Eldorado Gold SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eldorado Gold Bundle

Eldorado Gold's strengths lie in its established mining operations and diversified portfolio, but potential political instability in some regions presents a significant threat. Understanding these dynamics is crucial for any investor looking to navigate the gold market.

Want the full story behind Eldorado Gold's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Eldorado Gold's strength lies in its geographically diversified asset portfolio, spanning operations and development projects in Turkey, Canada, and Greece. This spread across different regions significantly reduces the impact of single-country geopolitical or operational disruptions, offering a more resilient production profile.

The company's flagship assets, such as the Kisladag mine in Turkey and the Lamaque mine in Canada, are pivotal contributors to its consistent gold production. For instance, in the first quarter of 2024, Kisladag produced approximately 59,000 ounces of gold, while Lamaque contributed around 50,000 ounces, showcasing the reliable output from these key locations.

Eldorado Gold showcased impressive financial results in the first quarter of 2025, reporting substantial revenue growth and a notable increase in net earnings. This uptick was primarily fueled by favorable realized gold prices, which bolstered the company's top-line performance.

The company’s robust financial health is further underscored by its strong cash position and ample total liquidity. This healthy financial buffer is crucial, enabling Eldorado to comfortably fund its ongoing operations and strategic growth initiatives, positioning it well for future development.

The Skouries copper-gold project in Greece is a major strength for Eldorado Gold, with first production slated for Q1 2026 and commercial production expected by mid-2026. This project is fully funded, positioning it to be a significant growth driver.

Skouries is projected to substantially boost Eldorado's gold output and introduce copper, diversifying the company's revenue streams. This diversification is a key element of its strategic advancement.

Commitment to Responsible Mining and ESG

Eldorado Gold's dedication to responsible mining and robust Environmental, Social, and Governance (ESG) principles is a significant strength. Their 2024 Sustainability Report highlights tangible progress, including a notable reduction in total recordable injury frequency rates, demonstrating a strong focus on safety. The company also reported increased diversity within its Board and senior management, reflecting a commitment to inclusive leadership.

This focus on ESG not only bolsters Eldorado Gold's social license to operate but also cultivates long-term value for all stakeholders. For instance, their 2024 report indicated a 15% decrease in their Lost Time Injury Frequency Rate (LTIFR) compared to 2023, showcasing a clear improvement in safety performance. Furthermore, the proportion of women in senior management roles rose to 30% in 2024, exceeding their initial target.

- Commitment to Safety: Achieved a 15% reduction in Lost Time Injury Frequency Rate (LTIFR) in 2024.

- Diversity and Inclusion: Increased women in senior management to 30% in 2024.

- Stakeholder Value: Enhanced social license to operate through sustainable practices.

- ESG Reporting: Transparently detailed progress in the 2024 Sustainability Report.

Consistent Production from Key Operations

Eldorado Gold benefits from a stable output from its core mining assets. Mines like Kisladag in Turkey have demonstrated robust and consistent gold production, with Kisladag alone seeing an impressive 18% increase in output during the first quarter of 2025. This reliable performance forms a solid base for the company's overall operational results.

Further bolstering this strength, the Lamaque Complex in Canada achieved record gold production in the fourth quarter of 2024 and maintained this strong performance throughout the entire year. These established and well-performing operations provide a dependable revenue stream and operational foundation for Eldorado Gold.

- Kisladag (Turkey): 18% production increase in Q1 2025.

- Efemcukuru (Turkey): Consistent strong production.

- Lamaque Complex (Canada): Record gold production in Q4 2024 and for the full year 2024.

Eldorado Gold's operational strengths are anchored by its diversified asset base, with key contributors like Kisladag in Turkey and Lamaque in Canada consistently delivering. Kisladag, for example, saw an 18% production increase in Q1 2025, while Lamaque achieved record output in Q4 2024 and for the full year. The company's financial health is robust, evidenced by substantial revenue growth and increased net earnings in Q1 2025, driven by favorable gold prices and a strong cash position.

