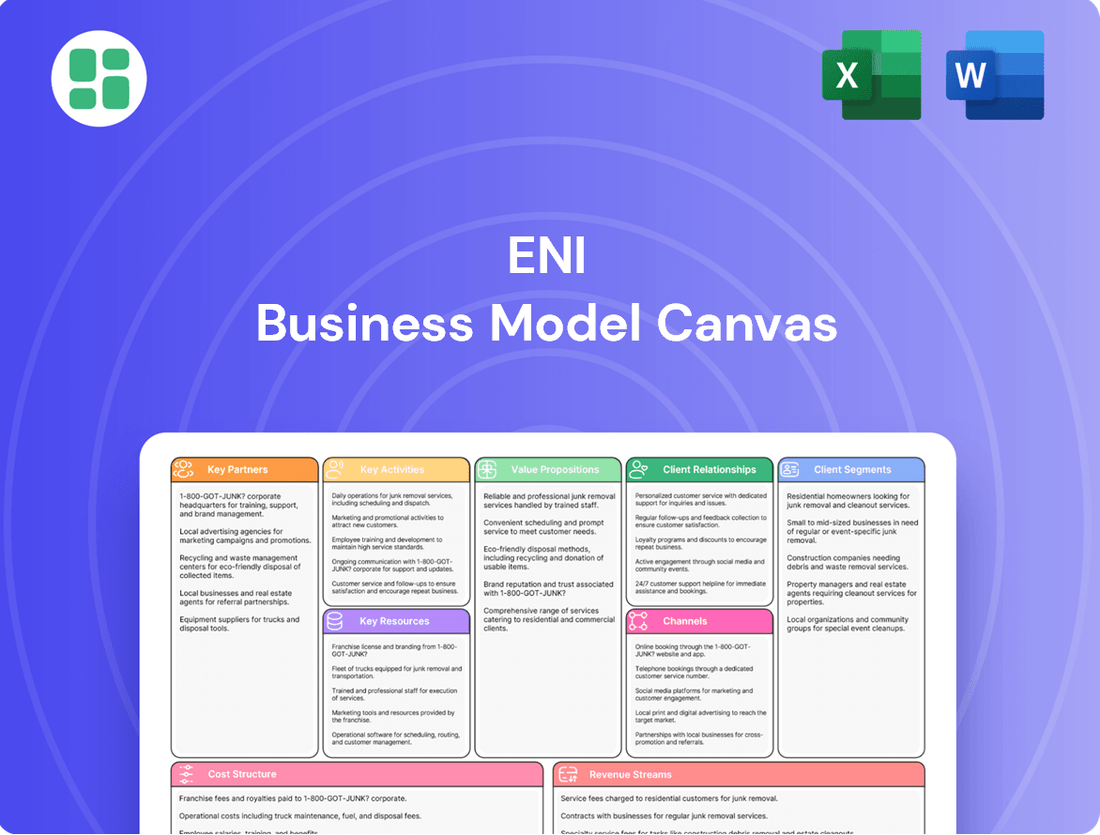

Eni Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eni Bundle

Unlock the full strategic blueprint behind Eni's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Eni actively cultivates strategic alliances through joint ventures and production-sharing agreements with national oil companies (NOCs) and other international energy firms. These collaborations are fundamental to sharing the substantial risks, specialized knowledge, and significant capital required for challenging exploration and production ventures worldwide.

These partnerships are instrumental in gaining entry to new geographical areas, harnessing invaluable local insights, and ensuring the most efficient development of discovered resources. For instance, Eni's operations in regions like Africa, the UK, and Indonesia are significantly bolstered by these carefully structured collaborations.

Eni actively partners with technology providers and research institutions to drive innovation. These collaborations are crucial for enhancing operational efficiency and achieving Eni's energy transition objectives. For instance, partnerships focus on co-developing cutting-edge exploration tools and advancing carbon capture and storage (CCS) technologies.

A prime example of this strategy is Eni's collaboration with Honeywell UOP, leveraging their Ecofining™ technology. This partnership is instrumental in the development and operation of Eni's biorefineries, contributing to the production of sustainable biofuels. These technological alliances are key to Eni's commitment to decarbonization and the expansion of its circular economy initiatives.

Eni actively forms joint ventures in renewable energy development to speed up its growth in solar, wind, and other green sectors. These partnerships, often managed through its Plenitude and Enilive divisions, are crucial for increasing its renewable energy capacity and securing the substantial capital needed for major infrastructure projects.

Key collaborations include significant investments from KKR and Energy Infrastructure Partners in Enilive and Plenitude, demonstrating strong financial backing. Furthermore, a notable joint venture with LG Chem focuses on biorefinery development, highlighting Eni's diversified approach to sustainable energy solutions.

Government and Regulatory Bodies

Eni's engagement with government and regulatory bodies is crucial for its operational legitimacy and strategic expansion. These relationships are the bedrock for obtaining essential licenses and concessions, particularly for its extensive oil and gas exploration and production activities. This also extends to new energy ventures, such as carbon capture and storage (CCS) projects, where governmental approval is paramount.

These partnerships are vital for ensuring Eni's operations remain stable and compliant with evolving national energy policies and stringent environmental standards. For instance, Eni's participation in the HyNet North West cluster in the UK highlights its commitment to collaborating with governmental initiatives aimed at decarbonization and the development of low-carbon hydrogen production.

- Securing Licenses and Concessions: Essential for accessing and developing hydrocarbon reserves and renewable energy sites.

- Navigating Regulatory Frameworks: Ensuring compliance with environmental, safety, and operational regulations.

- Aligning with National Energy Policies: Supporting government objectives for energy security and transition.

- Facilitating New Energy Projects: Enabling advancements in areas like CCS and hydrogen through collaborative frameworks.

