Eni Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eni Bundle

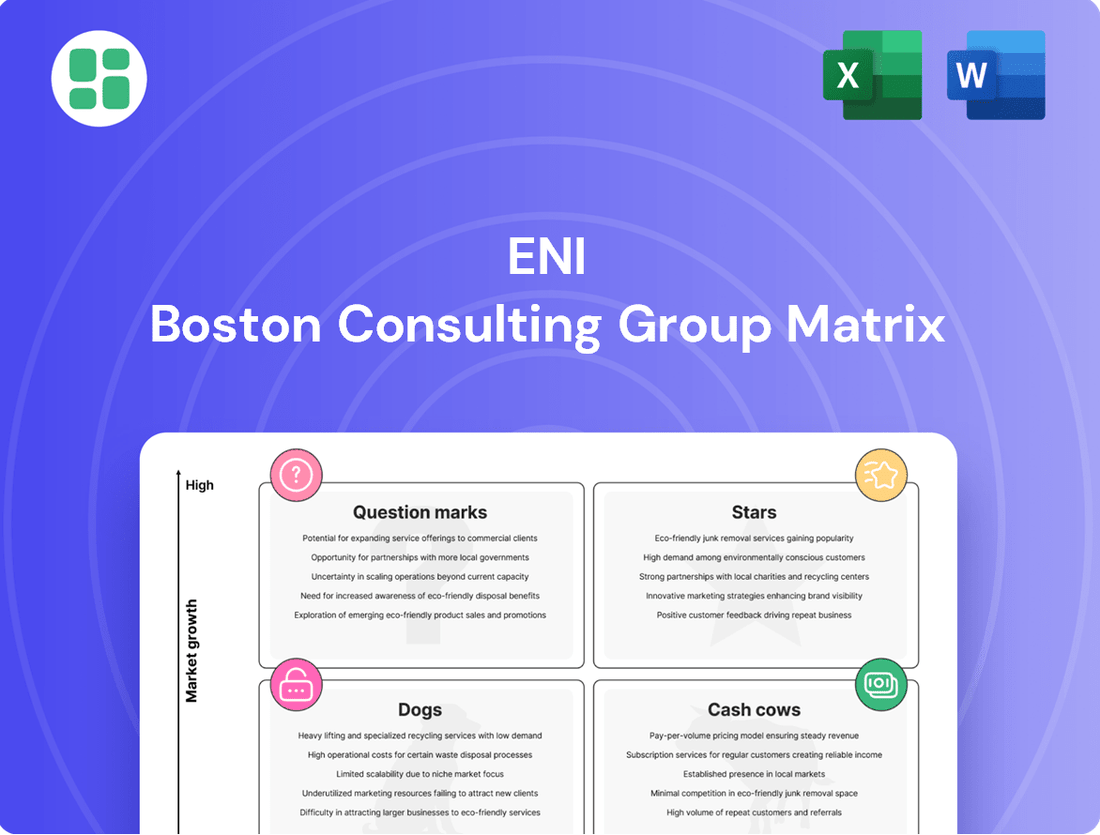

Unlock the strategic potential of the Eni BCG Matrix, revealing how their diverse portfolio is positioned for growth and profitability. Understand which ventures are fueling their success and which require careful consideration.

This glimpse into the Eni BCG Matrix is just the beginning. Purchase the full report to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights for optimizing their business strategy.

Stars

Plenitude, Eni's renewable energy business, is a burgeoning star in the BCG matrix. This segment is experiencing substantial growth, with installed capacity exceeding 4 GW in 2024.

The company has ambitious expansion plans, targeting over 8 GW by 2027 and a remarkable 15 GW by 2030. This rapid scaling positions Plenitude as a significant player in the expanding renewable energy market, directly supporting Eni's energy transition objectives.

This growth is projected to significantly boost Eni's financial performance, with Plenitude expected to double its pro-forma EBITDA. Its strong market penetration and clear growth trajectory solidify its star status within Eni's portfolio.