The impending Skouries project in Greece represents a significant future strength. Expected to commence first production in Q1 2026 and reach commercial production by mid-2026, this fully funded project is poised to substantially increase gold output and introduce copper, diversifying revenue streams. Eldorado's commitment to ESG principles is also a core strength, with a 15% reduction in LTIFR in 2024 and 30% women in senior management roles, enhancing its social license to operate and stakeholder value.

| Asset | Location | 2024 Performance Highlight | 2025 Outlook Highlight |

|---|---|---|---|

| Kisladag | Turkey | Consistent production | 18% production increase in Q1 2025 |

| Lamaque | Canada | Record gold production in Q4 2024 and full year | Continued strong performance |

| Skouries | Greece | Project development | First production in Q1 2026, commercial production mid-2026 |

What is included in the product

Analyzes Eldorado Gold’s competitive position through key internal and external factors, highlighting its operational strengths and potential market opportunities alongside its financial vulnerabilities and regulatory challenges.

Offers a clear, actionable breakdown of Eldorado Gold's internal capabilities and external market forces, simplifying complex strategic challenges.

Weaknesses

Eldorado Gold has grappled with escalating production expenses. In the first quarter of 2025, the company reported a notable uptick in both total cash costs and all-in sustaining costs (AISC).

These cost pressures stem from a confluence of factors, including increased royalty payments directly linked to higher gold prices, persistent labor inflation, and operational challenges encountered at various mine sites.

Effectively navigating and mitigating these rising costs is absolutely critical for Eldorado Gold to sustain and enhance its profitability in the current market environment.

Eldorado Gold has faced operational hurdles at individual mining sites, impacting its overall output. For instance, the Olympias mine in Greece experienced a significant 37% drop in production during the first quarter of 2025. This decline was primarily attributed to unexpected maintenance requirements and challenges in maintaining the stability of its flotation circuit.

Further operational disruptions were noted at the Kisladag mine, where extended leach cycles, longer than initially anticipated, coupled with lower-than-expected grades in the stacked material, led to reduced efficiency. These site-specific difficulties can have a ripple effect, potentially affecting the company's ability to meet its production targets and influencing its profitability metrics.

The Skouries project is experiencing significant setbacks, with initial production now slated for Q1 2026, a delay from the previously anticipated Q3 2025, and commercial production expected mid-2026. These extensions, coupled with rising expenses, present a substantial hurdle for Eldorado Gold.

The total capital expenditure for Skouries has escalated, driven by increased material costs, contractor inflation, and a constrained labor market for construction in Greece. This financial strain could potentially dampen investor confidence and negatively affect the project's overall profitability.

Exposure to Commodity Price Volatility

While recent strong gold prices have benefited Eldorado Gold, the company’s financial health is still tied to the unpredictable swings in gold and base metal markets. A sharp drop in these prices could significantly hurt earnings and profit margins, a risk outside the company's direct influence.

For instance, during the first quarter of 2024, Eldorado Gold reported an average realized gold price of $2,053 per ounce. However, a hypothetical 10% decrease in this price, to around $1,848 per ounce, would directly reduce revenue and compress profitability, illustrating the sensitivity to market fluctuations.

- Commodity Price Sensitivity: Exposure to fluctuations in gold and base metal prices remains a core vulnerability.

- Impact on Profitability: Significant price declines directly threaten revenue streams and profit margins.

- External Market Forces: The company has limited control over the global commodity markets that dictate these prices.

Workforce and Labor Market Challenges

Eldorado Gold has faced difficulties in attracting and retaining adequate staff, especially in Greece's competitive construction sector. This has notably impacted the progress of the Skouries project's ramp-up phase.

The company is also contending with rising labor costs due to inflation and increased wage demands in key operating areas such as Turkey and Quebec, directly affecting overall operating expenses.

These workforce-related hurdles pose a risk to project schedules and can diminish operational effectiveness.

- Skouries Project Delays: Labor shortages in Greece have hindered the timely execution of the Skouries project, potentially pushing back production timelines.

- Increased Operating Costs: Labor inflation in Turkey and Quebec in 2024 is estimated to have increased operating costs by 3-5% year-over-year, impacting profitability.

- Talent Acquisition: Competition for skilled labor in mining regions remains intense, making it challenging for Eldorado to secure the necessary personnel for both development and ongoing operations.

