Eagle Materials PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eagle Materials Bundle

Eagle Materials operates within a dynamic external environment, shaped by political stability, economic fluctuations, and evolving social trends. Understanding these forces is crucial for strategic planning and identifying potential opportunities or threats. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable intelligence.

Gain a competitive edge by understanding the political, economic, social, technological, legal, and environmental forces impacting Eagle Materials. This expertly crafted PESTLE analysis provides the insights you need to anticipate market shifts and make informed decisions. Download the full version now to unlock strategic clarity.

Political factors

Government initiatives and funding for infrastructure projects, such as roads, bridges, and public buildings, directly impact the demand for heavy construction materials like cement, a core product for Eagle Materials. Policies like the Infrastructure Investment and Jobs Act, enacted in late 2021, continue to drive significant investment, creating a stable demand outlook for Eagle Materials. For instance, the Act allocates hundreds of billions of dollars towards transportation and infrastructure improvements through 2026, directly benefiting material suppliers.

Any shifts in federal or state budget allocations for these vital projects could either boost or reduce the company's sales volume. For example, a projected $1.4 trillion in federal infrastructure spending through 2029 under the IIJA provides a strong tailwind, but potential budget constraints or reallocations at the state level could temper this growth in specific regions.

Changes in building codes, such as updated seismic requirements or new energy efficiency standards, can significantly impact demand for Eagle Materials' products. For instance, a shift towards more stringent insulation mandates might increase the appeal of certain gypsum wallboard products, while evolving concrete specifications could influence cement demand.

The regulatory environment for construction materials is constantly evolving. For example, the U.S. Environmental Protection Agency (EPA) continues to assess and potentially regulate materials based on their environmental impact, which could necessitate changes in manufacturing processes for Eagle Materials' cement and concrete products.

In 2024, many local jurisdictions are reviewing and updating their building codes to incorporate advancements in sustainability and resilience. These updates, often driven by concerns about climate change and natural disasters, directly shape the types and volumes of construction materials needed, affecting companies like Eagle Materials.

Trade policies significantly influence the construction materials sector. For Eagle Materials, operating primarily within the U.S., tariffs on imported cement or gypsum could lessen foreign competition, potentially bolstering domestic pricing power and market share. For instance, in early 2024, discussions around potential tariffs on imported steel, a key component in construction, highlighted the sensitivity of the industry to such trade actions.

Taxation Policies

Taxation policies directly impact Eagle Materials' bottom line and investment strategies. Changes in corporate tax rates, like the U.S. federal corporate tax rate which stood at 21% in 2024, can alter net income. Investment incentives, such as tax credits for renewable energy or infrastructure projects, could encourage capital expenditure. For instance, accelerated depreciation rules allow companies to deduct the cost of assets more quickly, freeing up cash flow for reinvestment.

Favorable tax treatment for specific industries or investments can significantly boost Eagle Materials' growth prospects. For example, if the government offers enhanced tax deductions for companies investing in new manufacturing facilities or upgrading existing ones, this could directly influence decisions to expand production capacity. Conversely, an increase in the overall corporate tax burden would likely reduce the capital available for such strategic initiatives, potentially slowing down expansion or innovation efforts.

- Corporate Tax Impact: The U.S. federal corporate tax rate of 21% (as of 2024) directly affects Eagle Materials' profitability.

- Investment Incentives: Tax credits or deductions for infrastructure or manufacturing investments can encourage capital expenditure.

- Depreciation Rules: Accelerated depreciation can improve cash flow, enabling more reinvestment in the business.

- Tax Burden Effects: Higher taxes can limit funds for growth and innovation, impacting long-term strategy.

Political Stability and Elections

Political stability significantly impacts Eagle Materials' operational environment. A predictable policy landscape, often fostered by stable governance, bolsters confidence among developers and investors, directly translating into increased demand for construction materials. For instance, the 2024 US federal election cycle, while introducing a degree of uncertainty, ultimately saw a continuation of infrastructure spending initiatives, which is generally positive for the building materials sector.

Conversely, periods of political upheaval or abrupt policy changes can create headwinds. If federal or state administrations prioritize austerity measures or significantly alter regulations impacting construction, it can dampen project pipelines and, consequently, Eagle Materials' sales. For example, any shifts in environmental regulations or zoning laws at the state level could affect project timelines and material requirements.

- Federal infrastructure spending, such as the Bipartisan Infrastructure Law, continues to provide a baseline demand for construction materials through 2025.

- State-level elections in key markets for Eagle Materials could lead to varied approaches on infrastructure investment and development.

- The overall political climate influences economic growth forecasts, which are critical for predicting construction activity.

Government policies, particularly those related to infrastructure investment, are a primary driver for Eagle Materials. The continued implementation of the Infrastructure Investment and Jobs Act (IIJA) through 2026, with substantial federal allocations for transportation and public works, ensures a robust demand for cement and concrete. For example, the IIJA earmarks over $550 billion in new federal spending for infrastructure, directly benefiting material suppliers like Eagle Materials.

