Eni PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eni Bundle

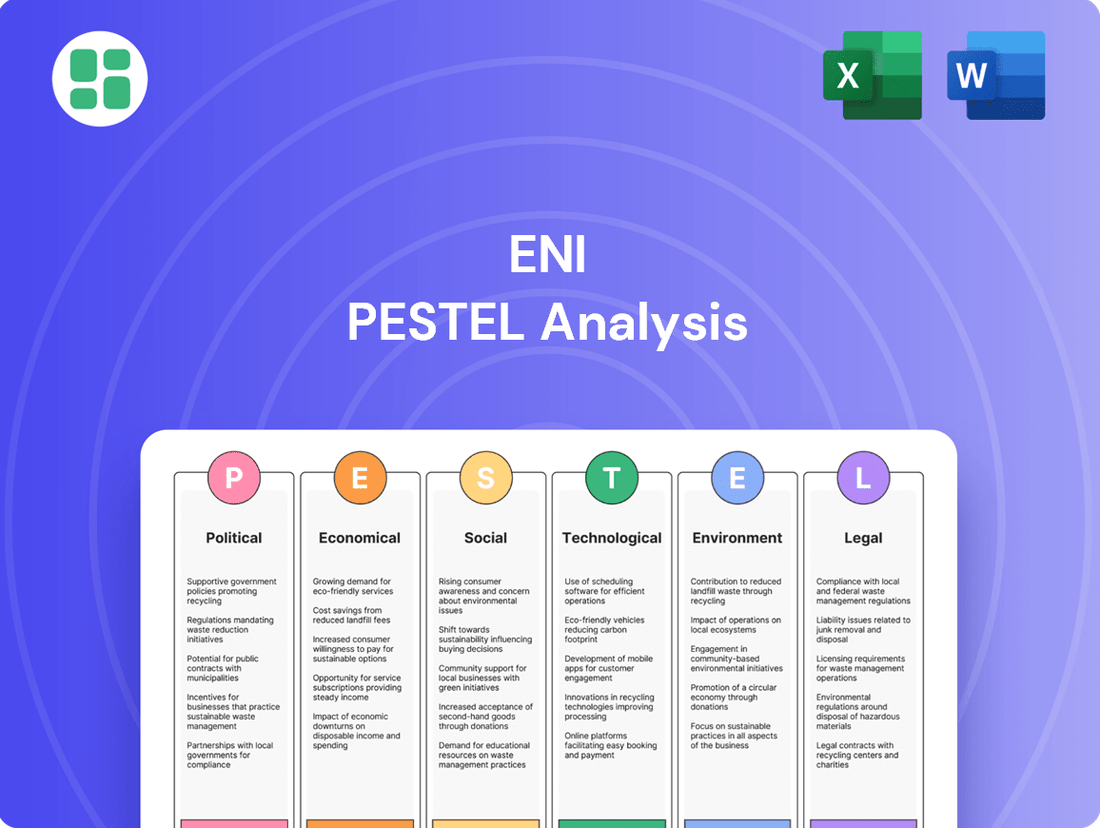

Navigate the complex external forces shaping Eni's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing this energy giant, and gain a critical edge in your market strategy. Download the full report now for actionable intelligence.

Political factors

Eni's operations are intrinsically linked to geopolitical stability, especially in regions like North Africa and the Eastern Mediterranean where it holds substantial exploration assets. Fluctuations in regional conflicts or political unrest directly impact production continuity and investment security. For instance, ongoing tensions in parts of the Middle East, while not directly impacting Eni's core production in 2024, contribute to a broader climate of uncertainty affecting global energy prices and supply chain reliability.

Ensuring energy security for Europe, a key market for Eni, is a paramount political factor. Following the significant disruptions in 2022, European nations, including Italy, have prioritized diversifying energy sources and securing stable supplies. Eni's role in supplying natural gas, particularly through its LNG portfolio and pipeline connections, remains crucial in this context, with the company actively seeking to bolster these flows to meet European demand through 2025.

The stability of countries where Eni operates, such as Egypt and Libya, directly shapes its strategic planning and operational capabilities. In 2024, Eni continued its focus on securing and expanding production in these areas, navigating complex political landscapes to maintain its upstream output. International relations, including trade agreements and sanctions regimes, also play a significant role in shaping Eni's market access and investment decisions.

Governments are accelerating energy transition initiatives, with many setting ambitious net-zero targets. For instance, the European Union's Fit for 55 package aims to cut emissions by at least 55% by 2030 compared to 1990 levels, directly influencing fossil fuel investments and promoting renewables. This policy landscape compels companies like Eni to adapt their operational strategies and capital allocation towards cleaner energy sources.

