Eni Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eni Bundle

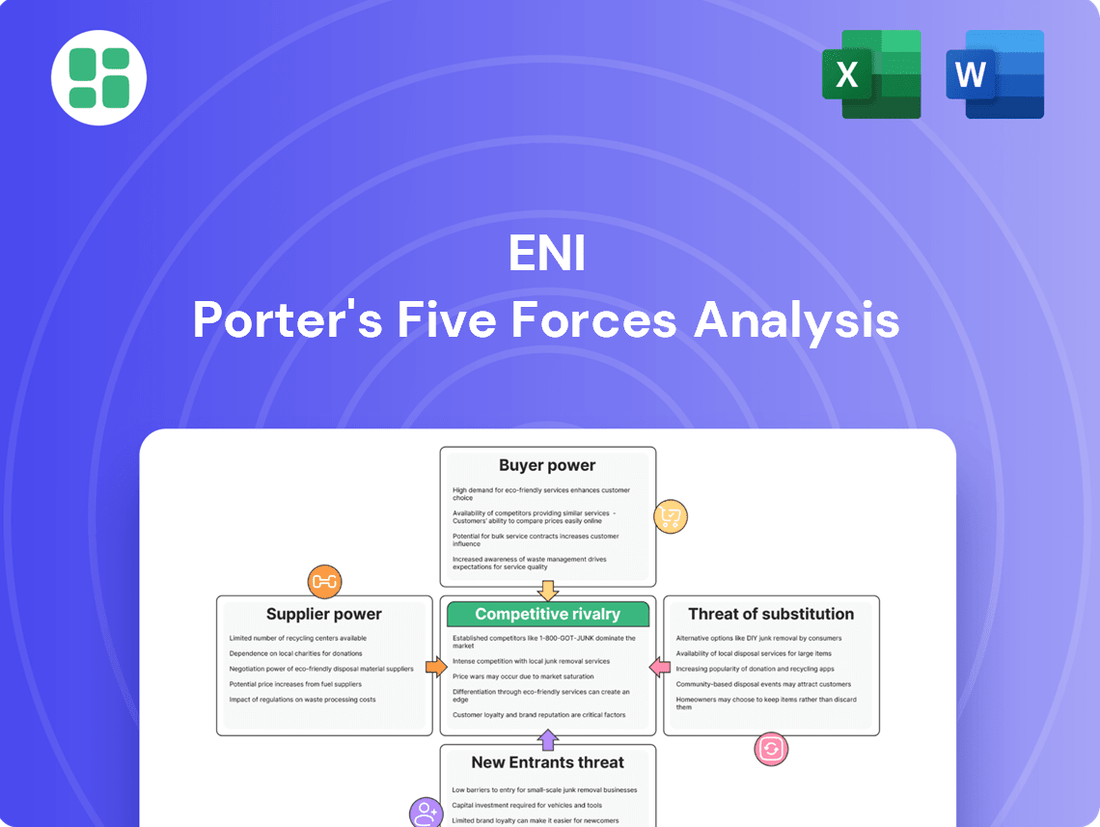

Porter's Five Forces provides a powerful framework to understand the competitive landscape of Eni. By examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry, we gain critical insights into Eni's market position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Eni’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Eni's reliance on a limited pool of specialized suppliers for crucial exploration and production equipment, advanced drilling technology, and intricate engineering services significantly impacts its operational costs and project timelines. For instance, in 2024, the global market for subsea drilling equipment saw a consolidation, with only a handful of manufacturers capable of producing the highly specialized components Eni requires. This scarcity can empower these suppliers, allowing them to command higher prices and dictate terms, especially when proprietary technologies or services involve substantial switching costs for Eni.

Governments and national oil companies (NOCs) in resource-rich nations wield significant influence over crude oil and natural gas supply. Their authority in granting licenses, setting tax regimes, and dictating production volumes grants them substantial bargaining power, directly affecting Eni's upstream expenditures and operational flexibility.

The energy sector's reliance on highly specialized professionals like geologists, engineers, and project managers significantly amplifies the bargaining power of suppliers in the form of skilled labor. For instance, in 2024, the demand for experienced petroleum engineers continued to outpace supply, particularly in regions with active exploration and production, leading to competitive salary packages and benefits.

