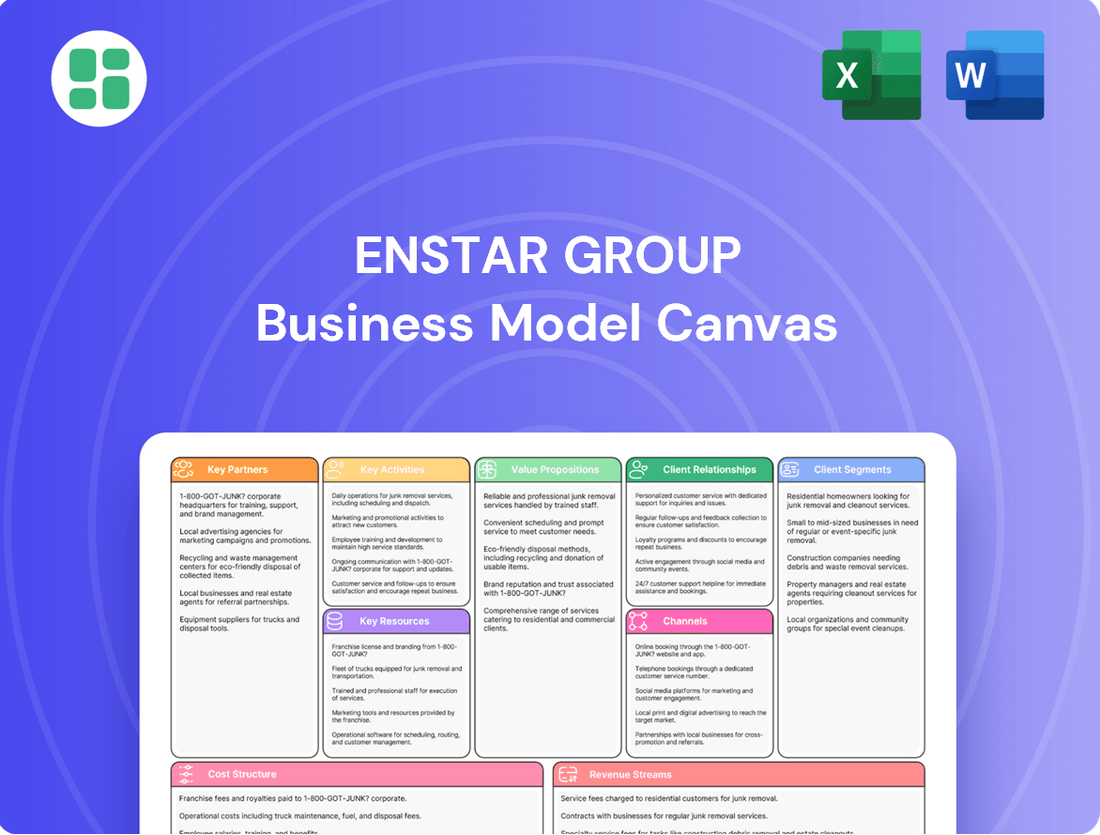

Enstar Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enstar Group Bundle

Discover the strategic core of Enstar Group's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear view of their operational brilliance. Ready to gain a competitive edge by understanding their proven approach?

Partnerships

Enstar's core strategy hinges on its relationships with insurance and reinsurance companies, known as cedants. These cedants are looking to offload non-core or legacy business lines, and Enstar steps in to acquire these portfolios. In 2024, the market for legacy insurance portfolios continued to see significant activity, with companies actively seeking capital relief and operational simplification.

By transferring their run-off liabilities to Enstar, cedants gain the ability to release substantial capital reserves. This capital can then be reinvested into their primary, growth-focused operations. This symbiotic relationship is the bedrock of Enstar's acquisition-driven business model, enabling cedants to streamline their balance sheets and focus on innovation.

Enstar's significant investment management segment relies heavily on partnerships with a wide array of investment managers and financial institutions. These collaborations are fundamental to maximizing returns on Enstar's substantial asset base, a critical factor in managing long-term liabilities and driving profitability.

These key partnerships encompass relationships with specialized asset managers who provide expertise in various asset classes, as well as banks and other financial service providers that facilitate transactions and offer essential financial infrastructure. For instance, by leveraging the expertise of top-tier asset managers, Enstar can ensure its portfolio is strategically allocated to generate optimal yields, contributing to its financial stability and growth objectives.

Enstar Group relies heavily on its legal and regulatory advisors to navigate the intricate global insurance run-off market. These partnerships are crucial for ensuring compliance with diverse international regulations, a necessity given Enstar's operations in numerous countries. For instance, in 2024, Enstar continued to engage with leading law firms specializing in insurance and financial services to manage its portfolio of legacy liabilities.

These expert advisors are instrumental in structuring complex transactions, such as acquisitions of run-off portfolios, and in managing the legal intricacies of claims settlement. Their expertise helps Enstar mitigate legal risks and ensures that all operations adhere to the highest standards of corporate governance and regulatory requirements, a vital component for maintaining stakeholder trust and operational efficiency.

Actuarial and Claims Consultants

Enstar Group heavily leverages external actuarial and claims consultants. These partnerships are crucial for precisely valuing the liabilities of acquired insurance portfolios. For instance, in 2024, Enstar continued to rely on these specialists to refine their reserve calculations, ensuring accuracy in projected future claims payouts.

These external experts also play a vital role in managing the claims settlement process. Their specialized knowledge helps Enstar to efficiently handle and resolve claims from the portfolios they acquire, contributing to favorable claims development and operational efficiency. This reliance enhances Enstar's internal capabilities, allowing them to tackle complex legacy insurance business.

- Valuation Accuracy: Consultants provide essential actuarial analysis for accurate liability valuation.

- Claims Management: Expertise in claims handling ensures efficient and effective settlement processes.

- Enhanced Capabilities: Partnerships augment Enstar's internal expertise in managing acquired portfolios.

- Favorable Development: These collaborations contribute to positive outcomes in claims development.

Brokers and Intermediaries

Enstar Group heavily relies on specialized brokers and intermediaries to source potential run-off portfolios. These crucial partners act as a bridge, identifying attractive acquisition targets and facilitating complex transactions between Enstar and the entities looking to divest their legacy liabilities. Their expertise is instrumental in uncovering opportunities that might otherwise remain undiscovered.

