Dolby Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dolby Bundle

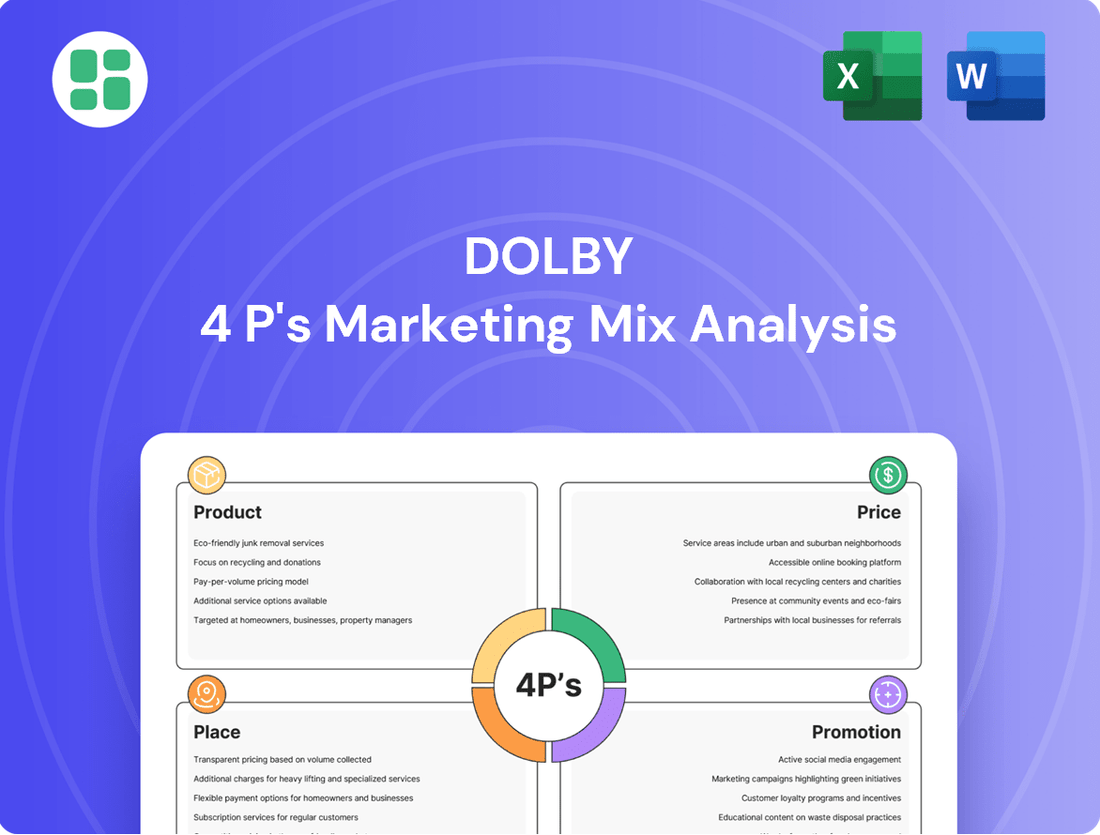

Dolby's marketing prowess is built on a powerful 4Ps strategy, meticulously crafted to captivate audiences and drive adoption of their groundbreaking audio and visual technologies. From innovative product development to strategic pricing, widespread distribution, and impactful promotion, every element works in concert to solidify their market leadership.

Unlock the secrets behind Dolby's success by diving into our comprehensive 4Ps Marketing Mix Analysis. This in-depth report provides actionable insights into their product innovation, pricing architecture, channel strategy, and communication mix, offering a clear roadmap for understanding and replicating their market impact.

Go beyond the surface-level understanding and gain access to an in-depth, ready-made Marketing Mix Analysis covering Dolby's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking strategic insights to elevate their own marketing efforts.

