Eni Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eni Bundle

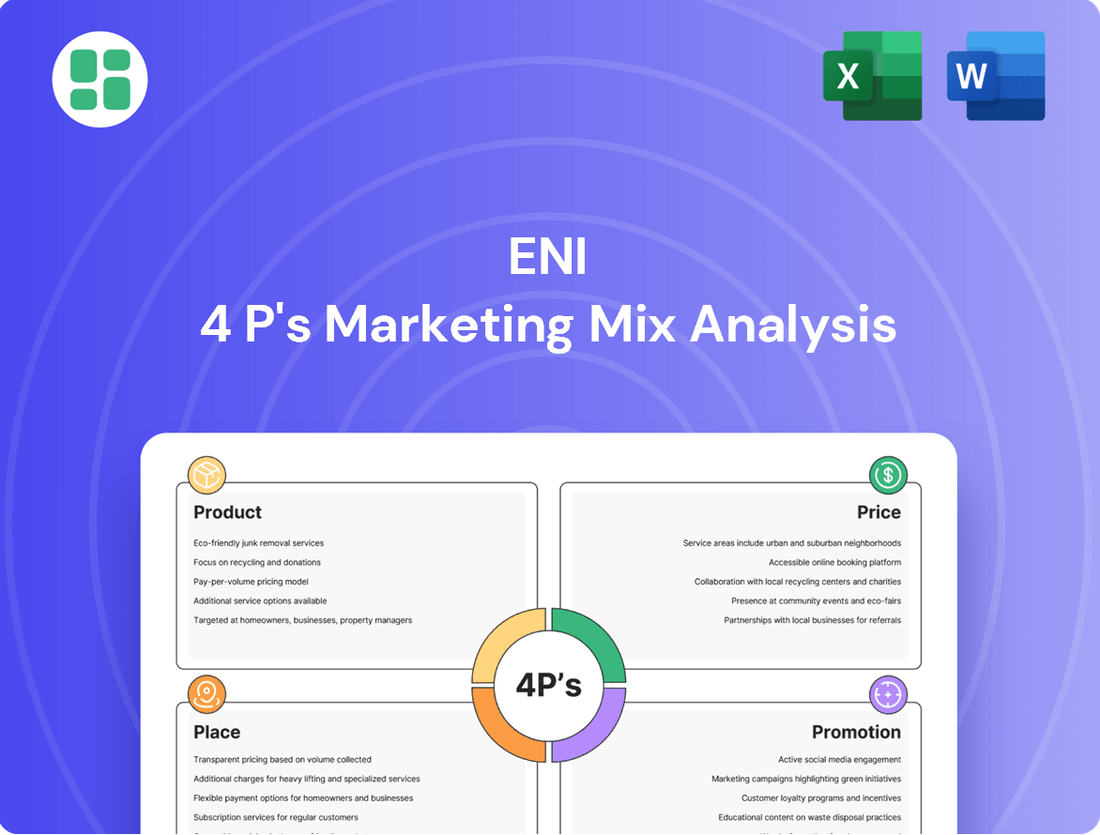

Uncover the strategic brilliance behind Eni's marketing efforts by exploring their Product, Price, Place, and Promotion. This analysis reveals how they craft compelling offerings, set competitive prices, establish effective distribution channels, and execute impactful promotional campaigns to capture market share.

Ready to elevate your own marketing strategy? Dive deeper into Eni's success with our comprehensive, ready-to-use 4Ps Marketing Mix Analysis. Gain actionable insights and a structured framework to benchmark and enhance your business planning.

Product

Eni's core product is the exploration, development, and production of crude oil and natural gas, the bedrock of its energy business. This upstream segment is vital for securing global energy resources and maintaining supply stability. In 2024, Eni continued to focus on optimizing its asset base, aiming for greater efficiency and sustainability across its operations.

Eni 4P offers a comprehensive portfolio of refined petroleum products, encompassing fuels like gasoline and diesel, alongside specialized lubricants, all distributed via its robust network of refineries and retail outlets.

This downstream segment is crucial, supplying vital energy commodities to both industrial clients and individual consumers, underpinning daily economic activities.

Eni 4P distinguishes itself through a commitment to high-quality fuel formulations and continuous innovation, aiming to enhance performance and efficiency for its customers.

