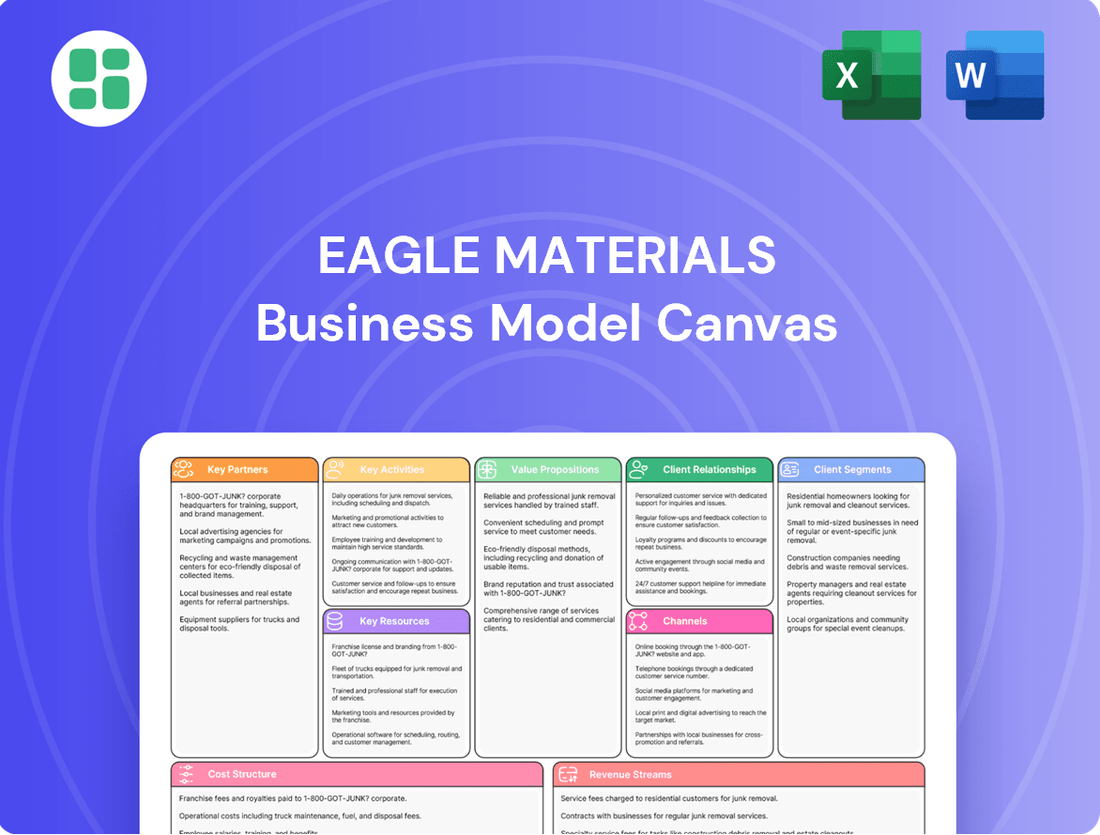

Eagle Materials Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eagle Materials Bundle

Unlock the core strategies behind Eagle Materials's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their key customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance. Perfect for anyone seeking to understand or replicate their winning formula.

Partnerships

Eagle Materials strategically acquires companies like Bullskin Stone & Lime to broaden its reach and product range, especially in developing areas. These acquisitions bolster their presence in specific regions and enrich their heavy materials segment.

In 2024, Eagle Materials continued this strategy, integrating new aggregate facilities that complement their existing infrastructure. This approach strengthens their competitive position by adding valuable assets and expanding their market penetration.

Eagle Materials actively engages in joint ventures to enhance its specialized production capabilities. A prime example is its 50/50 partnership with Heidelberg Materials, operating as Texas Lehigh Cement Company LP. This collaboration focuses on developing and managing specialized facilities, such as slag-cement plants.

These strategic alliances are crucial for producing vital materials and effectively meeting growing market demands. By pooling shared expertise and resources, Eagle Materials can undertake large-scale projects that might be challenging to manage independently.

Eagle Materials actively pursues technology and innovation collaborations, notably through exclusive agreements with companies like Terra CO2. These partnerships are instrumental in developing and implementing advanced, low-carbon cementitious materials.

These collaborations are vital for achieving sustainability targets, securing future sources of supplementary cementitious materials, and complying with increasingly stringent environmental regulations. For instance, the demand for sustainable building materials is projected to grow significantly, with the global green cement market expected to reach over $40 billion by 2027.

Raw Material Suppliers

Eagle Materials' success hinges on robust relationships with its raw material suppliers, primarily for limestone, clay, and natural gypsum. These partnerships are foundational to maintaining their cost-competitive advantage.

The strategic location of these mineral reserves close to their manufacturing plants directly supports their low-cost producer status. This proximity also guarantees a reliable and uninterrupted supply chain, crucial for meeting demand across their varied product offerings.

- Limestone, Clay, and Gypsum: Core raw materials vital for cement, concrete, and gypsum wallboard production.

- Geographic Proximity: Reserves located near production facilities minimize transportation costs and ensure supply continuity.

- Supply Chain Stability: Strong supplier relationships are key to avoiding disruptions and maintaining operational efficiency.

Logistics and Transportation Providers

Eagle Materials relies heavily on its partnerships with logistics and transportation providers to ensure the efficient distribution of its diverse product range. These collaborations are essential for moving bulk materials like cement and aggregates, as well as lighter products such as gypsum wallboard, from its numerous production facilities to customers across the country.

The company's extensive network, comprising over 70 facilities, necessitates robust relationships with freight and transportation companies. This includes trucking services for last-mile delivery and rail services for longer hauls, ensuring that materials reach construction sites and distribution centers in a timely and cost-effective manner. These partnerships are critical for maintaining competitive pricing and meeting project deadlines.