Enilive stands out as a key player in advanced biofuels, particularly with its production of Hydrogenated Vegetable Oil (HVO) and Sustainable Aviation Fuel (SAF). This segment is crucial for Eni's move towards greater sustainability and meeting the growing demand for cleaner energy sources.

In 2024, Enilive's biorefining capacity hit 1.65 million tonnes. The company has ambitious plans to more than triple this by 2030, aiming for over 5 million tonnes annually, underscoring its commitment to the rapidly expanding decarbonized mobility sector.

Eni's upstream segment showcases strong growth potential, exemplified by its major discoveries. The Baleine project in Côte d'Ivoire, for instance, is projected to reach a plateau production of 150,000 barrels of oil per day by 2024, significantly boosting Eni's African output.

Further bolstering its portfolio, Eni announced the Geng North discovery in Indonesia in late 2023, estimated to contain 2 trillion cubic feet of gas, underscoring its ability to find and rapidly develop new, high-value reserves. These successes position Eni as a key player in emerging exploration areas.

Global LNG Portfolio Expansion

Eni is actively growing its Liquefied Natural Gas (LNG) business, with the Congo FLNG unit slated for operation. This expansion aligns with Eni's strategy to increase gas's contribution to its hydrocarbon output, anticipating robust global demand for natural gas as a transitional fuel.

The company is targeting a significant boost in its LNG production capacity. For instance, by 2025, Eni aims to reach 15 billion cubic meters per year of LNG production. This strategic move positions Eni to capitalize on the increasing demand for flexible and cleaner energy sources.

- Strategic Expansion: Eni is focusing on expanding its LNG portfolio through new projects like the Congo FLNG.

- Energy Transition Role: LNG is viewed as a key element in the energy transition, supporting Eni's goal to increase gas's share in its production mix.

- Capacity Growth: Eni projects its LNG production capacity to reach 15 billion cubic meters per year by 2025.

- Market Demand: This expansion is driven by the growing global demand for natural gas as a cleaner energy alternative.

Strategic Acquisitions in Key Gas Markets

Eni's strategic acquisitions, such as the Neptune Energy deal completed in early 2024 for approximately $4.9 billion, significantly strengthen its footprint in crucial, gas-centric OECD markets. This move bolsters Eni's exposure to natural gas, aligning with its portfolio strategy.

The integration of Neptune Energy enhances Eni's market share in stable and growing gas markets, particularly in regions like the North Sea. This reinforces Eni's commitment to leveraging its satellite model for optimized growth and returns in these key areas.

- Neptune Energy Acquisition: Eni completed the acquisition of Neptune Energy in early 2024, a significant move to bolster its gas market presence.

- Strategic Market Focus: The acquisition targets key gas-focused OECD regions, enhancing Eni's exposure to natural gas.

- Market Share Enhancement: This strategy aims to increase Eni's market share in stable and growing gas markets, utilizing its satellite model.

Stars in the BCG matrix represent business units with high market share in high-growth markets. Eni's Plenitude, its renewable energy arm, is a prime example, with installed capacity exceeding 4 GW in 2024 and ambitious targets of 15 GW by 2030. Enilive, focusing on advanced biofuels, is also a star, having reached 1.65 million tonnes of biorefining capacity in 2024 with plans to more than triple it by 2030. Eni's upstream segment, driven by significant discoveries like Baleine and Geng North, also exhibits star characteristics due to its strong growth potential in emerging exploration areas.

| Business Unit | Market Growth | Market Share | 2024 Data Point | Future Projection |

|---|---|---|---|---|

| Plenitude (Renewables) | High | High | > 4 GW installed capacity | 15 GW by 2030 |

| Enilive (Biofuels) | High | High | 1.65 million tonnes biorefining capacity | > 5 million tonnes by 2030 |

| Upstream (Discoveries) | High | High | Baleine plateau production: 150,000 bpd (2024) | Geng North discovery: 2 Tcf gas |

What is included in the product

The Eni BCG Matrix analyzes business units based on market share and growth, guiding investment decisions.

