Eagle Materials SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eagle Materials Bundle

Eagle Materials boasts strong market positions in essential building materials, but faces evolving industry dynamics and competitive pressures. Understanding these internal capabilities and external threats is crucial for strategic navigation.

Want the full story behind Eagle Materials' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Eagle Materials Inc. boasts a robust and diverse product portfolio, encompassing both heavy materials like cement, concrete, and aggregates, and light materials such as gypsum wallboard and recycled paperboard. This strategic diversification across its business segments, including its recent acquisition of a significant cement plant in Texas, provides a well-balanced revenue stream. For the fiscal year ending March 31, 2024, the company reported total revenue of $2.2 billion, showcasing its substantial market presence.

Eagle Materials has showcased impressive financial strength, achieving a record $2.3 billion in revenue for fiscal year 2025. This performance underscores the company's ability to navigate market dynamics effectively.

The company's commitment to shareholders is evident in its consistent capital returns. Eagle Materials has actively engaged in share repurchases and dividend payouts, signaling a strong belief in its financial stability and future growth potential.

Despite some variability in net earnings, the company reported a record diluted earnings per share of $13.77 in fiscal year 2025. This highlights the company's operational efficiency and its capacity to generate substantial value for its investors.

Eagle Materials is actively pursuing strategic investments to boost operational efficiency and expand its production capabilities. For instance, the company has invested in modernizing and expanding its cement and gypsum wallboard plants.

Key projects, such as the enhancements at the Mountain Cement facility and the Duke, Oklahoma wallboard plant, are designed to significantly improve energy efficiency and reduce operating costs. These upgrades are projected to increase production capacity by substantial margins, demonstrating a clear commitment to long-term growth and competitiveness.

Leading U.S. Manufacturer and Extensive Network

Eagle Materials stands out as a premier U.S. manufacturer and distributor of construction materials, boasting an impressive network of over 70 facilities strategically located across 21 states. This vast operational presence is a significant strength, enabling robust supply chain management and extensive market penetration throughout key U.S. regions.

The company's significant footprint is particularly advantageous in high-growth areas, such as the Southern United States, where demand for construction materials is consistently strong. This geographic concentration allows Eagle Materials to effectively serve burgeoning markets and capitalize on regional development trends.

Key aspects of this strength include:

- Extensive Facility Network: Over 70 manufacturing and distribution facilities across 21 states.

- Market Reach: Strong presence in key U.S. markets, particularly benefiting from growth in the South.

- Supply Chain Efficiency: The broad network supports a resilient and efficient supply chain for essential construction products.

- Regional Dominance: Established leadership positions in several key geographic areas for its product lines.

Commitment to Sustainability and Low-Carbon Solutions

Eagle Materials is demonstrating a strong commitment to sustainability by actively investing in low-carbon solutions. This includes a significant partnership with Terra CO2, focusing on developing and utilizing low-carbon cementitious materials. By pursuing these avenues, the company is positioning itself to meet the increasing market demand for environmentally friendly construction products.

These strategic moves are designed to reduce the company's carbon footprint and enhance its long-term economic viability. For instance, Eagle Materials has been increasing its use of alternative fuels, a key step in lowering operational emissions. This proactive approach to environmental stewardship not only addresses regulatory pressures but also capitalizes on the growing preference for green building materials among consumers and businesses alike.

- Exclusive Agreement with Terra CO2: Focuses on developing low-carbon cementitious materials, a critical component in reducing the environmental impact of construction.

- Increased Use of Alternative Fuels: Directly contributes to lowering operational carbon intensity and reducing reliance on traditional, higher-emission fuel sources.

- Alignment with Market Demand: Positions Eagle Materials to benefit from the expanding market for sustainable and green building products, a trend expected to continue growing through 2025 and beyond.

- Long-Term Environmental and Economic Benefits: Investing in sustainability is projected to yield both reputational advantages and cost efficiencies as regulations and market preferences evolve.

