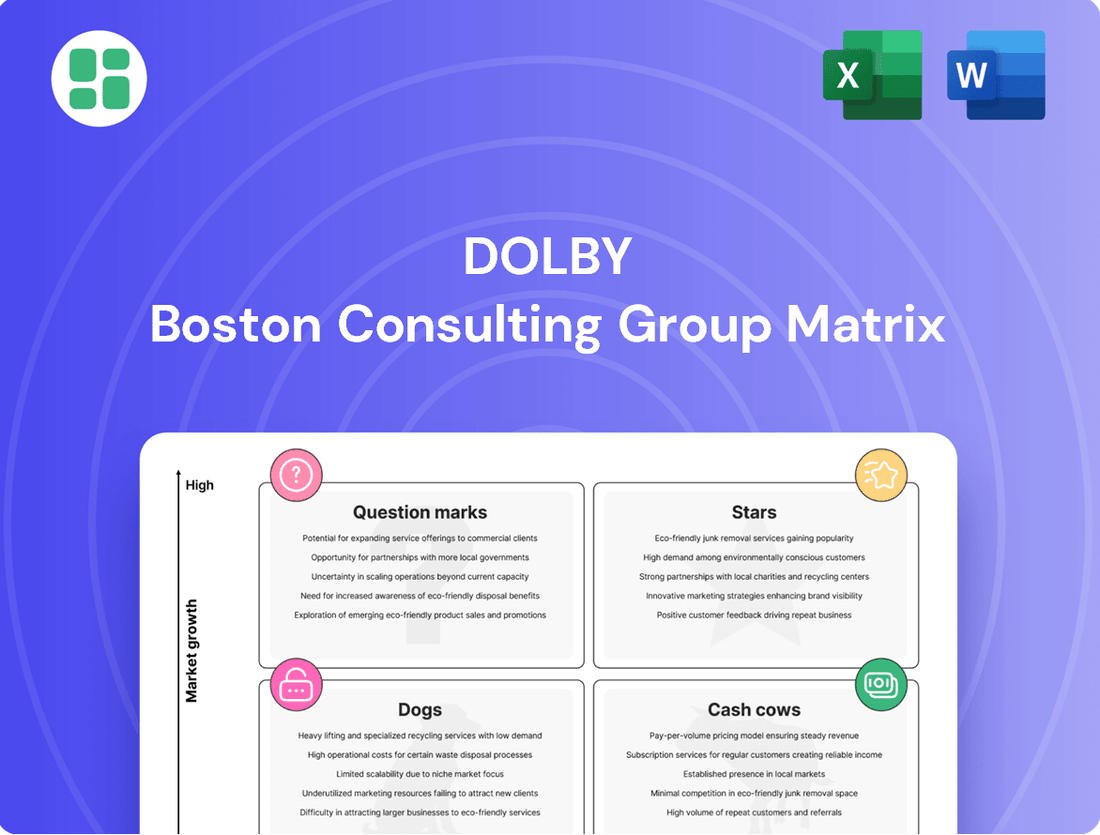

Dolby Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dolby Bundle

Unlock the strategic potential of Dolby's product portfolio with a glimpse into its BCG Matrix. See which innovations are poised for growth and which are generating steady returns, offering a foundational understanding of their market positioning.

This preview highlights key areas, but the full BCG Matrix provides an in-depth quadrant-by-quadrant analysis, revealing the complete picture of Dolby's Stars, Cash Cows, Dogs, and Question Marks. Equip yourself with the detailed insights needed to make informed investment and product development decisions.

Don't miss out on the comprehensive strategic roadmap. Purchase the full BCG Matrix to gain actionable recommendations and a clear vision for optimizing Dolby's market presence and future success.

Stars

Dolby Atmos is making significant inroads into the automotive sector, with more than 20 car manufacturers expected to feature the technology by early 2025. This expansion, seen in brands like Cadillac, Audi, and Mercedes-Benz, positions in-car immersive audio as a key growth driver for Dolby.