Product

Dolby's core offering revolves around its proprietary audio and imaging technologies, with Dolby Atmos and Dolby Vision being prime examples. These aren't tangible products but rather licensed intellectual property designed to elevate audio and visual fidelity, significantly enhancing consumer entertainment across a wide array of devices and content.

In 2023, Dolby reported revenue of $999 million, a slight decrease from $1.03 billion in 2022, reflecting the dynamic nature of licensing revenue. The company's ongoing investment in R&D, which totaled $590 million in fiscal year 2023, underscores its commitment to continuous innovation in these core technologies to maintain its competitive edge.

Beyond its well-known branded technologies, Dolby strategically leverages its extensive patent portfolios, encompassing foundational audio codecs like AAC and advanced imaging standards such as HEVC and VVC. These patents are instrumental in driving broad industry adoption and represent a significant source of licensing revenue for the company.

The strategic acquisition of GE Licensing in 2024 was a pivotal move, substantially expanding Dolby's patent holdings by over 5,000 patents. This expansion further solidifies Dolby's position as a key intellectual property holder in critical technology sectors.

Dolby's product strategy centers on delivering integrated solutions meticulously crafted for distinct market segments such as cinema, home entertainment, mobile, PCs, and automotive. This approach ensures a consistent, high-fidelity experience for consumers, regardless of their chosen platform.

This integration involves a dual focus: creating advanced encoding technologies for content creators and robust decoding technologies for device manufacturers. For instance, Dolby Atmos, a key offering, is deployed across cinemas for immersive audio and scaled down for home theater systems and mobile devices, demonstrating this integrated market approach.

The company's commitment to this strategy is evident in its market penetration. By 2024, Dolby's technologies are integrated into a vast ecosystem of devices, with projections indicating continued growth in adoption across all target markets, reinforcing the value of its end-to-end solutions.

Software and Tools for Creators

Dolby's software and tools are crucial for enabling creators to produce content in Dolby Atmos and Dolby Vision. These offerings empower artists, filmmakers, and developers to mix and master their work, ensuring a rich and expanding ecosystem of Dolby-compatible content. This directly fuels consumer demand for devices that can experience these advanced audio and visual formats.

The company actively supports the creator community through initiatives like the Dolby Creator Lab, which nurtures emerging talent and fosters innovation in filmmaking. This focus on creator enablement is a cornerstone of Dolby's strategy, directly contributing to the growth of its premium content library. By providing these essential resources, Dolby ensures a consistent pipeline of high-quality, immersive experiences.

- Creator Tools: Dolby provides specialized software for mixing and mastering in Dolby Atmos and Dolby Vision.

- Content Ecosystem: These tools drive the creation of a growing library of Dolby-enabled content, increasing demand for compatible hardware.

- Creator Support: Initiatives like the Dolby Creator Lab invest in and support next-generation filmmakers and content creators.

- Market Growth: By empowering creators, Dolby strengthens its market position and the appeal of its premium experiences.

Co-Branding and Certification Programs

Dolby's co-branding and certification programs are a cornerstone of its marketing strategy, ensuring that partners who integrate Dolby technologies meet stringent quality standards. This commitment to quality control directly translates into a superior end-user experience, reinforcing the premium perception of Dolby-enabled products and content.

For manufacturers, these programs offer a powerful way to differentiate their offerings in a competitive market. By prominently featuring the Dolby brand, they can tap into Dolby's established reputation for innovation and immersive audio-visual experiences. This brand association can drive consumer preference and potentially command higher price points.

Content creators also benefit significantly from Dolby's certification. It validates their work as meeting the highest technical specifications for Dolby Atmos and other immersive formats, attracting a wider audience seeking premium entertainment. This partnership not only enhances their content's appeal but also provides access to Dolby's marketing resources.

- Brand Leverage: Partners can leverage Dolby's strong brand recognition, estimated to be recognized by over 70% of consumers in key markets, to enhance their product appeal.