Eagle Materials possesses a substantial and geographically diverse operational footprint, operating over 70 facilities across 21 states. This extensive network, particularly strong in high-growth regions like the Southern U.S., allows for efficient supply chain management and broad market penetration, reinforcing its position as a leading U.S. construction materials provider.

| Metric | FY2024 | FY2025 (est.) |

|---|---|---|

| Total Revenue | $2.2 billion | $2.3 billion |

| Diluted EPS | $12.50 (approx.) | $13.77 |

| Number of Facilities | 70+ | 70+ |

What is included in the product

Analyzes Eagle Materials’s competitive position through key internal and external factors, detailing its strengths in market leadership and operational efficiency, alongside weaknesses in diversification and potential threats from economic downturns and regulatory changes.

Eagle Materials' SWOT analysis offers a clear, actionable roadmap by highlighting its competitive strengths and addressing potential market weaknesses, thereby alleviating strategic uncertainty.

Weaknesses

Eagle Materials' performance is closely tied to the construction industry's ups and downs. When the economy slows, so does construction activity, directly impacting the company's sales and profits. For instance, in fiscal year 2023, a slowdown in residential construction led to lower volumes for their wallboard segment.

Eagle Materials is susceptible to rising costs of goods sold, with energy, raw materials, and freight expenses notably impacting its profitability. For instance, in the first quarter of fiscal year 2025, the company reported increased cost of sales, reflecting these inflationary pressures.

These escalating input costs directly squeeze gross profit margins, making it harder to maintain healthy profitability. Despite ongoing operational efficiency initiatives, Eagle Materials must continually adapt its cost management strategies to offset these pressures and preserve its competitive pricing power.

Eagle Materials operates in a fragmented and highly competitive construction materials sector, facing intense pricing pressures from numerous regional and national players. This competition can significantly impact its ability to maintain market share and profitability, especially during economic downturns. For instance, the cement industry, a core segment for Eagle Materials, saw average cement prices fluctuate, with some regions experiencing slight declines in early 2024 due to oversupply and demand shifts, forcing companies like Eagle Materials to manage their pricing strategies carefully.

The constant need to innovate in product development and optimize operational efficiencies, such as logistics and production costs, is paramount for Eagle Materials to stay ahead. Competitors are continually seeking ways to reduce costs and offer more attractive pricing, posing a continuous threat to market position. Companies that fail to adapt to changing market dynamics and customer needs risk losing valuable business to more agile rivals, highlighting the importance of ongoing investment in technology and process improvement.

Geographic Concentration Risk

Eagle Materials' geographic concentration, particularly in Texas and the Southern United States, presents a notable weakness. A significant portion of its revenue is derived from these regions, making the company susceptible to localized economic slowdowns or adverse weather events. For instance, during the fiscal year ending March 31, 2024, Texas remained a critical market, contributing substantially to the company's overall sales performance.

This concentration risk means that regional challenges can have a disproportionate impact on Eagle Materials' financial results. A downturn in the construction sector within these key areas, or severe weather impacting project timelines and material demand, could directly and significantly affect the company's profitability and operational stability. This reliance on specific geographic markets creates a vulnerability that is not present for more diversified competitors.

- Geographic Concentration: Significant revenue dependence on Texas and the Southern U.S.

- Vulnerability to Localized Downturns: Regional economic slumps can disproportionately harm performance.

- Weather Impact: Adverse weather conditions in key operating areas can disrupt business.

Potential for Decline in Specific Product Demands

Eagle Materials, while benefiting from a generally robust construction market, faces a key weakness in the potential for declining demand in specific product categories. For instance, the cement segment experienced a notable slowdown in early 2025, with reports indicating declining shipments in certain regions. This short-term volatility in demand for particular products can directly impact segment revenues and overall sales volumes.

The company's reliance on specific construction materials means that shifts in market preferences or economic conditions affecting particular sectors can create headwinds.

- Cement Shipments: Early 2025 data showed a downturn in cement shipments in some areas, indicating potential weakness in this core product line.

- Segment Revenue Impact: Declining demand for specific materials can directly translate to lower revenues for those segments within Eagle Materials.