Eni's extensive international trade relations are significantly shaped by global agreements and potential sanctions. For instance, in 2023, the European Union continued to navigate complex trade dynamics with Russia, impacting energy supply routes and pricing for companies like Eni, which historically had substantial gas contracts with Russia. The imposition or removal of tariffs on oil and gas products directly influences Eni's trading margins and the cost-effectiveness of its supply chain, as seen with ongoing discussions around potential trade barriers impacting global energy flows.

Sanctions on specific nations can create substantial operational hurdles and necessitate strategic adjustments for Eni. For example, sanctions against countries involved in geopolitical conflicts can disrupt Eni's access to exploration blocks or impact its ability to repatriate profits. This was evident in 2024 as international bodies considered further measures impacting energy-producing nations, forcing Eni to re-evaluate its investment portfolios and seek alternative market access to mitigate risks and maintain profitability across its diverse oil, gas, and LNG operations.

Host Country Regulations and Nationalization Risks

Eni navigates a complex web of host country regulations, impacting everything from resource ownership and revenue sharing to local content mandates. These rules vary significantly across its operational footprint, presenting a dynamic challenge to consistent strategy implementation.

The specter of nationalization or abrupt shifts in fiscal policies poses a substantial risk to Eni's substantial, long-term investments. Such changes can dramatically alter the profitability and viability of projects, necessitating robust risk mitigation strategies.

Eni's approach prioritizes cultivating enduring partnerships with host nations and their communities. This strategy aims to foster stability and mutual benefit, thereby reducing the likelihood of adverse regulatory shifts or expropriation.

- Regulatory Divergence: Eni's operations span over 30 countries, each with unique regulatory frameworks, creating a complex compliance landscape.

- Fiscal Regime Sensitivity: Changes in tax rates or royalty structures in key producing countries can directly impact Eni's profitability, as seen in past adjustments in countries like Italy and Egypt.

- Partnership Focus: Eni's commitment to local content development and community engagement is a strategic pillar designed to enhance its social license to operate and mitigate political risks.

Political Support for Energy Transition Projects

Political backing is crucial for Eni's renewable energy and biorefining growth. Government subsidies, supportive regulations, and public-private collaborations are key drivers for ventures like Plenitude and Enilive. For instance, Italy's National Recovery and Resilience Plan (PNRR) allocates significant funds to green initiatives, potentially benefiting Eni's transition projects through 2026.

The political commitment to an accelerated energy transition directly influences the feasibility and expansion of Eni's low-carbon businesses. In 2024, the European Union's REPowerEU plan continues to emphasize renewable energy deployment, offering a favorable policy environment for companies like Eni investing in sustainable solutions.

- Government Incentives: Continued availability of tax credits and grants for renewable energy installations and biofuels production.

- Regulatory Stability: Predictable and supportive regulatory frameworks that encourage long-term investment in low-carbon technologies.

- Public-Private Partnerships: Opportunities for collaboration on large-scale energy transition infrastructure projects.

- International Agreements: Adherence to global climate targets, such as those under the Paris Agreement, which drives national policy towards decarbonization.

Political stability in Eni's operational regions, particularly North Africa and the Eastern Mediterranean, directly impacts its asset security and production continuity. Geopolitical tensions, while not always directly affecting Eni's output in 2024, contribute to market volatility and supply chain concerns. For example, ongoing regional instability can influence global energy prices, a factor Eni closely monitors.

European energy security remains a critical political driver, with Italy and other EU nations actively seeking diversification away from single suppliers. Eni's role in supplying natural gas, including its growing LNG portfolio, is vital to meeting this demand through 2025, as demonstrated by its continued efforts to secure new supply agreements.

Government policies promoting energy transition, such as the EU's Fit for 55 package aiming for a 55% emissions reduction by 2030, compel Eni to shift capital towards renewables and lower-carbon solutions. This regulatory push influences investment decisions and strategic planning for its future energy mix.

International relations and trade agreements significantly shape Eni's market access and operational costs. Sanctions regimes or trade disputes can disrupt supply chains and impact profitability, as seen with historical dependencies on Russian gas and ongoing global trade dynamics affecting energy flows in 2024.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Eni, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A concise, actionable summary of Eni's PESTLE analysis, highlighting key external factors that impact strategic decisions, thereby reducing the burden of sifting through extensive reports.

Economic factors

Eni's core upstream operations are deeply tied to the unpredictable swings in global oil and gas prices. These fluctuations are driven by a complex interplay of supply and demand, critical geopolitical developments, and the production decisions made by groups like OPEC+.