Supply Chain and Logistics Partners

Eni’s operational backbone is built upon a robust network of supply chain and logistics partners. These entities are crucial for sourcing equipment, securing specialized services, and managing the transportation of raw materials and finished energy products across Eni's extensive, integrated value chain. For example, in 2024, Eni continued to leverage its established relationships with major oilfield service providers and shipping companies to ensure the efficient movement of crude oil, natural gas, and refined products globally.

The efficiency and reliability of these partnerships directly impact Eni's ability to conduct its operations smoothly, from the initial stages of exploration and drilling to the final delivery of energy to consumers. This includes critical collaborations for the development of sustainable energy solutions. For instance, Eni's biorefining initiatives in 2024 heavily depend on securing consistent and high-quality agri-feedstock supply chains, necessitating strong partnerships with agricultural producers and logistics firms specializing in the transport of biomass.

- Equipment and Service Providers: Eni partners with numerous global suppliers for drilling rigs, exploration technology, refining catalysts, and maintenance services, ensuring access to state-of-the-art resources.

- Logistics and Transportation: Collaborations with shipping companies, pipeline operators, and trucking firms are vital for the safe and timely movement of oil, gas, and refined products to markets worldwide.

- Agri-feedstock Suppliers: For its biorefining operations, Eni establishes partnerships with agricultural producers and cooperatives to secure sustainable sources of vegetable oils and other feedstocks, crucial for producing biofuels.

- Technology and Innovation Partners: Eni also collaborates with technology providers and research institutions to develop and implement innovative solutions across its supply chain, enhancing efficiency and sustainability.

Eni's key partnerships are crucial for accessing resources, sharing risks, and driving innovation in both traditional and new energy sectors. These collaborations span national oil companies, technology providers, and financial investors, enabling Eni to undertake large-scale projects and advance its decarbonization goals.

In 2024, Eni continued to strengthen its alliances, particularly in renewables and biorefining. For instance, its joint ventures in renewable energy development, often managed through Plenitude and Enilive, secured significant capital, with notable investments from KKR and Energy Infrastructure Partners. These partnerships are vital for expanding Eni's green energy capacity and achieving its sustainability targets.

| Partner Type | Example Partnership | Strategic Importance | 2024 Focus/Impact |

|---|---|---|---|

| National Oil Companies (NOCs) & International Energy Firms | Production-Sharing Agreements (e.g., Africa, UK, Indonesia) | Resource access, risk sharing, operational expertise | Continued exploration and production optimization |

| Technology Providers & Research Institutions | Honeywell UOP (Ecofining™), various CCS/hydrogen research | Innovation, operational efficiency, energy transition | Advancing biorefinery tech, developing CCS solutions |

| Financial Investors | KKR, Energy Infrastructure Partners (in Enilive/Plenitude) | Capital infusion for growth, project financing | Accelerating renewable energy project development |

| Government & Regulatory Bodies | HyNet North West cluster (UK) | Licensing, compliance, policy alignment | Facilitating decarbonization initiatives and low-carbon hydrogen |

| Supply Chain & Logistics Partners | Oilfield service providers, shipping companies, agri-producers | Operational efficiency, resource sourcing, product delivery | Ensuring feedstock for biorefineries, efficient global logistics |

What is included in the product

A comprehensive, pre-written business model tailored to Eni's strategy, detailing its integrated energy operations from exploration to retail.

Organized into 9 classic BMC blocks, it covers Eni's diverse customer segments, channels, and value propositions with full narrative and insights.

The Eni Business Model Canvas acts as a pain point reliever by providing a structured framework to analyze and address complex business challenges.

It simplifies the process of identifying and resolving operational inefficiencies and strategic gaps within an organization.

Activities

Eni's core business revolves around the exploration and production (E&P) of hydrocarbons, focusing on discovering new oil and natural gas reserves and developing existing fields for efficient production. This involves substantial capital expenditure on new projects and the continuous optimization of current assets to maintain a reliable energy supply. As of the first quarter of 2024, Eni reported a significant increase in its upstream production, reaching 1.68 million barrels of oil equivalent per day, a testament to its ongoing E&P efforts.

Recent strategic moves underscore Eni's commitment to expanding its E&P footprint. The company announced new discoveries in Indonesia during 2023, further bolstering its reserve base. Additionally, the integration of Neptune Energy's assets, completed in early 2024, is expected to add approximately 160,000 barrels of oil equivalent per day to Eni's production, enhancing its global E&P portfolio and operational capabilities.

Eni's Global Gas, LNG, and Power Trading & Marketing activities are central to its strategy, managing a broad portfolio of natural gas and liquefied natural gas (LNG) from sourcing to delivery to a global customer base. This segment also includes electricity generation and trading, utilizing Eni's extensive gas infrastructure and increasingly investing in renewable energy sources.

The company is committed to gas and LNG playing a substantial role in its future, with projections indicating they will represent a significant portion of its overall production by 2045. This focus underscores Eni's dedication to the energy transition, leveraging its existing strengths while expanding into cleaner power generation.

Eni refines crude oil into essential products like gasoline, diesel, and lubricants, distributing them via its vast retail and wholesale networks. This core activity is evolving, with a significant push towards biorefining for sustainable fuels.

The ongoing conversion of the Livorno refinery is a prime example of this strategic shift, aiming to integrate biorefining capabilities and meet growing demand for greener energy solutions. In 2024, Eni continued to invest in upgrading its refining assets to enhance efficiency and sustainability.

Development of Renewable Energy and Biofuels

Eni's key activities prominently feature the development, construction, and operation of renewable energy sources like solar and wind power, alongside the production of advanced biofuels. This focus is fundamental to their decarbonization efforts and aims to significantly boost renewable capacity and biorefining operations. By 2030, Eni, through its subsidiaries Plenitude and Enilive, targets substantial growth in these areas.

Key aspects of this activity include:

- Renewable Energy Generation: Eni is actively expanding its portfolio of solar and wind farms. For instance, Plenitude is projected to reach 7 GW of installed capacity from renewables by 2026, a significant step towards its 2030 goal of 15 GW.