However, local and state-level budget decisions can introduce variability. While federal initiatives provide a strong foundation, shifts in state funding priorities or potential budget constraints could impact project pipelines in specific regions, influencing regional sales volumes for Eagle Materials.

Regulatory changes, such as updated building codes focusing on sustainability and resilience, also shape demand. For instance, evolving energy efficiency standards might favor certain gypsum wallboard products, while changes in concrete specifications could influence cement usage.

The political landscape, including upcoming elections in 2024, can introduce uncertainty but also reinforce existing trends. The general consensus on continued infrastructure spending, even amidst political transitions, provides a degree of stability for the construction materials sector.

| Policy Area | Impact on Eagle Materials | Example/Data Point |

|---|---|---|

| Infrastructure Spending | Drives demand for cement, concrete, and aggregates. | Infrastructure Investment and Jobs Act (IIJA) allocating over $550 billion through 2026. |

| Building Codes | Influences product specifications and material demand. | Updated codes emphasizing energy efficiency or seismic resilience. |

| Environmental Regulations | May necessitate changes in manufacturing processes. | EPA assessments on material impacts. |

| Taxation Policy | Affects profitability and investment decisions. | U.S. federal corporate tax rate of 21% (2024). |

What is included in the product

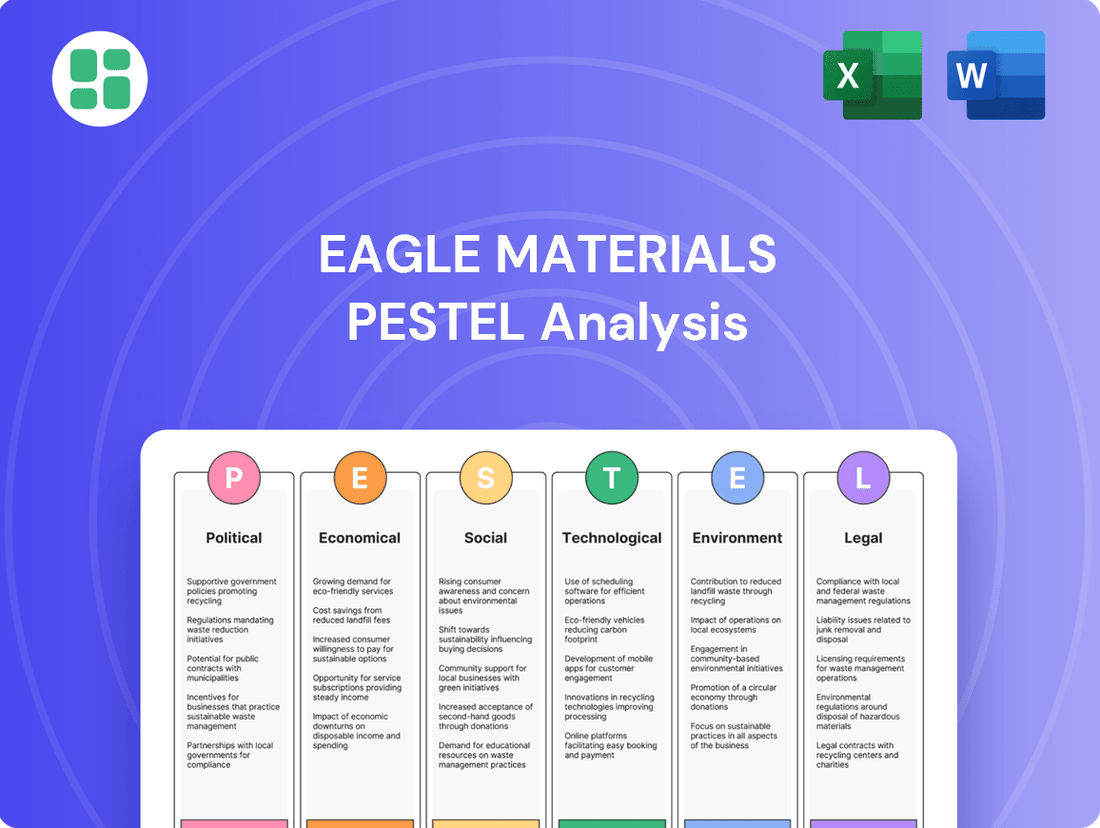

This PESTLE analysis examines the external macro-environmental factors impacting Eagle Materials, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces shape its operational landscape and strategic options.

A concise, actionable summary of Eagle Materials' PESTLE factors, designed to streamline strategic discussions and identify key external influences impacting the business.

Economic factors

Fluctuations in interest rates significantly impact the housing market by affecting mortgage affordability. For instance, the Federal Reserve's benchmark interest rate, which influences mortgage rates, saw increases throughout 2022 and 2023, reaching a range of 5.25%-5.50% by July 2023. This trend generally makes borrowing more expensive, potentially cooling demand for new homes and consequently reducing the need for construction materials like those supplied by Eagle Materials.

