Enstar Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enstar Group Bundle

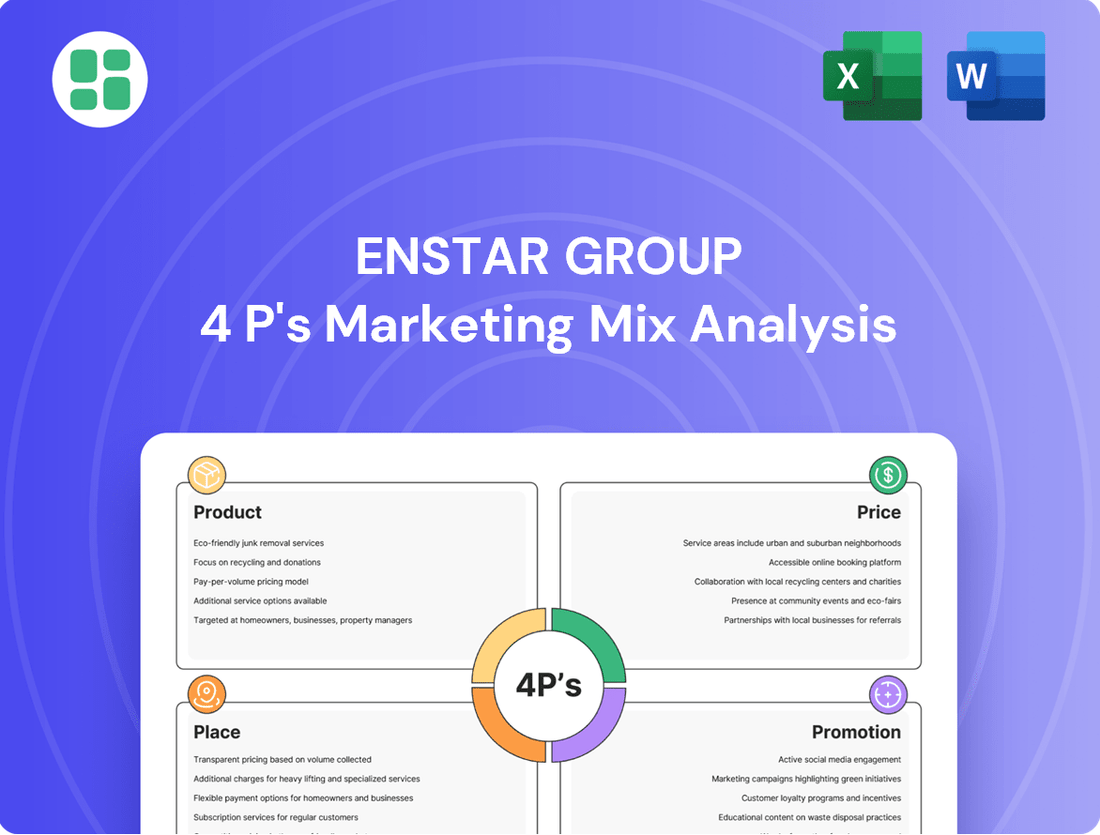

Uncover the strategic brilliance behind Enstar Group's marketing efforts with our comprehensive 4Ps analysis. We delve into their product innovation, pricing strategies, distribution channels, and promotional campaigns to reveal how they capture market share.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Enstar Group. Ideal for business professionals, students, and consultants looking for strategic insights.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning for Enstar Group.

Product

Enstar's core offering is the acquisition of non-life insurance and reinsurance portfolios that have ceased new business. This specialized service addresses companies seeking to divest from legacy liabilities and claims, effectively managing complex, long-tail exposures with a focus on efficient resolution.

This product is crucial for insurers aiming to streamline operations and reduce capital tied up in historical risks. For instance, Enstar's acquisition of the legacy business of a major European insurer in 2024 freed up significant capital for the seller, allowing them to reinvest in growth areas.

Enstar Group's claims management and optimization, a core element of their product offering, focuses on expertly handling and settling insurance and reinsurance claims from acquired portfolios. This process is vital for unlocking value in run-off business.

