Eldorado Gold PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eldorado Gold Bundle

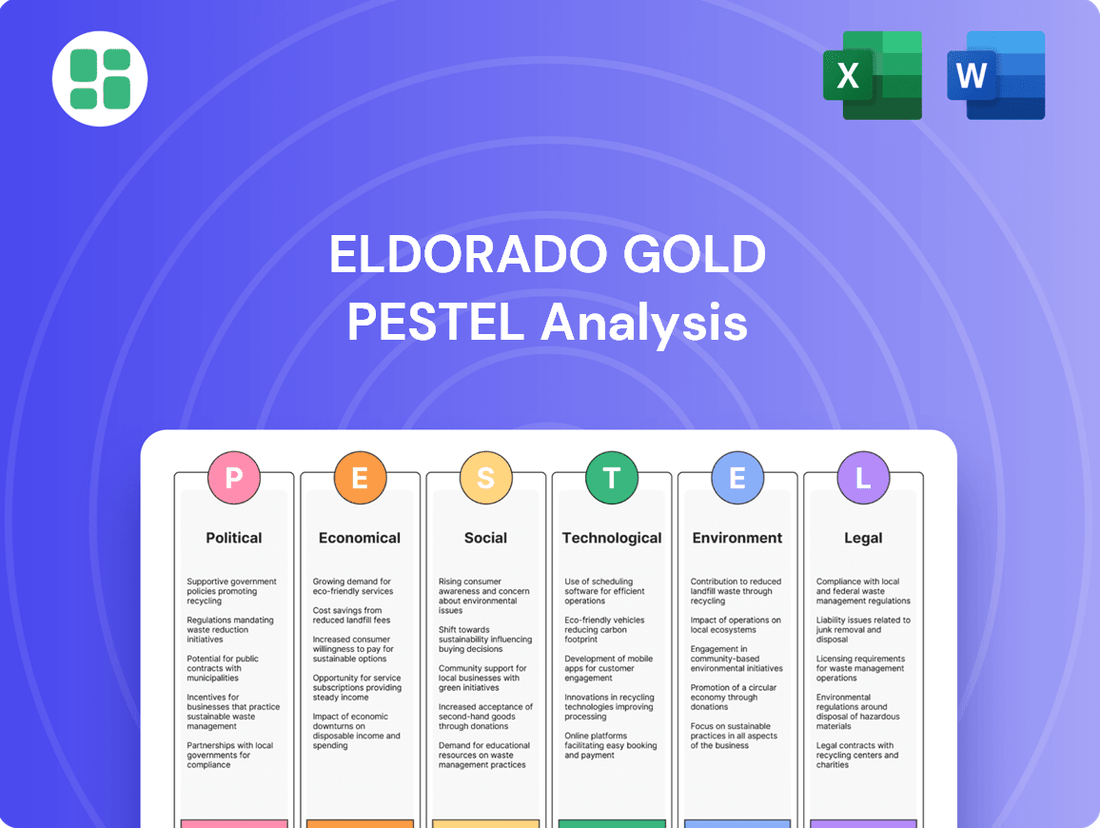

Gain a critical edge with our comprehensive PESTEL Analysis of Eldorado Gold. Understand the intricate political, economic, social, technological, legal, and environmental forces shaping its operational landscape and future growth. Equip yourself with actionable intelligence to anticipate market shifts and refine your own strategic approach. Download the full version now for unparalleled clarity.

Political factors

Eldorado Gold's operations are significantly influenced by political stability in key jurisdictions like Turkey, Canada, and Greece. For instance, Turkey's upcoming general elections in 2023-2024 could potentially alter mining regulations or fiscal policies, impacting Eldorado's Kisladag and Efemcukuru mines. Similarly, shifts in government in Canada or Greece could affect permitting processes or environmental standards for their respective projects.

The consistency of government support for foreign investment is paramount. In 2024, Eldorado Gold's ability to secure favorable terms for its Greek assets, like the Skouries project, will depend on the Greek government's continued commitment to attracting large-scale resource development, especially as the company navigates ongoing community relations and environmental assessments.

Unforeseen political disruptions pose a material risk. A sudden change in policy, such as increased mining royalties or environmental compliance burdens in any of Eldorado's operating countries, could directly affect profitability and the viability of long-term capital investments, potentially impacting the company's projected 2024-2025 earnings.

Resource nationalism presents a significant political risk for Eldorado Gold, especially in its key operating regions like Turkey and Greece. Governments in these emerging markets may push for a larger slice of mining profits, mandate higher local sourcing of goods and services, or even consider taking over mining operations. For instance, in 2023, Turkey's mining sector saw discussions around potential changes to royalty structures, reflecting a broader trend of governments seeking greater economic benefits from natural resources. Such policy shifts can directly impact Eldorado's profitability and create considerable uncertainty regarding asset security and operational freedom.

