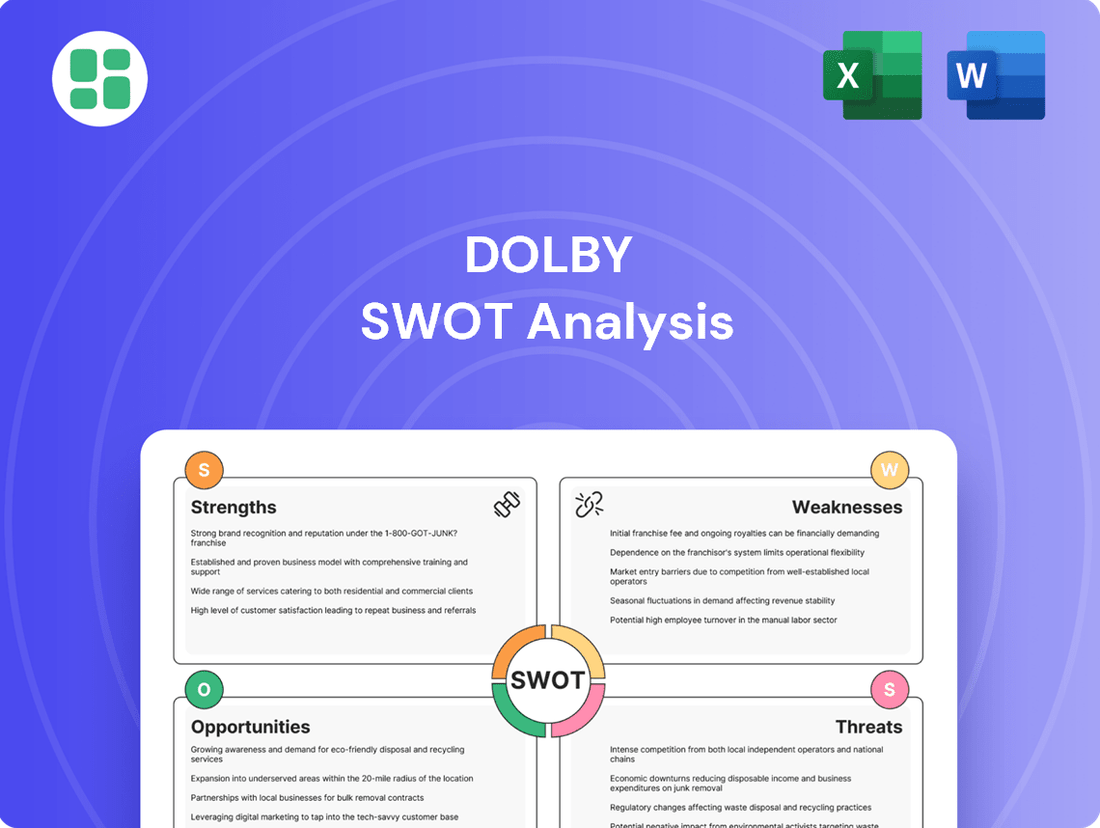

Dolby SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dolby Bundle

Dolby's dominance in audio technology is a clear strength, but the evolving digital landscape presents significant opportunities for expansion. However, reliance on licensing models and increasing competition pose potential threats that require strategic navigation.

Want the full story behind Dolby's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Dolby's strength lies in its extensive and growing library of patented audio and imaging technologies, such as Dolby Atmos and Dolby Vision, which are cornerstones of immersive entertainment. This robust intellectual property portfolio provides a substantial competitive edge, solidifying Dolby's market leadership.

The strategic acquisition of GE Licensing in 2024 significantly bolstered Dolby's IP assets, adding more than 5,000 patents. These include crucial video compression technologies, with projections indicating these new patents could yield over $1 billion in royalties in the coming years.

Dolby's brand is deeply ingrained in consumers' minds as a symbol of superior audio and visual quality, a perception reinforced by its widespread presence. This strong brand recognition translates into significant market leverage, making its technologies a sought-after feature by manufacturers and consumers alike.

This brand equity is a powerful asset, driving adoption across diverse sectors including cinemas, home theaters, and even mobile devices. For instance, in 2023, Dolby Vision and Dolby Atmos were integrated into a vast array of consumer electronics, with reports indicating over 2.5 billion enabled devices globally.

