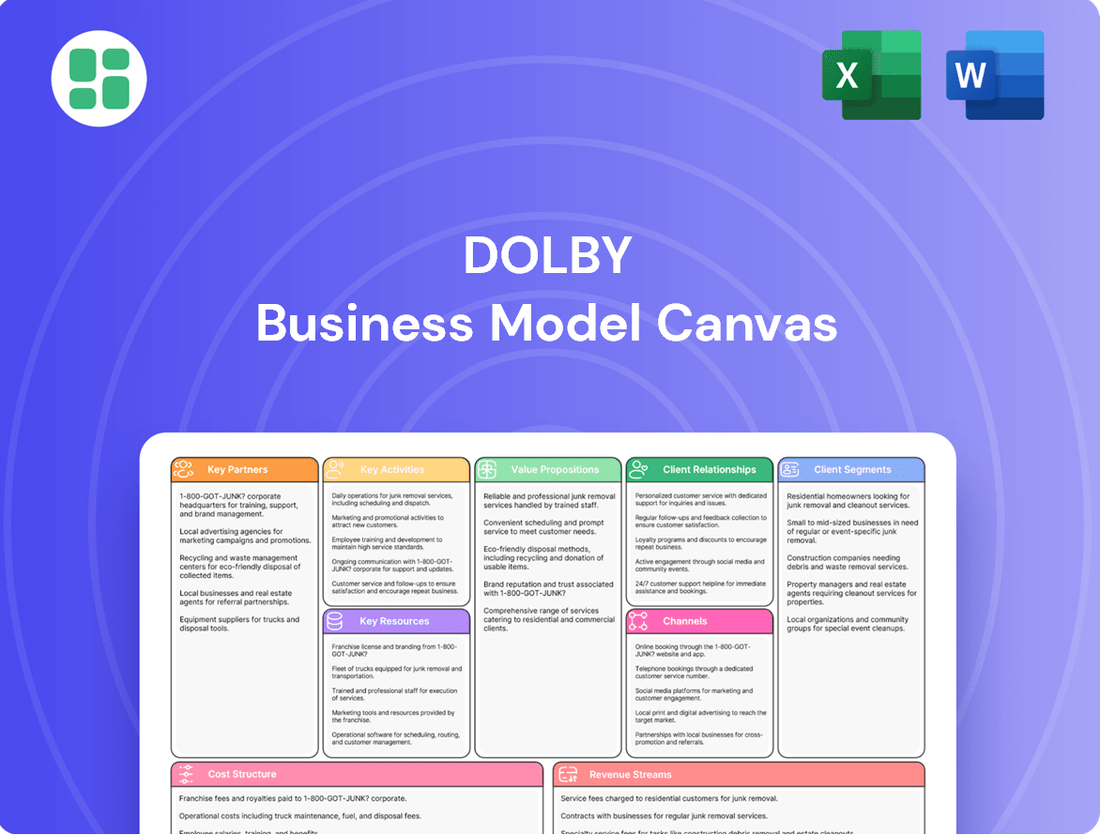

Dolby Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dolby Bundle

Uncover the intricate workings of Dolby's innovative business model with our comprehensive Business Model Canvas. This detailed breakdown illuminates how Dolby creates and delivers value, from its core technologies to its strategic partnerships.

Dive into the specifics of Dolby's customer relationships, revenue streams, and cost structure, gaining actionable insights for your own strategic planning.

Download the full, professionally designed Business Model Canvas today to unlock a deeper understanding of Dolby's enduring market success and identify opportunities for your business.

Partnerships

Dolby’s key partnerships with consumer electronics manufacturers are foundational to its business model. These collaborations involve integrating Dolby’s advanced audio and imaging technologies, such as Dolby Atmos and Dolby Vision, directly into devices like televisions, smartphones, soundbars, PCs, and gaming consoles.

This widespread integration is vital for driving consumer adoption and, in turn, generating substantial licensing revenue for Dolby. For instance, in 2024, Dolby continued its strong relationships with major players like Samsung, Xiaomi, LG, and Hisense, ensuring their latest TV and soundbar models featured Dolby technologies.

Furthermore, the partnership with Motorola to launch its first smartphone equipped with Dolby Vision Capture in 2024 highlights Dolby's expansion into new device categories and its commitment to enhancing the mobile content creation experience.

Dolby's success hinges on deep collaborations with major film studios, music labels, streaming platforms, and game developers. These partnerships are crucial for ensuring a steady stream of content that is expertly crafted for Dolby Atmos and Dolby Vision, thereby elevating the consumer experience across movies, TV, music, and gaming.

This content pipeline is robust; in 2024, a significant majority of top-tier music, including 7 out of the 8 Grammy nominees for Record of the Year and Album of the Year, were available in Dolby Atmos, showcasing the technology's widespread adoption and appeal.

Dolby is strategically forging key partnerships with leading automotive manufacturers, recognizing the burgeoning potential of in-car entertainment. This focus is driven by the increasing consumer demand for premium audio and visual experiences within vehicles, a trend that saw significant acceleration in 2024.

These collaborations are centered on integrating Dolby Atmos immersive audio and Dolby Vision high-dynamic-range video into the sophisticated infotainment systems of new car models. The automotive sector is rapidly evolving, with manufacturers like Audi, Cadillac, Porsche, Volvo, Xiaomi, and Hyundai actively embracing these technologies to differentiate their offerings.

Broadcasting and Streaming Service Providers

Dolby's key partnerships with broadcasting and streaming service providers are crucial for integrating its advanced audio and visual technologies directly into the content delivery pipeline. These collaborations ensure that premium content, such as live sports and popular TV series, reaches audiences with the immersive quality of Dolby Vision and Dolby Atmos. This strategic move extends Dolby's influence from hardware into the vital content ecosystem itself.

These partnerships are vital for expanding Dolby's market presence. For instance, Comcast's integration of Dolby Vision and Dolby Atmos for Olympics coverage demonstrates the tangible benefit to consumers. Similarly, collaborations with platforms like HBO Max for sports content highlight the adoption of Dolby's technologies for high-demand programming, directly impacting user experience and perceived content value.

- Broadcasters and Streaming Platforms: Essential partners for delivering Dolby-enhanced content to end-users.

