Eagle Materials Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eagle Materials Bundle

Eagle Materials faces moderate buyer power, as customers have some alternatives but are often tied to regional suppliers for bulk materials like cement and concrete. The threat of new entrants is somewhat limited by high capital requirements and established distribution networks, but competitive intensity remains a key factor.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Eagle Materials’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The market for essential raw materials like limestone for cement and natural gypsum for wallboard can feature concentrated regional suppliers. This concentration can grant these suppliers significant leverage in negotiating prices with companies like Eagle Materials. For instance, in some regions, the number of high-quality limestone quarries or gypsum mines may be limited, creating a situation where a few entities control a substantial portion of the supply.

The inherent availability and cost of these geological resources, often intrinsically linked to specific quarry or mine locations, directly influence a supplier's bargaining power. If a particular quarry possesses unique geological characteristics making its output particularly suitable for cement production or wallboard manufacturing, its importance and thus its power increase. This scarcity or unique quality can make it difficult for Eagle Materials to switch suppliers easily, reinforcing the existing supplier's position.

Furthermore, Eagle Materials' reliance on a few large-scale energy providers for its industrial operations, such as natural gas and electricity, also shapes supplier power. In 2024, energy costs remain a critical component of manufacturing expenses. Price volatility in these energy commodities directly impacts operational costs for Eagle Materials, and the limited number of major energy suppliers in certain operating areas can mean these providers hold considerable sway over pricing and terms, directly affecting the company's profitability.

The volatility of energy costs significantly impacts the bargaining power of suppliers in the construction materials industry. Processes like cement production and gypsum drying are highly energy-intensive, making natural gas and electricity substantial input expenses for companies like Eagle Materials.

Recent global events have exacerbated this, leading to unpredictable energy price swings. For instance, in early 2024, natural gas prices saw considerable fluctuations, impacting operational budgets for manufacturers. This instability grants energy suppliers greater leverage, as they can dictate terms more forcefully.

Eagle Materials, like other producers, faces the challenge of absorbing these rising costs or passing them on. If they cannot effectively transfer the increased energy expenses to their customers, their profit margins can be significantly compressed, highlighting the suppliers' enhanced bargaining power.

Eagle Materials might face substantial costs if it needs to switch suppliers for specialized inputs or proprietary processing chemicals. These costs could include retooling manufacturing equipment, the lengthy process of re-qualifying new materials to meet quality standards, and the potential for production disruptions during the transition. For instance, in the construction materials sector, integrating a new aggregate supplier might require extensive testing and adjustments to concrete mix designs, a process that can take months and incur significant expense.

Limited Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Eagle Materials' core businesses, such as cement or gypsum wallboard production, is largely constrained. This is due to the substantial capital outlay, specialized technical knowledge, and established distribution channels necessary for such ventures. Consequently, suppliers are unlikely to become direct competitors, which mitigates a significant source of their potential bargaining power.

This limited forward integration capability means suppliers cannot easily leverage their position by entering Eagle Materials' markets. For instance, a quarry operator supplying limestone for cement production would face immense hurdles in building and operating a cement plant, a process that can cost hundreds of millions of dollars. This barrier effectively keeps suppliers in their role, rather than as potential rivals.

However, this doesn't negate supplier power stemming from other factors.

- Control over unique or scarce raw materials: Suppliers with exclusive access to high-quality gypsum or specific aggregate types can exert considerable influence.

- Market concentration: If only a few suppliers dominate the market for a critical input, their bargaining power increases.

- Lack of substitutes: The absence of viable alternative materials for certain production processes further strengthens supplier leverage.

Impact of Labor Costs and Availability

The availability and cost of skilled labor in the mining, processing, and transportation sectors can significantly impact Eagle Materials' supply chain costs. For instance, a shortage of experienced heavy equipment operators or truck drivers in 2024 could drive up wages, directly increasing the cost of raw material extraction and delivery. This, in turn, translates to higher input prices for Eagle Materials, bolstering the bargaining power of suppliers who face these increased labor expenses.

Labor-related cost increases upstream can be substantial. For example, if the average hourly wage for mining equipment operators saw a 5% increase nationally in 2024 due to demand, this would directly add to the cost of extracting aggregates. This cost escalation is then passed on, making raw materials and transportation services more expensive for manufacturers like Eagle Materials.