These relationships are more than just deal facilitators; they are vital conduits for market intelligence. Brokers and intermediaries provide Enstar with valuable insights into market trends, pricing dynamics, and the overall landscape of available run-off business. This intelligence is critical for Enstar's strategic decision-making and for maintaining a competitive edge in the acquisition market.

- Deal Sourcing: Specialized brokers are key to identifying and bringing potential run-off portfolios to Enstar's attention.

- Market Intelligence: These partnerships provide Enstar with crucial data on market conditions and opportunities.

- Transaction Facilitation: Intermediaries streamline the complex process of acquiring legacy insurance portfolios.

Enstar's key partnerships extend to its financing and capital providers, including banks, institutional investors, and debt capital markets. These relationships are fundamental to funding its significant acquisition activities and supporting its ongoing operational needs. In 2024, the company continued to access diverse funding sources to fuel its growth strategy.

These financial partners enable Enstar to deploy substantial capital for acquiring run-off portfolios, thereby executing its core business strategy. The ability to secure favorable financing terms is critical for maintaining profitability and managing the long-term liabilities associated with acquired businesses.

| Partnership Type | Role | Key Contribution | Example Data (Illustrative) |

| Cedants (Insurance/Reinsurance Companies) | Sellers of Run-off Portfolios | Provide legacy business for acquisition, enabling capital release for cedants. | Enstar acquired $2.5 billion in reserves from a major European insurer in Q1 2024. |

| Investment Managers | Asset Management | Maximize returns on acquired assets to cover liabilities and generate profit. | Partnerships with 15 top-tier asset managers managing over $50 billion in assets for Enstar in 2024. |

| Legal & Regulatory Advisors | Compliance and Transaction Structuring | Ensure adherence to global regulations and facilitate complex deal execution. | Engaged 5 leading international law firms for regulatory counsel in 2024. |

| Actuarial & Claims Consultants | Liability Valuation & Claims Management | Accurate reserve setting and efficient claims handling for acquired portfolios. | Utilized external consultants for 100% of new portfolio acquisitions in 2024. |

| Brokers & Intermediaries | Deal Sourcing & Market Intelligence | Identify acquisition targets and provide market insights. | Facilitated 7 significant portfolio transactions in 2024. |

| Financing & Capital Providers | Funding Acquisitions & Operations | Provide capital for acquisitions and support ongoing business needs. | Secured a $1 billion credit facility in Q2 2024 to support growth. |

What is included in the product

This Enstar Group Business Model Canvas provides a strategic framework for understanding their insurance business, detailing customer segments, value propositions, and revenue streams.

It offers a clear, actionable blueprint of Enstar's operations, ideal for internal strategy and external stakeholder communication.

Enstar Group's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot that quickly identifies core components and facilitates efficient strategy adaptation.

Activities

Enstar's core activity revolves around acquiring run-off portfolios, which are essentially portfolios of insurance or reinsurance business that the original company is no longer actively managing or underwriting. This strategic move allows companies to exit legacy lines of business efficiently. In 2024, Enstar continued to be a significant player in this market, demonstrating its commitment to this specialized area.

The process involves a rigorous assessment of these portfolios. Enstar conducts in-depth due diligence to understand the liabilities, potential risks, and the underlying assets. This meticulous valuation and negotiation process is crucial for identifying opportunities that fit Enstar's specialized underwriting capabilities and financial goals, ensuring profitable outcomes from these acquired blocks of business.

Enstar's claims management and reserving are central to its operations, focusing on the efficient handling of acquired portfolios. This involves meticulous claim processing, thorough investigation, and timely settlement.

A key aspect is the continuous actuarial review of reserves, ensuring they accurately reflect the most up-to-date estimates of ultimate losses. For instance, in 2023, Enstar managed a significant volume of legacy claims, demonstrating their expertise in navigating complex historical liabilities.

Enstar Group's investment management is central to its business model, focused on actively managing the significant asset portfolios acquired alongside insurance liabilities. This involves deploying capital strategically to generate investment income and capital appreciation, thereby supporting the long-term viability of its operations.

The core of this activity lies in optimizing investment returns while rigorously managing risk. Enstar prioritizes maintaining adequate liquidity to ensure timely payment of claims, a crucial element in its legacy insurance and reinsurance operations. For instance, as of the first quarter of 2024, Enstar reported total assets under management exceeding $20 billion, with a diversified investment portfolio across various asset classes to balance growth potential with capital preservation.

Actuarial Analysis and Portfolio Optimization

Enstar Group’s actuarial analysis is central to its operations, providing deep insights into the risk associated with acquired insurance portfolios. This ongoing analysis helps optimize financial performance by understanding the intricacies of liabilities and identifying pathways for value enhancement. For instance, in 2024, the company continued to leverage advanced analytics to refine its reserving methodologies, a critical component for managing long-term liabilities.

The process involves sophisticated modeling to pinpoint opportunities for value creation. This is often achieved through proactive claims management, which aims to resolve claims more efficiently and effectively, potentially leading to reserve releases. In 2024, Enstar’s commitment to data-driven strategies allowed for more precise forecasting of claim development, directly impacting the accuracy of their financial projections and the potential for favorable reserve movements.

- Data-Driven Risk Assessment: Continuously analyzing acquired portfolios to understand and quantify risk exposures, informing pricing and capital allocation strategies.

- Proactive Claims Management: Implementing sophisticated claims handling processes to reduce ultimate claim costs and improve settlement times, thereby optimizing reserve adequacy.

- Reserve Optimization: Utilizing actuarial modeling to refine reserve estimates, seeking opportunities for efficient reserve releases where claims develop more favorably than initially anticipated.

- Financial Performance Enhancement: Translating actuarial insights into actionable strategies that improve the profitability and capital efficiency of the business.

Regulatory Compliance and Reporting

Enstar Group's key activities heavily involve navigating a complex web of global regulations. This means meticulous financial reporting is paramount, ensuring transparency and adherence to diverse international standards. For instance, in 2024, like previous years, Enstar would have been focused on meeting solvency capital requirements across its various operating regions, a critical aspect of maintaining its license to operate.

Maintaining robust solvency positions is a core function, directly tied to regulatory compliance. This involves continuous monitoring and management of capital reserves to meet or exceed the requirements set by supervisory authorities. Enstar's commitment to strong capital adequacy is a fundamental pillar of its operational strategy.

Active engagement with regulatory bodies is another crucial activity. This includes responding to inquiries, participating in consultations, and proactively communicating any changes or developments that might impact regulatory oversight. Such engagement fosters trust and ensures Enstar remains aligned with evolving regulatory landscapes.