- Content Integration: Ensures live sports, TV shows, and other media are experienced with superior audio and visual fidelity.

- Ecosystem Reach: Extends Dolby's technological footprint beyond devices into content distribution.

- Real-World Examples: Comcast's Olympics coverage in Dolby Vision/Atmos and HBO Max sports collaborations showcase this strategy.

Semiconductor and Component Suppliers

Dolby's key partnerships with semiconductor and component suppliers are crucial for embedding its audio and imaging technologies directly into the hardware. This collaboration ensures that Dolby experiences are optimized from the ground up, leading to superior performance and seamless integration within a vast array of consumer electronics.

These partnerships are vital for Dolby's strategy of widespread adoption. By working closely with chipmakers, Dolby can ensure its patented technologies are efficiently implemented, enhancing the audio-visual capabilities of devices before they even reach consumers.

Specifically, Dolby collaborates with major automotive System-on-Chip (SoC) and Digital Signal Processor (DSP) suppliers. For instance, in 2024, partnerships with companies like Analog Devices, MediaTek, and NXP Semiconductors are instrumental in bringing Dolby Atmos immersive audio experiences to a growing number of vehicles, enhancing the in-car entertainment sector.

- Semiconductor and Component Supplier Collaboration: Dolby works with leading chip manufacturers to integrate its audio and imaging technologies at the hardware level, ensuring optimal performance and compatibility.

- Automotive Sector Focus: Key partnerships with automotive SoC and DSP suppliers such as Analog Devices, MediaTek, and NXP Semiconductors are vital for deploying Dolby Atmos in vehicles.

- Seamless Integration: This foundational approach guarantees that Dolby's features are deeply embedded, providing a high-quality, consistent user experience across diverse devices.

Dolby's key partnerships with consumer electronics manufacturers are foundational, enabling the widespread integration of its audio and imaging technologies into devices like TVs, smartphones, and gaming consoles.

These collaborations, exemplified by ongoing relationships with Samsung, Xiaomi, and LG in 2024, are crucial for driving consumer adoption and generating licensing revenue.

The partnership with Motorola for its first smartphone with Dolby Vision Capture in 2024 underscores Dolby's expansion into mobile content creation.

| Partner Type | Key Collaborators (2024 Examples) | Technology Integration Focus | Impact |

| Consumer Electronics Manufacturers | Samsung, Xiaomi, LG, Hisense, Motorola | Dolby Atmos, Dolby Vision, Dolby Vision Capture | Widespread device adoption, licensing revenue, enhanced user experience |

| Content Creators & Distributors | Major Film Studios, Music Labels, Streaming Platforms (e.g., HBO Max), Game Developers | Dolby Atmos, Dolby Vision | Rich content pipeline, increased consumer demand for premium experiences |

| Automotive Manufacturers | Audi, Cadillac, Porsche, Volvo, Hyundai | Dolby Atmos, Dolby Vision | Premium in-car entertainment differentiation, expanding into new markets |

| Semiconductor Suppliers | Analog Devices, MediaTek, NXP Semiconductors | On-chip integration of Dolby audio/imaging | Optimized hardware performance, seamless integration across diverse devices |

What is included in the product

A detailed breakdown of Dolby's strategy, this Business Model Canvas outlines their core customer segments, value propositions, and revenue streams, emphasizing their licensing model and technological innovation.

This canvas provides a clear, actionable framework for understanding Dolby's operations, highlighting key partnerships and cost structures that drive their success in audio and imaging technologies.

The Dolby Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their complex licensing and technology integration, simplifying communication and strategic alignment for diverse stakeholders.

Activities

Dolby's engine of innovation is its robust Research and Development (R&D). This core activity focuses on creating and refining advanced audio and imaging technologies that define premium entertainment experiences.

Significant investment in R&D is crucial for Dolby to stay ahead. For the twelve months ending March 31, 2025, Dolby's R&D expenses amounted to $0.262 billion, underscoring its commitment to developing new, proprietary solutions.

Dolby's core activity revolves around the meticulous management and strategic licensing of its vast intellectual property. This includes a global portfolio of over 22,000 patents and pending applications, forming the bedrock of its revenue generation through royalty payments from manufacturers and content creators.

The company's commitment to expanding its technological advantage is evident in its 2024 acquisition of GE Licensing, which brought an additional 5,000 patents into its fold, further solidifying its market position and offering new avenues for licensing revenue.

Dolby actively collaborates with partners, integrating its advanced audio and visual technologies into a wide array of consumer electronics and content creation workflows. This partnership-driven approach ensures Dolby's innovations reach a broad audience. For instance, in 2024, Dolby continued its strong relationships with major smartphone manufacturers and streaming services, facilitating the seamless delivery of immersive experiences.

To facilitate this integration, Dolby provides comprehensive technical support, including specialized development kits and rigorous certification processes. These resources are crucial for ensuring that Dolby features are implemented correctly and deliver the superior performance users expect. The Dolby Creators Lab further supports this by engaging with educational institutions, manufacturers, and content creators, fostering an ecosystem of innovation and expertise.

Brand Building and Marketing

Dolby actively cultivates its brand by highlighting the superior audio and visual experiences offered by technologies like Dolby Atmos and Dolby Vision. This involves extensive marketing campaigns and strategic partnerships to showcase the value proposition to both consumers and content creators.

The company’s marketing efforts are designed to drive demand for Dolby-enabled devices and content. For instance, Dolby sponsors industry events such as Sonic Days, fostering engagement with professionals and encouraging innovation within the audio-visual sector.

- Brand Promotion: Marketing campaigns focus on the immersive benefits of Dolby Atmos and Dolby Vision, influencing consumer purchasing decisions.

- Partner Engagement: Collaborations with device manufacturers and content studios are key to expanding the reach of Dolby technologies.

- Industry Influence: Sponsorship of events like Sonic Days allows Dolby to connect with and influence key stakeholders in the entertainment and technology industries.

Compliance and Quality Assurance

Dolby's key activities heavily involve ensuring all licensed products and content adhere to their rigorous quality and performance benchmarks. This commitment is crucial for maintaining the premium perception of the Dolby brand.