Geopolitical tensions, particularly concerning resource-rich nations and major consuming economies, directly influence Eldorado Gold's export capabilities and the stability of its supply chains. For instance, ongoing trade friction between major global powers in 2024 could lead to unpredictable shifts in demand for gold and other precious metals, impacting Eldorado's sales volumes.

Trade disputes and the imposition of tariffs or sanctions present significant risks. In 2024, the potential for new trade barriers could increase the cost of essential imported mining equipment and materials for Eldorado, while simultaneously restricting access to key international markets for its refined products. This could add substantial operational expenses and reduce revenue streams.

Maintaining robust diplomatic ties between the countries where Eldorado Gold operates, such as Greece and Canada, and its key trading partners is paramount for ensuring seamless business continuity. Positive international relations foster a predictable environment for investment and trade, which is critical for Eldorado's long-term strategic planning and operational efficiency.

Permitting and Licensing Processes

The efficiency and transparency of permitting and licensing processes are crucial for Eldorado Gold's operations, directly shaped by the political will and administrative frameworks in its various operating countries. Changes or delays in approvals for new projects, expansions, or routine operational permits, often stemming from political interference or bureaucratic inefficiencies, can result in substantial cost increases and project schedule disruptions. For instance, in 2024, the company faced scrutiny regarding its Kisladag mine in Turkey, highlighting the impact of evolving regulatory landscapes on project timelines.

Eldorado Gold's ability to navigate these political factors is paramount. Bureaucratic hurdles and shifts in government priorities can significantly impact the company's ability to secure necessary approvals, potentially delaying crucial development phases or affecting ongoing production. The company's 2024 annual report indicated that regulatory timelines remain a key consideration for project execution across its portfolio.

- Regulatory Stability: Political stability and consistent regulatory environments are essential for predictable project development and operational continuity.

- Government Relations: Proactive engagement with governments and regulatory bodies is vital to mitigate risks associated with permitting and licensing.

- Permitting Timelines: Delays in obtaining permits, such as those for the Lamaque mine in Canada, can directly impact production forecasts and financial performance.

- Environmental and Social Governance (ESG): Increasingly, political pressure related to ESG standards influences permitting decisions, requiring robust stakeholder engagement.

Local Government Engagement

Eldorado Gold's operations are significantly shaped by local government engagement, as effective relationships are crucial for maintaining its social license to operate. For instance, in 2024, the company navigated complex local government discussions regarding environmental impact assessments for potential expansions in Greece, highlighting the direct link between political dialogue and project progression.

The influence of regional leaders and community representatives can directly impact critical aspects like project approvals and local employment commitments. In 2023, Eldorado Gold reported ongoing consultations with local authorities in Turkey concerning community benefit agreements, demonstrating a proactive approach to managing local expectations.

Neglecting these vital relationships can unfortunately lead to significant challenges, including protests and operational disruptions, as seen in past instances where community concerns, amplified by local political dynamics, have temporarily halted activities. The company's 2024 sustainability report detailed initiatives aimed at strengthening these local ties through increased transparency and dialogue.

- Social License: Effective engagement with local governments is paramount for securing and maintaining operational permission.

- Project Approvals: Regional political dynamics directly influence the timeline and success of project approvals.

- Community Relations: Local employment expectations and overall community acceptance hinge on strong governmental ties.

- Risk Mitigation: Proactive engagement helps prevent protests and operational disruptions stemming from local discontent.

Political stability in Eldorado Gold's operating countries, such as Turkey and Greece, directly impacts its operational continuity and investment climate. For example, upcoming elections in Turkey in 2024 could lead to shifts in mining regulations or fiscal policies affecting its Kisladag mine. Similarly, consistent government support for foreign investment, as seen in Greece for its Skouries project, is crucial for project progression and favorable terms.

Resource nationalism remains a key concern, with governments potentially seeking higher profit shares or local sourcing mandates. In 2023, discussions around royalty structures in Turkey highlighted this trend. Geopolitical tensions and trade disputes in 2024 could also affect gold demand and increase operational costs for imported equipment, impacting Eldorado's sales and profitability.

Efficient and transparent permitting processes are vital, with delays often caused by political interference or bureaucratic inefficiencies. For instance, in 2024, the company experienced scrutiny regarding its Kisladag mine, underscoring the impact of evolving regulatory landscapes. Maintaining strong diplomatic ties and engaging effectively with local governments are critical for securing social license and project approvals, as demonstrated by ongoing consultations in Turkey regarding community benefit agreements.

| Political Factor | Impact on Eldorado Gold | Example/Data Point (2023-2025) |

|---|---|---|

| Regulatory Stability | Affects project development and operational continuity. | Ongoing regulatory reviews for Kisladag mine in Turkey (2024). |

| Government Relations | Crucial for permitting, licensing, and social license. | Community benefit agreement consultations in Turkey (2023). |

| Resource Nationalism | Potential for increased royalties or local sourcing demands. | Discussions on royalty structures in Turkey's mining sector (2023). |

| Geopolitical Tensions | Influences gold demand and supply chain stability. | Global trade friction impacting commodity markets (2024). |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Eldorado Gold, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats relevant to Eldorado Gold's global operations and industry landscape.

