Enstar Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enstar Group Bundle

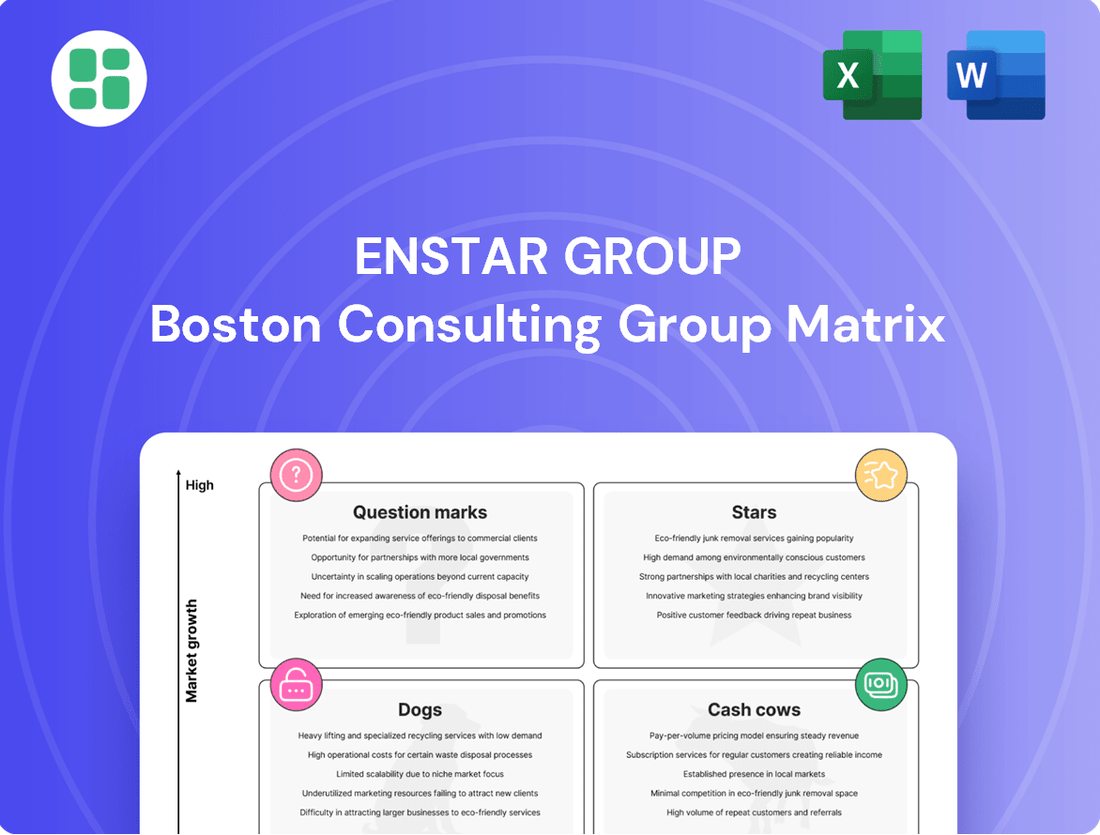

Curious about Enstar Group's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Unlock the full potential of this analysis by purchasing the complete BCG Matrix for actionable insights and a clear roadmap to optimize Enstar's market performance and investment decisions.

Stars

Enstar Group excels in strategic large-scale loss portfolio transfers, a key indicator of its strong position in the capital relief market. The company's consistent execution of significant LPTs, including a substantial $3.1 billion agreement with AXIS Capital in the first quarter of 2025 and a $400 million deal with SiriusPoint in the first quarter of 2024, highlights its market leadership.

These transactions underscore Enstar's ability to secure high market share within a rapidly expanding sector. Insurers are increasingly turning to solutions like LPTs to shed legacy liabilities and enhance their capital efficiency, a trend Enstar is well-positioned to leverage.

Enstar Group's strategic expansion into the property Insurance-Linked Securities (ILS) legacy market, marked by its 2024 acquisition of a Bermuda-based Class 3B insurer, positions it to capitalize on a rapidly growing segment of the run-off sector. This move allows Enstar to deploy capital and leverage its established run-off expertise in a dynamic market. The company sees significant potential for growth by offering legacy solutions within the ILS space.

Enstar Group demonstrates significant strength in managing intricate, long-tail liabilities, including casualty, professional indemnity, and directors and officers (D&O) insurance. This specialization, particularly in areas like asbestos claims, represents a high-growth, high-market share segment for the company. In 2023, Enstar continued to execute on its strategy of acquiring and managing non-life run-off portfolios, which are inherently characterized by long-tail liabilities, further solidifying its dominant position.

