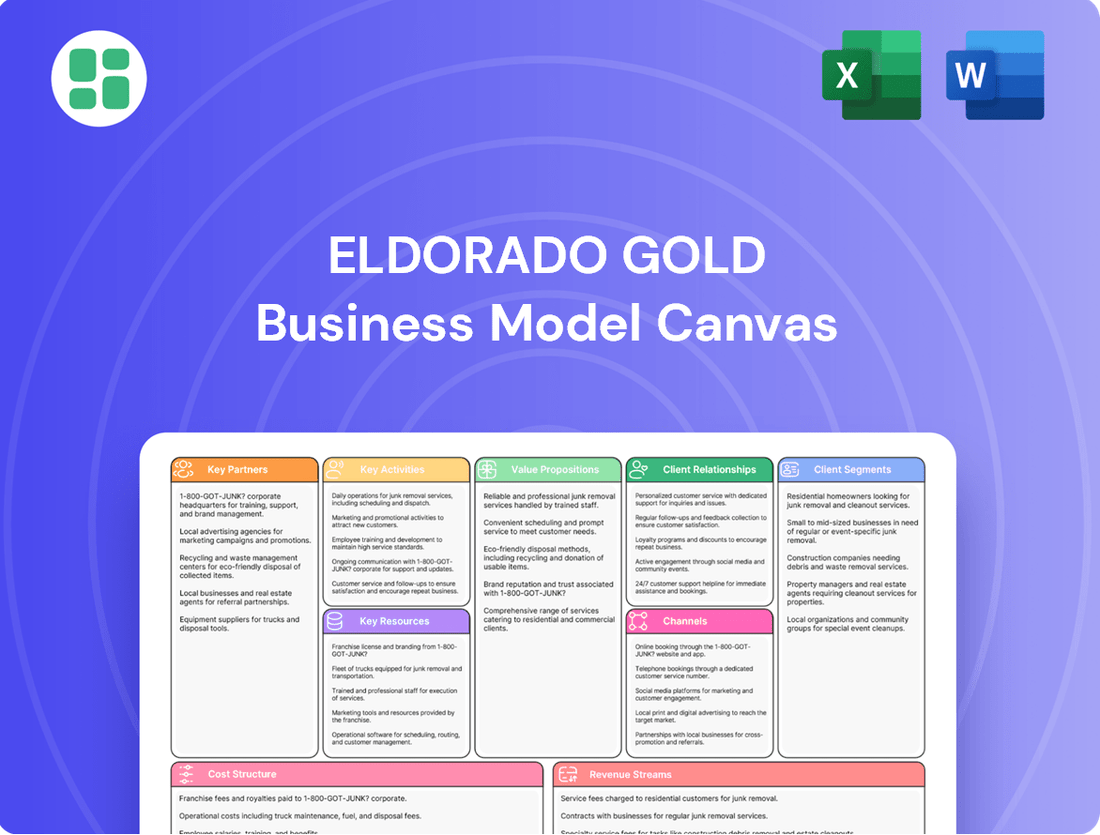

Eldorado Gold Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eldorado Gold Bundle

Discover the core elements of Eldorado Gold's operational strategy with our comprehensive Business Model Canvas. This detailed analysis breaks down how they create, deliver, and capture value in the competitive mining sector. Get the full picture to understand their market positioning and strategic advantages.

Partnerships

Eldorado Gold's operations are intrinsically linked to government agencies and regulators across its key jurisdictions, including Turkey, Canada, and Greece. These relationships are vital for securing and retaining mining licenses, obtaining necessary permits, and ensuring strict adherence to all regulatory frameworks. For instance, the progression of significant projects like Skouries in Greece hinges on favorable governmental approvals and ongoing compliance.

Maintaining a robust social license to operate, which is heavily influenced by regulatory engagement, is paramount. In 2024, Eldorado Gold continued its focus on transparent communication and collaboration with these bodies to navigate the complex legal and environmental landscapes inherent in the mining sector. The company's commitment to responsible mining practices is a cornerstone of these essential partnerships.

Eldorado Gold prioritizes building and maintaining strong ties with local communities and Indigenous groups, recognizing this as crucial for its operations. This commitment is demonstrated through continuous dialogue, actively addressing community concerns, and contributing to local economies via employment and local sourcing. For instance, the company's 2024 Sustainability Report details its efforts in fostering enduring relationships with host communities, underscoring the importance of a social license to operate for project viability and long-term success.

Eldorado Gold relies on a diverse network of suppliers and contractors to fuel its mining operations. These partnerships are crucial for securing essential equipment, raw materials, energy, and specialized services, as well as for construction and ongoing operational support. In 2024, the company demonstrated a strong commitment to local economies by paying over $851 million to domestic suppliers, underscoring the importance of these relationships for both operational efficiency and supply chain stability.

Financial Institutions and Investors

Eldorado Gold's ability to secure capital for its ambitious projects, including the fully funded Skouries development, hinges on robust relationships with financial institutions and a diverse investor base. These partnerships are vital for exploration, project financing, and maintaining operational liquidity.

Maintaining investor confidence is paramount. This is achieved through transparent reporting and consistently strong financial performance. As of December 31, 2024, Eldorado Gold reported a solid financial position, underscored by significant cash and liquidity, demonstrating the strength of these key financial partnerships.

- Banks: Provide essential debt financing for large-scale projects and working capital needs.

- Investment Funds: Offer equity and debt capital, often specializing in mining and natural resources.

- Individual Investors: Contribute to market capitalization and provide a stable shareholder base.

- Financial Performance: Directly impacts the willingness of these partners to provide future funding.