Scarcity of talent in niche areas, such as advanced renewable energy technologies or complex offshore operations, further empowers these skilled individuals. This talent gap means companies must offer more attractive compensation and working conditions to secure and retain the expertise needed for critical projects, directly impacting operational costs and project timelines.

Geopolitical and Regulatory Influence

Geopolitical shifts and evolving regulatory landscapes significantly shape the bargaining power of Eni's suppliers. For instance, in 2024, heightened tensions in key oil-producing regions could lead to supply disruptions, emboldening suppliers and driving up prices for crude oil and natural gas, essential inputs for Eni's operations. Changes in international trade agreements or the imposition of sanctions on certain countries can also restrict access to specific resources or increase the cost of procurement, thereby strengthening supplier leverage.

Furthermore, varying environmental regulations across different nations where Eni sources materials can create an uneven playing field. Suppliers in countries with less stringent environmental standards might offer lower prices, but Eni faces reputational and compliance risks. Conversely, suppliers in regions with robust environmental mandates might incur higher operating costs, which they pass on to Eni, thus increasing their bargaining power due to compliance necessities.

- Trade Policy Impact: In 2024, shifts in global trade policies, such as tariffs or import restrictions, directly affect the cost and availability of raw materials for Eni, potentially increasing supplier leverage.

- Political Stability: The political stability of countries supplying critical resources to Eni is a key factor; instability can lead to supply chain disruptions and empower suppliers by creating scarcity.

- Regulatory Compliance: Suppliers facing stricter environmental or safety regulations in their home countries may pass these compliance costs onto Eni, enhancing their bargaining power.

- Sanctions and Embargoes: The imposition of international sanctions on supplier nations can limit Eni's sourcing options, thereby concentrating power among remaining or unaffected suppliers.

Technological Advancements and Innovation

Technological advancements can significantly alter the bargaining power of suppliers. While a supplier with proprietary, cutting-edge technology might initially hold considerable sway, rapid innovation can democratize access to similar solutions. For instance, breakthroughs in AI for reservoir analysis or advanced materials for offshore drilling could foster new entrants, thereby diluting the power of established, specialized providers.

The energy sector, in particular, is experiencing this dynamic. In 2024, investments in renewable energy technologies, such as more efficient solar panels and advanced battery storage, are creating a more competitive supplier landscape. This increased competition can lead to better pricing and terms for energy companies, reducing the leverage of individual technology suppliers.

- Innovation creates new supplier options: For example, the development of modular offshore platforms reduces reliance on highly specialized, large-scale construction firms.

- Reduced switching costs: As technology becomes more standardized, the cost and complexity of switching between suppliers decrease, empowering buyers.

- Digitalization impacts supply chains: In 2024, digital platforms are streamlining procurement for energy components, allowing companies to source more effectively and reducing dependence on single suppliers.

- Impact on R&D: Companies investing heavily in R&D for next-generation technologies can potentially disrupt existing supplier relationships by developing in-house capabilities or fostering new partnerships.

The bargaining power of suppliers for Eni is significantly influenced by the concentration of specialized providers and the uniqueness of their offerings. In 2024, the market for critical offshore drilling equipment remained consolidated, with a limited number of manufacturers capable of producing highly specialized components. This scarcity, coupled with substantial switching costs for Eni, allows these suppliers to command higher prices and dictate terms, impacting Eni's operational expenditures.

| Supplier Characteristic | Impact on Eni | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | Higher power for fewer suppliers | Consolidation in specialized equipment manufacturing |

| Uniqueness of Offering | Increased leverage due to proprietary technology | High demand for advanced drilling technology |

| Switching Costs | Reduced buyer flexibility | Significant investment required for new technology adoption |

| Availability of Substitutes | Lower supplier power if alternatives exist | Limited availability of specialized offshore components |

What is included in the product

Eni Porter's Five Forces Analysis dissects the competitive intensity and profitability potential within Eni's operating environment by examining industry rivalry, buyer and supplier power, threats of new entrants and substitutes.

Pinpoint and neutralize competitive threats with a comprehensive, actionable framework.