- Labor Shortages: In 2024, sectors like construction and logistics experienced ongoing labor shortages, particularly for specialized roles.

- Wage Inflation: Reports indicated an average wage growth of around 4-5% across many industrial sectors in the US during 2024, impacting supplier operating costs.

- Transportation Costs: Increased driver wages and fuel surcharges, often linked to labor availability, contributed to higher freight expenses for raw materials.

- Upstream Cost Pass-Through: Suppliers facing these labor cost pressures are likely to pass them on to customers like Eagle Materials through higher material and service prices.

Suppliers of essential raw materials like limestone and gypsum, particularly those with unique geological properties or limited regional availability, can exert significant bargaining power over Eagle Materials. This power is amplified when substitutes are scarce or difficult to qualify, as demonstrated by the substantial costs associated with switching aggregate suppliers, which can involve months of testing and retooling. In 2024, labor shortages and wage inflation in mining and transportation sectors further bolstered supplier leverage, with average wage growth around 4-5% nationally impacting upstream costs.

| Factor | Impact on Eagle Materials | 2024 Data/Context |

|---|---|---|

| Raw Material Scarcity/Uniqueness | Increased input costs, limited supplier options | Concentrated regional suppliers for high-quality limestone and gypsum. |

| Switching Costs | High costs and production disruptions for new suppliers | Months of testing and re-qualification for new aggregate sources. |

| Labor Costs (Upstream) | Higher raw material and transportation prices | 4-5% average national wage growth in industrial sectors; driver shortages impacting freight. |

| Energy Costs | Increased operational expenses, reduced profit margins | Natural gas price volatility in early 2024 directly impacted manufacturers. |

What is included in the product

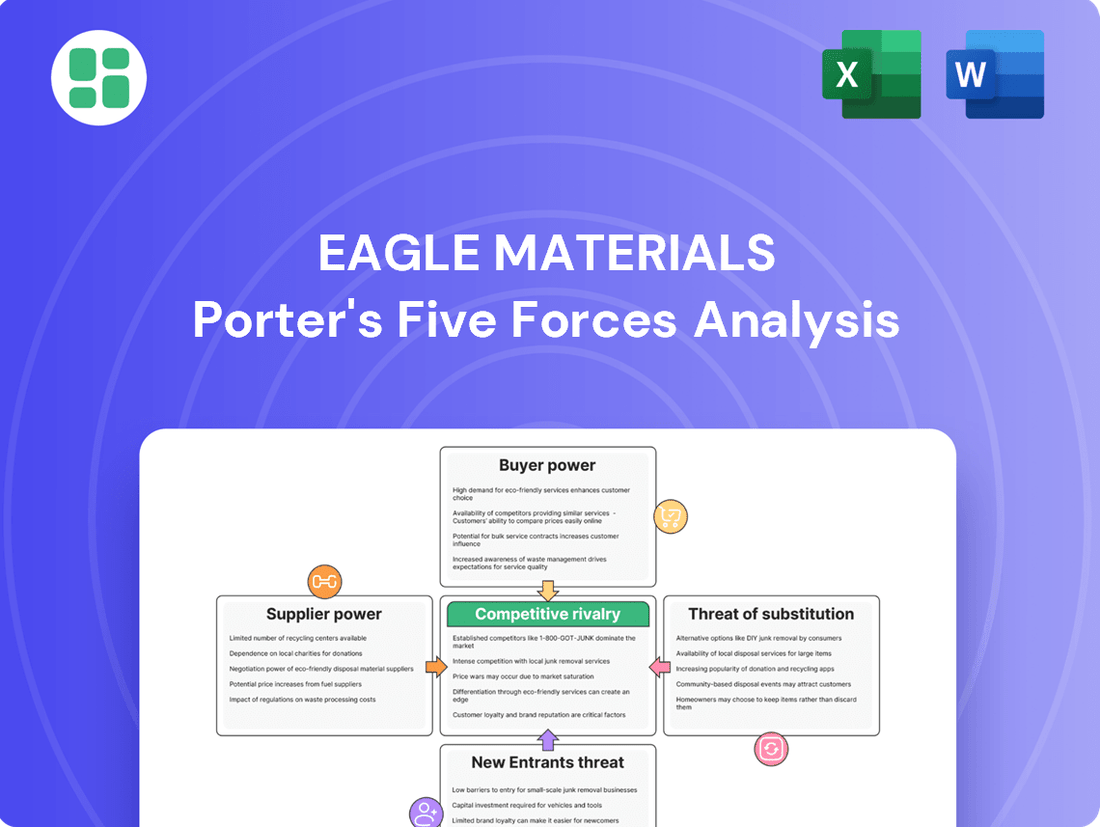

This Porter's Five Forces analysis for Eagle Materials dissects the competitive intensity within the building materials industry, focusing on buyer and supplier power, the threat of new entrants and substitutes, and the rivalry among existing players.