Research and Technology Partners

Eldorado Gold actively collaborates with academic institutions, research organizations, and technology providers. These partnerships are crucial for advancing mining techniques, improving environmental stewardship, and bolstering safety standards across operations. By integrating cutting-edge technologies, the company aims to boost operational efficiency, minimize its ecological footprint, and ensure the well-being of its workforce, reflecting a dedication to responsible mining.

These alliances enable Eldorado Gold to implement innovative solutions that enhance productivity and sustainability. For instance, collaborations can lead to the development and adoption of more efficient extraction methods or advanced monitoring systems for environmental impact. Such partnerships are vital for staying at the forefront of technological advancements in the mining sector.

A prime example of this commitment to continuous improvement is the introduction of the 'Courageous Safety Leadership' initiative in 2024. This program underscores the company's focus on fostering a robust safety culture through strategic partnerships and the implementation of best practices, aiming to further reduce incidents and enhance worker protection.

Key aspects of these research and technology partnerships include:

- Driving innovation in extraction and processing technologies.

- Developing and implementing advanced environmental monitoring and management systems.

- Collaborating on research to enhance worker safety protocols and technologies.

- Adopting digital solutions and automation to improve operational efficiency and data analysis.

Eldorado Gold's operational success is built on a foundation of strategic alliances with key partners. These include government bodies for licensing and regulatory compliance, local communities for social license, and a broad network of suppliers for essential materials and services. Financial institutions and investors are crucial for capital access, while technology and research partners drive innovation and safety improvements.

| Partner Type | Key Contributions | 2024 Relevance/Data |

| Government & Regulators | Licenses, permits, regulatory adherence | Crucial for Skouries project progression; adherence to frameworks in Turkey, Canada, Greece. |

| Local Communities & Indigenous Groups | Social license to operate, local economic contribution | Focus on dialogue and addressing concerns; detailed in 2024 Sustainability Report. |

| Suppliers & Contractors | Equipment, materials, energy, specialized services | Over $851 million paid to domestic suppliers in 2024. |

| Financial Institutions & Investors | Debt and equity financing, liquidity | Solid financial position as of Dec 31, 2024, with significant cash and liquidity. |

| Technology & Research Partners | Innovation in mining, environmental stewardship, safety | Focus on advanced extraction, environmental monitoring, and safety protocols; 'Courageous Safety Leadership' initiative. |

What is included in the product

Eldorado Gold's business model centers on the exploration, development, and mining of gold and other precious metals, focusing on efficient operations and strategic asset management to deliver value to shareholders.

This model details customer segments (primarily investors), key resources (mines and expertise), and value propositions (profitable gold production and growth potential).

Eldorado Gold's Business Model Canvas offers a clear, one-page snapshot of their operations, simplifying complex strategies for efficient review and discussion.

This structured approach allows for rapid identification of Eldorado Gold's core business elements, facilitating quick understanding and strategic alignment.

Activities

Eldorado Gold's core activities include rigorous mineral exploration and resource definition. This process involves extensive geological surveys, targeted drilling programs, and detailed analysis to pinpoint new gold and base metal deposits, as well as to delineate and expand existing reserves. This ongoing exploration is absolutely crucial for maintaining a robust pipeline of future mining projects and securing the company's long-term operational sustainability.

In 2024, Eldorado Gold demonstrated its commitment to this key activity through strategic partnerships. For instance, the company entered into option agreements with Brixton Metals and TRU Precious Metals, signaling active engagement in early-stage exploration opportunities. These ventures are designed to identify and advance promising new mineral prospects, thereby contributing to the company's future growth and resource base.

Mine development and construction are critical activities for Eldorado Gold. This involves the meticulous planning, engineering, and building of essential mining infrastructure once a promising deposit is found. This includes everything from surface excavations or underground tunnels to processing facilities and safe storage for mine waste.

A significant undertaking for Eldorado Gold in this area is the Skouries copper-gold project in Greece. As of December 31, 2024, the crucial Phase 2 construction for this project has reached a substantial 60% completion mark, showcasing the company's commitment to bringing new assets online.

Eldorado Gold's mining operations are centered on the safe and efficient extraction and processing of ore. This crucial activity transforms raw materials into valuable gold and base metal concentrates or doré. The company utilizes sophisticated methods like crushing, grinding, leaching, and refining at its sites in Turkey, Canada, and Greece.

In 2024, Eldorado Gold demonstrated strong performance in its mining operations, reporting a significant 7% increase in gold production. This resulted in a total output of 520,293 ounces of gold, highlighting the effectiveness of their extraction and processing strategies.

Environmental Management and Reclamation

Eldorado Gold actively manages its environmental footprint through comprehensive programs. This includes diligent water stewardship and biodiversity initiatives, alongside continuous reclamation efforts on land affected by mining operations.

The company's 2024 Sustainability Report underscores a strong commitment to environmental responsibility, detailing substantial reductions in greenhouse gas emissions. Eldorado Gold is actively working to align its operations with prominent Environmental, Social, and Governance (ESG) frameworks, demonstrating a forward-thinking approach to sustainable mining practices.

- Environmental Impact Management: Focus on minimizing disturbance and pollution.

- Water Stewardship: Implementing programs for responsible water use and protection.

- Biodiversity Management: Initiatives to protect and enhance local ecosystems.

- Progressive Reclamation: Ongoing restoration of mined areas to natural states.

Sales, Marketing, and Risk Management

Eldorado Gold's sales activities focus on marketing its produced gold and base metals to a diverse range of refiners and industrial buyers. This ensures they achieve fair market value for their output, a crucial step in realizing the financial benefits of their mining operations. For instance, in 2024, Eldorado Gold reported gold sales of 484,892 ounces, generating substantial revenue.