Higher borrowing costs can lead to a slowdown in both residential and commercial construction. When mortgage rates rise, fewer individuals can afford to buy new homes, leading to decreased housing starts. Similarly, businesses may postpone or cancel new construction projects due to increased financing expenses. This directly impacts Eagle Materials, as a weaker housing market translates to lower demand for their gypsum wallboard and cement products.

Conversely, periods of lower interest rates tend to stimulate construction activity. When borrowing becomes cheaper, it encourages more people to purchase homes and more businesses to invest in new facilities. For example, during periods of historically low rates, like those seen in 2020-2021 where mortgage rates dipped below 3%, there was a surge in housing demand. This increased activity directly benefits companies like Eagle Materials by boosting sales volumes for their core products.

Rising inflation significantly impacts Eagle Materials by increasing the cost of essential inputs like fuel for transportation and energy for kilns, crucial for cement and gypsum wallboard manufacturing. For instance, the Producer Price Index for inputs to construction industries saw a notable increase in late 2023 and early 2024, directly affecting these operational expenses.

Effectively managing these escalating input costs while aiming to maintain competitive pricing for their products presents a considerable challenge for Eagle Materials. The company's ability to pass these higher costs onto customers, particularly in the construction sector, is paramount for safeguarding profit margins.

The health of the U.S. economy, as indicated by Gross Domestic Product (GDP) growth, directly influences demand for construction materials. A growing economy, characterized by rising employment and consumer spending, typically fuels more investment in both residential and commercial construction, as well as infrastructure projects. For instance, the U.S. GDP grew at an annualized rate of 1.3% in the first quarter of 2024. This expansion suggests continued, albeit moderate, demand for Eagle Materials' products.

Residential and Commercial Construction Spending

Residential and commercial construction spending are critical economic drivers for Eagle Materials. In 2024, the U.S. Census Bureau reported that total construction spending reached an annualized rate of $2.07 trillion in April, with residential construction contributing approximately $673.7 billion and nonresidential construction accounting for $897.6 billion. This indicates robust activity across both sectors, directly impacting demand for Eagle Materials' products like cement and aggregates.

Eagle Materials' success is closely linked to the volume of new housing starts and commercial building permits issued. For instance, housing starts in the U.S. saw a notable increase in early 2024, with annualized figures often exceeding 1.3 million units. Similarly, commercial construction projects, from industrial facilities to retail spaces, represent significant revenue streams, making trends in this segment vital for the company's outlook.

- Residential Construction: The U.S. housing market, a key segment, showed resilience with new single-family home sales in April 2024 reported at an annualized rate of 673,000 units, up 7.2% from March.

- Commercial Construction: Nonresidential construction spending, particularly in manufacturing and infrastructure, has been a strong performer, with significant investments in new facilities.

- Renovation Market: Home improvement and renovation projects also contribute substantially to construction spending, providing a steady demand for building materials even when new construction cycles fluctuate.

- Permitting Activity: Building permits, a leading indicator, generally reflect future construction activity; an increase in permits signals higher demand for Eagle Materials' products in the coming months.

Labor Market Conditions

Labor market conditions are a critical factor for Eagle Materials, particularly concerning the availability and cost of skilled labor in both the construction sector and its manufacturing facilities. Shortages can directly impede construction timelines, consequently dampening the immediate demand for the company's products. For instance, the U.S. Bureau of Labor Statistics reported in early 2024 that construction employment continued to grow, but persistent shortages in skilled trades, such as electricians and plumbers, remained a challenge for many projects.

Wage pressures are also a significant consideration. As of mid-2024, wage growth in the construction industry has been robust, driven by demand and labor scarcity. This can lead to increased production costs for Eagle Materials, impacting their profit margins if not effectively managed through pricing strategies or efficiency improvements. Conversely, a well-supplied labor market with moderate wage increases supports sustained construction activity, which is beneficial for material demand.

The interplay of these factors highlights the need for strategic workforce planning. Eagle Materials must navigate the current economic environment where:

- Skilled labor shortages persist in key construction trades, potentially delaying projects and material orders.

- Wage inflation in the construction sector is a factor, impacting operational costs for manufacturers like Eagle Materials.

- A balanced labor market, with sufficient skilled workers and manageable wage growth, would support consistent demand for construction materials.

Interest rate hikes continue to influence the construction landscape, with the Federal Reserve maintaining its target rate between 5.25%-5.50% as of mid-2024. This sustained higher cost of borrowing can temper demand for new homes and commercial projects, directly impacting Eagle Materials' sales volumes for cement and gypsum wallboard.

Inflationary pressures remain a key economic factor, increasing operational costs for Eagle Materials. For example, the cost of fuel and energy, critical for manufacturing, saw continued upward trends into early 2024, necessitating careful cost management and pricing strategies.