The Eni BCG Matrix offers a clear, visual representation of your portfolio's health.

It simplifies complex business unit data into actionable insights for strategic decision-making.

Cash Cows

Eni's mature upstream oil and gas production assets, especially those in established regions like Italy and North Africa, serve as significant cash cows. These operations, benefiting from decades of investment and optimization, consistently deliver robust free cash flow, underpinning the company's financial stability and investment capacity.

In 2023, Eni's upstream segment reported a strong performance, with production averaging around 1.6 million barrels of oil equivalent per day. The company's focus on cost efficiency in these mature fields, coupled with favorable market conditions in parts of 2024, allowed these assets to generate substantial operating cash flow, contributing significantly to Eni's overall profitability.

Eni's global gas and LNG trading and marketing operations are a significant cash cow, generating substantial and consistent cash flow. This segment benefits from Eni's integrated value chain and wide-reaching network, allowing for efficient optimization of gas supplies and sales.

In 2024, Eni continued to demonstrate the resilience of this business model, successfully navigating market volatility. The company's ability to manage its extensive portfolio ensures stable earnings, reinforcing its position as a reliable generator of cash.

Eni's traditional refining and marketing network, encompassing its refineries and service stations, remains a significant cash cow. This established infrastructure consistently generates revenue from a loyal customer base, even as the company diversifies its energy portfolio. In 2023, Eni reported that its refining segment contributed positively to earnings, demonstrating the enduring strength of this business line.

Core Retail Electricity and Gas Sales (Plenitude)

Plenitude's core retail electricity and gas sales are a prime example of a cash cow within the Eni BCG Matrix. This segment benefits from an established and extensive customer base, exceeding 10 million, which translates into consistent and predictable revenue streams. Its mature market position allows for high profit margins, providing the financial fuel for Eni's strategic investments in growth areas.

- Customer Base: Over 10 million retail customers for electricity and gas.

- Revenue Stability: Generates recurring revenues due to the essential nature of utility services.

- Profitability: Benefits from high profit margins in a mature market.

- Funding Growth: Cash generated supports investments in renewable energy and electric mobility.

Initial Large-Scale Carbon Capture and Storage (CCS) Projects

Eni's pioneering Carbon Capture and Storage (CCS) initiatives, exemplified by its Ravenna CCS project, place it at the forefront of a vital decarbonization technology. This strategic positioning allows Eni to capitalize on its established infrastructure and technical know-how, not only for its own emissions but also to potentially provide CCS services to third parties.

The Ravenna CCS project, a significant undertaking for Eni, is designed to capture CO2 from industrial sources and store it permanently in depleted offshore gas fields. This project is a key component of Eni's broader strategy to achieve net-zero emissions and develop new business avenues. By demonstrating the viability and scalability of CCS, Eni is building a foundation for future, predictable revenue streams as the market for environmental services matures.

- Ravenna CCS Project Capacity: The Ravenna CCS project aims to capture approximately 25,000 tonnes of CO2 per year initially, with plans for significant expansion.

- Eni's Decarbonization Goals: Eni has set ambitious targets to reduce its net Scope 1 and 2 emissions, with CCS playing a crucial role in achieving these objectives.

- Market Potential: The global CCS market is projected to grow substantially, driven by climate policies and industrial decarbonization efforts, offering Eni a significant growth opportunity.

Eni's established upstream oil and gas assets, particularly those in mature fields, function as reliable cash cows. These operations benefit from optimized infrastructure and decades of expertise, consistently generating substantial free cash flow. This financial stability enables Eni to fund its strategic initiatives and investments across various business segments.

In 2023, Eni's upstream production averaged approximately 1.6 million barrels of oil equivalent per day, with cost efficiencies in mature fields contributing to strong operating cash flow in 2024, reinforcing their role as key profit generators.