- Trucking and Rail Partnerships: Eagle Materials collaborates with a wide array of trucking and rail operators to manage the transportation of its building materials.

- Nationwide Distribution Network: Over 70 production facilities are supported by these logistics partners, enabling nationwide reach for timely deliveries.

- Cost and Efficiency Focus: The strategic alliances aim to optimize delivery routes and modes of transport, ensuring cost-effectiveness and efficiency in supply chain operations.

- Impact on Customer Service: Reliable transportation is fundamental to meeting customer demands and supporting the construction industry's fast-paced environment.

Eagle Materials' key partnerships extend to joint ventures, such as its 50/50 collaboration with Heidelberg Materials operating as Texas Lehigh Cement Company LP, focusing on specialized facilities like slag-cement plants. They also forge technology alliances, notably with Terra CO2 for developing low-carbon cementitious materials, crucial for meeting sustainability goals and the growing demand for green building solutions.

| Partner Type | Example | Strategic Importance | Data Point |

|---|---|---|---|

| Joint Ventures | Texas Lehigh Cement Company LP (with Heidelberg Materials) | Specialized production capabilities, shared expertise | 50/50 partnership |

| Technology Collaborations | Terra CO2 | Low-carbon materials innovation, sustainability targets | Exclusive agreements |

| Raw Material Suppliers | Limestone, Clay, Gypsum providers | Cost-competitive advantage, supply chain stability | Proximity to plants minimizes transport costs |

| Logistics & Transportation | Trucking and Rail Operators | Nationwide distribution, cost-effective delivery | Supports over 70 production facilities |

What is included in the product

Eagle Materials' business model focuses on providing essential construction materials like cement and concrete to a broad customer base, leveraging efficient production and distribution channels to deliver value and maintain strong customer relationships.

Eagle Materials' Business Model Canvas offers a clear, structured approach to understanding their operations, effectively relieving the pain point of complex strategic analysis by presenting core components on a single, digestible page.

Activities

Eagle Materials' core manufacturing and production activities revolve around the large-scale creation of essential heavy and light construction materials. This encompasses the production of cement, concrete, and aggregates, alongside gypsum wallboard and recycled paperboard.

The company operates an extensive network of 21 cement plants, 10 wallboard plants, and 3 paperboard facilities strategically located across 21 states. This broad operational footprint allows for efficient distribution and caters to diverse regional market demands.

In fiscal year 2024, Eagle Materials reported significant operational output, with cement production reaching 7.6 million tons and aggregates volume at 25.2 million tons. The company also produced 2.5 billion square feet of wallboard, demonstrating its substantial capacity in light building materials.

Eagle Materials' core operations revolve around the meticulous sourcing and management of crucial raw materials, primarily limestone and gypsum. This involves not only the extraction of these vital components through mining but also the strategic procurement from external suppliers to guarantee a consistent and cost-effective supply chain.

Effective management of these raw material reserves is paramount for Eagle Materials. It directly impacts the company's ability to maintain uninterrupted production cycles and achieve cost leadership. In 2024, the building materials industry faced ongoing supply chain challenges and inflationary pressures, making robust raw material management even more critical for profitability and competitive positioning.

Eagle Materials excels in managing its extensive distribution network, which includes numerous cement distribution terminals and direct delivery capabilities. This ensures products arrive at customer sites precisely when needed, a critical factor in the fast-paced construction industry.

The company's logistics strategy focuses on optimizing transportation routes and meticulously managing inventory across its various facilities. This efficiency is key to getting products from their plants to active construction sites without delay or excess cost, contributing significantly to their operational effectiveness.

In 2024, Eagle Materials' commitment to efficient distribution was evident as they continued to serve a broad customer base across various construction sectors, from residential to heavy infrastructure projects, underscoring the importance of their robust logistics in meeting market demand.

Research and Development for Sustainability

Eagle Materials actively invests in research and development to bolster the sustainability of its product offerings. This focus includes the creation of cementitious materials with a reduced carbon footprint, a critical area given the construction industry's environmental impact. For instance, in 2024, the company continued its efforts to innovate in this space, aiming to meet growing market demand for greener building solutions.

The company's R&D strategy also encompasses significant initiatives for waste reduction across its operations. By investing in novel technologies and refining existing processes, Eagle Materials aims to minimize its environmental footprint while simultaneously boosting operational efficiency. This commitment to innovation is designed to yield both ecological and economic benefits.

- Developing Low-Carbon Cementitious Materials: Eagle Materials is dedicated to creating innovative cement products that significantly lower greenhouse gas emissions compared to traditional Portland cement.

- Waste Reduction Initiatives: The company implements advanced technologies and process improvements to minimize waste generation and maximize resource utilization across its manufacturing facilities.

- Investment in New Technologies: Ongoing investment in cutting-edge R&D supports the development of sustainable solutions and enhances overall operational efficiency.

- Environmental Impact Reduction: A core objective of R&D is to demonstrably reduce the company's environmental impact, aligning with global sustainability goals.

Strategic Capital Allocation and Growth Investments

Eagle Materials focuses on disciplined capital allocation, prioritizing organic growth through plant modernizations and expansions. This strategy aims to enhance their competitive advantage as a low-cost producer and increase operational capacity.

The company also pursues prudent acquisitions that align with its strategic goals, further strengthening its market position and driving long-term shareholder value. For instance, in fiscal year 2024, Eagle Materials invested significantly in capital expenditures to support these growth initiatives.

- Organic Growth Investments: Upgrading and expanding existing facilities to boost efficiency and output.