Their operational efficiencies and extensive industry expertise allow them to optimize claim resolutions, a critical factor in their business model. For instance, in 2023, Enstar continued to demonstrate strong performance in managing its legacy liabilities, contributing to its overall financial stability.

Enstar's financial risk transfer solutions act as a crucial element in their Product strategy, specifically addressing the Product aspect of the 4Ps. By acquiring and managing legacy insurance liabilities, Enstar offers a specialized service that allows other companies to offload complex and potentially burdensome financial risks. This is particularly relevant for insurers looking to streamline operations and improve capital efficiency. For instance, in 2024, the insurance industry continued to grapple with the impact of evolving regulatory landscapes and the need for robust capital management, making Enstar's offerings highly pertinent.

Investment Management of Acquired Assets

Enstar Group's investment management of acquired assets is a crucial element of its marketing mix, focusing on generating returns from the portfolios backing its run-off liabilities. This segment actively seeks risk-adjusted returns, contributing significantly to the company's overall financial health and profitability.

The investment management strategy is designed to optimize the performance of these acquired assets, ensuring they adequately cover the associated insurance liabilities while also generating surplus. This dual objective is key to Enstar's successful acquisition and management model.

- Asset Management Revenue: Enstar's investment portfolio management is a substantial revenue driver, with investment income playing a vital role in offsetting liabilities and contributing to profit.

- Risk-Adjusted Returns: The company focuses on generating competitive, risk-adjusted returns across its diverse investment portfolios, which include fixed income, equities, and alternative investments.

- Portfolio Growth: As of the first quarter of 2024, Enstar reported total investments of approximately $22.7 billion, demonstrating the scale of its asset management operations.

- Performance Impact: Investment performance directly influences Enstar's ability to meet its obligations and enhance shareholder value, making this a core strategic focus.

Diversified Legacy Solutions

Diversified Legacy Solutions, as part of Enstar Group, offers a comprehensive suite of services designed to manage and resolve legacy insurance liabilities. Their product strategy focuses on addressing a wide array of needs within the insurance industry, from traditional non-life run-off to more complex life and annuity portfolios.

Enstar's product diversification is a key strength, allowing them to cater to a global client base with varying legacy challenges. This breadth of offerings includes innovative solutions, such as those utilizing insurance-linked securities (ILS), demonstrating a forward-thinking approach to capital management and risk transfer.

The company's commitment to providing tailored solutions is evident in their approach to each segment. For instance, Enstar's expertise in non-life run-off enables insurers to exit discontinued lines of business efficiently. In the life and annuities sector, they provide capital relief and operational management for mature or underperforming blocks of business.

Key aspects of their product strategy include:

- Non-Life Run-Off Solutions: Facilitating the efficient closure and management of legacy non-life insurance portfolios.

- Life and Annuities Acquisitions: Acquiring and managing blocks of life and annuity business, providing capital and operational efficiency.

- Insurance-Linked Securities (ILS): Developing and utilizing ILS to transfer insurance risk and provide alternative capital solutions.

- Global Market Reach: Offering solutions across diverse geographical markets, adapting to local regulatory and business environments.

Enstar's product offering centers on acquiring and managing legacy insurance and reinsurance portfolios, focusing on non-life run-off business. This strategy allows clients to divest from discontinued operations and long-tail liabilities. Their expertise in claims management and operational efficiency unlocks value in these run-off portfolios.

The company also provides financial risk transfer solutions, enabling insurers to offload complex financial risks and improve capital efficiency. Enstar's investment management of acquired assets generates returns to cover liabilities and enhance profitability, with total investments reaching approximately $22.7 billion as of Q1 2024.

Enstar's product diversification extends to life and annuities, offering capital relief and operational management for mature business blocks. They also leverage innovative solutions like insurance-linked securities (ILS) for risk transfer, demonstrating a global market reach and a commitment to tailored legacy solutions.

| Product Focus | Key Features | 2024/2025 Relevance |

| Non-Life Run-Off | Acquisition and management of ceased new business portfolios, efficient claims resolution. | Continues to be the core business, addressing industry need for capital release from legacy liabilities. |

| Financial Risk Transfer | Offloading complex liabilities, improving capital efficiency for insurers. | Highly relevant given ongoing regulatory pressures and capital management focus in the insurance sector. |

| Investment Management | Generating risk-adjusted returns on acquired assets ($22.7B as of Q1 2024). | Crucial revenue driver, directly impacting Enstar's ability to meet obligations and enhance shareholder value. |

| Life & Annuities / ILS | Capital relief, operational management, alternative capital solutions. | Expands market reach and offers innovative solutions for diverse client needs in a dynamic financial landscape. |

What is included in the product

This analysis provides a comprehensive breakdown of Enstar Group's marketing mix, examining their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking to understand Enstar Group's market positioning and offers a robust framework for competitive benchmarking and strategic planning.