- Biofuel Production: Enilive is a major player in advanced biofuels, utilizing waste and residual materials. Their biorefineries, like the one in Porto Marghera, are crucial for producing low-carbon fuels.

- Decarbonization Strategy: These activities are directly linked to Eni's broader strategy to reduce its carbon footprint and transition towards more sustainable energy sources, aligning with global climate objectives.

Research, Development, and Carbon Management

Eni's commitment to innovation drives significant investment in research and development. In 2024, the company continued to focus on cutting-edge technologies such as carbon capture, utilization, and storage (CCUS), advanced materials, and digitalization. These efforts are geared towards improving operational efficiency and minimizing its environmental footprint.

Carbon management, particularly through CCUS initiatives, is evolving into a distinct business segment for Eni. This strategic shift aims to provide decarbonization solutions for industries that are challenging to abate. Projects like the one at Liverpool Bay exemplify this focus, demonstrating Eni's proactive approach to addressing climate change.

- R&D Investment: Eni allocates substantial resources to R&D, focusing on CCUS, advanced materials, and digitalization to boost efficiency and reduce environmental impact.

- Carbon Management as a Business: CCUS projects are being developed as standalone business activities to decarbonize hard-to-abate sectors.

- Liverpool Bay Project: This initiative serves as a prime example of Eni's investment in and development of CCUS technology for industrial decarbonization.

Eni's key activities encompass the entire energy value chain, from exploring for and producing oil and gas to refining, marketing, and increasingly, developing renewable energy and biofuels. The company is actively expanding its upstream production, evidenced by the Neptune Energy acquisition in early 2024, which added approximately 160,000 boe/d. Furthermore, Eni is a significant player in gas and LNG trading, with gas and LNG projected to be a major part of its portfolio by 2045. Its refining operations are undergoing a transformation towards biorefining, with ongoing investments in asset upgrades for efficiency and sustainability.

The company's strategic focus on decarbonization is reflected in its substantial investments in renewable energy generation, targeting 15 GW of installed capacity from solar and wind by 2030 through Plenitude. Concurrently, Enilive is a leader in advanced biofuel production, utilizing waste materials. Eni is also developing carbon management as a business, focusing on Carbon Capture, Utilization, and Storage (CCUS) technologies, exemplified by projects like the one at Liverpool Bay, to help decarbonize challenging industrial sectors.

| Activity Area | Key Focus | Recent Developments/Targets (as of mid-2024) |

|---|---|---|

| Exploration & Production (E&P) | Discovering and developing oil and gas reserves | Q1 2024 production: 1.68 million boe/d. Neptune Energy integration expected to add ~160,000 boe/d. New discoveries in Indonesia in 2023. |

| Global Gas, LNG & Power | Sourcing, trading, and marketing gas and LNG; power generation | Gas and LNG projected to be a significant part of the portfolio by 2045. Increasing investment in renewables for power generation. |

| Refining & Marketing | Producing and distributing refined products, shifting to biorefining | Ongoing conversion of Livorno refinery to biorefining. Continued investment in asset upgrades for efficiency and sustainability in 2024. |

| Renewables & Biofuels | Developing solar, wind, and advanced biofuels | Plenitude targeting 7 GW renewable capacity by 2026, 15 GW by 2030. Enilive focusing on advanced biofuels from waste. |

| Carbon Management (CCUS) | Developing CCUS technology for industrial decarbonization | Focus on CCUS as a distinct business segment. Liverpool Bay project as a key CCUS initiative. |

What You See Is What You Get

Business Model Canvas

The Eni Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file. Once your order is processed, you will gain full access to this professionally structured and formatted Business Model Canvas, enabling you to immediately begin strategizing and refining your business.

Resources

Eni's extensive oil and gas reserves and production assets are its core strength, representing proven and probable hydrocarbon inventories globally. These resources, coupled with the infrastructure like platforms and wells, are the foundation of its established business, generating the crucial cash flow needed to fund its energy transition initiatives.

The company's commitment to maximizing these traditional assets is evident in its operational performance. In 2024, Eni reported a notable 3% increase in hydrocarbon production, underscoring its ability to efficiently extract and deliver these vital resources.

Eni's global infrastructure for energy processing and distribution is a cornerstone of its business model. This extensive network includes refineries, gas processing plants, LNG terminals, and pipelines, all working in concert to transform crude oil and natural gas into usable energy products.

This integrated system is crucial for Eni's ability to efficiently deliver products to market. For example, Eni's refining capacity stood at approximately 230,000 barrels per day as of 2023, showcasing the scale of its processing operations.

Furthermore, Eni is actively expanding its biorefining capacity, a key strategic move towards sustainability. By 2023, Eni operated two major biorefineries in Italy, with plans for further growth, demonstrating a commitment to diversifying its product offerings and reducing its environmental footprint.

Eni's intellectual property portfolio is a cornerstone of its business model, encompassing proprietary exploration and production techniques that enhance resource recovery. Its Ecofining™ technology, for instance, is a key proprietary process for producing sustainable biofuels, demonstrating a commitment to lower-carbon energy.

These technological advancements are not just differentiators but also crucial enablers for Eni's strategic pivot towards more sustainable energy sources. The company's investment in advanced computational power, exemplified by its HPC6 supercomputer, further underscores its dedication to innovation and data-driven solutions in areas like carbon management and energy transition modeling.

Human Capital and Specialized Expertise

Eni's human capital is a cornerstone of its operations, featuring a globally distributed workforce of approximately 31,000 individuals as of early 2024. This extensive team includes highly specialized geologists, engineers, researchers, traders, and project managers, whose collective knowledge is vital for navigating the complexities of the energy sector.

Their specialized expertise is directly responsible for driving innovation and ensuring operational excellence across Eni's diverse business segments. This includes deep understanding of exploration and production, advanced research and development initiatives, and sophisticated strategic planning necessary for growth in dynamic energy markets.

- Highly Skilled Workforce: Eni employs around 31,000 people globally, a significant portion of whom possess specialized skills.