For instance, in early 2024, Brent crude oil prices hovered around $80 per barrel, a significant drop from the $90+ levels seen in late 2023, illustrating the rapid price shifts Eni must navigate. Such volatility directly affects Eni's revenue streams and its ability to fund future projects.

Despite Eni's efforts to build financial stability, substantial price drops can severely curtail its earnings and investment potential. This sensitivity means that market conditions, rather than just operational efficiency, play a huge role in Eni's financial performance.

Global economic growth is a primary driver of energy demand, influencing consumption for oil, natural gas, and electricity. A strong economy generally boosts demand for Eni's offerings, while downturns can suppress it and put downward pressure on prices.

For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 3.1% in 2023. This anticipated growth suggests a continued, albeit moderate, demand for energy resources.

Eni's own World Energy Review consistently highlights this correlation, showing how shifts in GDP directly impact energy consumption patterns and, consequently, the company's market performance and revenue streams.

Eni is significantly boosting its investments in renewable energy and biorefining, responding to a clear upward trend in demand for environmentally friendly fuels and electricity. This strategic pivot is crucial for the company's future growth and aligns with global decarbonization efforts.

The economic success of these new ventures hinges on several factors. For instance, the cost of advanced biofuels, like sustainable aviation fuel (SAF), needs to become competitive with traditional jet fuel. While SAF prices can range from $2 to $5 per gallon in 2024, depending on feedstock and production methods, achieving wider market adoption requires further cost reductions and supportive policies.

Eni aims for substantial expansion in its renewable and bio-based product segments by 2030. This includes increasing biorefining capacity and developing new renewable power generation projects, anticipating a growing market share for these sustainable alternatives.

Inflationary Pressures and Cost Management

Rising inflation presents a significant challenge for Eni, directly impacting its operational expenditures across the entire value chain from exploration and production to refining and new project development. For instance, the global inflation surge in 2022 and 2023 has demonstrably increased the cost of materials, labor, and logistics for energy companies.

Maintaining profitability and achieving financial objectives hinges on Eni's ability to implement robust cost management strategies and exercise strict capital discipline. This is particularly vital during periods of elevated inflation where cost overruns can quickly erode margins.

Eni's strategic initiatives explicitly address corporate cost efficiency as a core pillar. The company has outlined targets for cost savings and operational improvements to mitigate the impact of inflationary pressures.

Key areas of focus for Eni's cost management include:

- Optimizing exploration and production expenditures through technological advancements and efficient resource allocation.

- Streamlining refining and petrochemical operations to reduce energy and raw material consumption.

- Implementing rigorous project management to control capital expenditure and avoid cost overruns in new developments.

- Leveraging digital transformation to enhance operational efficiency and reduce administrative overheads.

Access to Capital and Financial Markets

Eni's substantial capital expenditure, encompassing both traditional oil and gas ventures and its burgeoning energy transition projects, critically depends on robust access to capital markets. The company's financial health and strategic capital allocation directly influence its ability to secure the necessary funding for these ambitious plans. Favorable market conditions, including interest rates and investor sentiment, play a significant role in Eni's financing costs and success.

Eni's financial strategy is geared towards maintaining a strong credit profile and a diverse shareholder base to ensure continued access to funding. This approach aims to instill investor confidence, which is crucial for attracting the significant capital required for its dual strategy of maintaining oil and gas production while investing heavily in renewable energy and decarbonization technologies. As of early 2024, Eni's robust balance sheet and commitment to shareholder returns have supported its ability to access capital, though market volatility remains a factor.

- Capital Expenditure: Eni planned to invest €16 billion in 2024, with a significant portion allocated to its energy transition segment, demonstrating a commitment to diversifying its energy sources.

- Debt Management: As of the first quarter of 2024, Eni maintained a net debt of approximately €56 billion, a figure actively managed through its financial operations and cash flow generation.

- Shareholder Returns: The company's dividend policy and share buyback programs are designed to enhance shareholder value and maintain attractiveness to investors, thereby supporting its capital access.

- Market Conditions: Global interest rate trends and the overall health of financial markets in 2024 continue to influence the cost and availability of capital for large-scale energy projects.

Global economic growth directly influences energy demand, impacting Eni's sales volumes and pricing power. The IMF's 3.2% global growth projection for 2024 suggests continued, moderate energy consumption, which supports Eni's revenue streams.