- Strategic Acquisitions: Pursuing well-chosen acquisitions to broaden market reach and product offerings.

- Shareholder Returns: Balancing growth investments with returning capital to shareholders.

- Capital Expenditure Focus: Directing capital towards projects that reinforce their low-cost leadership.

Eagle Materials' key activities center on efficient production and distribution of essential construction materials. They manage raw material sourcing, primarily limestone and gypsum, ensuring a steady supply for their extensive network of cement, wallboard, and paperboard facilities. The company also prioritizes optimizing logistics to deliver products reliably to construction sites.

In fiscal year 2024, Eagle Materials demonstrated robust production capabilities, producing 7.6 million tons of cement and 25.2 million tons of aggregates. Their commitment to efficient distribution was evident in serving diverse construction sectors nationwide.

The company actively invests in R&D for sustainable product development, focusing on low-carbon cementitious materials and waste reduction. This innovation strategy aims to meet market demand for greener building solutions while enhancing operational efficiency.

Disciplined capital allocation, including plant modernizations, expansions, and strategic acquisitions, underpins Eagle Materials' growth. In FY24, significant capital expenditures were directed towards these initiatives, reinforcing their low-cost leadership and expanding operational capacity.

| Key Activity | Description | FY24 Data/Impact |

| Manufacturing & Production | Large-scale creation of cement, concrete, aggregates, gypsum wallboard, and recycled paperboard. | 7.6 million tons cement, 25.2 million tons aggregates, 2.5 billion sq ft wallboard produced. |

| Raw Material Management | Sourcing and managing limestone and gypsum through mining and procurement. | Ensures consistent supply chain; critical for cost leadership amidst 2024 inflationary pressures. |

| Distribution & Logistics | Managing distribution terminals and direct delivery to optimize transportation and inventory. | Ensures timely product arrival at construction sites, supporting diverse project needs. |

| Research & Development | Developing sustainable products like low-carbon cement and implementing waste reduction technologies. | Focus on greener building solutions and operational efficiency improvements. |

| Capital Allocation | Investing in organic growth (plant upgrades/expansions) and strategic acquisitions. | Significant FY24 capital expenditures to enhance competitive advantage and market position. |

Preview Before You Purchase

Business Model Canvas

The Eagle Materials Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You'll gain full access to this comprehensive business model, ready for your strategic planning and analysis.

Resources

Eagle Materials' extensive manufacturing facilities and equipment are the backbone of its operations. The company boasts 8 cement plants, 2 slag cement facilities, and 5 gypsum wallboard plants, complemented by paperboard operations. This robust infrastructure, spread across 21 states, provides significant production capacity and a wide market presence.

Eagle Materials boasts significant owned raw material reserves, a crucial asset for its operations. These reserves primarily consist of limestone, essential for cement production, and gypsum, the key ingredient for wallboard.

This direct control over vital raw materials offers a distinct competitive edge. It guarantees a steady, cost-effective supply of inputs, shielding the company from the price fluctuations and uncertainties inherent in external commodity markets.

As of the first quarter of 2024, Eagle Materials reported approximately 3.4 billion tons of proven and probable gypsum reserves and 1.7 billion tons of proven and probable limestone reserves. This substantial resource base underpins their long-term operational stability and cost management strategies.

Eagle Materials relies on a highly skilled workforce, encompassing operational staff, engineers, and seasoned management. This human capital is crucial for efficient manufacturing processes and navigating the complexities of the construction materials market.

The expertise of their teams in logistics and understanding market cycles directly translates to operational efficiency and strategic decision-making. For instance, in 2023, Eagle Materials reported a robust revenue of $2.1 billion, underscoring the effective execution driven by their skilled personnel.

Established Distribution Network and Terminals

Eagle Materials leverages a significant distribution network, featuring over 28 cement distribution terminals and other crucial logistical assets. This established infrastructure is fundamental to their operational efficiency and market reach.

This extensive network enables Eagle Materials to reliably deliver its products across a broad geographic expanse within the United States. It ensures timely and cost-effective service to a wide array of customer segments, from large construction projects to smaller, regional needs.

- Extensive Reach: Over 28 cement distribution terminals facilitate broad market access.

- Logistical Efficiency: Integrated logistical assets ensure smooth product flow.

- Customer Service: Supports diverse customer needs across various U.S. regions.

Proprietary Technology and Production Processes

Eagle Materials leverages proprietary technology in its advanced manufacturing processes, particularly for cement and concrete. This focus on efficient production, including waste reduction, directly contributes to cost competitiveness and product quality. For instance, in fiscal year 2024, the company reported a strong performance driven by its operational efficiencies.

The company’s investment in and development of advanced manufacturing technologies, including those aimed at producing lower-carbon materials, is a key differentiator. These technological capabilities not only enhance product quality but also significantly reduce production costs and bolster sustainability efforts. This strategic approach allows Eagle Materials to meet evolving market demands for environmentally friendly construction materials.

- Advanced Manufacturing: Proprietary technologies for cement and concrete production.

- Cost Efficiency: Streamlined processes reduce operational expenses.

- Sustainability Focus: Development of low-carbon materials and waste reduction initiatives.

- Market Advantage: Enhanced product quality and competitiveness through technological innovation.

Eagle Materials' key resources are its manufacturing facilities, raw material reserves, skilled workforce, distribution network, and proprietary technology. These assets collectively enable efficient production, cost control, and market responsiveness.

The company's substantial raw material reserves, including billions of tons of gypsum and limestone, provide a significant cost advantage and supply chain security. This control over essential inputs is a cornerstone of their business model, ensuring long-term operational stability.