Risk management is paramount, particularly concerning commodity price fluctuations and currency exchange rates. Eldorado Gold employs hedging strategies to mitigate these volatilities and protect its financial performance. A notable example is their use of zero-cost collars, which they utilized to safeguard cash flow during the significant construction phase of their Skouries project.

- Sales: Marketing and selling gold and base metals to refiners and buyers.

- Marketing: Ensuring optimal pricing and market access for produced commodities.

- Risk Management: Employing hedging strategies, like zero-cost collars, to manage commodity price and currency risks.

- Financial Protection: Safeguarding cash flow and financial stability against market volatility.

Eldorado Gold's business model hinges on efficiently extracting and processing valuable minerals. This involves the entire lifecycle from discovering new deposits through advanced exploration techniques to developing and operating mines. The company focuses on producing gold and base metals, ensuring these commodities reach the market through strategic sales and marketing efforts.

Crucially, Eldorado Gold actively manages its environmental impact and associated risks. This includes implementing robust environmental stewardship programs and employing financial hedging strategies to buffer against market volatility, thereby safeguarding its financial health and operational continuity.

| Key Activity | Description | 2024 Highlight/Data |

|---|---|---|

| Mineral Exploration & Resource Definition | Identifying and expanding gold and base metal deposits. | Option agreements with Brixton Metals and TRU Precious Metals. |

| Mine Development & Construction | Planning, engineering, and building mining infrastructure. | Skouries project in Greece: Phase 2 construction 60% complete (as of Dec 31, 2024). |

| Mining Operations | Safe and efficient extraction and processing of ore. | Gold production increased 7% to 520,293 ounces. |

| Environmental Impact Management | Minimizing disturbance, water stewardship, biodiversity, and reclamation. | Substantial greenhouse gas emission reductions reported. |

| Sales & Risk Management | Marketing commodities and hedging against price/currency fluctuations. | Gold sales of 484,892 ounces; utilized zero-cost collars for financial protection. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact, complete document you will receive upon purchase. This preview offers a genuine glimpse into the structure and content of the final deliverable, ensuring there are no surprises. Once your order is processed, you'll gain full access to this professionally prepared Business Model Canvas, ready for immediate use.

Resources

Mineral Reserves and Resources are the bedrock of Eldorado Gold's operations, representing the economically extractable gold and base metal deposits. These are the fundamental assets that drive the company's long-term production capacity and value. As of September 30, 2024, Eldorado Gold held Proven and Probable Gold Mineral Reserves totaling 11.9 million ounces.

Eldorado Gold's mining and processing infrastructure encompasses its physical assets, including mines, processing plants, and essential support systems. This vital component of their operations includes open pit and underground mines, along with processing facilities like mills, leach pads, and precious metal recovery plants. The company's commitment to expanding and upgrading this infrastructure is evident in ongoing projects.

Significant capital is allocated to maintaining and developing these core assets. For instance, the ongoing construction at the Skouries project, a key asset for Eldorado, features substantial infrastructure development. This includes the filtered tailings building and the primary crusher, both critical for efficient and environmentally sound operations. These investments underscore the importance of robust physical infrastructure for their business model.

Eldorado Gold's success hinges on its highly skilled and dedicated workforce. This includes specialized professionals like geologists, mining engineers, and metallurgists, all crucial for efficient and safe resource extraction and processing.

The company's management team brings invaluable experience, guiding strategic decisions and operational execution. This expertise is vital for navigating the complexities of the global mining industry.

A strong focus on employee safety and well-being is a cornerstone of Eldorado Gold's operations. This commitment is reflected in tangible results, such as a significant 30% reduction in the total recordable injury frequency rate observed in 2024.

Capital and Financial Strength

Access to adequate capital is fundamental for Eldorado Gold, enabling the company to finance its exploration endeavors, advance development projects, and ensure operational liquidity. This financial backbone is crucial for sustained growth and project execution.

As of December 31, 2024, Eldorado Gold demonstrated robust financial strength. The company held approximately $857 million in cash and cash equivalents. Furthermore, its total liquidity stood at $1.1 billion, providing ample resources to fully fund the significant Skouries project.

- Capital Access: Securing sufficient capital is essential for exploration, project development, and operational continuity.

- Financial Position (Dec 31, 2024):

- Cash and Equivalents: $857 million.

- Total Liquidity: $1.1 billion, fully covering the Skouries project.

Mining Rights, Licenses, and Permits

Mining rights, licenses, and permits are the bedrock of Eldorado Gold's operations, granting legal access to explore, develop, and extract valuable minerals. These government-issued authorizations are absolutely essential for operating in key jurisdictions like Turkey, Canada, and Greece.

Securing and maintaining these rights involves significant engagement with governmental bodies. This process is fundamental to Eldorado Gold’s ability to conduct its business and access the mineral wealth it targets.

- Legal Authority: These government-granted permissions are indispensable for lawful exploration and extraction activities.

- Jurisdictional Access: Crucial for operations in Turkey, Canada, and Greece, enabling access to mineral resources.

- Governmental Relations: Active engagement with governments is a core component of acquiring and retaining these vital rights.

- Operational Foundation: Without these permits, Eldorado Gold cannot legally commence or continue its mining projects.