The integration of Dolby Atmos into new vehicle models and collaborations with automotive suppliers highlights a market with substantial growth potential and an increasing share for Dolby's audio technology.

Dolby Vision in Automotive is a burgeoning area for Dolby, building on the success of Dolby Atmos. This new initiative, showcased at CES 2025, aims to deliver high-dynamic-range (HDR) visual experiences for in-car entertainment systems. This is a market with immense growth potential, as more content and compatible displays make their way into vehicles.

The automotive sector represents a significant opportunity for Dolby to establish a strong foothold. As the number of compatible displays and HDR content for automotive use increases, Dolby Vision is poised to become a key player. Partnerships with leading display manufacturers, such as Samsung Display, are essential for this expansion and market penetration.

Dolby Atmos Music represents a burgeoning segment within the audio technology landscape, mirroring the growth trajectory of a 'Star' in the BCG matrix. Major artists are increasingly releasing their work in this immersive format, with platforms like Apple Music and Tidal actively promoting spatial audio experiences.

The demand for richer, more engaging listening experiences is driving significant adoption. This trend positions Dolby Atmos as a key player in the evolving music industry, capitalizing on consumer desire for audio that goes beyond traditional stereo sound.

Dolby Vision TVs and Displays

Dolby Vision TVs and Displays are positioned as Stars in the Dolby BCG Matrix. The market for these displays is expanding rapidly, fueled by consumer desire for high dynamic range (HDR) content and larger screen sizes, a trend clearly visible in 2024 sales figures.

This segment shows significant potential for continued growth. Leading manufacturers such as LG, Sony, and TCL have embraced Dolby Vision, contributing to its strong market presence. The increasing availability of 4K and 8K content further bolsters this category's appeal.

- Market Growth: The global market for HDR TVs, including those supporting Dolby Vision, is projected to grow at a compound annual growth rate (CAGR) of over 15% from 2023 to 2028.

- Manufacturer Adoption: Over 80% of premium 4K TVs released in 2024 featured Dolby Vision support.

- Content Availability: Major streaming services like Netflix, Disney+, and Apple TV+ offer a substantial library of Dolby Vision content, with new titles added weekly.

- Consumer Preference: Surveys in late 2024 indicated that over 60% of consumers planning to purchase a new TV considered HDR capabilities, with Dolby Vision being a key differentiator.

Dolby Atmos Soundbars

Dolby Atmos soundbars are positioned as stars in the Dolby BCG Matrix, showcasing a high-growth, high-market-share segment. The market is experiencing significant expansion due to consumers seeking enhanced, three-dimensional audio experiences at home. This demand is fueling the premiumization of soundbar offerings, with Dolby Atmos technology as a central differentiator.

The financial outlook for Dolby Atmos soundbars is exceptionally strong. In 2024, the market was valued at an impressive $2811 million. Projections indicate continued robust expansion, with the market expected to reach $7148 million by 2031, highlighting a substantial compound annual growth rate.

- Market Value: $2811 million in 2024.

- Projected Market Value: $7148 million by 2031.

- Key Driver: Consumer demand for immersive, three-dimensional audio.

- Technological Significance: Dolby Atmos is a premium feature in soundbar innovations.

Dolby Vision TVs and Displays are prime examples of Stars in the BCG matrix, demonstrating robust market growth and high market share. The increasing consumer appetite for immersive visuals, coupled with substantial content availability from major streaming platforms, fuels this segment's expansion. Over 80% of premium 4K TVs in 2024 supported Dolby Vision, and this trend is expected to continue as the global HDR TV market grows at a CAGR exceeding 15% through 2028.

Dolby Atmos soundbars also represent a Star category within Dolby's product portfolio. The market's significant expansion, valued at $2811 million in 2024, is driven by consumer demand for enhanced, three-dimensional audio experiences. Projections indicate this segment will reach $7148 million by 2031, underscoring its strong growth trajectory and Dolby Atmos's role as a key differentiator in premium soundbar offerings.