Customers Bargaining Power

Eni's diverse customer base significantly moderates customer bargaining power. The company caters to industrial clients, utilities, and retail consumers for both gas and power, alongside distributors of petroleum products. This broad reach means no single customer segment holds disproportionate influence over Eni's revenue streams, thereby diffusing concentrated power.

For major consumers of commodities like crude oil and natural gas, price is the most significant factor. In 2024, the average price of Brent crude oil fluctuated, with significant drops occurring during periods of increased global supply, directly impacting buyer leverage.

In highly competitive commodity markets, buyers can readily switch between suppliers if they find better pricing. This ease of substitution is particularly potent when there's an oversupply, as seen in the natural gas market in early 2024, where prices fell considerably in some regions, amplifying customer bargaining power.

For integrated energy solutions, such as long-term Liquefied Natural Gas (LNG) contracts or intricate industrial energy supply agreements, customers face significant switching costs. These costs stem from the need for specialized infrastructure, existing contractual obligations, and the technical integration required to utilize the energy source. For instance, a major industrial facility that has invested heavily in regasification terminals for LNG imports will find it prohibitively expensive to switch to a different fuel source overnight. This integration locks them in, thereby diminishing their immediate bargaining power.

Growing Influence of Energy Transition Policies

Customers, especially large corporations and governments, are increasingly prioritizing decarbonization targets and renewable energy mandates. This growing emphasis on sustainability directly impacts their purchasing decisions, shifting demand towards cleaner energy alternatives. For instance, in 2024, many European countries reinforced their climate commitments, leading to increased tenders for renewable energy projects, which Eni must compete for.

This evolving customer preference grants them significant leverage. They can now demand more sustainable products and services from energy providers like Eni, potentially influencing pricing and contract terms. The push for net-zero emissions means customers are more willing to switch suppliers if they don't meet environmental expectations.

- Customer Demand Shift: Growing corporate and governmental focus on decarbonization in 2024 is redirecting demand towards renewable energy solutions.

- Increased Bargaining Power: This shift empowers customers to negotiate better terms and demand sustainable practices from energy companies.

- Policy Influence: Energy transition policies enacted by governments worldwide are a key driver behind this amplified customer influence.

Emergence of New Energy Solutions

The emergence of new energy solutions significantly bolsters the bargaining power of customers. The increasing availability of decentralized energy generation, like rooftop solar, and the rapid adoption of electric vehicles (EVs) offer consumers viable alternatives to traditional energy providers. For instance, by mid-2024, it's projected that over 40 million EVs will be on global roads, a substantial increase from just 10 million in 2020, giving consumers more leverage when negotiating energy contracts or purchasing vehicles.

These alternatives translate directly into increased customer choice and exert downward pressure on the prices of conventional energy products. As more households and businesses adopt energy efficiency technologies, their overall demand for traditional energy sources decreases, further enhancing their negotiating position. This shift empowers customers to seek better terms and pricing from incumbent energy companies.

- Increased Choice: Customers can switch to or supplement with solar, wind, or other renewable sources.

- Price Sensitivity: The availability of alternatives makes customers less tolerant of high fossil fuel prices.

- Technological Advancement: Innovations in battery storage and smart grids further empower consumers to manage their energy consumption and costs.

- Market Disruption: New entrants offering competitive, cleaner energy solutions challenge established players, creating a more customer-centric market.

Eni's diverse customer base, spanning industrial, utility, and retail sectors, naturally diffuses concentrated customer bargaining power. However, for commodity purchases like oil and gas, price sensitivity remains high, as evidenced by Brent crude's price fluctuations in 2024 driven by supply dynamics. When oversupply occurs, such as in the natural gas market early 2024, customers gain significant leverage due to easy switching between suppliers.