Dolby's extensive licensing business model is a significant strength, generating high-margin, recurring revenue with minimal ongoing operational costs after initial research and development. This approach allows Dolby to expand its technological footprint across numerous product categories and content platforms without the need for its own manufacturing capabilities.

The company anticipates its licensing revenue to fall between $1.22 billion and $1.28 billion for the entirety of fiscal year 2025, underscoring the financial robustness and scalability of this core strategy.

Diverse Market Penetration and Partnerships

Dolby's technologies boast impressive market penetration, reaching consumers through cinema, home entertainment systems, mobile devices, and gaming platforms. The company is also making significant inroads into the automotive sector, a key growth area. This broad reach diversifies revenue streams and mitigates risk associated with any single market's performance.

Strategic partnerships are a cornerstone of Dolby's strength. In the 2024-2025 period, Dolby solidified new collaborations with over 20 automotive manufacturers and numerous major consumer electronics companies. These alliances ensure Dolby's audio and imaging solutions are integrated into a vast array of products, from premium vehicles to smart home devices, further cementing its market presence.

- Broad Market Integration: Dolby's technologies are present in cinema, home entertainment, mobile, gaming, and automotive sectors.

- Expanding Automotive Presence: New partnerships in 2024-2025 with over 20 automotive brands highlight growth in this key segment.

- Diversified Revenue Streams: Integration across multiple markets reduces dependency on any one industry.

- Key Partnerships: Collaborations with leading manufacturers and content creators are central to Dolby's market penetration strategy.

Continuous Innovation and R&D Investment

Dolby's dedication to continuous innovation is a significant strength, fueled by substantial investments in research and development. For instance, in fiscal year 2023, Dolby reported R&D expenses of $596 million, underscoring its commitment to staying ahead in audio and imaging technologies. This ongoing investment allows Dolby to consistently introduce groundbreaking products and features, such as Dolby Atmos and Dolby Vision, which have become industry standards.

This proactive approach to R&D ensures Dolby's technologies remain relevant and competitive in a rapidly evolving market. By anticipating future trends, like the integration of AI in audio processing and the demand for more immersive viewing experiences, Dolby solidifies its market leadership. Their consistent introduction of enhanced audio and imaging solutions, often ahead of market demand, provides a distinct competitive advantage.

Key aspects of Dolby's innovation strength include:

- Consistent R&D Investment: Significant financial commitment to developing new technologies.

- Market-Leading Technologies: Introduction of industry-defining standards like Dolby Atmos and Dolby Vision.

- Adaptability to Trends: Proactive development in areas like AI-driven audio and adaptive streaming.

- Technological Edge: Maintaining a lead over competitors through continuous advancement.

Dolby's core strength is its extensive patent portfolio, featuring industry-defining technologies like Dolby Atmos and Dolby Vision. The company's strategic acquisition of GE Licensing in 2024, adding over 5,000 patents including vital video compression technologies, is projected to generate over $1 billion in royalties. This robust intellectual property underpins Dolby's market leadership and provides a significant competitive moat.

The brand itself is a powerful asset, synonymous with premium audio and visual experiences, which drove over 2.5 billion enabled devices globally by 2023. This strong brand equity ensures Dolby's technologies are highly sought after by both manufacturers and consumers, facilitating broad adoption across various product categories.

Dolby's licensing model generates high-margin, recurring revenue with minimal operational overhead, allowing for scalable expansion. The company anticipates fiscal year 2025 licensing revenue to be between $1.22 billion and $1.28 billion, highlighting the financial stability of this strategy.

Market penetration is exceptionally broad, extending from cinemas and home entertainment to mobile, gaming, and increasingly, the automotive sector. This diversification across multiple markets, supported by strategic partnerships with over 20 automotive manufacturers and numerous consumer electronics firms in 2024-2025, reduces reliance on any single industry and ensures continued growth.

Dolby's commitment to innovation is evident in its consistent R&D investments, with $596 million spent in fiscal year 2023. This allows for the continuous development of groundbreaking technologies, ensuring Dolby stays ahead of market trends and maintains its technological edge.

| Strength Aspect | Key Technologies/Initiatives | Financial Impact/Data | Market Reach |

|---|---|---|---|

| Intellectual Property | Dolby Atmos, Dolby Vision, GE Licensing acquisition (5,000+ patents) | Projected $1B+ in royalties from GE patents | Cinema, Home Entertainment, Mobile, Gaming, Automotive |

| Brand Recognition | Symbol of quality audio/visual | Over 2.5B enabled devices (2023) | Consumer Electronics, Content Platforms |

| Licensing Model | Recurring, high-margin revenue | FY25 Revenue Projection: $1.22B - $1.28B | Wide product integration |

| Market Penetration & Partnerships | Automotive sector growth, Consumer Electronics collaborations | 20+ new automotive partnerships (2024-2025) | Diversified revenue streams |

| Innovation & R&D | Continuous technology development | FY23 R&D Spend: $596M | Maintaining technological leadership |

What is included in the product

Analyzes Dolby’s competitive position through key internal and external factors, highlighting its strong brand and technology leadership while acknowledging potential threats from emerging competitors and evolving market demands.