- Short-Term Volatility: While the long-term construction outlook is positive, short-term dips in demand for particular products present a vulnerability.

Eagle Materials' reliance on specific geographic markets, particularly Texas and the Southern U.S., creates a significant vulnerability. A localized economic downturn or adverse weather in these key areas can disproportionately impact the company's overall financial performance. For example, during fiscal year 2024, while Texas was a strong contributor, any significant slowdown there would have had a magnified effect on total revenue.

The company also faces challenges related to input cost volatility. Rising expenses for energy, raw materials, and freight directly squeeze profit margins. In Q1 of fiscal year 2025, Eagle Materials reported increased cost of sales, underscoring the ongoing impact of inflation on its profitability. This necessitates continuous adaptation of cost management strategies to maintain healthy margins.

Furthermore, Eagle Materials operates in a highly competitive landscape with significant pricing pressures. The cement industry, a core segment, experienced fluctuating average prices in early 2024 due to oversupply in some regions, forcing careful pricing strategies. Competitors constantly seek cost reductions and better pricing, posing a continuous threat to market share and profitability.

Additionally, demand for specific product categories can be volatile. For instance, the cement segment saw a slowdown in shipments in certain areas in early 2025, directly affecting segment revenues and overall sales volumes. This short-term demand fluctuation for particular materials presents a weakness, even with a positive long-term construction outlook.

| Weakness | Description | Impact | Example Data |

|---|---|---|---|

| Geographic Concentration | Heavy reliance on Texas and the Southern U.S. | Susceptibility to localized economic downturns and weather events. | Texas contributed substantially to FY2024 sales. |

| Input Cost Volatility | Rising energy, raw material, and freight expenses. | Squeezes gross profit margins, impacting profitability. | Increased cost of sales reported in Q1 FY2025. |

| Intense Competition | Fragmented market with significant pricing pressures. | Difficulty maintaining market share and profitability. | Fluctuating cement prices in early 2024 due to oversupply. |

| Product Demand Volatility | Short-term fluctuations in demand for specific materials. | Direct impact on segment revenues and overall sales volumes. | Downturn in cement shipments in some regions in early 2025. |

