Eldorado Gold Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eldorado Gold Bundle

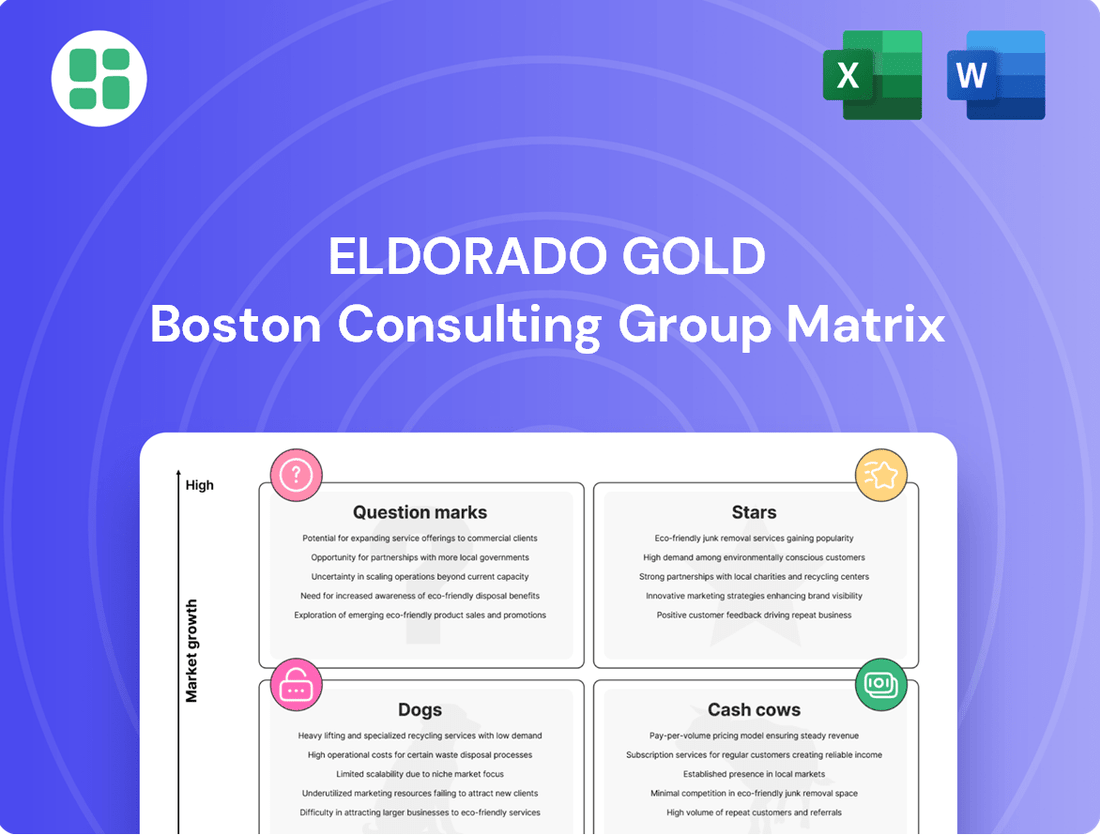

Uncover Eldorado Gold's strategic positioning with our detailed BCG Matrix analysis. See which of their operations are driving growth and which require a closer look to optimize resource allocation. This preview offers a glimpse into their market performance, but the full report provides the critical insights needed for informed investment decisions.

Dive deeper into Eldorado Gold's BCG Matrix and gain a clear view of where its operations stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Skouries Copper-Gold Project in Greece is poised to become a future Star for Eldorado Gold. With projected production commencement in Q1 2026, it's a significant growth asset benefiting from strong demand for both gold and copper. Eldorado Gold has already invested substantially in Skouries, anticipating it will significantly boost overall production and diversify revenue.

The Lamaque Complex, bolstered by the Ormaque deposit, is a key Star in Eldorado Gold's portfolio. In 2024, it achieved record gold production, underscoring its strong performance.

A significant achievement was reaching one million ounces poured by Q1 2025, showcasing the complex's robust output capabilities. This growth is driven by the development of the high-grade Ormaque deposit.

This expansion is set to introduce a second underground mine, promising sustained high production levels and enhanced operational flexibility within a secure mining jurisdiction.