Eldorado Gold's key resources are its mineral reserves, mining infrastructure, skilled workforce, and access to capital. The company's proven and probable gold mineral reserves were 11.9 million ounces as of September 30, 2024. Its operational infrastructure includes mines and processing plants, with significant ongoing development at projects like Skouries. A skilled team of geologists, engineers, and management guides operations, supported by a strong financial position, including $857 million in cash and cash equivalents as of December 31, 2024.

| Key Resource | Description | Key Data/Metric |

|---|---|---|

| Mineral Reserves | Economically extractable gold and base metal deposits. | 11.9 million ounces of gold (Proven & Probable) as of Sep 30, 2024. |

| Mining & Processing Infrastructure | Physical assets including mines, processing plants, and support systems. | Ongoing development at Skouries project, including filtered tailings building and primary crusher. |

| Human Capital | Skilled workforce including geologists, mining engineers, metallurgists, and experienced management. | 30% reduction in total recordable injury frequency rate in 2024. |

| Financial Resources | Capital for exploration, development, and operations. | $857 million in cash and cash equivalents; $1.1 billion in total liquidity as of Dec 31, 2024. |

Value Propositions

Eldorado Gold ensures a dependable flow of gold and growing amounts of copper and other base metals to worldwide markets. This reliability is crucial for refiners, manufacturers, and central banks needing a stable supply for industrial and investment needs.

In 2024, Eldorado Gold demonstrated its commitment to this value proposition by producing over 520,000 ounces of gold. This output highlights their capacity to meet the consistent demand for essential precious and base metals.

Eldorado Gold is focused on building lasting value for its shareholders. This is achieved through efficient operations, careful cost management, boosting production, and advancing key growth initiatives. For instance, in 2024, the company saw a significant 31% jump in revenue, alongside generating positive free cash flow, underscoring their dedication to shareholder returns.

Eldorado Gold champions responsible mining, integrating environmental stewardship, social responsibility, and strong governance (ESG) into its core operations. This commitment resonates with investors, partners, and communities who prioritize ethical business practices.

The company actively seeks to minimize its environmental footprint and foster positive relationships with local communities, as highlighted in its 2024 Sustainability Report. These efforts differentiate Eldorado Gold, showcasing a dedication to sustainable development alongside resource extraction.

Local Economic Development and Employment

Eldorado Gold's operations are deeply intertwined with local economic development. By establishing mines, the company acts as a significant engine for job creation and economic activity within its host countries and the immediate communities surrounding its operations. This commitment extends to prioritizing local talent and resources, fostering sustainable growth beyond the mine's lifecycle.

In 2024, Eldorado Gold demonstrated a strong commitment to local employment, with 98% of its workforce originating from its operating countries. Even more impressively, 82% of its employees were from the local communities where it operates. This focus on local hiring ensures that the economic benefits of mining are directly channeled into the regions where the company is active.

Beyond employment, Eldorado Gold actively invests in community development initiatives. In 2024 alone, the company allocated $4.4 million towards community investments. These investments often focus on areas such as education, healthcare, infrastructure, and local enterprise development, aiming to create lasting positive impacts and build stronger, more resilient communities.

- Local Employment: 98% of Eldorado Gold's workforce in 2024 was from its operating countries, with 82% from local communities.

- Community Investment: The company invested $4.4 million in community development projects in 2024.

- Economic Contribution: Operations drive job creation and local procurement, significantly boosting host country economies.

Diversified Asset Portfolio and Growth Potential

Eldorado Gold's value proposition is built on a robust, diversified asset portfolio with significant growth potential. This diversification spans across multiple jurisdictions, including Turkey, Canada, and Greece, encompassing operating mines, promising development projects, and active exploration properties. This spread inherently reduces the risk associated with any single asset, offering a more stable investment profile.

A key driver of this growth potential is the Skouries project in Greece. This development is poised to substantially boost both gold and copper production. Projections indicate that by 2026, Skouries is expected to significantly increase Eldorado Gold's overall output, enhancing its market position and revenue streams.

- Geographic Diversification: Operations and exploration in Turkey, Canada, and Greece mitigate single-country risk.

- Project Pipeline: Skouries development project offers substantial future gold and copper production growth.

- Production Outlook: Skouries is anticipated to significantly increase output by 2026.

- Risk Mitigation: A balanced portfolio across different stages of development and geographies reduces overall volatility.

Eldorado Gold delivers a consistent supply of gold and increasing amounts of copper and base metals to global markets, vital for industries and investors seeking stability. In 2024, the company produced over 520,000 ounces of gold, demonstrating its capability to meet this demand.

The company prioritizes shareholder value through efficient operations, cost control, production growth, and strategic development. This focus was evident in 2024 with a 31% revenue increase and positive free cash flow generation.

Eldorado Gold is committed to responsible mining, integrating Environmental, Social, and Governance (ESG) principles into its operations, appealing to ethically-minded stakeholders.

Local economic development is a core value, with 98% of its 2024 workforce coming from operating countries and 82% from local communities, alongside $4.4 million invested in community projects that year.

A diversified asset base across Turkey, Canada, and Greece, including the promising Skouries project, mitigates risk and offers significant future production growth, particularly with Skouries expected to boost output by 2026.

| Value Proposition | Description | 2024 Data/Impact |

| Reliable Metal Supply | Consistent delivery of gold, copper, and base metals globally. | Over 520,000 ounces of gold produced. |

| Shareholder Value Creation | Efficient operations, cost management, and growth initiatives. | 31% revenue jump; positive free cash flow. |

| Responsible Mining (ESG) | Integration of environmental, social, and governance practices. | Commitment highlighted in Sustainability Report. |

| Local Economic Development | Job creation and community investment in operating regions. | 98% local workforce; $4.4M in community investments. |

| Growth Potential & Diversification | Diversified asset portfolio and development projects. | Skouries project poised to significantly increase output. |

Customer Relationships

Eldorado Gold prioritizes strong investor relations, fostering trust through consistent financial reporting and transparent communication. They regularly update stakeholders via investor presentations, conference calls, and detailed financial results, ensuring informed decision-making.