Economic growth, measured by U.S. GDP, showed a 1.3% annualized increase in Q1 2024, signaling moderate demand for construction materials. Total construction spending in April 2024 was approximately $2.07 trillion, with residential and nonresidential sectors showing significant activity, providing a baseline for Eagle Materials' market performance.

| Economic Factor | Data Point | Impact on Eagle Materials |

|---|---|---|

| Federal Funds Rate (Target Range) | 5.25%-5.50% (as of mid-2024) | Increases borrowing costs, potentially reducing construction demand. |

| U.S. GDP Growth (Annualized) | 1.3% (Q1 2024) | Indicates moderate economic activity, supporting baseline demand. |

| Total Construction Spending (Annualized) | $2.07 trillion (April 2024) | Reflects overall market activity, driving material sales. |

| Producer Price Index (Inputs to Construction) | Notable increase in late 2023/early 2024 | Raises operational costs for raw materials and energy. |

Preview Before You Purchase

Eagle Materials PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Eagle Materials delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to actionable insights for strategic decision-making.

Sociological factors

Population growth and evolving demographics are fundamental drivers for the construction industry, directly impacting companies like Eagle Materials. As the global population continues to expand, particularly in developing regions, the demand for housing and infrastructure naturally increases. For instance, the United Nations projects the world population to reach 9.7 billion by 2050, necessitating significant investment in new construction.

Shifts in demographics, such as migration patterns and household formation rates, also play a crucial role. Urbanization trends, with more people moving to cities, create a constant need for new residential buildings, commercial spaces, and the infrastructure to support them. In the United States, the U.S. Census Bureau reported a continued trend of population growth in metropolitan areas through 2023, underscoring the sustained demand for building materials in these expanding hubs.

Furthermore, changes in household formation, like smaller family sizes or an increase in single-person households, influence the type and quantity of housing required. This dynamic, coupled with the expansion of suburban areas, ensures a continuous need for construction projects, from single-family homes to larger multi-unit dwellings and the associated infrastructure, directly benefiting suppliers of cement, concrete, and aggregates.

A significant societal shift is underway, with consumers and developers actively prioritizing environmentally conscious construction. This growing demand for sustainability directly impacts the building materials sector, pushing for products that minimize environmental impact.

In 2024, for instance, a significant percentage of new home buyers expressed a willingness to pay a premium for homes with green building certifications, reflecting a tangible shift in consumer preferences towards sustainability.

This trend is compelling manufacturers like Eagle Materials to innovate, focusing on gypsum wallboard and cement formulations that incorporate recycled content and offer enhanced energy efficiency, directly responding to market calls for greener building solutions.

Societal perceptions of vocational trades significantly influence the availability of skilled labor for Eagle Materials. A declining interest in trades can lead to shortages, as seen with the U.S. construction industry facing an estimated shortage of 1.4 million workers by 2025, according to Associated Builders and Contractors. This scarcity can impede project timelines, thereby dampening demand for Eagle Materials' products.

Furthermore, Eagle Materials' internal operational efficiency hinges on its ability to attract and retain a competent workforce for its manufacturing facilities. In 2024, manufacturing job openings in the U.S. remained elevated, indicating a competitive labor market. Retaining skilled personnel is vital for maintaining production levels and ensuring the quality of cement, concrete, and gypsum wallboard.

Urbanization and Infrastructure Needs

The United States continues to see a steady rise in urbanization, with more people moving into cities. This trend, coupled with the aging of existing infrastructure, fuels a consistent demand for construction materials. Eagle Materials is well-positioned to capitalize on this, as both new development and the crucial repair and renovation of roads, bridges, and utilities require substantial quantities of its products like cement and aggregates.

This societal shift towards denser urban living, along with the critical need to upgrade public utilities and transportation networks, forms a bedrock of demand for heavy construction materials. For instance, the American Society of Civil Engineers (ASCE) 2021 Report Card for America's Infrastructure highlighted a $2.59 trillion funding gap over ten years to bring U.S. infrastructure up to a state of good repair, directly benefiting companies like Eagle Materials.

- Urban Population Growth: By 2050, it's projected that 68% of the world's population will live in urban areas, with the U.S. mirroring this trend.

- Infrastructure Investment: The Infrastructure Investment and Jobs Act (IIJA) of 2021 allocates $1.2 trillion, with $550 billion in new spending, for infrastructure projects, a significant portion of which will drive demand for construction materials.

- Repair vs. New Construction: A substantial portion of infrastructure spending is dedicated to repairing and upgrading existing systems, which still requires significant material input.

- Material Demand: The demand for cement, a key product for Eagle Materials, is directly correlated with construction activity, which is bolstered by these urbanization and infrastructure trends.

Public Perception of the Construction Industry

Public perception of the construction industry significantly shapes its operational landscape. In 2024, ongoing discussions around worker safety and the industry's environmental footprint continue to be prominent. For instance, the U.S. Bureau of Labor Statistics reported that in 2023, fatal work injuries in construction accounted for 17.7% of all industry fatalities, a figure that remains a focal point for public concern and regulatory attention.

A positive public image can translate into smoother project approvals and a more robust talent pipeline. Conversely, negative perceptions, often stemming from safety incidents or environmental concerns, can trigger increased regulatory scrutiny and public opposition. This can directly impact project timelines and the demand for construction materials like those supplied by Eagle Materials.