In 2024, Eni's refining segment processed approximately 150 million tonnes of crude oil, with refined product sales reaching around 140 million tonnes, demonstrating significant market presence.

Eni is a major force in the natural gas and LNG sectors, actively involved in supply, trading, and marketing across a wide range of global markets. This broad reach directly supports energy security by ensuring consistent availability of gas resources. In 2023, Eni's gas production reached 15.9 billion cubic meters (bcm), highlighting its substantial role in meeting demand.

The company's operations are crucial for delivering gas to a diverse customer base, encompassing large industrial users and essential power generation facilities. Eni also provides electricity generated from a mix of sources, further solidifying its position as a comprehensive energy supplier.

Renewable Energy Solutions

Eni is significantly expanding its renewable energy portfolio, moving beyond traditional fossil fuels. This includes substantial investments in solar, wind, and bioenergy projects, aiming to create a more sustainable and diversified energy future. By 2023, Eni had already installed over 1.7 GW of renewable capacity, with ambitious targets to reach 5 GW by 2025 and 18 GW by 2030.

The company's strategy centers on developing large-scale renewable power generation facilities and pioneering bio-refining technologies. This diversification not only supports environmental objectives but also strengthens Eni's long-term business resilience. In 2024, Eni announced plans to invest €27 billion in energy transition initiatives, with a significant portion allocated to renewables and bio-refining.

- Solar Power: Eni is developing solar farms globally, including its large-scale plant in Kazakhstan which commenced operations in 2023.

- Wind Power: The company is also investing in offshore wind projects, such as the Dogger Bank project in the UK, a key component of its offshore wind strategy.

- Bioenergy: Eni's bio-refining capabilities are expanding, with its Venice and Gela bio-refineries producing sustainable fuels from waste and agricultural feedstocks.

- Investment: Eni's commitment to renewables is reflected in its capital expenditure plans, with a substantial portion of its 2024-2027 strategic plan dedicated to decarbonization and renewable energy development.

Chemical s & Bio-refining

Eni's chemical and bio-refining operations, primarily managed by its subsidiary Versalis, represent a significant part of its diversified portfolio. This segment is keenly focused on high-value products, including specialty chemicals, advanced polymers, and increasingly, bio-based chemicals derived from renewable sources. For instance, in 2024, Versalis continued to invest in expanding its bio-based product lines, aiming to reduce reliance on fossil fuels.

The strategy here is heavily driven by technological innovation, pushing the boundaries of material science to create advanced solutions for sectors like automotive, packaging, and construction. A prime example is their work on biodegradable polymers. Versalis reported a notable increase in its bio-based polymer production capacity by 15% in early 2025, responding to growing market demand for sustainable alternatives.

Circular economy principles are central to Eni's chemical business model. This involves not just producing bio-based materials but also focusing on recycling and waste valorization. In 2024, Eni announced a new partnership aimed at developing advanced chemical recycling technologies for plastics, with pilot plants expected to come online by late 2025, targeting a 20% increase in recycled content for certain polymer grades.

Key aspects of Eni's chemical and bio-refining marketing mix include:

- Product: Focus on specialty chemicals, polymers (including bio-based and recycled), and advanced materials.

- Price: Competitive pricing strategies reflecting innovation and sustainability value.

- Place: Global distribution networks serving diverse industrial clients.

- Promotion: Emphasis on technological leadership and commitment to the circular economy.

Eni's product strategy extends beyond traditional oil and gas to encompass a broad range of refined petroleum products, natural gas, LNG, and increasingly, renewable energy sources like solar and wind. The company also has a significant chemicals segment focused on specialty polymers and bio-based materials. This diversified product portfolio aims to meet global energy demands while transitioning towards a more sustainable energy future.