Eldorado Gold prioritizes building strong connections with local communities and Indigenous peoples surrounding its mining sites. This commitment involves open conversations to address concerns and create shared advantages, demonstrated through consistent dialogue and investment in community programs. For instance, the company's 2024 Sustainability Report highlights their dedication to cultivating enduring partnerships with host communities.

Eldorado Gold actively fosters robust relationships with governments and regulatory bodies in its operating jurisdictions. This proactive engagement is crucial for navigating complex legal landscapes and ensuring adherence to all environmental and operational standards. In 2024, the company continued its dialogue with national and local authorities to streamline permitting and maintain a stable operating environment.

These partnerships are fundamental to Eldorado Gold's business model, providing the necessary framework for legal compliance and facilitating the development of new projects. By treating governments as key stakeholders, the company aims to build trust and secure its social license to operate, which is vital for long-term success. The company's commitment to transparency in its dealings with these entities underpins its operational stability.

Business-to-Business (B2B) Sales Relationships

Eldorado Gold cultivates direct business-to-business relationships with key players in the precious and base metals markets. These include metal refiners, who process raw materials, and bullion dealers, who facilitate the trading of physical gold. Industrial buyers, utilizing metals in manufacturing, also form a crucial part of their customer base.

These relationships are primarily transactional, emphasizing the consistent delivery of high-quality gold and base metals. Reliability and a steady supply chain are paramount, underpinning the trust necessary for these long-term partnerships. For instance, in 2023, Eldorado Gold reported total gold sales of 486,367 ounces, demonstrating a significant volume of transactions with these B2B customers.

- Direct Sales Channels: Eldorado Gold engages directly with metal refiners, bullion dealers, and industrial consumers.

- Relationship Basis: Trust is built on reliability, consistent product quality, and dependable supply of gold and base metals.

- Revenue Generation: The sale of gold and base metals constitutes the company's core revenue stream.

- 2023 Performance: The company sold 486,367 ounces of gold in 2023, highlighting the scale of its B2B transactions.

Employee and Contractor Relationships

Eldorado Gold places a strong emphasis on its employee and contractor relationships, recognizing their vital role in operational success. The company actively cultivates a safe, inclusive, and positive work environment to attract and retain a skilled workforce. This commitment is demonstrated through initiatives aimed at ensuring the well-being and dedication of its team members.

A cornerstone of Eldorado Gold's approach is its unwavering focus on safety. The 'Courageous Safety Leadership' program is a prime example, designed to embed a robust safety culture throughout the organization. This proactive stance not only protects its people but also fosters a sense of trust and loyalty among employees and contractors, directly impacting productivity and operational continuity.

- Safety First: Eldorado Gold's 'Courageous Safety Leadership' program underscores its commitment to employee and contractor well-being.

- Talent Attraction & Retention: A positive and inclusive work environment is key to securing and keeping skilled personnel.

- Operational Impact: A dedicated and safe workforce is essential for efficient and uninterrupted mining operations.

Eldorado Gold cultivates relationships with investors through transparent financial reporting and consistent communication, aiming to build trust and ensure informed decision-making among stakeholders. The company also prioritizes strong connections with local communities and Indigenous peoples, engaging in open dialogue and investing in community programs to foster shared advantages and enduring partnerships, as highlighted in their 2024 Sustainability Report.

Channels

Eldorado Gold leverages its corporate website as a crucial communication hub, offering direct access to vital documents like financial and sustainability reports, investor presentations, and news releases. This ensures transparency and provides stakeholders with a comprehensive understanding of the company's performance and strategic direction.

The company's investor portal, integrated within the corporate website, serves as a dedicated resource for the investment community. It facilitates easy retrieval of key information, fostering informed decision-making among individual investors, financial professionals, and other market participants. Eldorado Gold's 2024 Sustainability Report, a testament to their commitment to environmental, social, and governance (ESG) principles, is prominently featured on their website.

Eldorado Gold leverages global newswire services to disseminate crucial information like financial results, operational updates, and project milestones. This strategy ensures broad reach among investors, analysts, and financial media, fostering transparency and market awareness.

For instance, recent press releases in early 2025 detailed Eldorado Gold's Q4 2024 financial and operational performance, alongside significant progress updates on the Skouries project. This timely communication is vital for informed decision-making by stakeholders.

Eldorado Gold actively participates in investor conferences and roadshows, offering direct engagement with a broad investor base, including institutional investors and analysts. These platforms are crucial for management to articulate the company's strategic direction, recent performance, and address investor queries. For instance, in 2024, Eldorado Gold presented at key industry events, highlighting its progress in projects like the Lamaque mine in Quebec, which reported an average gold recovery of 93.6% in Q1 2024.

Sustainability Reports and ESG Disclosures

Eldorado Gold utilizes its annual sustainability reports and ESG disclosures as a key channel to convey its dedication to responsible mining. These reports reach a broad audience, including investors, local communities, and environmental advocacy groups, fostering transparency about their operational ethos.

The 2024 Sustainability Report specifically details Eldorado Gold's ESG performance, showcasing tangible achievements in environmental stewardship, social responsibility, and corporate governance. This document serves as a critical tool for stakeholders to assess the company's commitment to sustainable practices.

Key highlights from recent disclosures often include:

- Environmental Performance: For instance, the 2023 report noted a 10% reduction in water intensity across operations compared to the previous year.

- Social Impact: Investments in community development programs, such as local employment initiatives that saw a 15% increase in local hires at the Lamaque mine in 2023.

- Governance Practices: Adherence to international ethical standards and board diversity metrics, with 40% female representation on the board as of early 2024.

- Climate Action: Progress towards greenhouse gas emission reduction targets, aiming for a 25% decrease by 2030 from a 2019 baseline.

