Eldorado Gold Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eldorado Gold Bundle

Eldorado Gold's marketing strategy is a complex interplay of its product offerings, pricing structures, distribution channels, and promotional activities. Understanding how these elements synergize is crucial for grasping their market position and competitive edge.

Dive deeper into Eldorado Gold's strategic choices, from their diverse gold product portfolio and competitive pricing to their global distribution network and targeted promotional campaigns. This comprehensive analysis provides actionable insights for business professionals and students alike.

Unlock a complete 4Ps Marketing Mix analysis for Eldorado Gold, meticulously researched and presented in an editable format. Gain a competitive advantage by understanding their proven marketing tactics and applying them to your own strategic planning.

Product

Eldorado Gold's core products are raw gold and a range of base metals, sourced directly from its mining operations. These are fundamental commodities, primarily traded with entities like refiners, sovereign wealth funds, and industrial manufacturers.

The market value and buyer confidence for these metals hinge significantly on their quality and purity. For instance, in 2024, the average purity for gold bars traded on major exchanges often exceeds 99.99%, a standard Eldorado Gold aims to meet to ensure competitive pricing and market acceptance.

Eldorado Gold's commitment to sustainable mining practices is a cornerstone of its product strategy, focusing on Environmental, Social, and Governance (ESG) integration. This dedication is evident in their operational approach from initial exploration through to site reclamation.

In 2023, Eldorado Gold reported a 9% reduction in greenhouse gas emissions intensity compared to 2022, demonstrating tangible progress in their environmental stewardship. Their social initiatives, including community investment programs, saw a 15% increase in funding in 2024, fostering positive relationships and local development.

These robust ESG efforts directly bolster the product's appeal, attracting a growing segment of socially conscious investors and ensuring market access with downstream partners who increasingly prioritize ethical sourcing and sustainable operations.

Eldorado Gold's exploration and development properties are crucial for its future, representing potential new sources of gold beyond current operations. These projects, such as the portfolio in Greece and Canada, are key to the company's long-term growth strategy and value proposition.

The geological potential and estimated reserves of these undeveloped assets are fundamental to their valuation. For instance, Eldorado's focus on advancing projects like the Skouries mine in Greece, which aims to resume construction in 2024, underscores the importance of these future production centers.

These properties are not just about future ounces; they are about securing the company's position in the market and offering investors a glimpse into sustained production. The company reported in its Q1 2024 update that it is targeting 510,000 to 570,000 ounces of gold production for the full year 2024, with development projects playing a vital role in achieving and exceeding these targets in the coming years.

Long-Term Value Creation

Eldorado Gold's product strategy centers on building enduring shareholder and stakeholder value. This is achieved through optimizing operational efficiency, rigorous cost management, and strategic reserve growth via exploration. The sustained profitability and operational life of their mining assets are key drivers of this long-term value proposition.

In 2023, Eldorado Gold reported significant progress in its value creation efforts. For instance, their production levels were robust, with total gold production reaching approximately 496,000 ounces, exceeding their guidance. This operational success directly fuels their long-term value creation strategy.

- Optimized Production: Achieved approximately 496,000 ounces of gold production in 2023, demonstrating operational efficiency.

- Cost Management: Maintained a focus on cost control to ensure profitability across their asset base.

- Strategic Exploration: Invested in exploration to expand and enhance the longevity of their mineral reserves, such as at the Lamaque mine in Canada.

- Asset Longevity: The profitability and extended mine lives of key assets, like Kisladag in Turkey, are crucial for sustained value.

Quality and Purity Assurance

Eldorado Gold prioritizes the highest quality and purity of its gold and base metals. This commitment is upheld through stringent metallurgical processes and comprehensive quality control at every mine site. For instance, in 2023, Eldorado Gold reported consistent production of high-purity gold, a key factor in its ability to secure favorable market prices.

These high purity standards are not merely about aesthetics; they are critical for meeting the exacting specifications required by industrial users and for qualifying as investment-grade bullion. This focus ensures Eldorado Gold’s products are competitive and command premium pricing in the global market.

- Metallurgical Excellence: Implementing advanced techniques to maximize metal recovery and purity.

- Quality Control: Implementing rigorous testing and verification at every stage of production.

- Market Demand: Meeting the stringent purity requirements for industrial applications and investment products.

- Price Premium: High purity directly correlates with enhanced market value and pricing power.

Eldorado Gold's product offering is centered on high-purity gold and base metals, directly sourced from its mining operations. These commodities are sold to refiners and industrial manufacturers, with quality and purity being paramount for market acceptance and competitive pricing. For example, in 2023, the company consistently produced gold meeting stringent purity standards, crucial for commanding premium prices.