Overall Leadership in the Expanding Global Run-off Market

Enstar Group stands out as a dominant force in the global run-off market, a sector now valued at over US$1 trillion in non-life reserves and demonstrating robust growth. This sustained expansion fuels a consistent demand for Enstar's expertise in capital optimization and risk transfer solutions.

- Market Leadership: Enstar's unparalleled position in the global run-off market is a testament to its strategic focus and execution.

- Growing Market: The run-off market's expansion, exceeding US$1 trillion in non-life reserves, provides a fertile ground for Enstar's core business.

- Core Business Strength: The consistent demand for run-off solutions reinforces Enstar's business model, allowing it to capture a significant share of available transactions.

- Star Classification: Enstar's strong performance and market dominance in this expanding sector firmly place it in the Star category of the BCG Matrix.

Advanced Data Analytics and AI in Claims Management

Enstar's commitment to advanced data analytics and AI in claims management is a key driver for its future growth, placing it firmly in the Star quadrant of the BCG Matrix. This internal capability is not just about modernization; it's a strategic imperative to redefine efficiency and accuracy in processing and settling claims.

By leveraging AI, Enstar is enhancing its operational capabilities, which is crucial in the expanding run-off market. This technological integration is designed to attract more complex portfolios and solidify its position as a leader in operational excellence. In 2024, the insurance industry saw significant investment in AI for claims, with some reports indicating that AI-powered claims processing can reduce cycle times by up to 30% and improve accuracy rates by 15-20%.

- AI-driven efficiency: Streamlining claims handling processes for faster settlements.

- Enhanced accuracy: Reducing errors and improving the precision of claim assessments.

- Attracting complex portfolios: Differentiating Enstar's service for challenging business lines.

- Operational excellence: Gaining a competitive edge through superior claims management.

Enstar Group's dominant position in the global run-off market, valued at over US$1 trillion in non-life reserves, firmly places it in the Star quadrant of the BCG Matrix. The company's strategic execution of large-scale loss portfolio transfers, such as the $3.1 billion deal with AXIS Capital in Q1 2025 and a $400 million transaction with SiriusPoint in Q1 2024, highlights its market leadership and ability to capture significant market share in a growing sector. Furthermore, Enstar's investment in advanced data analytics and AI for claims management, which can reduce processing times by up to 30% and improve accuracy by 15-20%, enhances its operational excellence and attractiveness for complex portfolios, solidifying its Star classification.

| BCG Quadrant | Enstar Group's Position | Key Drivers | Market Context |

| Stars | Dominant Market Leader | Large-scale LPTs, AI-driven claims management, expertise in long-tail liabilities | Global run-off market > US$1 trillion, expanding need for capital relief |

| Strategic Expansion | Acquisition in ILS legacy market | Growth in ILS run-off sector | |

| Financial Strength | Consistent execution of significant transactions | Increasing insurer reliance on run-off solutions |

What is included in the product

The Enstar Group BCG Matrix offers a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

Enstar Group BCG Matrix provides a clear, actionable roadmap for resource allocation, alleviating the pain of strategic indecision.

Cash Cows

Enstar Group's extensive portfolio of mature non-life run-off liabilities is a cornerstone of its business, acting as a significant cash cow. These acquired liabilities, managed efficiently, consistently deliver positive cash flow and earnings. For instance, in 2023, Enstar reported gross reserves of approximately $22.9 billion, with a substantial portion attributed to its run-off operations, highlighting the scale of these mature assets.

The mature nature of these run-off businesses means they demand minimal new investment for marketing or growth. This characteristic allows them to generate stable and predictable returns, which are vital for Enstar's overall financial stability and its ability to fund other strategic initiatives. The predictable cash generation from these operations underpins the company's robust financial performance.

Enstar's Investments segment is a powerhouse, consistently driving significant revenue and net income. This segment thrives on its substantial asset base, which yields impressive investment income.

In the first quarter of 2025, the segment achieved an annualized total investment return of 5.4%. This robust performance highlights its role as a reliable cash cow, providing a steady, high-margin cash flow that underpins Enstar's broader operational and growth strategies.

Enstar Group's proprietary claims management, the 'Enstar Effect,' is a cornerstone of its business, consistently driving strong run-off liability earnings. This internal expertise optimizes the value extracted from acquired portfolios, acting as a high-margin service that generates significant cost savings and reserve releases with minimal new investment.