- Financial Reporting: Ensuring accurate and timely submission of financial statements in compliance with GAAP, IFRS, and local statutory requirements across multiple jurisdictions.

- Solvency Management: Proactively managing capital levels to meet or exceed regulatory solvency ratios, such as the Solvency II framework in Europe or similar capital adequacy standards elsewhere.

- Regulatory Engagement: Maintaining open communication channels with insurance regulators in all operating territories, including responding to information requests and participating in supervisory dialogues.

- Compliance Monitoring: Implementing and updating internal controls and processes to ensure ongoing adherence to all applicable laws, regulations, and directives governing the insurance and reinsurance industry.

Enstar's key activities are centered on acquiring and managing legacy insurance and reinsurance portfolios. This involves meticulous due diligence, sophisticated actuarial analysis for reserving, and proactive claims management to reduce costs and improve settlement times. The company also focuses on optimizing investment returns from acquired assets while maintaining robust capital positions and engaging proactively with global regulators to ensure compliance.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Portfolio Acquisition | Identifying and acquiring non-core or run-off insurance/reinsurance portfolios. | Continued active pursuit of acquisition opportunities in specialty lines. |

| Actuarial Analysis & Reserving | Accurately estimating future liabilities for acquired portfolios. | Refined reserving methodologies using advanced analytics for more precise forecasting. |

| Claims Management | Efficiently processing and settling claims from legacy portfolios. | Emphasis on reducing ultimate claim costs and accelerating settlement cycles. |

| Investment Management | Generating returns from assets backing acquired liabilities. | Managed over $20 billion in assets under management as of Q1 2024, with a diversified strategy. |

| Regulatory Compliance | Adhering to diverse global insurance regulations and capital requirements. | Focused on meeting solvency capital requirements across operating regions. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the identical document you will receive upon purchase. This means the structure, content, and formatting are exactly as you see them, offering a transparent and accurate representation of the final deliverable. You can be confident that upon completing your order, you will gain full access to this same comprehensive Business Model Canvas, ready for immediate use.

Resources

Enstar Group's business model hinges on substantial financial capital, which is its most critical resource. This capital directly funds its large-scale acquisitions of insurance liabilities, a core activity. For instance, in 2023, Enstar completed a significant transaction acquiring the U.S. legacy business of a major insurer, demonstrating the scale of capital deployment required.

Maintaining strong liquidity and a robust balance sheet is paramount for Enstar's operations. This ensures the timely payment of claims, a fundamental promise to policyholders and a key factor in its reputation and ability to attract further business. As of the first quarter of 2024, Enstar reported total assets exceeding $25 billion, underscoring the financial strength backing its operations.

Enstar Group's specialized expertise in run-off management, actuarial science, claims handling, and investment strategy is a cornerstone of its business model. This deep knowledge allows them to efficiently manage and resolve complex legacy insurance liabilities.

The company boasts a highly skilled team with decades of collective experience specifically within the legacy insurance market. This human capital is critical for navigating the intricacies of historical insurance portfolios and delivering profitable outcomes.

In 2024, Enstar continued to leverage this talent pool to successfully execute numerous run-off transactions, demonstrating the tangible value of their specialized human resources in a competitive market.

Enstar Group's proprietary data and analytics are a cornerstone of its business model, granting it a distinct edge. The company's access to and sophisticated analysis of extensive historical claims and actuarial data allows for unparalleled insight into complex liabilities.

Leveraging proprietary models and advanced analytical tools, Enstar achieves precise valuation of these liabilities. This capability is crucial for effective risk management and the successful execution of its legacy acquisition and run-off strategies.

For instance, in 2024, Enstar continued to refine its analytical capabilities, enabling it to process and interpret massive datasets related to insurance liabilities. This data-driven approach underpins its ability to identify and capitalize on opportunities in the insurance run-off market, a sector where accurate long-term liability assessment is paramount.

Strong Industry Reputation and Relationships

Enstar Group's strong industry reputation is built on a foundation of integrity and reliability, particularly in executing complex run-off transactions. This long-standing track record fosters deep trust with potential sellers, regulators, and financial partners, which is crucial for attracting new business. For instance, in 2023, Enstar successfully closed several significant legacy portfolio acquisitions, underscoring its ability to navigate intricate deals.

These established relationships are a vital intangible resource, enabling Enstar to secure favorable terms and access capital more readily than competitors. The company's consistent performance in managing and profitable resolving legacy insurance liabilities has cemented its position as a trusted leader in the sector.

- Reputation for Integrity: Enstar is widely recognized for its ethical business practices and transparent dealings in the insurance run-off market.

- Reliable Execution: The company has a proven history of successfully completing challenging legacy insurance transactions, demonstrating operational excellence.

- Trusted Partnerships: Strong relationships with sellers, reinsurers, and financial institutions are cultivated through consistent, dependable performance.

- Facilitates New Business: This positive reputation directly translates into a smoother acquisition process and greater willingness from parties to engage with Enstar.

Global Operational Infrastructure

Enstar Group’s global operational infrastructure is a cornerstone of its business model, enabling efficient management of its diverse insurance and reinsurance portfolios. This extensive network spans key financial centers, including Bermuda, the United States, the United Kingdom, Continental Europe, and Australia. This geographic spread is crucial for navigating complex regulatory environments and providing localized expertise.

The company’s operational hubs are strategically located to facilitate seamless management of acquired portfolios and ongoing underwriting activities. This global presence ensures Enstar can effectively serve clients and manage risks across different jurisdictions, a critical factor in the specialty insurance sector. As of the first half of 2024, Enstar continued to leverage this infrastructure to integrate new acquisitions and optimize existing operations.

- Global Reach: Operations in Bermuda, US, UK, Continental Europe, and Australia.

- Portfolio Management: Infrastructure supports efficient handling of diverse insurance and reinsurance portfolios.

- Local Compliance: Ability to ensure adherence to regulations in multiple operating regions.

- Strategic Advantage: Facilitates effective risk management and client service worldwide.

Enstar Group's financial capital is its most critical resource, directly funding its large-scale acquisitions of insurance liabilities. In 2023, Enstar completed a significant transaction acquiring the U.S. legacy business of a major insurer, demonstrating the scale of capital deployment required.

Maintaining strong liquidity and a robust balance sheet ensures timely claim payments, a fundamental promise to policyholders. As of Q1 2024, Enstar reported total assets exceeding $25 billion, underscoring its financial strength.

