Eni SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eni Bundle

Eni's strengths lie in its integrated business model and significant upstream assets, but it faces challenges from volatile energy prices and the energy transition. Our comprehensive SWOT analysis delves into these critical factors, revealing the strategic opportunities and threats that will shape Eni's future.

Want to understand the full picture of Eni's competitive landscape and future trajectory? Purchase the complete SWOT analysis to gain access to actionable insights, expert commentary, and a detailed strategic roadmap, empowering your investment decisions.

Strengths

Eni's global integrated operations span the entire energy value chain, from upstream exploration and production to downstream refining, marketing, and chemicals. This extensive reach, covering over 60 countries in 2024, provides significant resilience by diversifying revenue streams and fostering operational synergies. For instance, in the first quarter of 2024, Eni reported adjusted operating results of €3.5 billion, showcasing the strength derived from its diversified portfolio.

Eni's strong upstream portfolio is a significant advantage, featuring a diverse array of oil and natural gas assets globally. This robust foundation includes substantial reserves and active production projects, ensuring a consistent supply of hydrocarbons to meet ongoing energy needs through 2025 and beyond.

This upstream strength is critical for generating stable cash flows, which are essential for funding Eni's strategic energy transition initiatives. It also underpins the company's operational stability, as evidenced by a 3% increase in production during 2024, highlighting the ongoing value and contribution of its hydrocarbon assets.

Eni's strategic diversification into green energy, encompassing solar, wind, bioenergy, hydrogen, and carbon capture, is a significant strength. This move positions the company for robust growth in an increasingly decarbonized global economy, thereby lessening its dependence on traditional fossil fuels.

This commitment to green energy not only aligns with critical global sustainability objectives but also appeals to a growing segment of environmentally conscious investors. Notably, Eni reported a substantial 37% increase in its installed renewable capacity during 2024, showcasing tangible progress in this strategic pivot.

Extensive Infrastructure and Market Access

Eni's extensive infrastructure, including its refining facilities and vast gas and LNG supply networks, provides a significant competitive edge. This robust network enables efficient product distribution across global markets, supporting its broad marketing presence. In 2024, Eni continued to expand its LNG portfolio, aiming to solidify its position as a key player in the global energy transition.

The company's established infrastructure facilitates strong market access and operational efficiency. This includes a growing LNG portfolio, which is crucial for meeting increasing global demand for cleaner energy sources. Eni also emphasizes its expanding biorefining capacity, demonstrating a commitment to diversifying its energy offerings and reducing its carbon footprint.

- Established Refining Capacity: Eni operates multiple refineries, contributing significantly to its product output.

- Global Gas and LNG Networks: The company possesses extensive infrastructure for gas and Liquefied Natural Gas (LNG) transportation and supply.

- Broad Marketing Presence: Eni's established brand and distribution channels ensure wide market reach for its energy products and services.

- Growing LNG Portfolio: In 2024, Eni actively expanded its LNG operations and partnerships to capitalize on the growing global demand for this cleaner fuel.

Advanced Technological Capabilities

Eni's advanced technological capabilities are a significant strength, particularly in optimizing exploration and production. The company's commitment to R&D fuels innovation across its portfolio, from traditional oil and gas to emerging sectors like sustainable mobility and bio-refining. This focus is underscored by the 2024 launch of its HPC6 supercomputer, designed to accelerate data processing and discovery in energy research.

This technological prowess translates into tangible benefits:

- Enhanced Efficiency: Eni's technological investments aim to improve operational efficiency in its core businesses, leading to better resource recovery and cost management.

- Innovation Driver: The company actively develops new energy technologies, positioning itself for future growth in areas like circular economy solutions and advanced materials.

- Supercomputing Power: The HPC6 supercomputer, operational in 2024, represents a leap in computational power, enabling faster analysis of complex geological data and the development of advanced energy solutions.

Eni's integrated business model, spanning upstream, midstream, and downstream operations, provides a robust foundation. This diversification across the energy value chain, active in over 60 countries as of 2024, creates significant resilience and allows for operational synergies. The company's first quarter 2024 adjusted operating results of €3.5 billion highlight the strength derived from this broad portfolio.