These activities include comprehensive testing protocols, a robust certification process, and continuous monitoring of licensed products. For instance, in 2024, Dolby continued its focus on certifying devices for Dolby Atmos and Dolby Vision, ensuring that the immersive audio and vibrant visual experiences meet the company's exacting standards across a wide range of consumer electronics and content production tools.

This meticulous approach protects Dolby's valuable brand reputation and guarantees a consistently high-quality, reliable experience for consumers worldwide.

- Brand Protection: Maintaining the integrity of the Dolby brand through strict adherence to quality standards.

- Performance Standards: Ensuring licensed products deliver the promised audio and visual fidelity.

- Certification Processes: Implementing thorough testing and validation for new and existing technologies.

- Ongoing Monitoring: Continuously assessing licensed products and content for compliance and quality.

Dolby's key activities are centered around innovation, intellectual property management, partner collaboration, brand promotion, and quality assurance.

These activities ensure the continuous development of cutting-edge audio and imaging technologies, their strategic licensing, seamless integration into consumer products, and the consistent delivery of premium entertainment experiences to users globally.

The company's commitment to these core functions is reflected in its substantial R&D investments and its proactive approach to brand building and quality control.

Dolby's strategic licensing of its extensive intellectual property portfolio, which includes over 22,000 patents, is a primary revenue driver.

| Key Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Research & Development | Creating and refining advanced audio and imaging technologies. | $0.262 billion in R&D expenses for the twelve months ending March 31, 2025. |

| Intellectual Property Management & Licensing | Managing and licensing a vast patent portfolio. | Over 22,000 patents and pending applications; acquired GE Licensing's 5,000 patents in 2024. |

| Partner Collaboration & Integration | Working with manufacturers and content creators to integrate Dolby technologies. | Continued strong relationships with major smartphone manufacturers and streaming services in 2024. |

| Brand Promotion | Marketing Dolby Atmos and Dolby Vision to consumers and creators. | Sponsorship of industry events like Sonic Days. |

| Quality Assurance & Certification | Ensuring licensed products meet Dolby's performance benchmarks. | Continued focus on certifying devices for Dolby Atmos and Dolby Vision in 2024. |

Delivered as Displayed

Business Model Canvas

The preview you see is not a sample; it's a genuine section of the Dolby Business Model Canvas you'll receive. Upon purchase, you'll gain immediate access to this exact, fully populated document, ready for your strategic planning. What you're viewing is the complete, unaltered file, ensuring you know precisely what you're investing in.

Resources

Dolby's intellectual property, particularly its patents and trademarks in audio and imaging, is a cornerstone of its business. This vast portfolio is the engine driving its licensing model, providing a significant competitive edge and consistent revenue.

As of recent reports, Dolby holds around 27,600 issued patents worldwide, with an additional 6,100 patent applications currently pending. This extensive collection of intellectual property is crucial for maintaining its market leadership and generating ongoing income through licensing agreements.

Dolby's highly skilled engineers and scientists are the bedrock of its innovation engine. These experts, deeply knowledgeable in audio processing and imaging science, are crucial for developing cutting-edge technologies that define immersive entertainment experiences. Their work directly fuels Dolby's research and development efforts, ensuring the company remains at the forefront of its industry.

Dolby's proprietary algorithms and software are the bedrock of its business model, representing the core intellectual property that drives its licensing revenue. These advanced audio and imaging technologies, including the renowned Dolby Atmos and Dolby Vision, are not just software; they are the very essence of the immersive experiences Dolby delivers.

These digital assets are meticulously crafted and continuously refined, forming a significant competitive advantage. They are the technical heart of Dolby's offerings, allowing partners to integrate unparalleled sound and visual quality into their devices and content, thereby creating the distinctive Dolby experience that consumers seek.

In 2024, Dolby's commitment to innovation in these areas continues to be a major focus, underpinning its ability to secure licensing agreements across a vast array of consumer electronics and entertainment platforms. The ongoing development and protection of these algorithms are crucial for maintaining Dolby's market leadership and driving future growth.

Brand Recognition and Reputation

Dolby's powerful brand recognition, encompassing 'Dolby,' 'Dolby Atmos,' and 'Dolby Vision,' is a cornerstone resource. This global awareness signals superior quality and deeply immersive experiences, resonating strongly with both consumers and business partners. In 2024, this brand equity continued to be a primary driver of consumer preference for Dolby-enabled devices and a catalyst for forging new strategic alliances across the entertainment ecosystem.

The brand's association with elevated entertainment is undeniable. This perception translates directly into demand for products featuring Dolby technologies, reinforcing Dolby's position as a leader in audio and visual innovation. By consistently delivering on its promise of enhanced experiences, Dolby solidifies its reputation, making it a preferred choice for content creators and hardware manufacturers alike.

- Global Brand Equity: 'Dolby,' 'Dolby Atmos,' and 'Dolby Vision' are recognized worldwide as benchmarks for premium audio and visual quality.

- Consumer Demand Driver: Strong brand recognition directly influences consumer purchasing decisions, favoring products equipped with Dolby technologies.

- Partnership Facilitator: The brand's reputation for innovation and quality makes Dolby an attractive partner for device manufacturers, content studios, and streaming services.

- Synonym for Enhanced Entertainment: Dolby is widely perceived as synonymous with superior, immersive entertainment experiences across various media platforms.

Global Network of Licensees and Partners

Dolby's extensive global network of licensees and partners is a cornerstone of its business model. This network includes thousands of manufacturers, content creators, and service providers, fostering widespread adoption of Dolby's audio and video technologies.

These deep-rooted relationships are crucial for ensuring Dolby's technologies are integrated into a vast array of devices and services, reaching consumers across diverse markets. For instance, Dolby Atmos technology is now featured in over 60 automotive models from 20 different original equipment manufacturers (OEMs), demonstrating the breadth of this network.

- Global Reach: Thousands of manufacturers, content creators, and service providers worldwide.

- Market Integration: Ensures widespread adoption across various markets and devices.

- Automotive Presence: Dolby Atmos available in over 60 automotive models from 20 OEMs.