- Worker Safety: Public concern over construction site safety remains high, influencing regulatory enforcement and company practices.

- Environmental Impact: Societal awareness of construction's environmental footprint drives demand for sustainable building practices and materials.

- Economic Contribution: The industry's role in job creation and infrastructure development is generally viewed positively, though often balanced against its other impacts.

- Talent Attraction: A strong public perception is crucial for attracting skilled labor, a persistent challenge in the construction sector.

Societal trends like urbanization and the demand for sustainable construction significantly influence Eagle Materials. As more people move to cities, the need for housing and infrastructure grows, directly boosting demand for cement and aggregates. For example, the U.S. saw continued population growth in metropolitan areas through 2023, according to the U.S. Census Bureau. Concurrently, a strong consumer preference for green building, with many buyers willing to pay more for sustainable homes in 2024, pushes manufacturers to innovate with eco-friendly materials.

The availability of skilled labor is a critical sociological factor impacting Eagle Materials. The U.S. construction sector faced an estimated shortage of 1.4 million workers by 2025, as reported by Associated Builders and Contractors, which can delay projects and affect material demand. Additionally, public perception of the construction industry, particularly regarding worker safety and environmental impact, shapes regulatory environments and talent attraction. In 2023, construction accounted for 17.7% of all industry fatalities, a statistic that remains a key concern for public and regulatory bodies.

The U.S. infrastructure needs, highlighted by the ASCE's 2021 Report Card indicating a $2.59 trillion funding gap, create a substantial and ongoing demand for construction materials. The Infrastructure Investment and Jobs Act of 2021, with its $550 billion in new spending, is set to further drive this demand, particularly for repairs and upgrades to existing systems. This focus on infrastructure development and maintenance directly benefits companies like Eagle Materials that supply essential products such as cement and concrete.

| Sociological Factor | Impact on Eagle Materials | Supporting Data/Trend |

|---|---|---|

| Urbanization | Increased demand for housing and infrastructure | 68% of world population projected urban by 2050; U.S. metro areas continue growth |

| Sustainability Focus | Demand for eco-friendly products, innovation | Premium paid by buyers for green homes in 2024 |

| Skilled Labor Shortage | Potential project delays, production challenges | Estimated 1.4 million worker shortage in U.S. construction by 2025 |

| Public Perception (Safety/Environment) | Regulatory scrutiny, talent attraction impact | Construction safety remains a public concern; 17.7% of industry fatalities in 2023 were in construction |

| Infrastructure Investment | Sustained demand for core products | $2.59 trillion U.S. infrastructure funding gap (ASCE 2021); IIJA allocates $550 billion new spending |

Technological factors

Eagle Materials' manufacturing processes are increasingly benefiting from advanced automation and robotics. This adoption in sectors like cement and gypsum wallboard production directly translates to improved efficiency and more consistent product quality. For instance, in 2023, the company reported a continued focus on operational improvements, which often involve technology upgrades aimed at reducing variable costs per unit.

The investment in these sophisticated technologies allows Eagle Materials to scale production capacity while simultaneously driving down operational expenses. This strategic move is crucial for maintaining profitability in a competitive market. By automating tasks, the company can reduce its reliance on manual labor, a significant cost factor, and ensure a higher degree of precision in its output.

Staying ahead in the industry necessitates continuous technological advancement. Eagle Materials understands that ongoing upgrades to its automated systems are vital for optimizing production output and securing a competitive advantage. This proactive approach to technology ensures the company remains agile and efficient in meeting market demands.

Technological progress in material science is driving the development of eco-friendly building materials. Innovations like low-carbon cement and gypsum boards incorporating more recycled content are becoming increasingly available, directly impacting companies like Eagle Materials.

Eagle Materials' commitment to research and development in these sustainable materials is vital for navigating stricter environmental regulations and capitalizing on the growing consumer preference for green construction. This focus on innovation can unlock new avenues for market growth and differentiation.

Eagle Materials is leveraging digitalization and data analytics to sharpen its competitive edge. The integration of technologies like Building Information Modeling (BIM) and IoT sensors allows for significant optimization in supply chain management and project planning. For instance, by mid-2024, the construction industry's adoption of BIM is projected to increase efficiency by up to 20%, a trend Eagle Materials is actively capitalizing on.

Harnessing data-driven insights empowers Eagle Materials to more accurately forecast demand and refine logistics, leading to better inventory control and more efficient operations. This analytical approach supports improved customer service by enabling proactive problem-solving and tailored solutions, a critical factor in the highly competitive materials sector.

This digital transformation is not just about efficiency; it's about fostering operational agility and enhancing decision-making across the organization. By mid-2025, companies that effectively integrate advanced analytics are expected to see a 15-25% improvement in operational performance metrics.