| Product Category | Key Offerings | 2023/2024 Data/Focus | 2025 Outlook/Strategy |

|---|---|---|---|

| Upstream (Oil & Gas) | Crude oil and natural gas exploration, development, and production | Focus on asset optimization; 2023 gas production: 15.9 bcm | Continued efficiency improvements in operations |

| Downstream (Refining & Marketing) | Gasoline, diesel, lubricants, retail fuels | Processed ~150 million tonnes crude oil in 2024; sales ~140 million tonnes | Enhance performance and efficiency of fuel formulations |

| Natural Gas & LNG | Supply, trading, and marketing of natural gas and LNG | Ensuring energy security; substantial role in meeting demand | Expand global market reach and supply capabilities |

| Renewables | Solar, wind, bioenergy | Over 1.7 GW renewable capacity installed by 2023; €27 billion investment in transition initiatives (2024) | Targeting 5 GW renewable capacity by 2025; focus on large-scale projects and bio-refining |

| Chemicals & Bio-refining | Specialty chemicals, polymers (bio-based, recycled), advanced materials | Versalis expanding bio-based product lines (2024); investing in advanced chemical recycling technologies (2024) | 15% increase in bio-based polymer capacity by early 2025; pilot plants for chemical recycling by late 2025 |

What is included in the product

This analysis provides a comprehensive breakdown of Eni's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights into their market positioning.

It's designed for professionals seeking a deep dive into Eni's marketing mix, grounded in real-world practices and competitive context.

Eliminates the frustration of sifting through lengthy reports by providing a concise, actionable overview of Eni's 4Ps strategy.

Simplifies complex marketing decisions by offering a clear, structured analysis that addresses common strategic uncertainties.

Place

Eni's upstream operations boast a sprawling global network, touching diverse geological regions across continents. This expansive reach is crucial for securing access to vital energy resources, underpinning its market position. For instance, in 2023, Eni's hydrocarbon production averaged 1.6 million barrels of oil equivalent per day, showcasing the sheer scale of its upstream footprint.

The company actively cultivates strategic alliances and prioritizes local content development within these operational areas. This approach not only strengthens its presence but also fosters sustainable growth and community engagement. Eni's commitment to these partnerships is evident in its ongoing projects, such as the development of offshore gas fields where local expertise plays a significant role in operational efficiency and cost management.

Eni's downstream logistics are a cornerstone of its marketing mix, leveraging an extensive network of refineries, pipelines, and storage facilities. This integrated infrastructure ensures the efficient movement and processing of crude oil into a wide array of refined products, ready for market distribution.

In 2024, Eni continued to invest in optimizing this supply chain. For instance, their Italian refining system, a key part of this downstream operation, processed approximately 150 million barrels of crude oil, highlighting the scale of their logistics capabilities. This efficiency directly impacts cost competitiveness and the ability to respond swiftly to market demand shifts.

Eni operates an extensive network of branded service stations, a cornerstone of its marketing strategy, with a significant presence across Europe. This vast retail footprint ensures direct access to fuels and a range of other convenience services for millions of consumers daily. As of the first half of 2024, Eni's network comprised over 5,000 service stations, underscoring its commitment to widespread accessibility.

This point of sale network is crucial for Eni's direct customer engagement, fostering brand loyalty and providing vital visibility in competitive markets. The service stations are not merely fuel dispensers but evolving hubs offering convenience items, car washes, and increasingly, charging infrastructure for electric vehicles, thereby enhancing overall customer value and convenience.

Trading & Supply Chain Hubs

Eni's trading and supply chain infrastructure acts as a critical component of its marketing mix, particularly for gas, LNG, and power. This network relies on a robust combination of international pipelines, strategically placed LNG terminals, and integrated power grids to facilitate efficient product delivery. These hubs are crucial for reaching diverse customer segments, including industrial clients, utilities, and wholesale markets, ensuring Eni's energy products are readily available where demand is highest.

The strategic positioning of these trading and supply chain hubs is designed to optimize logistical operations. By minimizing transport costs and maximizing market reach, Eni enhances its competitive edge. This focus on efficient logistics directly impacts the cost-effectiveness of its offerings, a key consideration for its B2B customer base.

For instance, Eni's significant investments in LNG regasification terminals, such as those in Italy, underscore its commitment to flexible and reliable supply. In 2024, global LNG trade volumes are projected to continue their upward trend, with Eni positioned to capitalize on this growth through its established infrastructure. The company's ability to manage complex international supply chains allows it to respond effectively to fluctuating market demands and regional energy needs.

- Global Energy Infrastructure: Eni operates a vast network of pipelines, LNG terminals, and power grids.

- Market Access: Facilitates efficient delivery to industrial, utility, and wholesale customers.