Eni's profitability is highly sensitive to oil and gas price volatility; Brent crude trading around $80/barrel in early 2024 highlights this risk. The company's strategic shift towards renewables aims to mitigate this, with biorefining costs for products like SAF needing to become competitive, with prices ranging from $2-$5/gallon in 2024.

Inflationary pressures in 2023 and early 2024 have increased Eni's operational costs, necessitating stringent cost management and capital discipline. Eni's planned €16 billion capital expenditure for 2024, with a significant portion for energy transition, relies on continued access to capital markets, influenced by interest rates and investor sentiment.

| Economic Factor | Eni's Exposure/Impact | 2024 Data/Projections |

|---|---|---|

| Global Economic Growth | Drives energy demand; impacts Eni's sales volume and pricing. | Projected 3.2% global growth by IMF. |

| Commodity Prices (Oil & Gas) | Directly affects Eni's revenue and profitability. | Brent crude around $80/barrel in early 2024. |

| Inflation | Increases operational costs across the value chain. | Persistent global inflation impacting material, labor, and logistics costs. |

| Investment in Renewables | Growth opportunity; cost competitiveness is key. | SAF prices $2-$5/gallon in 2024; Eni plans €16bn capex for 2024, with significant renewable allocation. |

What You See Is What You Get

Eni PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Eni covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides valuable insights for strategic decision-making.

Sociological factors

Growing public awareness about climate change is significantly shaping consumer preferences and investment decisions, prompting energy firms like Eni to ramp up their sustainable energy initiatives. This shift is evident in the increasing demand for renewable energy sources, with global renewable energy capacity expected to grow substantially in the coming years, influencing Eni's strategic direction.

Eni's commitment to a 'Just Transition' underscores its understanding of the social implications of decarbonization, aiming for inclusive energy access while reducing emissions. This approach acknowledges that the shift to cleaner energy must consider societal equity and economic impacts, a sentiment increasingly echoed in public discourse and policy discussions.

Eni actively champions workforce diversity and inclusion, understanding that varied perspectives fuel innovation and business success. In 2023, Eni reported that women held 31.5% of management positions, a figure steadily increasing as part of its gender equality goals.

The company's commitment extends to fostering age diversity and supporting employees with disabilities, aiming for a truly equitable and inclusive environment. These efforts are crucial for attracting and retaining top talent in an increasingly globalized and competitive energy sector.

Eni’s social license to operate hinges on robust corporate social responsibility (CSR) and community engagement across its global operations. In 2023, Eni continued to invest in local development, supporting projects focused on education and healthcare, aiming to foster positive relationships in the regions where it extracts resources.

The company’s commitment to human rights protection is paramount, especially in areas with potential social vulnerabilities. Eni’s 2024 sustainability reports highlight ongoing efforts to address community grievances through dedicated dialogue mechanisms, a crucial aspect for maintaining operational continuity and trust.

Health and Safety Standards

Eni places a high priority on the health and safety of its workforce, acknowledging the significant risks inherent in the oil and gas sector. This commitment is not just an operational necessity but also a fundamental social expectation, driving continuous improvement in safety performance.

In 2023, Eni reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.45 per million hours worked, demonstrating a strong focus on workplace safety. This metric reflects the company's dedication to minimizing accidents and ensuring the well-being of its employees and contractors across all operations.

- Employee Well-being: Eni's proactive approach to health and safety aims to protect its most valuable asset – its people.

- Operational Excellence: Robust safety standards are intrinsically linked to efficient and reliable operations in the energy industry.

- Social Responsibility: Adherence to and exceeding safety expectations is crucial for maintaining Eni's social license to operate and its reputation.

- Continuous Improvement: The company actively seeks to enhance its safety protocols and performance through ongoing training and technological advancements.

Talent Attraction and Retention in Energy Transition

Eni's pivot towards renewable energy and digital solutions necessitates a strategic focus on talent. Attracting individuals with specialized skills in areas like solar, wind, hydrogen, and advanced analytics is paramount for the company's decarbonization strategy. For instance, as of early 2024, the global demand for renewable energy engineers was projected to grow significantly, with a particular emphasis on those with digital integration experience.

To meet these evolving needs, Eni must invest heavily in continuous professional development and reskilling initiatives. The energy sector is undergoing a rapid transformation, and by mid-2024, many companies were reporting a skills gap in areas critical to the energy transition. Providing robust training programs ensures that Eni's workforce remains adept at implementing sustainable practices and achieving its environmental objectives.

- Talent Demand: By 2025, the International Energy Agency (IEA) anticipates a substantial increase in jobs related to clean energy technologies, requiring new skill sets.