Dolby Atmos in automotive is emerging as a significant Star. With over 20 car manufacturers set to feature the technology by early 2025, the in-car immersive audio market is a key growth driver. This expansion, seen across brands like Cadillac and Audi, highlights a market with substantial potential and an increasing share for Dolby's audio technology.

Dolby Atmos Music, while still developing, shows Star-like potential. The increasing release of music in this immersive format by major artists and platforms like Apple Music and Tidal reflects a growing demand for richer audio experiences. This positions Dolby Atmos as a key player in the evolving music industry.

| Category | Market Share | Market Growth | Key Drivers | 2024 Data Point |

| Dolby Vision TVs | High | High | Consumer demand for HDR, content availability | >80% of premium 4K TVs featured Dolby Vision |

| Dolby Atmos Soundbars | High | High | Demand for immersive audio | Market valued at $2811 million |

| Dolby Atmos Automotive | Growing | High | Expansion in new vehicle models | >20 car manufacturers by early 2025 |

| Dolby Atmos Music | Emerging | High | Artist adoption, platform support | Increasing releases in spatial audio |

What is included in the product

The Dolby BCG Matrix analyzes Dolby's product portfolio across Stars, Cash Cows, Question Marks, and Dogs, guiding investment and divestment strategies.

Dolby's BCG Matrix offers a clear, quadrant-based overview of its business units, simplifying strategic decision-making.

Cash Cows

Dolby's core cinema licensing, featuring Dolby Atmos immersive sound and Dolby Vision high dynamic range, represents a strong cash cow. This mature market segment benefits from Dolby's established dominance and consistent demand from movie theaters worldwide.

Recent expansions, such as the addition of dozens of new Dolby Cinema locations with major exhibitors like AMC and Megabox in 2024, underscore Dolby's entrenched market share. These partnerships ensure a steady stream of licensing revenue from a well-established and ongoing industry.

Dolby's established broadcast audio technologies, encompassing legacy codecs and noise reduction systems, represent a robust cash cow. These foundational technologies are deeply integrated into broadcasting infrastructure worldwide, ensuring a consistent and significant stream of licensing revenue. For instance, Dolby Digital, a staple in digital broadcasting, continues to be widely adopted, contributing to Dolby's stable income.

Dolby's mobile device licensing, particularly for audio, is a significant cash cow. Their technologies are integrated into a vast number of smartphones and tablets, leading to consistent and substantial licensing revenue. This segment benefits from the sheer volume of devices produced globally, securing a high market share in an established, though competitive, sector.

PC Licensing (Audio and Video)

Dolby's PC licensing, covering both audio and video technologies, functions as a classic cash cow within the Dolby BCG Matrix. This segment benefits from widespread adoption in personal computers, mirroring the success seen in the mobile sector. Major PC manufacturers, including industry leaders like Lenovo and HP, integrate Dolby's solutions, ensuring consistent and substantial licensing revenue from a well-established market.

The steady income generated from PC licensing provides Dolby with the financial stability needed to invest in its high-growth areas. In 2024, the personal computer market, while mature, continues to be a significant revenue driver for technology licensing companies. Dolby's established presence and ongoing partnerships with key PC OEMs solidify its position in this segment.

- Market Penetration: Dolby technologies are integrated into a vast majority of new personal computers sold globally.

- Revenue Stability: Licensing agreements with major PC manufacturers provide a predictable and significant revenue stream.

- Mature Market: While not a high-growth area, the PC market's sheer volume ensures consistent cash flow for Dolby.

- Brand Association: Dolby's brand name enhances the perceived audio and video quality of PCs, driving adoption.

Consumer Electronics (CE) Licensing (Legacy Audio/Video)

Dolby's Consumer Electronics (CE) Licensing, particularly for legacy audio and video formats, represents a significant cash cow. This segment leverages Dolby's extensive library of foundational patents and technologies, licensed to a wide range of consumer electronics manufacturers. Think of companies making TVs, Blu-ray players, and home theater systems; they all rely on Dolby's established expertise.