The company's commitment to ESG principles is integrated into its product strategy, enhancing its appeal to socially conscious investors and partners. In 2023, Eldorado Gold achieved a 9% reduction in greenhouse gas emissions intensity, showcasing tangible environmental progress that resonates with the market.

Future growth and value are underpinned by exploration and development properties, such as those in Greece and Canada. The company's 2024 guidance targets 510,000 to 570,000 ounces of gold production, with these development projects playing a key role in achieving long-term output and shareholder value.

| Product Aspect | Key Features | 2023/2024 Data/Focus |

|---|---|---|

| Commodity Type | Gold, Base Metals | Primary products from mining operations. |

| Quality Focus | High Purity (>99.99%) | Consistent production of high-purity gold in 2023, crucial for market pricing. |

| Sustainability | ESG Integration | 9% reduction in GHG emissions intensity (2023 vs 2022); increased community investment (15% in 2024). |

| Future Production | Exploration & Development Assets | Targeting 510,000-570,000 oz gold production in 2024, with development projects supporting future growth. |

What is included in the product

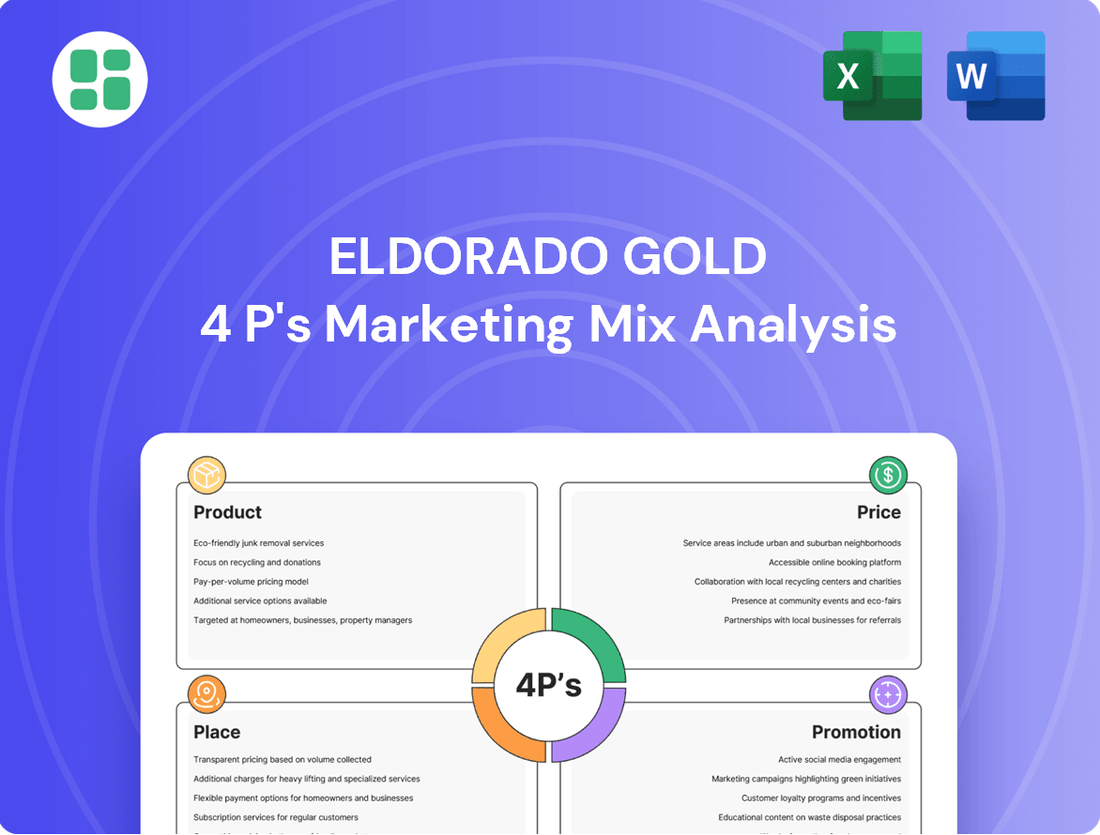

This analysis offers a comprehensive examination of Eldorado Gold's marketing mix, dissecting their strategies across Product, Price, Place, and Promotion to reveal their market positioning and competitive approach.

Simplifies complex marketing strategies into actionable insights, addressing the pain point of information overload for busy executives.

Provides a clear, concise overview of Eldorado Gold's 4Ps, relieving the pressure of needing extensive background knowledge for quick decision-making.

