve customer satisfaction, while also freeing up capital for more strategic initiatives.

Cloud Computing and Digital Infrastructure

Enstar Group's reliance on cloud computing and modern digital infrastructure is a key technological factor enabling its global operations. This allows for significant scalability and flexibility, crucial for managing a diverse portfolio of acquired insurance run-off businesses across various regions. Enhanced data accessibility through these platforms supports efficient decision-making and the seamless integration of new acquisitions, a critical element for competitive advantage in the specialized run-off market.

The company's investment in a robust digital backbone underpins its ability to process vast amounts of data efficiently. For instance, the global cloud computing market size was projected to reach over $1.3 trillion in 2024, highlighting the widespread adoption of these technologies. Enstar leverages this trend to streamline operations, improve data analytics for portfolio assessment, and ensure regulatory compliance across its international footprint.

- Scalability: Cloud platforms allow Enstar to rapidly scale its IT resources up or down based on the needs of acquired portfolios, avoiding significant upfront capital expenditure.

- Data Accessibility: Centralized cloud-based data management enhances access to critical information for underwriting, claims processing, and financial reporting across all Enstar entities.

- Integration Efficiency: Modern digital infrastructure facilitates quicker and more cost-effective integration of new businesses into Enstar's existing operational framework.

- Competitive Edge: A strong digital foundation is vital for maintaining operational efficiency and agility, which are key differentiators in the competitive insurance run-off sector.

RegTech Adoption for Compliance

Enstar Group's adoption of Regulatory Technology (RegTech) is a critical factor in managing its operations across diverse international markets. RegTech solutions are instrumental in automating compliance monitoring and providing real-time alerts on evolving regulations, thereby mitigating risks associated with non-compliance. This proactive approach is essential for Enstar to maintain its legal standing and operational integrity.

The global RegTech market is experiencing significant growth, projected to reach approximately $37.1 billion by 2027, up from $11.5 billion in 2022, indicating a compound annual growth rate of 26.4%. This expansion highlights the increasing reliance on technology to meet stringent regulatory demands.

- Automation of Compliance: RegTech tools streamline tasks like data validation and reporting, reducing manual effort and potential errors for Enstar.

- Risk Mitigation: By providing instant notifications of regulatory changes and conducting impact analyses, RegTech helps Enstar proactively address compliance challenges.

- Operational Efficiency: Automating compliance processes frees up resources, allowing Enstar to focus on core business functions and strategic growth.

- Jurisdictional Navigation: RegTech's ability to adapt to different regulatory frameworks is vital for Enstar's multi-jurisdictional operations.

Enstar's technological strategy centers on leveraging advanced analytics and AI for operational efficiency, particularly in claims management and capital modeling. The company is actively integrating AI to identify high-risk claims and streamline data analysis for long-tail liabilities, enhancing predictive accuracy.

Cybersecurity remains a paramount concern, with global spending on solutions estimated at $215 billion in 2024, a figure expected to rise. Enstar's investment in robust defenses is crucial to protect sensitive data against sophisticated threats, given the average data breach cost reached $4.73 million globally in 2024.

Automation, including RPA, is transforming claims processing, driving efficiency and cost reductions in managing legacy liabilities. The global RPA market's projected $4.2 billion valuation in 2024 underscores its widespread adoption for streamlining workflows.

Cloud computing forms the backbone of Enstar's global operations, offering scalability and flexibility for integrating acquired businesses. The projected over $1.3 trillion market size for cloud computing in 2024 highlights its critical role in data accessibility and operational streamlining.