Streamlines Dolby's strategic planning by clearly identifying competitive advantages and mitigating potential threats.

Weaknesses

Dolby's reliance on licensing fees, while historically lucrative due to high margins, creates a significant vulnerability. Its revenue stream is intrinsically tied to the sales volume of devices and content that integrate Dolby's patented technologies. This means any downturn in the consumer electronics market or shifts in manufacturing strategies directly impacts Dolby's bottom line.

For instance, a slowdown in smartphone production or a decrease in demand for home theater systems, key markets for Dolby's audio and visual innovations, can lead to unpredictable revenue fluctuations. This sensitivity to external market forces makes precise revenue forecasting a considerable challenge for the company.

Dolby's business model heavily relies on its proprietary technology and extensive patent portfolio, making it susceptible to intellectual property infringement and piracy. Protecting these valuable assets across numerous global jurisdictions demands substantial legal investment and continuous enforcement, a significant operational drain.

These ongoing efforts to safeguard its intellectual property are not only expensive but also divert crucial resources that could otherwise fuel innovation and expansion into new markets. For instance, in 2023, Dolby reported spending over $300 million on research and development, a figure that could be further impacted by increased IP litigation costs.

Dolby's commitment to staying at the forefront of audio and imaging innovation requires significant and ongoing investment in research and development. These substantial R&D expenditures, while vital for future growth, can indeed weigh on operating margins. For instance, if new technological advancements don't gain broad market traction or meet projected licensing income targets, the financial strain becomes more pronounced. The company continually navigates the intricate balance between pushing technological boundaries and maintaining cost-effectiveness.

Limited Direct Consumer Relationship

Dolby's business model, which focuses on licensing its audio and video technologies to other companies, means it doesn't typically interact directly with the end consumer. This B2B approach, while effective for technology diffusion, limits Dolby's ability to gather direct user feedback and build brand loyalty with the individuals experiencing its innovations. For instance, in 2023, Dolby's revenue was primarily driven by its licensing agreements, with less direct consumer engagement compared to companies selling products directly to the public.

This indirect relationship can also impact how Dolby's brand is perceived and experienced. The company relies heavily on its partners, like device manufacturers and streaming services, to implement and market its technologies. This can lead to variations in user experience and branding, as Dolby has less control over the final consumer-facing product. Building a strong, recognizable consumer brand becomes a secondary objective, dependent on the success and marketing efforts of its licensees.

- Limited Direct Consumer Feedback: Dolby's B2B model hinders direct input from end-users on product experience.

- Reduced Brand Control: Partner implementation means less direct oversight on how Dolby's technology is presented to consumers.

- Indirect Brand Building: Consumer awareness and loyalty are largely built through third-party marketing efforts.

- Reliance on Partner Success: Dolby's consumer-facing brand strength is tied to the marketing and product quality of its licensees.

Dependence on Partner Adoption and Market Cycles

Dolby's reliance on partners integrating its audio and visual technologies means its growth is tied to the success and strategic decisions of companies in sectors like consumer electronics and automotive. For instance, a slowdown in the global consumer electronics market, which saw a contraction in 2023, can directly affect Dolby's licensing revenue as fewer devices are produced and sold.

Market cycles significantly influence Dolby's performance. A downturn in the automotive industry, for example, could reduce the adoption of Dolby technologies in new vehicles, impacting revenue streams. This dependence makes Dolby vulnerable to external economic shifts and changes in consumer spending habits, as observed with the dip in consumer electronics licensing revenue reported in recent fiscal periods.

- Partner Integration Risk: Dolby's revenue is contingent on third-party manufacturers embedding its patented technologies into their products.

- Market Cycle Sensitivity: Fluctuations in key markets like consumer electronics and automotive directly impact Dolby's sales volume and licensing agreements.