Simplifies complex Enstar Group 4Ps marketing strategy into actionable insights, alleviating the pain of information overload.

Provides a clear, concise overview of Enstar's 4Ps, addressing the challenge of communicating marketing effectiveness to diverse teams.

Place

Enstar Group's direct engagement with cedents is the cornerstone of its marketing strategy, focusing on bespoke solutions for insurance and reinsurance companies looking to divest run-off portfolios. This approach prioritizes deep relationships and tailored negotiations over mass-market outreach.

This direct interaction allows Enstar to understand the unique complexities of each cedent's situation, facilitating the acquisition of legacy business. For instance, in 2024, Enstar continued its active pursuit of such opportunities, demonstrating its commitment to this relationship-centric model.

Enstar Group leverages a strategically diversified global network, operating through group companies in key insurance hubs like Bermuda, the US, London, Continental Europe, and Australia. This extensive footprint, as of their latest reporting in early 2025, allows them to effectively source and execute transactions across a multitude of international jurisdictions, enhancing their market reach and operational capabilities.

Enstar's 'place' strategy is fundamentally about actively seeking out and acquiring underperforming or non-core insurance portfolios globally. This isn't a passive approach; it's a deliberate and continuous hunt for specific types of business that fit their expertise in managing run-off. They are constantly evaluating acquisition opportunities across various geographies, ensuring a steady pipeline of potential deals.

This rigorous deal sourcing is the engine driving Enstar's growth. By identifying the right prospects, they can effectively deploy their capital and operational capabilities to generate value from these portfolios. For instance, in 2024, Enstar continued its proactive strategy, completing several significant transactions, including the acquisition of a substantial portfolio of U.S. legacy liabilities, demonstrating their commitment to this core element of their business.

Industry Relationships and Referrals

Enstar Group's market access is heavily influenced by its deeply entrenched industry relationships and the resulting referrals. These connections are vital for identifying and securing opportunities to acquire legacy insurance liabilities. The company's long-standing reputation within the insurance and reinsurance sectors fosters trust, leading to a consistent flow of potential business through established networks.

This reliance on industry relationships underscores the importance of networking and maintaining a strong reputation. For instance, in 2024, a significant portion of Enstar's deal flow originated from introductions and trusted partnerships, rather than purely proactive market outreach. This organic growth mechanism is a testament to the value placed on long-term, reliable connections in the complex world of legacy insurance.

- Referral-driven Deal Sourcing: A substantial percentage of Enstar's acquisition pipeline in 2024 was attributed to direct referrals from existing industry contacts.

- Reputation as a Key Asset: Enstar's consistent track record and financial stability have cultivated a reputation that encourages proactive engagement from potential sellers.

- Network Leverage: The company actively leverages its extensive network of brokers, consultants, and other insurance carriers to identify undervalued or complex legacy portfolios.

- Trust and Reliability: In a niche market like legacy liabilities, trust is paramount, making Enstar's established relationships a critical competitive advantage.

Strategic Partnerships and Collaborations

Enstar Group actively leverages strategic partnerships to broaden its operational scope and enhance its service offerings. These alliances, particularly with investment firms and entities within the insurance-linked securities (ILS) sector, are crucial for identifying new deal opportunities and effectively deploying capital. For instance, Enstar's participation in ILS markets, which saw significant growth in 2024, allows it to access diverse risk pools and capital sources.

These collaborations are designed to be mutually beneficial, providing Enstar with access to specialized expertise and broader market penetration. In 2024, the global ILS market experienced a notable influx of capital, with total market capacity estimated to be in the tens of billions of dollars, presenting a fertile ground for Enstar's partnership strategies.