Place

Eldorado Gold's primary products, gold and base metals, are channeled directly to a global network of refiners, financial institutions, and niche purchasers. This approach sidesteps conventional retail, mirroring the standard practice for bulk commodity sales. The company's established connections are key to ensuring smooth transactions and timely deliveries.

Eldorado Gold strategically operates in key mining regions like Turkey, Canada, and Greece, ensuring access to substantial mineral reserves. These locations are chosen for their favorable mining environments and existing infrastructure. In 2023, Eldorado Gold's production was significantly driven by its Turkish operations, particularly the Kisladag and Efemcukuru mines, contributing over 200,000 gold ounces to the company's total output.

Eldorado Gold's integrated supply chain management is crucial for its global operations, covering everything from mining ore to delivering finished products. This intricate process involves careful planning of logistics, managing inventory of doré bars and concentrates, and ensuring the secure transit of these materials to refineries and international ports. In 2023, the company reported total gold production of 490,845 ounces, highlighting the scale of materials that need efficient movement.

Global Commodity Exchanges

While Eldorado Gold primarily engages in direct sales, the pricing and availability of its gold products are heavily influenced by global commodity exchanges. These exchanges are crucial for price discovery, with the London Bullion Market Association (LBMA) being a key benchmark for gold pricing worldwide. Eldorado's sales are consistently benchmarked against these established global market prices, ensuring competitiveness and alignment with international market dynamics.

The LBMA, for instance, sets the twice-daily "gold fix," a globally recognized price that directly impacts Eldorado's revenue. In 2024, gold prices have shown significant volatility, with the LBMA Gold Price reaching highs of over $2,400 per troy ounce in May 2024, reflecting geopolitical tensions and inflation concerns. This benchmark provides a transparent and liquid foundation for Eldorado's sales contracts.

- LBMA Gold Fix: The London Bullion Market Association's twice-daily fixing mechanism is a primary reference for global gold prices.

- Price Discovery: Exchanges like the LBMA facilitate transparent price discovery, crucial for Eldorado's revenue streams.

- Market Liquidity: These platforms offer essential liquidity, enabling efficient trading and sales execution for producers like Eldorado.

- 2024 Price Benchmarking: Gold prices in 2024 have fluctuated, with the LBMA Gold Price reaching over $2,400/oz, directly influencing Eldorado's sales realization.

Secure Transportation and Logistics

Given the inherent value of gold and base metals, secure transportation and robust logistics are absolutely critical for Eldorado Gold's 'place' strategy. This isn't just about moving product; it's about safeguarding a high-value commodity. In 2023, Eldorado Gold reported total gold sales of 498,041 ounces, underscoring the sheer volume and value that needs secure transit.

Their approach involves specialized freight services designed for precious metals, comprehensive insurance coverage, and strict adherence to international shipping regulations. This meticulous attention to detail ensures the safe and reliable movement of their products from their mines, such as the Kisladag mine in Turkey or the Lamaque mine in Canada, all the way to their buyers.

- Specialized Freight: Utilizing carriers experienced in high-value cargo transport.

- Insurance: Comprehensive coverage against loss or damage during transit.

- Regulatory Compliance: Strict adherence to all national and international shipping laws.

- Risk Mitigation: Implementing protocols to minimize theft and damage risks.

Eldorado Gold's 'Place' strategy centers on direct sales to a global network of refiners and financial institutions, bypassing traditional retail channels. This direct approach is supported by strategically located mining operations in regions like Turkey and Canada, which provided significant production in 2023. The company's logistical capabilities are paramount, ensuring the secure and efficient movement of substantial volumes of gold and base metals, as evidenced by their 2023 sales figures.

| Operational Location | Key Mines | 2023 Gold Production (oz) | 2023 Gold Sales (oz) |

|---|---|---|---|

| Turkey | Kisladag, Efemcukuru | >200,000 | N/A |

| Canada | Lamaque | N/A | N/A |

| Greece | Skouries, Olympias | N/A | N/A |

| Total Company | 490,845 | 498,041 |

Full Version Awaits

Eldorado Gold 4P's Marketing Mix Analysis

The Eldorado Gold 4P's Marketing Mix Analysis you see here is the exact, fully completed document you'll receive instantly after purchase. This means no surprises, just immediate access to a comprehensive breakdown of their strategy. You're viewing the final version, ready for your immediate use and analysis.

Promotion

Eldorado Gold places significant emphasis on investor relations, a key component of its marketing mix. This involves proactively communicating financial results, operational milestones, and strategic direction to stakeholders. For instance, the company's Q1 2024 earnings report highlighted a strong start to the year, with revenues reaching $216.5 million, demonstrating operational progress and financial discipline.