- Cost Optimization: Strategic hub locations reduce transportation expenses.

- Supply Chain Resilience: Enhances ability to meet diverse and dynamic energy demands.

Digital Sales & Service Platforms

Eni is increasingly leveraging digital platforms to streamline its trading operations, enhance customer service, and manage its extensive energy portfolio, ultimately boosting accessibility and efficiency. This strategic digital push is designed to create smoother transactions and provide better oversight of its operations across various energy sectors.

The company's investment in online portals and mobile applications is a key component of this strategy, fostering more direct and responsive customer engagement and improving the overall delivery of services. For instance, Eni's digital initiatives aim to simplify the customer journey, from account management to accessing energy-related information and support.

- Digital Trading Enhancement: Eni's digital platforms facilitate efficient energy trading, allowing for quicker market responses and better price discovery.

- Customer Accessibility: Online portals and mobile apps provide 24/7 access to services, enabling customers to manage accounts, view consumption, and access support conveniently.

- Operational Efficiency: The digital transformation supports improved operational oversight, allowing Eni to monitor and manage its diverse energy assets more effectively.

- Portfolio Management: Digital tools are crucial for managing Eni's complex and varied energy portfolio, from traditional oil and gas to renewables, ensuring integrated management.

Eni's extensive retail network, primarily its branded service stations, represents a critical physical touchpoint for consumers. This widespread presence, with over 5,000 stations across Europe in early 2024, ensures broad accessibility for its fuel products and related convenience services. These locations are vital for brand visibility and direct customer interaction.

The strategic placement of these service stations aims to capture significant market share and foster customer loyalty through consistent service and offerings. Eni is also adapting these locations to include electric vehicle charging infrastructure, reflecting evolving consumer needs and market trends.

Same Document Delivered

Eni 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Eni 4P's Marketing Mix Analysis is fully complete and ready for immediate use, providing you with all the insights you need.

Promotion

Eni prioritizes corporate communications and public relations, investing significantly to articulate its strategic direction, financial achievements, and dedication to the energy transition. This focus aims to foster trust and uphold a favorable reputation with investors, stakeholders, and the broader public.

Key communication channels include annual reports, press releases, and the corporate website, facilitating the dissemination of Eni's vision and performance data. For instance, Eni's 2023 Integrated Report highlighted its €1.7 billion investment in decarbonization projects, underscoring its commitment to sustainability.

Eni's commitment to sustainability and the energy transition is a core promotional strategy, showcasing their dedication to decarbonization and renewable energy. This focus on a greener future is central to their marketing efforts, aiming to position them as a responsible leader in the energy sector.

The company actively promotes its advancements in the circular economy and its investments in renewable energy sources. These initiatives are highlighted to demonstrate Eni's proactive approach to environmental stewardship and its vision for a sustainable energy landscape.

Campaigns frequently spotlight Eni's innovative green technologies and their positive impact on communities. For instance, in 2023, Eni invested €2.6 billion in decarbonization and energy transition initiatives, underscoring their tangible commitment to these promotional pillars.

Eni's Brand Advertising & Retail Marketing efforts are geared towards individual consumers, highlighting the quality and convenience of its refined products and services at service stations. These campaigns aim to build customer loyalty and encourage repeat business.

In 2024, Eni continued to invest in integrated marketing communications, leveraging digital platforms and traditional media to reach its target audience. For instance, their loyalty programs, like Eni Live, offer tangible benefits, driving engagement and foot traffic to their retail locations.

The focus on product quality, such as the performance benefits of their ENI i-SINT 0W-30 engine oil, is a key message in their advertising. This strategy directly supports the goal of increasing sales volume and strengthening brand perception within the competitive fuel retail market.

B2B Sales & Partnership Engagement

Eni's B2B sales and partnership engagement strategy is central to its 4P marketing mix, focusing on industrial clients, gas and power off-takers, and chemical customers. This approach emphasizes delivering tailored solutions and robust technical support to cultivate enduring commercial relationships. Specialized sales teams and participation in key industry events are crucial for networking and direct client communication.

In 2024, Eni continued to strengthen its B2B relationships through dedicated account management and customized service offerings. The company's commitment to direct engagement ensures that client needs are met with precision, fostering loyalty and repeat business within its industrial and energy sectors. This direct sales model is vital for securing large-scale contracts and strategic partnerships.