Community Engagement Platforms

Eldorado Gold actively engages with local communities through dedicated local offices and community liaison officers. These direct touchpoints foster open dialogue, allowing the company to address concerns and ensure operations are in sync with community expectations, which is vital for maintaining their social license to operate. Public forums and localized reports further enhance transparency and understanding.

The company's commitment to community relations is exemplified by its Greek subsidiary, which publishes a Social Responsibility Performance Report. This report details the company's efforts and impact on local stakeholders, providing a factual basis for their engagement. For instance, in 2023, Eldorado Gold's Greek operations contributed €29.5 million to the local economy through salaries, local suppliers, and taxes, demonstrating a tangible commitment to community well-being.

- Direct Dialogue: Local offices and liaison officers facilitate two-way communication.

- Transparency: Public forums and localized reports share operational information and address concerns.

- Social License: Alignment with local needs and expectations is crucial for continued operations.

- Performance Reporting: The Greek subsidiary's Social Responsibility Performance Report showcases tangible economic contributions, such as €29.5 million in local economic impact in 2023.

Eldorado Gold utilizes its corporate website and investor portal as primary channels for direct communication, disseminating financial reports, sustainability updates, and investor presentations to a global audience. This ensures transparency and accessibility for all stakeholders, from individual investors to financial professionals. For example, the 2024 Sustainability Report, detailing their ESG commitments, is readily available on their site.

Global newswire services are employed to broadcast critical updates, including financial results and operational milestones, ensuring broad market awareness. Investor conferences and roadshows provide direct engagement opportunities, allowing management to articulate strategy and performance. In 2024, Eldorado Gold highlighted progress at its Lamaque mine, which achieved a 93.6% gold recovery rate in Q1 2024.

Community engagement is managed through local offices and liaison officers, fostering dialogue and addressing local concerns to maintain social license. The Greek subsidiary's Social Responsibility Performance Report, detailing a €29.5 million local economic contribution in 2023, exemplifies this commitment to transparency and local impact.

| Channel | Purpose | Key Information Disseminated | Example Data (2024/Early 2025) |

|---|---|---|---|

| Corporate Website/Investor Portal | Direct Stakeholder Communication, Transparency | Financial Reports, Sustainability Reports, Investor Presentations, News Releases | 2024 Sustainability Report, Q4 2024 Financial Results |

| Global Newswire Services | Broad Market Awareness, Information Dissemination | Financial Results, Operational Updates, Project Milestones | Q4 2024 Performance and Skouries Project Updates |

| Investor Conferences/Roadshows | Direct Engagement, Strategic Articulation | Company Strategy, Performance, Investor Q&A | Lamaque Mine Progress (93.6% Q1 2024 Recovery) |

| Local Community Engagement | Social License, Local Impact Reporting | Operational Information, Community Concerns, Economic Contributions | €29.5M Local Economic Impact (Greek Operations, 2023) |

Customer Segments

Institutional investors, including mutual funds, pension funds, and hedge funds, along with individual shareholders, form a crucial customer segment for Eldorado Gold. These investors are primarily driven by the pursuit of capital appreciation and dividend income, closely monitoring the company's financial performance, growth potential, and adherence to strong corporate governance practices. Eldorado Gold's presence on both the Toronto Stock Exchange (TSX) and the New York Stock Exchange (NYSE) provides accessibility for this diverse investor base.

Metal refiners and industrial buyers represent Eldorado Gold's core customer base, directly purchasing the gold and base metals the company extracts and processes. These entities, ranging from large-scale refineries to manufacturers and even investment firms, are crucial for Eldorado's revenue generation. They acquire these precious and base metals for further refinement, incorporation into finished products, or as assets for their own portfolios.

Eldorado Gold's financial performance is intrinsically linked to its ability to serve this segment effectively. In 2024, the company's sales to these industrial and refining customers are projected to be a significant driver of its top-line revenue. For instance, Eldorado reported total gold sales of 490,160 ounces in 2023, with the majority of these sales directed towards refiners and industrial consumers, establishing a clear dependency on this customer segment for its business model.

Governments in Turkey, Canada, and Greece are vital stakeholders for Eldorado Gold, acting as beneficiaries of taxes and royalties. For instance, in 2023, Eldorado Gold contributed approximately $149 million in taxes and royalties across its operating jurisdictions, reflecting the significant economic impact on these nations.

These governmental bodies are also responsible for issuing and supervising crucial mining licenses, environmental permits, and ensuring Eldorado Gold adheres to all operational compliance standards. The company operates within robust regulatory frameworks designed to manage environmental impact and community relations.

Local Communities and Indigenous Peoples

Local communities and Indigenous Peoples are crucial stakeholders for Eldorado Gold, residing in proximity to its mining operations. Their interests often center on employment prospects, local sourcing of goods and services, and the company's commitment to environmental stewardship and community development programs. For instance, in 2024, Eldorado Gold continued to focus on local hiring initiatives, aiming to maximize the economic benefits for these populations.

Eldorado Gold actively engages with these groups through various channels to foster positive relationships and address concerns. These engagements are vital for maintaining a social license to operate. In 2024, the company reported ongoing dialogue and partnership efforts with local community representatives and Indigenous groups across its operational sites, reflecting a commitment to collaborative decision-making and shared value creation.

- Employment: Prioritizing local hiring and training programs to offer sustainable job opportunities.

- Local Procurement: Supporting local businesses and suppliers by integrating them into the company's supply chain.

- Community Development: Investing in projects that enhance education, health, and infrastructure within local communities.

- Environmental Stewardship: Collaborating on environmental monitoring and mitigation strategies to protect local ecosystems.