- Skills Gap: Reports from late 2023 indicated that over 60% of energy companies faced challenges in finding talent with expertise in digital transformation and sustainability.

- Training Investment: Companies like Eni are increasing their training budgets, with some allocating over 15% of their HR budget to upskilling programs for the energy transition.

- Retention Strategies: Offering clear career progression paths and opportunities for involvement in cutting-edge sustainable projects is key to retaining talent in this competitive landscape.

Societal expectations regarding corporate responsibility and ethical conduct are increasingly influencing Eni's operations and strategic decisions. Public demand for transparency in environmental impact and community engagement continues to grow, pushing companies to adopt more sustainable practices. This is reflected in the rising importance of environmental, social, and governance (ESG) metrics in investment decisions, with global ESG assets projected to reach over $50 trillion by 2025.

Eni's commitment to a 'Just Transition' demonstrates an awareness of the social implications of energy shifts, aiming for equitable outcomes. This focus on inclusivity is crucial as societies grapple with the economic and social impacts of decarbonization. Public discourse increasingly emphasizes the need for policies that protect vulnerable communities during this transition.

The company's emphasis on diversity and inclusion, with women holding 31.5% of management positions in 2023, reflects a broader societal push for gender equality. This commitment extends to fostering age diversity and supporting employees with disabilities, crucial for attracting and retaining talent in a competitive global market.

Eni's social license to operate is reinforced through significant investment in local development and community engagement, particularly in education and healthcare projects in 2023. The company's dedication to human rights protection and addressing community grievances through dialogue mechanisms is vital for maintaining trust and operational continuity.

Technological factors

Eni's upstream operations are significantly impacted by continuous innovation in exploration and production technologies. Advanced seismic imaging, for instance, allows for more precise identification of hydrocarbon reserves, reducing the risk and cost associated with exploration. In 2023, Eni reported a significant increase in exploration success rates, partly attributed to these technological upgrades.

New drilling techniques, including managed pressure drilling and extended reach drilling, enable Eni to access previously uneconomical reserves and operate more efficiently. Reservoir management technologies, such as enhanced oil recovery (EOR) methods, are crucial for maximizing the output from existing fields. These technological advancements also bolster Eni's commitment to safer and more environmentally responsible operations, a key consideration in the current energy landscape.

Eni's strategic pivot towards renewable energy, a significant technological factor, hinges on advancements in solar photovoltaic (PV) and wind power. The continued cost decline in these sectors, for instance, global solar PV costs dropped by approximately 8% in 2023, makes scaling up Eni's renewable capacity increasingly viable. Similarly, improvements in wind turbine efficiency and offshore wind installation techniques are crucial for Eni's offshore renewable projects.

Energy storage technologies, particularly battery solutions, are another critical technological determinant for Eni's renewable energy expansion. As battery costs continue to fall, projected to decrease by another 10-15% by the end of 2024, their integration becomes more economically feasible, enabling better grid stability and maximizing the output from intermittent renewable sources. Eni's investment in R&D and collaborations with tech firms are therefore essential to leverage these evolving storage capabilities.

Eni is at the forefront of biorefining, transforming agricultural waste and residues into advanced biofuels like sustainable aviation fuel (SAF). By the end of 2024, Eni's biorefining capacity is projected to reach 3 million tonnes per year, a significant step towards its 2030 goal of 6 million tonnes.

Technological advancements in diversifying feedstock sources, optimizing conversion processes, and developing novel bio-based products are crucial for Eni to achieve its ambitious biorefining expansion targets and contribute to sustainable mobility.

Carbon Capture, Utilization, and Storage (CCUS) Technologies

Carbon Capture, Utilization, and Storage (CCUS) is a cornerstone of Eni's decarbonization efforts, particularly vital for sectors where emissions are challenging to eliminate, like industrial processes and existing hydrocarbon operations. The economic feasibility and widespread adoption of CCUS hinge on ongoing advancements in technology and significant cost reductions. For instance, Eni's Ravenna CCS project in Italy and its involvement in the HyNet North West initiative in the UK are prime examples of this commitment, aiming to demonstrate the practical application and scalability of these critical technologies.

Technological progress in CCUS directly impacts Eni's ability to meet its climate targets. Continued innovation is essential to improve capture efficiency and reduce the energy penalty associated with the process. The global CCUS market is projected to grow substantially, with estimates suggesting it could reach hundreds of billions of dollars annually by 2030, driven by policy support and industrial demand for decarbonization solutions. This growth trajectory underscores the importance of Eni's investments in developing and deploying these advanced systems.

- Technological Maturation: Ongoing research and development are crucial for enhancing the efficiency and reducing the cost of carbon capture technologies.

