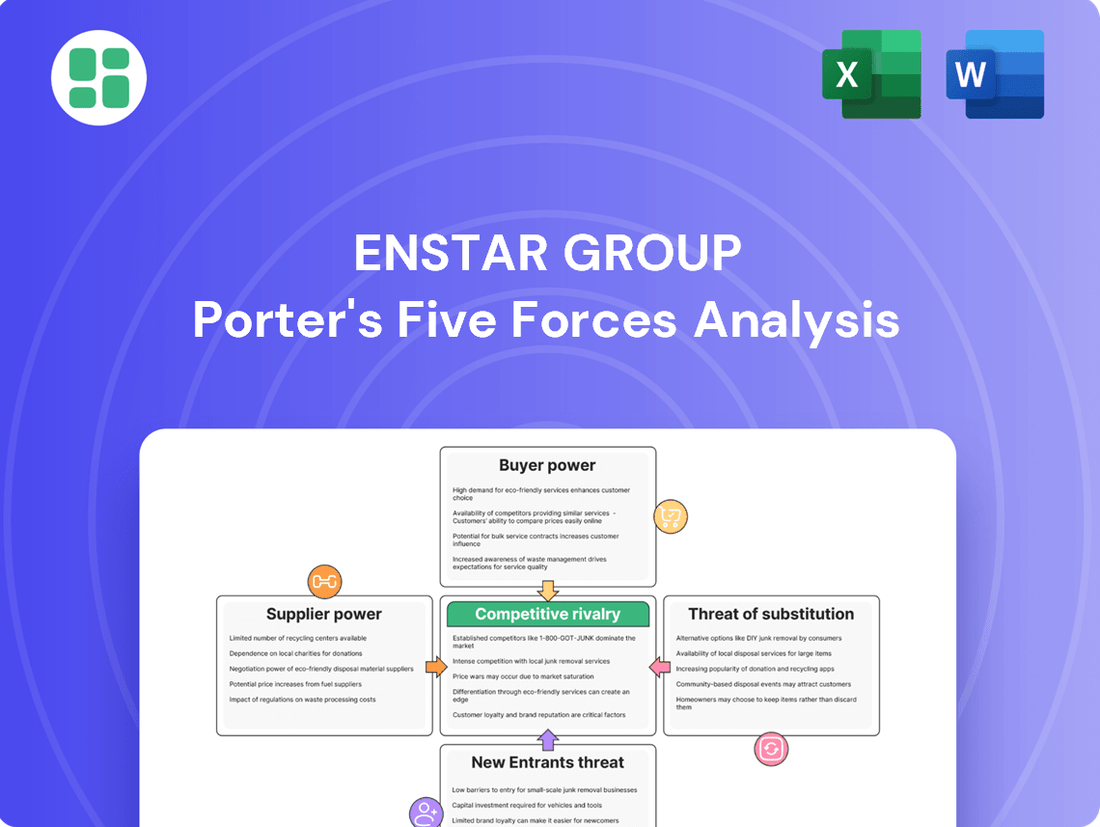

Enstar Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enstar Group Bundle

Enstar Group operates in an industry shaped by moderate bargaining power of buyers and suppliers, with a manageable threat from new entrants and substitutes. The competitive rivalry within the insurance sector presents a significant force, demanding strategic agility.

The complete report reveals the real forces shaping Enstar Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Enstar's business model is inherently capital-intensive, necessitating substantial financial resources for both acquiring new portfolios and managing ongoing claims. The availability and cost of this capital directly impact Enstar's strategic flexibility. For instance, in 2023, global insurance-linked securities (ILS) market capacity, a key source of reinsurance, experienced growth, but pricing remained elevated due to prior year losses, demonstrating supplier leverage.

The bargaining power of capital providers, whether through debt financing from banks or equity from investors, can significantly shape Enstar's cost of capital. This power is amplified when large-scale acquisitions are contemplated, requiring substantial upfront investment. Similarly, access to competitive reinsurance capacity, which Enstar utilizes to transfer specific risks and manage its own capital, acts as a critical supplier relationship.

The primary suppliers to Enstar Group are insurance and reinsurance companies looking to offload non-core or legacy business. Their bargaining power hinges on how many other buyers are available for these run-off portfolios, how complicated and appealing the liabilities are, and how quickly they need to exit. For instance, in 2023, the global run-off market saw significant activity, with major insurers like Allianz and Zurich actively managing their legacy portfolios, indicating a strong supply of potential deals.