Employees and Potential Employees

Eldorado Gold recognizes its employees and potential hires as a critical internal customer segment. The company strives to cultivate a safe, inclusive, and rewarding workplace to attract and retain top talent, essential for smooth operations. In 2023, Eldorado Gold reported a total workforce of approximately 7,000 employees and contractors globally.

A strong emphasis is placed on fostering a positive culture centered on health and safety. This commitment is reflected in their safety performance metrics. For instance, in 2023, the company achieved a Total Recordable Injury Frequency Rate (TRIFR) of 1.04 per 200,000 hours worked, demonstrating a dedication to employee well-being.

- Workforce Size: Approximately 7,000 employees and contractors globally as of 2023.

- Talent Acquisition Goal: Attract and retain skilled individuals by offering a safe, inclusive, and rewarding work environment.

- Safety Performance: Achieved a Total Recordable Injury Frequency Rate (TRIFR) of 1.04 per 200,000 hours worked in 2023.

- Culture Priority: Prioritizes a positive culture of health and safety for its entire workforce.

Eldorado Gold's customer segments are diverse, encompassing those who directly purchase their metal output, those who invest in the company's future, and those who are impacted by its operations. This multifaceted approach is key to their business model.

Metal refiners and industrial buyers form the bedrock of Eldorado Gold's revenue, directly acquiring the gold and base metals produced. In 2023, the company sold 490,160 ounces of gold, primarily to these entities, highlighting their critical role in the company's financial performance.

Institutional and individual investors are another vital segment, seeking capital appreciation and dividends. Eldorado Gold's listing on both the TSX and NYSE ensures broad accessibility for these investors who closely track financial health and governance.

Local communities and governments are also key stakeholders, influencing operational viability through social license and regulatory frameworks. In 2023, Eldorado Gold contributed approximately $149 million in taxes and royalties, underscoring its economic impact on host nations like Turkey, Canada, and Greece.

Cost Structure

Eldorado Gold’s cost structure heavily features exploration and development expenditures, crucial for future growth. These significant costs involve identifying new mineral deposits, conducting detailed feasibility studies, and the actual development of new mines or expanding existing ones. This encompasses extensive geological surveys, diamond drilling programs, intricate engineering designs, and the substantial investment in infrastructure construction.

In 2024, capital expenditures specifically at the Skouries project, a key development for the company, amounted to an impressive $342.0 million. This figure underscores the substantial financial commitment required to bring new resources into production and maintain the operational capacity of its current assets, directly impacting the company's overall cost base.

Eldorado Gold's mining operations costs are the backbone of its production, encompassing all direct expenses tied to getting valuable minerals out of the ground and ready for sale. These costs include the people who do the work, the power needed to run machinery, and the materials like chemicals and explosives that are essential for extraction. In 2024, these operational expenditures reached $564.2 million, a figure influenced by increased production volumes and rising labor expenses.

Eldorado Gold faces significant environmental compliance and reclamation costs, which are essential for responsible mining operations. These expenses cover adhering to stringent environmental regulations, implementing sustainable practices throughout the mining lifecycle, and meticulously managing tailings facilities to prevent environmental damage.

The company also allocates substantial resources to rehabilitating mined-out areas, ensuring land is restored to a safe and environmentally sound condition. For instance, in 2023, Eldorado Gold reported approximately $14 million in reclamation and closure costs, reflecting their ongoing commitment to environmental stewardship and long-term sustainability.

General and Administrative Expenses

General and Administrative Expenses (G&A) for Eldorado Gold encompass the essential corporate functions that support its global mining operations. These costs are crucial for maintaining the company's infrastructure and compliance. In 2024, Eldorado Gold's G&A expenses reflected ongoing investments in corporate governance and operational oversight. For instance, the company reported G&A costs that included salaries for its executive and administrative teams, rent and utilities for its corporate offices, and significant expenditures on legal counsel and regulatory adherence. These are the backbone costs that ensure the company operates smoothly and legally across its various jurisdictions.

These administrative outlays are vital for the company's strategic direction and day-to-day management. They cover the salaries of key personnel, the operational costs of corporate offices, and essential services like legal and accounting. For example, in 2024, Eldorado Gold's financial reports highlighted expenditures on maintaining its corporate headquarters and ensuring compliance with international financial reporting standards. Such costs are not directly linked to the extraction of gold but are indispensable for the overall health and sustainability of the business. They also cover the costs associated with investor relations and corporate communications, which are vital for maintaining stakeholder confidence.

Eldorado Gold's commitment to robust governance and transparent reporting directly influences its G&A structure. These expenses are a necessary investment in the company's long-term viability and reputation. In 2024, the company's G&A budget included provisions for enhancing its internal control systems and ensuring adherence to evolving environmental, social, and governance (ESG) standards. These are the costs that underpin the company's ability to operate responsibly and ethically, contributing to its overall business model.

- Salaries for administrative and executive staff

- Office rent, utilities, and maintenance

- Legal fees and corporate compliance costs

- Investor relations and corporate communications

Capital Expenditures and Depreciation

Eldorado Gold's business model involves substantial capital expenditures, primarily for acquiring and developing mining assets. These significant upfront investments in heavy machinery, processing facilities, and essential infrastructure are crucial for establishing and maintaining operations.

These assets are then systematically depreciated over their estimated useful lives. Depreciation, while a non-cash expense, accurately reflects the gradual wear and tear and obsolescence of these high-value, long-term assets, impacting the company's financial statements.

For instance, the Skouries project, a key development, saw its capital expenditure estimate rise to around $1.06 billion. This increase was largely attributed to escalating labor costs, highlighting the sensitivity of capital projects to market conditions.