- Access to New Markets: Partnerships facilitate entry into specialized or geographically diverse insurance markets.

- Enhanced Deal Flow: Collaborations with investment firms can uncover a wider range of acquisition and reinsurance opportunities.

- Capital Deployment: Strategic alliances in the ILS market enable Enstar to efficiently deploy capital into various risk transfer solutions.

- Risk Diversification: Partnering allows Enstar to participate in a broader spectrum of risks, diversifying its portfolio.

Enstar's 'place' strategy is about actively sourcing and acquiring run-off insurance portfolios globally, a deliberate and continuous hunt for specific business types. This proactive deal sourcing is crucial for their growth, enabling them to deploy capital effectively. In 2024, Enstar completed several significant transactions, including acquiring a substantial U.S. legacy liabilities portfolio.

Their market access relies heavily on deeply entrenched industry relationships and referrals, fostering trust and a consistent flow of potential business. In 2024, a significant portion of their deal flow originated from these trusted partnerships, highlighting the value of long-term connections.

Enstar also leverages strategic partnerships, particularly with investment firms and within the insurance-linked securities (ILS) sector, to broaden operations and enhance offerings. These collaborations, crucial for identifying deals and deploying capital, allowed Enstar to access diverse risk pools in the growing ILS market of 2024.

| Key Aspect | 2024/2025 Focus | Impact |

| Deal Sourcing | Active global acquisition of run-off portfolios | Drives growth and capital deployment |

| Market Reach | Global network (Bermuda, US, London, Europe, Australia) | Facilitates international transaction execution |

| Relationship Leverage | Referral-driven from industry contacts | Ensures consistent deal flow and trust |

| Partnerships | ILS and investment firms | Enhances capital access and market penetration |

What You See Is What You Get

Enstar Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Enstar Group 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Enstar Group leverages its established industry reputation, a cornerstone of its marketing mix, to attract clients and partners. This reputation is built on over 120 successful legacy acquisitions since its inception, showcasing a proven ability to manage complex run-off portfolios effectively. Their track record signifies deep expertise and reliability within the insurance sector.

Enstar Group emphasizes its specialized expertise in claims management, actuarial analysis, and financial management as a core differentiator in the insurance run-off market. This deep knowledge allows them to effectively manage complex legacy portfolios. For instance, by the end of 2024, Enstar's continued focus on acquiring and managing run-off portfolios, which often require intricate actuarial modeling and financial restructuring, positions them as a leader.

Targeted business development and outreach are crucial for Enstar Group's marketing mix. This involves actively identifying and approaching insurance and reinsurance companies that are potential sellers of run-off business. Enstar's strategy focuses on demonstrating how it can unlock capital, reduce risk, and efficiently manage liabilities for these companies.

Enstar's direct outreach highlights the significant financial advantages of their solutions. For instance, in 2024, the global run-off market was estimated to be worth over $1 trillion, presenting a substantial opportunity for companies seeking to divest legacy portfolios. Enstar's ability to provide liquidity and specialized management for these portfolios is a key selling proposition.

Investor Relations and Financial Reporting

Enstar Group actively cultivated its public image through robust investor relations, highlighting its financial stability and strategic direction. This involved detailed quarterly and annual reports, alongside investor presentations designed to foster confidence and showcase the company's value proposition.

Prior to its acquisition by Sixth Street, Enstar's promotional efforts focused on demonstrating its financial health and operational performance. For instance, in its 2023 investor communications, the company consistently emphasized its strong capital position and its ability to generate consistent returns.

- Financial Strength: Enstar consistently reported strong solvency ratios, a key metric for the insurance industry, throughout its public tenure.

- Performance Metrics: The company regularly disclosed key performance indicators such as return on equity and net income, demonstrating its profitability.

- Strategic Vision: Investor presentations outlined Enstar's growth strategies, including its approach to acquiring and managing legacy insurance portfolios.

- Stakeholder Trust: Transparent and frequent communication built credibility with investors, crucial for maintaining market confidence.

Corporate Governance and Financial Strength

Enstar Group highlights its robust corporate governance and strong financial standing as key promotional elements. This focus on stability and ethical operations is crucial for building trust with stakeholders in the financial sector.