- Key Expertise Areas: Geologists, engineers, researchers, traders, and project managers form the core of this specialized workforce.

- Driving Innovation: The expertise of these professionals is crucial for Eni's research and development efforts and the introduction of new technologies.

- Operational Excellence: Their deep knowledge in complex energy operations ensures efficiency and effectiveness in project execution and management.

Financial Capital and Access to Funding

Eni's financial capital is a cornerstone of its business model, enabling the execution of its energy transition and operational strategies. Robust cash flow generation is critical for funding these capital-intensive endeavors.

In 2024, Eni demonstrated significant financial strength, surpassing its own projections. The company reported adjusted EBIT exceeding €13 billion and generated approximately €12 billion in cash flow from operations, highlighting its capacity to self-fund growth initiatives.

Access to diverse funding sources is also paramount. Eni leverages both international debt and equity markets to secure the necessary capital for its large-scale projects, including those focused on decarbonization and new energy sources. Strategic investments from partners further bolster its financial resources.

- Robust Cash Flow: Eni's 2024 operational cash flow of around €12 billion provides a strong foundation for investment.

- Access to Markets: The company actively utilizes international debt and equity markets for capital raising.

- Strategic Partnerships: Investments from partners supplement Eni's internal financial capabilities.

- Financial Performance: Exceeding 2024 guidance for adjusted EBIT underscores financial health.

Eni's key resources are its substantial oil and gas reserves, extensive global infrastructure for processing and distribution, a strong portfolio of intellectual property including proprietary technologies like Ecofining™, and its highly skilled workforce of approximately 31,000 individuals. The company's financial capital, demonstrated by its robust 2024 cash flow of around €12 billion and access to capital markets, underpins these operational and innovative capabilities.

| Resource Category | Key Assets/Attributes | 2024 Data/Highlights |

| Hydrocarbon Reserves & Production | Proven and probable reserves, production assets, platforms, wells | 3% increase in hydrocarbon production |

| Infrastructure | Refineries, gas processing plants, LNG terminals, pipelines, biorefineries | Refining capacity ~230,000 bpd (2023); 2 major biorefineries (2023) |

| Intellectual Property | Proprietary exploration/production techniques, Ecofining™ technology, advanced computing (HPC6) | Focus on sustainable biofuel production and data-driven solutions |

| Human Capital | Geologists, engineers, researchers, traders, project managers | ~31,000 employees globally (early 2024) |

| Financial Capital | Cash flow generation, access to debt/equity markets, strategic investments | Adjusted EBIT > €13 billion, Cash Flow from Operations ~€12 billion |

Value Propositions

Eni is committed to delivering a dependable and varied energy supply, covering oil, natural gas, LNG, and electricity to cater to the varied demands of worldwide markets. This integrated approach, coupled with a wide geographic footprint, bolsters energy security and resilience.

In 2023, Eni's upstream business reported a strong performance, with production averaging 1.6 million barrels of oil equivalent per day, highlighting its capacity to maintain a stable supply. The company's strategic focus for 2024 and beyond is on offering energy that is not only affordable and reliable but also increasingly lower in carbon emissions.

Eni is actively developing and offering a growing portfolio of lower-carbon energy solutions. This includes expanding its renewable electricity generation capacity, producing advanced biofuels, and providing carbon capture, utilization, and storage (CCUS) services. These offerings directly support global decarbonization goals.

The company has established ambitious, science-based targets for reducing its greenhouse gas emissions. In 2024, Eni continued to significantly invest in new green technologies and sustainable businesses, demonstrating a concrete commitment to its transition strategy. This includes substantial capital allocation towards renewables and biofuels.

Eni's overarching goal is to achieve carbon neutrality across its operations and value chain by 2050. This long-term vision guides its strategic investments and operational changes, ensuring its business model aligns with a low-carbon future.

Eni's commitment to technological innovation drives efficiency across its entire value chain, from exploration to new energy solutions. By integrating advanced digital technologies and R&D, Eni optimizes operations, reduces costs, and enhances the performance of its energy products and services. This focus on innovation is central to its strategy for sustainable growth and a reduced environmental impact.

In 2024, Eni continued to invest heavily in research and development, particularly in areas like carbon capture and storage (CCS) and biofuels. For instance, its bio-refinery in Porto Marghera achieved a 90% reduction in CO2 emissions compared to traditional refining processes. This dedication to cutting-edge technology allows Eni to offer more sustainable and efficient energy solutions, positioning it as a leader in the energy transition.

Integrated Solutions Across the Energy Value Chain

Eni provides a complete spectrum of services, from finding oil and gas to selling it and developing new energy solutions. This integrated approach delivers cohesive value to customers by blending established energy sources with newer, greener options. For example, in 2024, Eni continued to expand its portfolio of renewable energy projects alongside its traditional oil and gas operations, aiming to meet diverse customer needs.

The company's strategy involves developing distinct business units, often referred to as a satellite model, designed to operate with a high degree of integration. This structure allows Eni to optimize operations and offer tailored solutions across its entire value chain. In 2024, Eni reported significant progress in its integrated refining and marketing businesses, demonstrating the effectiveness of this model in enhancing efficiency and customer service.

Key aspects of Eni's integrated solutions include:

- Upstream to Downstream Integration: Eni manages the entire lifecycle of energy resources, from exploration and production to refining, marketing, and distribution, ensuring seamless operations and value capture.

- Hybrid Energy Offerings: The company combines traditional hydrocarbon products with a growing range of low-carbon energy solutions, such as biofuels and renewable electricity, catering to evolving market demands.

- Satellite Business Model: Eni fosters the development of specialized, integrated businesses within its structure, promoting agility and focused growth across different segments of the energy market.

Sustainability and Responsible Operations

Eni's commitment to sustainability is deeply embedded in its operations, prioritizing environmental stewardship, social equity, and robust governance. This translates into tangible actions like reducing greenhouse gas emissions and ensuring responsible water management across its activities.