Quickly identify and mitigate competitive threats with a visual breakdown of buyer power, supplier leverage, and new entrant risks.

Customers Bargaining Power

Eagle Materials' customer base is quite varied, encompassing residential builders, commercial developers, and infrastructure projects, alongside distributors. This broad reach generally diffuses individual customer power.

However, the dynamic shifts when dealing with substantial infrastructure projects or large commercial ventures. These customers, by virtue of the sheer volume of materials they require, gain considerable leverage in negotiating prices, potentially impacting Eagle Materials' margins.

Similarly, major distributors, due to their aggregated purchasing power, also possess a degree of influence in price discussions with suppliers like Eagle Materials.

Eagle Materials operates in markets where its core products, like cement and gypsum wallboard, are largely considered commodities. This lack of significant product differentiation means customers, particularly in the construction sector, are highly attuned to price. In 2024, the competitive landscape for these materials remained intense, with project bids often favoring the lowest cost option.

This inherent price sensitivity directly impacts Eagle Materials' bargaining power. When customers can easily substitute one supplier for another based primarily on price, they exert considerable downward pressure on the company's margins. For instance, in large-scale construction projects, a few percentage points difference in material cost can translate to substantial savings for the buyer, making price a paramount consideration.

Consequently, Eagle Materials must maintain rigorous cost control and operational efficiency to remain competitive. The company's ability to secure contracts and maintain profitability is directly linked to its cost structure relative to its competitors. Any increase in input costs for Eagle Materials, such as energy or raw materials, directly translates to a challenge in passing those costs onto price-sensitive customers.

While Eagle Materials' products are crucial for construction, customers generally encounter moderate costs when switching suppliers. These costs can involve reconfiguring delivery logistics, getting new materials approved for ongoing projects, or setting up new payment terms.

For instance, a construction company might spend several weeks re-qualifying a new concrete supplier, impacting project timelines. This transition period, coupled with potential initial quality variations, presents a hurdle.

However, the strength of existing supplier relationships, a track record of consistent product quality, and dependable delivery schedules can significantly anchor customers to Eagle Materials, making the decision to switch less straightforward despite the moderate switching costs.

Access to Market Information by Customers

Customers, particularly large contractors and distributors in the construction materials sector, possess considerable leverage due to their easy access to market information. This includes detailed insights into pricing structures, product availability, and the array of alternative suppliers available. For instance, in 2024, the readily available data on cement prices across different regions allowed major buyers to pinpoint the most cost-effective options.

The inherent transparency within the construction materials market, further amplified by industry publications and the competitive nature of bidding processes, equips customers with the ability to meticulously compare different suppliers' offerings. This informed position directly translates into enhanced bargaining power, enabling them to negotiate more favorable terms and pricing.

- Informed Purchasing Decisions: Customers can readily compare prices and product specifications from multiple suppliers.

- Negotiating Leverage: Access to market data empowers customers to demand better pricing and contract terms.

- Supplier Competition: Increased transparency forces suppliers to remain competitive to retain business.

- Impact on Profitability: Lower input costs for customers can directly improve their project margins.

Backward Integration Potential is Low

The threat of customers integrating backward into the production of cement, gypsum wallboard, or recycled paperboard for Eagle Materials is very low. This is primarily due to the significant capital requirements, stringent regulatory approvals, and the specialized operational knowledge needed for efficient production. For instance, establishing a new cement plant can cost hundreds of millions of dollars, a barrier most end-users cannot overcome.

This limited backward integration potential significantly curtails a key source of customer power. Customers are therefore unlikely to shift to self-production, maintaining their dependence on specialized suppliers like Eagle Materials.

- High Capital Investment: Building a cement plant can cost upwards of $500 million, while a wallboard plant requires tens of millions.

- Regulatory Complexity: Obtaining permits and adhering to environmental regulations for manufacturing these materials is a lengthy and costly process.