- Commercial Viability: Projects like Eni's Ravenna CCS and HyNet North West aim to prove the economic feasibility of CCUS at scale.

- Cost Reduction: Lowering the operational and capital expenditures for CCUS is key to its widespread adoption across industries.

- Market Growth: The global CCUS market is anticipated to expand significantly, creating opportunities for companies like Eni that are investing in the technology.

Digital Transformation and AI Integration

Eni is actively embracing digital transformation, integrating advanced technologies like data analytics and artificial intelligence (AI) across its operations. This strategic shift aims to boost efficiency, refine decision-making processes, and speed up the development of new business ventures. For instance, Eni's commitment to digitalization is evident in its investment in supercomputing capabilities, which are crucial for complex data analysis in areas like reservoir management and predictive maintenance.

The company's digital strategy is comprehensive, touching every facet of its business, from the initial stages of exploration and production to customer-facing services. This pervasive digitalization is not just about improving current performance; it's a fundamental enabler for Eni to achieve its ambitious net-zero emissions targets. By optimizing energy consumption and developing more efficient processes through digital tools, Eni is positioning itself for a sustainable future.

The integration of AI and advanced analytics is a cornerstone of Eni's approach to tackling the energy transition. In 2023, Eni continued to expand its use of AI in areas such as seismic data interpretation and optimizing offshore platform operations. This focus on digital innovation is expected to yield significant operational improvements and cost savings, supporting the company's long-term strategic goals.

- Digital Transformation: Eni is implementing digital solutions across its value chain to enhance efficiency and innovation.

- AI Integration: The company is leveraging artificial intelligence for advanced data analysis, operational optimization, and new business development.

- Supercomputing: Eni utilizes supercomputing power to process vast datasets for improved decision-making in exploration and production.

- Net-Zero Enabler: Digitalization is identified as a key driver for achieving Eni's sustainability and net-zero emission objectives.

Technological advancements are pivotal for Eni's operational efficiency and strategic expansion, particularly in areas like carbon capture and renewable energy. Innovations in seismic imaging and drilling techniques are enhancing exploration success rates and accessing previously uneconomical reserves. The company's investment in biorefining, aiming for 6 million tonnes of capacity by 2030, is driven by advancements in feedstock processing and biofuel conversion.

Furthermore, Eni's commitment to digital transformation, including AI and supercomputing, is optimizing operations and supporting its net-zero targets. The decreasing costs of solar PV, projected to drop further, and advancements in battery storage are crucial for scaling up renewable energy projects. Eni's strategic focus on these technological fronts positions it for growth in the evolving energy landscape.

Legal factors

Eni operates under a stringent regulatory landscape governing environmental impact, including significant restrictions on greenhouse gas emissions and methane. For instance, the European Union's Fit for 55 package aims for a 55% net reduction in greenhouse gas emissions by 2030 compared to 1990 levels, directly influencing Eni's operational planning and investment in cleaner technologies.

Compliance with directives such as the European Corporate Sustainability Reporting Directive (CSRD) is a legal imperative, requiring detailed disclosure of environmental, social, and governance (ESG) performance. Eni's commitment to achieving net-zero emissions by 2050, a legally binding target within the EU framework, necessitates substantial capital allocation towards decarbonization strategies and renewable energy sources.

Eni's global operations are significantly shaped by international energy treaties and agreements. These frameworks, including investment protection accords and bilateral treaties with host nations, are critical for Eni to secure exploration and production rights. For instance, in 2023, Eni continued to navigate complex legal landscapes across its diverse portfolio, from the Mediterranean to Africa, where such agreements underpin its operational stability and investment security.

Eni navigates a complex web of health, safety, and labor laws globally. This includes stringent regulations on worker safety, such as those enforced by the Occupational Safety and Health Administration (OSHA) in the US, and similar bodies in Europe. In 2023, the International Labour Organization reported on the continued need for robust safety measures across industries, highlighting that workplace accidents remain a significant concern.

Compliance extends to ensuring fair employment conditions and upholding human rights throughout Eni's operations and its extensive supply chains. This means adhering to international standards and national legislation that govern wages, working hours, and the prohibition of forced labor. For instance, the EU's Corporate Sustainability Due Diligence Directive, expected to be fully implemented in the coming years, will further scrutinize supply chain labor practices.

Antitrust and Competition Laws

Eni navigates intensely competitive energy sectors, making rigorous adherence to antitrust and competition regulations across all operating regions a critical necessity. This commitment to compliance underpins fair market conduct and actively deters monopolistic practices, directly shaping Eni's strategic market approaches and its engagement in mergers and acquisitions.