Eni's global gas and LNG trading and marketing operations are also significant cash cows, leveraging an integrated value chain for efficient supply and sales optimization. Despite market volatility in 2024, the segment's robust portfolio management ensured stable earnings, underscoring its reliability as a cash generator.

The company's traditional refining and marketing network, including its refineries and service stations, continues to be a dependable cash cow. This established infrastructure consistently generates revenue from a loyal customer base, with the refining segment contributing positively to earnings in 2023, highlighting its enduring strength.

Delivered as Shown

Eni BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after completing your purchase. This means no watermarks, no demo content, and no hidden surprises – just a comprehensive strategic tool ready for your immediate use.

Dogs

Eni's basic chemicals business, primarily managed by Versalis, has been a significant drag on the company's performance. In the first quarter of 2024, this segment reported substantial losses, continuing a trend seen over previous years.

The European market for these basic chemicals is characterized by low growth and structural decline, making it difficult to generate consistent profits. This challenging environment has led Eni to initiate a major transformation plan.

The core of this strategy involves reducing Eni's exposure to these traditional basic chemical products, signaling a strategic shift away from its legacy operations in this sector.

Eni's strategic shift involves retiring outdated refining and petrochemical assets, specifically mentioning the cracking plants in Brindisi and Priolo, along with the Ragusa polyethylene plant. These facilities are being phased out because they hold a small market share in segments of the chemical industry that are experiencing a decline. This move is designed to free up resources for more forward-looking, sustainable projects.

Eni has been actively divesting non-strategic upstream assets as part of its portfolio optimization strategy. These sales focus on fields with lower growth prospects or marginal profitability, allowing Eni to concentrate resources on more promising ventures. For instance, in 2023, Eni completed the sale of its stake in the UK's Liverpool Bay area, a move aligned with its objective to streamline its upstream portfolio.

Marginal/Underperforming Exploration Blocks

Marginal or underperforming exploration blocks within Eni's portfolio, while less common given their track record, can be categorized as 'Dogs' in the BCG matrix. These are ventures that, despite initial promise, consistently fail to deliver commercially viable discoveries or encounter insurmountable technical or economic hurdles. Eni, like any major energy company, must manage these to optimize capital allocation.

These 'Dog' blocks represent a drain on resources, consuming capital without generating meaningful returns. For instance, in 2024, Eni might have several smaller, high-risk exploration licenses in frontier regions that have yielded only minor finds or proven uneconomical to develop. This necessitates a rigorous review process to decide whether to divest, farm out, or cease operations.

- Capital Drain: Blocks with persistent sub-commercial results tie up significant capital that could be reinvested in more promising ventures.

- Portfolio Optimization: Identifying and addressing these 'Dogs' is crucial for maintaining a healthy and productive exploration portfolio.

- Strategic Divestment: Eni may choose to exit these marginal blocks, freeing up capital and management focus for higher-potential areas.

Legacy, High-Emission Operations without Clear Decarbonization Path

Eni's legacy, high-emission operations without a clear decarbonization path represent potential 'dogs' in its BCG matrix. These are segments, like certain upstream oil and gas assets, that are inherently carbon-intensive. Their continued operation contributes significantly to greenhouse gas emissions, posing a challenge in a world increasingly focused on climate action.

The lack of a cost-effective or strategically viable decarbonization strategy for these assets is a key concern. Without a clear plan to reduce their carbon footprint, they risk becoming stranded assets, unable to compete or meet future regulatory requirements. This can lead to write-downs and hinder Eni's overall transition to a lower-carbon energy future.

- High Carbon Intensity: Certain Eni upstream assets, particularly older oil fields with associated gas flaring, fall into this category.

- Decommissioning Costs: The eventual decommissioning of these high-emission facilities could incur significant costs.

- Regulatory Risk: Increasing carbon taxes or stricter emissions regulations could make these operations unprofitable.

