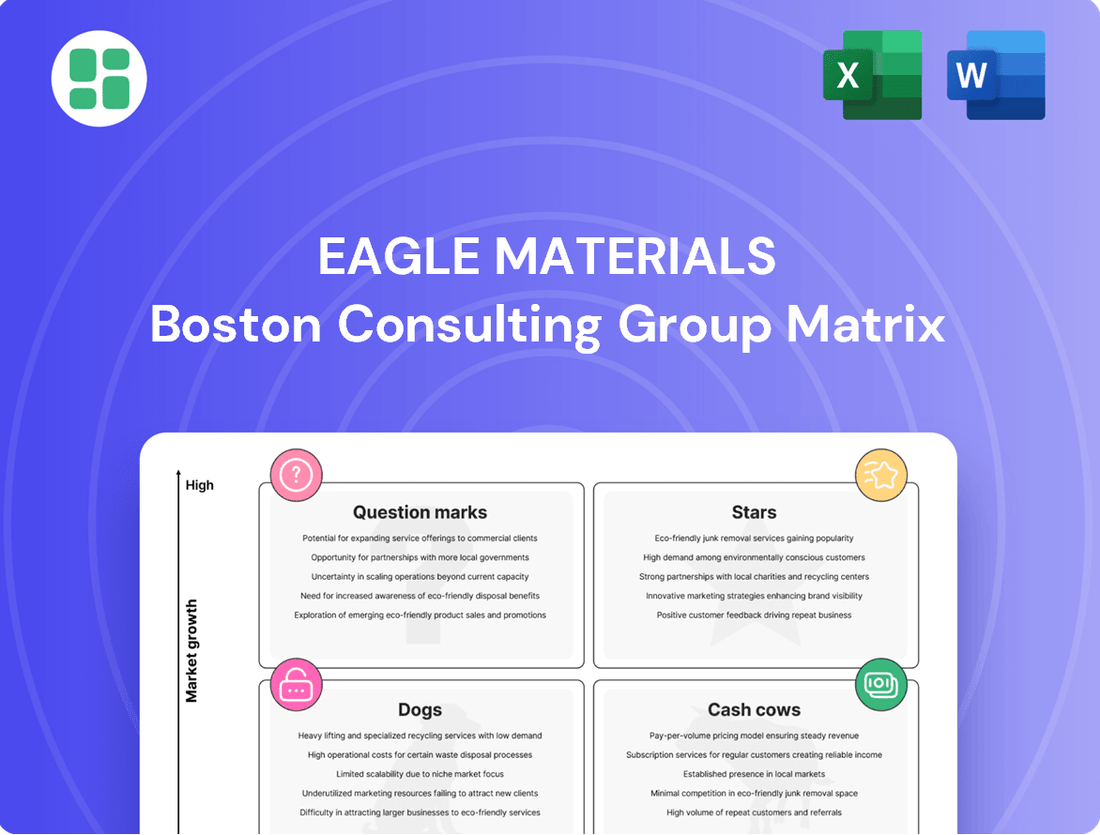

Eagle Materials Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eagle Materials Bundle

Eagle Materials' BCG Matrix offers a powerful snapshot of its product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. Understanding these positions is crucial for strategic resource allocation and future growth.

This preview highlights the core framework, but the full BCG Matrix report provides the detailed analysis and data-driven recommendations you need to make informed decisions. Purchase the complete report to unlock a clear roadmap for optimizing Eagle Materials' product strategy and driving market leadership.

Stars

Eagle Materials commands a leading role in the gypsum wallboard sector, a market benefiting from strong momentum in new housing starts and ongoing urbanization. In 2024, the US saw a significant increase in residential construction, with housing starts projected to reach over 1.4 million units, directly fueling demand for wallboard.

The company's strategic emphasis on expanding its presence in rapidly developing areas, particularly the US South, has been a key driver in capturing a larger share of this growing market. This region consistently shows higher population growth and construction activity compared to other parts of the country.

Eagle Materials' commitment to maintaining its leadership is evident in its substantial capital expenditures, which have been directed towards increasing production capacity and upgrading existing facilities. For instance, the company announced plans in early 2024 to expand its wallboard plant in Texas, adding significant capacity to meet anticipated demand.

Eagle Materials' planned $330 million investment in its Duke, Oklahoma wallboard plant is a significant move. This expansion aims to boost capacity by 25%, which is crucial for meeting growing demand in high-growth markets.

The modernization is also expected to lower manufacturing costs, directly improving the profitability of this product line. This strategic capital expenditure is designed to solidify Eagle Materials' market position in the wallboard sector.

Eagle Materials' gypsum wallboard business benefits significantly from robust demand in the single-family housing sector. This segment has demonstrated remarkable resilience, maintaining steady activity even amidst broader economic uncertainties. For instance, in 2024, housing starts, particularly in key Sunbelt markets where Eagle Materials has a strong presence, continued to show positive momentum, providing a consistent revenue stream.

The company's strategic geographic footprint, heavily weighted towards regions experiencing strong population growth and, consequently, higher housing demand, allows it to effectively capture this sustained interest. This focus positions Eagle Materials to capitalize on the reliable growth engine that single-family residential construction represents for its light materials segment.

Leveraging Sustainable Building Trends

Eagle Materials' gypsum wallboard business is a prime example of a Star in the BCG matrix, driven by the surging demand for sustainable building solutions. Green construction practices are no longer niche; they are becoming mainstream, with consumers and regulators alike prioritizing eco-friendly materials. This trend directly benefits gypsum wallboard due to its inherent recyclability and a comparatively lower environmental footprint than many alternatives.

The market is clearly responding. For instance, the global green building materials market was valued at approximately $265 billion in 2023 and is projected to reach over $500 billion by 2030, showcasing robust growth. Eagle Materials' focus on gypsum aligns perfectly with this expansion, as these products are increasingly specified in projects seeking LEED certification or other environmental accreditations.

- Growing Demand: The global green building market is expanding rapidly, creating significant opportunities for sustainable material providers.

- Environmental Advantages: Gypsum wallboard offers recyclability and a reduced environmental impact, making it a preferred choice for eco-conscious construction.

- Regulatory Tailwinds: Stricter environmental regulations and building codes worldwide favor materials like gypsum, boosting market adoption.

- Market Position: Eagle Materials is well-positioned to capitalize on these trends, leveraging its gypsum production to meet the evolving needs of the construction industry.

Innovation in Product Performance

Ongoing advancements in gypsum board technology, such as the development of lightweight, highly durable, and mold-resistant boards, contribute to its 'Star' status within Eagle Materials' product portfolio. These innovations directly address market demands for improved building materials.

Eagle Materials' dedication to enhancing product performance ensures its offerings align with evolving customer needs and maintain a significant competitive advantage. For instance, their investment in research and development for advanced gypsum formulations is a key driver.

- Market Share Growth: Eagle Materials has seen consistent growth in its gypsum wallboard market share, driven by product innovation.

- Customer Adoption: New product lines, like their enhanced mold-resistant gypsum board, have experienced rapid adoption by builders and contractors.

- Pricing Power: Superior product performance allows for premium pricing, contributing to higher profit margins in this segment.

Eagle Materials' gypsum wallboard business is a clear Star in the BCG matrix, fueled by robust demand and technological advancements. The company’s strategic focus on high-growth regions and capacity expansions, such as the Texas plant upgrade announced in early 2024, directly supports this classification. This segment benefits from increasing housing starts, projected to exceed 1.4 million units in the US in 2024, and a growing preference for sustainable building materials.

The company's investment in its Duke, Oklahoma facility, a $330 million expansion designed to increase capacity by 25%, underscores its commitment to this high-performing product line. Furthermore, innovations like lightweight and mold-resistant gypsum boards have driven market share growth and allowed for premium pricing, enhancing profitability.

The gypsum wallboard segment is a significant contributor to Eagle Materials' overall success, demonstrating strong market share growth and customer adoption. This segment's ability to command premium pricing due to superior product performance further solidifies its Star status, aligning with the broader trend towards green building solutions.

| Product Segment | Market Growth Rate | Relative Market Share | BCG Category |

|---|---|---|---|

| Gypsum Wallboard | High | High | Star |

| Cement | Moderate | Moderate | Cash Cow |

| Aggregates & Concrete | Moderate | Low | Question Mark |

What is included in the product

Eagle Materials' BCG Matrix analyzes its business units by market share and growth rate, guiding strategic investment decisions.

A clear visualization of Eagle Materials' portfolio, simplifying complex strategic decisions.

Cash Cows

Eagle Materials holds a commanding position within the United States cement market, a sector characterized by its maturity and fundamental importance to infrastructure development. This established presence translates into a stable revenue stream, even with typical seasonal or economic dips in construction activity.

The company's operational prowess and cost-effective production methods are key differentiators, allowing it to maintain its competitive edge. For instance, in fiscal year 2024, Eagle Materials reported cement segment revenues of $1.9 billion, underscoring its substantial market penetration and consistent performance.

Eagle Materials' cement business, a cornerstone of its operations, consistently generates substantial operating cash flow. This robust cash generation is crucial for the company's financial health and strategic flexibility.

In fiscal year 2024, Eagle Materials reported significant cash flow from operations, enabling them to reinvest in growth initiatives and reward shareholders. This consistent performance underscores the cash cow status of their heavy materials segment.

Eagle Materials' cement business is a prime candidate for a Cash Cow in its BCG Matrix, largely due to the robust demand fueled by infrastructure spending. The Infrastructure Investment and Jobs Act (IIJA), enacted in late 2021, is a significant driver, allocating substantial funds to transportation and utility projects across the United States. This legislative tailwind is expected to persist for years, providing a stable and growing market for cement.

The IIJA has earmarked over $1 trillion for infrastructure improvements, with a considerable portion directly impacting cement consumption through road construction, bridge repair, and water system upgrades. As of early 2024, a significant portion of these funds are being deployed, translating into increased project starts and, consequently, higher cement demand. Eagle Materials, with its established production facilities and distribution networks, is well-positioned to capitalize on this sustained demand surge.

Pricing Power in Core Markets

Eagle Materials' cement and heavy materials segments are classic cash cows, characterized by their strong pricing power in core markets. The company has shown a consistent ability to raise prices, even when sales volumes dip, a testament to the essential nature of its products and favorable regional market conditions.

This pricing resilience directly translates into robust profit margins, a key indicator of a mature business generating consistent, reliable cash flow. For instance, in fiscal year 2024, Eagle Materials reported a significant increase in its cement segment's average selling price, contributing to healthy profitability despite fluctuating demand.

- Pricing Power: Demonstrated ability to increase prices in core cement and heavy materials businesses.

- Profitability: High profit margins driven by essential product nature and regional market dynamics.

- Cash Generation: Consistent cash flow generation characteristic of a cash cow.

- Fiscal Year 2024 Performance: Reported strong average selling price increases in the cement segment, bolstering profitability.

Recycled Paperboard Profitability

The recycled paperboard segment within Eagle Materials demonstrates robust financial performance, consistently achieving record sales volumes. This strong showing significantly bolsters the operating earnings of the Light Materials sector.

While the market growth for recycled paperboard may not match that of wallboard, its substantial market share and operational efficiencies translate into impressive profitability and substantial cash generation. This segment is a key driver of stable and reliable income for the company.

- Record Sales Volumes: The segment has consistently hit new sales volume highs.

- Positive Earnings Contribution: It makes a significant positive impact on the Light Materials sector's operating earnings.

- High Market Share & Profitability: Despite slower market growth, its dominant market share and efficient operations ensure strong profits.

- Stable Cash Generation: This segment provides a dependable and consistent income stream for Eagle Materials.

Eagle Materials' cement and heavy materials segments are definitively cash cows within its BCG Matrix. These businesses operate in mature markets with consistent demand, particularly bolstered by ongoing infrastructure projects. Their established market positions and operational efficiencies allow for strong pricing power and high profit margins, leading to reliable and substantial cash generation.

The company's cement segment, for example, reported revenues of $1.9 billion in fiscal year 2024, demonstrating its significant market presence. This segment consistently generates robust operating cash flow, which is vital for funding other business areas and shareholder returns. The stability and profitability of these segments are key to Eagle Materials' overall financial strength.

The recycled paperboard segment also functions as a cash cow, consistently achieving record sales volumes and contributing significantly to the Light Materials sector's earnings. Despite potentially slower market growth compared to other segments, its high market share and operational efficiencies ensure strong profitability and a dependable income stream.

| Segment | BCG Category | Fiscal Year 2024 Revenue (Cement) | Key Characteristic | Cash Generation |

|---|---|---|---|---|

| Cement & Heavy Materials | Cash Cow | $1.9 billion | Mature market, strong pricing power | Substantial and consistent |

| Recycled Paperboard | Cash Cow | (Part of Light Materials Sector) | High market share, operational efficiencies | Reliable and stable |

What You’re Viewing Is Included

Eagle Materials BCG Matrix

The Eagle Materials BCG Matrix preview you are viewing is the identical, complete document you will receive upon purchase. This means no watermarks, no altered content, and no hidden surprises – just the fully formatted, professionally analyzed BCG Matrix ready for your strategic decision-making. You can trust that the insights and structure presented here are exactly what you'll be working with to assess Eagle Materials' product portfolio. This preview serves as your direct gateway to a comprehensive strategic tool.

Dogs

Certain older production facilities within Eagle Materials, particularly those in the heavy materials sector, may be exhibiting lower efficiency and higher operating costs. For instance, a facility built in the early 2000s might struggle to match the energy efficiency or output per labor hour of a plant constructed in the late 2010s. These older assets could be classified as 'dogs' if their contribution to overall profitability is marginal or if they demand substantial capital for essential repairs.

These underperforming facilities could represent a drag on Eagle Materials' financial performance, potentially yielding lower returns on invested capital. In 2024, the company reported that its cement segment, which includes older plants, saw a slight decrease in operating income compared to the previous year, partly due to increased maintenance expenses. This suggests that the costs associated with keeping these older sites operational might be outweighing their revenue generation.

Consequently, these 'dog' assets might be prime candidates for strategic review, with options including divestiture to a more specialized operator or substantial investment in modernization to improve their competitive standing. A thorough cost-benefit analysis would be crucial to determine the most effective path forward, balancing the potential for future returns against the immediate costs of overhaul or sale.

Eagle Materials might find its 'dog' segments in regions experiencing a sustained downturn in construction. For instance, areas heavily reliant on a single, now-stagnant industry, like parts of the Rust Belt, could see reduced demand for cement and gypsum wallboard. This lack of new projects, coupled with existing overcapacity, makes these markets challenging for growth.

Consider the Midwest, where certain metropolitan areas have seen slower population growth and thus less new housing starts compared to Sun Belt states. In 2023, for example, while national housing starts saw some recovery, specific Midwestern markets lagged, potentially indicating a dog quadrant for materials suppliers focused there. This slowdown ties up valuable capital in facilities that are not generating significant returns.

Within Eagle Materials' broader product lines, certain legacy variations or niche offerings might be categorized as dogs in the BCG matrix. These could be older types of cement or aggregate products that are losing market relevance due to evolving construction standards or a shift towards more specialized materials. For instance, a specific type of concrete mix that is less energy-efficient compared to newer formulations might fall into this category.

The challenge with these dog products is that their diminishing demand can tie up valuable resources that could otherwise be invested in more promising growth areas. In 2024, companies like Eagle Materials are increasingly focused on sustainability and efficiency; therefore, products that don't align with these trends are likely to see continued decline in sales and market share.

Inefficient Logistics and Distribution Channels

Inefficiencies within Eagle Materials' logistics and distribution channels, such as slower transit times or higher freight expenses, could position certain segments as 'dogs' in the BCG matrix. These operational drags can significantly impact profitability, particularly for products with thinner margins. For instance, if a specific distribution route for cement or aggregates experiences consistent delays, it directly increases carrying costs and reduces the competitiveness of those offerings.

These logistical bottlenecks can become substantial cash drains, eroding the potential returns from otherwise solid product lines. Optimizing these supply chain elements is therefore paramount to avoid these segments becoming perpetual underperformers. In 2024, the average cost of trucking in the US saw increases, underscoring the financial impact of inefficient distribution networks.

- Higher Freight Costs: Inefficient routing or underutilized transport capacity can lead to increased per-unit shipping expenses, directly cutting into profit margins.

- Longer Delivery Times: Delays in distribution can result in lost sales opportunities and decreased customer satisfaction, especially in time-sensitive construction projects.

- Inventory Holding Costs: Extended delivery times can necessitate larger safety stocks, increasing warehousing and inventory management expenses.

- Reduced Competitiveness: When logistical inefficiencies make products more expensive or slower to arrive than competitors', market share can be lost.

Products Heavily Reliant on Fading Demand Cycles

Products heavily reliant on fading demand cycles, often categorized as 'dogs' in a BCG matrix, represent business units with low market share in a low-growth industry. For Eagle Materials, this could manifest in product lines tied to specific, short-term construction booms that are now subsiding. Without a robust diversification strategy into more stable or growing market segments, these products might face declining revenues and profitability.

Consider the scenario where a particular type of cement or aggregate was in high demand due to a specific infrastructure project or a regional housing surge that has now concluded. If Eagle Materials has significant capacity dedicated to such a product and lacks alternative markets or applications, it would fit the 'dog' profile. For instance, if a company heavily invested in specialized concrete for a particular type of bridge construction that is no longer being widely implemented, that product line could become a dog.

- Declining Market Share: A product line experiencing a downturn in demand due to the end of a construction cycle would likely see its market share shrink if competitors pivot more effectively.

- Low Growth Industry: The specific segment of the construction market that the product serves is no longer expanding, indicating a low-growth or declining industry.

- Reduced Profitability: As demand wanes and potentially overcapacity exists, pricing power diminishes, leading to lower profit margins for these products.

- Strategic Re-evaluation Needed: Companies must assess whether to divest these dog products, invest in revitalizing them through new applications, or manage them for cash flow until they are phased out.

Within Eagle Materials' portfolio, certain older production facilities or niche product lines might be classified as dogs. These are typically characterized by low market share in low-growth or declining industries, demanding significant capital for upkeep without generating substantial returns. For instance, a legacy cement product facing reduced demand due to evolving construction standards could be a dog.

In 2024, Eagle Materials' cement segment experienced a slight dip in operating income, partly attributed to increased maintenance on older plants, highlighting the cost drag these assets can represent. Such underperforming units may offer lower returns on invested capital, potentially tying up resources that could be better allocated to growth areas.

These dog segments, whether aging facilities or products with fading demand, necessitate strategic evaluation. Options range from divestiture to specialized operators, to modernization investments aimed at improving efficiency and competitiveness. A thorough cost-benefit analysis is crucial to determine the most effective path forward for these units.

Eagle Materials might encounter dog segments in geographic regions experiencing a sustained construction downturn. For example, areas with slower population growth and fewer new housing starts, like certain Midwestern markets, can lead to reduced demand for cement and gypsum wallboard. This can result in overcapacity and stagnant returns for facilities serving these areas.

| Segment/Product | Market Share | Industry Growth | Profitability | Strategic Implication |

|---|---|---|---|---|

| Older Cement Plants | Low | Low/Declining | Marginal/Negative | Divest or Modernize |

| Legacy Aggregate Products | Low | Low/Declining | Marginal | Phased Out or Repurposed |

| Specific Construction Materials for Stagnant Regions | Low | Low | Low | Evaluate Divestment or Market Diversification |

Question Marks

Eagle Materials' newly acquired aggregates businesses, integrated in late 2024, are currently positioned as question marks within its BCG Matrix. These operations, while immediately boosting production capacity, necessitate substantial ongoing investment to unlock their full growth potential and solidify their market position. Their long-term contribution to Eagle Materials' overall market share and profitability remains a developing narrative.

Eagle Materials' ventures into low-carbon cement technologies, like its collaboration with Terra CO2 for supplementary cementitious material (SCM) production, are currently positioned as question marks within the BCG framework. These initiatives tap into a rapidly expanding market fueled by increasing environmental regulations and customer demand for sustainable building materials, a trend expected to continue growing significantly through 2025 and beyond.

While these emerging technologies offer substantial growth prospects, they currently command a small market share, reflecting their nascent stage of development and adoption. For instance, the overall market for SCMs, while growing, still represents a fraction of the traditional cement market, with low-carbon alternatives being even more niche.

Achieving leadership in this segment will necessitate substantial investment in research, development, and scaling production, alongside efforts to build market acceptance and prove the economic viability and performance of these alternatives. The success hinges on overcoming current technological hurdles and securing widespread adoption as the construction industry increasingly prioritizes decarbonization efforts.

Eagle Materials' strategic expansion into untapped geographic markets often positions them as question marks within the BCG matrix. These are areas where the company has a limited footprint but anticipates substantial future growth, perhaps driven by favorable demographic trends or upcoming construction projects. For example, entering a rapidly urbanizing region in the Sun Belt could represent such an opportunity, demanding significant upfront capital for new facilities and distribution networks.

The success of these ventures is not guaranteed and depends heavily on the speed and effectiveness of market penetration. Eagle Materials must quickly establish a strong market share to justify the initial investment. This often involves aggressive pricing, targeted marketing, and building robust local relationships. The company's ability to adapt to local market dynamics and regulatory environments will be critical.

Advanced Manufacturing Capabilities

Eagle Materials' investments in advanced manufacturing capabilities, such as exploring novel concrete formulations or implementing AI-driven predictive maintenance across its plants, would likely be classified as question marks. These initiatives represent a significant departure from standard modernization, aiming to create entirely new production methods. For instance, the company might be investigating self-healing concrete or advanced composite materials for specialized infrastructure projects.

The potential upside is substantial; successful adoption could lead to a dominant market share in emerging segments, much like early pioneers in 3D-printed construction are finding. However, these ventures carry considerable risk. They demand substantial research and development expenditure, and market acceptance for such radical innovations is often slow and uncertain. For example, the global advanced materials market, which includes many areas Eagle Materials might explore, was projected to reach over $100 billion in 2024, but the specific segments Eagle is targeting may still be in their infancy.

Key considerations for these question mark investments include:

- High R&D Intensity: Significant capital allocation is needed for research, testing, and pilot programs, with uncertain timelines for commercial viability.

- Market Uncertainty: The demand for entirely new production methods or material compositions is yet to be fully established, requiring substantial market development efforts.

- Technological Risk: The success of these advanced manufacturing techniques hinges on overcoming complex engineering and scientific challenges, with a possibility of failure.

- Potential for Disruption: If successful, these capabilities could redefine industry standards and create substantial competitive advantages, potentially capturing significant market share in new or re-segmentized markets.

Digital Solutions and Construction Technology Integration

Exploring and integrating digital solutions like advanced logistics platforms or Building Information Modeling (BIM) services positions Eagle Materials within a high-growth technological market, but currently holds a low market share for a traditional materials company. This strategic pivot requires substantial investment to develop and scale these offerings, aiming to capture a more significant competitive advantage in the evolving construction landscape.

The construction technology market is experiencing rapid expansion. For instance, the global construction technology market was valued at approximately $10.4 billion in 2023 and is projected to reach $32.7 billion by 2030, growing at a CAGR of 17.9% during this period. This presents a significant opportunity for companies like Eagle Materials to invest and gain traction.

- High Growth Market: The construction technology sector is a rapidly expanding area with significant future potential.

- Low Market Share: Eagle Materials currently possesses a small footprint in this technologically driven segment.

- Investment Required: Significant capital outlay is necessary to build robust digital service capabilities.

- Competitive Advantage: Successful integration of these technologies can differentiate Eagle Materials from competitors.

Eagle Materials' question marks represent strategic bets on future growth, demanding significant investment to cultivate. These ventures, whether new acquisitions, innovative technologies, or market expansions, currently hold low market share but operate in high-growth potential areas. Their success hinges on effective capital deployment and market penetration to transition them into stars or cash cows.

BCG Matrix Data Sources

Our Eagle Materials BCG Matrix leverages a robust data foundation, incorporating internal financial performance metrics, industry-specific market share data, and external construction sector growth forecasts to provide a comprehensive strategic overview.