- Specialized Expertise: Efficiently managing the complex chemical processes and logistics involved in cement and wallboard production demands specific technical skills.

Customers of Eagle Materials, particularly large construction firms and distributors, wield significant bargaining power due to the commodity nature of products like cement and wallboard, where price is a primary differentiator. In 2024, intense market competition meant buyers could easily switch suppliers for marginal cost savings, putting downward pressure on Eagle Materials' margins.

While switching costs for customers are moderate, involving logistical adjustments and approval processes, the transparency of pricing and availability in the construction materials market in 2024 empowered buyers to negotiate favorable terms. The threat of backward integration by customers is minimal, given the substantial capital and expertise required for production.

| Factor | Impact on Eagle Materials | 2024 Context |

|---|---|---|

| Product Commoditization | High customer price sensitivity | Intense competition favored lowest-cost bids for cement and wallboard. |

| Switching Costs | Moderate, but relationships and reliability anchor customers | Logistical planning and supplier qualification can take weeks. |

| Information Availability | Empowers customers to negotiate better pricing | Regional cement price data readily available to major buyers. |

| Backward Integration Threat | Very Low | New cement plant costs can exceed $500 million. |

Preview Before You Purchase

Eagle Materials Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Eagle Materials, detailing the competitive landscape and strategic positioning of the company within the building materials industry. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, offering actionable insights without any placeholders or alterations. You're looking at the actual document; once your purchase is complete, you'll gain instant access to this precise file, empowering you with a thorough understanding of Eagle Materials' market dynamics.

Rivalry Among Competitors

Eagle Materials operates in a U.S. construction materials market, especially for cement and heavy building materials, where several large, established national and international companies compete fiercely. Key rivals like Martin Marietta Materials, Vulcan Materials Company, Cemex, and Holcim are significant players, meaning Eagle Materials must constantly adapt its strategies and optimize its operations to maintain its market position.

The construction industry's growth prospects for 2025 present a complex picture. The American Cement Association anticipates a modest dip in cement consumption, though future demand is buoyed by burgeoning AI data centers and essential infrastructure investments.

While the Bipartisan Infrastructure Law is poised to stimulate public construction, residential and non-residential segments are currently navigating headwinds from elevated interest rates. This fragmented recovery intensifies competition among firms vying for limited project opportunities.

For foundational building materials like Portland cement and standard gypsum wallboard, the ability to stand out from competitors is often quite slim. This means that the main battleground for these products is usually price, how reliably you can deliver, and how efficiently you can get it to the customer. In 2024, the construction industry's reliance on these commodities means that even small price fluctuations can significantly impact market share.

High Exit Barriers

The heavy construction materials sector, where Eagle Materials operates, presents considerable exit barriers. Companies are burdened with substantial fixed assets, encompassing large manufacturing facilities, quarrying operations, and extensive distribution infrastructure. These significant capital outlays make it extremely difficult and expensive for firms to leave the market.

Consequently, even when market conditions deteriorate, existing players are compelled to stay operational. This persistence intensifies competitive rivalry, as companies fight harder for a shrinking or stagnant market share, rather than exiting.

- High Capital Investment: The construction materials industry requires massive upfront investment in plants and equipment, creating a significant barrier to entry and exit.

- Asset Specificity: Assets like cement kilns or aggregate processing plants are highly specialized and lack alternative uses, making them difficult to sell or repurpose.

- Continued Operation During Downturns: Companies often continue to operate at reduced capacity rather than incurring substantial losses from asset disposal, keeping supply and competitive pressure elevated.

- Industry Consolidation Trends: While consolidation can occur, the sheer scale of assets means that even smaller players with specialized regional operations might remain, contributing to ongoing rivalry.

Capacity Utilization and High Fixed Costs

Eagle Materials, like many in the building materials sector, faces intense rivalry driven by substantial fixed costs. These costs, stemming from maintaining plants, machinery, and a skilled workforce, necessitate high capacity utilization for profitability. For instance, cement plants typically have fixed costs that can represent a significant portion of their operating expenses, requiring continuous operation to spread these costs over a larger production volume.

When demand falters, this cost structure creates a powerful incentive for companies to engage in aggressive pricing. The urgency to keep production lines running and avoid underutilization penalties pushes firms to accept lower margins to secure sales. This leads to price wars, especially during economic downturns or periods of oversupply, directly impacting the profitability of all players, including Eagle Materials.