Dolby's intellectual property, particularly its patents and trademarks in audio and imaging, is a cornerstone of its business, driving its licensing model and providing a significant competitive edge. As of recent reports, Dolby holds around 27,600 issued patents worldwide, with an additional 6,100 patent applications pending, underscoring the depth of its innovation. These proprietary algorithms and software, such as Dolby Atmos and Dolby Vision, are the technical heart of its offerings, allowing partners to integrate unparalleled sound and visual quality into their products.

Dolby's highly skilled engineers and scientists are crucial for developing cutting-edge technologies that define immersive entertainment experiences, fueling its research and development. The company's powerful brand recognition, encompassing 'Dolby,' 'Dolby Atmos,' and 'Dolby Vision,' signals superior quality and deeply immersive experiences, driving consumer preference and facilitating strategic alliances. This brand equity continued to be a primary driver in 2024, reinforcing Dolby's position as a leader in audio and visual innovation.

The extensive global network of licensees and partners, including thousands of manufacturers, content creators, and service providers, fosters widespread adoption of Dolby's technologies. This network ensures Dolby's presence across diverse markets and devices, exemplified by Dolby Atmos technology being featured in over 60 automotive models from 20 different OEMs in 2024. These deep-rooted relationships are vital for integrating Dolby's innovations into a vast array of consumer products and services.

| Key Resource | Description | 2024 Relevance |

| Intellectual Property (Patents & Trademarks) | Extensive portfolio of audio and imaging technologies. Holds ~27,600 issued patents globally. | Drives licensing revenue and competitive advantage. Essential for maintaining market leadership. |

| Proprietary Algorithms & Software | Core technologies like Dolby Atmos and Dolby Vision. Advanced audio and imaging processing. | Forms the technical foundation for immersive experiences. Key differentiator for partners. |

| Skilled Workforce (Engineers & Scientists) | Deep expertise in audio processing and imaging science. Drives innovation and R&D. | Crucial for developing and refining cutting-edge technologies. Ensures industry leadership. |

| Global Brand Equity | Recognition of 'Dolby,' 'Dolby Atmos,' and 'Dolby Vision' as premium quality. | Drives consumer demand and partnership opportunities. Signals superior entertainment experiences. |

| Global Network of Licensees & Partners | Thousands of manufacturers, content creators, and service providers. | Facilitates widespread market integration and adoption of Dolby technologies. Expands reach across devices and platforms. |

Value Propositions

Dolby's commitment to enhancing the entertainment experience is central to its value proposition. Through technologies like Dolby Atmos for sound and Dolby Vision for visuals, consumers are treated to a more lifelike and captivating journey, making content truly come alive.

This immersive quality translates into richer soundscapes and stunning picture clarity, featuring vibrant colors and deep blacks. For instance, Dolby Vision HDR content can offer up to 100 times the brightness of standard dynamic range, providing unparalleled detail and realism.

In 2024, the demand for premium home entertainment continues to grow, with consumers actively seeking out technologies that deliver a superior viewing and listening experience. Dolby's innovations are a key differentiator, setting it apart in a competitive market by offering a tangible upgrade to how people consume media.

Dolby's technologies frequently establish themselves as industry benchmarks, fostering effortless compatibility between diverse devices and content sources. This inherent reliability and uniformity benefit both those who create content and those who consume it, streamlining the entire digital landscape.

This commitment to standardization actively combats market fragmentation, thereby encouraging broader acceptance and integration of Dolby's innovations. For instance, the widespread adoption of Dolby Atmos in 2024 across numerous streaming services and cinema releases underscores its role as an de facto standard for immersive audio experiences.

Dolby's commitment to innovation and cutting-edge technology is a core value proposition, offering partners and consumers access to the very latest in audio and imaging advancements. This ensures manufacturers can equip their products with state-of-the-art features, giving content creators the tools to explore new creative frontiers.

The company's significant investment in research and development fuels a continuous pipeline of new features and improvements, keeping Dolby at the forefront of the industry. For instance, Dolby's ongoing work in areas like Dolby Atmos and Dolby Vision demonstrates their dedication to pushing the boundaries of immersive audio and lifelike visuals.

Simplified Integration for Manufacturers

Dolby offers manufacturers a streamlined path to integrating its advanced audio and imaging technologies. This includes comprehensive toolkits, dedicated support, and a clear licensing structure, significantly easing the adoption of complex Dolby features.

This simplified integration directly translates to reduced development cycles and lower costs for hardware partners. Manufacturers can therefore accelerate their time-to-market, bringing innovative Dolby-enhanced products to consumers more efficiently.

The ease of integration is a core value proposition, allowing partners to focus on their product's unique features rather than the intricacies of audio and imaging technology implementation. This focus on accessibility empowers a broader range of manufacturers to leverage Dolby's premium experiences.

- Simplified Integration: Dolby provides manufacturers with comprehensive tools and support to easily integrate advanced audio and imaging technologies.

- Reduced Development Time & Cost: This streamlined process lowers engineering overhead and speeds up the product development lifecycle.

- Faster Time-to-Market: Manufacturers can quickly launch Dolby-enabled products, gaining a competitive edge.

- Focus on Core Competencies: Partners can concentrate on their product's unique design and features, leveraging Dolby's expertise for audio and imaging.

Monetization and Differentiation for Content Creators

Dolby technologies empower content creators by offering advanced audio and visual capabilities that set their work apart. This differentiation is crucial in today's crowded digital landscape, allowing creators to deliver a premium experience that can attract and retain audiences. For instance, Dolby Atmos, a key technology, enables immersive soundscapes that can significantly enhance viewer engagement.

By integrating Dolby's solutions, creators can unlock new monetization strategies. This often involves offering premium content tiers or experiences that leverage the enhanced quality Dolby provides. This allows for a clear value proposition to consumers willing to pay for superior audio-visual fidelity, as seen in the growing adoption of Dolby Vision and Dolby Atmos in streaming services and home entertainment setups.

- Enhanced Artistic Expression: Dolby technologies provide tools for creators to realize their artistic vision with unparalleled audio and visual depth.

- Market Differentiation: Superior sound and picture quality enabled by Dolby helps content stand out in a competitive market, attracting more viewers.

- Premium Content Delivery: Creators can leverage Dolby's capabilities to offer a high-quality, immersive experience, justifying premium pricing models.