Their advanced manufacturing processes, supported by proprietary technology, drive cost efficiency and product quality. Eagle Materials' commitment to innovation in materials, such as low-carbon cement, positions them favorably in a market increasingly focused on sustainability.

| Key Resource | Description | Impact |

|---|---|---|

| Manufacturing Facilities | 8 cement plants, 2 slag cement facilities, 5 gypsum wallboard plants, paperboard operations across 21 states. | Significant production capacity and broad market presence. |

| Raw Material Reserves | Approx. 3.4 billion tons of gypsum and 1.7 billion tons of limestone (as of Q1 2024). | Cost advantage, supply chain security, and long-term operational stability. |

| Skilled Workforce | Operational staff, engineers, management with expertise in logistics and market cycles. | Operational efficiency, strategic decision-making, and effective execution. |

| Distribution Network | Over 28 cement distribution terminals and other logistical assets. | Reliable product delivery, broad market access, and customer service. |

| Proprietary Technology | Advanced manufacturing processes for cement, concrete, and low-carbon materials. | Cost competitiveness, product quality, and sustainability advantage. |

Value Propositions

Eagle Materials ensures a steady flow of vital construction components like cement, concrete, and aggregates, alongside light building materials such as gypsum wallboard. This consistent availability is crucial for the successful execution of major building and infrastructure initiatives throughout the U.S.

Eagle Materials prioritizes offering high-quality products at competitive prices. This is achieved by maintaining a low-cost producer status through streamlined operations and modern facilities. For instance, in fiscal year 2024, the company reported a net sales increase of 12% to $2.1 billion, demonstrating strong market demand for their cost-effective offerings.

Their strategic advantage lies in owning significant raw material reserves, which directly contributes to cost control and consistent product quality. This allows them to remain a compelling choice for customers operating in price-sensitive sectors.

Eagle Materials leverages a strategically positioned network of over 70 facilities and numerous distribution terminals across 21 states. This expansive footprint is crucial for ensuring the efficient and timely delivery of its construction materials to a wide customer base.

This extensive geographic reach allows Eagle Materials to effectively serve diverse regional markets, from residential construction to large infrastructure projects. Their ability to respond quickly to customer needs is directly supported by this robust logistical infrastructure.

For the fiscal year ending March 31, 2024, Eagle Materials reported net sales of $2.1 billion, underscoring the scale of operations enabled by their strategic geographic presence and delivery capabilities.

Commitment to Sustainable Building Solutions

Eagle Materials is increasingly focusing on offering building materials and processes that are better for the environment. This includes developing cementitious materials with a lower carbon footprint and actively working to reduce waste and the overall intensity of their carbon emissions.

This dedication to sustainability provides significant value to customers who are looking for construction solutions that align with their own environmental goals. It also helps Eagle Materials stay ahead of and comply with increasingly stringent environmental regulations and market demands for greener building practices.

- Low-Carbon Cementitious Materials: Eagle Materials is investing in and promoting products designed to reduce the embodied carbon in construction projects.

- Waste Reduction Initiatives: The company is implementing programs to minimize waste throughout its operations, contributing to a more circular economy.

- Reduced Carbon Intensity: Through process improvements and technological adoption, Eagle Materials aims to lower the carbon intensity of its manufacturing and supply chain.

- Meeting Evolving Standards: This commitment positions Eagle Materials favorably in a market where environmental performance is becoming a key differentiator and a regulatory requirement.

Support for Critical Infrastructure Development

Eagle Materials' value proposition for critical infrastructure development is deeply rooted in its role as a provider of essential construction materials. The company's cement, aggregates, and concrete are fundamental to the construction, expansion, and ongoing maintenance of the nation's roads, highways, bridges, and other public works. This direct contribution fuels national economic growth and ensures the development of vital public infrastructure.

In 2024, the infrastructure sector continued to be a significant driver of demand for construction materials. For instance, ongoing federal initiatives and state-level projects aimed at modernizing transportation networks and improving utility systems directly benefit companies like Eagle Materials. The company's ability to supply high-quality, reliable materials is crucial for the timely and successful completion of these projects, underscoring its importance in the infrastructure ecosystem.

- Foundation for Infrastructure: Eagle Materials supplies cement, aggregates, and concrete, the building blocks for roads, highways, and public works.

- Economic Growth Driver: By providing these essential inputs, the company directly supports national economic expansion through infrastructure development.

- Project Enablement: The reliability and quality of Eagle Materials' products are critical for the successful and timely completion of vital public infrastructure projects.

- National Modernization: The company plays a key role in the ongoing efforts to modernize transportation networks and upgrade essential public utilities.

Eagle Materials' value proposition centers on being a reliable, high-quality supplier of essential construction materials. Their extensive network of over 70 facilities across 21 states ensures efficient delivery, supporting timely project completion. This strategic positioning, combined with a focus on cost-effectiveness, makes them a preferred partner for a wide range of construction needs.

The company's commitment to owning significant raw material reserves directly translates to cost control and consistent product quality. This vertical integration allows them to offer competitive pricing, a critical factor in the price-sensitive construction market. For fiscal year 2024, net sales reached $2.1 billion, reflecting strong market acceptance of their value-driven offerings.

Eagle Materials also emphasizes environmental responsibility by developing lower-carbon cementitious materials and reducing operational waste. This forward-thinking approach appeals to customers seeking sustainable building solutions and positions the company favorably for future regulatory landscapes. Their investment in greener practices supports both client environmental goals and their own long-term viability.