A concise Eldorado Gold PESTLE analysis that highlights key external factors, enabling proactive strategy development and mitigating potential disruptions.

This PESTLE analysis provides a clear, actionable overview of Eldorado Gold's operating environment, serving as a valuable tool for informed decision-making and risk management.

Economic factors

Fluctuations in global gold prices directly impact Eldorado Gold's revenue and profitability, as gold is their primary commodity. For instance, in the first quarter of 2024, the average realized gold price for Eldorado Gold was $2,113 per ounce, a significant increase from $1,834 per ounce in the same period of 2023, directly boosting their financial results.

The prices of base metals like silver, lead, and zinc, which are often co-produced by Eldorado Gold, also contribute to their economic viability. For example, the company reported by-product credits from silver, lead, and zinc in Q1 2024, which helped offset some of their operating costs, demonstrating the economic importance of these metals.

A sustained downturn in commodity markets can significantly reduce cash flow and investment capacity for mining companies. Conversely, rising prices, as seen with gold in early 2024, enhance financial performance, enabling greater capital allocation for exploration and development projects.

Inflationary pressures in Eldorado Gold's operating countries, such as Turkey and Canada, directly impact operational costs. For instance, rising energy prices and increased labor wages in 2024 and early 2025 can significantly inflate expenses for mining and processing, potentially squeezing profit margins if not effectively managed through cost control measures or price adjustments.

Rising global interest rates, as seen with central bank policy shifts in 2024, increase Eldorado Gold's cost of capital. This makes financing new exploration projects or expanding existing mines more expensive. Furthermore, servicing existing debt becomes costlier, impacting the company's overall financial leverage and investment capacity.

Eldorado Gold's ability to navigate these macroeconomic headwinds is crucial for its financial resilience. By implementing robust hedging strategies for commodity prices and managing its debt structure proactively, the company aims to mitigate the impact of inflation and interest rate volatility, ensuring continued competitiveness in the global gold market.

Eldorado Gold's global footprint, with operations in Turkey, Canada, and Greece, inherently exposes the company to significant currency exchange rate volatility. Fluctuations in the Turkish Lira, Canadian Dollar, and Euro against the US Dollar, the benchmark for gold sales, directly affect reported profits, local operating expenses, and the valuation of its international assets. For instance, the Turkish Lira experienced considerable depreciation in 2023, impacting the cost of local inputs for Eldorado's Kisladag and Efemcukuru mines when translated back to USD.

These currency swings can create substantial headwinds or tailwinds for Eldorado Gold. A weaker Lira, for example, can increase the cost of imported goods and services for its Turkish operations, while a stronger Canadian Dollar could inflate operating costs in that country. Conversely, favorable movements can boost reported earnings. Eldorado actively manages this risk through hedging strategies, aiming to stabilize its financial performance amidst these global currency dynamics.

Global Economic Growth and Demand

The health of the global economy directly impacts industrial demand for metals like gold, as well as investor sentiment towards gold as a safe-haven asset. A strong global economy typically boosts demand for industrial commodities, potentially making gold less attractive. Conversely, economic uncertainty and downturns often see gold prices rise as investors seek stability.

For Eldorado Gold, this means its revenue streams are closely tied to global economic performance. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, indicating a mixed environment for industrial demand but continued potential for gold's safe-haven appeal amidst lingering geopolitical risks.

- Global economic growth forecasts: The IMF's projection of 3.2% for 2024 highlights a moderating but still positive global economic landscape.

- Inflationary pressures: Persistent inflation in major economies can influence central bank policies, impacting interest rates and thus the attractiveness of gold.

- Geopolitical instability: Ongoing global conflicts and political tensions contribute to economic uncertainty, often driving demand for gold as a hedge.

Capital Availability and Investment Climate

The availability of capital for mining projects is a critical factor for Eldorado Gold's growth. In 2024, global mining investment is projected to reach approximately $130 billion, indicating a generally positive but competitive landscape for securing funding. Access to affordable financing, whether through equity, debt, or strategic partnerships, directly impacts Eldorado's ability to advance its development pipeline and expand operations.

The investment climate within the mining sector significantly influences Eldorado Gold's strategic initiatives. Factors such as commodity price stability, geopolitical risks, and regulatory certainty shape investor confidence. A robust investment climate, characterized by predictable policies and strong commodity demand, encourages capital allocation to projects like Eldorado's.

- Global Mining Investment (2024 Projection): ~$130 billion

- Impact of Capital Access: Essential for exploration, development, and expansion.

- Investment Climate Drivers: Commodity prices, geopolitical stability, regulatory frameworks.

- Eldorado's Need: Favorable climate crucial for project funding and strategic growth.