Advanced Logistics and Supply Chain Technology

Innovations in transportation and warehousing, like advanced fleet management systems and real-time tracking, are significantly reducing delivery times and costs for construction materials. For a company like Eagle Materials, optimizing its supply chain through technology directly translates to improved efficiency and greater reliability. This ensures that essential construction inputs reach sites precisely when needed, boosting customer satisfaction and bolstering operational margins.

Eagle Materials likely leverages these advancements to streamline its distribution network. For instance, the adoption of AI-powered route optimization in 2024 is projected to cut fuel consumption by an average of 10-15% for logistics companies. Furthermore, real-time inventory management systems, widely implemented by industry leaders in 2025, reduce stockouts and minimize holding costs, contributing to a more robust and cost-effective supply chain operation.

- Reduced Delivery Times: Technologies like GPS tracking and predictive analytics enhance delivery speed.

- Cost Optimization: Advanced fleet management and route planning cut fuel and labor expenses.

- Improved Reliability: Real-time visibility ensures consistent and timely material availability for construction projects.

- Enhanced Efficiency: Automation in warehousing and logistics minimizes errors and speeds up order fulfillment.

Energy Efficiency Technologies

Technological advancements in energy efficiency are reshaping the manufacturing landscape for companies like Eagle Materials. Innovations such as advanced waste heat recovery systems and more efficient kilns for cement production offer substantial reductions in both operational expenses and environmental footprint. For instance, a modern, energy-efficient cement kiln can consume up to 30% less energy compared to older models.

Eagle Materials' strategic investment in these cutting-edge technologies directly addresses the challenge of volatile energy prices and increasingly stringent environmental regulations. By adopting solutions that minimize energy consumption and emissions, the company not only enhances its financial resilience but also bolsters its commitment to environmental sustainability. This proactive approach is crucial as global energy costs, particularly for natural gas and electricity, saw significant fluctuations throughout 2024, impacting manufacturing sectors worldwide.

- Waste Heat Recovery: Systems that capture and reuse heat generated during production processes can improve overall energy utilization by up to 15%.

- Kiln Efficiency: Newer kiln technologies can reduce specific fuel consumption in cement manufacturing, leading to lower CO2 emissions per ton of cement produced.

- Operational Cost Reduction: Implementing these technologies can lead to direct savings on energy bills, potentially reducing energy costs by 10-20% annually for well-optimized plants.

- Environmental Compliance: Enhanced efficiency aids in meeting emissions targets, such as those related to NOx and SOx, which are becoming more rigorous globally.

Technological advancements are central to Eagle Materials' operational strategy, focusing on automation, digitalization, and energy efficiency. The company is actively integrating robotics and advanced analytics to boost production output and reduce costs, aiming for enhanced precision and scalability. By mid-2025, the industry anticipates a 15-25% improvement in operational performance for companies adopting advanced analytics, a trend Eagle Materials is positioned to leverage.

Innovations in material science are also a key technological factor, driving the development of sustainable building materials. Eagle Materials' R&D in low-carbon cement and recycled gypsum board content is crucial for meeting evolving environmental standards and consumer preferences for green construction. This focus is vital for market differentiation and future growth.

Digitalization efforts, including Building Information Modeling (BIM) and IoT sensors, are optimizing Eagle Materials' supply chain and project planning. By mid-2024, BIM adoption was projected to increase industry efficiency by up to 20%, a benefit the company is actively integrating. These digital tools enhance demand forecasting, logistics, and inventory control, leading to more agile operations and improved decision-making.

Furthermore, technological upgrades in transportation and warehousing, such as AI-powered route optimization, are reducing delivery times and costs. In 2024, AI route optimization was expected to cut fuel consumption by 10-15%. Real-time inventory management systems, widely adopted by 2025, further minimize stockouts and holding costs, creating a more robust supply chain.

| Technology Area | Impact on Eagle Materials | Key Data/Projections |

|---|---|---|

| Automation & Robotics | Improved efficiency, consistent quality, reduced labor costs | Focus on operational improvements often involves technology upgrades (2023) |

| Digitalization & Data Analytics | Optimized supply chain, better demand forecasting, enhanced decision-making | BIM adoption projected to increase efficiency by up to 20% (mid-2024) |

| Material Science Innovations | Development of eco-friendly products, meeting environmental regulations | Growing consumer preference for green construction |

| Transportation & Warehousing Tech | Reduced delivery times and costs, improved reliability | AI route optimization projected to cut fuel consumption by 10-15% (2024) |

| Energy Efficiency | Reduced operational expenses, lower environmental footprint | Efficient kilns can consume up to 30% less energy; waste heat recovery can improve energy utilization by up to 15% |

Legal factors

Eagle Materials faces stringent environmental regulations, especially concerning air emissions like CO2, NOx, and SOx from its cement production facilities. For instance, the U.S. Environmental Protection Agency (EPA) sets limits on these pollutants, requiring significant investment in advanced pollution control equipment. In 2024, companies in the cement industry are increasingly focused on meeting these standards, which can involve millions in capital expenditures for upgrades.