Eldorado Gold faces significant operational challenges, with production declines at key sites like Olympias, down 37% in Q1 2025 due to maintenance and flotation circuit issues. Kisladag also experienced reduced efficiency from extended leach cycles and lower grades. These site-specific problems directly impact the company's ability to meet production targets and overall profitability.

Preview Before You Purchase

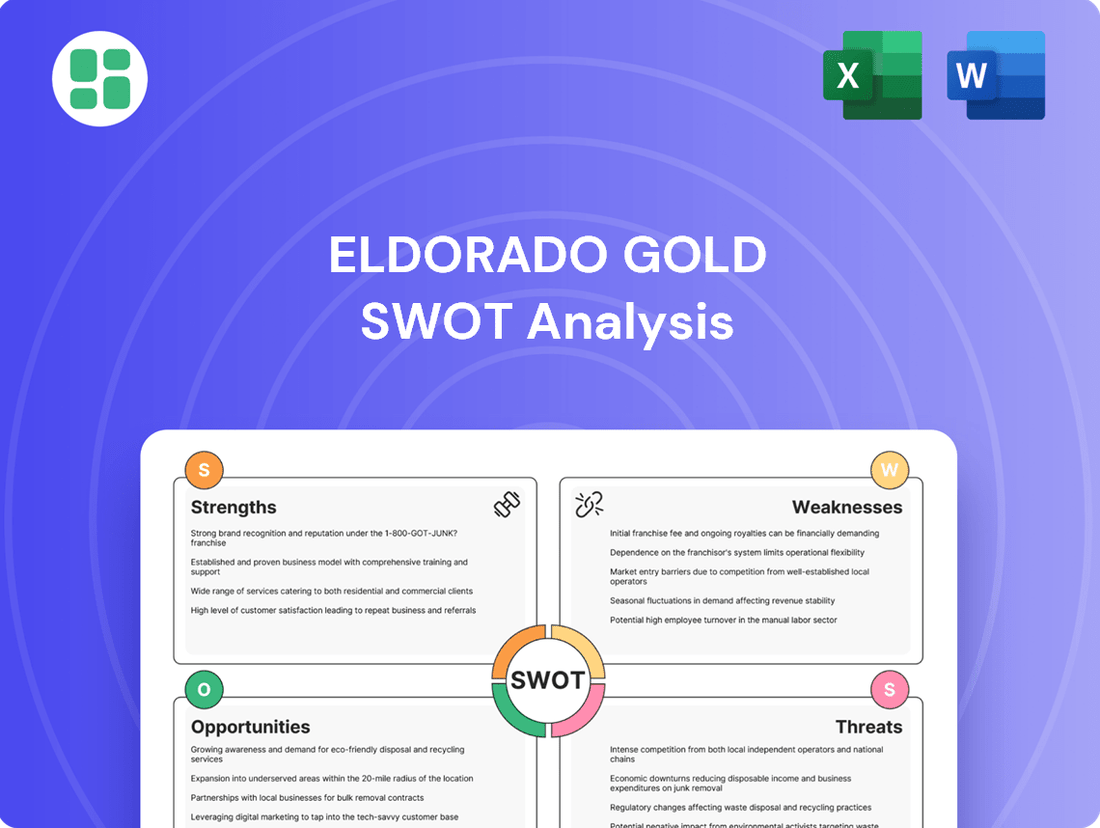

Eldorado Gold SWOT Analysis

This is the actual Eldorado Gold SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, alongside external opportunities and threats. This detailed analysis is crucial for strategic planning and decision-making.

Opportunities

The imminent completion and ramp-up of the Skouries project in Greece represents a substantial growth catalyst for Eldorado Gold. This development is poised to significantly boost the company's gold output, with projections indicating a 43% increase in gold production by 2027, relative to 2023 figures. Furthermore, Skouries will diversify revenue streams by introducing copper, a valuable commodity.

This strategic expansion is anticipated to generate positive free cash flow by the close of 2025. The project's contribution is crucial for Eldorado's forward momentum, marking a key phase in its operational and financial growth trajectory.