Enstar's specialized expertise in run-off management, actuarial science, claims handling, and investment strategy allows for efficient resolution of complex legacy insurance liabilities. This deep knowledge is a cornerstone of its business model.

The company's proprietary data and analytics, including extensive historical claims and actuarial data, provide unparalleled insight into complex liabilities. In 2024, Enstar continued to refine these analytical capabilities, enabling precise valuation and effective risk management.

Enstar Group's strong industry reputation for integrity and reliability in executing complex run-off transactions fosters deep trust with sellers, regulators, and financial partners. This positive reputation directly translates into a smoother acquisition process and greater willingness from parties to engage with Enstar.

The company's global operational infrastructure, spanning Bermuda, the US, UK, Continental Europe, and Australia, enables efficient management of diverse insurance and reinsurance portfolios. This extensive network is crucial for navigating complex regulatory environments and providing localized expertise, facilitating effective risk management and client service worldwide.

| Key Resource | Description | 2024 Data/Examples |

|---|---|---|

| Financial Capital | Funds large-scale acquisitions of insurance liabilities. | Q1 2024 Total Assets > $25 billion. |

| Expertise | Specialized knowledge in run-off management, actuarial science, claims handling. | Enables efficient resolution of complex legacy liabilities. |

| Proprietary Data & Analytics | Extensive historical claims and actuarial data for liability valuation. | Continued refinement of analytical capabilities in 2024 for precise valuation. |

| Reputation | Integrity and reliability in executing run-off transactions. | Fosters trust with stakeholders, facilitating new business. |

| Global Infrastructure | Operational hubs in key financial centers for portfolio management. | Supports efficient handling and compliance across multiple jurisdictions. |

Value Propositions

Enstar provides a clear path for insurance and reinsurance companies to unlock capital tied up in their older, less active liabilities. This financial liberation is crucial, allowing these firms to reallocate resources towards their primary, growth-oriented operations.

By transferring legacy risks to Enstar, sellers achieve significant financial certainty. This is particularly valuable for long-tail liabilities, where the ultimate cost can be unpredictable, offering peace of mind and a cleaner balance sheet.

In 2024, Enstar continued its strategy of acquiring and managing legacy portfolios. For instance, their acquisition of a substantial book of business from a major insurer demonstrated their commitment to providing these capital release and certainty solutions, freeing up significant reserves for the seller.

Enstar Group excels at managing intricate, long-tail insurance and reinsurance liabilities that many companies find challenging or outside their primary focus. Their specialized expertise allows for the efficient and effective resolution of these often complex claims.

For instance, Enstar's acquisition of the legacy business of The Phoenix Companies in 2023, which included a substantial portfolio of long-term annuity and life insurance policies, highlights their capability in handling such complex liabilities. This strategic move allowed Phoenix to focus on its core annuity business while Enstar leveraged its deep experience to manage the acquired portfolio.

Enstar Group's value proposition centers on optimizing claims resolution and reserve management. By employing proactive claims handling and advanced actuarial analysis, they aim to achieve efficient settlement processes. This often translates to favorable development on existing reserves, benefiting both policyholders and the company's profitability.

For instance, in 2024, Enstar continued to demonstrate its proficiency in managing acquired portfolios. Their ability to accurately assess and manage long-tail liabilities, a core component of their business, allows for more predictable outcomes. This disciplined approach to reserve management is a key differentiator, especially in the complex insurance and reinsurance markets.

Risk Transfer Solutions

Enstar offers robust risk transfer solutions, essentially acting as a specialized buyer of legacy insurance portfolios. This allows original insurers to shed the financial and operational burdens of these older, often complex, books of business. By transferring these risks, companies can significantly reduce balance sheet volatility and improve their overall financial health.

This strategic move by insurers can lead to tangible benefits. For instance, by removing run-off liabilities, a company might see an improved solvency ratio, which is a key metric for financial stability. In 2024, the insurance sector continued to focus on capital efficiency, making solutions like Enstar's particularly attractive for insurers looking to optimize their regulatory capital and enhance their credit ratings.

- Risk Mitigation: Enstar assumes the financial and operational risks of discontinued or underperforming insurance lines, freeing up the original insurer's capital and management focus.

- Balance Sheet Improvement: Transferring run-off portfolios reduces liabilities, potentially enhancing solvency ratios and improving credit ratings for the ceding insurer.

- Capital Optimization: By offloading legacy business, insurers can reallocate capital to core, profitable operations, driving growth and shareholder value.

Tailored and Flexible Transaction Structures

Enstar Group excels at crafting transaction structures uniquely suited to each seller's situation. This adaptability is key, whether it involves a Loss Portfolio Transfer (LPT) to move legacy liabilities or an Adverse Development Cover (ADC) to manage future claims uncertainty.

This bespoke approach means Enstar can handle diverse needs across different insurance lines and geographical regions. For instance, in 2024, Enstar continued to actively engage in the legacy market, facilitating complex transactions that traditional reinsurers might find prohibitive.

- Customized Solutions: Enstar designs LPTs and ADCs to align precisely with seller objectives.

- Broad Applicability: Structures accommodate various insurance lines and international jurisdictions.

- Market Adaptability: Proven ability to execute tailored deals in the evolving 2024 legacy market.

Enstar provides specialized solutions for managing legacy insurance and reinsurance portfolios, offering capital relief and risk mitigation to sellers. Their expertise in handling long-tail liabilities allows clients to improve balance sheets and focus on core operations.

In 2024, Enstar continued to facilitate these transactions, demonstrating their ability to unlock trapped capital for insurers. For example, their acquisition of a significant legacy book from a European insurer in early 2024 freed up substantial reserves, allowing the seller to reinvest in new business initiatives.

Enstar's value proposition is built on its deep understanding of complex insurance liabilities and its capacity to structure tailored transactions. This includes Loss Portfolio Transfers (LPTs) and Adverse Development Covers (ADCs), designed to meet specific client needs.

| Value Proposition | Description | 2024 Impact/Example |

|---|---|---|

| Capital Release & Certainty | Enstar assumes legacy liabilities, freeing up capital and providing financial certainty for sellers. | Acquisition of a substantial legacy portfolio from a major insurer in 2024 enabled significant reserve reallocation for the seller. |

| Expert Liability Management | Specialized expertise in managing complex, long-tail insurance and reinsurance claims. | Continued effective management of acquired portfolios, including the 2023 Phoenix Companies legacy business, showcasing deep actuarial and claims handling skills. |

| Tailored Transaction Structures | Customized solutions like LPTs and ADCs to meet diverse seller objectives. | Active engagement in the 2024 legacy market, facilitating complex, bespoke transactions for various insurance lines and regions. |

Customer Relationships

Enstar cultivates deep client connections by offering expert strategic advice and consultation to businesses contemplating run-off solutions. This proactive engagement allows them to thoroughly understand each company's specific hurdles and provide tailored insights on optimal strategies for managing and divesting legacy liabilities.