The global economic outlook significantly influences demand for gold and investor sentiment. With the IMF projecting 3.2% global growth for 2024, a slight slowdown from 2023, this indicates a mixed environment for industrial demand but continued appeal for gold as a safe-haven asset amid geopolitical uncertainties.

Inflationary pressures and rising interest rates in 2024 directly impact Eldorado Gold's operational costs and cost of capital. For example, higher energy prices and wages can inflate expenses, while increased interest rates make financing new projects more expensive, affecting debt servicing and investment capacity.

Currency exchange rate volatility, particularly with the Turkish Lira, Canadian Dollar, and Euro against the US Dollar, directly affects Eldorado Gold's reported profits and asset valuations. The depreciation of the Turkish Lira in 2023, for instance, impacted local operating costs for its Turkish mines when translated back to USD.

| Economic Factor | 2024 Data/Projection | Impact on Eldorado Gold |

|---|---|---|

| Average Realized Gold Price (Q1 2024) | $2,113 per ounce | Boosted revenue and profitability compared to $1,834 in Q1 2023. |

| Global Economic Growth (IMF Projection 2024) | 3.2% | Influences industrial demand and gold's safe-haven appeal. |

| Global Mining Investment (2024 Projection) | ~$130 billion | Indicates a competitive landscape for securing project financing. |

| Inflationary Pressures | Ongoing in operating countries (e.g., Turkey, Canada) | Increases operational costs (energy, labor), potentially squeezing margins. |

| Interest Rates | Rising global rates (2024) | Increases cost of capital, making financing and debt servicing more expensive. |

| Currency Exchange Rates (e.g., TRY vs USD) | Volatile (e.g., Lira depreciation in 2023) | Affects reported profits and local operating expenses. |

Preview Before You Purchase

Eldorado Gold PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Eldorado Gold delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Eldorado Gold's ability to operate hinges on maintaining a strong social license, which means fostering positive relationships with the communities where it mines. This involves open communication and actively addressing local concerns, ensuring mining benefits communities through jobs, infrastructure improvements, and social initiatives.

In 2023, Eldorado Gold reported investing approximately $62 million in community development and social programs across its operations, demonstrating a commitment to local impact. For instance, at its Kisladag mine in Turkey, the company supported over 40 local projects, ranging from education to healthcare.

Failure to secure this community backing can result in significant disruptions. In 2024, protests at a project in Greece led to temporary operational halts, costing the company an estimated $15 million in lost production and impacting its reputation.

Eldorado Gold's operational success hinges on its workforce, making labor relations a paramount sociological factor. The company must navigate complex collective bargaining agreements and ensure competitive compensation and safe working environments to avoid disruptions. For instance, in 2023, Eldorado Gold reported a total workforce of approximately 3,300 employees and contractors, highlighting the scale of its human capital management.

Attracting and retaining skilled labor, particularly in remote mining locations like its Kisladag mine in Turkey or the Olympias mine in Greece, presents ongoing challenges. The availability of specialized mining expertise and the company's ability to offer attractive career paths are crucial for maintaining operational efficiency and growth.

Eldorado Gold's dedication to employee and community well-being is a crucial sociological element. The company's investment in comprehensive safety training and emergency response, like their 2023 initiatives which included over 15,000 hours of safety training across operations, directly impacts its social license to operate.

Maintaining rigorous health and safety standards is paramount; a strong safety record, such as Eldorado Gold's reported reduction in lost-time injury frequency rate by 15% in 2023 compared to 2022, fosters trust and operational continuity.

Conversely, any lapses in safety protocols, which can lead to incidents, risk not only severe consequences for individuals but also significant reputational damage and potential operational disruptions, impacting community relations and investor confidence.

Cultural Sensitivity and Indigenous Rights

Eldorado Gold's operations in Canada and Greece necessitate a deep understanding of local cultures and a commitment to indigenous rights. For instance, in Canada, the company must navigate complex land claim agreements and engage in ongoing dialogue with First Nations communities, ensuring their traditional territories and cultural heritage are respected throughout project lifecycles. This commitment is not merely ethical but also a strategic imperative for maintaining operational stability and social license to operate.

Meaningful consultation is key to building trust and ensuring that projects align with community expectations. In 2024, Eldorado Gold continued to invest in community engagement programs, with specific initiatives focused on cultural heritage preservation and economic development opportunities for indigenous populations in its Canadian operating regions. These efforts aim to foster mutually beneficial relationships, mitigating potential disputes and contributing to sustainable development.

Failure to adequately address cultural sensitivities and indigenous rights can lead to significant project delays, legal challenges, and reputational damage. For example, past mining projects globally have faced considerable setbacks due to inadequate consultation, resulting in protracted legal battles and loss of investor confidence. Eldorado Gold's proactive approach in 2024, emphasizing transparency and collaboration, is designed to preempt such issues.

- Cultural Sensitivity: Adapting operational practices to align with Canadian First Nations traditions and Greek cultural norms.