A strong upstream portfolio, rich in diverse oil and natural gas reserves and production projects, ensures consistent hydrocarbon supply through 2025. This underpins stable cash flows, crucial for funding Eni's energy transition initiatives and maintaining operational stability, as seen with a 3% production increase in 2024.

Eni's strategic pivot towards green energy, including solar, wind, bioenergy, and hydrogen, is a key strength. This positions the company for growth in a decarbonizing economy, reducing reliance on fossil fuels and appealing to environmentally conscious investors. Notably, Eni reported a 37% increase in installed renewable capacity in 2024.

The company's extensive infrastructure, encompassing refining facilities and vast gas and LNG networks, offers a competitive advantage. This robust network ensures efficient global product distribution and market access. Eni's expanding LNG portfolio in 2024 aims to solidify its role in the global energy transition.

| Strength Area | Key Aspect | 2024/2025 Data/Context |

|---|---|---|

| Integrated Operations | Global presence and value chain coverage | Active in over 60 countries; Q1 2024 adjusted operating results: €3.5 billion |

| Upstream Portfolio | Diverse oil and gas reserves and production | Ensures stable cash flows; 3% production increase in 2024 |

| Green Energy Diversification | Investment in renewables, bioenergy, hydrogen | 37% increase in installed renewable capacity in 2024 |

| Infrastructure & Networks | Refining, gas and LNG supply chains | Expanding LNG portfolio; focus on biorefining capacity |

| Technological Capabilities | R&D, optimization, supercomputing | HPC6 supercomputer launched in 2024 for accelerated research |

What is included in the product

Delivers a strategic overview of Eni’s internal and external business factors, highlighting its strengths in integrated operations and opportunities in energy transition, while acknowledging weaknesses in legacy assets and threats from market volatility.

Offers a clear, structured framework to identify and address Eni's strategic challenges and opportunities, thereby alleviating common business planning pain points.

Weaknesses

Eni's significant reliance on hydrocarbon prices remains a key weakness. Despite ongoing diversification into renewables, a substantial part of its revenue and profitability is still tied to the volatile markets for crude oil and natural gas. This exposure makes long-term financial forecasting difficult.

Fluctuations in commodity prices directly impact Eni's financial performance. For instance, while Eni reported strong results in early 2024, the underlying dependence on oil and gas prices means that downturns in these markets can quickly erode profitability and investment capacity. This price volatility is a persistent risk factor.

Eni's integrated energy model necessitates significant capital expenditure. This includes ongoing maintenance of its vast oil and gas infrastructure, the costly development of new extraction fields, and substantial investments in its growing renewable energy portfolio. These large outlays can put pressure on the company's cash flow and potentially increase its debt burden, thereby limiting its financial agility.

Despite efforts to manage capital spending, Eni's projections indicate a considerable financial commitment. The company anticipates a net capital expenditure of approximately €27 billion for the period spanning 2024 through 2027. This sustained high level of investment underscores the capital-intensive nature of its operations and future growth strategies.

Eni faces significant environmental and regulatory scrutiny as a major fossil fuel company. This scrutiny translates into increasing compliance costs, as demonstrated by the €2.7 billion in environmental provisions Eni reported for 2023. The pressure to decarbonize rapidly and meet evolving climate targets, such as the EU's Fit for 55 package, poses substantial operational and financial challenges, potentially impacting project timelines and investment strategies.

Geopolitical Risks and Operational Instability

Eni's extensive global footprint, particularly in regions facing political volatility, presents a significant weakness. For instance, operations in North Africa and parts of Sub-Saharan Africa, while offering growth potential, are inherently exposed to risks like sudden regulatory shifts or social unrest. These factors can directly impede exploration, production, and the secure transport of energy resources, impacting Eni's revenue streams and operational continuity.

The company's exposure to diverse and sometimes unstable political landscapes means that geopolitical tensions, such as those observed in 2024 impacting global energy markets, can directly disrupt Eni's supply chains and project execution. This necessitates substantial investment in risk mitigation and security, diverting resources that could otherwise be allocated to growth initiatives. Such instability can also lead to unexpected asset impairments or even expropriation, as seen in historical instances in politically sensitive jurisdictions.