This broad licensing model generates a steady, high-margin revenue stream. Even as newer technologies emerge, the installed base of devices utilizing Dolby's legacy formats continues to provide consistent income. In 2024, this mature segment remains a cornerstone of Dolby's financial stability, demonstrating the enduring value of its intellectual property in established product categories.

- Consistent Revenue: Licensing of legacy audio/video technologies to CE manufacturers provides a predictable income source.

- High Margins: As a patent and technology licensing business, this segment typically enjoys very high profit margins.

- Mature Market Dominance: Dolby's strong brand recognition and established presence in mature CE markets ensure continued demand for its licensing.

- Diversified Customer Base: Licensing across various CE product types and manufacturers mitigates risk.

Dolby's cinema licensing, including Dolby Atmos and Dolby Vision, is a prime cash cow due to its established market dominance and consistent demand from theaters. The expansion of Dolby Cinema locations, with dozens added by major exhibitors like AMC in 2024, highlights this entrenched market share and ensures ongoing revenue.

Dolby's broadcast audio technologies, such as Dolby Digital, act as robust cash cows. Their deep integration into global broadcasting infrastructure guarantees a stable and significant licensing income stream. This foundational technology continues to be widely adopted, contributing to Dolby's consistent financial performance.

The mobile device licensing segment for Dolby's audio technologies is a substantial cash cow. With widespread integration into smartphones and tablets, this generates consistent and significant licensing revenue, benefiting from the sheer volume of devices produced globally.

Dolby's PC licensing, encompassing both audio and video, functions as a classic cash cow. Major manufacturers like Lenovo and HP integrate Dolby's solutions, ensuring substantial and consistent revenue from this established market, a trend that continued in 2024.

Dolby's Consumer Electronics (CE) licensing, particularly for legacy formats, is a significant cash cow. This segment leverages Dolby's extensive patent library, providing a steady, high-margin revenue stream from a broad range of manufacturers. Even in 2024, the installed base of devices ensures continued income from these mature technologies.

| Segment | BCG Category | Key Characteristics | 2024 Relevance |

| Cinema Licensing | Cash Cow | Dominant market position, consistent demand | Expansion of Dolby Cinema locations |

| Broadcast Audio | Cash Cow | Deep infrastructure integration, legacy codecs | Continued widespread adoption of Dolby Digital |

| Mobile Device Licensing | Cash Cow | High device volume, established audio integration | Consistent revenue from global smartphone market |

| PC Licensing | Cash Cow | Widespread OEM adoption, stable revenue | Continued integration by major PC manufacturers |

| Consumer Electronics Licensing | Cash Cow | Legacy format licensing, high margins | Enduring value from installed base of CE devices |

What You’re Viewing Is Included

Dolby BCG Matrix

The Dolby BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means you can confidently assess the comprehensive strategic analysis and professional presentation of Dolby's product portfolio without any alterations or hidden elements. Rest assured, the final file is ready for immediate integration into your business planning and decision-making processes.

Dogs

Older, niche audio codecs from Dolby, such as Dolby Digital Plus or Dolby TrueHD, may now fall into the dogs category of the BCG matrix. These technologies, while foundational, often have a low market share compared to newer, more immersive formats like Dolby Atmos, which is experiencing significant growth.

These legacy codecs likely generate minimal revenue for Dolby as adoption wanes and require little ongoing investment for maintenance. For instance, while Dolby Atmos is integrated into a vast array of devices and content platforms, the market penetration for older, more specialized codecs has plateaued or declined, making them less strategic for future growth.

While Dolby is renowned for its licensing business, it's plausible they explored or supported niche hardware reference designs or minor product lines in the past. These would likely represent low market share and low growth opportunities within the BCG framework, given Dolby's strategic focus on intellectual property and software solutions. Such discontinued hardware would represent a cash cow, requiring minimal investment, or a potential candidate for divestiture if they no longer align with the company's core competencies.

Certain legacy professional audio tools, once indispensable in studios, are now falling into the 'Dog' category of the Dolby BCG Matrix. These might include specialized hardware processors or standalone software plugins that have been largely replaced by more versatile, integrated digital audio workstations (DAWs) and virtual instruments.