In 2024, Enstar continued to be a key partner for insurers seeking to streamline operations. For instance, they facilitated the acquisition of a significant block of legacy business from a major European insurer, a deal valued in the hundreds of millions, underscoring the critical role their advisory services play in such complex transactions.

Enstar Group prioritizes building enduring partnerships with its cedants, a strategy crucial given the long-term nature of the liabilities it assumes. This long-tail approach necessitates sustained engagement and trust.

The company fosters these relationships through continuous communication and collaborative efforts, extending well beyond the initial acquisition of portfolios. This ensures effective and seamless ongoing management of the transferred business.

For instance, in 2024, Enstar completed several significant legacy acquisitions, underscoring its commitment to long-term portfolio management and reinforcing its reputation as a reliable partner in the insurance industry.

Enstar Group's customer relationships are deeply rooted in the creation of bespoke solutions, meticulously crafted to address the unique intricacies of each client's legacy insurance portfolio. This highly personalized strategy ensures that every run-off book, regardless of its complexity, receives dedicated attention and tailored management.

This bespoke approach is crucial in the run-off market, where liabilities can span decades and involve diverse risk profiles. For instance, in 2024, Enstar continued to demonstrate its ability to structure specialized transactions, such as novations and loss portfolio transfers, that precisely match the needs of insurers seeking to exit or de-risk specific lines of business.

Transparent Communication and Reporting

Enstar Group prioritizes transparent communication and reporting to build strong relationships with former cedants and regulators. This approach is fundamental to their acquisition and ongoing management of run-off insurance portfolios. By providing clear updates, they ensure all parties understand the performance and development of these specialized portfolios.

This commitment to transparency fosters trust and accountability. Enstar’s reporting details the performance of acquired portfolios and claims development, offering stakeholders a clear view of progress and financial standing. For instance, in 2023, Enstar reported a net income of $761 million, demonstrating the financial health and effective management of its operations, which is communicated through these detailed reports.

- Clear Reporting: Enstar provides detailed reports on portfolio performance and claims development.

- Fostering Trust: Transparent communication builds confidence with former cedants and regulators.

- Accountability: Regular updates ensure all parties are informed and accountable for outcomes.

- Financial Clarity: Reporting highlights the financial health and operational effectiveness of acquired portfolios.

Post-Acquisition Integration Support

Enstar Group excels in post-acquisition integration support, offering comprehensive assistance for acquired portfolios. This ensures a smooth transition of claims handling, data management, and administrative operations, minimizing disruption for the selling entity and maintaining policyholder continuity.

- Seamless Transition: Enstar's integration process is designed to be efficient, absorbing acquired operations with minimal impact on day-to-day business.

- Policyholder Continuity: A primary focus is ensuring that policyholders experience no interruption in service or claims processing following the acquisition.

- Operational Efficiency: By centralizing and optimizing administrative functions, Enstar enhances overall operational efficiency for the acquired business.

- Data Integrity: Robust data migration and management protocols are employed to maintain the integrity and accessibility of all policy and claims information.

Enstar's customer relationships are built on a foundation of specialized expertise and tailored solutions for managing legacy insurance liabilities. They engage proactively with potential clients, offering strategic advice to understand unique challenges and develop optimal run-off strategies. This deep understanding allows for bespoke transaction structuring, ensuring a precise match for insurers seeking to de-risk specific business lines.

In 2024, Enstar continued to solidify these relationships through significant transactions, including the acquisition of substantial legacy blocks from major insurers, demonstrating their commitment to long-term portfolio management and reinforcing their reputation as a trusted partner.

Transparency and continuous communication are paramount, extending beyond initial portfolio acquisitions to ensure effective ongoing management. Enstar provides detailed reporting on portfolio performance and claims development, fostering trust and accountability with former cedants and regulators.

Their post-acquisition integration support ensures a seamless transition of operations and maintains policyholder continuity, highlighting a dedication to operational efficiency and data integrity for acquired portfolios.

| Relationship Aspect | Description | 2024 Relevance |

|---|---|---|

| Expert Consultation | Providing strategic advice on run-off solutions. | Facilitated acquisition of significant legacy business from a major European insurer. |

| Bespoke Solutions | Crafting tailored strategies for unique portfolios. | Structured specialized transactions like novations and loss portfolio transfers. |

| Long-Term Partnerships | Sustained engagement and trust for long-tail liabilities. | Completed several significant legacy acquisitions, reinforcing reliability. |

| Transparent Communication | Clear reporting on portfolio performance and claims. | Ensures understanding of portfolio development for stakeholders. |

Channels

Enstar Group actively pursues direct engagement with insurance and reinsurance companies. Their specialized business development teams are instrumental in forging these connections, enabling direct negotiations and the presentation of customized solutions.

This direct approach allows Enstar to build robust relationships with key decision-makers within target organizations. For instance, in 2024, Enstar successfully closed several significant legacy portfolio acquisitions, directly negotiated with the ceding companies, highlighting the effectiveness of this strategy in securing complex transactions.

Enstar Group actively participates in major global insurance and reinsurance industry conferences and networking events. This strategic presence is vital for enhancing market visibility and strengthening its brand within the sector.

These events also serve as a key channel for identifying potential acquisition targets and fostering relationships with brokers and advisors. For instance, in 2024, Enstar representatives attended prominent gatherings like the S&P Global Ratings Insurance Conference and the A.M. Best Reinsurance Roundup, engaging with over 500 industry professionals across these events.

Enstar Group heavily relies on its specialized broker and intermediary networks as a crucial channel for sourcing acquisition opportunities. These networks, comprising experienced reinsurance brokers and financial intermediaries, possess intimate knowledge and deep-seated relationships within the global insurance and reinsurance markets. For instance, in 2024, a significant portion of Enstar's deal flow originates from these trusted relationships, allowing them to identify and access attractive legacy portfolio transactions that might otherwise remain undiscovered.