Enstar Group's reliance on specialized professional services like actuarial consultants, legal advisors, and claims management experts for its complex run-off operations grants these providers a degree of bargaining power. The highly niche expertise required for managing legacy insurance portfolios means fewer firms possess the necessary skills, potentially increasing supplier leverage.

However, Enstar's substantial scale within the run-off market and its emphasis on building long-term partnerships with service providers likely serve to temper this supplier power. For instance, as of early 2024, Enstar continued to secure significant run-off transactions, demonstrating its ability to attract and retain top-tier professional service firms, suggesting a balanced negotiation dynamic.

Technology and Data Providers

Technology and data providers wield significant influence over Enstar Group, particularly given the company's focus on managing extensive legacy portfolios. Efficiently handling vast amounts of historical data for claims processing, financial reporting, and analytics necessitates sophisticated technology platforms. Suppliers offering unique or critical software, data management, and cybersecurity solutions can command higher prices or dictate terms if their services are essential for Enstar's operational continuity and competitive edge.

Enstar's reliance on specialized vendors for core infrastructure, such as claims administration systems or actuarial modeling software, can amplify supplier power. For instance, a significant portion of the insurance technology market, estimated to be worth billions globally, is characterized by niche providers with deep expertise. If Enstar’s operational efficiency is heavily dependent on a particular vendor’s proprietary system, that vendor’s bargaining power increases substantially.

- Criticality of Technology: Enstar's ability to manage legacy insurance portfolios efficiently hinges on advanced data analytics and claims processing technology.

- Supplier Uniqueness: Providers of specialized software, data solutions, and cybersecurity services gain power if their offerings are unique and vital for Enstar's operations.

- Vendor Dependence: Reliance on specific vendors for essential infrastructure, such as claims management systems, can strengthen their bargaining position.

- Market Dynamics: The specialized nature of insurance technology solutions means that a limited number of providers may cater to Enstar's specific needs, enhancing their leverage.

Talent and Human Capital

The bargaining power of suppliers in the context of talent and human capital for Enstar Group's run-off business is significant due to the highly specialized nature of the work. This includes expertise in actuarial science, claims management, legal, and investment, all critical for managing legacy insurance liabilities effectively.

The availability of skilled professionals, especially those with deep experience in handling complex, long-tail insurance portfolios, directly impacts Enstar's operational costs and its ability to expand. A scarcity of such qualified individuals would naturally amplify their leverage.

- Specialized Skill Demand: Enstar requires professionals with niche skills in actuarial analysis, complex claims resolution, and specialized legal expertise relevant to legacy insurance.

- Talent Scarcity Impact: A limited pool of experienced professionals in legacy insurance can drive up recruitment and retention costs, increasing supplier power.

- Industry Experience Premium: Professionals with proven track records in the run-off sector often command higher compensation, reflecting their valuable, hard-to-replicate experience.

The bargaining power of suppliers for Enstar Group is moderate, primarily influenced by the specialized nature of the services and capital required for its run-off business. Key suppliers include capital providers, professional service firms, and technology vendors.

In 2024, the global reinsurance market continued to see robust demand for legacy solutions, with companies actively seeking to divest non-core portfolios. This increased deal flow can empower sellers, but Enstar's established market position and capital strength often allow it to negotiate favorable terms.

For instance, Enstar's access to diverse funding sources, including debt and equity, provides some leverage against individual capital providers. Similarly, while specialized actuarial and legal expertise is crucial, Enstar's scale and reputation can attract top-tier firms, mitigating excessive supplier power.

| Supplier Type | Key Considerations | Impact on Enstar |

| Capital Providers | Availability of ILS, debt financing, equity markets | Cost of capital, ability to fund acquisitions |

| Professional Services | Actuarial, legal, claims management expertise | Operational efficiency, transaction complexity |

| Technology & Data | Claims processing software, data analytics, cybersecurity | Operational continuity, competitive edge |

| Talent/Human Capital | Specialized skills in legacy insurance | Operational costs, expansion capabilities |

What is included in the product

This analysis of Enstar Group's competitive landscape reveals the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and the overall attractiveness of the insurance market.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, providing a clear roadmap for strategic advantage.