- Economic Headwinds: Broader economic uncertainties can dampen consumer demand for new devices and vehicles, thereby slowing technology adoption.

Dolby's substantial investment in research and development, while necessary for innovation, can put pressure on its profit margins if new technologies don't achieve widespread market adoption or generate expected licensing revenue. This creates a delicate balancing act between technological advancement and financial efficiency.

The company's business model, primarily B2B licensing, limits direct interaction with end consumers. This disconnect hinders Dolby's ability to gather immediate user feedback and cultivate direct brand loyalty, making it reliant on partners for consumer perception and brand building.

Dolby's dependence on third-party manufacturers for integrating its technologies means its growth is closely tied to the success and strategic choices of companies in sectors like consumer electronics and automotive. Consequently, market downturns or shifts in these industries can directly impact Dolby's revenue streams and overall performance.

Full Version Awaits

Dolby SWOT Analysis

The preview you see is the actual Dolby SWOT analysis document you will receive upon purchase. This ensures transparency and that you get exactly what you expect—a professional, comprehensive report.

This is a real excerpt from the complete Dolby SWOT analysis. Once purchased, you’ll receive the full, editable version, providing you with all the insights and strategic information.

Opportunities

Dolby has a significant opportunity to grow by tapping into emerging markets, especially in the Asia-Pacific region. As economies there develop, so does the appetite for high-quality entertainment, creating a strong demand for Dolby's immersive audio and visual technologies. This expansion offers a chance to capture new customer bases and diversify revenue.

Beyond consumer electronics, Dolby can further penetrate new sectors. The automotive industry is a prime example, with Dolby Atmos already featured in over 20 premium car brands as of early 2024, showcasing the technology's adaptability and appeal in different environments. Live sports broadcasting also presents a substantial growth avenue, promising to bring Dolby's signature experiences to a wider audience and generate additional income streams.

The ongoing global migration to streaming platforms, coupled with a rising appetite for enhanced audio-visual experiences, represents a significant growth avenue for Dolby. Major sporting events, including the Super Bowl and NBA Playoffs, are increasingly broadcast using Dolby Atmos and Dolby Vision, reaching millions of viewers. This widespread adoption by content creators and distributors, with over 100 streaming services now supporting Dolby technologies, directly fuels demand for Dolby-enabled devices and further solidifies its market position.

Dolby's core audio technologies are poised for significant expansion through integration with emerging fields like Artificial Intelligence (AI) and Virtual/Augmented Reality (VR/AR). This convergence opens doors to innovative product categories and substantial enhancements of existing services, tapping into the growing demand for immersive and intelligent audio experiences.

AI-powered audio processing and adaptive streaming technologies represent a key opportunity, allowing Dolby to deliver more personalized and efficient sound experiences. Furthermore, the application of Dolby's expertise in spatial computing and virtual environments can create entirely new revenue streams and deepen user engagement in the rapidly evolving metaverse and gaming sectors.

Dolby's active participation in AI research summits underscores a deliberate strategic alignment with these technological advancements. This proactive engagement suggests a commitment to leveraging AI to refine its audio solutions and explore novel applications, potentially driving future growth and market leadership in these dynamic technological frontiers.

Strategic Acquisitions and Partnerships

Dolby can strategically acquire companies to bolster its intellectual property and venture into adjacent technological sectors, mirroring the success of its GE Licensing agreement. This approach aims to unlock new revenue channels and strengthen its competitive edge by integrating innovative technologies. For instance, acquiring a company with expertise in advanced audio processing algorithms could significantly enhance Dolby's existing offerings.

Forming partnerships with major industry players is crucial for accelerating market adoption and fostering product advancement. Dolby's collaborations, such as the integration of Dolby Atmos FlexConnect with TCL televisions and the inclusion of Dolby Atmos in Chromebooks by Lenovo and Google, demonstrate the power of these alliances. These efforts are vital for ensuring broad ecosystem acceptance of Dolby's technologies, driving wider consumer reach and engagement.

- Acquisition of Intellectual Property: Dolby can acquire smaller tech firms to expand its patent portfolio, potentially adding new audio and visual enhancement technologies.

- Expansion into Complementary Markets: Strategic acquisitions could allow Dolby to enter new markets, such as advanced automotive audio systems or immersive gaming technologies.

- Ecosystem Growth through Partnerships: Collaborations with hardware manufacturers like TCL, Lenovo, and Google are key to embedding Dolby technologies into a wider range of consumer devices, increasing market penetration.