- Indigenous Rights: Adhering to the UN Declaration on the Rights of Indigenous Peoples and Canada's Action Plan.

- Consultation: Implementing robust, ongoing dialogue with local communities and indigenous groups.

- Partnership: Building long-term, trust-based relationships for sustainable project development.

Stakeholder Engagement and Expectations

Managing the diverse expectations of stakeholders, from employees and local communities to governments and shareholders, presents a significant sociological challenge for Eldorado Gold. The company must navigate these often-competing interests by actively engaging with each group, maintaining transparency in its reporting, and clearly demonstrating the positive impacts of its mining activities. For instance, in 2023, Eldorado Gold reported significant community investment programs, contributing to local infrastructure and social development projects, which are crucial for building trust and mitigating potential operational disruptions.

Effective stakeholder management is paramount for fostering a stable operating environment and minimizing risks. This involves not only addressing concerns but also proactively seeking input and collaboration. Eldorado Gold's approach includes regular consultations with local communities near its operations in Greece and Canada, ensuring that their perspectives are considered in operational planning and decision-making. This proactive engagement helps to build social license to operate, a vital intangible asset in the mining sector.

- Community Investment: Eldorado Gold's commitment to local communities is reflected in its 2023 sustainability report, which detailed investments in education, healthcare, and infrastructure in areas surrounding its mines.

- Employee Relations: Maintaining positive employee relations is key, with ongoing efforts in training and development to ensure a skilled and motivated workforce, contributing to operational efficiency.

- Shareholder Value: Balancing stakeholder needs with shareholder expectations is a core tenet, aiming for sustainable growth and profitability while adhering to strong environmental and social governance principles.

- Government Relations: Engaging constructively with regulatory bodies and governments ensures compliance and fosters a collaborative relationship, essential for long-term operational stability.

Eldorado Gold's social license to operate is heavily influenced by its relationships with local communities and its workforce. In 2023, the company invested approximately $62 million in community development, with over 40 projects supported at its Kisladag mine in Turkey alone.

Maintaining strong labor relations is crucial, especially with a workforce of around 3,300 employees and contractors in 2023. The company's commitment to safety, evidenced by a 15% reduction in lost-time injury frequency rate in 2023, directly impacts its social standing and operational continuity.

Respecting indigenous rights and cultural sensitivities, particularly in Canada, is a strategic imperative. Eldorado Gold's 2024 engagement programs focus on cultural heritage and economic development for indigenous populations, aiming to build trust and avoid disruptions like those seen in Greece in 2024, which caused an estimated $15 million in lost production.

| Sociological Factor | 2023 Data/Initiatives | 2024 Outlook/Impact |

|---|---|---|

| Community Investment | $62 million invested globally; 40+ projects at Kisladag | Continued focus on local infrastructure and social programs |

| Workforce Size | ~3,300 employees and contractors | Ongoing need for skilled labor, particularly in remote locations |

| Safety Performance | 15% reduction in lost-time injury frequency rate | Maintaining rigorous safety standards to foster trust and avoid incidents |

| Indigenous Relations | Ongoing dialogue and cultural heritage programs in Canada | Proactive engagement to mitigate project delays and legal challenges |

| Community Protests (Greece) | Temporary operational halts in 2024 | Estimated $15 million in lost production; reputational impact |

Technological factors

The mining industry's increasing embrace of automation and remote operations offers Eldorado Gold significant opportunities to boost efficiency and safety. For instance, autonomous haul trucks and drilling systems can operate around the clock, reducing downtime and human exposure to hazardous conditions, a critical factor given mining's inherent risks.

By adopting these technologies, Eldorado Gold can optimize resource extraction and lower operating costs. Companies like Caterpillar are reporting substantial productivity gains with their autonomous mining solutions, suggesting a strong potential for similar improvements for Eldorado. This strategic investment can unlock greater operational performance and provide a distinct competitive advantage.

Eldorado Gold leverages advanced exploration technologies like airborne geophysics and remote sensing. These tools significantly enhance the efficiency and precision in identifying new mineral deposits, a critical factor in expanding the company's resource base. For instance, advancements in AI-driven data analytics are transforming raw geological data into actionable insights, reducing the time and cost typically associated with traditional exploration methods.

Innovations in mineral processing and extraction are crucial for boosting efficiency. For instance, advancements in comminution circuits and flotation methods can significantly improve how much valuable metal is recovered from the ore, while also cutting down on the energy needed for these processes. This directly translates to higher yields and lower operational expenses.

Eldorado Gold, like many in the mining sector, benefits immensely from adopting these cutting-edge technologies. By implementing improved techniques, the company can extract more gold from its existing reserves, enhancing resource utilization. For example, in 2023, Eldorado Gold reported an all-in sustaining cost of $1,266 per ounce, and further process efficiencies could potentially lower this figure.