The company utilizes various channels to engage with the investment community, including detailed quarterly and annual reports, investor presentations, and active participation in financial conferences. This commitment to transparent and timely disclosure, exemplified by their regular updates on projects like the Kisladag mine expansion, is crucial for fostering investor confidence and attracting necessary capital for growth.

Eldorado Gold actively promotes its commitment to responsible mining and sustainable development. This includes publishing detailed sustainability reports, such as their 2023 report, which outlines progress in environmental stewardship and community engagement. For instance, the company reported a 12% reduction in greenhouse gas intensity in 2023 compared to 2022, demonstrating tangible environmental efforts.

Engaging directly with local communities is a cornerstone of their promotional strategy, fostering trust and demonstrating shared value creation. Eldorado Gold's community investment in 2023 reached $10.5 million globally, supporting various social and economic development projects. These initiatives are consistently highlighted to showcase their dedication to positive social impact.

By consistently showcasing strong Environmental, Social, and Governance (ESG) performance, Eldorado Gold aims to enhance its corporate reputation. This focus on ESG, including their commitment to water management and biodiversity conservation, appeals to a growing segment of ethical investors. In 2024, the company was recognized by Sustainalytics with a low-risk ESG rating, underscoring their efforts.

Eldorado Gold’s presence at key global mining conferences, such as the Prospectors & Developers Association of Canada (PDAC) convention, is crucial. In 2024, PDAC saw over 1,100 exhibitors and 25,000 attendees, providing Eldorado with a vital platform to connect with investors, suppliers, and potential employees. These events are instrumental for showcasing their project pipeline, like the ongoing development at the Skouries mine in Greece, and for fostering relationships that can lead to valuable strategic partnerships.

Digital Presence and Stakeholder Engagement

Eldorado Gold actively manages its digital footprint, utilizing its corporate website, various social media platforms, and online news releases to connect with a broad audience. This multi-channel approach facilitates direct communication with key stakeholders, including investors, employees, local communities, and the wider public.

The company's commitment to transparency and consistent engagement through these digital channels helps to build and reinforce its brand reputation. For instance, in early 2024, Eldorado Gold reported a significant increase in website traffic following the release of its Q4 2023 financial results, indicating strong investor interest.

- Website: Serves as a central hub for corporate information, financial reports, and sustainability initiatives.

- Social Media: Platforms like Twitter and LinkedIn are used for timely updates and community interaction.

- Online News Releases: Dissemination of crucial company news and operational updates to ensure broad accessibility.

- Stakeholder Engagement: Direct communication channels foster trust and understanding with investors, employees, and communities.

Public Relations and Media Outreach

Eldorado Gold actively manages its public image through strategic public relations and media outreach. The company issues press releases to disseminate crucial information, such as recent exploration successes or operational updates. For instance, in early 2024, Eldorado Gold announced positive drill results from its Olympias project in Greece, highlighting the potential for resource expansion.

These communications aim to foster positive media coverage, which is vital for building trust and enhancing brand perception among stakeholders. By proactively sharing key developments, Eldorado Gold seeks to reach a wider audience and reinforce its standing in the mining sector. The company's commitment to transparency in its reporting, including quarterly financial updates, further supports this outreach.

- Press Releases: Eldorado Gold regularly publishes press releases detailing significant corporate events, such as exploration discoveries and operational achievements.

- Media Engagement: The company actively engages with media outlets to ensure accurate and positive reporting of its activities and financial performance.

- Brand Perception: Positive media coverage is leveraged to enhance Eldorado Gold's reputation and reach a broader spectrum of investors and interested parties.

- Financial Reporting: Consistent and transparent financial reporting, including quarterly earnings, forms a core part of their communication strategy to the public and financial community.

Eldorado Gold's promotional efforts are multifaceted, focusing on investor relations, ESG commitment, and strategic event participation. Their transparent communication, exemplified by strong Q1 2024 revenues of $216.5 million, builds investor confidence. Furthermore, tangible ESG progress, like a 12% reduction in greenhouse gas intensity in 2023, and significant community investment of $10.5 million globally in 2023, bolster their corporate reputation and appeal to ethical investors.

| Promotional Activity | Key Metrics/Examples | Impact |

|---|---|---|

| Investor Relations | Q1 2024 Revenue: $216.5 million; Kisladag mine expansion updates | Builds investor confidence, attracts capital |

| ESG Commitment | 2023 GHG Intensity Reduction: 12%; 2023 Community Investment: $10.5 million | Enhances corporate reputation, appeals to ethical investors |

| Event Participation | PDAC 2024 (1,100+ exhibitors, 25,000+ attendees); Skouries mine development | Facilitates networking, showcases project pipeline |

| Digital Presence | Increased website traffic post-Q4 2023 results; active social media | Broad stakeholder engagement, reinforces brand |

Price

The price of gold, Eldorado Gold's main product, is heavily influenced by global commodity markets and experiences daily changes. As a price-taker, the company sells its gold at the current spot price available on international exchanges, a key factor in how they generate revenue.