Compliance with these environmental mandates, including water discharge and waste management rules, necessitates substantial capital outlays for pollution abatement technologies. This ongoing commitment to environmental stewardship is crucial for operational continuity and avoiding penalties. The company's 2024 sustainability reports highlight ongoing efforts and investments in these areas.

Looking ahead, potential future regulations, particularly those targeting carbon emissions, could introduce further operational costs or necessitate fundamental shifts in production processes. As of mid-2025, discussions around stricter climate policies are intensifying, potentially impacting energy-intensive industries like cement manufacturing.

Eagle Materials, operating in a heavy industry, must strictly adhere to workplace safety regulations, such as those enforced by OSHA in the United States. These laws cover critical areas like dust control, machinery guarding, and the mandatory use of personal protective equipment (PPE). For instance, OSHA's combustible dust National Emphasis Program (NEP) highlights the agency's focus on preventing fires and explosions in facilities that handle such materials, a relevant concern for cement and gypsum wallboard manufacturers.

Compliance is not merely a legal obligation but a cornerstone of operational integrity for Eagle Materials. A strong safety record prevents costly accidents, protects employees, and avoids significant penalties. In 2023, OSHA reported over 1.7 million citations issued, underscoring the rigorous enforcement environment. Failure to meet these standards can result in substantial fines, legal battles, and severe damage to the company's reputation, impacting investor confidence and customer trust.

Antitrust and competition laws are crucial for Eagle Materials, as they aim to prevent monopolies and ensure fair play in the building materials sector. These regulations directly impact how Eagle Materials can grow, particularly concerning mergers and acquisitions. For instance, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) actively review transactions that could substantially lessen competition. In 2024, the FTC continued its robust enforcement, challenging several large mergers across various industries, signaling ongoing vigilance that would extend to the building materials market.

Operating within these legal boundaries means Eagle Materials must carefully consider the competitive impact of any strategic moves, including pricing. The Sherman Act and Clayton Act, for example, prohibit price-fixing and other anti-competitive agreements. While these laws foster a more equitable market, they can also place constraints on business expansion or market dominance strategies. The ongoing focus on market concentration in 2024 suggests that companies like Eagle Materials will face continued scrutiny on their pricing and acquisition plans to ensure they do not stifle competition.

Product Liability and Quality Standards

Legal frameworks around product liability mean manufacturers like Eagle Materials are accountable for any harm caused by defects in their products. This is particularly relevant for their cement, gypsum wallboard, and paperboard, where failures can lead to significant damage and safety concerns.

Eagle Materials must maintain rigorous quality control to meet or exceed industry standards, thereby minimizing the risk of costly lawsuits and safeguarding their reputation. For instance, adherence to ASTM International standards for construction materials is a key aspect of this.

The company's commitment to quality is not just about avoiding legal trouble; it's fundamental to building and keeping customer trust. Meeting these stringent performance requirements is a critical operational imperative.

Key considerations for Eagle Materials include:

- Ensuring compliance with all federal and state product safety regulations.

- Maintaining certifications from relevant industry bodies, such as those recognized by the American Concrete Institute for cement products.

- Implementing robust quality assurance processes throughout the manufacturing lifecycle.

- Proactively addressing any potential product defects to prevent harm and litigation.

Zoning and Land Use Regulations

Zoning and land use regulations are critical for Eagle Materials, directly influencing where its manufacturing plants and raw material quarries can operate. These local and state laws dictate site selection and expansion possibilities, potentially limiting growth and resource access.

For instance, in 2024, many municipalities continued to tighten zoning restrictions on industrial development, particularly concerning environmental impact and proximity to residential areas. This trend can increase the cost and time required to secure new sites or expand existing operations for companies like Eagle Materials.

- Stricter zoning can increase land acquisition costs for new facilities.

- Expansion of existing quarries may face new environmental review requirements.

- Permitting processes for new plant construction can be lengthy and complex due to land use planning.

- Changes in zoning can impact the long-term viability of current operational sites.

Eagle Materials operates under a complex web of legal and regulatory frameworks that significantly shape its operations and strategic decisions. Compliance with environmental laws, such as those set by the EPA regarding emissions, requires substantial capital investment, with companies in the sector allocating millions for upgrades in 2024 to meet stricter standards. Similarly, workplace safety regulations, enforced by bodies like OSHA, mandate rigorous protocols for dust control and machinery operation, with OSHA issuing over 1.7 million citations in 2023 alone, underscoring the critical need for adherence to prevent hefty fines and reputational damage.

Antitrust laws, enforced by agencies like the FTC and DOJ, scrutinize mergers and acquisitions to prevent market monopolization, impacting Eagle Materials' growth strategies and pricing policies. Product liability laws hold manufacturers accountable for defects, necessitating robust quality control to meet standards like those from ASTM International and avoid costly litigation. Furthermore, zoning and land use regulations critically influence site selection and expansion, with tightening restrictions in 2024 increasing land acquisition costs and lengthening permitting processes.