The company actively works to uphold human rights and foster inclusive growth, aiming to create shared value with the communities where it operates. This focus is clearly articulated in its reporting, with the 'Eni for 2024' document underscoring its dedication to a Just Transition, ensuring that the shift to a low-carbon economy benefits all stakeholders.

Key initiatives include:

- Reducing Scope 1 and 2 emissions intensity by 35% by 2025 compared to 2018 levels.

- Investing in circular economy projects, with a target of treating 2 million tonnes of waste by 2025.

- Implementing water management plans across 100% of its sites with significant water withdrawal by 2025.

- Achieving a 75% reduction in flaring intensity by 2025.

Eni provides reliable, diverse energy sources and is transitioning to lower-carbon solutions, driven by innovation and a commitment to sustainability. Its integrated business model and satellite structure ensure efficiency and tailored offerings, aiming for carbon neutrality by 2050.

Customer Relationships

Eni fosters enduring B2B relationships with industrial clients, utilities, and fellow energy firms through robust supply agreements, joint ventures, and strategic alliances. These partnerships are built on direct engagement, customized solutions, and a shared dedication to significant, large-scale energy projects, as exemplified by their extensive gas and LNG contracts.

Eni assigns dedicated account managers to its major industrial and wholesale clients. These specialists offer tailored service, technical expertise, and swift problem-solving, building robust, long-term partnerships.

Eni's retail customers benefit from a robust digital ecosystem, including dedicated mobile apps and online portals. These platforms allow for easy account management, bill payments, and access to energy consumption data, enhancing convenience. As of 2024, Eni's subsidiary Plenitude serves a substantial 10 million customers, underscoring the reach and importance of these digital self-service options.

Community Engagement and Social Responsibility

Eni actively fosters strong ties with the communities where it operates. This commitment is demonstrated through dedicated social development projects and environmental stewardship, aiming to create shared value and maintain a positive social license to operate, especially in regions facing unique challenges.

In 2024, Eni's commitment to community engagement was substantial, with the company spearheading more than 100 local development projects spread across 21 different countries. This extensive reach highlights a strategic focus on building trust and ensuring sustainable operations through direct, positive impact.

- Community Investment: Eni's 2024 initiatives included over 100 local development projects in 21 countries, directly benefiting communities in its operating areas.

- Social License: These projects are crucial for building trust and securing a positive social license to operate, particularly in sensitive geopolitical or environmental contexts.

- Impact Areas: Engagement focuses on social development, environmental initiatives, and creating local employment opportunities, fostering mutual benefit.

Investor Relations and Shareholder Communication

Eni prioritizes open and consistent dialogue with its investors and shareholders. This is achieved through detailed financial reports, engaging investor presentations, and direct investor relations channels, fostering trust and offering crucial financial insights.

The company's commitment to shareholder value is evident in its proactive communication strategy. For instance, Eni's 2024 performance highlighted significant financial achievements, leading to an increase in shareholder remuneration.

- Transparent Reporting: Eni regularly publishes financial statements and performance reviews, ensuring shareholders have access to up-to-date information.

- Investor Engagement: Dedicated investor relations teams facilitate communication, addressing queries and providing strategic updates.

- Shareholder Value Focus: 2024 saw Eni report robust financial results, which translated into enhanced shareholder returns and a strengthened commitment to rewarding investors.

Eni cultivates strong relationships with its retail customers through a comprehensive digital platform, including mobile apps and online portals, facilitating easy account management and access to energy data. As of 2024, its subsidiary Plenitude serves approximately 10 million customers, highlighting the effectiveness of these self-service channels.

The company also prioritizes community engagement, undertaking over 100 local development projects across 21 countries in 2024 to foster trust and ensure a positive social license to operate.

Furthermore, Eni maintains transparent communication with investors through detailed financial reports and direct engagement, reinforcing shareholder confidence, as demonstrated by its 2024 financial performance and increased shareholder remuneration.

| Customer Segment | Relationship Type | Key Engagement Channels | 2024 Data/Highlights |

|---|---|---|---|

| Industrial Clients, Utilities, Energy Firms | B2B Partnerships | Supply Agreements, Joint Ventures, Direct Engagement | Extensive gas and LNG contracts |

| Retail Customers | Direct Consumer | Digital Platforms (Apps, Portals), Customer Service | Plenitude serves ~10 million customers |

| Communities | Social Impact | Local Development Projects, Environmental Stewardship | Over 100 projects in 21 countries |

| Investors & Shareholders | Financial Stakeholders | Financial Reports, Investor Presentations, Investor Relations | Increased shareholder remuneration following robust 2024 performance |

Channels

Eni's direct sales and trading desks are crucial for its B2B operations, handling sales of crude oil, refined products, natural gas, LNG, and power. These channels connect Eni directly with major industrial clients, utility companies, and wholesale traders worldwide. In 2024, Eni's trading activities are expected to continue to be a significant contributor to its revenue streams, leveraging its integrated upstream and downstream assets.

Eni's retail service station network is a cornerstone of its business, providing refined petroleum products and a growing focus on electric vehicle charging. This extensive network caters to both individual drivers and commercial fleets, offering a comprehensive range of fuels, lubricants, and essential convenience services.

Through its Enilive division, Eni is actively enhancing its mobility offerings. In 2024, Eni continued to expand its EV charging infrastructure across its service stations in Italy and other European markets, aiming to capture a significant share of the evolving energy landscape for transportation.

Eni leverages its extensive network of owned or jointly-owned pipelines for the secure transportation of oil and gas, ensuring efficient delivery from extraction points to processing facilities and end markets. This robust infrastructure is a cornerstone of their operations, facilitating the movement of vital energy resources across various geographies.

The company also operates a significant fleet of Liquefied Natural Gas (LNG) carriers, which are essential for the global distribution of natural gas. This capability allows Eni to participate actively in the international LNG market, connecting supply with demand worldwide.