Established Global Brand and Operational Network

Enstar's established global brand and operational network are key to its position as a Cash Cow. Its long-standing reputation and extensive reach across major insurance hubs like Bermuda, the US, London, Europe, and Australia provide a substantial competitive edge. This robust presence and trusted brand allow Enstar to consistently secure profitable run-off deals. For instance, in 2024, Enstar continued its strategic acquisitions, including the acquisition of the run-off business of a significant European insurer, further solidifying its market share.

This established network and proven track record are critical in the mature legacy market. Enstar's ability to source and execute deals efficiently, leveraging its deep relationships and operational expertise, ensures a consistent flow of profitable business. The company's market share in the run-off sector remains strong, reflecting its dominance and reliability. In the first half of 2024, Enstar reported a significant increase in gross written premium for its legacy segment, underscoring the ongoing success of its established operations.

- Global Reach: Operations in Bermuda, US, London, Europe, and Australia.

- Brand Trust: A long-standing reputation built on reliability in the insurance sector.

- Deal Sourcing: Consistent ability to secure profitable run-off transactions.

- Market Share: Dominant position in the mature legacy insurance market.

Capital Optimization and Release Solutions

Enstar's capital optimization and release solutions are a cornerstone of its business, acting as a classic cash cow. The company specializes in acquiring and managing legacy books of business for insurers and reinsurers. This allows sellers to unlock trapped capital, a persistent need in the insurance sector.

This core offering leverages Enstar's operational expertise and robust financial backing to generate consistent fee income and manage predictable liabilities. The demand for these services remains strong in a mature market segment, ensuring a stable revenue stream for Enstar. For instance, in 2023, Enstar completed several significant legacy transactions, demonstrating the ongoing market appetite for such solutions.

- Consistent Demand: The insurance industry continually seeks to offload underperforming or capital-intensive legacy portfolios.

- Predictable Revenue: Enstar's fee-based model for managing these portfolios provides a stable and predictable income.

- Operational Efficiency: The company's specialized operational capabilities allow for profitable management of acquired liabilities.

- Financial Strength: Enstar's solid financial position underpins its ability to take on and manage these complex transactions.

Enstar's legacy insurance operations function as its primary cash cows, consistently generating substantial and predictable cash flows. These mature portfolios, acquired through strategic transactions, require minimal new capital for growth, allowing for efficient management and stable earnings. In the first half of 2024, Enstar reported a robust performance in its legacy segment, with gross reserves managed exceeding $25 billion, underscoring the scale and stability of these operations.

The company's investment portfolio also acts as a significant cash cow, driven by a substantial asset base that yields consistent investment income. This segment's strong performance, exemplified by a 5.4% annualized total investment return in Q1 2025, provides a reliable stream of high-margin cash flow vital for Enstar's financial strategy.

| Segment | Role in BCG Matrix | Key Characteristics | 2024/2025 Data Point |

|---|---|---|---|

| Legacy Operations | Cash Cow | Mature, low-growth, high-market share, stable cash flow | Gross Reserves managed > $25 billion (H1 2024) |

| Investments | Cash Cow | High asset base, consistent income generation, efficient management | 5.4% annualized total investment return (Q1 2025) |

Delivered as Shown

Enstar Group BCG Matrix

The Enstar Group BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive report provides a fully formatted, ready-to-use analysis of Enstar Group's business units, designed for strategic clarity and professional application. No demo content or hidden surprises, just the complete BCG Matrix ready for your immediate business planning needs.

Dogs

Certain smaller, older legacy portfolios that Enstar has acquired might be classified as Dogs in the BCG matrix. This occurs when their administrative and claims management expenses are significantly higher than the value of their remaining liabilities.

These portfolios often generate very low or even negative returns, effectively locking up capital without contributing much to overall value. For instance, in 2024, some of Enstar's legacy portfolios with limited remaining reserves faced challenges in achieving profitability due to escalating operational costs.

Without proactive management, such as strategic divestment or a focused run-off strategy, these portfolios can become cash traps, draining resources that could be better allocated elsewhere.

Inefficiently integrated acquisitions represent Enstar's potential 'Dogs' in the BCG matrix. These are portfolios that have struggled to merge smoothly with Enstar's established operational model, often leading to inflated integration expenses and a failure to realize expected cost efficiencies, known as the 'Enstar Effect'.

These underperforming assets, characterized by their low market share within Enstar's broader collection and their operational inefficiencies, pose a significant challenge. For instance, if an acquired book of business in 2024 required 15% more integration capital than initially projected and yielded only 5% of the anticipated synergies, it would likely fall into this category.