As a key provider for critical infrastructure, Eagle Materials supplies the foundational cement, aggregates, and concrete necessary for national development. Their materials are integral to building and maintaining roads, highways, and public works, directly contributing to economic growth and modernization efforts. The company's ability to deliver these vital components reliably underpins the success of numerous public projects.

| Key Value Proposition | Description | Supporting Data (FY2024) |

|---|---|---|

| Reliable Supply Chain | Extensive network of facilities for timely delivery of construction materials. | Over 70 facilities across 21 states. |

| Cost Competitiveness | Low-cost producer status due to streamlined operations and raw material ownership. | Net sales of $2.1 billion. |

| Product Quality | Consistent quality derived from control over raw material reserves. | Supports customer needs in price-sensitive sectors. |

| Infrastructure Support | Provision of essential materials for national infrastructure development. | Cement, aggregates, and concrete are foundational for public works. |

Customer Relationships

Eagle Materials prioritizes direct sales, building strong ties with major contractors, builders, and distributors. This direct engagement is facilitated by dedicated account managers who ensure consistent communication and a thorough understanding of each customer's specific project needs.

This direct sales model allows Eagle Materials to offer customized solutions and maintain a deep understanding of their clients' evolving project requirements. For instance, in fiscal year 2024, the company reported net sales of $2.2 billion, reflecting the success of these direct relationships in driving substantial revenue.

Eagle Materials offers robust technical support, ensuring customers can effectively utilize their construction materials. This expertise helps clients optimize usage and overcome on-site challenges, fostering a collaborative relationship.

By sharing deep product knowledge, Eagle Materials moves beyond a transactional supplier role, becoming a trusted advisor. This commitment to customer success, exemplified by their detailed product guides and responsive support teams, directly contributes to customer loyalty and repeat business.

Long-term supply agreements with key customers are a cornerstone of Eagle Materials' strategy, fostering stable demand for their essential building materials. These agreements offer customers the crucial benefit of supply security and predictable pricing, which is vital in the often-volatile construction industry.

These arrangements go beyond simple transactions; they cultivate stronger, more committed relationships between Eagle Materials and its major clients. This mutual commitment underpins consistent revenue streams and operational planning for the company.

For instance, in fiscal year 2024, Eagle Materials reported that its cement segment, a primary beneficiary of such agreements, continued to demonstrate resilience, contributing significantly to the company's overall performance amidst fluctuating market conditions.

Responsive Customer Service

Eagle Materials prioritizes responsive customer service to handle inquiries, process orders efficiently, and resolve any issues that arise, which is crucial in the fast-paced construction sector. This dedication to prompt communication and effective problem-solving directly impacts customer satisfaction, fostering loyalty and encouraging repeat business.

- Timely Issue Resolution: Addressing customer concerns swiftly builds trust and minimizes project disruptions.

- Order Management Efficiency: Streamlined order processing ensures reliable delivery of materials, vital for project timelines.

- Dedicated Support Channels: Providing accessible avenues for communication keeps clients informed and supported.

- Building Long-Term Relationships: Consistently excellent service encourages repeat business and positive referrals, a key driver for sustained growth in the materials supply chain.

Community and Stakeholder Engagement

Eagle Materials actively engages with local communities surrounding its operations, fostering positive relationships through transparent communication and addressing environmental concerns. This commitment is crucial for maintaining operational continuity and building trust. For instance, in 2024, the company continued its efforts to support local initiatives, a practice that underpins its social license to operate.

Participation in industry associations allows Eagle Materials to stay abreast of best practices and contribute to shaping industry standards. This collaboration is vital for navigating regulatory landscapes and promoting sustainable development within the sector. Such engagement reinforces the company's standing as a responsible corporate citizen.

- Community Outreach: Eagle Materials prioritizes open dialogue with local residents, addressing potential impacts and contributing to community well-being.

- Industry Collaboration: Active membership in trade groups facilitates knowledge sharing and advocacy for responsible industry practices.

- Stakeholder Transparency: Maintaining clear communication channels with all stakeholders, including investors and regulators, is a cornerstone of their customer relationship strategy.

- Environmental Stewardship: Demonstrating a commitment to environmental protection through operational improvements and community engagement builds long-term goodwill.

Eagle Materials cultivates deep customer loyalty through a direct sales approach, supported by dedicated account managers who understand specific project needs. This strategy, coupled with robust technical support and product knowledge sharing, positions them as a trusted advisor rather than just a supplier.

Long-term supply agreements provide customers with supply security and predictable pricing, fostering stable demand for Eagle Materials' products, particularly in their cement segment which demonstrated resilience in fiscal year 2024.

Responsive customer service, efficient order management, and timely issue resolution are paramount in the fast-paced construction sector, directly contributing to customer satisfaction and repeat business for Eagle Materials.

Beyond direct customer interactions, Eagle Materials builds goodwill through community engagement and industry collaboration, ensuring transparency and responsible practices that support their social license to operate and industry standing.

| Customer Relationship Aspect | Description | Impact on Eagle Materials | Supporting Data (FY2024) |

| Direct Sales & Account Management | Dedicated managers understand client project needs. | Drives substantial revenue and customized solutions. | Net sales of $2.2 billion |

| Technical Support & Product Knowledge | Expertise aids in optimal material usage and problem-solving. | Fosters collaborative client relationships and loyalty. | N/A (Qualitative focus) |

| Long-Term Supply Agreements | Ensures supply security and predictable pricing for customers. | Underpins stable demand and consistent revenue streams. | Cement segment resilience |

| Responsive Customer Service | Efficient order processing and swift issue resolution. | Enhances customer satisfaction and encourages repeat business. | N/A (Qualitative focus) |

| Community & Industry Engagement | Transparent communication and participation in industry standards. | Builds trust, maintains social license, and enhances corporate reputation. | Continued support for local initiatives |

Channels

Eagle Materials leverages a dedicated direct sales force to cultivate relationships with major players in the construction and industrial sectors. This hands-on approach enables personalized service and the development of tailored solutions for large-scale projects, fostering loyalty and understanding of client needs.