The Ormaque deposit, a recent addition to Eldorado Gold's Lamaque Complex in Canada, firmly positions itself as a Star in the BCG Matrix. Its substantial gold resource base, estimated at 1.1 million ounces of indicated gold as of year-end 2023, coupled with significant exploration upside, points to high growth potential.

Developing Ormaque is projected to extend the Lamaque Complex's mine life by several years, boosting its overall production capacity. This strategic integration leverages the existing infrastructure at Lamaque, ensuring efficient development and a high-value contribution to Eldorado Gold's portfolio.

Strategic Diversification into Copper Production

Eldorado Gold's strategic move to integrate significant copper output, primarily via its Skouries project, firmly places it as a Star within the diversified metals sector. This expansion taps into a high-demand market fueled by the global energy transition. For instance, the International Energy Agency projected copper demand to potentially double by 2040 due to its critical role in renewable energy technologies and electric vehicles.

This diversification strategy is crucial for Eldorado Gold. It mitigates risks associated with over-reliance on gold alone and opens up substantial avenues for future growth. By 2024, the company anticipates Skouries to be a significant contributor to its overall production profile, reflecting this strategic shift.

- Copper's Role in Energy Transition: Copper is vital for electric vehicles, wind turbines, and solar panels, driving robust demand.

- Skouries Project Significance: This project is Eldorado Gold's key initiative for copper production, enhancing its market position.

- Reduced Commodity Dependence: Diversifying into copper lessens Eldorado Gold's vulnerability to gold price fluctuations.

- Growth Potential: The increasing demand for copper presents a strong growth trajectory for the company.

High-Grade Brownfield Exploration Targets

Eldorado Gold's strategic emphasis on high-grade brownfield exploration, notably at Olympias and along the Stratoni Fault Corridor, positions these as Stars within its portfolio. This focus leverages existing geological knowledge to pinpoint extensions of known mineralization, significantly increasing the likelihood of discovering substantial new reserves.

These targeted exploration efforts are designed to unlock considerable long-term growth and value by capitalizing on Eldorado's established operational areas. For instance, in 2024, the company continued to advance its brownfield programs, aiming to convert inferred resources into higher confidence categories and expand the mine life at key sites.

- Olympias Expansion: Continued drilling focused on extending mineralization down-dip and along strike, targeting high-grade zones identified in previous campaigns.

- Stratoni Fault Corridor: Exploration efforts concentrated on understanding the geological controls for high-grade mineralization and identifying new drill targets within this prolific area.

- Resource Conversion: The company aims to convert a significant portion of its existing inferred resources into measured and indicated categories through systematic infill drilling in 2024.

- Value Creation: Successful brownfield exploration is projected to enhance the net present value of existing assets and provide a robust pipeline for future production.

The Skouries Copper-Gold Project is a prime example of a Star, with projected production to begin in Q1 2026, tapping into strong demand for both metals. Lamaque Complex, especially with the Ormaque deposit, is another Star, achieving record gold production in 2024 and reaching one million ounces poured by Q1 2025.

Brownfield exploration at Olympias and along the Stratoni Fault Corridor also positions these as Stars, leveraging existing knowledge to find new reserves and extend mine life. These efforts are crucial for unlocking long-term value and growth through targeted exploration in 2024.

| Project/Asset | BCG Category | Key Drivers | 2024 Status/Outlook |

|---|---|---|---|

| Skouries Copper-Gold Project | Star | High demand for copper and gold, energy transition | Significant investment, projected Q1 2026 production start |

| Lamaque Complex (Ormaque) | Star | High-grade deposit, record production, mine life extension | Record gold production in 2024, 1 million oz poured by Q1 2025 |

| Olympias & Stratoni Fault Corridor | Star | Brownfield exploration, resource expansion, value creation | Continued drilling, resource conversion focus in 2024 |

What is included in the product

Eldorado Gold's BCG Matrix analyzes its mining assets, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

Eldorado Gold's BCG Matrix provides a clear, visual roadmap, alleviating the pain of strategic uncertainty.

Cash Cows

The Kisladag Mine in Turkey is a clear cash cow for Eldorado Gold. In 2024, it was the company's top gold producer, with preliminary output reaching 174,080 ounces. This consistent, high-volume performance, supported by its mature operational status and existing infrastructure, ensures it remains a significant contributor to the company's financial strength.