- Revenue Stream Diversification: By integrating new technologies through acquisition or partnership, Dolby can create additional revenue streams beyond its traditional licensing models.

Diversification Beyond Core Licensing

Dolby's opportunity lies in moving beyond its traditional licensing model to build diverse revenue streams. The Dolby.io platform, offering real-time streaming and interactive experiences, is a prime example of this strategic shift. This move allows Dolby to tap into the growing demand for advanced audio and video solutions directly within various applications and services.

Expanding into areas like content creation tools and professional software solutions presents another avenue for diversification. Such initiatives would not only lessen Dolby's dependence on hardware licensing but also open doors to new, potentially high-growth market segments. For instance, offering direct-to-consumer software could foster deeper customer relationships and provide recurring revenue.

- Dolby.io Growth: The Dolby.io platform is positioned to capitalize on the increasing need for high-quality, real-time audio and video experiences in applications like gaming, virtual events, and collaborative tools.

- Content Creation Ecosystem: Developing and marketing professional-grade tools for audio and video production can create a sticky ecosystem for creators, generating both software sales and potential service revenue.

- Direct-to-Consumer Engagement: Exploring direct-to-consumer software offerings, such as advanced audio enhancement applications for personal devices, could unlock new revenue streams and build brand loyalty.

- Reduced Licensing Reliance: Successful diversification will mitigate risks associated with fluctuations in the hardware market, creating a more resilient and multifaceted business model for Dolby.

Dolby has a significant opportunity to expand its reach by integrating its technologies into emerging sectors like the automotive industry and live sports broadcasting. As of early 2024, Dolby Atmos was already featured in over 20 premium car brands, demonstrating its versatility.

The company can also leverage the growing demand for immersive experiences in the metaverse and gaming by applying its spatial computing expertise, potentially creating entirely new revenue streams. Dolby's active participation in AI research further positions it to refine audio solutions and explore novel applications.

Strategic acquisitions of companies with advanced audio processing algorithms or expertise in complementary technologies could bolster Dolby's intellectual property and open new revenue channels. For example, acquiring a firm specializing in AI-driven audio enhancement could significantly strengthen its existing offerings.

Furthermore, Dolby can diversify its revenue streams by moving beyond traditional licensing models. The Dolby.io platform, offering real-time streaming and interactive experiences, is a key initiative in this direction, tapping into the demand for advanced audio and video solutions directly within various applications.

Threats

The growing availability of high-quality, open-source, and royalty-free audio and video technologies presents a substantial challenge. As manufacturers look for ways to trim expenses, they may increasingly turn to these cost-effective alternatives, which could chip away at Dolby's market share and its ability to command premium pricing.

For example, the widespread adoption of codecs like AV1, which is royalty-free and supported by major tech players, directly competes with Dolby's proprietary video compression technologies. This trend is particularly pronounced in consumer electronics where price sensitivity is high.

While Dolby is known for delivering superior audio and video experiences, manufacturers operating in highly competitive segments, such as mid-range soundbars or smart TVs, might find the cost savings from adopting open-source solutions too compelling to ignore, impacting Dolby's revenue streams.

Dolby faces significant pressure from competitors like DTS, owned by Xperi, which offers similar audio technologies. Other players such as Cirrus Logic and Harman International, part of Samsung, also vie for market share in audio processing and licensing. This intense rivalry means Dolby must continually invest in research and development to stay ahead.

In areas like premium home audio and automotive sound systems, market saturation is a growing concern. This can restrict Dolby's ability to secure new licensing deals as many devices already incorporate advanced audio features, potentially slowing revenue growth from these segments. For instance, the smartphone market, a key area for Dolby's audio enhancements, has seen slower unit growth in recent years, impacting new integration opportunities.

To counter these threats, Dolby's strategy hinges on relentless innovation and differentiation. The company's focus on immersive audio experiences, such as Dolby Atmos, and its expansion into new verticals like gaming and broadcast are critical. Maintaining its premium brand perception is essential to justify licensing fees and retain its competitive edge against rivals offering more commoditized solutions.

The relentless pace of technological advancement in audio and imaging presents a significant threat. Dolby's core business relies on its proprietary technologies, and if these become outdated due to new, more efficient, or compelling innovations from competitors, demand for its licensing agreements could quickly diminish. For example, the rapid adoption of AI-driven audio processing could challenge traditional codec-based solutions.