Looking ahead, Eni is strategically focused on expanding its energy production and bolstering its infrastructure in North Africa, a key region for its operations. This includes investments in pipeline capacity and LNG terminals to support growing production volumes and enhance export capabilities.

In 2023, Eni's gas production reached 65.7 billion cubic meters, underscoring the importance of its transportation and distribution channels. The company's commitment to infrastructure development, particularly in regions like North Africa, aims to support its strategic growth objectives and strengthen its position in the global energy landscape.

Power Grids and Energy Distribution Networks

Eni leverages existing national and regional power grids to distribute electricity, particularly from its growing renewable energy portfolio, to a wide range of customers. This reliance on established infrastructure is crucial for its energy sales, ensuring power reaches residential, commercial, and industrial users efficiently.

Plenitude, Eni's retail energy arm, is actively integrating its renewable energy production with energy sales, aiming to provide a cleaner energy mix to its customer base. This strategy directly utilizes the power grids for delivery, connecting Eni's generation assets to the end consumer.

In 2024, Eni continued to expand its renewable capacity, with its installed gross power generation capacity from renewables reaching approximately 6.7 GW by the end of the first half of 2024. This growth directly feeds into the power grids, increasing the volume of green energy available for distribution and sale.

- Infrastructure Reliance: Eni's business model for electricity sales fundamentally depends on the existing power grids and distribution networks for last-mile delivery to customers.

- Renewable Integration: Plenitude's strategy focuses on seamlessly blending renewable energy generation with retail sales, utilizing the grid as the conduit.

- Capacity Growth: By H1 2024, Eni's gross renewable power generation capacity stood at around 6.7 GW, directly impacting the volume of electricity flowing through these networks.

Digital Platforms and Online Presence

Eni utilizes its corporate website and dedicated investor relations portals to disseminate crucial information, including financial reports and strategic updates, fostering transparency with its stakeholders.

The company actively engages its audience through these digital channels, providing a platform for two-way communication and feedback.

Plenitude, Eni's renewable energy subsidiary, effectively employs digital platforms for customer acquisition, onboarding, and ongoing service delivery, streamlining interactions and enhancing customer experience.

In 2023, Eni reported a significant increase in digital engagement across its platforms, with website traffic growing by over 15% year-over-year, reflecting a stronger online presence.

- Corporate Website & Investor Relations: Eni's primary digital hub for official communications and stakeholder engagement.

- Digital Communication: Facilitates the sharing of financial reports, sustainability initiatives, and company news.

- Plenitude's Digital Strategy: Focuses on customer acquisition and service delivery for renewable energy solutions.

- Stakeholder Engagement: Digital platforms are key to building relationships and transparency with investors and customers.

Eni's digital channels, including its corporate website and investor relations portals, are vital for transparent communication and disseminating financial and strategic information. Plenitude, its retail energy arm, leverages these digital platforms for customer acquisition, onboarding, and service delivery, particularly for its renewable energy offerings.

In 2023, Eni saw a notable surge in digital engagement, with its website traffic climbing by over 15% year-over-year, underscoring the growing importance of its online presence for stakeholder interaction and information sharing.

| Channel | Purpose | Key Metrics/Developments (2023-2024) |

|---|---|---|

| Corporate Website & Investor Relations | Information dissemination, stakeholder engagement | Over 15% YoY website traffic growth in 2023 |

| Plenitude Digital Platforms | Customer acquisition, onboarding, service delivery (renewables) | Streamlined customer interactions for green energy solutions |

Customer Segments

Industrial and Commercial Enterprises represent a core customer segment for Eni, encompassing major players like large-scale manufacturers, chemical producers, and power generation companies. These businesses rely heavily on substantial volumes of oil, natural gas, and electricity to fuel their extensive operations, making Eni a critical energy supplier.

These enterprises often secure their energy needs through long-term supply contracts, providing Eni with predictable revenue streams and a stable customer base. For instance, in 2024, Eni continued to foster these relationships, ensuring reliable energy delivery for industrial processes that are vital to the global economy.

Governments and national energy companies are pivotal customers and collaborators for Eni, particularly in resource-rich countries. Eni secures exploration and production concessions, enters into significant energy supply agreements, and partners on large-scale infrastructure development with these entities.

These relationships are fundamental to Eni's global operations, enabling access to reserves and the execution of complex projects. For instance, in 2023, Eni's upstream segment saw production of 1.73 million barrels of oil equivalent per day, a figure heavily influenced by its agreements with national oil companies and governments worldwide.

Wholesale energy traders and distributors form a crucial segment for Eni, involving the large-scale procurement and sale of energy commodities. These entities operate within complex global markets, managing supply and demand for natural gas, oil, and refined products. Eni's Global Gas & LNG Portfolio is a key enabler for these businesses, facilitating their trading activities.

In 2024, the global wholesale energy market continued to be influenced by geopolitical events and the ongoing energy transition. Eni's strategic positioning in LNG, for instance, allows it to provide flexible and reliable supply to these traders, a critical factor in a volatile market. The company's ability to source and deliver significant volumes underpins its value proposition to this segment.

Retail Consumers (Households and Small Businesses)

Eni's retail consumer segment, encompassing households and small to medium-sized businesses, is a cornerstone of its operations, primarily served through its Plenitude and Enilive brands. This segment leverages Eni's integrated energy offerings, providing essential electricity, gas, and evolving mobility solutions.

Plenitude, a key brand within this segment, has demonstrated significant reach, surpassing 10 million customers. This extensive customer base highlights Eni's capacity to deliver energy and related services to a broad spectrum of the market. The offerings extend beyond traditional energy, incorporating fuels and the growing demand for electric vehicle (EV) charging infrastructure.

- Customer Reach: Plenitude has successfully acquired over 10 million customers, indicating a strong presence in the retail energy market.

- Product Diversification: Eni provides a comprehensive suite of products including electricity, gas, fuels, and EV charging services to its retail and small business clients.