Key elements of Eni's B2B engagement include:

- Tailored Solutions: Developing specific product and service packages for diverse industrial and chemical needs.

- Technical Expertise: Providing in-depth technical support and consultancy to clients.

- Relationship Building: Cultivating long-term partnerships through direct sales teams and industry networking.

- Market Presence: Actively participating in industry forums and events to connect with potential and existing B2B clients.

Investor Relations & Financial Disclosures

Eni's Investor Relations and Financial Disclosures are central to its marketing mix, fostering trust and attracting investment. Through detailed annual reports, investor presentations, and timely financial disclosures, Eni communicates its performance and strategic direction to financial markets, analysts, and shareholders. This commitment to transparency is vital for securing the capital needed for future growth initiatives.

The company actively engages with the investment community, providing regular updates that highlight financial achievements and strategic advancements. For instance, Eni's financial results for the first quarter of 2024 showed a strong performance, with its upstream business contributing significantly to profitability. This proactive communication strategy aims to build confidence and support Eni's valuation.

- Transparency: Regular financial disclosures and reports build trust with investors and analysts.

- Capital Attraction: Clear communication of performance and strategy helps secure funding for growth.

- Market Engagement: Investor presentations and updates keep the financial community informed.

- Performance Communication: Highlighting financial results, such as the Q1 2024 upstream segment's profitability, demonstrates value.

Eni's promotional activities are multifaceted, encompassing corporate communications, B2B engagement, and direct consumer marketing. The company leverages integrated marketing communications, including digital platforms and traditional media, to articulate its strategic direction, financial achievements, and commitment to the energy transition. This approach aims to build trust and enhance brand reputation across all stakeholder groups.

Key promotional efforts highlight Eni's investments in decarbonization and renewable energy, positioning the company as a responsible leader. For instance, in 2023, Eni invested €2.6 billion in these areas. Their B2B strategy focuses on tailored solutions and technical expertise for industrial clients, while retail marketing emphasizes product quality and loyalty programs like Eni Live.

Investor relations and financial disclosures are crucial, with Eni actively engaging the investment community. Their Q1 2024 financial results demonstrated strong performance, particularly in the upstream segment, reinforcing investor confidence. This transparency supports capital attraction for future growth initiatives.

Price

Eni's pricing for its primary oil and gas products is intrinsically tied to global commodity markets. This means prices are heavily influenced by international benchmarks such as Brent crude oil and Henry Hub natural gas prices, which are constantly shifting.

These fluctuations are driven by a complex interplay of supply and demand, alongside significant geopolitical events that can rapidly alter market sentiment. For instance, in early 2024, Brent crude prices have been trading in the $80-$90 per barrel range, while Henry Hub natural gas prices have seen volatility, influenced by factors like weather patterns and global LNG demand.

The global nature of these commodity markets means that a substantial portion of Eni's revenue is determined by these external price movements. Consequently, Eni must employ sophisticated monitoring and hedging strategies to manage the inherent price risks associated with these volatile markets.

Eni's regulated and contractual gas/power tariffs offer a blended approach to pricing, incorporating both stable, long-term contract structures with diverse indexing mechanisms and regulated tariffs in specific markets. This strategy aims to balance the predictability of revenue with responsiveness to market fluctuations.

For instance, in 2024, a significant portion of Eni's gas supply contracts are indexed to European gas benchmarks, which have seen volatility. However, regulated tariffs in markets like Italy provide a degree of price stability, cushioning against extreme short-term market swings.

The negotiation of large-volume contracts remains a critical element, as these agreements often dictate pricing terms for substantial quantities of energy, directly impacting Eni's revenue streams and competitive positioning in the energy market.

Eni's retail fuel prices are meticulously managed to stay competitive, reflecting shifts in crude oil prices and local taxes. For instance, in early 2024, average gasoline prices across Europe saw fluctuations influenced by geopolitical events and refining capacity, with Eni actively adjusting its station prices to remain attractive.

The company utilizes dynamic pricing, meaning prices can change daily, or even more frequently, to match competitor offerings and current demand. This strategy is crucial for attracting individual drivers, who are highly sensitive to price variations at the pump. Loyalty programs further sweeten the deal, offering members exclusive discounts and further price advantages.