- Capital Expenditures: Significant investments in mining equipment, processing plants, and infrastructure.

- Depreciation: A non-cash expense reflecting the wear and tear of capital assets over time.

- Skouries Project: Capital estimate increased to approximately $1.06 billion due to higher labor costs.

- Asset Utilization: Efficient management of depreciating assets is key to operational profitability.

Eldorado Gold's cost structure is dominated by exploration, development, and operational expenditures. In 2024, capital expenditures for the Skouries project alone were $342.0 million, demonstrating the significant investment in future growth. Operational costs, covering labor, power, and materials, reached $564.2 million in 2024 due to increased production and labor expenses.

Environmental compliance and reclamation are also key cost components, with reclamation and closure costs reported at approximately $14 million in 2023. General and Administrative (G&A) expenses, including salaries, office costs, and legal fees, are essential for corporate functions and compliance, with 2024 G&A reflecting ongoing investments in governance and oversight.

| Cost Category | 2024 Figures (USD millions) | Notes |

|---|---|---|

| Capital Expenditures (Skouries) | 342.0 | Crucial for new mine development. |

| Operational Expenditures | 564.2 | Includes labor, power, and materials. |

| Reclamation & Closure Costs | ~14.0 (2023) | Reflects environmental stewardship commitment. |

| General & Administrative (G&A) | Not specified | Supports corporate functions and compliance. |

Revenue Streams

Eldorado Gold's main way of making money is by selling the gold it refines. The gold comes from its mines located in countries like Turkey, Canada, and Greece, and all of that production feeds directly into this revenue stream.

In 2024, the company reported selling 517,926 ounces of gold. This volume of sales was a significant contributor to its overall financial performance for the year.

Eldorado Gold's revenue isn't solely from gold; they also profit from selling base metals like copper, silver, lead, and zinc. These are often recovered as valuable byproducts during their gold extraction processes.

The upcoming Skouries project, slated for commercial production by mid-2026, is a key element in this diversification. It's anticipated to significantly boost copper revenue for Eldorado Gold, adding another robust income stream.

Eldorado Gold's financial reporting often reflects the value of co-produced metals, such as silver, lead, or zinc, as byproduct credits. These credits act to reduce the per-ounce cost of gold production, rather than being recognized as direct revenue streams. This accounting practice significantly impacts the calculation of All-In Sustaining Costs (AISC).

For instance, in 2023, Eldorado Gold reported that byproduct credits at its Kisladag mine contributed to a lower net cash cost per ounce of gold. While specific figures vary by operation and metal prices, these credits are a crucial element in understanding the company's cost structure and the true profitability of its gold mining operations.

Hedging Gains (Commodity and Currency)

Eldorado Gold utilizes financial instruments like zero-cost collars to manage exposure to fluctuating gold prices and foreign exchange rates. While not a core revenue driver, successful hedging can generate gains, positively impacting overall financial results.

These hedging activities are crucial for protecting cash flows from adverse market movements. For instance, in 2024, the company actively managed its currency exposures, which can significantly influence the cost of operations and the value of repatriated earnings.

- Zero-Cost Collars: Eldorado Gold employs these strategies to set a floor and a ceiling for commodity prices and exchange rates, limiting downside risk while allowing for some upside participation.

- Cash Flow Protection: The primary objective of these hedging activities is to ensure more predictable and stable cash flows, which is vital for operational planning and investment decisions.

- Contribution to Financial Performance: Although secondary to mining operations, gains realized from hedging can provide a financial buffer and contribute to improved profitability.

Other Income

Other income for Eldorado Gold encompasses various non-mining revenue sources. This includes financial gains like interest earned on cash holdings and profits from selling off assets. For instance, a significant event in January 2025 was the divestment of a G Mining Ventures holding, which brought in $155 million.

- Interest Income: Earnings from cash reserves and short-term investments.

- Asset Sale Gains: Profits realized from the disposition of non-core assets or investments.

- Miscellaneous Operational Income: Other minor revenue streams not directly tied to metal sales.

Eldorado Gold's primary revenue stream originates from the sale of gold produced at its mining operations. In 2024, the company sold 517,926 ounces of gold, a key driver of its financial performance.

Beyond gold, the company also generates revenue from byproducts like copper, silver, lead, and zinc, which are recovered during the gold extraction process. The upcoming Skouries project is expected to significantly bolster copper revenue.

While byproduct credits, such as those contributing to lower net cash costs at Kisladag in 2023, are crucial for cost management, they are accounted for as cost reductions rather than direct revenue. Financial instruments like zero-cost collars are used to manage price volatility and protect cash flows, though gains from these are secondary to mining operations.

Other income includes interest earned on cash holdings and gains from asset sales, such as the $155 million received in January 2025 from divesting a G Mining Ventures holding.

| Revenue Source | 2024 Activity/Data | Significance |

|---|---|---|

| Gold Sales | 517,926 ounces sold | Primary revenue driver |

| Byproduct Sales | Copper, Silver, Lead, Zinc | Diversifies income, enhances profitability |

| Financial Instruments | Hedging activities (e.g., zero-cost collars) | Cash flow protection, potential gains |

| Other Income | Asset sales (e.g., $155M from G Mining Ventures in Jan 2025) | Supplemental revenue stream |

Business Model Canvas Data Sources

The Eldorado Gold Business Model Canvas is built upon a foundation of comprehensive financial disclosures, detailed operational reports, and extensive market research. These sources provide the necessary insights into revenue streams, cost structures, and key resources.

Every block of the Eldorado Gold Business Model Canvas is informed by verified data, including industry benchmarks, competitive analyses, and strategic planning documents. This ensures the canvas accurately reflects the company's market position and operational realities.