Preview Before You Purchase

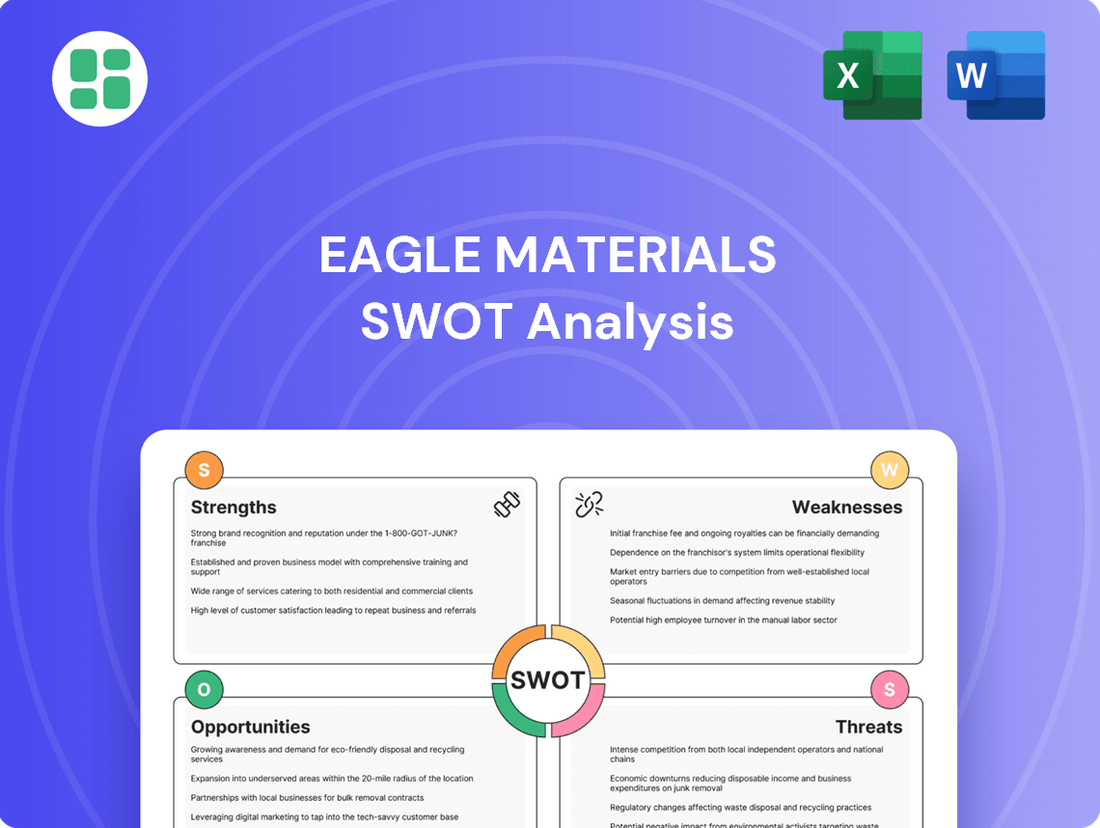

Eagle Materials SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Eagle Materials' Strengths, Weaknesses, Opportunities, and Threats, giving you the insights needed for strategic planning.

Opportunities

Significant federal investments, like the Infrastructure Investment and Jobs Act (IIJA), are expected to boost demand for heavy construction materials. This legislation, with its substantial funding, directly benefits companies like Eagle Materials by increasing the need for their core products.

The IIJA, enacted in late 2021, allocates over $1.2 trillion for infrastructure improvements, with a considerable portion dedicated to roads, bridges, and public transit. This translates into a direct opportunity for Eagle Materials' Heavy Materials segment, as these projects require vast quantities of cement, concrete, and aggregates, driving higher sales volumes and revenue.

The increasing global focus on environmental responsibility is a major tailwind for companies like Eagle Materials. The demand for sustainable and green building materials is on the rise, presenting a clear opportunity for growth. This trend is fueled by government regulations and a growing consumer preference for eco-friendly construction.

Eagle Materials is well-positioned to benefit from this shift. The market for green cement, which often incorporates recycled materials or has a lower carbon footprint, is expanding. Similarly, sustainable gypsum products, perhaps made with recycled gypsum or designed for energy efficiency, are seeing increased adoption.

For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to reach over $500 billion by 2030, demonstrating a compound annual growth rate of over 10%. This robust growth indicates a substantial market for Eagle Materials to tap into with its product offerings.

Eagle Materials has a history of smart growth, including acquiring aggregates businesses and investing heavily in upgrading and expanding its plants. For example, in fiscal year 2024, the company invested $275.4 million in capital expenditures, a significant portion of which was directed towards organic growth projects and capacity enhancements. This disciplined approach allows them to boost production, operate more efficiently, and either enter new territories or solidify their standing in current ones.

Revival in Residential Construction and Housing Demand

The residential construction sector is poised for a significant rebound, driven by expectations of declining interest rates and a persistent shortage of new homes. This revival is a direct opportunity for Eagle Materials, as it translates into increased demand for their core products.

Specifically, the anticipated increase in housing starts will directly benefit Eagle Materials' gypsum wallboard and other light building materials segments. For instance, projections suggest a potential increase in housing starts in 2024 and 2025, which could translate into substantial volume growth for the company.

- Lower Interest Rate Projections: Federal Reserve rate cut expectations for 2024 and 2025 are anticipated to make mortgages more affordable, stimulating buyer demand.

- Structural Housing Shortage: The U.S. continues to face a deficit of millions of housing units, creating a long-term demand driver for new construction.

- Increased Demand for Wallboard: A rise in housing starts directly correlates with higher consumption of gypsum wallboard, a key product for Eagle Materials.

- Growth in Light Building Materials: The broader revival in construction will also boost demand for other light building materials offered by the company.