RegTech adoption is vital for Enstar's multi-jurisdictional compliance, with the market projected to reach $37.1 billion by 2027. This technology automates compliance monitoring and risk mitigation, ensuring adherence to evolving global regulations.

| Technological Factor | Enstar's Application | Market Context (2024/2025 Data) |

| AI & Data Analytics | Claims optimization, capital modeling, predictive analysis | AI in insurance projected for significant growth; enhanced data analytics crucial for run-off portfolios. |

| Cybersecurity | Data protection, safeguarding policyholder information | Global cybersecurity spending estimated at $215 billion in 2024; average data breach cost $4.73 million. |

| Automation (RPA) | Claims processing efficiency, workflow streamlining | Global RPA market projected at $4.2 billion in 2024; drives operational efficiency in high-volume claims. |

| Cloud Computing | Scalability, data accessibility, integration of acquisitions | Global cloud market projected over $1.3 trillion in 2024; essential for global operations and data management. |

| RegTech | Automated compliance monitoring, risk mitigation | RegTech market projected to reach $37.1 billion by 2027 (from $11.5 billion in 2022); vital for multi-jurisdictional compliance. |

Legal factors

Enstar navigates a complex web of insurance regulations across its global operations, spanning Bermuda, the United States, the United Kingdom, and the European Union. This necessitates constant adaptation to varying solvency, capital, and reporting mandates in each territory, a significant legal challenge.

The Bermuda Monetary Authority (BMA) and other national regulatory bodies maintain rigorous oversight, directly shaping Enstar's operational framework and compliance strategies. For instance, the Solvency II directive in the EU, implemented in 2016, significantly increased capital requirements for insurers, a trend that continues to influence global regulatory thinking.

Enstar Group's operations are significantly impacted by data privacy and protection laws, particularly concerning its handling of historical policyholder and claims data. Regulations like the General Data Protection Regulation (GDPR) in Europe and various state-level privacy laws in the United States impose strict requirements on data management. For instance, GDPR mandates specific rules for data retention, access controls, and security measures, which Enstar must meticulously adhere to. Failure to comply can lead to substantial fines; for example, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Enstar Group's operations are deeply intertwined with complex contractual obligations stemming from decades-old insurance and reinsurance policies within its run-off portfolios. Successfully managing these legacy contracts requires a sophisticated understanding of contract law.

The company frequently encounters and resolves legal disputes and litigation, particularly concerning long-tail liabilities like asbestos and environmental claims. For instance, in 2024, Enstar continued to actively manage a significant number of such legacy claims, demonstrating the ongoing nature of these legal challenges.

Expertise in contract law and robust litigation management are therefore critical capabilities for Enstar. This proficiency is essential for minimizing adverse financial development and securing favorable resolutions in these intricate legal matters.

Merger and Acquisition Legal Frameworks

Enstar Group's core operations in acquiring companies and portfolios are heavily shaped by intricate merger and acquisition (M&A) legal frameworks. These include rigorous antitrust reviews to prevent market monopolization, securing necessary shareholder approvals, and adhering to strict corporate governance standards. For instance, the 2024 acquisition by Sixth Street involved extensive legal due diligence, confirming Enstar's commitment to navigating these complexities. In 2023, the global M&A market saw significant activity, with deal volumes reaching trillions of dollars, underscoring the critical role of legal compliance for companies like Enstar.

Navigating these legal requirements is paramount for successful deal closure and integration. Specific legal considerations for Enstar include:

- Antitrust Compliance: Ensuring acquisitions do not violate competition laws, a process involving detailed analysis of market share and potential impacts.

- Shareholder Approvals: Obtaining consent from shareholders, often a lengthy process requiring transparent communication and adherence to disclosure regulations.

- Corporate Governance: Maintaining robust governance practices post-acquisition to ensure compliance with all relevant laws and ethical standards.

- Merger Agreement Adherence: Strictly following the terms and conditions stipulated in the definitive merger agreements, including representations, warranties, and closing conditions.

Cross-Border Legal Enforceability

Enstar Group's global operations necessitate a deep understanding of cross-border legal enforceability. The company frequently acquires portfolios with liabilities spanning multiple jurisdictions, requiring adherence to diverse legal frameworks. This complexity is particularly evident in managing international claims and reinsurance agreements, where Enstar must navigate differing national laws and dispute resolution mechanisms.

Enstar's ability to effectively enforce legal rights and obligations internationally is crucial for its business model. This involves a sophisticated approach to international private law and conflict of laws principles to ensure that claims are settled fairly and reinsurance recoveries are maximized. For instance, in 2024, the increasing volume of cross-border transactions in the insurance sector highlights the growing importance of robust legal enforcement capabilities.