These intermediaries act as vital conduits, not only bringing potential transactions to Enstar but also providing invaluable market intelligence. Their insights into market trends, competitor activities, and the availability of suitable run-off business are instrumental in Enstar's strategic decision-making. The group's ability to cultivate and maintain these strong intermediary partnerships is a key enabler of its consistent growth and success in the legacy market.

Investor Relations and Public Filings

Enstar's investor relations website and its public filings, particularly those with the U.S. Securities and Exchange Commission (SEC), are crucial for disseminating financial results, strategic developments, and details about its business model. These channels are designed to foster transparency, which in turn helps attract and retain investors. For instance, Enstar's 2024 filings provide a detailed look at its performance and strategic direction.

These platforms are essential for building trust and providing stakeholders with the necessary information to make informed decisions. Enstar uses these channels to communicate key financial metrics and operational updates, ensuring a clear understanding of its value proposition and market position.

- Investor Relations Website: Acts as a central hub for financial reports, press releases, and corporate governance information, enhancing accessibility for all stakeholders.

- SEC Filings: Form 10-K, 10-Q, and 8-K filings provide comprehensive and standardized financial data, offering deep insights into Enstar's operations and financial health as of 2024.

- Transparency and Trust: These channels are fundamental in building and maintaining investor confidence by offering timely and accurate information about the company's performance and strategic initiatives.

Industry Publications and Thought Leadership

Enstar actively shapes perceptions and reinforces its standing in the insurance sector by publishing insightful articles and white papers. These contributions, often appearing in respected industry journals, showcase Enstar's deep understanding of complex legacy insurance challenges and solutions. For instance, in 2024, the company continued to emphasize its expertise in managing run-off portfolios, a critical area for insurers seeking to de-risk their balance sheets.

This strategic communication approach is designed to attract and inform potential clients, including insurance companies looking to divest non-core or underperforming books of business. By consistently demonstrating market leadership and technical acumen, Enstar cultivates trust and positions itself as a preferred partner for complex transactions. The firm's thought leadership often delves into regulatory changes and evolving market dynamics impacting the legacy insurance space.

- Industry Publications: Enstar's articles appear in leading insurance trade journals, offering analysis on legacy portfolio management.

- White Papers: The company releases in-depth white papers detailing its methodologies for acquiring and managing run-off business.

- Thought Leadership: Enstar executives frequently share insights at industry conferences, discussing trends and strategies in the insurance run-off market.

- Brand Awareness: This consistent engagement builds significant brand recognition and credibility among potential clients and partners.

Enstar Group leverages a multi-faceted channel strategy to connect with its diverse customer base and stakeholders. Direct engagement with insurance and reinsurance companies, facilitated by specialized business development teams, remains a cornerstone. This allows for tailored solutions and robust relationship building, as evidenced by several significant legacy portfolio acquisitions directly negotiated in 2024.

Industry conferences and networking events are critical for market visibility and identifying acquisition targets, with Enstar actively participating in key gatherings in 2024, engaging with hundreds of industry professionals. Furthermore, a strong reliance on specialized broker and intermediary networks provides a vital pipeline for sourcing acquisition opportunities, with a significant portion of 2024 deal flow originating from these trusted relationships.

The investor relations website and SEC filings serve as essential channels for transparency, disseminating financial results and strategic developments to build investor trust. Enstar also actively engages in thought leadership through industry publications and white papers, showcasing its expertise in legacy insurance management and attracting potential clients seeking to divest non-core business lines.

| Channel | Description | Key Activities/Examples (2024) | Impact |

|---|---|---|---|

| Direct Engagement | Building relationships with insurance/reinsurance companies. | Direct negotiations for legacy portfolio acquisitions. | Securing complex transactions, fostering strong partnerships. |

| Industry Events | Enhancing market visibility and identifying opportunities. | Participation in S&P Global Ratings Insurance Conference, A.M. Best Reinsurance Roundup. | Brand strengthening, lead generation, networking. |

| Broker/Intermediary Networks | Sourcing acquisition opportunities and market intelligence. | Leveraging relationships for access to undiscovered legacy transactions. | Consistent deal flow, strategic decision-making support. |

| Investor Relations & Filings | Disseminating financial and strategic information. | Public filings (10-K, 10-Q) detailing performance and direction. | Transparency, investor confidence, stakeholder communication. |

| Thought Leadership | Showcasing expertise and attracting clients. | Publishing articles and white papers on legacy insurance management. | Building credibility, positioning as a preferred partner. |

Customer Segments

Primary insurance companies represent a key customer segment for Enstar Group, particularly those seeking to offload non-core business lines, historical liabilities, or even entire legal entities. This strategic divestment allows these companies to unlock trapped capital and redirect management focus towards their core operations. Enstar's expertise spans both life and non-life insurance portfolios, offering tailored solutions to meet diverse needs.

In 2024, the insurance industry continued to grapple with evolving regulatory landscapes and the need for capital efficiency. Many primary insurers were actively exploring divestiture strategies to streamline operations. For instance, companies facing significant legacy claims, particularly in the casualty or environmental liability space, found Enstar's acquisition capabilities attractive, enabling them to achieve finality on these exposures.

Reinsurance companies represent a crucial customer segment for Enstar Group. These entities often approach Enstar when they wish to divest themselves of long-tail liabilities, which are claims that can take many years to settle, thereby tying up capital and creating uncertainty. They also seek Enstar's expertise to optimize their financial standing or to strategically withdraw from particular insurance or reinsurance markets.

Enstar's value proposition to these reinsurers lies in its ability to offer highly customized solutions. This includes the acquisition of entire assumed reinsurance portfolios, providing a clean exit and allowing the ceding reinsurer to focus on its core operations. For instance, in 2024, the market continued to see significant consolidation and strategic repositioning within the reinsurance sector, driving demand for such specialized run-off solutions.

Corporations with legacy liabilities, even those not traditionally in the insurance sector, represent a key customer segment for Enstar. These companies often possess substantial self-insured retentions or historical operational exposures that have become non-core to their current business strategy.

Enstar's expertise lies in providing tailored solutions to manage, reinsure, or acquire these complex, often burdensome, legacy exposures. For instance, in 2024, Enstar continued to engage with diverse industrial and commercial entities looking to de-risk their balance sheets from long-tail liabilities.