The Efemcukuru mine in Turkey is a prime example of a Cash Cow for Eldorado Gold. It consistently delivers predictable gold production, acting as a stable contributor to the company's overall output and revenue streams. In 2024, Efemcukuru produced 80,143 ounces of gold, and with stable production guidance for 2025, it's a reliable generator of cash for Eldorado Gold.

Because Efemcukuru is a mature operation, it requires less investment in promotional activities and market placement compared to newer ventures. This lower operational expenditure translates directly into strong profit margins, further solidifying its position as a valuable cash-generating asset within Eldorado Gold's portfolio.

Eldorado Gold's existing mines are thriving in a robust gold price environment, with the average price reaching $2,933 per ounce in Q1 2025. This elevated market condition significantly boosts revenue and free cash flow from current operations. These strong financial results from high realized prices provide a solid foundation for funding other company initiatives.

Strong Liquidity and Balance Sheet

Eldorado Gold's strong liquidity and balance sheet are indicative of a healthy Cash Cow. As of Q1 2025, the company reported approximately $978.1 million in cash and cash equivalents. This, combined with $1.2 billion in total liquidity, highlights its significant cash-generating ability.

This robust financial position is crucial. It provides Eldorado Gold with the capital needed to fund ongoing operations and potential growth initiatives without needing to heavily rely on external debt. This self-sufficiency is a hallmark of mature, profitable businesses.

- Strong Cash Position: Approximately $978.1 million in cash and cash equivalents as of Q1 2025.

- Total Liquidity: Stands at $1.2 billion, demonstrating significant financial flexibility.

- Funding Capability: The solid balance sheet enables self-funding of growth projects and operational stability.

- Reduced Financing Risk: Less reliance on external financing for capital expenditures.

Operational Efficiency and Cost Management

Despite inflationary pressures impacting input costs across the mining sector, Eldorado Gold has maintained a strong grip on operational efficiency. In 2024, the company has largely kept its costs within projected guidance, a testament to proactive management. For instance, ongoing optimization efforts at its Kisladag mine are designed to further enhance productivity and cost control.

Eldorado Gold’s ability to manage its all-in sustaining costs (AISC) competitively against industry peers is crucial. This efficiency ensures that its current production levels are highly profitable, contributing significantly to the company’s cash flow. Maintaining this cost discipline is key to maximizing returns from its established assets.

- 2024 Costs within Guidance: Demonstrates effective management despite market pressures.

- Kisladag Optimization: Specific efforts to improve efficiency at a key asset.

- Competitive AISC: Ensures high profitability of current production relative to industry peers.

- Enhanced Cash Generation: Continued focus on efficiency bolsters the financial strength of mature operations.

The Kisladag and Efemcukuru mines are Eldorado Gold's cash cows, consistently generating substantial revenue with minimal reinvestment. These mature operations benefit from established infrastructure and efficient processes, allowing them to capitalize on favorable gold prices. For example, Kisladag produced 174,080 ounces in 2024, while Efemcukuru contributed 80,143 ounces, solidifying their roles as reliable cash generators.

| Mine | 2024 Production (Ounces) | Cash Flow Contribution |

| Kisladag | 174,080 | High |

| Efemcukuru | 80,143 | Stable |

What You See Is What You Get

Eldorado Gold BCG Matrix

The Eldorado Gold BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means you're getting a professionally analyzed and formatted report, ready for immediate strategic application without any alterations or watermarks. The insights and visual representation of Eldorado Gold's portfolio, as presented here, will be yours to download and utilize directly for your business planning and decision-making processes.

Dogs

The Olympias mine in Greece is facing considerable operational hurdles, impacting its performance within Eldorado Gold's portfolio. Production saw a sharp decline of 37% in the first quarter of 2025. This downturn is attributed to unexpected maintenance needs and delays in bringing the mill expansion online, directly affecting output.

These ongoing operational difficulties, coupled with a revised and lowered production forecast for 2025, suggest that Olympias is struggling to achieve consistent operational efficiency and hold its market position. The mine is currently a significant drain on company resources, consuming cash and management focus without generating the anticipated financial returns, a clear characteristic of a question mark in the BCG matrix.