This direct channel is crucial for securing significant contracts and understanding market demands at a granular level. For instance, in fiscal year 2024, Eagle Materials reported total revenue of $2.3 billion, with a substantial portion likely driven by these direct client engagements, highlighting the channel's importance in their overall sales strategy.

Eagle Materials leverages a robust network of company-owned distribution terminals for cement and other construction materials. These facilities are crucial for warehousing and efficiently distributing products across various regions. In 2024, the company continued to optimize this network to ensure timely delivery and maintain optimal inventory levels, a key factor in meeting customer demand for essential building supplies.

Eagle Materials relies heavily on third-party logistics (3PL) providers and a diverse network of freight carriers, including trucking and rail, to efficiently transport its heavy construction materials. This strategic outsourcing is crucial for reaching its broad customer base across various job sites, ensuring timely and cost-effective delivery.

In 2024, the transportation and warehousing sector, which encompasses 3PL services, continued to be a significant cost factor for heavy material producers. For instance, freight costs as a percentage of revenue for similar industries can range from 5% to 15%, directly impacting profitability. Eagle Materials' ability to negotiate favorable rates with its carrier partners is therefore paramount.

The company's extensive operational footprint necessitates robust logistics solutions. By leveraging the expertise and capacity of 3PLs and specialized freight carriers, Eagle Materials can manage the inherent complexities of shipping bulk commodities, ensuring product integrity and customer satisfaction, even in challenging delivery environments.

Dealer and Distributor Networks

Eagle Materials effectively utilizes a network of dealers and distributors to extend its reach, particularly for its light building materials segment, such as gypsum wallboard. This strategy is crucial for accessing a wider customer base, including smaller contractors and retail clients who may not engage in direct bulk purchases.

This distribution channel is key to achieving broader market penetration. For instance, in fiscal year 2024, Eagle Materials reported net sales of $2.1 billion, with a significant portion of its gypsum wallboard sales likely flowing through these established networks, ensuring product availability across diverse geographic regions.

- Broader Market Access: Dealers and distributors provide access to smaller contractors and retail customers, expanding market reach beyond direct sales.

- Product Availability: This network ensures that products like gypsum wallboard are readily available in various markets, catering to diverse project needs.

- Fiscal Year 2024 Performance: Eagle Materials achieved $2.1 billion in net sales in FY2024, underscoring the importance of its distribution channels in driving revenue.

Online Investor Relations and Corporate Website

Eagle Materials leverages its official website and dedicated investor relations portal as a primary channel. This digital presence is crucial for disseminating financial results, updates on sustainability initiatives, and comprehensive corporate information directly to investors, financial analysts, and the broader public. It's a cornerstone for maintaining transparency and ensuring easy access to vital company data.

The company's online platforms are designed to provide a centralized hub for all investor-related communications. This includes quarterly earnings reports, annual reports, investor presentations, and press releases. For instance, in fiscal year 2024, Eagle Materials reported a net sales increase to $2.4 billion, with their website serving as the immediate source for this data and its accompanying details.

- Official Website: The primary gateway for all corporate and financial information.

- Investor Relations Portal: Dedicated section for financial reports, presentations, and SEC filings.

- Transparency and Accessibility: Ensures timely and open communication with stakeholders.

- Digital Communication Hub: Facilitates direct engagement with investors and analysts.

Eagle Materials utilizes a direct sales force for major construction and industrial clients, fostering strong relationships and understanding specific project needs. This channel is vital for securing large contracts, as evidenced by the company's $2.3 billion in total revenue for fiscal year 2024, with direct sales forming a significant component.

The company also operates company-owned distribution terminals for efficient warehousing and delivery of cement and other materials. In 2024, optimizing this network was key to meeting customer demand and ensuring timely product availability across regions.

Furthermore, Eagle Materials relies on third-party logistics providers and various freight carriers to transport its heavy materials, reaching a broad customer base cost-effectively. Managing these logistics is critical, especially considering freight costs can represent 5-15% of revenue in similar industries, impacting profitability.

For its light building materials like gypsum wallboard, Eagle Materials uses a network of dealers and distributors to reach smaller contractors and retail customers. This distribution strategy contributed to the company's $2.1 billion in net sales for gypsum wallboard in fiscal year 2024, broadening market penetration.

The company's official website and investor relations portal serve as key channels for communicating financial results, sustainability updates, and corporate information. In fiscal year 2024, Eagle Materials reported net sales of $2.4 billion, with these digital platforms providing immediate access to such data.

Customer Segments

Residential construction companies, including homebuilders and developers, are key customers for Eagle Materials. They rely on the company's cement and gypsum wallboard for new homes and renovations. Demand from this sector is closely tied to housing starts, mortgage rates, and population growth trends.

In 2024, the U.S. housing market experienced fluctuations, with new single-family home sales showing resilience despite higher interest rates. For instance, data from the U.S. Census Bureau indicated a notable number of new housing starts throughout the year, directly impacting the demand for construction materials like those supplied by Eagle Materials.

Commercial construction enterprises, encompassing businesses focused on building offices, retail spaces, hospitals, and other non-residential structures, represent a core customer segment for Eagle Materials. These businesses have a substantial need for both heavy and light construction materials to bring their projects to life.

The demand from this sector is a significant driver of Eagle Materials' revenue streams, particularly for its cement and aggregates products. For instance, in fiscal year 2024, Eagle Materials reported that its cement segment, heavily utilized in commercial construction, generated approximately $1.8 billion in revenue, underscoring the segment's importance.

Infrastructure and Public Works Contractors represent a critical customer segment for Eagle Materials. This group encompasses government entities and private firms engaged in substantial public projects like highways, bridges, and essential public buildings. Their demand is a significant driver for Eagle Materials' cement and aggregates.