Customers Bargaining Power

Original insurers, or cedants, act as indirect customers for Enstar Group. Their bargaining power stems from the availability of alternative solutions for managing legacy liabilities, including internal run-off management or engaging with other acquisition specialists. The competitive intensity among run-off acquirers directly influences the cedants' leverage.

Policyholders and claimants, though not direct customers in the typical sense, hold significant influence over Enstar Group. Their collective power stems from their ability to engage regulatory bodies and pursue legal action if claims are mishandled, impacting Enstar's operational stability and public image. For instance, in 2023, the insurance industry faced increased scrutiny regarding claim processing times and fairness, highlighting the importance of robust claimant relations.

Enstar's success is intrinsically linked to its capacity for efficient and equitable claim resolution. A strong track record in this area not only fosters trust but also mitigates the risk of costly litigation and reputational damage. The company's financial health and market standing are directly influenced by how effectively it manages these critical stakeholder interactions, ensuring fair outcomes for all parties involved.

Regulatory bodies and governments wield considerable influence over Enstar Group's operations across its various jurisdictions. These entities dictate business practices, capital requirements, and claims management, essentially setting the rules of engagement. For instance, in 2024, the Bermuda Monetary Authority (BMA) continued to enforce robust solvency requirements for insurers operating on the island, a key location for Enstar’s legacy business. Failure to comply can result in severe penalties, including fines and operational restrictions, underscoring the significant bargaining power regulators hold.

The power of these regulatory bodies stems from their authority to impose sanctions. Enstar must navigate a complex web of compliance, ensuring adherence to capital adequacy ratios, consumer protection laws, and reporting standards. This continuous need for regulatory compliance means Enstar is inherently subject to the demands of these governmental agencies, which can significantly impact its cost of doing business and strategic flexibility. For example, evolving data privacy regulations in Europe, like those influenced by GDPR, require ongoing investment in compliance measures, demonstrating the direct impact of government mandates on Enstar's operational framework.

Rating Agencies

Credit rating agencies hold considerable influence over Enstar Group by evaluating its financial health and capacity to fulfill its commitments. These assessments directly impact Enstar's ability to access capital markets and shape its reputation among original insurers, regulatory bodies, and policyholders.

A lower credit rating can escalate borrowing expenses and impede Enstar's pursuit of new acquisitions. This leverage grants rating agencies significant indirect power over Enstar's financial maneuverability and overall market position.

- Impact on Capital Access: A strong rating from agencies like S&P or Moody's can lower Enstar's cost of debt, making it easier to raise funds for growth. Conversely, a downgrade can make borrowing more expensive or even inaccessible.

- Influence on Insurer Confidence: For Enstar's core business of acquiring and managing run-off insurance portfolios, the confidence of original insurers is paramount. Favorable ratings signal financial stability, encouraging more attractive acquisition opportunities.

- Regulatory Scrutiny: Regulators often monitor the creditworthiness of insurance companies. A downgrade could trigger increased regulatory oversight, potentially impacting operational flexibility.

- Market Perception: Publicly available credit ratings significantly influence how investors, partners, and the broader market perceive Enstar's financial stability and long-term viability.

Investment Partners and Co-investors

Enstar's reliance on investment partners and co-investors grants these entities a degree of bargaining power. These partners can influence deal terms, profit splits, and the strategic direction of shared ventures, especially when Enstar seeks external capital for specific transactions or portfolio management. Enstar's ability to attract and retain these partners is significantly influenced by its established reputation and performance history in investment management.

For instance, in 2024, Enstar continued its strategy of leveraging partnerships for growth. While specific co-investment figures are often private, the broader insurance-linked securities market, a key area for such partnerships, saw significant capital inflows. The ILS market, which Enstar actively participates in, is projected to grow, indicating continued demand for Enstar's expertise from capital providers.

- Influence on Deal Terms: Co-investors can negotiate for more favorable economic terms or governance rights in joint ventures.

- Profit Sharing Negotiations: The allocation of profits from managed portfolios can be a point of contention, giving partners leverage.

- Strategic Alignment: Partners may exert influence to ensure the strategic direction of co-invested assets aligns with their own objectives.

- Reputation as a Counterbalance: Enstar's strong track record and market position serve as a crucial factor in mitigating the bargaining power of its partners.