- Increased Audience Engagement: Immersive audio and vibrant visuals contribute to a more captivating experience, leading to higher viewer retention and satisfaction.

Dolby's core value proposition centers on delivering unparalleled audio and visual experiences that captivate consumers. Technologies like Dolby Atmos and Dolby Vision provide lifelike immersion, making content more engaging and memorable. This focus on quality differentiates Dolby-enabled products in a crowded market.

For manufacturers, Dolby offers a clear advantage by simplifying the integration of advanced technologies. This reduces development time and costs, allowing partners to bring innovative products to market faster. By leveraging Dolby's expertise, manufacturers can focus on their core strengths while ensuring a premium consumer experience.

Content creators benefit from Dolby's tools by enhancing artistic expression and differentiating their work. The ability to deliver premium, immersive experiences allows for new monetization strategies and increased audience engagement. This creates a virtuous cycle where high-quality content drives demand for Dolby-enabled hardware.

In 2023, Dolby reported revenue of $1.03 billion, with a significant portion driven by its licensing model across consumer electronics and content creation. The continued growth in streaming services and premium home theater adoption in 2024 further solidifies the demand for Dolby's technologies.

| Value Proposition Aspect | Description | Key Benefit | Supporting Data/Trend (2024 Focus) |

|---|---|---|---|

| Immersive Entertainment | Delivering lifelike audio and visual experiences | Enhanced consumer engagement and satisfaction | Growing consumer demand for premium home entertainment solutions |

| Technology Leadership | Providing cutting-edge audio and imaging advancements | Access to state-of-the-art features for partners and consumers | Continuous R&D investment fueling new innovations |

| Simplified Integration | Offering comprehensive toolkits and support for manufacturers | Reduced development cycles and faster time-to-market | Ease of adoption for complex Dolby features across diverse devices |

| Content Differentiation | Empowering creators with advanced capabilities | Standing out in a crowded digital landscape, enabling premium content tiers | Widespread adoption of Dolby Atmos in streaming services and cinema |

Customer Relationships

Dolby's customer relationships are significantly shaped by its long-term licensing agreements, which are the bedrock of its business model. These agreements provide a stable and predictable revenue stream through ongoing royalty payments for the use of Dolby's extensive intellectual property.

In 2024, Dolby continued to leverage these deep-rooted partnerships, which often span many years and multiple product cycles. This approach fosters loyalty and ensures partners remain integrated with Dolby's evolving audio and imaging technologies, a strategy that has historically delivered consistent financial performance.

Dolby offers robust technical support and consultation, ensuring licensees effectively integrate and optimize its audio and visual technologies. This direct engagement helps partners troubleshoot implementation challenges, leading to higher product quality and user satisfaction.

Dolby's partnership management involves dedicated teams who maintain close ties with key partners through consistent communication and joint strategic planning. This ensures Dolby’s offerings are integrated seamlessly with partner roadmaps, driving mutual success.

In 2024, Dolby continued to strengthen its ecosystem by fostering collaborative initiatives with a diverse range of technology and content partners. This proactive approach to relationship management is crucial for expanding the reach and impact of Dolby's audio and visual technologies across various platforms and devices.

Joint Marketing Initiatives

Dolby frequently collaborates on joint marketing and co-branding ventures with its partners. These efforts aim to boost awareness and demand for products and content featuring Dolby technologies, creating a win-win scenario for Dolby and its licensees.

This strategic approach leverages Dolby's established brand recognition to influence consumer purchasing decisions. For instance, Dolby often secures prominent placement and showcases at major industry events such as CES, a key platform for product launches and consumer engagement.

- Co-Branding Benefits: Dolby's brand association enhances the perceived value and appeal of partner products.

- Consumer Awareness: Joint campaigns effectively reach wider audiences, driving interest in Dolby-enabled experiences.

- Industry Event Presence: Participation in events like CES provides direct consumer interaction and product demonstrations.

- Licensing Growth: Successful marketing initiatives contribute to increased adoption of Dolby technologies by manufacturers and content creators.

Developer Programs and Resources

Dolby actively cultivates its developer and content creator community through specialized programs and extensive resources. These offerings are crucial for enabling the widespread adoption of Dolby Atmos and Dolby Vision technologies.

For content creators and software developers, Dolby provides dedicated programs, Software Development Kits (SDKs), and a wealth of resources. This support is designed to streamline the process of creating and mastering content in Dolby Atmos and Dolby Vision formats.

- Developer Programs: Dolby offers programs tailored to software developers and hardware manufacturers, providing them with the tools and knowledge to integrate Dolby technologies into their products and services.

- SDKs and Resources: A comprehensive suite of SDKs, documentation, and sample code is available, empowering developers to efficiently implement Dolby Atmos and Dolby Vision features.

- Content Ecosystem Growth: By facilitating content creation, Dolby ensures a robust and growing library of compatible material, which is essential for the consumer experience.

- Dolby Institute: This initiative fosters innovation within the industry through educational programs, workshops, and grants, further nurturing the talent pool and encouraging new applications of Dolby's technologies.

Dolby's customer relationships are built on long-term licensing, robust technical support, and collaborative marketing, fostering deep loyalty and ensuring technology integration. In 2024, this strategy continued to drive growth, with Dolby actively engaging its developer and content creator communities through specialized programs and extensive resources like SDKs to promote Dolby Atmos and Dolby Vision adoption.

| Relationship Type | Key Activities | 2024 Focus/Data Point |

|---|---|---|

| Licensing Partners | Long-term agreements, royalty payments | Continued expansion of device integrations across consumer electronics. |

| Technical Support | Consultation, troubleshooting, integration assistance | Enhanced support for new device categories and evolving content formats. |

| Developer/Content Creator Community | SDKs, programs, educational resources | Focus on empowering creators for Dolby Atmos and Dolby Vision content production. |

| Co-Branding & Marketing | Joint campaigns, industry event presence | Increased co-branded product launches and promotional activities. |

Channels

Dolby's direct licensing sales team is the backbone of its revenue generation, directly engaging with manufacturers and content creators worldwide to forge licensing agreements. This specialized team navigates complex intellectual property negotiations, a critical function for Dolby's business model.