The robust demand from this sector is further fueled by substantial federal infrastructure investment. For instance, the Infrastructure Investment and Jobs Act, enacted in 2021, allocated over $1 trillion to improve roads, bridges, public transit, and water systems, directly benefiting suppliers like Eagle Materials throughout 2024 and beyond.

Industrial Construction Clients

Industrial construction clients, such as those involved in constructing manufacturing plants and complex industrial facilities, are a key customer segment for Eagle Materials. These clients require robust and high-performance materials to ensure the longevity and integrity of their specialized projects. For instance, in 2024, the industrial construction sector continued to invest in infrastructure, with projects demanding advanced concrete and aggregate solutions.

Eagle Materials serves this segment by providing essential foundational and structural materials crucial for building durable industrial infrastructure. This includes a range of products designed to withstand demanding environments and heavy loads. The company's offerings are vital for projects that form the backbone of manufacturing and production capabilities.

- Key Needs: Durability, high-performance materials, structural integrity for demanding environments.

- Project Types: Manufacturing plants, power generation facilities, heavy industrial complexes.

- Market Relevance: Continued investment in industrial infrastructure in 2024 highlights ongoing demand for specialized construction materials.

Other Building Material Manufacturers and Converters

Eagle Materials serves other building material manufacturers and converters by supplying them with recycled paperboard. This is a crucial inter-industry relationship where companies like gypsum wallboard producers utilize Eagle Materials' paperboard as a key component in their manufacturing processes. For instance, in 2024, the construction industry continued its robust demand for wallboard, a primary application for recycled paperboard.

This customer segment represents a vital downstream market for Eagle Materials' recycled paperboard products. These manufacturers integrate the paperboard into their own production lines, transforming it into finished goods for the broader construction sector. The efficiency and quality of Eagle Materials' output directly impact the cost and performance of these converters' end products.

- Inter-industry Supply: Eagle Materials acts as a supplier to other manufacturers, notably gypsum wallboard producers.

- Input Material: Recycled paperboard from Eagle Materials is used as a primary input for these converters.

- Market Integration: This segment highlights Eagle Materials' role within the larger building materials supply chain.

- Demand Driver: The health of the construction sector, and specifically demand for products like wallboard, directly influences this customer segment's purchasing power.

Eagle Materials also serves a segment of other building material manufacturers, primarily supplying recycled paperboard. These converters, such as gypsum wallboard producers, integrate Eagle Materials' paperboard into their own production processes, making it a crucial component for their finished goods.

This inter-industry relationship is vital, as the demand for products like wallboard directly impacts the purchasing power of these converters. For instance, the continued strength in the residential construction market throughout 2024 sustained demand for wallboard, benefiting Eagle Materials' recycled paperboard segment.

The company's recycled paperboard is a key input material, highlighting Eagle Materials' integral role within the broader building materials supply chain. The quality and cost-effectiveness of their paperboard directly influence the performance and pricing of their customers' end products.

| Customer Segment | Key Products Supplied | 2024 Market Relevance |

| Other Building Material Manufacturers | Recycled Paperboard | Continued demand from residential construction supported wallboard production, a primary use for recycled paperboard. |

Cost Structure

Eagle Materials' cost structure heavily relies on raw material procurement, with limestone, gypsum, and aggregates forming a substantial portion of expenses. For instance, in fiscal year 2024, the company's cost of goods sold, which includes these materials, represented a significant outlay, directly influenced by market prices for these essential inputs.

The company's strategy to mitigate price volatility involves efficient sourcing and the management of its own reserves. This vertical integration helps control costs, as seen in their ongoing investments in quarrying operations, ensuring a more stable supply chain and predictable cost of goods sold for their cement and concrete products throughout 2024.

Eagle Materials, as a heavy industrial manufacturer, faces significant energy and fuel expenses. These costs encompass natural gas, coal, oil, and electricity, all vital for powering operations like their cement kilns. For instance, in their fiscal year ending March 31, 2024, the company reported total cost of materials and supplies, which includes energy inputs, as $1.25 billion.

The fluctuating nature of energy prices directly impacts Eagle Materials' operating expenses. This volatility means that the cost of producing cement and other building materials can change considerably from one period to the next, affecting overall profitability and pricing strategies.

Transportation and logistics costs are a significant component of Eagle Materials' expenses, driven by the need to distribute its heavy building materials like cement, concrete, and gypsum wallboard across a broad geographic footprint. These costs are directly impacted by fluctuating fuel prices, the availability and cost of trucking and rail freight services, and the overall efficiency of their supply chain network. For instance, in fiscal year 2024, Eagle Materials reported that freight and transportation costs amounted to $358.9 million, a notable increase from $302.5 million in fiscal year 2023, highlighting the material impact of these operational necessities.

Manufacturing and Operational Costs

Manufacturing and operational costs are a significant component of Eagle Materials' business model. These encompass the direct labor required to run their various plants, as well as the ongoing expenses for maintaining their extensive machinery and facilities. Other overheads tied to operating numerous production sites also fall into this category.

These costs can directly influence profitability, with events like planned maintenance outages having a noticeable impact on quarterly earnings. For instance, in the fiscal year ending March 31, 2024, Eagle Materials reported total cost of goods sold of approximately $1.6 billion, reflecting these substantial manufacturing and operational expenditures.

- Labor: Wages and benefits for plant workers.

- Maintenance: Upkeep of production equipment and facilities.

- Overheads: Utilities, insurance, and other site-specific operating expenses.

- Impact of Outages: Planned downtime for maintenance can affect production output and revenue in specific periods.