Environmental factors

The cement industry is a significant source of global carbon emissions, placing companies like Eagle Materials under intense pressure to address climate change. In 2023, the cement sector alone accounted for approximately 7% of global CO2 emissions, highlighting the scale of the challenge. This environmental factor directly impacts Eagle Materials through evolving regulations and public expectations to decarbonize operations.

Eagle Materials is actively pursuing strategies to reduce its carbon footprint. These include exploring alternative fuels, investing in carbon capture technologies, and innovating with low-carbon cement products. For instance, by 2024, many industry leaders are aiming to incorporate at least 15-20% supplementary cementitious materials (SCMs) in their products to lower embodied carbon. Meeting future, more stringent emissions targets presents a substantial hurdle for the company's long-term environmental strategy and operational costs.

Eagle Materials' reliance on raw materials like limestone and gypsum makes resource depletion a key environmental concern. The company must ensure sustainable quarrying practices to maintain its supply chain and minimize ecological disruption. For instance, in 2024, the global demand for cement, a primary product for Eagle Materials, continued to rise, placing further pressure on limestone reserves.

Effective management of industrial waste and promoting building material recycling are critical environmental duties for companies like Eagle Materials. In 2023, the construction and demolition debris generated in the United States was an estimated 600 million tons, highlighting the significant opportunity for recycling within the industry.

Eagle Materials' utilization of recycled paperboard in its products showcases a dedication to circular economy practices, reducing reliance on virgin resources. This aligns with broader industry trends, as the global recycled paper market is projected to reach over $130 billion by 2027.

Continued focus on waste reduction, reuse, and recycling across all product lines is vital for Eagle Materials' environmental stewardship and ensures ongoing compliance with evolving environmental regulations, which often impose stricter controls on waste disposal and recycling rates.

Water Usage and Pollution Control

Eagle Materials, like other players in the cement industry, faces significant water usage challenges. Cement production is inherently water-intensive, requiring substantial amounts for cooling, dust suppression, and material processing. In 2024, the company's operational efficiency hinges on managing this consumption effectively.

To mitigate environmental impact and comply with stringent regulations, robust wastewater treatment systems are crucial. These systems are designed to remove pollutants before water is discharged or reused, ensuring adherence to standards like the Clean Water Act. Failure to manage wastewater properly can lead to substantial fines and damage to community relations.

The potential for water scarcity in operational regions presents a growing concern for Eagle Materials. Regions experiencing drought or increased competition for water resources could impact production costs and continuity.

- Water Intensity: Cement manufacturing can consume significant water volumes per ton of product.

- Regulatory Compliance: Adherence to Clean Water Act and local discharge permits is paramount.

- Wastewater Treatment: Investment in advanced treatment technologies is necessary to prevent pollution.

- Water Scarcity Risks: Operational disruptions and increased costs may arise from water availability issues in certain areas.

Biodiversity and Land Reclamation

Eagle Materials' quarrying operations inherently interact with local ecosystems, making biodiversity and land reclamation critical environmental considerations. The company is tasked with minimizing its ecological footprint through diligent land management and effective site restoration post-extraction.

Stakeholder and regulatory pressure for sustainable land use and biodiversity protection around operational sites is intensifying. For instance, in 2024, the U.S. Fish and Wildlife Service reported that over 130,000 acres of previously mined land were actively being reclaimed for conservation purposes nationwide, highlighting a growing trend that impacts companies like Eagle Materials.

- Ecological Impact: Quarrying can disrupt habitats, affecting local flora and fauna.

- Reclamation Responsibility: Eagle Materials must implement robust plans for restoring mined land.

- Stakeholder Expectations: Regulators and the public increasingly demand evidence of biodiversity conservation.

- License to Operate: Proactive environmental stewardship is vital for maintaining operational permits and social acceptance.

The cement industry's substantial contribution to global carbon emissions, estimated at 7% in 2023, places significant pressure on Eagle Materials to adopt decarbonization strategies. This includes exploring alternative fuels and low-carbon cement products, with industry leaders aiming for 15-20% supplementary cementitious materials by 2024 to reduce embodied carbon.

Resource depletion, particularly for limestone and gypsum, is a key concern, especially with rising global cement demand in 2024 impacting reserves. Furthermore, managing industrial waste and promoting recycling are crucial, given that construction and demolition debris in the U.S. reached an estimated 600 million tons in 2023, presenting recycling opportunities.

Water usage in cement production, vital for cooling and dust suppression, requires efficient management, with robust wastewater treatment systems essential for regulatory compliance. Water scarcity in operational regions poses a growing risk, potentially affecting production costs and continuity.

Biodiversity and land reclamation are critical environmental considerations for Eagle Materials' quarrying operations, with increasing stakeholder and regulatory pressure for sustainable land use. In 2024, over 130,000 acres of mined land were being reclaimed for conservation nationwide, reflecting a broader industry trend.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Eagle Materials is built on a robust foundation of data from official government publications, leading economic indicators, and reputable industry-specific research. We incorporate insights from environmental agencies, legislative updates, and market trend reports to ensure comprehensive coverage.