In 2023, Dolby reported that licensing revenue represented a significant portion of its total revenue, underscoring the importance of this direct sales channel. The team's expertise in handling intricate contracts ensures that Dolby's innovative audio and imaging technologies are widely adopted across consumer electronics and entertainment sectors.

Dolby's Technology Integration Teams are crucial for embedding its audio and visual innovations into partner products. These teams collaborate directly with manufacturers' engineers, offering expert guidance and support to ensure seamless integration of Dolby technologies. Their work is vital for maintaining the high-quality experience Dolby is known for.

These integration specialists act as a direct bridge, providing partners with the necessary documentation, software development kits, and hands-on troubleshooting. This direct engagement helps accelerate the development cycle and ensures that Dolby's advanced features are implemented correctly and efficiently, leading to superior end-user experiences.

Industry conferences and trade shows are vital for Dolby. They actively participate in major events such as CES, IBC, and NAB. These gatherings allow Dolby to unveil cutting-edge technologies, announce new collaborations, and connect with both existing and potential licensees, fostering crucial business development and enhancing brand recognition.

Dolby's commitment to these platforms is substantial. For instance, in 2025, Dolby proudly served as a Platinum Sponsor for Sonic Days, a significant industry gathering. Such sponsorships underscore their dedication to engaging with the broader audio-visual community and showcasing their innovations.

Developer Portals and Documentation

Dolby's developer portals act as a crucial self-service channel. They offer content creators and software developers access to essential tools like SDKs, APIs, technical specifications, and implementation guidelines for Dolby's audio and video technologies. This accessibility fosters a wide-ranging ecosystem of innovation, driving the adoption of Dolby's standards across various platforms and devices.

These portals are instrumental in democratizing access to Dolby's advanced capabilities, allowing a diverse group of developers to integrate Dolby's immersive audio and enhanced video experiences into their own products and services. This strategy directly fuels market penetration and reinforces Dolby's position as an industry leader.

- Developer Portals: Provide self-service access to SDKs, APIs, and technical documentation.

- Ecosystem Enablement: Foster innovation by empowering third-party developers to integrate Dolby technologies.

- Widespread Adoption: Facilitate the broad implementation of Dolby standards across consumer electronics and content creation.

- Resource Hub: Offer guidelines and specifications crucial for seamless integration and optimal performance.

Strategic Alliances and Joint Ventures

Dolby frequently engages in strategic alliances and joint ventures to broaden its technological reach and accelerate market adoption. These partnerships allow Dolby to tap into existing distribution channels and specialized knowledge, effectively expanding its influence across various sectors. For instance, collaborations with device manufacturers are crucial for integrating Dolby's audio and visual technologies into consumer electronics.

By joining forces, Dolby can co-develop innovative solutions and gain access to new customer segments that might be difficult to reach independently. This collaborative approach is particularly valuable for developing niche applications or entering emerging markets. The company's strategy often involves leveraging partners' established customer bases and market expertise to drive growth.

- Strategic Alliances: Dolby partners with key industry players to integrate its technologies into a wider range of products and services, enhancing market penetration.

- Joint Ventures: Dolby may form joint ventures to co-develop new technologies or enter specific markets, sharing risks and rewards with partners.

- Leveraging Expertise: These alliances enable Dolby to benefit from partners' market access, brand recognition, and technical capabilities, speeding up innovation and commercialization.

- IP Expansion: Strategic moves, such as the acquisition of GE Licensing, exemplify Dolby's approach to expanding its intellectual property portfolio through targeted partnerships and acquisitions.

Dolby's developer portals serve as a vital self-service channel, offering creators and developers access to SDKs, APIs, and technical documentation. This empowers a broad ecosystem to integrate Dolby's audio and video technologies, driving widespread adoption and reinforcing its industry leadership.

Strategic alliances and joint ventures are key for Dolby to expand its technological reach and market penetration. By collaborating with device manufacturers and other industry players, Dolby leverages partners' expertise and customer bases to accelerate innovation and commercialization.

Industry conferences and trade shows are crucial platforms for Dolby to showcase new technologies and foster business development. Their active participation in events like CES and NAB, including significant sponsorships, highlights their commitment to engaging the audio-visual community.

Dolby's direct licensing sales team is fundamental to its revenue, negotiating agreements with manufacturers and content creators. Their expertise in intellectual property ensures broad adoption of Dolby's technologies, a critical component of their business model as licensing revenue formed a significant portion of their 2023 total revenue.

Customer Segments

Consumer electronics manufacturers, including giants like Samsung, Xiaomi, LG, and Hisense, represent a core customer segment for Dolby. These companies integrate Dolby's advanced audio and imaging technologies into a vast array of products such as televisions, soundbars, smartphones, PCs, and gaming consoles.

By incorporating Dolby technologies, these manufacturers aim to differentiate their products in a competitive market, offering consumers enhanced, premium entertainment experiences. This integration allows them to attract customers who prioritize superior sound and visual quality, thereby boosting sales and brand perception.

Professional Content Creation Studios, encompassing major film studios like Warner Bros. Discovery and music production houses such as Universal Music Group, are key customers. These entities leverage Dolby's advanced technologies, including Dolby Atmos and Dolby Vision, to craft immersive audio and stunning visual experiences for their productions. In 2024, the global film and TV production market was valued at over $270 billion, with a significant portion dedicated to enhancing post-production quality, directly benefiting Dolby's offerings.

Broadcasting and streaming companies, including traditional TV networks, cable providers, and burgeoning OTT platforms, represent a crucial customer segment for Dolby. These entities license Dolby's audio and video enhancement technologies to elevate the consumer viewing experience, particularly for live events and premium content like movies and series. For instance, in 2023, the global streaming market was valued at over $80 billion, with major players like Netflix and Disney+ investing heavily in content and technology to attract and retain subscribers, making Dolby's solutions increasingly valuable.

Automotive Manufacturers

Automotive manufacturers represent a rapidly growing customer segment for Dolby, as they integrate Dolby Atmos and Dolby Vision into their in-car entertainment systems. This strategic move addresses the escalating consumer desire for high-quality audio and visual experiences, effectively elevating the entire driving journey. This integration transforms vehicles into immersive entertainment hubs, a key differentiator in today's competitive automotive market.