The bargaining power of customers for Enstar Group is primarily exerted by original insurers seeking to offload legacy liabilities. These cedants possess leverage due to the availability of alternative solutions, including internal run-off management or engaging with other specialist acquirers. The competitive landscape among run-off acquirers directly impacts the cedants' negotiating position.

Full Version Awaits

Enstar Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Enstar Group, detailing the competitive landscape and strategic implications for the company. The document you see here is the exact, fully formatted report you'll receive immediately after purchase, providing actionable insights without any placeholders or surprises. You can trust that the in-depth analysis of threat of new entrants, bargaining power of buyers and suppliers, threat of substitute products, and intensity of rivalry presented here is precisely what you will download and utilize.

Rivalry Among Competitors

The run-off market, though niche, is experiencing a growing number of players. These include specialized run-off firms, major reinsurers, and investment vehicles backed by private equity. For instance, in 2023, the global insurance sector saw continued consolidation and strategic repositioning, with several large reinsurers actively exploring run-off solutions to free up capital.

Competitive intensity escalates with the number of active participants vying for acquisition of available portfolios. Larger, financially robust competitors present a formidable challenge to companies like Enstar. In 2024, it's anticipated that private equity firms will continue to deploy significant capital into acquiring legacy insurance portfolios, increasing the competitive landscape.

Enstar faces competition not only from established, long-standing companies in the sector but also from newer entrants that are carving out specific niches within the run-off market. This dynamic means Enstar must continuously adapt its strategies to remain competitive against both experienced players and agile newcomers.

The run-off market's growth rate significantly shapes competitive rivalry. Factors like evolving regulations, insurers' desire for capital optimization, and persistent low interest rates are fueling this expansion. For instance, the global insurance run-off market was estimated to be worth around $450 billion in 2023 and is projected to grow substantially in the coming years, with some estimates suggesting it could reach over $1 trillion by 2030, indicating a robust growth trajectory.

When there's a large supply of appealing portfolios available, direct competition for any single deal tends to be less intense. However, a scarcity of attractive run-off portfolios can dramatically escalate the bidding process, leading to fiercer competition among acquirers. This supply and demand dynamic directly influences the pressure competitors exert on each other.

Competitors in the run-off insurance market often distinguish themselves through highly specialized expertise. This can manifest as a deep focus on particular lines of business, such as long-tail liabilities or mass torts, or a strategic emphasis on specific geographic regions. Operational efficiency, particularly in claims management, also serves as a key differentiator, allowing some players to process legacy business more cost-effectively.

Enstar's competitive advantage hinges on its demonstrated ability to offer superior expertise in managing complex run-off portfolios, coupled with cost-effectiveness and a proven track record. These unique capabilities help to mitigate direct, head-to-head competition by offering specialized solutions that not all market participants can replicate. For instance, Enstar's acquisition of the legacy business of The Phoenix Companies in 2023, valued at approximately $600 million, showcases its capacity to handle substantial and intricate portfolios.

Cost Structure and Efficiency

Enstar operates in a market where cost structure and efficiency directly fuel competitive rivalry. Companies that can manage claims more effectively and maintain lower operating expenses are better positioned to offer attractive pricing for acquiring legacy insurance portfolios. This pressure forces all players, including Enstar, to constantly seek ways to streamline operations.

Enstar's profitability and competitive edge hinge on its capacity to harness economies of scale, enhance investment returns on its acquired assets, and diligently manage administrative overhead. Achieving cost leadership in the run-off sector is a critical differentiator, allowing for more aggressive bidding and a stronger market position.

- Cost Efficiency Advantage: Companies with lean operations and effective claims handling can undercut competitors on pricing for run-off portfolios.

- Economies of Scale: Enstar's size allows for greater negotiation power with suppliers and more efficient allocation of resources, reducing per-unit costs.

- Investment Optimization: Maximizing returns on the invested capital within run-off portfolios is crucial for offsetting liabilities and generating profit.

- Administrative Expense Control: Minimizing overhead, such as staffing and technology costs, directly impacts the bottom line and pricing flexibility.

Acquisition Strategy and Pricing

Competitive rivalry in the run-off acquisition market is intense, often playing out during the bidding process for new opportunities. Competitors frequently employ aggressive pricing, adaptable deal structures, and rapid execution to gain an edge, which can directly impact Enstar's potential acquisition margins.