Their commitment to sound governance practices directly translates into confidence for potential partners and investors, underscoring Enstar's reliability and long-term viability. This is a powerful differentiator in a competitive market.

For instance, Enstar's financial strength is often reflected in its ratings from agencies like AM Best. As of recent reports, companies within the Enstar group have consistently maintained strong financial strength ratings, such as A (Excellent), which signifies a superior ability to meet ongoing insurance obligations.

- Commitment to Governance: Enstar actively promotes its adherence to high standards of corporate governance.

- Financial Strength Ratings: Maintaining strong ratings from independent agencies like AM Best is a testament to their financial stability.

- Investor Confidence: These factors are leveraged to assure investors of Enstar's integrity and capacity to manage risks effectively.

- Market Trust: Demonstrating financial strength and good governance builds essential trust within the financial services industry.

Enstar Group's promotional strategy centers on highlighting its proven expertise in the insurance run-off sector, emphasizing its track record of over 120 successful legacy acquisitions. This deep specialization in claims management and actuarial analysis positions them as a trusted partner for companies seeking to divest complex portfolios.

Their outreach directly communicates the significant financial benefits of their services, targeting a global run-off market estimated to exceed $1 trillion as of 2024. Enstar's ability to unlock capital and efficiently manage liabilities for sellers is a core part of their value proposition.

Financial strength and robust corporate governance are consistently promoted to build stakeholder trust. Maintaining strong financial strength ratings, such as A (Excellent) from AM Best, underscores Enstar's reliability and capacity to meet ongoing obligations.

Enstar's promotional efforts, particularly prior to its acquisition by Sixth Street, focused on showcasing its financial stability and operational performance through detailed investor communications, emphasizing strong capital positions and consistent return generation.

| Key Promotional Aspects | Description | Supporting Data/Facts (as of 2024/2025) |

| Industry Expertise | Specialization in insurance run-off and legacy portfolio management. | Over 120 successful legacy acquisitions. Deep expertise in claims, actuarial, and financial management. |

| Market Opportunity | Highlighting financial advantages for sellers of run-off business. | Global run-off market valued over $1 trillion (2024 estimate). Ability to provide liquidity and specialized management. |

| Financial Strength & Governance | Emphasis on stability, ethical operations, and strong ratings. | Consistent strong financial strength ratings (e.g., A Excellent from AM Best). Transparent investor communications showcasing capital position and returns. |

Price

Enstar Group's approach to pricing complex actuarial valuations for run-off portfolios is deeply rooted in meticulous analysis. They leverage sophisticated actuarial models to assess the true cost of assuming existing liabilities and claims, ensuring a fair and accurate valuation.

This process involves a granular examination of historical claims data, coupled with forward-looking projections that account for various risk factors. For instance, in 2024, Enstar continued to refine its methodologies for valuing long-tail liabilities, such as those found in workers' compensation or asbestos claims, which can span decades.

The company's ability to accurately price these complex portfolios is a key differentiator, enabling them to take on obligations that other insurers may find too unpredictable. This deep actuarial expertise underpins their pricing strategy, ensuring they can offer competitive terms while managing inherent risks effectively.

Enstar Group's pricing for acquired portfolios is meticulously crafted, reflecting a deep dive into inherent risks. This means they don't just look at the face value of liabilities; they scrutinize factors like the predictability of claim payouts and the possibility of claims costing more than initially estimated. For instance, in 2024, the insurance industry saw increased scrutiny on reserving practices, particularly for lines with long reporting tails, which directly impacts how Enstar prices such portfolios.

This risk-adjusted approach is crucial for long-term viability. By factoring in the potential for adverse development, which can significantly alter the ultimate cost of liabilities, Enstar ensures its pricing adequately covers future uncertainties. This is particularly relevant in the current economic climate, where inflation can exacerbate claims costs, a factor actively considered in their 2025 pricing models.

Negotiated transaction pricing for Enstar Group's acquisitions is far from a one-size-fits-all approach. These deals are highly customized, reflecting the unique nature of each insurance portfolio being acquired. For instance, during 2024, Enstar continued its strategy of acquiring legacy portfolios, with deal values determined through rigorous, bespoke negotiations.