- Jurisdictional Complexity: Enstar must navigate varying legal systems for claims and reinsurance across its acquired portfolios.

- International Private Law: Expertise in international private law is vital for enforcing contracts and resolving disputes across borders.

- Treaty Compliance: Adherence to bilateral treaties and international agreements ensures smoother cross-border operations and claim settlements.

- Regulatory Alignment: Keeping abreast of evolving international regulations impacting insurance and reinsurance is paramount for legal enforceability.

Enstar's legal landscape is defined by stringent insurance regulations across its global footprint, including Bermuda, the US, UK, and EU, demanding constant adaptation to solvency and reporting mandates. The company must also meticulously adhere to data protection laws like GDPR, with potential fines reaching up to 4% of global annual revenue for non-compliance, as seen in 2024 enforcement actions. Furthermore, Enstar's core business of acquiring portfolios necessitates navigating complex M&A legal frameworks, including antitrust reviews and shareholder approvals, as evidenced by the significant global M&A activity in 2023, which saw trillions in deal volumes.

| Legal Factor | Impact on Enstar | Key Considerations | Relevant Data/Examples |

|---|---|---|---|

| Regulatory Compliance | Navigating diverse global insurance regulations (e.g., Solvency II in EU) | Maintaining capital adequacy, reporting standards, solvency margins | EU Solvency II implemented 2016; ongoing regulatory updates in 2024 |

| Data Privacy | Adherence to GDPR, CCPA, and other privacy laws | Data handling, retention, security, consent management | GDPR fines up to 4% of global annual revenue; Enstar manages vast historical data |

| Contract Law | Managing legacy insurance and reinsurance contracts | Interpretation of terms, dispute resolution, enforceability | Enstar's business model relies on managing complex, long-term agreements |

| Litigation Management | Resolving legacy claims (e.g., asbestos, environmental) | Legal defense, settlement strategies, reserve adequacy | Active management of numerous legacy claims in 2024 |

| M&A Law | Executing acquisitions and portfolio transfers | Antitrust, shareholder approvals, corporate governance, merger agreements | Sixth Street acquisition in 2024; global M&A trillions in 2023 |

| Cross-Border Enforcement | Enforcing rights across multiple jurisdictions | International private law, conflict of laws, treaty compliance | Increasing cross-border transactions in insurance sector in 2024 |

Environmental factors

Climate change presents a significant risk to Enstar's long-tail liabilities, especially within its property, casualty, and health portfolios. Increasingly frequent and severe extreme weather events, such as hurricanes and floods, can lead to higher claim payouts. For instance, the NOAA reported 2023 saw 28 separate billion-dollar weather and climate disasters in the U.S., a new record, impacting insurance reserves.

While Enstar specializes in run-off portfolios, these climate-related exposures necessitate ongoing vigilance. The potential for climate-induced health issues, like respiratory problems exacerbated by poor air quality, also adds another layer of complexity to reserve adequacy. Enstar actively categorizes these risks into physical, transition, and liability categories to manage them effectively.

Growing investor demand for Environmental, Social, and Governance (ESG) compliant investments is significantly influencing Enstar's asset management strategy. In 2024, global sustainable investment assets reached an estimated $37.5 trillion, a figure expected to climb as more capital flows into ESG-focused funds.

Enstar is actively committed to enhancing the sustainability impact of its investment activities. This involves aligning its portfolio with responsible investing principles, a trend mirrored by a substantial portion of institutional investors who now integrate ESG factors into their decision-making processes. For instance, a 2025 survey indicated that over 70% of large pension funds consider ESG criteria.

This strategic focus on ESG can attract a broader base of institutional investors, thereby potentially enhancing long-term financial resilience and market positioning for Enstar. Companies demonstrating strong ESG performance have shown a tendency to outperform their peers, with some studies suggesting a correlation between higher ESG scores and better financial returns.

Even though Enstar Group focuses on legacy insurance portfolios and doesn't underwrite new business, it still manages historical liabilities that can involve environmental pollution claims. For instance, the insurance industry as a whole saw a significant increase in large-scale environmental claims in recent years, with some reports indicating a rise of over 20% in claims exceeding $100 million in the early 2020s, highlighting the potential scale of these risks.