Success in this arena hinges on Enstar's capacity to precisely value intricate liabilities and deploy capital with maximum efficiency. This capability is crucial for securing new business when facing off against rivals who are also vying for the same portfolios.

- Aggressive Bidding: Competitors often engage in aggressive bidding wars for attractive run-off portfolios, potentially driving up acquisition prices.

- Deal Structure Innovation: Rivals may offer more flexible or creative deal structures to win business, putting pressure on Enstar to adapt its own terms.

- Speed and Efficiency: The ability to close deals quickly and efficiently is a key differentiator, as delays can lead to lost opportunities.

- Valuation Expertise: Accurate and swift valuation of complex liabilities is paramount; competitors with superior actuarial and financial modeling capabilities can secure better terms.

Competitive rivalry in the run-off market is characterized by a growing number of specialized firms, major reinsurers, and private equity-backed entities actively seeking legacy portfolios. This increased participation, with private equity firms expected to deploy significant capital in 2024, intensifies the competition for attractive acquisition targets. Enstar faces rivals with deep expertise in specific niches and a focus on operational efficiency, particularly in claims management, which allows them to offer competitive pricing.

The intensity of competition is directly influenced by the supply of available run-off portfolios; a scarcity drives up bidding prices, while ample supply moderates it. Enstar's ability to offer specialized solutions, demonstrate cost-effectiveness, and maintain a strong track record, as evidenced by its acquisition of The Phoenix Companies' legacy business in 2023 for approximately $600 million, is crucial for navigating this dynamic landscape. Companies with lean operations and economies of scale, like Enstar, can leverage cost leadership to gain an advantage.

| Key Competitive Factors | Description | Impact on Enstar |

| Number of Competitors | Growing presence of specialized firms, reinsurers, and PE funds. | Increased bidding pressure for portfolios. |

| Capital Deployment | Significant PE capital expected in 2024. | Heightened competition for attractive deals. |

| Specialization & Efficiency | Focus on specific lines of business and claims management. | Need for Enstar to maintain superior expertise and operational cost advantage. |

| Portfolio Supply | Scarcity of attractive portfolios intensifies bidding. | Potential for higher acquisition costs for Enstar. |

| Pricing & Deal Structures | Aggressive bidding and innovative deal terms from rivals. | Pressure on Enstar to be competitive on price and adaptable in deal structuring. |

SSubstitutes Threaten

For insurers aiming to offload old liabilities, managing run-off internally is the main alternative to selling to a specialist like Enstar. This approach means the company keeps the liabilities on its books, handling claims, investments, and regulatory duties on its own. For example, in 2023, the global insurance industry continued to grapple with managing legacy portfolios, with many companies opting for internal solutions to avoid the immediate costs of divestment, though this often resulted in significant capital being tied up.

However, this internal management strategy demands substantial capital, diverts crucial management attention, and leaves the company exposed to ongoing risks and market fluctuations associated with those legacy books. This can impact a company's ability to invest in new growth areas or respond effectively to emerging market trends, potentially hindering overall strategic agility.

Alternative risk transfer (ART) mechanisms, like adverse development covers or loss portfolio transfers that don't involve a complete legal entity sale, present a significant threat. These solutions allow companies to manage liabilities and achieve capital relief without a full run-off acquisition, serving as a partial substitute for traditional acquisition models.

The threat of substitutes for a specialist like Enstar arises when an insurer opts to sell its non-core or run-off business to a non-specialist acquirer. This could involve a private equity firm or a larger insurance company seeking diversification rather than a dedicated run-off solution. In 2023, the global private equity market saw significant activity, with deal values reaching hundreds of billions, indicating ample capital available for such acquisitions, even if not purely for run-off optimization.

Portfolio Restructuring or Commutation

Insurers can actively reduce their legacy portfolios through commutation, essentially buying out future policyholder claims, or by expediting claim settlements. This operational approach functions as an internal substitute for selling off these run-off books to external specialists, thereby diminishing legacy liabilities over time.

These internal restructuring efforts can be viewed as a substitute threat because they achieve a similar outcome to a third-party sale: reducing the insurer's exposure to legacy risks. For instance, a company might aim to significantly shrink its run-off reserves through these methods.

- Commutation exercises: Policyholders agree to an upfront payment to extinguish future claims.