- Operational Disruptions: Eni's presence in countries like Libya, where political instability has been a persistent issue, can lead to temporary or prolonged shutdowns of production facilities.

- Supply Chain Vulnerability: Geopolitical events can create bottlenecks or outright blockades in key shipping routes or transit corridors, affecting Eni's ability to deliver oil and gas to market.

- Regulatory Uncertainty: Frequent changes in local laws and policies in operating countries can create an unpredictable business environment, impacting long-term investment decisions and project profitability.

- Asset Impairment Risk: In extreme cases of political upheaval or conflict, Eni's physical assets could be damaged or seized, leading to significant write-downs on its balance sheet.

Brand Perception and Transition Challenges

Eni grapples with shifting its brand image from a legacy oil and gas entity to a forward-thinking, sustainable energy provider. This transition is vital for attracting top talent and securing investment for its burgeoning green initiatives.

Historical ties to fossil fuels can create headwinds, potentially impacting public perception and investor confidence in its sustainability commitments. This is particularly relevant as Eni's chemical division reported losses in Q1 2025, highlighting the need for a clear and compelling narrative around its diversified energy strategy.

- Brand Transformation: Eni needs to effectively communicate its pivot towards renewables and sustainable practices to overcome past associations with fossil fuels.

- Talent Acquisition: A strong sustainability image is crucial for attracting and retaining skilled professionals in a competitive energy market.

- Financing Green Projects: Positive brand perception is key to securing capital for new, environmentally focused ventures.

- Public Acceptance: Overcoming negative perceptions related to historical operations is essential for gaining broad societal support for its future energy mix.

Eni's substantial capital expenditure requirements, projected at approximately €27 billion between 2024 and 2027, place a significant strain on its financial flexibility. This high level of investment, covering both traditional and renewable energy infrastructure, can impact cash flow and debt levels. The company's substantial environmental provisions, amounting to €2.7 billion in 2023, further highlight the financial burden associated with regulatory compliance and decarbonization efforts.

The company's significant exposure to volatile hydrocarbon prices remains a core weakness, directly impacting its revenue and profitability. For instance, while Eni reported strong financial results in early 2024, this performance is inherently linked to the fluctuating oil and gas markets. This price volatility creates uncertainty for long-term financial planning and investment capacity.

Eni's operational footprint in politically unstable regions, such as North Africa and Sub-Saharan Africa, introduces significant risks. Geopolitical tensions and potential regulatory shifts in these areas can disrupt supply chains, hinder project execution, and even lead to asset impairment, as historical events in sensitive jurisdictions have demonstrated. The company's chemical division also faced challenges, reporting losses in Q1 2025, underscoring the need for a robust strategy to manage its diversified energy portfolio and brand perception.