Leading automotive brands are actively partnering with Dolby to deliver these premium experiences. Key players include Audi, Cadillac, Porsche, and Hyundai, all of whom are embedding Dolby's advanced technologies into their latest vehicle models. This adoption signifies a strong industry trend towards enhanced in-car media consumption.

- Growing Demand: Consumers increasingly expect premium entertainment features in their vehicles, driving adoption of technologies like Dolby Atmos and Vision.

- Key Partnerships: Major automotive manufacturers such as Audi, Cadillac, Porsche, and Hyundai are integrating Dolby's solutions.

- Market Differentiation: Dolby's technologies provide a competitive edge for automakers by offering superior in-car audio-visual experiences.

- Enhanced Driving Experience: The integration aims to transform the car into an immersive entertainment space, improving passenger satisfaction.

PC Hardware and Software Developers

This segment comprises manufacturers of personal computers, laptops, and monitors, along with software developers crafting applications for these platforms. These partners integrate Dolby's advanced audio and visual technologies to elevate the user experience across productivity, entertainment, and gaming. For instance, in 2024, the global PC market saw shipments reaching approximately 240 million units, highlighting the vast reach for Dolby-enhanced experiences.

Companies like Dell, Alienware, ASUS, Lenovo, and Google are key players within this ecosystem. They leverage Dolby's innovations to differentiate their products and capture a market increasingly demanding immersive audio and visual quality. The integration of Dolby Atmos and Dolby Vision in gaming laptops, for example, directly appeals to a significant portion of this user base.

- PC Hardware Manufacturers: Companies like Dell, ASUS, and Lenovo integrate Dolby technologies into their laptops and monitors to offer superior audio-visual capabilities.

- Software Developers: Application creators utilize Dolby's SDKs to embed enhanced audio and visual features into their PC software, improving user engagement.

- Market Integration: The PC hardware and software developer segment is crucial for bringing Dolby's immersive experiences to a broad consumer base, impacting millions of users annually.

Dolby's customer segments are diverse, ranging from consumer electronics manufacturers like Samsung and Xiaomi who embed Dolby technologies into devices such as TVs and smartphones, to professional content creators including Warner Bros. Discovery and Universal Music Group, who utilize Dolby Atmos and Vision for immersive productions. Broadcasting and streaming services like Netflix and Disney+ also license Dolby's solutions to enhance viewer experiences, capitalizing on the booming streaming market valued at over $80 billion in 2023.

Cost Structure

Dolby's commitment to innovation is reflected in its substantial Research and Development (R&D) expenses. This category encompasses crucial investments such as the salaries for its highly skilled engineers and scientists, the acquisition and maintenance of advanced laboratory equipment, and the ongoing process of patent development and protection.

These R&D expenditures are not merely costs; they are vital for Dolby to sustain its technological leadership in the audio and visual space and to build a strong pipeline of intellectual property. For the quarter ending March 31, 2025, Dolby reported R&D expenses of $0.062 billion, underscoring the significant financial commitment to future product development and technological advancements.

Dolby's cost structure heavily features intellectual property and legal expenses, crucial for safeguarding and profiting from its innovative audio and imaging technologies. These costs encompass the considerable effort and financial outlay required to file, maintain, and defend its extensive patent portfolio, which boasted over 22,000 patents as of late 2023. This robust protection is fundamental to their business model, ensuring the exclusivity and value of their core assets.

Furthermore, legal expenditures are significant, covering the negotiation and management of licensing agreements with numerous partners across the entertainment and technology sectors. They also allocate resources to address potential infringement cases, a necessary measure to uphold the integrity and enforceability of their intellectual property rights. These ongoing legal and IP management costs are a substantial, yet vital, component of Dolby's operational expenses.

Dolby's sales, marketing, and business development activities represent a substantial cost center. These expenses encompass the salaries and commissions for their global sales force, the development and execution of targeted marketing campaigns across various media, and participation in key industry trade shows and conferences. For instance, Dolby's presence at events like CES or IFA is crucial for showcasing their latest audio and imaging technologies to potential partners and licensees.

These investments are directly linked to acquiring new licensees and expanding Dolby's market penetration across consumer electronics, automotive, and broadcast sectors. In 2024, the company continued to invest heavily in digital marketing and content creation to educate the market and highlight the value proposition of Dolby technologies, such as Dolby Atmos and Dolby Vision, which directly drives adoption and subsequent revenue growth.

General and Administrative Overheads

General and administrative (G&A) overheads represent the essential costs of running Dolby's corporate functions, encompassing executive leadership, finance, human resources, and IT. These are the backbone costs that keep the global enterprise operational and compliant with regulations. For instance, in their fiscal year 2023, Dolby reported selling, general, and administrative expenses of $798.2 million, which includes these crucial overheads supporting their worldwide operations.

These G&A costs are vital for the day-to-day functioning of the business, ensuring smooth operations across all departments. They facilitate strategic decision-making, manage employee relations, and maintain the technological infrastructure necessary for Dolby's innovation and service delivery.

- Executive Management: Salaries and benefits for top leadership driving company strategy.

- Finance & Accounting: Costs for financial planning, reporting, and compliance.

- Human Resources: Expenses related to talent acquisition, employee development, and HR operations.

- IT Infrastructure: Investment in technology systems and support for company-wide IT needs.

Operational Support and Partner Enablement

Dolby's cost structure heavily features expenses related to operational support and partner enablement. These are crucial for ensuring their technology is adopted and implemented effectively by a wide range of licensees.

Significant costs are associated with providing ongoing technical support, comprehensive training programs, and dedicated integration assistance to their partners. This includes maintaining the sophisticated development tools that partners rely on and managing robust certification programs to guarantee quality.

These investments are essential for successful technology implementation and the delivery of high-quality end products by licensees. For instance, the Dolby Creators Lab represents a direct investment in fostering this ecosystem.

- Technical Support & Training: Costs for dedicated support teams and developing training materials for partners.

- Integration Assistance: Expenses incurred to help partners seamlessly integrate Dolby technologies.

- Development Tools & Certification: Investment in maintaining and updating development tools and managing certification processes.

- Dolby Creators Lab: Operational costs for facilities and programs designed to support creators.