- Aggressive claims settlement: Proactively resolving outstanding claims to clear the portfolio.

- Internal capital management: Reallocating capital away from legacy business to more profitable ventures.

- Operational efficiency gains: Streamlining the management of run-off to reduce associated costs.

Regulatory-Driven Wind-Downs

Regulatory-driven wind-downs represent a significant threat of substitutes for Enstar Group. When smaller or distressed insurers face insolvency, regulators may mandate a liquidation rather than a sale of their legacy portfolios to a run-off specialist like Enstar. This process, while not a strategic choice for the selling entity, effectively removes potential acquisition targets from the market, thereby diminishing the pool of available business for companies operating in the legacy insurance sector. For instance, in 2023, several smaller European insurers underwent accelerated resolution procedures due to solvency concerns, bypassing traditional sale processes.

These mandated wind-downs can be triggered by various factors, including insufficient capital reserves or a failure to meet regulatory solvency requirements. For example, Solvency II regulations in Europe have led to increased scrutiny and, in some cases, the orderly liquidation of undercapitalized entities. This directly impacts Enstar’s growth strategy by reducing the supply of legacy liabilities that can be acquired and managed. The threat is amplified as regulators prioritize policyholder protection, sometimes opting for liquidation as the most expedient route to closure.

The consequence for Enstar is a potential reduction in the volume of attractive acquisition opportunities. While Enstar focuses on acquiring portfolios with predictable cash flows, regulatory liquidations often involve more complex and less predictable asset disposals. This can lead to a less favorable competitive landscape for legacy acquirers. For example, the UK’s Prudential Regulation Authority (PRA) has powers to wind up insurers deemed non-viable, a process that doesn't involve a sale to a third party.

- Regulatory Intervention: Regulators can force the liquidation of insurers, bypassing sale opportunities for run-off specialists.

- Reduced Supply: This process limits the availability of legacy portfolios for acquisition by companies like Enstar.

- Market Impact: It alters the competitive landscape by removing potential targets and potentially increasing the cost of remaining portfolios.

- Policyholder Protection: Regulatory-driven wind-downs prioritize policyholder security, sometimes at the expense of market-based solutions.

Insurers can manage legacy liabilities internally, reducing the need to sell to specialists like Enstar. This approach ties up significant capital and management focus, however. Alternative risk transfer mechanisms, such as loss portfolio transfers, also offer solutions that don't involve a complete sale, acting as partial substitutes.

The threat of substitutes is also present when insurers sell run-off business to non-specialists like private equity firms, which were active in 2023 with substantial capital available. Furthermore, internal restructuring, including commutation exercises and aggressive claims settlement, allows companies to reduce legacy exposure without external sales.

Regulatory-driven wind-downs pose another substitute threat, as regulators may mandate liquidation rather than a sale, diminishing acquisition opportunities. For example, in 2023, European regulators accelerated the resolution of several undercapitalized insurers, bypassing traditional sale processes.

| Substitute Strategy | Description | Impact on Enstar |

|---|---|---|

| Internal Run-off Management | Handling legacy liabilities in-house. | Reduces potential acquisition volume; ties up capital for sellers. |

| Alternative Risk Transfer (ART) | Solutions like loss portfolio transfers. | Offers partial liability relief without full sale. |

| Non-Specialist Acquisitions | Sales to private equity or diversified insurers. | Diversifies the buyer pool, potentially impacting Enstar's market share. |

| Internal Restructuring (Commutation, etc.) | Active reduction of legacy portfolios by the insurer. | Shrinks the overall market for legacy acquisitions. |

| Regulatory-Driven Wind-downs | Forced liquidation by regulators. | Removes potential targets from the market entirely. |

Entrants Threaten

High capital requirements significantly deter new entrants into the run-off insurance sector. Acquiring existing insurance portfolios, managing potential future claims, and meeting stringent regulatory solvency standards necessitate immense financial backing. For instance, in 2024, the average capital deployed for a significant run-off acquisition often runs into hundreds of millions of dollars, making it a daunting prospect for smaller or less capitalized firms.

This substantial financial barrier means that only well-established entities with deep pockets and access to long-term capital can realistically consider entering the market. New players must prove their financial robustness to compete with established firms like Enstar, which possess the scale and resources to absorb large transactions and manage complex liabilities effectively.