- High Fixed Costs: Building materials manufacturers incur substantial expenses for plant upkeep, machinery, and labor, making efficient operation crucial.

- Capacity Utilization Pressure: To cover these fixed costs and achieve profitability, companies must operate their facilities at high utilization rates.

- Aggressive Pricing: Softening demand often triggers price reductions as firms compete fiercely for market share to maintain production levels.

- Margin Erosion: This price competition, fueled by the need to utilize capacity, can significantly depress profit margins across the industry.

The competitive rivalry within the U.S. construction materials market, particularly for cement and heavy building materials, is intense. Major players like Martin Marietta Materials and Vulcan Materials Company vie for market share, making differentiation difficult for products like Portland cement and gypsum wallboard, where price and reliable delivery are paramount. In 2024, this commodity nature means even minor price shifts significantly impact market standing.

The industry's high capital investment and asset specificity create substantial exit barriers, forcing companies to remain operational even during downturns. This persistence intensifies competition, as firms fight for market share rather than withdrawing, leading to price pressures and margin erosion, especially when demand softens.

| Competitor | Primary Products | Estimated 2024 Market Share (U.S. Cement) |

|---|---|---|

| Martin Marietta Materials | Aggregates, Cement, Ready Mixed Concrete | ~10% |

| Vulcan Materials Company | Aggregates, Cement, Asphalt, Ready Mixed Concrete | ~9% |

| Cemex | Cement, Aggregates, Ready Mixed Concrete | ~7% |

| Holcim | Cement, Aggregates, Ready Mixed Concrete, Building Solutions | ~6% |

SSubstitutes Threaten

The construction sector's increasing focus on sustainability is driving the development and adoption of alternatives to traditional Portland cement. These innovations, such as low-clinker cements and geopolymer concrete, directly challenge conventional cement's market share by offering reduced environmental impact.

These sustainable options, incorporating materials like fly ash and slag, are gaining traction as the industry seeks to lower its carbon footprint. For instance, the global market for green cement is projected to reach $60.5 billion by 2030, indicating a significant shift away from traditional products and a growing threat to established cement producers like Eagle Materials.

The threat of substitutes for Eagle Materials' core products, particularly gypsum wallboard and cement, is growing with the rise of alternative building materials. Innovations like mass timber, hempcrete, and even recycled plastic bricks offer compelling advantages such as reduced environmental impact and enhanced insulation properties. For instance, the mass timber market, while still nascent, saw significant growth in 2023, with projects like the Ascent building in Milwaukee, Wisconsin, showcasing its potential for high-rise construction, directly challenging traditional concrete and steel.

Customer willingness to adopt green solutions is a significant factor influencing the threat of substitutes for companies like Eagle Materials. There's a clear trend showing consumers, businesses, and even governments increasingly favoring sustainable building materials. This growing environmental awareness means that even if greener options have a slightly higher upfront cost, people are more inclined to choose them to lessen their environmental footprint.

This shift in preference directly boosts the threat of substitutes for Eagle Materials' traditional offerings. For instance, a 2024 report indicated that 65% of construction companies are actively seeking to incorporate more recycled or low-carbon materials into their projects, a notable increase from previous years. This heightened demand for eco-friendly alternatives means that products offering environmental benefits, even if not perfectly comparable in every aspect, pose a credible threat to established market share.

Technological Advancements in Material Science

The threat of substitutes for Eagle Materials is amplified by rapid technological advancements in material science. Ongoing research is consistently yielding new materials with superior performance, such as enhanced strength or energy efficiency, directly challenging traditional offerings.

Innovations like engineered cementitious composite (ECC) and graphene-reinforced concrete present compelling alternatives. For instance, ECC can exhibit significantly higher tensile strain capacity than conventional concrete, offering greater resilience in seismic zones.

These advanced materials can reduce lifecycle costs through increased durability and reduced maintenance requirements. As of early 2024, the global advanced materials market is projected to reach hundreds of billions of dollars, indicating substantial investment and adoption potential for these substitutes.

- Engineered Cementitious Composites (ECC): Offer enhanced ductility and crack resistance, potentially reducing the need for reinforcement in certain applications.

- Graphene-Reinforced Concrete: Demonstrates increased compressive strength and reduced permeability, leading to longer service life and lower maintenance costs.