Non-core, early-stage exploration properties are those assets within Eldorado Gold's portfolio that are not central to its current operational strategy. These properties are characterized by their nascent stage of development, meaning they are in the very initial phases of exploration and have not yet demonstrated substantial potential for economically viable resource extraction. Their inclusion in this category signifies a lack of clear progress towards resource definition, often due to technical challenges or the need for significant, unbudgeted capital outlay. For instance, in 2024, Eldorado Gold continued to assess its exploration pipeline, with a portion of its exploration expenditures directed towards early-stage projects that had not yet yielded definitive positive results, reflecting the inherent uncertainty in this segment of the mining lifecycle.

Eldorado Gold's legacy infrastructure, particularly older processing plants or mines with declining ore grades, can be categorized as Dogs if they require disproportionately high sustaining capital expenditure. For instance, if a facility needs significant upgrades to meet environmental standards or to maintain operational capacity, and these costs don't translate into a meaningful boost in output or a reduction in per-unit production costs, it fits this profile. In 2024, the company's focus on optimizing existing assets means that any infrastructure demanding over 15% of its annual operating budget for maintenance without clear return on investment would be a prime candidate for re-evaluation.

Underperforming Smaller Projects

Underperforming Smaller Projects would be classified as Dogs in Eldorado Gold's BCG Matrix. These are initiatives that consistently miss their performance targets and deliver very little return on the investment made. While they might cover their costs, they consume valuable financial and human resources that could be more effectively deployed in areas with greater growth potential.

The continuation of these Dog projects is often driven by sunk costs or historical commitment rather than a clear assessment of their future prospects. In 2024, Eldorado Gold's focus has been on optimizing its portfolio, which includes divesting or winding down such non-core, low-return assets to streamline operations and improve overall capital efficiency.

- Resource Drain: These projects tie up capital and personnel, diverting attention from more promising opportunities.

- Low ROI: They generate minimal returns, failing to justify the resources allocated.

- Strategic Re-evaluation: Management is actively reviewing these smaller ventures to determine if they can be revitalized or if their closure is the most prudent course of action.

Divested Assets (e.g., G Mining Ventures Holding)

The divestment of G Mining Ventures Holding in January 2025 for $155 million highlights a strategic move to shed assets that were previously considered 'Dogs' or non-core to Eldorado Gold's primary objectives. This sale generated significant capital, demonstrating a clear intent to reallocate resources away from underperforming or misaligned ventures. Such actions are crucial for optimizing the company's portfolio and focusing on areas with higher potential for growth and profitability.

- Divestment Value: $155 million in January 2025.

- Asset Classification: Previously a 'Dog' or non-core holding.

- Strategic Rationale: Elimination of underperforming assets and capital reallocation.

- Impact: Frees up capital for more promising growth initiatives.

Eldorado Gold's "Dogs" represent assets that consume resources without generating significant returns, often requiring high capital for maintenance or showing minimal progress. These are typically legacy operations with declining grades or smaller, underperforming projects that fail to meet performance targets. The company's strategy involves re-evaluating and often divesting these assets to streamline operations and improve capital efficiency, as seen with the January 2025 sale of G Mining Ventures Holding for $155 million.

| Asset Category | Characteristics | 2024/2025 Data Point | Strategic Action |

| Legacy Infrastructure | High sustaining capital expenditure, declining ore grades | Maintenance costs exceeding 15% of annual operating budget without clear ROI | Re-evaluation for optimization or closure |

| Underperforming Projects | Consistently miss performance targets, low ROI | Consume valuable financial and human resources | Streamlining and potential divestment |

| Non-Core Exploration | Early-stage, not central to current strategy | Uncertainty in resource definition, need for unbudgeted capital | Assessment and potential reallocation of funds |

| Divested Assets | Previously considered 'Dogs' or non-core | G Mining Ventures Holding sale for $155 million (Jan 2025) | Capital reallocation to higher-potential areas |

Question Marks

The Skouries project, while poised to become a Star for Eldorado Gold, currently resides in the Question Mark quadrant of the BCG Matrix. This classification stems from its position in the final pre-commercial production phase, demanding substantial investment.

As of December 2024, the project still requires an estimated $705 million in capital expenditure. This significant outlay, coupled with past delays, means Skouries is a cash consumer without current revenue generation, a hallmark of Question Marks.

Its market share is effectively zero at this stage. However, the project boasts high growth potential, contingent on a successful transition to commercial production, which is anticipated for mid-2026.