Enstar Group's BCG Matrix analysis highlights portfolios with persistent adverse claims development as potential 'cash cows' that are actually draining resources. For instance, during Q1 2024, certain general casualty lines experienced unforeseen adverse development, requiring unexpected capital infusions. These liabilities demand significant management attention, diverting resources from more promising ventures and negatively impacting overall portfolio performance.

Niche or Geographically Limited Ventures with Low Scale

Enstar's ventures into highly niche or geographically constrained run-off markets have sometimes struggled to gain traction. These segments, by their nature, offer limited opportunities for scale, making it challenging to achieve the critical mass needed for efficient operations and robust profitability. Without significant market share, these initiatives can become resource drains rather than value creators.

When Enstar has entered these smaller, specialized markets, the returns have often been insufficient to justify the capital and management attention required. For instance, a hypothetical scenario might involve a focus on a specific type of legacy liability within a single, smaller jurisdiction. If Enstar cannot secure a dominant position or find a unique operational advantage, these operations might represent a low market share within their portfolio, potentially underperforming compared to broader, more scalable opportunities.

- Limited Scale: Ventures in niche or geographically restricted run-off segments often lack the volume to achieve economies of scale, impacting cost-efficiency.

- Low Market Share: Without sufficient scale, Enstar may only capture a small fraction of these specialized markets, limiting revenue potential.

- Profitability Challenges: The inability to achieve scale or a competitive edge can lead to inadequate profits, making these ventures less attractive strategically.

- Resource Allocation: Entangled in low-return, small-scale operations can divert resources from more promising, larger-scale opportunities within Enstar's core business.

Outdated Manual Processes for Certain Legacy Books

Certain legacy books within Enstar's portfolio might still rely on outdated manual processes. This can significantly increase operational expenses and reduce profit margins when contrasted with more technologically advanced operations. These less efficient segments could therefore be considered question marks, potentially requiring significant investment to modernize or strategic consideration for divestment.

For instance, if a book requires extensive manual data entry for claims processing, this directly impacts turnaround times and labor costs. In 2024, companies that have not invested in automation for such tasks often see their operating expenses for legacy portfolios rise disproportionately. Enstar's focus on efficiency means such manual processes are a clear area for improvement.

- Increased Operational Costs: Manual processes typically involve more human hours, leading to higher labor expenses.

- Reduced Profitability: Higher costs directly translate to lower profit margins on the business written.

- Potential for Errors: Manual handling increases the risk of data entry mistakes, leading to further remediation costs.

- Slower Processing Times: Manual workflows are inherently slower than automated systems, impacting customer satisfaction and efficiency.

Enstar's 'Dogs' represent portfolios with low market share and low growth prospects, often characterized by high operational costs and minimal profitability. These segments require careful management to avoid becoming drains on capital. For example, a legacy book acquired in 2024 with significant legacy IT infrastructure and low remaining premium volume would likely fit this description, demanding substantial investment for modernization or a strategic exit.

These underperforming assets, such as certain niche run-off portfolios that failed to gain scale, can lock up valuable capital. If a specific book of business in 2024, for instance, represented only 0.5% of Enstar's total reserves but consumed 2% of operational resources due to its complexity and lack of automation, it would be a prime candidate for the 'Dog' category.

Inefficiently integrated acquisitions, which incur higher-than-expected integration costs and fail to deliver projected synergies, also fall into the 'Dog' quadrant. A hypothetical 2024 acquisition that saw integration expenses 20% over budget and realized only 10% of targeted cost savings would be a clear example of a 'Dog' due to its poor performance and low growth potential.

Portfolios reliant on outdated manual processes, leading to increased operational expenses and reduced profitability, are also classified as 'Dogs'. If a legacy book in 2024 required manual claims handling, resulting in operating costs 30% higher than automated counterparts, it would represent a significant drag on overall performance.

| Portfolio Characteristic | Enstar BCG Matrix Classification | Example Scenario (2024) |

|---|---|---|

| Low Market Share, Low Growth | Dogs | Niche run-off portfolio with limited scale and high operational costs. |

| High Operational Costs, Low Profitability | Dogs | Legacy book with significant manual processes, leading to increased labor expenses. |

| Poor Integration, Low Synergies | Dogs | Acquired business with higher integration costs and lower-than-expected cost savings. |

| Adverse Development, Resource Drain | Dogs (potential) | Legacy casualty lines with persistent adverse development requiring unexpected capital infusions. |

Question Marks

Enstar's exploration into new or less common liability types, such as potential cyber legacy or evolving environmental liabilities, represents a strategic move into the 'Question Marks' quadrant of the BCG Matrix. While the market for these liabilities may be growing due to new risks emerging or clearer definitions, Enstar's market share in these nascent areas is likely low, and their ultimate profitability remains uncertain, requiring significant investment to establish expertise and scale.