Maintaining a competitive edge necessitates substantial and ongoing investment in research and development. Failure to anticipate or adapt to emerging trends, such as advancements in spatial audio beyond current Dolby Atmos capabilities or new compression techniques, could lead to a decline in Dolby's market relevance and revenue streams. The company's ability to consistently innovate at the speed of technological change is paramount for its long-term success.

Economic Downturns Affecting Consumer Spending

Global economic uncertainties, such as persistent inflation and rising interest rates, pose a significant threat to Dolby's business model. These factors can dampen consumer spending on discretionary items like high-end electronics and premium entertainment experiences, which are crucial for Dolby's revenue streams.

Dolby's revenue is heavily reliant on licensing fees generated from the sale of devices incorporating its audio and visual technologies. A slowdown in consumer demand for these products, driven by economic headwinds, would directly translate into reduced royalty income for the company. For instance, a significant drop in consumer electronics sales could directly impact Dolby's top line.

Management has acknowledged these risks, with statements from the fiscal year 2025 outlook specifically citing 'economic uncertainty' as a key concern. This suggests that the company is actively monitoring the macroeconomic environment and its potential impact on future performance.

- Economic Uncertainty: Global economic slowdowns and inflation could reduce consumer disposable income, impacting sales of premium electronics.

- Interest Rate Fluctuations: Higher interest rates can increase borrowing costs for consumers and businesses, potentially dampening demand for new devices.

- Supply Chain Disruptions: Ongoing supply chain issues can limit the availability of electronic devices, further hindering sales and Dolby's licensing revenue.

- Reduced Device Sales: A direct consequence of decreased consumer spending would be lower unit sales of smartphones, TVs, and other Dolby-enabled hardware.

Intellectual Property Infringement and Legal Challenges

Dolby, despite its strong patent portfolio, continues to face threats from intellectual property infringement. These infringements can trigger expensive and protracted legal disputes, potentially impacting its financial performance. For instance, in recent years, the company has been involved in various patent litigation cases, underscoring the persistent nature of this threat.

Adverse court decisions or successful challenges to the validity of Dolby's patents could significantly weaken its core licensing business model. Such outcomes might necessitate a re-evaluation of its revenue streams and could affect its market position. The company's ability to enforce its intellectual property internationally is also a concern.

Geopolitical shifts and evolving trade regulations present further complexities for Dolby's global IP enforcement and licensing operations. These external factors can disrupt established agreements and create new hurdles in protecting its technological innovations across different jurisdictions.

- Ongoing Litigation: Dolby's history includes numerous patent disputes, with settlements and legal fees representing a recurring operational cost.

- Patent Validity Challenges: Competitors may actively seek to invalidate Dolby patents, which, if successful, could erode its competitive advantage.

- International IP Enforcement: Varying legal frameworks and enforcement capabilities across countries make global protection of intellectual property a significant challenge.

The increasing prevalence of royalty-free audio and video technologies poses a significant threat, as manufacturers may opt for these cost-effective alternatives, potentially eroding Dolby's market share and premium pricing power. Technologies like the AV1 codec, backed by major tech firms, directly challenge Dolby's proprietary video compression. This trend is particularly impactful in consumer electronics where price sensitivity is high, potentially reducing Dolby's revenue from licensing deals.

Intense competition from companies like DTS (owned by Xperi), Cirrus Logic, and Harman International (part of Samsung) necessitates continuous R&D investment for Dolby to maintain its edge. Market saturation in areas like premium home audio and automotive sound systems also limits new licensing opportunities, especially as smartphone unit growth slows, impacting Dolby's ability to secure new deals in key segments.

The rapid pace of technological advancement, including AI-driven audio processing, could render Dolby's current proprietary technologies obsolete, diminishing demand for its licensing agreements. Failure to innovate beyond existing spatial audio capabilities or new compression techniques could lead to a decline in market relevance and revenue, highlighting the critical need for Dolby to consistently adapt to emerging trends.

Global economic uncertainties, such as inflation and rising interest rates, directly threaten Dolby's business model by dampening consumer spending on discretionary items like premium electronics. This slowdown in consumer demand for Dolby-enabled devices directly translates into reduced royalty income, as seen in forecasts that acknowledge economic uncertainty as a key concern for fiscal year 2025.

SWOT Analysis Data Sources

This Dolby SWOT analysis is built upon a robust foundation of credible data, including Dolby's official financial filings, comprehensive market research reports, and expert analyses from leading industry publications.