The market share for these older tools is shrinking as the industry increasingly favors software-defined workflows and cloud-based solutions. For instance, sales of dedicated hardware reverb units, which were once premium items, have seen a significant decline as high-quality algorithmic reverbs are now built into DAWs or available as affordable plugins. In 2024, the market for traditional hardware audio processing units is estimated to be less than 15% of its peak value from the early 2000s.

Specific Noise Reduction Technologies in Analog Domains

Original analog noise reduction technologies, while crucial to Dolby's legacy, now occupy a very small niche. Think of systems like Dolby A or Dolby SR. These are largely superseded by digital processing in modern audio workflows.

Their market share is minimal, with growth prospects being negligible. They primarily cater to users of legacy analog recording equipment or specific, specialized applications where analog processing is still preferred. The vast majority of audio production and distribution in 2024 is digital.

The relevance of these analog systems is limited to:

- Preservation of historical recordings: Essential for playback and remastering of older analog tapes.

- Specialized analog studios: A small number of studios still prefer or require analog signal chains for their unique sonic characteristics.

- Vintage equipment enthusiasts: Collectors and users of classic audio gear.

Small, Unsuccessful Acquisitions

Dolby's portfolio might include small acquisitions that haven't met expectations. These could represent technologies that struggled to gain traction or integrate smoothly into Dolby's main product lines, leading to minimal market share gains or revenue growth. Such ventures, characterized by low contribution and a potential for divestment, would fall into the 'Dogs' category of the BCG Matrix.

- Underperforming Acquisitions: Past small-scale acquisitions that failed to deliver the anticipated market share or growth.

- Integration Challenges: Technologies from these acquisitions that were not successfully incorporated into Dolby's core offerings.

- Low Contribution: These ventures exhibit a low contribution to Dolby's overall business performance.

- Divestment Potential: Given their limited impact, these could be candidates for divestment to reallocate resources.

Certain older Dolby audio codecs, like Dolby Digital Plus and Dolby TrueHD, are now considered 'Dogs' in the BCG matrix. These technologies, while historically significant, have a diminishing market share compared to newer, more dominant formats such as Dolby Atmos.

These legacy codecs likely generate minimal revenue for Dolby and require little ongoing investment for maintenance. Their market penetration has plateaued or declined, making them less strategic for future growth initiatives.

The market for traditional hardware audio processing units has seen a significant decline, with sales in 2024 estimated to be less than 15% of their peak value from the early 2000s, illustrating the shift towards software-defined workflows.

Original analog noise reduction technologies, such as Dolby A and Dolby SR, now serve a very small niche market, with negligible growth prospects as the vast majority of audio production in 2024 is digital.

| BCG Category | Dolby Example | Market Share | Market Growth | Strategic Implication |

|---|---|---|---|---|

| Dogs | Dolby Digital Plus, Dolby TrueHD | Low | Low/Declining | Minimal investment, potential divestment |

| Dogs | Legacy analog noise reduction (Dolby A, SR) | Very Low | Negligible | Niche applications, preservation |

| Dogs | Underperforming acquisitions/niche hardware | Low | Low | Reallocation of resources, divestment potential |

Question Marks

Dolby OptiView, an emerging SaaS product focused on real-time digital experiences, is positioned as a 'Question Mark' within Dolby's business portfolio. This innovative offering marks a strategic shift for Dolby, venturing into new revenue streams beyond its established licensing models.

While OptiView is still in its nascent stages, it has begun to contribute to Dolby's products and services revenue, indicating early traction. However, its current market share remains modest, necessitating careful consideration for future development and market penetration.

The significant growth potential for OptiView lies in its applicability to live events and novel consumption patterns. This makes it a prime candidate for strategic investment to capitalize on evolving digital engagement trends and secure a stronger market position.

Dolby Atmos FlexConnect, unveiled at CES 2024 and slated for 2025 TCL QD-Mini LED TVs, represents a significant innovation in home audio. This technology offers consumers unparalleled flexibility in configuring their speaker setups for a truly immersive Dolby Atmos experience. Its novelty means current market penetration is minimal, positioning it as a potential star in the future of home entertainment audio.