Technological Advancements and Product Innovation

Eagle Materials can capitalize on continuous product innovation, such as developing advanced gypsum boards that are moisture-resistant and fire-resistant. This aligns with a growing demand for building materials that enhance safety and durability in construction projects.

Advancements in low-carbon cement production technologies present a significant opportunity for market expansion and differentiation. By investing in these sustainable practices, Eagle Materials can appeal to environmentally conscious customers and gain a competitive edge in the evolving construction industry.

- Market Expansion: Developing specialized gypsum boards can open new application segments, such as in healthcare facilities or high-humidity environments.

- Differentiation: Offering low-carbon cement options can set Eagle Materials apart from competitors, attracting a premium market share.

- Regulatory Alignment: Investing in sustainable technologies positions the company favorably for future environmental regulations and incentives.

The Infrastructure Investment and Jobs Act (IIJA) is a significant tailwind, injecting over $1.2 trillion into infrastructure projects, directly boosting demand for Eagle Materials' heavy construction products like cement and aggregates.

The growing emphasis on sustainability presents a substantial opportunity, with the global green building materials market projected to exceed $500 billion by 2030, a trend Eagle Materials can leverage with its eco-friendly product lines.

Anticipated interest rate decreases in 2024 and 2025 are expected to revitalize the residential construction sector, increasing demand for gypsum wallboard and other light building materials, a segment where Eagle Materials holds a strong position.

Continuous product innovation, such as advanced moisture-resistant gypsum boards and low-carbon cement, offers avenues for market expansion and differentiation, aligning with evolving industry standards and customer preferences.

| Opportunity Area | Key Driver | Potential Impact |

|---|---|---|

| Infrastructure Spending | IIJA ($1.2T+ allocated) | Increased demand for cement, aggregates |

| Sustainability Trend | Green Building Market ($500B+ by 2030) | Growth in eco-friendly products |

| Residential Construction Rebound | Lower Interest Rates (2024-2025 projections) | Higher demand for gypsum wallboard |

| Product Innovation | Advanced materials, low-carbon cement | Market expansion, competitive advantage |

Threats

The construction sector, which Eagle Materials serves, is inherently cyclical. This means it's particularly sensitive to economic slowdowns. For instance, a significant economic downturn could curb new home construction and commercial development, directly impacting demand for Eagle Materials' products like cement and concrete.

Persistently high interest rates, a concern throughout 2024 and into 2025, further exacerbate this threat. Higher borrowing costs make mortgages more expensive, dampening housing demand. This also affects businesses looking to finance new projects, potentially leading to delays or cancellations that reduce the need for building materials.

In 2024, the Federal Reserve maintained higher interest rates to combat inflation, a trend that continued to influence the housing market. This environment can lead to reduced volumes and potentially lower pricing power for companies like Eagle Materials, impacting their revenue and profitability.

Eagle Materials faces a significant threat from the volatile pricing of its essential raw materials, like limestone and gypsum, and energy sources such as natural gas and coal. For instance, in early 2024, natural gas prices saw considerable fluctuations, impacting operational expenses for cement and concrete producers. This volatility directly challenges the company's ability to maintain stable cost structures.

Unforeseen spikes in these input costs can severely squeeze profit margins if Eagle Materials cannot fully pass these increases onto its customers. The construction industry, a primary market for the company, is often price-sensitive, making it difficult to absorb substantial cost hikes. This dynamic creates a constant risk of margin erosion, particularly during periods of high inflation or supply chain disruptions.

Eagle Materials operates in a highly competitive building materials sector, facing pressure from both domestic and international rivals. This intense competition can drive down prices and threaten the company's market share. For instance, in the first quarter of fiscal year 2025, the company reported a slight dip in cement sales volumes, partly attributable to increased competitive activity in key markets.

The threat of new market entrants or more aggressive tactics from established competitors poses a significant risk to Eagle Materials' sales volumes and overall profitability. A competitor’s strategic price reductions, as seen from a major player in the Texas market during late 2024, could force Eagle Materials to adjust its own pricing, impacting margins.