- Limited Future Investment: Capital allocation towards these segments is likely to decrease as Eni prioritizes sustainable energy sources.

Eni's commitment to divesting non-core, low-return assets aligns with managing 'Dogs' in its portfolio. The company has been actively optimizing its upstream footprint, shedding assets that no longer fit its strategic vision or offer compelling growth prospects. This proactive approach is essential for freeing up capital and management attention for more promising areas.

The strategic divestments are not merely about size but about enhancing overall portfolio quality and financial performance. By exiting marginal ventures, Eni can redirect resources towards its energy transition objectives and higher-margin businesses.

For instance, Eni’s divestment of its stake in the UK's Liverpool Bay area in 2023 exemplifies this strategy. This move allowed Eni to streamline its upstream portfolio and focus on more strategic growth opportunities, a clear indication of managing potential 'Dogs'.

The company's ongoing review of its asset base, particularly in light of evolving market dynamics and decarbonization pressures, will continue to identify and address any remaining 'Dog' segments, ensuring capital is allocated efficiently.

| Segment | BCG Category | Rationale | 2024 Outlook/Action |

|---|---|---|---|

| Basic Chemicals (Versalis) | Dogs | Low growth, structural decline in European markets, legacy assets. | Transformation plan, reducing exposure, divesting non-strategic assets. |

| Certain Upstream Oil & Gas Assets | Dogs | High carbon intensity, potential stranded assets, uncertain decarbonization path. | Focus on decommissioning costs, regulatory risk, limited future investment. |

| Marginal Exploration Blocks | Dogs | Sub-commercial results, technical/economic hurdles, low discovery rates. | Rigorous review for divestment, farm-out, or cessation of operations. |

Question Marks

Versalis, Eni's chemical subsidiary, is investing €2 billion to pivot towards sustainable chemistry and circular economy products. This strategic shift targets high-growth sectors like bio-based chemicals and advanced recycling, aiming to establish Eni as a leader in these emerging markets.

While these new chemical platforms represent significant future potential, Eni's current market share in these nascent areas is low. This necessitates substantial capital allocation to develop the necessary technologies and scale production to capture market leadership.

Eni is actively pursuing hydrogen production, notably through methane gas for its biorefineries, alongside developing energy storage solutions as a cornerstone of its energy transition. This dual focus positions hydrogen and storage as potential high-growth areas within Eni's portfolio, though they currently represent nascent technologies with a low market share.

These initiatives require significant capital investment and ongoing technological advancement, reflecting their status as question marks on the BCG matrix. For instance, Eni's Versalis subsidiary is exploring hydrogen production linked to its chemical operations, aiming to decarbonize processes and create new value streams.

The global hydrogen market is projected to grow substantially, with estimates suggesting it could reach over $2.5 trillion by 2050, underscoring the strategic importance of Eni's early investments in this sector. Similarly, energy storage, particularly battery technology and hydrogen storage solutions, is critical for grid stability and integrating renewable energy sources, offering Eni a pathway to diversify its energy offerings.

Eni's strategic focus extends beyond established carbon capture and storage (CCS) to advanced carbon utilization and storage (CCUS) technologies, particularly those that convert captured CO2 into valuable products. These innovative areas hold substantial long-term potential for deep decarbonization, aligning with global net-zero ambitions and offering new revenue streams.

While Eni's current market presence in these nascent CCUS applications is still building, their investment in research and development signals a commitment to capturing future growth. For instance, projects exploring the use of CO2 in producing sustainable fuels or building materials represent emerging markets where Eni aims to establish a competitive edge.

Global Expansion of EV Charging Infrastructure

Plenitude's global expansion of EV charging infrastructure presents a question mark within the Eni BCG matrix. While Italy's network is robust, venturing into less mature international markets offers significant growth opportunities for electric mobility. However, Eni's current market share in these nascent regions and its development of cutting-edge charging solutions are still developing, necessitating strategic capital allocation.