Data Analytics and Digitalization

Eldorado Gold is increasingly leveraging big data analytics and digitalization across its mining operations. This integration spans from initial mine planning and exploration to intricate logistics and predictive maintenance of heavy machinery. By harnessing real-time data, the company can make more informed decisions, optimizing everything from production schedules to supply chain management.

The impact of this technological shift is significant. Real-time data monitoring allows for dynamic adjustments to production plans, minimizing downtime and maximizing output. Furthermore, predictive analytics can forecast equipment failures, enabling proactive maintenance and avoiding costly breakdowns. This technological integration is directly contributing to substantial cost savings and a more efficient management of the company's valuable resources.

- Data-driven Optimization: Eldorado Gold utilizes advanced analytics to refine mine planning, resource allocation, and operational workflows, aiming for peak efficiency.

- Predictive Maintenance: Real-time sensor data is analyzed to anticipate equipment malfunctions, reducing unexpected stoppages and repair costs.

- Supply Chain Efficiency: Digitalization streamlines logistics, from ore transport to material procurement, enhancing the speed and reliability of the supply chain.

- Informed Decision-Making: Access to comprehensive, up-to-the-minute data empowers management to make strategic choices with greater confidence and precision.

Sustainable Mining Technologies

Eldorado Gold is increasingly focused on sustainable mining technologies to minimize its environmental impact. This involves adopting innovations in areas like water conservation, efficient waste rock and tailings management, and boosting energy efficiency across its operations. For instance, in 2023, the company reported progress on water management initiatives, aiming to reduce freshwater withdrawal by a targeted percentage across its sites.

The integration of renewable energy sources is also a key technological factor. By investing in solar or wind power for its mines, Eldorado Gold can significantly lower its carbon emissions and operational costs. This aligns with global trends where mining companies are actively seeking cleaner energy solutions to meet sustainability goals and regulatory demands. The company's ongoing efforts in this domain are crucial for maintaining its social license to operate and ensuring long-term viability.

- Water Management: Implementing advanced water recycling and treatment systems to reduce consumption and discharge.

- Waste & Tailings: Utilizing technologies for safer and more environmentally sound storage and potential reprocessing of mine waste.

- Energy Efficiency: Adopting energy-saving equipment and optimizing processes to lower overall energy demand.

- Renewable Energy: Exploring and integrating solar, wind, or other renewable sources to power mining operations, reducing reliance on fossil fuels.

Technological advancements are reshaping Eldorado Gold's operational landscape, driving efficiency and sustainability. The company is actively adopting automation, from autonomous haul trucks to advanced exploration tools, which enhance precision and safety while lowering costs. Innovations in mineral processing promise higher yields and reduced energy consumption, directly impacting profitability.

Digitalization and big data analytics are central to Eldorado Gold's strategy, enabling data-driven optimization of everything from mine planning to predictive maintenance. This focus on real-time data allows for dynamic adjustments, minimizing downtime and maximizing output. For example, in 2023, Eldorado Gold reported an all-in sustaining cost of $1,266 per ounce, with technological efficiencies aimed at further reduction.

Furthermore, Eldorado Gold is investing in sustainable technologies, including advanced water management and waste handling systems, to minimize its environmental footprint. The integration of renewable energy sources, such as solar and wind power, is also a priority to reduce carbon emissions and operational expenses, aligning with industry-wide sustainability goals.

| Technology Area | Impact on Eldorado Gold | Example/Data Point (2023/2024 Focus) |

|---|---|---|

| Automation & Remote Operations | Increased efficiency, enhanced safety, reduced operating costs | Autonomous haul trucks and drilling systems can operate 24/7, improving uptime. |

| Advanced Exploration | More precise and cost-effective identification of mineral deposits | AI-driven data analytics transforming geological data into actionable insights. |

| Mineral Processing Innovations | Higher metal recovery rates, lower energy consumption | Improved comminution and flotation methods boost yields and reduce operational expenses. |

| Digitalization & Big Data | Optimized planning, predictive maintenance, streamlined logistics | Real-time data monitoring allows dynamic production adjustments; predictive analytics forecasts equipment failures. |

| Sustainable Technologies | Reduced environmental impact, lower carbon footprint, improved resource management | Focus on water recycling, efficient tailings management, and renewable energy integration for operations. |

Legal factors

Eldorado Gold navigates a complex legal landscape across its key operational regions: Turkey, Canada, and Greece. These jurisdictions impose stringent mining laws and regulations that dictate everything from initial exploration rights to the granting of mining concessions and the management of production quotas. For instance, in Greece, the company's Skouries project has faced evolving regulatory frameworks, impacting timelines and operational plans.

The financial viability of Eldorado's projects is directly tied to these legal frameworks, which also specify royalty payments and environmental compliance standards. A notable example is the ongoing dialogue and legal challenges surrounding environmental permits in Greece, which can significantly affect capital expenditure and production schedules. The company must remain agile, constantly adapting its strategies to comply with or anticipate changes in these mining laws, which could include new royalty rates or stricter environmental impact assessments.