Failure to comply can result in substantial penalties. For instance, in 2023, the European Commission imposed fines totaling over €1.4 billion on several companies for cartel activities in the energy sector, highlighting the significant financial risks associated with competition law violations.

- Regulatory Scrutiny: Eni faces ongoing scrutiny from competition authorities like the European Commission and national regulators to ensure its market practices are fair and do not stifle competition.

- Merger Control: Acquisitions and joint ventures undertaken by Eni are subject to review by antitrust bodies to prevent the creation of dominant market positions.

- Market Conduct: Eni's pricing strategies, distribution agreements, and access to infrastructure are all areas where competition laws dictate permissible actions to maintain a level playing field.

Corporate Governance and Reporting Standards

Eni operates under stringent corporate governance and financial reporting mandates, dictated by its listings on exchanges like Borsa Italiana and adherence to international norms. The company must comply with evolving regulations, ensuring transparency in its operations and financial health. For instance, the upcoming mandatory adoption of the European Sustainability Reporting Standards (ESRS) under the Corporate Sustainability Reporting Directive (CSRD) will significantly expand Eni's disclosure obligations for fiscal year 2024 reporting, due in 2025.

These legal frameworks are crucial for maintaining investor confidence and market integrity. Eni's compliance ensures that its financial statements and sustainability data are presented accurately and consistently.

- Enhanced Transparency: Legal requirements, including CSRD, mandate detailed reporting on environmental, social, and governance (ESG) factors, increasing Eni's accountability.

- Regulatory Compliance: Adherence to Italian and international financial reporting standards (e.g., IFRS) is critical for Eni's global operations and access to capital markets.

- Corporate Governance Oversight: Eni's governance structure is legally bound by the principles of fairness, accountability, and responsibility, overseen by its Board of Directors and relevant authorities.

- Risk Management: Compliance with legal and reporting standards helps Eni identify and mitigate legal and financial risks, safeguarding its reputation and financial stability.

Eni's operations are heavily influenced by environmental regulations, particularly those concerning emissions and sustainability. The EU's ambitious targets, like the Fit for 55 package aiming for a 55% net greenhouse gas reduction by 2030, directly impact Eni's investment in cleaner technologies and operational strategies.

Compliance with directives such as the Corporate Sustainability Reporting Directive (CSRD) is now a legal necessity, demanding comprehensive ESG disclosures. Eni's commitment to net-zero by 2050, a goal aligned with EU climate objectives, requires significant capital for decarbonization and renewable energy expansion.

International energy treaties and bilateral agreements are crucial for Eni's global exploration and production rights, ensuring operational stability and investment security across its diverse portfolio, as seen in its 2023 operations.

Global health, safety, and labor laws, including those enforced by OSHA and European bodies, are paramount. The International Labour Organization's 2023 reports underscore the ongoing need for robust safety measures, highlighting workplace accident prevention as a critical concern.

Eni must also adhere to fair employment conditions and human rights across its supply chains, aligning with international standards and national laws, including upcoming EU directives like the Corporate Sustainability Due Diligence Directive.

Navigating competitive energy markets requires strict compliance with antitrust and competition regulations to ensure fair market conduct and prevent monopolistic practices, influencing Eni's market strategies and M&A activities.

Failure to comply with competition laws carries substantial financial risks, as evidenced by over €1.4 billion in fines imposed by the European Commission in 2023 for energy sector cartel activities.

Eni is subject to rigorous corporate governance and financial reporting mandates, including upcoming European Sustainability Reporting Standards (ESRS) under the CSRD, set for mandatory adoption for fiscal year 2024 reporting in 2025, enhancing transparency.

These legal requirements bolster investor confidence and market integrity by ensuring accurate and consistent financial and sustainability data reporting.

| Legal Area | Key Regulations/Implications | Impact on Eni | Example Data/Fact |

|---|---|---|---|

| Environmental | EU Fit for 55, Emissions Trading System (ETS) | Mandatory emissions reduction targets, investment in renewables, potential carbon costs | EU aims for 55% GHG reduction by 2030; Eni investing heavily in renewables and CCS. |

| Sustainability Reporting | CSRD, ESRS | Increased ESG disclosure requirements, enhanced transparency and accountability | ESRS adoption for FY2024 reporting (due 2025) expands Eni's reporting scope. |

| Competition Law | EU Antitrust Regulations, National Competition Authorities | Scrutiny of market practices, M&A, pricing strategies; risk of fines | €1.4 billion in EU energy sector fines in 2023 for cartel activities. |

| Corporate Governance | Listing Rules (Borsa Italiana), IFRS | Adherence to financial reporting standards, transparency, board oversight | Eni follows IFRS for financial statements; governance overseen by Board of Directors. |

Environmental factors

Eni faces intense pressure to decarbonize due to climate change, a critical environmental factor. This translates into a strategic imperative to reduce greenhouse gas (GHG) emissions across its value chain. For instance, Eni aims for a 55% reduction in Upstream Scope 1 and 2 emissions by 2024 compared to 2018 levels, with a net-zero target by 2050.