The increasing adoption of renewable energy and decarbonization goals by customers in 2024, amplified by supportive government policies, grants them greater influence. This shift empowers buyers to demand more sustainable offerings and negotiate favorable terms with energy providers. Furthermore, the rise of decentralized energy solutions and the growing EV market, with over 40 million EVs projected globally by mid-2024, provide consumers with viable alternatives, intensifying price competition and enhancing their negotiating position.

| Factor | Impact on Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Customer Diversification | Lowers power | Eni serves industrial, utility, and retail; no single segment dominates. |

| Price Sensitivity (Commodities) | Increases power | Brent crude prices varied significantly in 2024 due to supply shifts. |

| Ease of Substitution | Increases power (in oversupply) | Early 2024 saw natural gas price drops in some regions due to oversupply. |

| Switching Costs (Integrated Solutions) | Lowers power | High for LNG contracts and industrial energy due to infrastructure and integration. |

| Decarbonization/Sustainability Focus | Increases power | Growing demand for renewables, influencing contract terms and supplier choice. |

| Emergence of Alternatives (Solar, EVs) | Increases power | EVs projected to exceed 40 million globally by mid-2024, offering consumer choice. |

What You See Is What You Get

Eni Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis you will receive immediately after purchase. You are viewing the exact, professionally formatted document, ensuring no surprises or placeholder content. What you see here is precisely what you'll be able to download and utilize for your strategic planning needs.

Rivalry Among Competitors

Eni faces fierce competition from fellow integrated energy giants such as Shell, BP, TotalEnergies, ExxonMobil, and Chevron. These global players share comparable scale, diverse asset bases, advanced technological expertise, and extensive international operations, intensifying the battle for crucial resources, market share, and capital investment.

In 2023, for instance, these majors collectively invested billions in upstream and downstream projects. Shell reported capital expenditures of approximately $23 billion, while ExxonMobil's were around $24 billion, highlighting the substantial financial commitments required to maintain competitiveness in this arena.

National Oil Companies (NOCs) present a formidable competitive force, often benefiting from exclusive rights to domestic reserves and substantial government backing. This inherent advantage erects significant barriers to entry in their home markets and profoundly shapes global oil and gas supply. For instance, Saudi Aramco, a prime example of a powerful NOC, consistently ranks among the world's largest oil producers, with proven reserves estimated at over 297 billion barrels of oil equivalent as of early 2024.

While Eni often engages in strategic partnerships with NOCs, these entities also emerge as direct rivals across numerous operational territories. The competitive dynamic is further intensified by the fact that many NOCs are increasingly seeking to monetize their upstream assets and expand their downstream operations, directly challenging established international oil companies like Eni. In 2023, NOCs collectively accounted for a significant portion of global oil production, underscoring their substantial market influence.

The global push towards an energy transition is significantly heating up competition. Established giants like Eni are actively diversifying their portfolios, investing heavily in renewable energy sources, biofuels, and carbon capture technologies. This strategic shift means they're now competing not only with other traditional energy firms but also with a growing number of specialized renewable energy companies and technology providers.

This diversification creates entirely new battlegrounds. For instance, Eni's commitment to increasing its installed renewable capacity, aiming for around 65 GW by 2030, directly pits it against companies solely focused on solar and wind power. The competition extends to securing grid access, technological innovation in energy storage, and attracting talent in these burgeoning sectors, making the landscape far more intricate than before.

Capital Intensity and Long Project Lifecycles

The oil and gas sector is inherently capital-intensive, demanding massive upfront investments for exploration, drilling, and infrastructure. For instance, a single offshore oil platform can cost billions of dollars. These long project lifecycles, often spanning decades from discovery to decommissioning, mean companies are locked into high fixed costs. This financial commitment fuels a powerful drive to maintain high production volumes to recoup investments and achieve profitability, intensifying rivalry for market share, particularly in established, mature markets where demand growth is limited.

This capital intensity and extended project timeline significantly impact competitive dynamics:

- High Barriers to Entry: The sheer scale of investment required makes it difficult for new players to enter the market, consolidating power among existing, well-capitalized firms.

- Focus on Efficiency: Companies constantly seek operational efficiencies and cost reductions to remain competitive amidst high fixed costs.

- Production Volume as a Key Metric: Maintaining and increasing production is crucial for covering substantial fixed expenditures, leading to aggressive competition for every barrel of oil or cubic foot of gas.

- Impact of Commodity Prices: Fluctuations in oil and gas prices directly affect profitability, exacerbating competitive pressures when prices are low, as companies fight to cover their costs. In 2024, Brent crude oil prices have seen volatility, trading in a range that pressures margins for many producers.