- Advanced Polymers and Composites: Provide lightweight alternatives with high strength-to-weight ratios, suitable for specialized construction projects.

- Sustainable Building Materials: Growing demand for eco-friendly options like recycled aggregates or bio-based materials also presents a substitution threat.

Regulatory and Environmental Pressures

Stricter environmental regulations and policies promoting green building and circular economy principles are compelling the construction industry to shift towards more sustainable materials. This regulatory push, alongside corporate sustainability commitments, creates a strong incentive for customers to explore and adopt substitutes, directly impacting the demand for traditional heavy construction materials.

For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize embodied carbon reduction in construction materials, influencing project specifications. Many states and municipalities have also introduced or strengthened building codes requiring higher percentages of recycled content or mandating the use of low-carbon alternatives.

- Growing demand for recycled and reclaimed materials: Initiatives promoting a circular economy are increasing the viability and adoption of recycled concrete aggregate and other reclaimed materials as substitutes for virgin resources.

- Increased focus on embodied carbon: Regulations and market preferences are driving demand for materials with lower embodied carbon footprints, pushing innovation in concrete mixes and alternative binders.

- Government incentives for sustainable construction: Tax credits and grants for green building projects, often tied to material choices, further encourage the use of substitute materials over traditional ones.

The threat of substitutes for Eagle Materials' core products like cement and gypsum wallboard is significant and growing. Innovations in material science and increasing demand for sustainable building practices are introducing viable alternatives. For example, the global green cement market is projected to reach $60.5 billion by 2030, highlighting a substantial shift towards eco-friendly options that directly compete with traditional cement.

New materials such as mass timber, hempcrete, and even recycled plastic bricks offer advantages like reduced environmental impact and improved insulation. The mass timber market, for instance, experienced notable growth in 2023, with projects demonstrating its potential in high-rise construction, directly challenging concrete and steel applications.

Furthermore, advancements like engineered cementitious composites (ECC) and graphene-reinforced concrete offer enhanced performance, such as greater ductility and increased compressive strength, potentially leading to lower lifecycle costs and less maintenance. The global advanced materials market, projected to reach hundreds of billions of dollars by early 2024, underscores the significant investment and adoption potential for these emerging substitutes.

| Substitute Material | Key Advantages | Market Trend/Projection |

|---|---|---|

| Green Cement (Low-Clinker, Geopolymer) | Reduced carbon footprint, lower embodied energy | Projected to reach $60.5 billion by 2030 |

| Mass Timber | Sustainable sourcing, carbon sequestration, lighter weight | Growing adoption in high-rise construction (e.g., Ascent building, Milwaukee) |

| Engineered Cementitious Composites (ECC) | Enhanced ductility, crack resistance, seismic resilience | Increasing research and development for specialized applications |

| Graphene-Reinforced Concrete | Increased compressive strength, reduced permeability, longer service life | Emerging technology with high potential for performance improvement |

Entrants Threaten

The threat of new entrants in the heavy construction materials sector, like that of Eagle Materials, is significantly mitigated by exceptionally high capital requirements. Establishing a competitive presence demands substantial upfront investment, often in the hundreds of millions of dollars, for essential assets such as land for quarries, advanced manufacturing plants, specialized heavy machinery, and extensive transportation networks.

For instance, constructing a modern cement plant alone can cost upwards of $500 million, a figure that presents a formidable financial hurdle. This capital intensity effectively acts as a powerful deterrent, making it exceedingly difficult for new players to enter the market and compete on a meaningful scale against established entities like Eagle Materials, which already possess these critical infrastructure assets.

Existing players in the building materials sector, like Eagle Materials, benefit from significant economies of scale. This means they can produce and distribute their products more cheaply per unit than a newcomer could. For instance, in 2023, Eagle Materials reported net sales of $2.2 billion, indicating a substantial operational footprint that allows for cost advantages in raw material sourcing and manufacturing processes.

A new entrant would find it incredibly challenging to match these cost efficiencies without a massive initial investment to achieve comparable production volumes. This inherent cost disadvantage makes it difficult for new companies to compete effectively on price against established firms like Eagle Materials, thereby posing a considerable barrier to entry.

Eagle Materials and its competitors boast deeply entrenched distribution networks, often involving significant investments in rail, truck, and even water transport infrastructure across numerous states. For instance, in 2024, the cost to establish a comparable logistics operation could easily run into hundreds of millions of dollars, making it a formidable hurdle.