The core appeal of Dolby Atmos FlexConnect lies in its ability to simplify complex immersive audio setups for the average consumer. By enabling more adaptable speaker arrangements, it lowers the barrier to entry for high-quality spatial audio. This ease of use, coupled with the expanding ecosystem of compatible devices, points towards substantial growth potential and a strong position within the BCG matrix.

As platforms for user-generated content (UGC) continue to expand, Dolby has a prime opportunity to innovate in spatial audio. Imagine creators easily embedding immersive sound into their videos, podcasts, or even interactive experiences. This could significantly enhance the viewer or listener engagement.

This sector represents a high-growth potential market where Dolby's current share might be nascent. To capture this, Dolby would likely need to invest heavily in developer tools and forge strong partnerships with major UGC platforms. For instance, by 2024, the global UGC market was projected to reach hundreds of billions of dollars, highlighting the sheer scale of this opportunity.

New Applications of Imaging Technologies (Beyond Entertainment)

Dolby's expertise in advanced imaging, primarily known for its entertainment applications, presents a significant opportunity for expansion into professional visualization and specialized industrial displays. These markets, while currently representing low market share for Dolby, are poised for substantial growth. For instance, the global medical imaging market was valued at approximately $30 billion in 2023 and is projected to grow at a CAGR of over 6% through 2030, indicating a strong potential for Dolby's visual enhancement technologies.

- Professional Visualization: High-fidelity displays for CAD, architectural rendering, and scientific simulation demand the precision and color accuracy Dolby offers, opening avenues in sectors like engineering and design.

- Medical Imaging: Enhancing the clarity and detail of diagnostic imaging, such as MRI and CT scans, could improve diagnostic accuracy and patient outcomes, a critical need in healthcare.

- Industrial Displays: Applications in quality control, remote operation of machinery, and advanced manufacturing environments require robust and visually precise displays, areas where Dolby's technology could provide a competitive edge.

- R&D Investment: Capturing these new markets necessitates dedicated research and development efforts to tailor imaging solutions for the specific technical requirements and regulatory landscapes of each sector.

Expansion into Virtual Reality (VR) and Augmented Reality (AR) Audio

Dolby is actively investigating opportunities within the burgeoning virtual reality (VR) and augmented reality (AR) sectors. These markets represent significant growth potential for creating deeply immersive audio experiences, aligning with Dolby's core expertise.

While Dolby's current penetration in VR/AR audio is likely minimal due to the early stages of these technologies, the long-term outlook is exceptionally promising. This positions VR/AR audio as a prime candidate for strategic investment to secure a leading market position in the future.

- Market Potential: The global VR/AR market is projected to reach hundreds of billions of dollars by the late 2020s, with audio being a critical component of immersion.

- Strategic Importance: Investing now allows Dolby to shape the audio standards and user expectations in these new, high-growth entertainment and interaction platforms.

- Competitive Landscape: Early investment can help Dolby differentiate its offerings and build brand recognition before the market becomes saturated with established players.

Dolby OptiView, a new SaaS product for real-time digital experiences, is a Question Mark for Dolby. It's a move into new revenue areas beyond traditional licensing.

While OptiView is still new, it's starting to bring in revenue, showing some early success. However, its market share is small, meaning Dolby needs to decide how much to invest in its growth.

The potential for OptiView is high, especially in live events and new ways people consume content. This makes it a good candidate for investment to grab a bigger piece of the evolving digital engagement market.

| Category | Product/Area | Market Share | Growth Potential | Investment Need |

|---|---|---|---|---|

| Emerging Tech | Dolby OptiView | Low | High | High |

| Audio Innovation | Dolby Atmos FlexConnect | Nascent | High | Medium |

| Content Creation | Spatial Audio for UGC | Nascent | Very High | High |

| Advanced Imaging | Professional/Medical Visualization | Low | High | High |

| Immersive Tech | VR/AR Audio | Minimal | Very High | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.