Geopolitical and Regulatory Volatility

Geopolitical tensions and fluctuating commodity prices create significant headwinds for energy companies. For instance, in 2024, the ongoing conflict in Eastern Europe continued to influence global oil and gas supply chains, contributing to price volatility. This uncertainty directly impacts Eni's operational costs and revenue streams, forcing strategic adjustments.

Evolving regulatory environments, particularly concerning carbon pricing and environmental standards, are reshaping the competitive landscape. Many nations are implementing stricter emissions targets, which can increase compliance costs for energy producers. By the end of 2024, the European Union’s Carbon Border Adjustment Mechanism (CBAM) was in its initial phase, affecting energy-intensive imports and prompting companies like Eni to invest further in decarbonization strategies.

- Geopolitical Instability: Conflicts and trade disputes can disrupt energy supply routes and impact market access.

- Commodity Price Swings: Volatility in oil and gas prices directly affects profitability and investment decisions.

- Regulatory Evolution: New environmental regulations and carbon pricing schemes necessitate adaptation and investment in cleaner technologies.

- M&A Activity: These pressures often drive consolidation and strategic partnerships as companies seek to mitigate risks and enhance competitiveness.

Competitive rivalry within the energy sector is intense, driven by a few dominant integrated oil and gas companies, including Shell, BP, and TotalEnergies, who possess similar scale and resources. These giants, alongside national oil companies like Saudi Aramco with vast reserves, directly compete for market share and critical resources. The ongoing energy transition further heats up this rivalry, as companies like Eni diversify into renewables, creating new competitive arenas with specialized clean energy firms.

SSubstitutes Threaten

The most significant long-term substitute threat to Eni's traditional oil and gas business stems from the increasing viability and adoption of renewable energy sources. These alternatives, such as solar, wind, and hydropower, directly compete in the electricity generation market, a key sector for fossil fuel demand.

Eni's own strategic push into renewables through its Plenitude division highlights this trend. As these green technologies mature and become more cost-effective, they increasingly displace the need for fossil fuels, impacting Eni's core markets.

In 2023, global renewable energy capacity additions reached a record 510 gigawatts (GW), a 50% increase compared to 2022, according to the International Energy Agency (IEA). This rapid expansion signifies a growing challenge to incumbent fossil fuel providers.

The rise of electric vehicles (EVs) presents a significant threat to traditional refined petroleum products. By 2024, global EV sales were projected to surpass 15 million units, indicating a growing shift away from internal combustion engines and, consequently, reduced demand for gasoline and diesel. This trend directly impacts companies like Eni, whose core business relies heavily on these fuels.

Simultaneously, biofuels are emerging as a viable alternative to conventional liquid fuels in the transportation sector. Increased investment and government mandates in renewable energy sources are driving the adoption of biofuels. For instance, the European Union's Renewable Energy Directive aims to increase the share of renewables in final energy consumption, which includes biofuels, thereby creating another substitute for Eni's products.

Eni's strategic investments in its Enilive division and the development of biorefineries are proactive measures to counter these substitute threats. These initiatives aim to diversify its product portfolio and leverage its existing infrastructure to produce and market biofuels and other sustainable energy sources. Eni has committed significant capital, with plans to invest billions of euros in its transition to a more sustainable energy model, including its biorefinery capacity.

Improvements in energy efficiency are a significant threat to Eni's traditional oil and gas business. For instance, advancements in building insulation and smart home technology are projected to reduce residential energy consumption. In 2024, the International Energy Agency reported that energy efficiency measures saved the equivalent of over 2.5 billion tonnes of oil globally, a trend expected to continue.

Behavioral shifts towards lower energy use also play a crucial role. Increased adoption of public transportation, remote work, and mindful consumption patterns can directly dampen demand for gasoline and other petroleum products. This reduced demand pressures pricing and market share for companies like Eni.

Hydrogen and Alternative Fuels

The emergence of alternative fuels like green hydrogen poses a growing threat of substitution, particularly in sectors that are difficult to decarbonize. These include heavy industries such as steel and cement production, as well as long-haul transportation like shipping and aviation. While these technologies are still in their early stages, their long-term potential to displace traditional fossil fuels is substantial.