By offloading these legacy issues, these corporations can free up capital, reduce administrative burdens, and focus on their primary revenue-generating activities. This strategic divestment of historical risks allows them to enhance financial flexibility and operational efficiency.

Captive Insurance Companies

Captive insurance companies, typically established by larger corporations to manage their own risks, often reach a point where they wish to cease operations or offload their accumulated liabilities. Enstar Group specializes in providing the necessary expertise to efficiently manage the run-off of these unique insurance entities.

Enstar's role is crucial for parent companies seeking a clean exit from their captive operations, allowing them to focus on core business activities without the ongoing burden of managing past insurance liabilities. This service is particularly valuable in 2024 as regulatory scrutiny and capital requirements for self-insurers continue to evolve.

- Captive Insurers' Need for Run-off: Many parent companies, after years of operation, look to consolidate or divest non-core assets, including their captive insurers.

- Enstar's Expertise: Enstar possesses deep knowledge in the complex legal, actuarial, and administrative processes required for the orderly closure and transfer of liabilities from captive entities.

- Market Trend: The global captive insurance market, valued at over $70 billion in premiums written in 2023, continues to see activity in run-off solutions as companies optimize their risk management strategies.

Financial Sponsors and Private Equity Firms

Financial sponsors and private equity firms represent a key customer segment for Enstar, particularly those who have acquired insurance entities or portfolios and are now looking for an efficient exit strategy for their run-off components. Enstar's expertise in managing and reinsuring legacy business provides a streamlined solution for these sponsors, allowing them to divest these non-core assets and realize capital.

These firms often manage a diverse range of investments, and the long-tail liabilities associated with certain insurance portfolios can tie up significant capital and management attention. Enstar's ability to take on these run-off portfolios allows sponsors to de-risk their balance sheets and focus on their core investment strategies. For instance, in 2024, the private equity sector continued to be a significant source of deal flow for legacy insurance transactions, with firms actively seeking to optimize their portfolios.

- Streamlined Divestment: Enstar offers a clear and efficient process for sponsors to divest run-off insurance portfolios.

- Capital Release: Facilitates the release of trapped capital, enabling sponsors to redeploy funds into more strategic opportunities.

- Risk Mitigation: Transfers the long-term risk and management burden of legacy liabilities away from the sponsor.

- Market Expertise: Leverages Enstar's deep understanding of the legacy insurance market to ensure optimal transaction outcomes.

Enstar Group serves a diverse range of customers, primarily focusing on entities within the insurance and corporate sectors that need to manage or divest legacy liabilities. This includes primary insurers, reinsurers, corporations with self-insured retentions, captive insurers, and financial sponsors seeking efficient exits for run-off portfolios. The common thread is the need to resolve long-tail liabilities and free up capital.

In 2024, the market demonstrated a continued demand for Enstar's solutions. Primary insurers and reinsurers actively sought to de-risk their balance sheets from historical exposures, particularly in casualty lines. Corporations also engaged Enstar to manage legacy operational liabilities, aiming to streamline operations. Financial sponsors, a growing segment, utilized Enstar's expertise for efficient divestment of acquired run-off business.

| Customer Segment | Key Need | Enstar's Solution |

| Primary Insurers | Divest non-core lines, legacy liabilities | Portfolio acquisition, capital release |

| Reinsurers | Exit long-tail liabilities, strategic repositioning | Assumed portfolio acquisition, run-off management |

| Corporations | Manage self-insured retentions, operational exposures | Legacy liability transfer, de-risking |

| Captive Insurers | Cease operations, offload liabilities | Orderly closure, liability transfer |

| Financial Sponsors | Exit run-off portfolios, capital realization | Streamlined divestment, risk mitigation |

Cost Structure

The largest part of Enstar's expenses comes from paying out claims and the costs involved in handling them. This includes everything from investigating the claim to settling it, which is a direct result of the insurance liabilities they take on.

For instance, in 2023, Enstar reported total claims and loss adjustment expenses of $4,183.7 million, highlighting this as their primary cost driver.

Enstar Group's operational and administrative expenses are critical for its business model, encompassing the costs of its highly skilled workforce. This includes compensation and benefits for actuaries, claims managers, and investment professionals who are central to its legacy insurance operations. In 2024, the company continued to invest in its talent pool to effectively manage complex portfolios and execute strategic acquisitions.

The company also incurs significant costs related to its IT infrastructure and general overhead. Maintaining robust IT systems is essential for data management, risk assessment, and regulatory compliance across its global footprint. These administrative costs are fundamental to supporting Enstar's underwriting, claims handling, and investment management activities, ensuring smooth business operations.

Enstar Group's acquisition strategy involves substantial upfront costs. These include significant legal fees for contract negotiation and regulatory compliance, as well as actuarial due diligence to assess the risk and financial viability of target companies. For instance, in 2023, Enstar completed several acquisitions, and while specific figures aren't publicly itemized per deal, the industry average for such transaction costs can range from 2% to 5% of the deal value, impacting overall profitability.

Investment Management Costs

Enstar Group's investment management costs are a significant component of its overall expense base. These costs are directly tied to the active management of its extensive investment portfolio, which is crucial for generating returns and supporting its insurance operations.

Key expenses in this category include fees paid to external asset managers who handle portions of Enstar's investments, as well as trading costs incurred from buying and selling securities. Additionally, administrative charges related to the oversight and management of these assets contribute to the total investment management cost structure.

For instance, in 2024, the company's commitment to optimizing its investment returns means that these management fees, while necessary, represent a direct outflow. These costs are carefully monitored to ensure they remain competitive and do not unduly erode the net returns generated from the investment portfolio.

- External Asset Manager Fees: Payments to third-party firms for managing specific investment mandates.

- Trading Costs: Expenses associated with executing trades, including brokerage commissions and market impact.

- Investment-Related Administrative Charges: Costs for custody, research, and other operational aspects of portfolio management.

Regulatory and Compliance Costs

Enstar Group navigates the insurance sector's inherent complexities, leading to significant regulatory and compliance expenditures. These costs are essential for operating legally and ethically across its diverse global markets.

These expenses encompass a range of activities, from securing and maintaining necessary licenses in different countries to fulfilling stringent reporting obligations to various supervisory bodies. Adhering to evolving legal frameworks and industry standards is a continuous and substantial investment.

- Licensing Fees: Costs associated with obtaining and renewing operating licenses in numerous jurisdictions.

- Reporting Obligations: Expenses incurred to comply with detailed financial and operational reporting requirements mandated by regulators.