The sheer scale and efficiency of existing players' logistics capabilities are incredibly difficult and expensive for newcomers to replicate. This complexity and the substantial capital required to build out similar capabilities act as a significant deterrent, effectively raising the barrier to entry for potential new competitors in the building materials sector.

Strict Regulatory and Environmental Hurdles

The construction materials sector faces formidable barriers to entry due to strict regulatory and environmental requirements. Companies must navigate complex permitting processes, adhere to stringent safety standards, and manage environmental impacts related to quarrying and manufacturing. For instance, obtaining permits for new quarry operations can take years and involve extensive environmental impact assessments, a significant hurdle for potential new entrants.

These regulations, covering everything from emissions control to waste disposal, demand substantial upfront investment in compliance technology and expertise. In 2024, the average cost for environmental compliance in the heavy industrial sector, which includes construction materials, continued to rise, with many new projects requiring multi-million dollar investments in pollution control equipment alone. This financial burden effectively deters many smaller or less capitalized companies from entering the market.

- Stringent Environmental Regulations: Compliance with air, water, and land use regulations adds significant operational costs and complexity.

- Lengthy Permitting Processes: Obtaining necessary permits for extraction and manufacturing can be a multi-year, capital-intensive process.

- High Capital Investment: Meeting safety and environmental standards requires substantial investment in specialized equipment and technology.

- Limited Access to Raw Materials: Securing rights to quarry or mine essential raw materials is often difficult and costly, further restricting new market entrants.

Access to Raw Materials and Site Selection

Securing access to high-quality, economically viable raw material deposits, such as limestone and gypsum, is a significant hurdle for new entrants in the building materials industry. These resources are finite and often already controlled by established companies, creating a natural barrier to entry. For instance, the U.S. Geological Survey reported in 2024 that cement production, a key component derived from limestone, relies heavily on readily available and accessible quarries.

Strategic site selection for manufacturing facilities also presents a considerable challenge. New companies must identify locations that not only offer proximity to essential raw materials but also provide efficient access to key markets. This dual requirement is often complicated by local opposition to new industrial sites and the scarcity of suitable land, making it difficult for newcomers to establish a competitive operational footprint. In 2023, the average lead time for obtaining permits for new industrial facilities in the U.S. could extend over a year, impacting the speed to market for new players.

- Limited Availability of Prime Quarry Sites: The concentration of high-grade limestone and gypsum deposits in specific geographic areas, often already exploited by incumbents, restricts the options for new entrants.

- High Capital Investment for Exploration and Permitting: Discovering and securing new, economically viable raw material sources requires substantial upfront capital for geological surveys, exploration, and obtaining environmental and operational permits, which can be prohibitive for startups.

- Logistical Challenges and Transportation Costs: New entrants may face higher transportation costs if their chosen sites are not strategically located near both raw material sources and major consumer markets, unlike established players with optimized supply chains.

- Regulatory Hurdles and Community Opposition: Gaining approval for new quarry operations and manufacturing plants often involves navigating complex environmental regulations and addressing potential community concerns, which can delay or prevent market entry.

The threat of new entrants for companies like Eagle Materials is significantly low due to immense capital requirements, stringent regulations, and established economies of scale. Newcomers face a steep uphill battle against incumbents with vast infrastructure and optimized supply chains.

The sheer cost of establishing operations, from acquiring land for quarries to building advanced manufacturing plants and transportation networks, can easily run into hundreds of millions of dollars. For example, a single new cement plant could cost over $500 million to construct. Furthermore, navigating complex environmental regulations and securing necessary permits can take years and require multi-million dollar investments in compliance technology, effectively acting as a powerful deterrent.

| Barrier to Entry | Estimated Cost/Timeframe (2024) | Impact on New Entrants |

| New Cement Plant Construction | $500+ million | Prohibitive capital investment |

| Environmental Compliance Tech | Multi-million dollar investment | Increases upfront operational costs |

| Quarry/Industrial Permitting | 1+ year lead time | Significant delay to market entry |

| Logistics Network Development | Hundreds of millions of dollars | Difficult and expensive to replicate |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Eagle Materials leverages data from their annual reports and SEC filings, alongside industry-specific market research from sources like IBISWorld and construction trade publications to provide a comprehensive view of the competitive landscape.