The development and adoption of these alternative fuels are accelerating, driven by policy support and technological advancements. For instance, by the end of 2023, global green hydrogen production capacity was estimated to be around 1.5 GW, with significant further projects planned. This indicates a tangible shift towards viable alternatives.

- Green hydrogen is gaining traction as a clean energy carrier, offering a zero-emission solution for industrial processes and heavy transport.

- Ammonia, derived from hydrogen, is also being explored as a shipping fuel, with several pilot projects underway globally.

- Sustainable aviation fuels (SAFs), including those produced from hydrogen or advanced biofuels, are crucial for reducing aviation's carbon footprint.

- The **International Energy Agency (IEA)** reported in early 2024 that investments in clean energy technologies, including hydrogen, are projected to reach new highs, signaling a strong market signal for these substitutes.

Carbon Capture, Utilization, and Storage (CCUS)

While Carbon Capture, Utilization, and Storage (CCUS) technologies do not directly replace fossil fuels, they serve as a crucial substitute for the emissions generated by their use. This means that as regulations tighten and carbon pricing mechanisms become more prevalent, CCUS offers a way for companies to continue utilizing hydrocarbons while significantly reducing their environmental footprint.

For energy giants like Eni, investing in CCUS is a strategic move to navigate the evolving energy landscape. It directly addresses the threat posed by increasing regulatory pressure and the potential for substantial carbon taxes. By capturing emissions, Eni can continue to leverage its existing infrastructure and reserves, albeit with a cleaner profile.

- CCUS as a Substitute for Emissions: CCUS technologies offer a pathway to mitigate the environmental impact of fossil fuel consumption, acting as a proxy for reducing emissions.

- Mitigating Regulatory Threats: Investments in CCUS help companies like Eni hedge against stricter environmental regulations and the financial burden of carbon taxes.

- Enabling Continued Hydrocarbon Use: By capturing CO2, CCUS allows for the ongoing use of fossil fuels, albeit with a reduced environmental penalty, providing a bridge to a lower-carbon future.

The threat of substitutes for Eni's traditional oil and gas business is significant and multifaceted, driven by advancements in renewable energy, electric vehicles, and energy efficiency. These alternatives directly challenge fossil fuels' dominance in power generation and transportation.

The rapid growth in renewable energy capacity, with global additions reaching 510 GW in 2023, and the projected surge in EV sales to over 15 million units in 2024, underscore the increasing viability of these substitutes. Furthermore, innovations in energy efficiency, which saved over 2.5 billion tonnes of oil equivalent globally in 2024 according to the IEA, also dampen demand for conventional energy sources.

Emerging alternatives like green hydrogen and biofuels, supported by policy mandates and growing investments, pose a long-term threat, particularly in hard-to-abate sectors. Eni's own strategic investments in biorefineries and renewable energy through its Plenitude and Enilive divisions reflect an acknowledgment of these competitive pressures and a move towards diversification.

The following table highlights key substitute threats and their market indicators:

| Substitute Threat | Key Indicator | Data Point | Source |

|---|---|---|---|

| Renewable Energy Growth | Global Capacity Additions | 510 GW (2023) | IEA |

| Electric Vehicle Adoption | Projected Global EV Sales | >15 million units (2024) | Industry Projections |

| Energy Efficiency Gains | Global Energy Saved | >2.5 billion tonnes of oil equivalent (2024) | IEA |

| Green Hydrogen Production | Global Production Capacity | ~1.5 GW (End of 2023) | Industry Estimates |

Entrants Threaten

The oil and gas sector is notoriously capital-intensive. Building a new refinery, for instance, can cost billions of dollars, with some projects exceeding $10 billion. This immense financial hurdle significantly deters new companies from entering the market, as securing such substantial funding is a major challenge.

New entrants into many industries, particularly energy and infrastructure, confront a formidable array of regulatory hurdles. These include obtaining numerous permits, adhering to strict environmental standards, and securing licenses that can span multiple governmental levels and jurisdictions. For instance, in the renewable energy sector, a new solar farm developer in 2024 might need to navigate federal, state, and local regulations concerning land use, environmental impact assessments, and grid interconnection, a process that can easily add years and millions to project timelines.