What You See Is What You Get

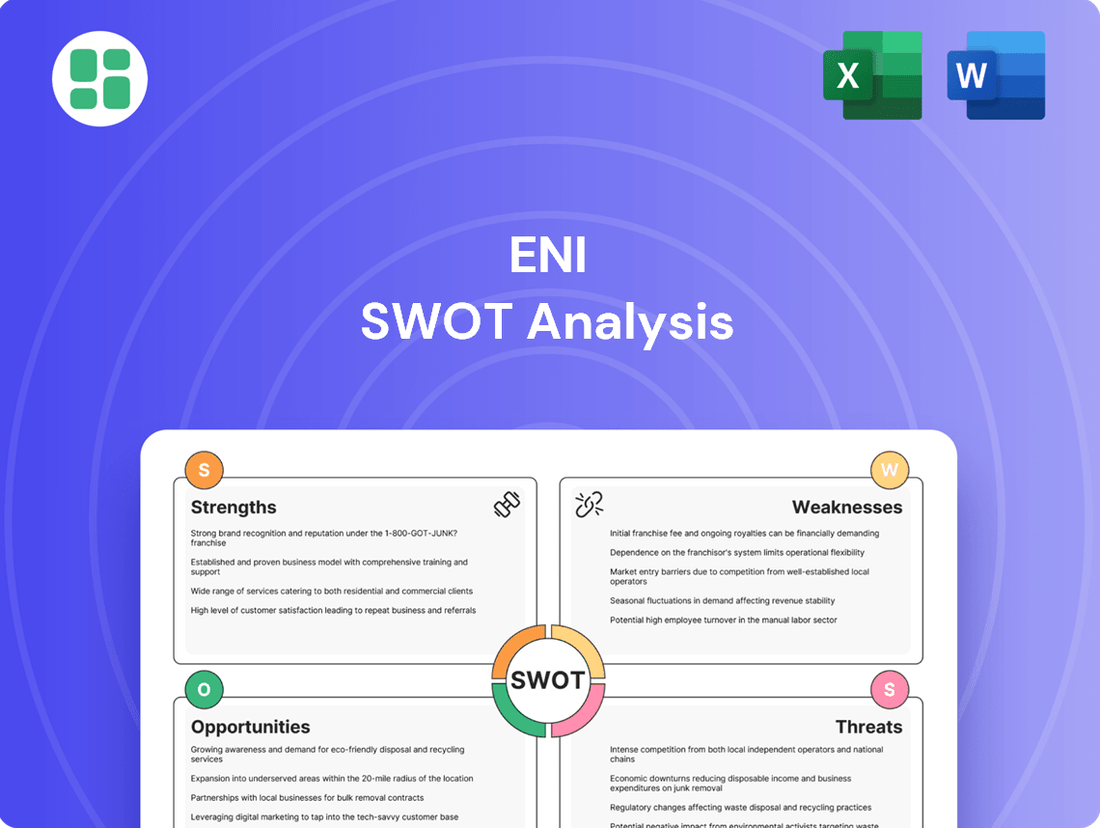

Eni SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you get exactly what you expect—a professionally structured and comprehensive report. Unlock the full, detailed analysis by completing your purchase.

Opportunities

The global drive for decarbonization is a significant opportunity for Eni to speed up its shift towards renewable energy and cleaner solutions. By growing its presence in solar, wind, biofuels, and hydrogen, Eni can tap into new income sources and become a frontrunner in the sustainable economy.

This strategic pivot resonates with international climate objectives and the increasing investor interest in environmentally responsible investments. For instance, Eni's subsidiary, Plenitude, has set an ambitious target to reach 15 gigawatts of installed renewable capacity by 2030, demonstrating a concrete commitment to this growth area.

Natural gas, especially liquefied natural gas (LNG), is increasingly viewed as a vital bridge fuel. It presents a cleaner option compared to coal and oil across numerous sectors. This growing global appetite for LNG, fueled by energy security needs and the push for reduced carbon emissions, directly benefits Eni’s substantial gas production and liquefaction infrastructure.

Eni is strategically positioned to capitalize on this trend, aiming to expand its LNG portfolio significantly. The company plans to reach approximately 18 million tons per year of LNG by 2027, demonstrating a clear commitment to meeting this escalating market demand.

Eni is well-positioned to capitalize on technological advancements, particularly in AI and big data analytics, to boost efficiency in its operations. By integrating these technologies, Eni can achieve more precise exploration, streamlined production, and optimized refining processes. This digital transformation promises to lower operational expenses and elevate safety standards across the board.

The company's strategic investments in cutting-edge technologies like quantum computing and supercomputers are geared towards developing innovative solutions for the energy transition. Eni is actively exploring opportunities in carbon capture, utilization, and storage (CCUS) and the burgeoning hydrogen market, leveraging these powerful computational tools to accelerate progress in these critical areas.

Expansion in Emerging Markets

Many emerging economies are witnessing accelerated industrialization and urbanization, which directly translates to a significant surge in energy demand. Eni is well-positioned to tap into these expanding markets by offering a comprehensive suite of energy solutions, encompassing both conventional energy sources and the development of new renewable energy infrastructure.

By strategically establishing a strong presence in these dynamic regions, Eni can effectively diversify its revenue streams across different geographies. This approach not only mitigates risk but also cultivates valuable long-term growth partnerships. For instance, Eni has committed a substantial €24 billion investment in North Africa over a four-year period, underscoring its commitment to these burgeoning markets.

- Growing Energy Demand: Emerging markets' rapid industrialization fuels a substantial increase in energy needs.

- Diversified Offerings: Eni can supply both traditional and renewable energy solutions to meet this demand.

- Geographic Diversification: Expanding in these regions reduces reliance on single markets and enhances revenue stability.