The planned mill expansion at Olympias to 650 kilotonnes per annum (ktpa) and ongoing resource conversion drilling are key initiatives aimed at unlocking its substantial resource base. These efforts are designed to significantly boost future production, building on Eldorado Gold's strategic vision.

Despite prior operational hurdles, these developments at Olympias are crucial for increasing future output. The success of this expansion is directly tied to overcoming past challenges and effectively utilizing the increased mill capacity.

Olympias presents a high-potential investment opportunity, contingent on resolving operational issues and realizing the benefits of its expanded capacity. The conversion drilling, in particular, is vital for solidifying the mine's long-term economic viability.

Eldorado Gold's new regional exploration programs in Canada, Turkey, and Greece represent significant investments classified as question marks in the BCG matrix. These initiatives are characterized by high upfront costs associated with extensive drilling and geological evaluation, aiming to uncover new gold deposits.

These exploration efforts, while holding the promise of substantial future discoveries and high growth potential, currently possess a low market share within Eldorado's portfolio. For instance, in 2024, the company allocated a significant portion of its capital expenditure towards exploration, with a substantial part directed towards these new regions, underscoring the high cash consumption and uncertain returns inherent in such ventures.

Integration of Advanced Technologies (e.g., Teleremote Mining)

Eldorado Gold's integration of advanced technologies, such as teleremote mining at its Lamaque operation, represents a strategic move to enhance operational performance. These investments are designed to boost efficiency, elevate safety standards, and increase overall productivity.

While the benefits are being realized, the complete return on these substantial capital expenditures and their broader implementation across all Eldorado Gold operations are under ongoing assessment. The company is carefully evaluating the long-term impact on market position and financial returns.

- Investment Focus: Teleremote mining at Lamaque aims to improve operational efficiency and safety.

- ROI Evaluation: Full return on investment and widespread adoption are still being assessed.

- Capital Requirements: Significant upfront capital and integration efforts are necessary for these technologies.

- Impact on Market Share: The ultimate effect on market share and profitability is still developing.

Development of Ormaque Deposit to Full Production

The Ormaque deposit at Eldorado Gold's Lamaque operation is currently positioned as a Question Mark in the BCG matrix. Its development is progressing, but it hasn't yet reached full production capacity, meaning its future market share and growth potential are uncertain.

Significant capital is being invested to establish Ormaque as a second underground mine at Lamaque. This requires careful financial planning and execution to ensure the project moves forward efficiently.

The transition of Ormaque from a development stage to a consistent producer hinges on several factors. These include a successful ramp-up of operations and the reliable extraction of high-grade ore.

- Ormaque's current status: Under development, not yet a significant contributor to overall production.

- Investment required: Substantial capital for establishing a second underground mine.

- Key success factors: Smooth operational ramp-up and consistent delivery of high-grade ore.

- BCG Matrix classification: Question Mark, reflecting its uncertain future market position and growth.

Question Marks in Eldorado Gold's portfolio represent ventures with high growth potential but currently low market share, requiring significant investment. These are typically early-stage projects or new exploration initiatives where the outcome is uncertain but could lead to future Stars.

The Skouries project, despite its potential, remains a Question Mark due to ongoing capital needs and the absence of current revenue. Similarly, new regional exploration programs in Canada, Turkey, and Greece are consuming capital with uncertain returns, fitting the Question Mark profile.

The Ormaque deposit at Lamaque is also a Question Mark as it transitions from development to production, needing substantial investment for its ramp-up. These ventures are critical for Eldorado's future growth but carry inherent risks that are being actively managed.

| Project/Initiative | BCG Quadrant | Key Characteristics | Investment Status (as of Dec 2024) | Growth Potential |

| Skouries | Question Mark | Pre-commercial production, high capital expenditure | Requires ~$705 million CAPEX | High, contingent on successful production |

| Regional Exploration (Canada, Turkey, Greece) | Question Mark | New initiatives, extensive drilling, low market share | Significant CAPEX allocation in 2024 | High, dependent on discovery success |

| Ormaque (Lamaque) | Question Mark | Under development, establishing second underground mine | Substantial capital investment | Moderate to High, dependent on ramp-up and ore grade |

BCG Matrix Data Sources

Our Eldorado Gold BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.