Capital Expenditures and Environmental Compliance

Eagle Materials invests heavily in capital expenditures to keep its facilities up-to-date, expand capacity, and meet stringent environmental standards. These are significant, ongoing costs crucial for long-term operational health and sustainability.

In fiscal year 2024, Eagle Materials reported capital expenditures of $349.7 million, a notable increase from $217.9 million in fiscal year 2023. A substantial portion of this spending is allocated to environmental compliance initiatives, ensuring adherence to evolving regulations and promoting responsible operations.

- Capital Expenditures: $349.7 million in FY2024, reflecting investments in facility maintenance, modernization, and expansion.

- Environmental Compliance: A significant portion of capital spending is dedicated to meeting and exceeding environmental regulations.

- Long-Term Investment: These expenditures are strategic, supporting sustainable growth and operational longevity.

- Increased Spending: FY2024 saw a substantial rise in capital outlays compared to FY2023.

Eagle Materials' cost structure is dominated by raw materials, energy, and transportation. These variable costs are directly tied to production volume and market fluctuations. For instance, in fiscal year 2024, the cost of goods sold, heavily influenced by these factors, was approximately $1.6 billion, with freight and transportation alone reaching $358.9 million.

| Cost Category | FY2024 (Millions USD) | FY2023 (Millions USD) |

| Cost of Goods Sold (incl. materials) | ~1,600 | ~1,400 |

| Freight and Transportation | 358.9 | 302.5 |

| Capital Expenditures | 349.7 | 217.9 |

Revenue Streams

Revenue from cement sales, encompassing both Portland cement and slag cement, is a primary income source for Eagle Materials. This revenue is directly tied to the health of the construction sector, including infrastructure development, commercial building, and residential projects.

In the fiscal year ending March 31, 2024, Eagle Materials reported significant revenue from its Cement segment. For instance, during the third quarter of fiscal 2024, cement sales contributed substantially to the company's overall financial performance, reflecting robust demand in its operating regions.

The company's cement pricing and sales volumes are closely monitored, as they are inherently sensitive to fluctuations in construction activity and market pricing dynamics. These factors directly influence the revenue generated from this critical business line.

Sales of gypsum wallboard represent a core revenue stream for Eagle Materials, directly tied to the health of the construction sector. This revenue is primarily generated from supplying materials for both new residential builds and commercial projects, as well as for renovation and repair work. In fiscal year 2024, Eagle Materials reported that its Cement and Gypsum segments together generated approximately $2.1 billion in revenue, with gypsum wallboard being a substantial component of that figure.

Eagle Materials generates significant revenue from selling concrete and aggregates, crucial components for local and regional construction. This segment includes ready-mix concrete, crushed stone, sand, and gravel.

The company's strategic acquisitions in recent years have bolstered this revenue stream, enhancing its market presence. For example, in the fiscal year ending March 31, 2024, Eagle Materials reported that its Heavy Materials segment, which includes aggregates and cement, saw a revenue increase to $1.36 billion, up from $1.05 billion in the prior year.

Sales of Recycled Paperboard

Eagle Materials generates consistent income through the sale of recycled paperboard. This material is a key component in the manufacturing of gypsum wallboard, creating a reliable internal demand. Additionally, the company benefits from external sales to other businesses that convert paperboard for packaging uses.

The company's recycled paperboard segment is crucial for its integrated business model. In fiscal year 2024, Eagle Materials reported significant sales from this area, contributing to overall profitability. This dual demand, both internal for their own wallboard production and external for the packaging sector, underscores the resilience of this revenue stream.

- Internal Demand: Recycled paperboard is a primary input for Eagle Materials' gypsum wallboard production.

- External Sales: The company also sells recycled paperboard to external customers in the packaging industry.

- Fiscal Year 2024 Performance: Sales of recycled paperboard contributed positively to the company's financial results in the most recent fiscal year.

Strategic Acquisition Contributions

Eagle Materials' revenue stream is significantly bolstered by the strategic acquisition of new businesses. These acquisitions immediately add to the company's top-line revenue upon successful integration, contributing to overall growth and market presence. This strategy diversifies revenue sources and strengthens the company's financial performance.

Recent examples of this strategy in action include the acquisition of aggregates businesses located in Kentucky and Western Pennsylvania. These additions not only expand Eagle Materials' geographic footprint but also enhance its product and service offerings, directly impacting revenue generation. The company actively seeks opportunities that align with its growth objectives and market position.

- Acquisition-driven revenue growth: New businesses acquired contribute immediately to the top line.

- Geographic diversification: Acquisitions in Kentucky and Western Pennsylvania expand market reach.

- Strengthened market position: These moves enhance overall revenue and competitive standing.

Eagle Materials' revenue is diversified across several key segments, with cement and gypsum wallboard being primary contributors. The company also generates income from concrete, aggregates, and recycled paperboard. Strategic acquisitions further enhance revenue streams and market penetration.

| Revenue Segment | Fiscal Year 2024 Contribution (Approximate) | Key Drivers |

|---|---|---|

| Cement | Significant portion of $2.1 billion (Cement & Gypsum combined) | Construction demand (infrastructure, commercial, residential) |

| Gypsum Wallboard | Substantial component of $2.1 billion (Cement & Gypsum combined) | New residential construction, commercial projects, renovations |

| Concrete & Aggregates | Part of $1.36 billion (Heavy Materials) | Local and regional construction projects |

| Recycled Paperboard | Contributes to overall profitability | Internal demand for wallboard, external sales to packaging industry |

| Acquisitions | Immediate revenue addition | Expansion into new markets (e.g., Kentucky, Western PA) |

Business Model Canvas Data Sources

The Eagle Materials Business Model Canvas is informed by a blend of financial disclosures, industry-specific market research, and internal operational data. These sources provide a comprehensive view of the company's performance and strategic positioning.