Eldorado Gold's profitability hinges on its production costs, with all-in sustaining costs (AISC) and all-in costs (AIC) per ounce of gold serving as key metrics. For instance, in the first quarter of 2024, Eldorado reported an AISC of $1,346 per ounce, a slight increase from $1,314 per ounce in Q1 2023, directly impacting their ability to maintain healthy profit margins, especially when gold prices fluctuate.

Effective cost management is paramount for Eldorado to ensure robust profit margins. By diligently controlling operational expenses and enhancing efficiency, the company can better navigate periods of lower gold prices. Understanding these costs is fundamental in establishing the minimum viable selling price required to achieve profitability.

To navigate the inherent price fluctuations of gold, Eldorado Gold might implement hedging strategies. While many gold producers opt for unhedged positions to capitalize on upward price movements, any hedging undertaken would directly impact the actual price received per ounce for a portion of their output.

These financial risk management tools are crucial for stabilizing revenue streams. For instance, if Eldorado Gold were to hedge a portion of its 2024 production, the realized price per ounce would reflect both the market price and the terms of those hedging contracts, providing a degree of certainty against potential downturns.

Currency Exchange Rate Fluctuations

Eldorado Gold's international footprint, with operations in Turkey, Canada, and Greece, makes it highly susceptible to currency exchange rate fluctuations. These shifts directly impact the company's realized prices and costs, as revenues and expenses are often denominated in local currencies before being translated to the US Dollar for reporting. For instance, a stronger Canadian Dollar against the US Dollar would reduce the USD equivalent of revenues generated in Canada, while a weaker Turkish Lira could boost the USD value of Turkish production costs.

The company's effective pricing strategy must account for these currency movements. For example, in Q1 2024, Eldorado Gold reported an average realized gold price of $2,059 per ounce, but the underlying impact of currency can alter the profitability of specific operations. Managing this currency exposure is a critical element of their marketing mix, influencing how they price their products and manage their cost base across different jurisdictions to maintain competitive margins.

- Impact on Realized Prices: Fluctuations in the CAD/USD and TRY/USD exchange rates directly alter the US Dollar equivalent of gold sales in Canada and Turkey, affecting the company's overall average realized price.

- Cost Management: Changes in the Euro/USD rate can influence operating costs in Greece, impacting the company's cost of sales and overall profitability.

- Currency Hedging: Eldorado Gold actively manages currency risk through hedging strategies to mitigate the adverse effects of adverse exchange rate movements on its financial performance.

- 2024 Outlook: For 2024, continued volatility in major currency pairs like EUR/USD and CAD/USD is anticipated, necessitating ongoing vigilance in currency risk management for Eldorado Gold.

Market Demand and Supply Dynamics

The global demand for gold and base metals directly influences market prices, and Eldorado Gold actively tracks these dynamics. Factors like geopolitical stability, inflation outlook, and central bank actions significantly shape the supply-demand equilibrium. For instance, in early 2024, gold prices saw a notable surge driven by persistent inflation concerns and increased central bank buying, reaching highs not seen in years.

Eldorado Gold's strategy involves closely monitoring these macroeconomic indicators to anticipate potential price movements for its products.

- Global gold demand in Q1 2024 reached 1,102 tonnes, up 3% year-on-year, according to the World Gold Council.

- Central bank net purchases of gold continued robustly in 2023, adding 1,037 tonnes.

- Industrial demand for metals like copper, crucial for the green energy transition, remained strong through 2024, supporting higher price levels.

Eldorado Gold operates as a price-taker in the global gold market, meaning its realized price is dictated by prevailing spot market conditions. In Q1 2024, the company achieved an average realized gold price of $2,059 per ounce, a figure directly influenced by market volatility and currency exchange rates. This highlights the critical need for efficient cost management, as demonstrated by their Q1 2024 All-in Sustaining Costs (AISC) of $1,346 per ounce, to maintain healthy profit margins.

4P's Marketing Mix Analysis Data Sources

Our Eldorado Gold 4P's analysis is grounded in comprehensive data, including official company reports, investor relations materials, and industry-specific market intelligence. We leverage information on their operational footprint, product development, pricing strategies, and distribution networks to provide a holistic view.