The ultimate price paid is the culmination of extensive due diligence, often involving competitive bidding processes. This negotiation with the seller is critical, ensuring the agreed-upon price accurately reflects the specific risks, liabilities, and operational characteristics of the target portfolio. Enstar's successful acquisition of the legacy casualty business from a major insurer in late 2024, valued in the hundreds of millions, exemplifies this negotiated process.

Capital Management and Return Targets

Enstar's pricing strategy is deeply intertwined with its capital management and return targets. The company carefully evaluates acquisition prices to ensure they align with its financial models, aiming to generate sufficient profit from run-off business after claims are settled and investment income is realized. This meticulous approach underpins their ability to meet desired return on investment metrics.

For instance, Enstar's approach to acquiring portfolios, like those from legacy insurers, is driven by the expectation of achieving specific internal rates of return (IRR). While exact deal pricing isn't publicly disclosed, their consistent profitability in the run-off sector, often exceeding industry averages, suggests successful pricing strategies. In 2024, the specialty insurance market, where Enstar operates, saw continued interest in legacy transactions, indicating a favorable environment for their capital deployment strategy.

- Capital Efficiency: Enstar structures deals to optimize capital deployment, ensuring acquisitions contribute positively to its overall return on equity.

- Profitability Targets: Pricing is set to achieve specific profit margins, factoring in claims handling efficiency and investment yield expectations.

- Run-off Economics: The long-term nature of run-off business allows Enstar to price based on projected cash flows and the time value of money, aiming for attractive risk-adjusted returns.

- Market Alignment: Acquisition prices reflect current market conditions and the perceived value of legacy liabilities, balancing risk and reward.

Market Conditions and Competitor Pricing

Enstar's pricing strategy is dynamic, reflecting the broader economic climate and the specific dynamics of the legacy insurance market. For instance, in 2024, rising interest rates generally make it more attractive for insurers to reinsure their liabilities, potentially increasing demand for Enstar's services. However, this also means Enstar must price its solutions competitively to capture these opportunities.

The competitive environment plays a significant role in Enstar's pricing decisions. With several other well-capitalized companies operating in the legacy and runoff space, Enstar must ensure its proposed transaction terms are compelling enough to win deals. This involves balancing the need for attractive pricing for sellers with Enstar's own return on capital targets. For example, a competitor offering slightly more favorable terms on a large block of business could sway a seller's decision.

Key factors influencing Enstar's pricing include:

- Market Interest Rates: Higher rates can increase the present value of future liabilities, potentially making runoff solutions more appealing to sellers and impacting Enstar's investment income assumptions.

- Capital Availability: The amount of capital available from competitors and the broader market influences pricing power.

- Regulatory Environment: Changes in regulations can affect the cost of capital and the attractiveness of certain types of transactions.

- Deal Complexity: Highly complex or unique transactions may command different pricing due to the specialized expertise and risk assessment required.

Enstar Group's pricing for run-off portfolios is meticulously determined by in-depth actuarial analysis and risk assessment, ensuring fair valuations. Their strategy considers historical data, future projections, and factors like inflation, as seen in their 2024 and 2025 modeling for long-tail liabilities. Ultimately, pricing is a negotiated outcome, reflecting unique portfolio risks and Enstar's targeted returns, exemplified by a significant 2024 legacy deal.

| Pricing Factor | 2024 Impact | 2025 Outlook |

|---|---|---|

| Actuarial Valuation Accuracy | Refined methodologies for long-tail liabilities. | Continued focus on complex risk modeling. |

| Risk Adjustment (e.g., Adverse Development) | Considered inflation's impact on claims costs. | Active consideration of economic uncertainties. |

| Negotiated Terms | Bespoke pricing for legacy portfolio acquisitions. | Continued competitive bidding for deals. |

| Capital Efficiency & Profitability Targets | Alignment with internal rates of return (IRR). | Maintaining profitability in specialty insurance market. |

4P's Marketing Mix Analysis Data Sources

Our Enstar Group 4P's analysis is built upon a foundation of verified, up-to-date information. We meticulously review company actions, pricing models, distribution strategies, and promotional campaigns, drawing from credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks.