Eagle Materials Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eagle Materials Bundle

Eagle Materials leverages a robust marketing mix, focusing on essential building materials that meet diverse construction needs. Their product strategy emphasizes quality and reliability, crucial for contractors and developers.

Dive deeper into Eagle Materials' strategic brilliance by exploring their pricing architecture, distribution channels, and promotional tactics. Understand how these elements converge to create a powerful market presence and gain actionable insights for your own business.

Product

Eagle Materials Inc.'s core construction materials, primarily Portland Cement (including Portland Limestone Cement) and gypsum wallboard, are essential building blocks for the U.S. construction sector. These products are crucial for everything from residential development to major infrastructure projects. In fiscal year 2024, Eagle Materials reported significant sales in its Cement segment, underscoring the demand for these foundational materials.

Eagle Materials' products are engineered to meet the demanding standards of the construction sector, prioritizing both quality and performance. Their gypsum wallboard, for example, is a top-tier building material celebrated for its natural fire resistance, a critical safety feature for homes and businesses alike.

Eagle Materials is prioritizing sustainable development within its product strategy by expanding its range of blended cement, notably Portland Limestone Cement (PLC). This move directly addresses growing market demand for environmentally conscious construction materials. For instance, in fiscal year 2024, Eagle Materials reported a significant increase in the production of these lower-carbon alternatives.

Expanded Portfolio

Eagle Materials has significantly broadened its product portfolio through a series of strategic acquisitions, notably integrating aggregates and concrete into its core offerings. This expansion positions the company as a more complete provider of essential building materials, catering to a wider range of customer needs.

Recent moves, including acquisitions in Kentucky and Western Pennsylvania, underscore this strategy by extending Eagle Materials' operational footprint and enhancing its product distribution capabilities in key regional markets. These geographic expansions are crucial for capturing greater market share and serving a more diverse client base.

The company's commitment to portfolio expansion is evident in its financial performance. For fiscal year 2024, Eagle Materials reported a substantial increase in revenue, driven in part by the contributions of its newly acquired businesses. Specifically, the aggregates segment saw robust growth, reflecting the successful integration of these operations.

- Aggregates and Concrete Integration: Eagle Materials now offers a more comprehensive suite of building materials, moving beyond its traditional cement focus.

- Geographic Expansion: Acquisitions in Kentucky and Western Pennsylvania have extended the company's market reach.

- Fiscal Year 2024 Performance: The company experienced revenue growth, partly attributed to the integration of new aggregate and concrete businesses.

- Market Position: The expanded portfolio strengthens Eagle Materials' competitive stance as a full-service building materials supplier.

Innovation in Materials

Eagle Materials is actively pursuing innovation in materials, a key element of their product strategy. This includes investing in and exploring new technologies, such as exclusive agreements for low-carbon supplementary cementitious materials (SCMs). These SCMs are crucial for reducing the environmental footprint of concrete. For instance, by Q4 2024, the company reported progress in integrating these advanced materials into their product lines, aiming to capture a growing segment of the market demanding sustainable construction solutions.

These advancements are designed to boost product performance, offering enhanced durability and strength in construction applications. Simultaneously, the focus on SCMs directly addresses the increasing regulatory and consumer pressure for reduced carbon emissions in the building sector. Eagle Materials' commitment to these innovative materials is a strategic move to stay ahead in a market that is rapidly prioritizing sustainability and efficiency.

The company’s investment in these areas is expected to yield significant benefits by:

- Developing next-generation construction materials with superior performance characteristics.

- Significantly lowering the carbon footprint of their cement and concrete products.

- Meeting the evolving demands of environmentally conscious construction projects.

- Securing a competitive advantage through proprietary material technologies.

Eagle Materials' product strategy centers on foundational construction materials like cement and wallboard, with a significant expansion into aggregates and concrete. This diversification, driven by acquisitions, broadens their market appeal and strengthens their position as a comprehensive building materials supplier.

The company is actively innovating with sustainable materials, particularly Portland Limestone Cement (PLC) and low-carbon supplementary cementitious materials (SCMs). This focus on eco-friendly options aligns with market demand and regulatory trends, enhancing product performance and reducing environmental impact.

Eagle Materials' commitment to product enhancement is reflected in its fiscal year 2024 performance, which saw revenue growth partly due to the integration of new businesses and a strong showing in its aggregates segment.

| Product Segment | FY2024 Performance Highlight | Strategic Focus |

|---|---|---|

| Cement | Significant sales, driven by Portland Cement and PLC | Expanding low-carbon alternatives (SCMs) |

| Gypsum Wallboard | Top-tier material with fire resistance | Maintaining quality and performance standards |

| Aggregates & Concrete | Robust growth, strong contribution from acquisitions | Comprehensive building materials offering |

What is included in the product

This analysis offers a comprehensive examination of Eagle Materials' marketing strategies across Product, Price, Place, and Promotion, grounded in their actual business practices and competitive landscape.

It provides a detailed breakdown of Eagle Materials' marketing positioning, ideal for professionals seeking to understand their approach and benchmark against industry standards.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of understanding Eagle Materials' market positioning.

Provides a clear, concise overview of Eagle Materials' 4Ps, removing the guesswork from marketing planning and execution.

Place

Eagle Materials boasts an impressive U.S. distribution network, encompassing over 70 facilities strategically positioned across 21 states. This extensive physical presence, as of early 2024, underscores their commitment to widespread product accessibility. Their operational footprint is designed to efficiently reach and serve a diverse array of regional markets.

Eagle Materials' marketing strategy heavily emphasizes regional market focus, a crucial element given the substantial transportation costs of its core products like cement. By concentrating operations within specific geographic areas, the company effectively controls logistics expenses, which can represent a significant portion of overall costs for heavy materials. This localized approach allows for greater efficiency and responsiveness to the unique demand patterns within each region.

Eagle Materials strategically locates its heavy materials manufacturing, like cement and concrete, in the U.S. heartland, a region with significant infrastructure and industrial demand. This focus leverages proximity to key resources and customer bases, optimizing logistics for bulk products.

Conversely, the company centers its light materials production, such as gypsum wallboard, in the southern U.S. This area experiences strong residential construction activity, allowing Eagle Materials to efficiently serve a growing housing market. For instance, in the fiscal year ending March 2024, Eagle Materials reported that its Cement segment's revenue grew by 4%, reflecting the ongoing demand in infrastructure and industrial projects, many of which are concentrated in the heartland.

Integrated Supply Chain and Logistics

Eagle Materials' integrated supply chain is a core strength, allowing for control from quarry to customer. This vertical integration, encompassing raw material extraction and processing, streamlines operations and reduces reliance on external suppliers. For instance, their extensive network of company-owned aggregate quarries and cement plants forms the backbone of this strategy.

The company leverages a robust logistics network, utilizing both rail and truck transportation to ensure efficient delivery. This multimodal approach enhances flexibility and cost-effectiveness in reaching diverse customer bases across various regions. In the fiscal year ending March 31, 2024, Eagle Materials reported capital expenditures of $350.9 million, a significant portion of which likely supported their logistics and operational infrastructure.

- Vertical Integration: Control over raw materials (aggregates, cement) to finished products.

- Logistics Network: Utilizes company-owned railcars and a fleet of trucks for efficient distribution.

- Efficiency Gains: Reduced lead times and greater reliability in product delivery to construction sites.

- Cost Management: Internal logistics capabilities help manage transportation costs, a key factor in material pricing.

Distribution Channel Expansion

Eagle Materials is actively expanding its distribution channels to better serve growing markets. This strategy involves both building new facilities and acquiring existing ones. For instance, a new slag-cement facility is planned for Houston, a significant industrial hub, and a new terminal is being developed in northern Colorado to capture regional demand.

These strategic expansions are designed to enhance the company's ability to deliver its products efficiently. By increasing its physical footprint, Eagle Materials aims to reduce lead times and improve customer service. This proactive approach to distribution is crucial for meeting the rising demand for construction materials in key growth areas.

- New Slag-Cement Facility: Planned for Houston, Texas, to bolster capacity in a high-demand region.

- Northern Colorado Terminal: Development underway to strengthen presence and distribution efficiency in the Rocky Mountain area.

- Strategic Acquisitions: The company consistently evaluates opportunities to acquire or expand facilities, reinforcing its distribution network.

- Market Responsiveness: These moves directly address increasing customer demand and solidify market share in targeted growth corridors.

Eagle Materials' place strategy leverages a vast U.S. distribution network, featuring over 70 facilities across 21 states as of early 2024. This expansive physical presence is crucial for ensuring product accessibility, particularly for heavy materials like cement and concrete where transportation costs are significant. Their strategically located operations are designed to efficiently serve diverse regional markets, optimizing logistics and responsiveness to local demand patterns.

| Facility Type | Count (Early 2024) | Key Regions Served |

|---|---|---|

| Distribution Facilities | 70+ | 21 States |

| Manufacturing Plants (Cement/Concrete) | Concentrated in Heartland | Infrastructure & Industrial Demand |

| Manufacturing Plants (Gypsum Wallboard) | Concentrated in Southern U.S. | Residential Construction Demand |

What You See Is What You Get

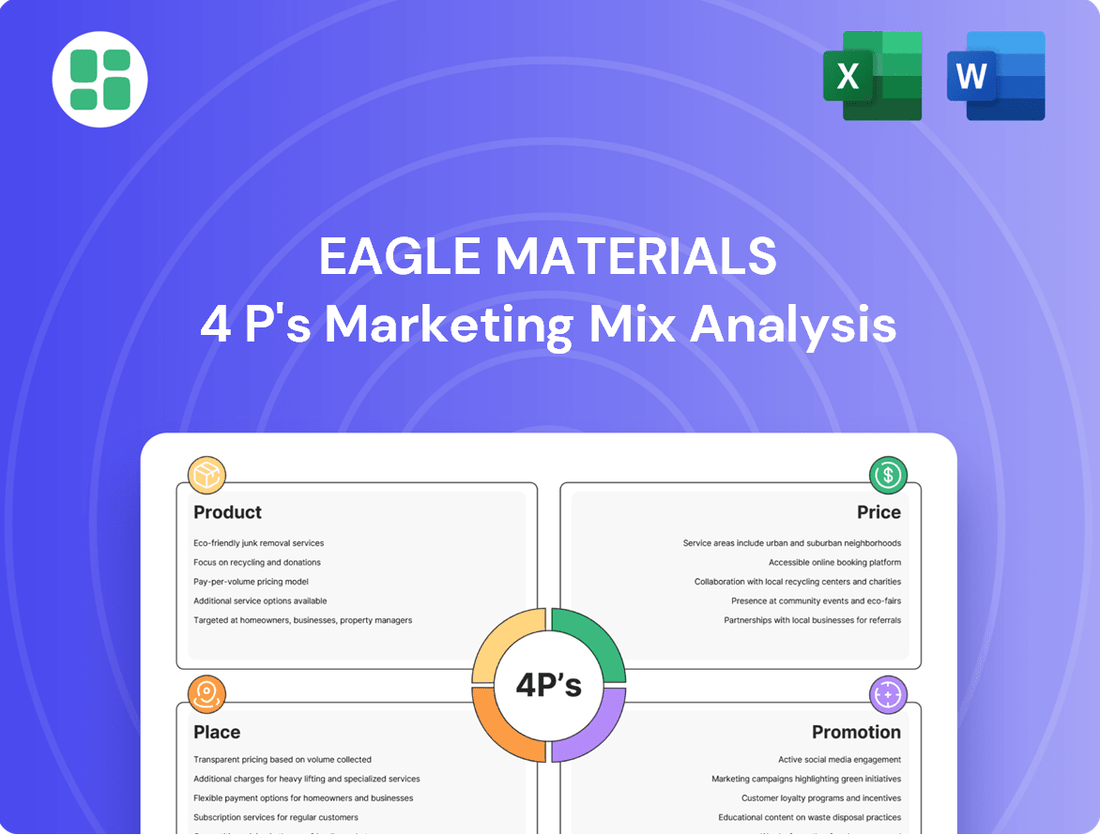

Eagle Materials 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Eagle Materials' 4P's Marketing Mix covers Product, Price, Place, and Promotion in detail. You'll gain immediate access to actionable insights upon completing your purchase.

Promotion

Eagle Materials' marketing strategy is heavily rooted in business-to-business (B2B) engagement, focusing on building strong relationships with major contractors, developers, and distributors. This approach is essential for securing large-scale projects and ensuring consistent demand for their construction materials.

The company's dedicated sales force plays a pivotal role, acting as the primary interface for clients and driving contract negotiations. Their expertise in understanding customer needs and project specifications is key to maintaining a competitive edge in the B2B market.

In the fiscal year ending March 31, 2024, Eagle Materials reported net sales of $2.1 billion, underscoring the significance of their B2B relationships in generating substantial revenue. This figure highlights the success of their targeted engagement with industry professionals.

Eagle Materials prioritizes investor relations as a key component of its marketing mix, focusing on transparent and consistent communication. This includes detailed quarterly earnings calls, comprehensive annual reports, and timely press releases that provide crucial financial data and strategic updates to stakeholders.

For instance, in their fiscal year 2024, which concluded on March 31, 2024, Eagle Materials reported net sales of $2.1 billion. Their proactive approach to sharing such figures aims to foster trust and provide financial analysts and investors with the necessary information for informed decision-making.

The company's commitment to robust financial communication, including the dissemination of information on capital allocation and operational performance, is designed to build and maintain investor confidence. This strategic outreach helps position Eagle Materials favorably in the financial markets.

Eagle Materials' corporate website is the cornerstone of its digital presence, acting as a vital channel for disseminating product details, highlighting their commitment to sustainability, and providing timely investor relations updates. This platform is designed for maximum transparency, offering all stakeholders convenient access to critical company information.

In 2024, Eagle Materials continued to leverage its digital footprint to engage with its audience. For instance, their investor relations section likely provided access to their latest financial reports, such as the Q3 2024 earnings release, which showed a net sales increase of 8% year-over-year, demonstrating the website's role in communicating performance metrics.

Sustainability Reporting and Messaging

Eagle Materials actively communicates its dedication to environmental responsibility, primarily through its annual sustainability reports. These reports detail initiatives aimed at lowering their carbon footprint and introducing more environmentally friendly products. This approach resonates with stakeholders who are increasingly focused on sustainability, thereby bolstering the company's brand reputation.

For instance, in their 2023 sustainability report, Eagle Materials highlighted a 5% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity compared to their 2020 baseline. They also detailed investments in energy-efficient technologies across their cement plants. This commitment is crucial for attracting environmentally conscious investors and customers.

- Environmental Stewardship: Eagle Materials publishes annual sustainability reports detailing their environmental performance and initiatives.

- Carbon Footprint Reduction: The company actively reports on efforts to decrease greenhouse gas emissions, such as a 5% reduction in Scope 1 and 2 emissions intensity by 2023.

- Eco-Friendly Products: Development and promotion of sustainable product lines are key components of their messaging.

- Stakeholder Appeal: Their sustainability reporting aims to attract environmentally conscious stakeholders and enhance brand image.

Strategic Growth Announcements

Eagle Materials frequently highlights its strategic growth initiatives as a core part of its promotional messaging. These announcements often detail significant investments in plant modernizations and capacity expansions, demonstrating a proactive approach to meeting future market demand. For instance, in fiscal year 2024, the company continued to invest in its cement and concrete operations, focusing on efficiency and output enhancement.

These strategic growth announcements serve to underscore Eagle Materials' dedication to solidifying its competitive standing within the industry. By communicating plans for acquisitions and organic growth, the company aims to assure stakeholders of its commitment to delivering sustained, long-term value. This focus on expansion and improvement is a key element in how Eagle Materials communicates its value proposition to investors and customers alike.

Key promotional messages often revolve around strategic growth initiatives, such as plant modernizations, capacity expansions, and acquisitions. These announcements reinforce the company's commitment to strengthening its market position and delivering long-term value.

- Plant Modernization: Investments aimed at improving operational efficiency and production capabilities.

- Capacity Expansion: Initiatives to increase output and meet growing market demand for construction materials.

- Acquisitions: Strategic purchases of complementary businesses to broaden market reach and product offerings.

- Long-Term Value: Communication of how these growth strategies translate into enhanced shareholder returns and market leadership.

Eagle Materials' promotional efforts center on its robust B2B relationships, leveraging a dedicated sales force to secure large contracts and maintain consistent demand. The company's financial transparency, particularly through detailed investor relations communications and its corporate website, builds trust and provides critical data to stakeholders.

Furthermore, Eagle Materials actively promotes its commitment to environmental stewardship through sustainability reports, highlighting initiatives like carbon footprint reduction and eco-friendly products, which appeals to a growing segment of conscious consumers and investors. Strategic growth initiatives, including plant modernizations and capacity expansions, are also key promotional themes, underscoring the company's dedication to long-term value creation and market leadership.

| Key Promotional Focus Areas | Description | Supporting Data/Examples (FY24 unless noted) |

| B2B Relationships & Sales Force | Building strong ties with contractors, developers, and distributors. | Net sales of $2.1 billion in FY24. |

| Financial Transparency & Investor Relations | Providing detailed financial data and strategic updates. | Quarterly earnings calls, annual reports, press releases. |

| Environmental Stewardship | Highlighting sustainability efforts and eco-friendly products. | 5% reduction in Scope 1 & 2 GHG emissions intensity by 2023 (vs. 2020 baseline). |

| Strategic Growth Initiatives | Communicating investments in modernization, expansion, and acquisitions. | Continued investment in cement and concrete operations for efficiency and output. |

Price

Eagle Materials' pricing for its core products like cement and gypsum wallboard is heavily dictated by what the market will bear, reflecting a keen understanding of supply and demand. This means prices aren't static; they adjust based on the real-time needs of the construction sector and broader economic health.

For instance, during periods of robust construction activity, particularly in key regions like the Sun Belt or Texas where Eagle Materials has a strong presence, pricing power tends to increase. Conversely, economic downturns or slowdowns in housing starts can lead to downward pressure on prices, forcing the company to adapt its strategies to remain competitive.

Looking at recent trends, the demand for construction materials remained strong through much of 2023 and into early 2024, supported by infrastructure spending and a resilient housing market in certain areas. This environment allowed companies like Eagle Materials to maintain or even increase prices, with average selling prices for cement showing year-over-year increases in recent reporting periods.

Eagle Materials employs a competitive and value-based pricing strategy for its construction materials. The company aims to price its products competitively within the market while also ensuring that pricing reflects the intrinsic value and essential role these materials play in construction projects.

This approach is evident in their recent performance. For instance, in fiscal year 2024, Eagle Materials reported that despite some fluctuations in sales volume for certain products, they generally achieved higher net sales prices for their core offerings, such as cement and concrete and aggregates.

Eagle Materials leverages cost efficiency as a key pricing lever, stemming from its commitment to operational excellence and ongoing modernization. This focus on being a low-cost producer allows them to offer competitive pricing in the market while still achieving robust profit margins.

Investments in plant upgrades and the adoption of alternative fuels directly contribute to lower manufacturing expenses. For instance, in the fiscal year ending March 31, 2024, Eagle Materials reported a gross profit margin of 28.4%, demonstrating their ability to manage costs effectively even as they invest in efficiency.

Regional and Seasonal Adjustments

Eagle Materials' pricing strategy considers regional differences. For instance, pricing in a high-demand metropolitan area might differ from a more rural location due to varying transportation expenses and local competition. This granular approach ensures pricing aligns with specific market dynamics.

Seasonal demand significantly impacts Eagle Materials' pricing and sales. Construction activity, heavily influenced by weather, often peaks in warmer months. This seasonality can lead to adjustments in pricing to manage inventory and capitalize on periods of high demand, especially for products like cement used in infrastructure projects.

- Regional Pricing Variance: Eagle Materials likely adjusts prices based on local market conditions, transportation costs, and competitive pressures in different geographic areas.

- Seasonal Demand Impact: Weather-dependent construction cycles influence sales volumes, prompting potential short-term price adjustments to align with seasonal demand fluctuations.

- 2024/2025 Outlook: Anticipated infrastructure spending and a robust housing market in certain regions could support stable to increasing pricing power for Eagle Materials throughout 2024 and into 2025, though regional variations will persist.

Impact of Acquisitions on Pricing Power

Eagle Materials' recent acquisitions, such as the purchase of a significant aggregates business in the Sun Belt region in late 2023, bolster its market presence. This expansion directly translates to a larger share of regional markets, which can lead to increased pricing power by reducing the number of viable competitors for customers.

These strategic inorganic growth initiatives are designed to consolidate market positions and improve operational efficiencies. By integrating acquired assets, Eagle Materials can optimize its supply chain and production, ultimately aiming to enhance revenue streams and boost profitability through more favorable pricing structures.

The impact on pricing power is evident in the company's ability to negotiate terms and set prices with a stronger market standing. For instance, in fiscal year 2024, Eagle Materials reported a substantial increase in revenue, partly driven by contributions from its expanded operations.

- Market Share Growth: Acquisitions have increased Eagle Materials' footprint in key growth areas, particularly in aggregates.

- Reduced Competition: Consolidating regional players limits competitive pressures, allowing for more stable pricing.

- Revenue Optimization: Inorganic growth strategies are directly linked to improved revenue generation and profitability metrics.

- Fiscal Year 2024 Performance: The company saw significant revenue growth, demonstrating the positive financial impact of its expansion efforts.

Eagle Materials' pricing strategy is a dynamic blend of market responsiveness, cost leadership, and strategic market positioning. The company leverages its low-cost producer status, driven by operational efficiencies and investments in modernization, to offer competitive prices. This is further enhanced by its value-based approach, ensuring pricing reflects the essential nature of its products.

Recent performance data for fiscal year 2024 indicates that Eagle Materials has successfully translated these strategies into higher net sales prices for key products like cement and aggregates. This pricing power is bolstered by strategic acquisitions, which expand market share and reduce competitive intensity in key regions, contributing to overall revenue growth.

| Metric | FY 2024 (Ending March 31, 2024) | Commentary |

|---|---|---|

| Cement Average Net Sales Price | Increased year-over-year | Reflects strong demand and pricing power. |

| Gross Profit Margin | 28.4% | Demonstrates effective cost management and pricing strategy. |

| Revenue Growth | Substantial increase | Driven by volume, acquisitions, and favorable pricing. |

4P's Marketing Mix Analysis Data Sources

Our Eagle Materials 4P's Marketing Mix Analysis is constructed using official company disclosures, including SEC filings and annual reports, alongside industry-specific market research. We also incorporate data from their corporate website and investor presentations to provide a comprehensive view of their strategies.