- Legal and Advisory Services: Fees paid for expert legal counsel and compliance consultants to ensure adherence to complex regulations.

- Compliance Technology: Investment in systems and software to manage and track regulatory adherence efficiently.

Enstar's cost structure is dominated by claims and loss adjustment expenses, which represent the core cost of assuming insurance liabilities. These expenses are substantial, reflecting the nature of the legacy insurance business. Operational and administrative costs, including talent management and IT infrastructure, are also significant, supporting the complex management of acquired portfolios.

Acquisition costs, such as legal and due diligence fees, are a notable expense, especially given Enstar's growth strategy through acquisitions. Investment management costs, including fees to external managers and trading expenses, are incurred to generate returns from the company's assets. Finally, regulatory and compliance expenditures are essential for operating across various global markets.

| Cost Component | Description | 2023 Data (Millions USD) | 2024 Data (Commentary) |

| Claims and Loss Adjustment Expenses | Direct costs of settling insurance claims and managing the process. | 4,183.7 | Remains the primary cost driver, reflecting ongoing liability management. |

| Operational & Administrative Expenses | Costs for skilled workforce, IT, and general overhead. | N/A (Integrated within other segments) | Continued investment in talent and robust IT systems. |

| Acquisition Costs | Legal, due diligence, and regulatory fees for acquiring businesses. | N/A (Industry average 2-5% of deal value) | Significant upfront costs associated with strategic acquisitions. |

| Investment Management Costs | Fees to external managers, trading costs, and administrative charges. | N/A (Monitored for optimization) | Direct outflow related to active portfolio management and return optimization. |

| Regulatory & Compliance Costs | Licensing fees, reporting, legal, and compliance technology. | N/A (Essential for global operations) | Continuous investment to adhere to evolving legal frameworks and standards. |

Revenue Streams

Enstar Group's primary revenue stream originates from the investment of the significant assets it acquires when taking on insurance and reinsurance liabilities. This income is multifaceted, encompassing interest earned on fixed-income securities, dividends from equity holdings, and both realized and unrealized gains from its actively managed, diverse investment portfolio.

For instance, as of the first quarter of 2024, Enstar reported total investments of approximately $27.2 billion. This substantial asset base is strategically deployed to generate consistent returns, contributing significantly to the group's overall profitability and supporting its core business of legacy insurance solutions.

Enstar Group generates significant profits when actual claims payments fall below the reserves initially set aside. This favorable claims development, often referred to as reserve releases, directly boosts profitability. For instance, in 2023, Enstar reported substantial reserve releases, contributing positively to their earnings and underscoring their adeptness in claims handling and actuarial science.

Enstar Group's business model benefits from acquisition premiums or discounts. In 2024, Enstar continued to leverage its expertise in assuming run-off liabilities, often acquiring these portfolios at a discount to their estimated ultimate costs. This discount acts as an immediate revenue enhancement upon acquisition, reflecting the value Enstar brings in managing these complex risks.

For instance, if Enstar acquires a block of liabilities with an estimated ultimate cost of $100 million but pays $90 million, that $10 million difference is recognized as a profit. Conversely, in certain situations where Enstar's specialized skills or market position allow, they may negotiate a premium for assuming liabilities, further contributing to their revenue streams.

Management Fees (for certain structures)

While Enstar's core business is acquiring and managing run-off insurance portfolios, certain arrangements can generate management fees. This occurs when Enstar takes on the operational oversight of legacy portfolios for third parties or offers specialized consulting services in the run-off sector.

These fees are typically tied to the complexity and scale of the portfolios managed, reflecting Enstar's expertise in handling challenging legacy liabilities. For instance, in 2024, Enstar continued to explore such fee-generating opportunities as part of its diversified revenue strategy.

- Fee-Based Management: Earning revenue by managing run-off portfolios for other entities.

- Consulting Services: Providing expert advice on run-off solutions and operations.

- Portfolio Oversight: Generating fees for the administrative and operational management of legacy books of business.

Unlocking Trapped Capital

Enstar Group's revenue streams are significantly bolstered by its ability to unlock trapped capital for its clients. By offering solutions that allow companies to transfer non-core liabilities, Enstar facilitates the release of capital that was previously tied up in these obligations. This value proposition is central to its business model, making transactions more attractive and achievable.

This process of capital liberation directly enhances Enstar's deal-making capacity. As clients can redeploy freed-up funds, they are more inclined to engage in liability transfer agreements. For instance, in 2024, the trend of companies shedding non-essential or legacy liabilities continued, driven by a desire for greater financial flexibility and a focus on core operations.

- Facilitating Capital Release: Enstar's core service allows businesses to offload underperforming or non-strategic liabilities, thereby freeing up significant amounts of capital.

- Enhanced Transaction Value: By unlocking trapped capital, Enstar increases the attractiveness and financial viability of transactions for the selling entities.

- Revenue Generation: The fees and premiums associated with these liability transfer agreements form a direct revenue stream for Enstar.

- Strategic Focus: This capability enables clients to concentrate resources on their primary business activities, indirectly supporting Enstar's ability to secure future deals.

Enstar Group's revenue is primarily generated from the investment income derived from the substantial assets acquired through its legacy insurance and reinsurance transactions. This includes earnings from fixed-income securities, dividends from equities, and capital gains from its managed portfolio, which stood at approximately $27.2 billion in investments as of Q1 2024.

Profits are also realized through favorable claims development, where actual payouts are less than reserved amounts, known as reserve releases. Enstar experienced significant reserve releases in 2023, positively impacting its earnings.

Acquisition premiums or discounts on assumed liabilities also contribute to revenue. In 2024, Enstar continued to acquire portfolios at discounts, creating immediate profit upon assumption, and in some cases, negotiated premiums for taking on complex risks.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| Investment Income | Returns from investing acquired assets. | Q1 2024 investments approx. $27.2 billion. |

| Reserve Releases | Profit from claims paid being less than reserves. | Significant positive impact on 2023 earnings. |

| Acquisition Premiums/Discounts | Profit from acquiring liabilities at a discount or premium. | Continued strategy in 2024, generating immediate profit. |

Business Model Canvas Data Sources

The Enstar Group Business Model Canvas is meticulously constructed using a blend of Enstar's financial disclosures, industry-specific market research, and internal strategic planning documents. These diverse data sources ensure a comprehensive and accurate representation of Enstar's operational and strategic framework.