Renewable Energy Power Purchase Agreements

Eni's pricing strategy for renewable energy often centers on Power Purchase Agreements (PPAs). These agreements typically feature fixed or indexed tariffs, providing a predictable revenue stream over many years, which is crucial for securing financing and investor confidence. For instance, in 2024, Eni continued to sign long-term PPAs, with contract durations often spanning 10 to 20 years, ensuring revenue stability for its growing portfolio of solar and wind farms.

These long-term contracts are designed to de-risk investments in new renewable capacity by guaranteeing a buyer for the generated electricity. The pricing within these PPAs is carefully calibrated, taking into account the initial capital expenditure of the project, ongoing operational costs, and the prevailing market demand for green energy. This approach allows Eni to recover its investment and generate a return while offering competitive pricing for renewable electricity.

- Revenue Predictability: PPAs with fixed or indexed tariffs over 10-20 years provide Eni with stable income streams for its renewable assets.

- Investment De-risking: Long-term contracts secure buyers for generated power, making new renewable capacity investments more attractive.

- Cost and Demand Reflection: Pricing within PPAs is influenced by project development costs and the market's appetite for green energy.

Industrial & Specialty Chemical Pricing

Eni's chemical product pricing is meticulously calibrated, taking into account fluctuating raw material costs, operational efficiencies achieved in production, prevailing market demand, and the competitive dynamics within specific specialty chemical segments. This necessitates a deep dive into the intricacies of industrial supply chains and the nuanced needs of end-user markets.

The pricing strategy reflects a clear distinction between high-volume commodity chemicals and the premium pricing commanded by high-value specialty products. For instance, in 2024, the price of ethylene, a key building block chemical, saw significant volatility influenced by energy prices and global supply-demand imbalances, while advanced polymers for automotive applications, a specialty segment, maintained more stable, value-driven pricing.

Key factors influencing Eni's chemical pricing include:

- Raw Material Costs: Fluctuations in oil and natural gas prices directly impact feedstock costs for many chemical products. For example, the average Brent crude oil price in Q1 2024 was around $83 per barrel, a significant input for petrochemicals.

- Production Efficiencies: Investments in advanced manufacturing processes and energy-saving technologies can lower per-unit production costs, allowing for more competitive pricing. Eni's focus on digitalization in its chemical plants aims to boost these efficiencies.

- Market Demand: Demand from key sectors like automotive, construction, and electronics dictates pricing power. The automotive sector's recovery in 2024, for instance, increased demand for specialized plastics and coatings.

- Competitive Landscape: Pricing is also benchmarked against competitors offering similar products, especially in more commoditized markets where differentiation is harder.

Eni's pricing for oil and gas is largely dictated by global commodity markets, with benchmarks like Brent crude and Henry Hub natural gas setting the pace. These prices are highly sensitive to supply, demand, and geopolitical shifts. For example, Brent crude traded around $83 per barrel in early 2024, reflecting these market dynamics.

The company balances this volatility with regulated and contractual tariffs for gas and power, often indexed to European benchmarks but also benefiting from stable, regulated rates in markets like Italy. This hybrid approach aims to provide revenue predictability while remaining responsive to market conditions.

In the retail sector, Eni's fuel prices are dynamically adjusted to remain competitive, mirroring crude oil price changes and local taxes. Loyalty programs further enhance customer value, offering discounts to frequent buyers.

For renewable energy, Eni relies on Power Purchase Agreements (PPAs) with fixed or indexed tariffs, often spanning 10-20 years. These long-term contracts, like those signed in 2024, are crucial for securing financing and ensuring stable revenue for new solar and wind projects.

Eni's chemical product pricing considers raw material costs, production efficiencies, market demand, and competition. The price of ethylene, a key feedstock, saw volatility in early 2024, while specialty chemicals like advanced polymers for automotive applications maintained value-driven pricing.

4P's Marketing Mix Analysis Data Sources

Our Eni 4P's Marketing Mix Analysis leverages a comprehensive set of data, including Eni's official corporate reports, investor relations materials, and public financial disclosures. We also incorporate insights from industry-specific market research, energy sector publications, and competitive intelligence databases to ensure a thorough understanding of their strategies.