Eldorado Gold navigates a landscape shaped by stringent environmental regulations, particularly concerning air and water quality, waste disposal, and biodiversity. These legal frameworks are paramount, influencing everything from exploration to mine closure. For instance, in 2023, the company reported that its environmental expenditures, including compliance and permitting activities, amounted to $47.6 million, highlighting the significant financial commitment required.

Securing and sustaining the requisite environmental permits is a protracted and intricate undertaking. Failure to adhere to these regulations can trigger substantial financial penalties, operational shutdowns, and considerable damage to the company's public image. Eldorado Gold's ongoing efforts to maintain compliance underscore the critical nature of these legal obligations.

The company's strategy necessitates continuous investment in sophisticated environmental management systems. This commitment ensures adherence to evolving legal standards and mitigates risks associated with environmental impact, a crucial element for long-term operational viability and stakeholder trust.

Eldorado Gold navigates a complex web of labor and employment laws across its global operations, from Canada to Greece and Turkey. These regulations govern everything from minimum wage requirements and working hour limits to employee benefits and the right to collective bargaining. For instance, in Canada, provincial labor laws dictate specific standards, while in Greece, the company must adhere to EU-influenced labor directives. Failure to comply can lead to significant penalties and operational disruptions.

Managing these diverse legal frameworks is a constant challenge. Eldorado Gold's 2023 sustainability report highlighted ongoing efforts to ensure fair labor practices, a critical component in maintaining positive employee relations and avoiding costly labor disputes. For example, in 2023, the company reported investing in employee training programs across its sites, aiming to align with evolving employment standards and foster a skilled, compliant workforce.

Corporate Governance and Anti-Corruption Laws

Eldorado Gold, as a Canadian-listed entity, navigates a complex legal landscape governed by robust corporate governance standards and stringent anti-corruption legislation, including the Corruption of Foreign Public Officials Act. This necessitates rigorous adherence to these laws across its global mining operations, especially in regions with elevated corruption risk profiles.

Failure to comply can result in severe consequences, including substantial fines, damage to brand reputation, and erosion of investor trust. For instance, in 2023, companies faced significant penalties under such legislation; while specific Eldorado Gold cases aren't publicly detailed for this period, the trend underscores the financial and operational risks associated with non-compliance.

- Regulatory Scrutiny: Publicly traded status mandates adherence to exchange listing rules and securities regulations, impacting reporting and disclosure.

- Anti-Corruption Compliance: Operations in diverse jurisdictions require proactive measures against bribery and corruption, as exemplified by enforcement actions against other resource companies in recent years.

- Legal Ramifications: Non-compliance can lead to investigations, litigation, operational disruptions, and significant financial penalties, impacting profitability and shareholder value.

- Investor Confidence: Demonstrating strong governance and ethical practices is crucial for attracting and retaining investment, particularly in the volatile mining sector.

Taxation and Royalty Regimes

The tax and royalty structures in Turkey, Canada, and Greece are crucial determinants of Eldorado Gold's profitability. For instance, changes in corporate tax rates or royalty percentages directly influence the net income generated from its operations in these regions. Governments often adjust these fiscal policies in response to fluctuating commodity prices or their own budgetary requirements, which can significantly alter Eldorado Gold's expected financial outcomes.

Navigating these diverse and evolving fiscal landscapes is paramount for Eldorado Gold's financial planning. The company must meticulously account for varying corporate income tax rates, which can differ substantially between jurisdictions. For example, as of 2024, Turkey's corporate tax rate stands at 20%, while Canada's federal rate is 15% with provincial variations, and Greece's rate is 22%. These differences, alongside royalty obligations, directly impact the economic feasibility and profitability of each mining project.

- Corporate Tax Rates: Turkey (20%), Canada (15% federal + provincial), Greece (22%) as of 2024.

- Royalty Frameworks: Each country has specific royalty structures tied to production or revenue, impacting net returns.

- Fiscal Policy Volatility: Potential government adjustments to tax and royalty regimes based on market conditions or fiscal needs require continuous monitoring.

Legal factors significantly shape Eldorado Gold's operations, particularly concerning mining concessions, environmental compliance, and labor laws across Turkey, Canada, and Greece. Evolving regulatory frameworks, such as those impacting the Skouries project in Greece, necessitate constant strategic adaptation. The company's commitment to environmental stewardship is underscored by its 2023 expenditure of $47.6 million on environmental compliance and permitting, highlighting the financial implications of adherence to stringent legal standards.

Environmental factors

Water is absolutely vital for mining, and Eldorado Gold, like many in the industry, grapples with ensuring enough clean water is available. This includes dealing with how much water they use, recycling it effectively, and making sure any water they release back into the environment meets strict rules. For instance, in 2023, Eldorado Gold reported on its water management initiatives, highlighting efforts to reduce freshwater withdrawal by a certain percentage compared to previous years across its global operations.