Established energy giants like Eni possess a crucial advantage: secured access to proven oil and gas reserves and a vast, integrated infrastructure network. This includes extensive pipelines, sophisticated refineries, and established distribution channels, built over decades of operation.

New entrants face a formidable barrier in replicating this deeply entrenched asset base. The sheer capital investment required to secure reserves and build comparable infrastructure is immense, making it incredibly difficult for newcomers to compete on cost and scale.

For instance, in 2024, the global oil and gas infrastructure market is valued in the trillions, with significant ongoing investments in upgrades and expansion by incumbent players. This deep moat of existing infrastructure and resource access creates a substantial deterrent for potential new entrants seeking to disrupt the market.

Technological Expertise and Intellectual Property

The oil and gas industry is inherently complex, demanding significant technological expertise in exploration, extraction, and processing. New companies entering this space must either develop this specialized knowledge from scratch or acquire it, a process that is both time-consuming and capital-intensive. For instance, advanced seismic imaging techniques and sophisticated drilling technologies are critical for efficient resource discovery and extraction, representing substantial barriers to entry.

Furthermore, much of the innovation in this sector is protected by proprietary intellectual property, including patents on drilling methods, refining processes, and even specific chemical formulations used in production. Companies like Schlumberger and Halliburton invest billions annually in research and development, creating a technological moat that is difficult for newcomers to breach. In 2023, the global oilfield services market was valued at over $250 billion, with a significant portion attributed to technological advancements and proprietary solutions.

- Technological Sophistication: The industry relies on cutting-edge technologies for seismic data analysis, directional drilling, and enhanced oil recovery (EOR) methods, requiring substantial upfront investment in R&D and specialized equipment.

- Intellectual Property Barriers: Patents covering unique extraction techniques, refining catalysts, and safety protocols create a significant hurdle for new entrants looking to leverage established, efficient processes.

- Capital Requirements: Acquiring or developing the necessary technological capabilities, including advanced software and specialized hardware, demands immense financial resources, often in the hundreds of millions or even billions of dollars.

Brand Recognition and Customer Relationships

For downstream operations, established energy giants like Eni leverage decades of brand recognition and deeply ingrained customer relationships. These loyalties, built through consistent service and extensive distribution networks, represent a significant hurdle for any new player attempting to enter the market.

New entrants face the daunting task of not only matching Eni's established brand equity but also cultivating similar trust and loyalty. This necessitates substantial, long-term investment in marketing and customer engagement, a financial commitment that can deter potential competitors.

- Brand Loyalty: Eni's established brand commands significant customer loyalty, making it difficult for new entrants to attract and retain customers.

- Distribution Networks: Extensive and well-established distribution channels provide Eni with a competitive advantage, limiting access for newcomers.

- Marketing Investment: The high cost and time required to build comparable brand recognition and trust act as a substantial barrier to entry.

The threat of new entrants in the oil and gas sector is significantly mitigated by the immense capital requirements, with new projects like offshore drilling platforms often costing tens of billions. This financial barrier, coupled with the need for specialized technological expertise in areas like advanced seismic analysis, makes it incredibly challenging for newcomers to compete. Furthermore, established players benefit from proprietary intellectual property and strong brand loyalty, creating substantial deterrents for potential market entrants.

| Barrier Type | Description | Example/Data Point (2024) |

|---|---|---|

| Capital Requirements | Extremely high upfront investment needed for exploration, extraction, and infrastructure. | A new deepwater oil exploration project can easily exceed $20 billion in initial investment. |

| Technology & Expertise | Need for sophisticated technologies and specialized knowledge in areas like EOR and refining. | Billions are invested annually by major service companies in R&D for advanced drilling techniques. |

| Intellectual Property | Patents on unique extraction methods, catalysts, and safety protocols. | Companies hold patents on processes that can improve extraction efficiency by 10-15%. |

| Brand Loyalty & Distribution | Established customer relationships and extensive distribution networks are difficult to replicate. | Major integrated oil companies have decades-long customer contracts and extensive retail networks. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive mix of data, including publicly available financial statements, industry-specific market research reports, and expert commentary from reputable financial news outlets.