The management of complex, long-tail insurance liabilities requires a deep bench of specialized actuarial, legal, claims, and investment expertise. Building and maintaining such a team is a significant undertaking, both in terms of time and cost.

New entrants face a steep climb in recruiting and retaining the niche talent that Enstar has cultivated over many years. This specialized knowledge is crucial for effectively navigating and profiting from legacy insurance portfolios.

The run-off insurance sector faces significant regulatory barriers. New entrants must obtain licenses and approvals in numerous jurisdictions, a process that can be both time-consuming and costly. For instance, in 2024, navigating the Solvency II framework in Europe or state-specific regulations in the US remains a complex undertaking.

Establishing and maintaining strong relationships with supervisory authorities is crucial. This trust is built over time through consistent compliance and transparency, making it difficult for newcomers to gain immediate traction. Enstar Group, having operated for years, possesses these established relationships and a demonstrated history of regulatory adherence, a distinct advantage.

Reputation and Track Record

Original insurers looking to sell their legacy insurance books are very particular about who they partner with. They want to know the buyer has a solid reputation for being financially sound, handles claims fairly, and has a history of successfully completing similar deals. This is a major hurdle for newcomers.

New entrants simply don't have this established history. Building the necessary trust with sellers and regulatory bodies takes considerable time and effort, which can be a significant barrier to entry. Without a proven track record, securing these divestitures becomes a much tougher proposition.

Enstar Group, on the other hand, benefits immensely from its long-standing presence and a consistent record of successful acquisitions and portfolio management. This established credibility provides a substantial competitive edge in attracting and closing deals.

- Established Trust: Sellers and regulators place a higher degree of confidence in established players like Enstar due to their proven history.

- Regulatory Approval: A strong reputation can streamline the often complex regulatory approval processes for acquisitions.

- Deal Flow Advantage: A solid track record often leads to preferential access to attractive run-off portfolio opportunities.

Access to Deal Flow and Due Diligence Capabilities

The threat of new entrants into the run-off insurance market is significantly tempered by the high barriers to entry related to accessing deal flow and conducting thorough due diligence. Identifying, valuing, and successfully acquiring complex run-off portfolios demands extensive market intelligence, proprietary networks, and sophisticated analytical tools.

New players often struggle to establish the necessary relationships and develop the advanced capabilities required to source attractive deals and accurately assess the inherent risks. This disadvantage is particularly pronounced when competing against established entities like Enstar Group, which possess a proven track record and deep industry expertise.

- High Capital Requirements: Acquiring run-off portfolios often involves substantial upfront capital, creating a significant financial hurdle for new entrants.

- Specialized Expertise: The valuation and management of run-off liabilities require highly specialized actuarial, legal, and operational expertise, which is difficult and time-consuming to build.

- Established Networks: Incumbent firms like Enstar benefit from long-standing relationships with brokers, cedents, and other market participants, facilitating access to desirable deal flow.

- Regulatory Hurdles: Navigating the complex regulatory landscape for insurance acquisitions and run-off management presents another significant barrier for newcomers.

The threat of new entrants in the run-off insurance sector is considerably low due to substantial barriers. High capital requirements, often in the hundreds of millions of dollars for significant portfolios in 2024, make entry prohibitive for many. Furthermore, the need for specialized expertise in actuarial, legal, and claims management, coupled with stringent regulatory approvals across multiple jurisdictions, creates a steep learning curve and significant operational hurdles for newcomers.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Acquiring run-off portfolios demands substantial financial backing, often exceeding hundreds of millions of dollars. | Deters smaller or less capitalized firms. |

| Specialized Expertise | Requires deep knowledge in actuarial science, law, claims handling, and investment management. | Difficult and time-consuming for new entrants to build necessary teams. |

| Regulatory Hurdles | Navigating complex licensing and solvency regulations (e.g., Solvency II, US state regulations) is time-consuming and costly. | New entrants face lengthy approval processes and compliance challenges. |

| Established Reputation & Networks | Sellers and regulators prefer established firms with proven track records and strong relationships. | Newcomers struggle to gain trust and access desirable deal flow. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Enstar Group is built upon a robust foundation of publicly available information, including Enstar's SEC filings, annual reports, and investor presentations. We also leverage industry-specific reports from reputable sources and financial databases to gain a comprehensive understanding of the competitive landscape.