Failure to manage water properly, whether it's not having enough or causing pollution, can really slow down or even stop mining activities. This can also cause significant pushback from local communities who depend on these water sources. The company's sustainability reports often detail specific water consumption figures per tonne of ore processed and the investments made in advanced water treatment technologies to comply with evolving regulations in regions like Greece and Canada.

Eldorado Gold faces significant environmental scrutiny regarding its tailings and waste management. In 2023, the company reported managing a substantial volume of tailings across its operations, with a focus on robust engineering and monitoring to prevent environmental incidents. The company's commitment to responsible disposal is crucial, as past failures in the mining industry have demonstrated severe ecological damage and financial liabilities.

The company is actively investing in technologies to improve tailings storage facility stability and reduce the overall volume of waste generated. This includes exploring dry stack tailings and paste backfill methods, which aim to minimize water content and enhance structural integrity. Such advancements are vital as regulatory bodies worldwide, including those in Greece and Canada where Eldorado operates, increasingly tighten environmental standards for mining waste.

Eldorado Gold faces growing scrutiny over climate change, with potential carbon pricing and stricter emissions rules impacting operations. For instance, Canada's federal carbon pricing system, which applies to industrial emitters, could increase operational costs if not managed effectively. The company is actively assessing its carbon footprint and exploring renewable energy options to enhance resilience and meet stakeholder expectations.

Biodiversity and Ecosystem Protection

Eldorado Gold's mining operations inherently carry the risk of impacting local biodiversity and ecosystems. To address this, the company is obligated to conduct comprehensive environmental impact assessments and implement robust mitigation strategies. These efforts are crucial for safeguarding flora, fauna, and sensitive habitats surrounding its mine sites.

Key to this commitment is the development and execution of biodiversity management plans. These plans often include measures for rehabilitating disturbed areas post-operation and ensuring that mining activities do not lead to deforestation or the endangerment of species. For instance, in 2023, Eldorado Gold reported on its biodiversity initiatives, highlighting efforts to restore over 1,000 hectares of land across its global operations, with a specific focus on native vegetation in regions like Greece and Canada.

- Environmental Impact Assessments: Eldorado Gold conducts detailed studies to understand potential effects on local ecosystems before and during operations.

- Biodiversity Management Plans: The company develops and implements specific plans to protect and enhance biodiversity at its mine sites.

- Habitat Rehabilitation: Efforts are made to restore disturbed land to its natural state, promoting the return of native flora and fauna.

- Species Protection: Measures are in place to prevent operations from contributing to species endangerment or habitat loss.

Mine Closure and Reclamation

Eldorado Gold faces significant environmental responsibilities related to mine closure and reclamation. This includes planning for the rehabilitation of its sites to ensure they are stable and safe, thereby minimizing long-term environmental liabilities. For instance, in 2023, the company reported ongoing reclamation activities at its Kisladag mine in Turkey, with a focus on progressive rehabilitation of disturbed areas.

Effective closure strategies are crucial for demonstrating responsible environmental stewardship. This involves integrating post-mining land use planning with local community input, ensuring a sustainable future for the areas impacted by mining operations. By adhering to stringent closure standards, Eldorado Gold aims to avoid substantial future environmental remediation costs.

The company's commitment to responsible closure is reflected in its financial planning. While specific figures for 2024/2025 closure provisions are subject to ongoing assessments and regulatory approvals, companies in the mining sector typically set aside substantial funds. For example, industry benchmarks suggest that closure and reclamation costs can represent a significant percentage of a mine's total operating expenses over its life-of-mine, often running into tens or even hundreds of millions of dollars depending on the scale and complexity of the site.

- Progressive Reclamation: Eldorado Gold engages in ongoing rehabilitation of disturbed land during mine operations, as seen at Kisladag.

- Community Integration: Post-mining land use plans are developed in collaboration with local communities.

- Liability Minimization: Effective closure practices reduce the risk of future environmental remediation expenses.

- Financial Provisions: The company maintains financial provisions for closure, aligning with industry best practices and regulatory requirements.

Eldorado Gold's environmental performance is heavily influenced by water management, with a 2023 focus on reducing freshwater withdrawal across its global operations. Strict regulations in regions like Greece and Canada necessitate advanced water treatment technologies, with the company reporting specific consumption figures per tonne of ore processed.

Tailings and waste management are critical, with substantial volumes managed in 2023 under robust engineering and monitoring. Eldorado Gold is investing in technologies like dry stack tailings to improve stability and reduce waste, aligning with increasingly stringent global environmental standards.

Climate change presents risks through potential carbon pricing and emissions rules, particularly in Canada. Eldorado Gold is assessing its carbon footprint and exploring renewable energy to mitigate these impacts and meet stakeholder expectations.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Eldorado Gold is built on a robust foundation of data from reputable sources including government publications, financial news outlets, and industry-specific reports. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends impacting the mining sector.