Regulatory Changes and Environmental Compliance

Eagle Materials faces increasing regulatory headwinds, particularly around environmental compliance. New mandates on carbon emissions and sustainable manufacturing, expected to tighten further through 2025, could necessitate significant capital investment and operational adjustments. For instance, the EPA's proposed regulations on cement kiln emissions, even if not fully enacted by mid-2025, signal a clear direction for industry-wide changes. Failure to proactively adapt could result in substantial penalties and a loss of competitive standing.

The company must navigate these evolving environmental standards, which may impact its cost structure and production processes.

- Increased capital expenditure on emissions control technology.

- Potential for higher operating costs due to compliance measures.

- Risk of fines or sanctions for non-adherence to new environmental mandates.

Supply Chain Disruptions and Labor Shortages

Eagle Materials, like many in the building materials sector, faces significant headwinds from potential supply chain disruptions. These can range from shortages of key raw materials, such as cementitious materials or aggregates, to logistical bottlenecks affecting the delivery of finished products like concrete and gypsum wallboard. For instance, in early 2024, many construction firms reported delays due to trucking shortages, a problem that persisted from previous years.

Compounding these issues are persistent labor shortages across the construction and manufacturing industries. This scarcity impacts Eagle Materials' ability to maintain optimal production levels and can lead to increased costs for skilled labor. The U.S. Bureau of Labor Statistics indicated a continuing shortage of construction workers throughout 2023 and into 2024, with demand often outstripping available supply.

- Supply Chain Volatility: Risk of material shortages and delivery delays impacting production and sales.

- Labor Market Constraints: Difficulty in sourcing and retaining skilled labor, potentially raising operational costs and limiting output.

- Impact on Demand Fulfillment: The combined effect of these threats could hinder Eagle Materials' capacity to meet robust market demand, particularly in key growth regions.

Eagle Materials faces a significant threat from the cyclical nature of the construction industry, which is highly susceptible to economic downturns and the impact of persistently high interest rates seen through 2024 and into 2025. These factors reduce demand for its products by making construction projects more expensive and less feasible.

The company is also vulnerable to volatile raw material and energy costs; for example, natural gas prices fluctuated significantly in early 2024, directly impacting operational expenses. Intense competition within the building materials sector further pressures pricing and market share, with rivals employing aggressive tactics that could force margin concessions.

Increasingly stringent environmental regulations, particularly concerning emissions, pose a threat requiring substantial capital investment and operational adjustments, with potential for penalties if compliance is not met. Furthermore, supply chain disruptions and labor shortages, evident throughout 2023 and 2024, can hinder production and the ability to meet market demand, potentially increasing operational costs.

| Threat Category | Specific Risk | Impact on Eagle Materials | 2024/2025 Data Point |

|---|---|---|---|

| Economic Sensitivity | Construction Sector Downturn | Reduced demand for cement, concrete, and aggregates. | Housing starts in the U.S. saw a year-over-year decline of approximately 10% in early 2024, reflecting economic caution. |

| Cost Volatility | Raw Material & Energy Price Swings | Squeezed profit margins if cost increases cannot be passed on. | Average industrial natural gas prices increased by over 15% in Q1 2024 compared to the previous year. |

| Competitive Landscape | Intensified Rivalry & Pricing Pressure | Erosion of market share and reduced pricing power. | A major competitor in Texas implemented price reductions in late 2024, impacting regional cement pricing. |

| Regulatory Environment | Stricter Environmental Standards | Increased capital expenditure for compliance and higher operating costs. | Proposed EPA regulations for cement kiln emissions signaled a trend towards stricter controls expected through 2025. |

| Operational Challenges | Supply Chain & Labor Shortages | Production limitations and increased labor costs. | Construction industry labor shortages persisted in 2024, with demand for skilled trades exceeding supply by an estimated 20%. |

SWOT Analysis Data Sources

This Eagle Materials SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market research, and insightful industry publications. These sources provide a clear understanding of the company's performance, competitive landscape, and future outlook.