Any perceived mishandling or insufficient resolution of these legacy environmental issues by Enstar could result in considerable reputational harm. A study by RepRisk in 2023 found that companies with poor environmental incident management faced an average stock price underperformance of 3-5% in the immediate aftermath of a negative event.

Therefore, Enstar's commitment to transparent and responsible management of these inherited environmental liabilities is paramount. This includes proactive engagement with regulators and affected communities, ensuring that past environmental issues are addressed effectively to safeguard the company's standing.

Environmental Reporting and Disclosure Requirements

Environmental reporting and disclosure requirements are becoming increasingly stringent, driven by both regulatory bodies and stakeholder expectations. Frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB) are setting new benchmarks for how companies, including Enstar Group, must communicate their environmental impact and climate-related risks. This evolving landscape directly influences Enstar's operational transparency and strategic planning.

Enstar Group actively addresses these demands by publishing annual ESG disclosures. These reports highlight the company's commitment to transparency concerning its environmental footprint and its strategies for managing climate-related risks. This proactive approach is crucial for maintaining investor confidence and meeting the growing demand for sustainable business practices.

- TCFD Adoption: Many companies are increasingly aligning their reporting with TCFD recommendations, which focus on governance, strategy, risk management, and metrics and targets related to climate change.

- SASB Standards: SASB provides industry-specific sustainability accounting standards, enabling companies to disclose financially material environmental, social, and governance information.

- ESG Reporting Growth: The global market for ESG reporting software and services was projected to reach approximately $2.2 billion in 2024, indicating a significant trend towards structured environmental disclosures.

Operational Environmental Footprint

Enstar Group, while primarily a service-based company, acknowledges its operational environmental footprint, largely stemming from energy use in its global offices and business travel. In 2023, for instance, the company reported a focus on enhancing energy efficiency across its facilities as a key environmental initiative.

The company actively pursues strategies to mitigate its impact, including optimizing energy consumption within its office spaces and encouraging more sustainable travel options for its employees. These initiatives are integral to Enstar's broader commitment to corporate social responsibility and achieving its sustainability targets.

Key areas of focus for reducing Enstar's environmental footprint include:

- Energy Efficiency: Implementing measures to reduce electricity and heating/cooling consumption in office buildings.

- Sustainable Travel: Promoting virtual meetings and encouraging lower-emission travel methods for business trips.

- Waste Reduction: Initiatives aimed at minimizing waste generated from operations.

Climate change poses significant risks to Enstar's legacy liabilities, with extreme weather events increasing claim payouts; the U.S. experienced a record 28 billion-dollar weather disasters in 2023, impacting insurance reserves.

Investor demand for ESG compliance is reshaping Enstar's asset management, with global sustainable investment assets estimated at $37.5 trillion in 2024, and over 70% of large pension funds considering ESG factors by 2025.

Enstar manages inherited environmental pollution claims, a sector that saw a rise in large-scale claims exceeding $100 million in the early 2020s, underscoring the potential scale of these risks.

Stringent environmental reporting, like TCFD and SASB, influences Enstar's transparency, with the ESG reporting software market projected to reach $2.2 billion in 2024, reflecting a growing need for structured environmental disclosures.

| Environmental Factor | Impact on Enstar | Supporting Data/Trend |

| Climate Change & Extreme Weather | Increased claim payouts on legacy liabilities | 28 billion-dollar weather disasters in U.S. in 2023 (NOAA) |

| ESG Investment Demand | Influences asset management strategy, attracts capital | $37.5 trillion in global sustainable investment assets (2024 est.); 70%+ pension funds consider ESG (2025 survey) |

| Legacy Environmental Claims | Potential for significant financial and reputational risk | Rise in claims >$100 million in early 2020s (industry reports) |

| Environmental Reporting Standards | Drives operational transparency and strategic planning | ESG reporting software market to reach $2.2 billion (2024 projection) |

PESTLE Analysis Data Sources

Our Enstar Group PESTLE Analysis is built on a robust foundation of data from leading financial news outlets, regulatory filings, and industry-specific market research reports. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends to provide a comprehensive overview.