- Brand Synergy: The Plenitude and Enilive brands work in tandem to serve millions of residential and small to medium-sized business customers, offering integrated energy and mobility solutions.

- Market Penetration: Eni's strategy focuses on capturing a significant share of the retail energy market by offering competitive and diverse energy solutions.

Transportation Sector (Aviation, Automotive, Marine)

Airlines, car manufacturers, and shipping companies are key customers for Eni, particularly in their transition towards cleaner energy sources. These industries rely heavily on traditional fuels but are increasingly seeking sustainable alternatives. Eni's biorefining capabilities are crucial here, especially for producing Sustainable Aviation Fuel (SAF).

In 2024, the demand for SAF is projected to grow significantly as airlines aim to meet decarbonization targets. Eni's Venice and Gela biorefineries are central to this strategy, with the Venice facility, for instance, having a capacity to process 750,000 tons of crude oil and biofuels annually. This positions Eni as a vital supplier for the transportation sector's evolving energy needs.

- Aviation: Airlines are a major focus, with Eni supplying SAF to meet stringent environmental regulations and corporate sustainability goals.

- Automotive: Car manufacturers are exploring biofuels and advanced fuels for internal combustion engines as a transitional solution.

- Marine: Shipping lines are also integrating biofuels and looking at alternative fuels to reduce their carbon footprint in line with international maritime organizations.

Eni serves a diverse range of customer segments, from large industrial enterprises and governments to individual households and specialized sectors like aviation. These segments represent varying needs for energy supply, from bulk commodities to specialized sustainable fuels.

The company's strategy involves catering to the foundational energy requirements of industrial giants and national entities, while also engaging with the growing demand for cleaner energy solutions in retail and transportation. This broad market approach is supported by Eni's integrated business model.

In 2024, Eni's focus on customer relationships remained strong across all segments. For instance, its retail arm, Plenitude, continued its expansion, serving over 10 million customers with electricity, gas, and mobility services, underscoring its commitment to a broad consumer base.

The company's upstream production in 2023 reached 1.73 million barrels of oil equivalent per day, a testament to its significant role in supplying energy to national companies and governments worldwide, solidifying its position as a key global energy partner.

Cost Structure

Eni's cost structure heavily relies on exploration, development, and production activities, which are inherently capital-intensive. These include the extensive costs of geological surveys, exploratory drilling, developing extraction fields, and the day-to-day operational expenses for bringing oil and natural gas to market.

The company's strategic financial roadmap demonstrates this commitment, with a planned net capital expenditure averaging €7 billion annually for the period spanning 2024 through 2027. This significant investment underscores the substantial financial resources required to maintain and expand its upstream operations.

Eni's operating expenses for refining, trading, and marketing are substantial, encompassing the complex logistics of processing crude oil, managing global energy flows, and reaching consumers. These costs are critical to its downstream segment's profitability.

In 2023, Eni reported refining and marketing operating expenses of €16.6 billion, a significant portion of its overall operational costs. This figure reflects the ongoing investment in maintaining and upgrading its refining assets, including its growing biorefinery operations, to meet evolving environmental standards and market demands.

Eni is significantly increasing its capital expenditure on energy transition initiatives. These investments, totaling €1.4 billion annually from 2025 to 2028, are directed towards expanding renewable energy generation, developing advanced biorefineries, and building carbon capture and storage (CCS) infrastructure.

This strategic allocation of capital underscores Eni's commitment to its decarbonization roadmap and its ambition to become a leader in emerging, lower-carbon energy markets. These expenditures are fundamental to the company's long-term vision and its ability to adapt to a changing global energy landscape.

Research and Development (R&D) and Technology Investment

Eni's commitment to innovation is reflected in significant investments in Research and Development (R&D) and technology. These costs are crucial for developing new energy solutions, enhancing existing operations, and staying ahead in a rapidly evolving market. The company's focus on digitalization and advanced chemistry across its diverse business segments drives these expenditures.

In 2024, Eni continued to prioritize technological advancement. For instance, its exploration and production activities heavily rely on cutting-edge seismic technologies and advanced drilling techniques, contributing to efficient resource discovery and extraction. The company's integrated energy approach means R&D costs span from upstream oil and gas to downstream refining, chemicals, and renewable energy development.

- R&D Investment: Eni allocates substantial capital to R&D, focusing on areas like carbon capture, utilization, and storage (CCUS), hydrogen technologies, and advanced biofuels.

- Digitalization Efforts: Costs associated with implementing digital solutions, AI, and data analytics across operations aim to optimize efficiency, reduce environmental impact, and improve decision-making.

- Advanced Chemistry: Investments in developing sustainable chemicals, advanced materials, and bio-based products are integral to Eni's circular economy strategy.

- Technology Partnerships: Eni collaborates with universities and research institutions, incurring costs for joint projects and technology licensing to accelerate innovation.

Environmental Compliance and Sustainability Initiatives

Eni's cost structure includes significant expenses for environmental compliance and sustainability. These costs cover adherence to stringent environmental regulations, efforts to reduce Scope 1 and 2 emissions, and methane abatement programs. For instance, Eni's 2023 financial report highlighted investments in decarbonization technologies and waste management systems as key cost drivers.

The company's commitment to sustainability extends to implementing social responsibility programs, which also contribute to operating expenses. Eni has set an ambitious target to reduce methane emissions to near zero by 2030, necessitating ongoing investment in advanced monitoring and mitigation technologies.

- Environmental Regulations: Costs associated with complying with evolving global and local environmental laws.

- Emissions Reduction: Investments in technologies and processes to lower Scope 1 and 2 greenhouse gas emissions.

- Methane Abatement: Expenses for leak detection and repair programs to drastically cut methane releases, aiming for near-zero by 2030.

- Waste Management & Social Programs: Costs related to responsible waste handling and the execution of corporate social responsibility initiatives.