The current macroeconomic climate, characterized by elevated gold prices, offers a significant tailwind for Eldorado Gold. This sustained high price environment directly translates into stronger revenue streams and improved profitability for the company. For instance, in Q1 2024, Eldorado reported an average realized gold price of $2,057 per ounce, contributing to a substantial increase in revenue.

These favorable price conditions allow Eldorado Gold to generate robust cash flows, which are crucial for reinvesting in its existing operations and exploring new growth opportunities. This financial strength also positions the company to enhance shareholder returns through dividends or share buybacks, further solidifying its market position.

Eldorado Gold is actively pursuing exploration to convert and expand resources within its existing mines like Lamaque and Olympias. This focus on in-mine exploration is crucial for extending mine lives and uncovering more value from its current assets.

In 2023, Eldorado reported a significant increase in its gold reserves and resources, with Lamaque being a key contributor to this growth. The company's ongoing drilling programs are designed to identify new targets and ensure a sustainable pipeline of future production.

Operational Efficiency and Cost Optimization

Eldorado Gold is actively implementing operational efficiency improvements, such as shifting to an owner-operated model for open-pit mining at Skouries. This strategic move aims to decrease dependence on external contractors, potentially leading to reduced long-term operational expenses.

Further efforts are underway to optimize crushing and leach circuits at the Kisladag mine, a process designed to boost both productivity and cost-effectiveness. These focused initiatives are expected to positively impact the company's profit margins and overall financial performance.

- Transition to owner-operated mining at Skouries: This aims to cut contractor costs and improve control.

- Kisladag circuit optimization: Enhancing crushing and leach processes for better output and cost efficiency.

- Potential margin improvement: Successful execution of these strategies could lead to higher profitability.

Enhanced Shareholder Value Initiatives

Eldorado Gold's improving financial health, marked by anticipated positive free cash flow, presents a significant opportunity to boost shareholder returns. This could manifest through expanded share repurchase programs, building on the recent amendment to its Normal Course Issuer Bid, which allows for the acquisition of up to 5% of its outstanding shares.

Furthermore, the company may consider initiating or increasing dividend payments, a move that typically appeals to a broader investor base and signals confidence in sustained profitability. For instance, in 2023, Eldorado Gold generated $172 million in adjusted EBITDA, showcasing a solid operational performance that underpins these potential value-enhancement strategies.

- Share Buybacks: Continued or increased share repurchase programs can reduce the number of outstanding shares, thereby increasing earnings per share and potentially the stock price.

- Dividend Potential: The introduction or augmentation of dividends can attract income-seeking investors and reward existing shareholders, signaling financial stability.

- Financial Strength: A strengthening balance sheet and positive free cash flow generation provide the necessary financial flexibility to implement these shareholder-friendly initiatives.

The company is well-positioned to capitalize on the current high gold price environment, which directly benefits its revenue and profitability. This favorable market condition, with average realized gold prices around $2,057 per ounce in Q1 2024, provides a strong foundation for financial growth and reinvestment.

The upcoming Skouries project in Greece is a key growth driver, expected to increase gold production by 43% by 2027 and introduce copper, diversifying revenue. Positive free cash flow generation is anticipated by the end of 2025, bolstering the company's financial standing.

Continued exploration success at existing mines like Lamaque and Olympias offers opportunities to expand reserves and extend mine life, ensuring a sustainable production pipeline. Operational efficiencies, such as transitioning to owner-operated mining at Skouries and optimizing Kisladag's circuits, are set to improve cost structures and boost margins.

Eldorado Gold's strengthening financial health, evidenced by $172 million in adjusted EBITDA in 2023, creates avenues for enhanced shareholder returns through potential dividend increases or expanded share buyback programs.

Threats

Fluctuations in global commodity prices, especially for gold and copper, represent a significant threat to Eldorado Gold's financial stability. For instance, the average realized gold price for Eldorado Gold in Q1 2024 was $2,070 per ounce, down from $2,196 per ounce in Q1 2023, illustrating this volatility. A prolonged slump in these prices directly impacts revenue and profitability, even with cost management initiatives, as a substantial portion of the company's income is tied to these market rates.

Eldorado Gold's operations in countries like Turkey and Greece mean it's exposed to global political shifts and changing rules. For instance, in 2023, the company navigated complex permitting processes in Greece, highlighting the sensitivity of its development timelines to governmental decisions.