- Strategic Investment: Eni's €24 billion investment in North Africa exemplifies its focus on these growth opportunities.

Circular Economy and Bio-Product Development

Eni's chemical division is well-positioned to capitalize on the growing circular economy. By focusing on bio-product development, Eni can create high-value offerings from renewable feedstocks and waste streams.

This strategic pivot involves innovation in areas like bio-plastics, sustainable chemicals, and advanced biofuels. These products not only meet increasing consumer and regulatory demand for eco-friendly solutions but also reduce dependence on finite fossil resources, boosting resource efficiency.

- Innovation in Bio-Products: Developing plastics and chemicals from plant-based materials and recycled waste.

- Sustainable Chemicals: Creating chemical intermediates and end-products with a lower environmental footprint.

- Advanced Biofuels: Producing next-generation biofuels that offer significant greenhouse gas emission reductions.

- Resource Efficiency: Transforming waste into valuable resources, aligning with circular economy principles.

Eni has set an ambitious target to increase its biorefining capacity to over 5 million tons per year by 2030, underscoring its commitment to this growth area. This expansion is expected to drive significant revenue and market share gains in the sustainable products sector.

The global push for decarbonization presents a significant opportunity for Eni to expand its renewable energy portfolio, targeting a 15 GW installed capacity by 2030 through its Plenitude subsidiary.

Natural gas, particularly LNG, is a key transition fuel, and Eni aims to grow its LNG production to around 18 million tons per year by 2027, addressing energy security and emission reduction goals.

Eni is leveraging advanced technologies like AI and big data to enhance operational efficiency, reduce costs, and improve safety across its exploration, production, and refining activities.

Emerging economies' rising energy demand offers Eni a chance to diversify geographically, with a €24 billion investment planned for North Africa, strengthening its market presence and revenue streams.

Eni's chemical division is poised to benefit from the circular economy, aiming to boost biorefining capacity to over 5 million tons per year by 2030 through innovation in bio-products and sustainable chemicals.

Threats

The energy sector's inherent volatility, fueled by geopolitical tensions, supply-demand shifts, and economic cycles, presents a significant threat to Eni. Fluctuations in oil, gas, and power prices directly impact Eni's revenue streams and profitability, potentially disrupting long-term investment strategies.

For instance, lower Brent crude prices, averaging around $85 per barrel in Q3 2024, directly affected Eni's upstream segment performance, underscoring the sensitivity to market price movements.

Managing this price uncertainty necessitates sophisticated hedging instruments and adaptable operational frameworks to mitigate adverse financial impacts and maintain investment capacity.

Increasingly stringent climate policies, such as carbon pricing and greenhouse gas emission regulations, present a significant challenge to Eni's traditional fossil fuel business. These measures can directly increase operating expenses and potentially decrease market demand for conventional energy sources. For instance, the EU's Fit for 55 package aims for a 55% reduction in net greenhouse gas emissions by 2030 compared to 1990 levels, impacting the entire energy sector.

The potential for stranded assets within Eni's hydrocarbon portfolio is a growing concern as global efforts to decarbonize accelerate. Regulations designed to limit fossil fuel use could render existing reserves less economically viable. This necessitates substantial strategic shifts and considerable investment in cleaner energy alternatives to mitigate these risks and ensure long-term business sustainability.

New European sustainability reporting directives, like the Corporate Sustainability Reporting Directive (CSRD), which began applying to large companies in 2024, will increase transparency and scrutiny on Eni's environmental impact. This heightened regulatory landscape demands robust compliance strategies and proactive adaptation to evolving environmental standards, potentially affecting Eni's access to capital and market perception.

Eni's push into renewables, a sector projected to grow significantly with global decarbonization efforts, is met with fierce competition. Established renewable energy giants, traditional utilities pivoting to green sources, and agile new entrants with specialized technological know-how are all vying for dominance.

This crowded market can compress profit margins, making it harder for Eni to achieve its ambitious renewable capacity goals. For instance, the global renewable energy market was valued at approximately $1.2 trillion in 2023 and is expected to reach over $2.5 trillion by 2030, indicating substantial growth but also intense rivalry for projects and market share.