Eni's cost structure is dominated by capital-intensive exploration, development, and production, with planned net capital expenditure averaging €7 billion annually from 2024-2027. Significant operating expenses are also incurred in refining, trading, and marketing, with refining and marketing operating expenses reaching €16.6 billion in 2023. The company is also investing €1.4 billion annually from 2025-2028 in energy transition initiatives, including renewables and biorefineries, alongside substantial R&D and environmental compliance costs.

| Cost Category | 2023 (EUR Billion) | 2024-2027 (Annual Avg. EUR Billion) | 2025-2028 (Annual Avg. EUR Billion) |

|---|---|---|---|

| Exploration, Development & Production Capex | N/A | 7.0 | N/A |

| Refining & Marketing Operating Expenses | 16.6 | N/A | N/A |

| Energy Transition Capex | N/A | N/A | 1.4 |

| R&D and Technology Investment | N/A | Significant | Significant |

| Environmental Compliance & Sustainability | Significant | Ongoing | Ongoing |

Revenue Streams

Eni's core revenue generation hinges on the sale of crude oil and natural gas, sourced from its extensive global upstream activities. These vital commodities are supplied to a diverse customer base, including refineries, petrochemical manufacturers, and gas distribution networks, forming the bedrock of its financial performance.

In 2024, Eni saw a notable increase in its hydrocarbon production volumes, a key driver for this primary revenue stream. This upward trend in output directly translates to greater sales potential and a stronger financial contribution from its oil and gas extraction operations.

Eni's primary revenue stream comes from selling refined petroleum products like gasoline, diesel, and lubricants. These sales occur through both wholesale operations and their vast network of service stations, ensuring broad market reach.

The company is also seeing growing contributions to its earnings from Enilive's biorefining initiatives, indicating a strategic shift towards more sustainable products and diversifying revenue sources.

Eni's revenue streams include the significant sale of Liquefied Natural Gas (LNG) to global markets, a segment experiencing notable growth. This trading and supply operation is a core component of their energy portfolio.

Beyond LNG, Eni also generates substantial revenue from the sale of electricity. This power is produced from a mix of conventional and renewable sources, catering to a broad customer base including industrial, commercial, and retail consumers.

In 2023, Eni's upstream segment, which includes gas production and LNG sales, saw a significant contribution to its overall results, reflecting the increasing importance of its LNG business in the international energy landscape.

Sales of Biofuels and Chemical Products

Eni diversifies its income through the sale of biofuels, such as Hydrotreated Vegetable Oil (HVO) and Sustainable Aviation Fuel (SAF), derived from renewable sources. Additionally, its chemical products division, Versalis, contributes significantly to revenue.

The company has ambitious goals, aiming for a biorefining capacity of 5 million tonnes per year by 2030, underscoring its commitment to expanding its sustainable product offerings.

- Biofuel Sales: Revenue generated from HVO and SAF, catering to the growing demand for lower-emission transportation fuels.

- Chemical Product Sales: Income from Versalis's portfolio, including polymers, elastomers, and intermediates.

- Biorefining Capacity Target: Eni's strategic objective to reach 5 million tonnes/year by 2030, indicating future revenue growth potential in biofuels.

Carbon Capture and Storage (CCS) Services

Eni is actively developing Carbon Capture and Storage (CCS) as a significant new revenue stream. This initiative focuses on providing essential decarbonization solutions for industries that find it particularly challenging to reduce their emissions, often referred to as hard-to-abate sectors. By capturing and securely storing carbon dioxide (CO2), Eni aims to offer a vital service to other companies that emit greenhouse gases.

This emerging business is designed to serve third-party emitters, meaning Eni will be providing CCS services to external clients. The company anticipates launching a dedicated CCS satellite company in 2025 to spearhead these operations. This strategic move underscores Eni's commitment to expanding its role in the energy transition and creating value from climate solutions.

- New Revenue Stream: Developing CCS to capture and store CO2 for hard-to-abate industries.

- Third-Party Services: Offering CCS solutions to external emitters as a service.

- 2025 Launch: Planning to establish a new CCS satellite company in 2025.

Eni's revenue is multifaceted, extending beyond traditional oil and gas sales. The company generates income from the sale of refined petroleum products, including gasoline and lubricants, through its extensive service station network. Furthermore, Eni is increasingly capitalizing on its biorefining capabilities, selling biofuels like HVO and SAF, with a target of 5 million tonnes per year capacity by 2030.

The company's electricity sales, derived from both conventional and renewable sources, contribute significantly to its revenue mix. In 2023, Eni's upstream segment, particularly its gas and LNG operations, demonstrated robust financial performance, highlighting the growing importance of its liquefied natural gas business in the global market.

A key emerging revenue stream for Eni is Carbon Capture and Storage (CCS), offering decarbonization solutions to hard-to-abate industries. This service-oriented business, set to be bolstered by a dedicated satellite company launch in 2025, targets third-party emitters, positioning Eni as a provider of climate solutions.

| Revenue Stream | Description | Key Developments/Targets |

| Hydrocarbon Sales | Crude oil and natural gas extraction and sale. | Increased production volumes in 2024. |

| Refined Products | Gasoline, diesel, lubricants sold via wholesale and service stations. | Broad market reach through extensive retail network. |

| Biofuels | HVO and SAF sales from biorefining. | Targeting 5 million tonnes/year biorefining capacity by 2030. |

| Electricity Sales | Power generation from mixed sources. | Catering to industrial, commercial, and retail consumers. |

| LNG Sales | Liquefied Natural Gas trading and supply. | Significant contribution to upstream results in 2023. |

| Chemical Products | Polymers, elastomers, and intermediates from Versalis. | Diversified income stream. |

| Carbon Capture & Storage (CCS) | Decarbonization solutions for industries. | Planned satellite company launch in 2025 for third-party services. |

Business Model Canvas Data Sources

The Eni Business Model Canvas is built upon a foundation of internal operational data, market intelligence reports, and financial performance analyses. These diverse sources ensure a comprehensive and accurate representation of Eni's strategic and economic landscape.