Past experiences, such as delays in obtaining permits for its Skouries project in Greece, demonstrate how regulatory hurdles can significantly impact project schedules and increase operational costs. The potential for stricter environmental regulations in these regions also poses a threat, potentially requiring additional investment in compliance measures.

Persistent inflation is a significant concern for Eldorado Gold, directly impacting its operating costs. Key inputs like labor, raw materials, and energy continue to see price increases, pushing up the all-in sustaining costs (AISC).

For instance, in Q1 2024, Eldorado Gold reported an AISC of $1,337 per ounce, a notable increase from previous periods, reflecting these inflationary headwinds. These rising costs can squeeze profit margins and make it difficult for the company to achieve its projected cost targets.

This external economic pressure poses a threat to Eldorado's competitive standing and overall financial stability, as it directly affects the profitability of its gold production.

Environmental and Social Activism

Eldorado Gold continues to face significant headwinds from environmental and social activism, especially concerning its Greek and Turkish operations. Protests and legal challenges, often stemming from worries about cyanide use and potential contamination from waste dams, can directly impact project timelines and operational continuity. For instance, the Skouries project in Greece has experienced prolonged delays due to such opposition, highlighting the financial and strategic implications of environmental concerns.

These activist campaigns not only threaten to disrupt current mining activities but also pose a substantial risk to Eldorado's social license to operate. Reputational damage can deter investors and make it harder to secure permits for future projects. In 2023, the company reported ongoing engagement with local communities and regulatory bodies to address these environmental and social concerns, a critical aspect of managing these threats.

- Ongoing scrutiny of cyanide use and waste dam management in Greece and Turkey.

- Risk of protests and legal challenges impacting operations and project development.

- Potential for reputational damage and erosion of social license to operate.

Operational Disruptions and Production Shortfalls

Eldorado Gold faces significant threats from operational disruptions and production shortfalls. These can stem from various sources, including unexpected equipment failures requiring extensive maintenance, labor disagreements that halt operations, or severe weather events impacting mining activities. For instance, issues encountered at its Olympias and Kisladag operations highlight the vulnerability to these disruptions.

Such problems directly translate into production shortfalls, meaning the company mines less gold than anticipated. This not only increases the cost per ounce of gold produced but also makes it challenging to meet the annual production targets provided to investors. Failure to meet guidance can erode investor confidence and negatively impact the company's stock price and overall financial performance.

- Unplanned Maintenance: Equipment breakdowns can halt production, as potentially seen in past operational challenges.

- Labor Disputes: Strikes or work stoppages can lead to significant production losses.

- Weather Impacts: Extreme weather events can disrupt mining and processing activities.

- Ore Grade Variability: Lower-than-expected ore grades directly reduce the amount of gold extracted, impacting output.

Eldorado Gold is susceptible to geopolitical instability and regulatory changes in its operating regions, particularly Greece and Turkey. Shifts in government policies or unexpected legal challenges can impede project timelines and increase operational costs, as evidenced by past permitting complexities in Greece. Furthermore, the company must contend with the persistent threat of inflation, which directly escalates operating expenses like labor and materials, impacting its all-in sustaining costs.

For instance, Eldorado Gold's all-in sustaining costs (AISC) in Q1 2024 were reported at $1,337 per ounce, reflecting these inflationary pressures. The company also faces significant risks from environmental and social activism, with protests and legal actions potentially disrupting operations and damaging its social license to operate, as seen with ongoing concerns regarding cyanide use and waste dam management.

| Threat Category | Specific Risk | Impact | Example/Data Point |

| Geopolitical & Regulatory | Policy changes, permitting delays | Increased costs, project delays | Past permitting hurdles in Greece |

| Economic | Inflationary pressures | Higher operating costs, squeezed margins | Q1 2024 AISC: $1,337/ounce |

| Environmental & Social | Activism, legal challenges | Operational disruption, reputational damage | Concerns over cyanide use and waste dams |

SWOT Analysis Data Sources

This Eldorado Gold SWOT analysis is built upon a foundation of credible data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry analyses to provide a robust and informed perspective.