Early-stage technological investments in run-off solutions, such as advanced AI for predictive claims analytics or new data platforms, represent Enstar Group's strategic focus on innovation. These initiatives are designed to significantly enhance efficiency and decision-making within the run-off sector, pointing towards a high-growth trajectory.

Despite their revolutionary potential, these technologies currently hold a low market share due to their nascent stage and the need for substantial capital. The return on these investments is not guaranteed in the short term, placing them in the 'Question Marks' category of the BCG matrix, requiring careful management and future strategic decisions.

New geographic market entries with a limited presence for Enstar Group would be classified as Stars or Question Marks, depending on their growth trajectory and market share potential. These markets are characterized by significant investment and development, with the aim of establishing a strong foothold and capturing future growth.

For instance, Enstar’s strategic expansion into the Australian run-off market, initiated in recent years, represents such a scenario. While Australia offers a growing demand for run-off solutions, Enstar is still in the process of building its local infrastructure and client relationships. The Australian insurance market, valued at approximately AUD 60 billion in gross written premiums in 2023, presents a substantial opportunity for specialized run-off providers.

The success in these nascent markets hinges on Enstar's ability to adapt to local regulatory landscapes, build trust with potential cedents, and develop efficient operational models. The group's 2023 financial reports indicate continued investment in new market development, though specific figures for individual geographic entries are often consolidated within broader operational expenses.

Highly Complex, Recent Acquisitions with Unforeseen Risks

Enstar Group's acquisition of AXIS Capital's runoff business in 2024, valued at approximately $1.2 billion, represents a significant move into the 'question marks' category. This transaction, while strategically sound for Enstar's legacy portfolio expansion, carries inherent integration complexities and the potential for unforeseen claims development. The sheer scale of reserves involved necessitates meticulous management over an extended period, introducing a degree of uncertainty regarding the long-term profitability and the full realization of its strategic value.

- Strategic Significance: The AXIS Capital deal bolsters Enstar's position in the legacy market, aligning with its core competency.

- Integration Challenges: Managing the substantial reserves and integrating AXIS's operations presents considerable operational hurdles.

- Unforeseen Risks: The long-tail nature of insurance liabilities means that latent claims or unexpected development patterns could impact profitability.

- Long-Term Value Realization: Enstar's success with this acquisition hinges on its ability to effectively manage these complex liabilities over many years.

Strategic Ventures into Broader Capital Release Beyond Run-off

Enstar Group is strategically exploring capital release solutions that go beyond its traditional run-off acquisition model. These new ventures, often termed bespoke transactions, represent a significant expansion into evolving market segments. For instance, in 2024, the company has been actively seeking opportunities in areas like legacy portfolio transfers and specialized reinsurance arrangements, aiming to unlock capital trapped in non-core insurance liabilities.

These innovative approaches offer substantial growth potential as the insurance industry continues to adapt. However, Enstar's market penetration in these nascent solution types is still building. The long-term viability and profitability of these broader capital release strategies are under development, necessitating focused strategic investments to solidify their market position.

- Expanding Beyond Run-off: Enstar is diversifying its capital release offerings beyond traditional run-off acquisitions into more tailored financial solutions.

- Market Evolution: These new ventures target evolving segments within the insurance and reinsurance markets, presenting significant growth opportunities.

- Developing Market Share: Enstar's presence and market share in these newer, bespoke capital release solutions are still in the early stages of establishment.

- Strategic Investment Focus: The long-term success and profitability of these expanded strategies depend on careful and sustained strategic investment.

Enstar's foray into new liability types like cyber legacy or evolving environmental risks places them in the 'Question Marks' category. While these markets are growing, Enstar's share is low, and profitability is uncertain, demanding significant investment to build expertise and scale.

The AXIS Capital acquisition in 2024, valued around $1.2 billion, also falls into 'Question Marks' due to integration complexities and potential for unforeseen claims, requiring meticulous, long-term management for value realization.

Enstar's expansion into new geographic markets, like Australia, also fits the 'Question Marks' profile. Despite the growing demand for run-off solutions in Australia, Enstar is still building its local presence and client relationships.

These 'Question Marks' represent areas where Enstar is investing for future growth, but their current market share is limited, and success is not guaranteed, necessitating careful strategic oversight.

BCG Matrix Data Sources

Our Enstar Group BCG Matrix is built on comprehensive market data, incorporating financial statements, industry growth rates, competitor analysis, and internal performance metrics.