To navigate this, Eni must effectively differentiate its renewable energy solutions and secure profitable projects. Success hinges on its ability to innovate and secure a strong position in a rapidly evolving energy landscape.

Technological Disruption and Substitution

Rapid advancements in alternative energy technologies, such as enhanced battery storage and breakthroughs in fusion energy, pose a significant threat. These innovations could accelerate the decline in demand for fossil fuels, impacting Eni's established business model.

For instance, the global energy storage market, crucial for integrating renewables, was projected to reach USD 100 billion by 2025, demonstrating the rapid pace of this technological shift. Eni must actively monitor and invest in these disruptive areas to mitigate long-term risks.

- Technological Substitution: Emerging technologies like advanced solar PV and green hydrogen production could directly compete with and displace traditional fossil fuel products.

- Investment Needs: Significant capital investment is required to adapt to or lead in these new technological frontiers, potentially straining resources.

- Market Volatility: The speed of technological adoption can create unforeseen market shifts, making long-term planning more challenging for companies reliant on legacy assets.

Geopolitical Instability and Supply Chain Risks

Ongoing geopolitical tensions, such as the conflict in Ukraine and broader global trade disputes, pose a significant threat to Eni's operations. These events can disrupt critical supply chains for oil and gas, impacting Eni's ability to secure resources and deliver products. For instance, disruptions in the Mediterranean region, where Eni has substantial assets, could lead to increased operational costs and project delays.

Sanctions and political instability in regions where Eni operates, particularly in North Africa and the Middle East, present further risks. These factors can jeopardize operational security, leading to potential financial losses and impacting Eni's access to key markets. In 2023, the energy sector globally saw increased volatility due to these geopolitical factors, with companies facing challenges in navigating complex regulatory environments and ensuring asset safety.

Eni's exposure to these risks is amplified by the interconnected nature of the global energy market. Diversifying supply routes and investing in robust cybersecurity measures are crucial strategies to mitigate these threats. The company's commitment to energy transition also means navigating the complexities of new geopolitical alliances and potential trade barriers related to renewable energy technologies and critical minerals.

- Geopolitical Disruptions: Conflicts and trade disputes directly impact Eni's global supply chains, affecting resource availability and market access.

- Operational Security: Sanctions, political unrest, or infrastructure attacks in operating regions can lead to significant financial losses and project delays.

- Market Access: Geopolitical tensions can restrict Eni's ability to operate in or export to certain key markets, impacting revenue streams.

- Mitigation Strategies: Diversifying supply routes and strengthening cybersecurity are essential to counter fragmentation and volatility in the global energy landscape.

Eni faces significant threats from the increasing global focus on decarbonization, which could lead to regulatory pressures and the devaluation of its hydrocarbon assets. The company must navigate a complex landscape of evolving climate policies, such as the EU's Fit for 55 package, which aims for substantial emissions reductions by 2030. This transition necessitates considerable investment in cleaner energy, while also managing the risk of stranded assets in its traditional portfolio.

The competitive renewable energy market presents another challenge, with established players and new entrants vying for market share in a sector projected for significant growth. Intense competition can compress profit margins, making it difficult for Eni to achieve its renewable capacity targets. For instance, the global renewable energy market was valued at approximately $1.2 trillion in 2023, highlighting both the opportunity and the fierce rivalry.

Rapid technological advancements in areas like battery storage and alternative energy sources pose a disruptive threat to Eni's established business model. The global energy storage market, for example, was projected to reach USD 100 billion by 2025, indicating the pace at which new technologies are reshaping energy demand. Eni's ability to adapt and invest in these disruptive areas will be crucial for mitigating long-term risks.

Geopolitical instability and trade disputes continue to threaten Eni's global operations by disrupting supply chains and impacting market access. Conflicts, sanctions, and political unrest in key operating regions can lead to increased costs, project delays, and jeopardized operational security. In 2023, the energy sector experienced heightened volatility due to these geopolitical factors, underscoring the need for robust mitigation strategies such as supply chain diversification.

SWOT Analysis Data Sources

This Eni SWOT analysis is built upon a robust foundation of data, drawing from Eni's official financial statements, comprehensive market research reports, and insights from industry experts and analysts to provide a well-rounded perspective.