Dolby's cost structure is heavily influenced by its significant investment in research and development, essential for maintaining its technological edge. This includes substantial spending on highly skilled personnel, advanced equipment, and patent protection. For the quarter ending March 31, 2025, R&D expenses were reported at $0.062 billion, highlighting a continuous commitment to innovation.

Intellectual property and legal expenses are also a major cost component, vital for safeguarding Dolby's extensive patent portfolio, which exceeded 22,000 patents by late 2023. These costs support licensing negotiations and the enforcement of their intellectual property rights, crucial for their revenue streams.

Sales, marketing, and business development are significant cost drivers, funding global sales teams, marketing campaigns, and industry event participation. In 2024, Dolby continued to invest in digital marketing to promote technologies like Dolby Atmos and Dolby Vision, directly impacting market adoption.

General and administrative (G&A) overheads, including executive, finance, HR, and IT functions, are fundamental to operational stability. In fiscal year 2023, Dolby's selling, general, and administrative expenses amounted to $798.2 million, reflecting the costs of supporting global operations.

| Cost Category | Description | Example Data Point (as of latest available) |

|---|---|---|

| Research & Development (R&D) | Investment in innovation, talent, and technology advancement. | $0.062 billion (Q1 2025) |

| Intellectual Property & Legal | Protecting and managing patents, licensing, and legal affairs. | Over 22,000 patents (late 2023) |

| Sales, Marketing & Business Development | Driving market adoption and partner acquisition. | Continued heavy investment in digital marketing (2024) |

| General & Administrative (G&A) | Corporate functions and operational overheads. | $798.2 million (FY 2023 SG&A) |

Revenue Streams

Dolby's core revenue comes from licensing its advanced audio and imaging technologies, such as Dolby Atmos and Dolby Vision. Manufacturers pay a royalty fee for each product that integrates these innovations.

This royalty model is incredibly effective, as Dolby's technologies are embedded in billions of devices globally, from smartphones and televisions to soundbars and gaming consoles.

For the first quarter of fiscal year 2025, Dolby reported a substantial $289.9 million in licensing revenue, underscoring the consistent demand and value of its intellectual property in the consumer electronics market.

Dolby generates significant revenue by licensing its vast patent portfolio, encompassing crucial audio and video compression technologies, including standard essential patents. This strategy creates a wide-reaching revenue stream across numerous digital media and electronics industries.

The acquisition of GE Licensing in 2024 was a strategic move that substantially enhanced Dolby's patent licensing revenue. This expansion of their intellectual property holdings is expected to further diversify and strengthen their market position.

Dolby earns revenue by licensing its Software Development Kits (SDKs) and specialized tools to a wide range of users. These include content creators, software developers, and professionals who need to produce and perfect content that utilizes Dolby technologies. This licensing model is crucial for building and maintaining the Dolby content pipeline, ensuring a steady flow of Dolby-enabled material.

Certification and Compliance Fees

Dolby collects certification and compliance fees from manufacturers. These fees are essential for ensuring that products meet Dolby's stringent quality and performance standards. This process upholds the integrity of the Dolby brand and guarantees a consistent, premium user experience across all Dolby-enabled devices.

These fees are a critical revenue stream, directly supporting Dolby's commitment to innovation and maintaining its reputation for high-fidelity audio and visual experiences. For instance, in fiscal year 2023, Dolby reported revenue of $1.06 billion, with licensing and royalty fees forming the bulk of this income, which includes these certification components.

- Certification Fees: Manufacturers pay to have their products tested and certified against Dolby's technical specifications.

- Compliance Fees: Ongoing fees ensure continued adherence to Dolby's evolving standards and brand guidelines.

- Brand Integrity: These fees help maintain Dolby's premium market positioning and consumer trust.

- Revenue Generation: A significant portion of Dolby's overall revenue is derived from these licensing and certification agreements with hardware manufacturers.

Professional Services and Support

Dolby's Professional Services and Support segment offers specialized expertise, generating revenue beyond its standard licensing agreements. This can involve consulting and advanced integration assistance, particularly for partners undertaking complex projects or requiring bespoke solutions.

This revenue stream is crucial for deepening relationships with key partners and ensuring the successful implementation of Dolby technologies. For instance, Dolby provides specialized integration support for new automotive models, a growing area for immersive audio experiences.

- Consulting and Custom Solutions: Dolby offers expert advice and tailored integration services for intricate deployments.

- Advanced Integration Support: This includes specialized assistance for partners, such as automotive manufacturers integrating new audio systems.

- Revenue Supplementation: These services provide an additional income stream that complements Dolby's primary licensing revenue.

Dolby's revenue model is primarily built on licensing its intellectual property, including audio and imaging technologies. This includes royalties paid by manufacturers for integrating Dolby Atmos and Dolby Vision into billions of devices. For the first quarter of fiscal year 2025, Dolby reported $289.9 million in licensing revenue, showcasing the ongoing demand for its patented technologies across the consumer electronics market.

Beyond core licensing, Dolby generates income through certification and compliance fees, ensuring products meet rigorous quality standards and uphold brand integrity. These fees are vital for maintaining Dolby's premium market position and consumer trust. In fiscal year 2023, Dolby's total revenue was $1.06 billion, with licensing and royalty fees, including these certification components, forming the largest share.

Dolby also offers professional services and support, providing consulting and advanced integration assistance for complex projects and bespoke solutions. This segment, which includes specialized integration support for automotive manufacturers, supplements its primary licensing revenue and deepens partner relationships.

| Revenue Stream | Description | Key Data Point (FY25 Q1 unless noted) |

|---|---|---|

| Licensing & Royalties | Fees from manufacturers for integrating Dolby technologies (e.g., Atmos, Vision) | $289.9 million (Licensing Revenue) |

| Certification & Compliance Fees | Fees for product testing, certification, and ongoing adherence to standards | Part of overall $1.06 billion revenue (FY23), supporting brand integrity |

| Professional Services & Support | Consulting and specialized integration assistance for partners | Supports automotive sector and complex deployments |

Business Model Canvas Data Sources

The Dolby Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and analysis of technological advancements. These sources ensure each element, from value propositions to revenue streams, is grounded in Dolby's strategic positioning and market realities.