These emerging markets are crucial for future EV adoption, with projections indicating substantial growth. For instance, the global EV charging market was valued at approximately $25 billion in 2023 and is expected to reach over $100 billion by 2030, driven by government incentives and increasing consumer demand.

- Market Potential: Emerging economies are anticipated to see a compound annual growth rate (CAGR) of over 25% in EV charging infrastructure deployment through 2030.

- Current Share: Plenitude's presence in these new territories is still building, meaning its market share is relatively small compared to established players in more mature markets.

- Investment Needs: Significant investment is required to build out charging stations, secure permits, and adapt to local regulations in these developing regions.

- Technological Advancement: Developing advanced charging solutions, such as ultra-fast charging or integrated smart grid capabilities, demands ongoing R&D and capital expenditure.

Development of Agri-feedstock Supply Chains for Biofuels

Eni is strategically expanding its agri-business to ensure a consistent supply of sustainable feedstock for its growing network of biorefineries. The company aims to source over 700,000 tonnes of such materials by 2027, demonstrating a significant commitment to this sector.

This initiative involves the creation of new, intricate supply chains within a market that is experiencing robust growth for sustainable raw materials. Eni is actively building its presence and market share in this evolving landscape, moving from a comparatively early stage.

- Feedstock Diversification: Eni is exploring a range of agri-feedstocks beyond traditional sources to enhance supply chain resilience and sustainability.

- Supply Chain Innovation: The company is investing in technologies and partnerships to optimize the collection, processing, and transportation of agricultural products for biofuel production.

- Market Position: As of early 2024, Eni is establishing its footing in the competitive agri-feedstock market, focusing on securing long-term contracts and developing direct relationships with agricultural producers.

- Sustainability Focus: A key driver is ensuring that all feedstock sourcing adheres to strict environmental and social sustainability criteria, aligning with global efforts to reduce carbon emissions.

Question Marks in Eni's portfolio represent areas with high growth potential but currently low market share. These ventures require significant investment to develop technology and scale operations, aiming to become future Stars. For instance, Eni's push into sustainable chemistry through Versalis, with a €2 billion investment, exemplifies this. Similarly, their focus on hydrogen production and energy storage solutions, critical for the energy transition, are also categorized as Question Marks due to their nascent stage and substantial capital needs.

These emerging sectors, like advanced carbon utilization and storage (CCUS) and EV charging infrastructure via Plenitude, are characterized by substantial future market growth but require Eni to build its current market share. The global hydrogen market, projected to exceed $2.5 trillion by 2050, and the EV charging market, expected to surpass $100 billion by 2030, highlight the strategic imperative for Eni's early investments in these areas.

Eni's agri-business expansion, aiming to secure over 700,000 tonnes of sustainable feedstock by 2027, also falls under the Question Mark category. This involves building new supply chains in a growing market for sustainable raw materials, demanding strategic capital allocation for technological advancement and market positioning.

| Eni Business Area | BCG Category | Market Potential | Current Share | Investment Need |

|---|---|---|---|---|

| Sustainable Chemistry (Versalis) | Question Mark | High (Circular Economy) | Low | High (€2 billion investment) |

| Hydrogen Production | Question Mark | Very High (>$2.5 trillion by 2050) | Low | High (Technology Development) |

| Energy Storage Solutions | Question Mark | High (Grid Stability) | Low | High (R&D, Infrastructure) |

| Advanced CCUS | Question Mark | High (Deep Decarbonization) | Building | High (R&D, Project Development) |

| EV Charging Infrastructure (Plenitude) | Question Mark | High (>$100 billion by 2030) | Low (in new markets) | High (Infrastructure Build-out) |

| Agri-business (Feedstock) | Question Mark | High (Sustainable Raw Materials) | Early Stage | High (Supply Chain Development) |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, and competitive landscape analysis, to accurately position business units.