Achieving these ambitious goals requires a significant shift towards lower-carbon energy sources and substantial investment in technologies like carbon capture. This transition is not just about regulatory compliance but also about maintaining long-term viability and investor confidence in a world increasingly focused on sustainability.

Eni's exploration and production activities, especially in offshore and remote terrestrial areas, pose potential risks to biodiversity and delicate ecosystems. The company is actively working to mitigate these impacts through robust environmental management systems.

In 2024, Eni continued to invest in projects aimed at minimizing its environmental footprint, including initiatives focused on reducing emissions and improving waste management. These efforts are crucial for safeguarding biodiversity in operational regions, as highlighted by their commitment to responsible resource utilization.

For instance, Eni's commitment to ecosystem management includes biodiversity action plans for key operational sites, aiming to protect local flora and fauna. This focus is becoming increasingly important as regulatory scrutiny and stakeholder expectations around environmental stewardship intensify.

Water availability and quality are significant environmental factors for Eni, particularly in regions where it operates that face water stress. The company is actively working on sustainable water management, aiming to achieve water positivity at select high-consumption sites by 2035. This commitment underscores the growing importance of responsible water withdrawal and efficient usage in the energy sector.

Methane Emissions Reduction

Methane is a powerful greenhouse gas, and Eni is actively working to slash its emissions. The company has set an ambitious goal to reduce methane emissions across its operations to near zero by 2030. This commitment is crucial for environmental sustainability and aligns with global efforts to combat climate change.

To achieve this, Eni is deploying sophisticated measurement technologies to pinpoint and address methane leaks effectively. Furthermore, the company is fostering collaborations with international bodies to enhance the accuracy of methane reporting and implement robust mitigation strategies. These actions underscore Eni's dedication to responsible energy production.

- Near-zero methane emissions target by 2030.

- Deployment of advanced measurement and detection technologies.

- Collaboration with international organizations for improved reporting and mitigation.

- Focus on reducing fugitive emissions across the entire value chain.

Circular Economy and Waste Management

Eni is increasingly focused on circular economy principles, including waste reduction and recycling, which are critical environmental considerations. The company is actively transforming its industrial assets to produce sustainable products and minimize waste, a move supported by growing regulatory pressure and consumer demand for eco-friendly solutions.

This strategic shift is evident in Eni's investments in biorefining, utilizing biogenic feedstocks to create lower-impact products. For instance, in 2023, Eni's biorefineries processed approximately 1.1 million tonnes of waste and residual materials, a significant increase from previous years, demonstrating a tangible commitment to waste valorization.

- Waste Reduction and Recycling: Eni aims to reduce waste generation across its operations by 10% by 2025 compared to 2018 levels.

- Biorefining Capacity: The company plans to expand its biorefining capacity to 2 million tonnes per year by 2025, primarily using waste and residual materials.

- Sustainable Product Portfolio: Eni is developing a portfolio of products derived from recycled materials and biogenic feedstocks, targeting a 20% share of its total product sales by 2030.

Eni's environmental strategy is heavily influenced by climate change, driving a commitment to decarbonization and reducing greenhouse gas emissions. For example, the company targets a 55% reduction in Scope 1 and 2 emissions by 2024 compared to 2018, with a net-zero goal by 2050.

Biodiversity protection is also a key focus, with Eni implementing action plans for key operational sites to safeguard local flora and fauna, especially in sensitive offshore and remote terrestrial areas.

Sustainable water management is critical, particularly in water-stressed regions, as Eni aims for water positivity at select high-consumption sites by 2035.

The company is also dedicated to achieving near-zero methane emissions by 2030 through advanced detection technologies and international collaborations.

Furthermore, Eni is embracing circular economy principles, with its biorefineries processing significant volumes of waste and residual materials, aiming for a 10% waste reduction by 2025.

PESTLE Analysis Data Sources

Our Eni PESTLE Analysis is meticulously crafted using data from leading international organizations like the IEA and OPEC, alongside national energy agencies and reputable market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting Eni's operations.