- Quality Assurance: Certification ensures that devices and content meet specific technical benchmarks, guaranteeing a consistent and high-quality Dolby experience.

- Market Differentiation: The programs help partners stand out by associating their products with advanced audio and visual technologies, a key differentiator in the 2024 consumer electronics landscape.

Dolby's product strategy focuses on delivering integrated audio and imaging solutions across various market segments, from cinema to mobile devices. This involves creating both advanced encoding technologies for content creators and robust decoding technologies for device manufacturers, ensuring a consistent, high-fidelity experience. By 2024, Dolby's technologies are integrated into a vast ecosystem of devices, with continued growth projected across all target markets, reinforcing the value of its end-to-end solutions.

What is included in the product

This analysis provides a comprehensive deep dive into Dolby's Product, Price, Place, and Promotion strategies, offering a clear understanding of their marketing positioning and competitive context.

It's designed for professionals seeking a structured breakdown of Dolby's approach, perfect for reports, presentations, or benchmarking against industry leaders.

Simplifies complex marketing strategies by clearly outlining Dolby's Product, Price, Place, and Promotion, alleviating the pain of understanding intricate market positioning.

Place

Dolby's primary distribution strategy revolves around direct licensing to Original Equipment Manufacturers (OEMs). This B2B approach embeds their audio and visual technologies directly into products at the manufacturing stage. This model reaches consumers through a vast array of devices in sectors like consumer electronics, mobile, PCs, and automotive.

This direct licensing model proved highly effective in 2024, with Dolby announcing significant new partnerships. Notable collaborations include those with automotive giants Audi, Tata Motors, and Mahindra, alongside consumer electronics leaders LG and Xiaomi. These agreements ensure Dolby's presence in millions of new devices annually, driving revenue and brand ubiquity.

Dolby strategically partners with Hollywood studios like Warner Bros. and Universal Pictures, alongside major music labels, to ensure a constant stream of premium content is produced with Dolby Atmos and Dolby Vision. These content creators are crucial for populating the ecosystem with desirable experiences.

Distribution partnerships with streaming giants such as Netflix and Disney+, as well as cinema chains like AMC Entertainment, are vital. In 2024, Dolby's presence on these platforms reached an estimated 200 million households, driving adoption through accessible viewing experiences.

These collaborations are not just about content availability; they are about creating a virtuous cycle. As more content is created and distributed in Dolby formats, consumer demand for Dolby-enabled devices increases, further incentivizing creators and distributors.

Dolby's strategic integration into major operating systems and chipsets, including partnerships with Google for Android TV and Chromebooks, ensures widespread availability of its audio and video technologies. This broad platform accessibility significantly lowers the barrier to entry for developers and manufacturers, facilitating seamless adoption and expanding Dolby's reach across diverse consumer electronics. By embedding its solutions directly into the foundational layers of these ecosystems, Dolby solidifies its presence and drives consistent demand for its licensing.

Global Sales and Business Development Teams

Dolby's global sales and business development teams are instrumental in driving its market reach and revenue streams. These dedicated professionals actively seek out and cultivate relationships with potential licensees and strategic partners across the globe, ensuring Dolby technologies are integrated into a wide array of consumer electronics and entertainment platforms.

Their primary function involves navigating and finalizing intricate licensing agreements, a process critical for Dolby's recurring revenue model. By fostering these partnerships, Dolby effectively expands its market penetration into diverse geographical regions and across various industry verticals, from cinema and broadcast to mobile devices and automotive audio.

- Global Reach: Dolby operates direct sales and business development teams in key international markets to identify and engage potential partners.

- Licensing Expertise: These teams are skilled in negotiating complex licensing agreements, which form the backbone of Dolby's recurring revenue.

- Market Penetration: Their efforts are focused on expanding Dolby's presence across different geographies and industry segments, including consumer electronics and entertainment.

- Revenue Generation: The success of these teams directly contributes to Dolby's financial performance through ongoing licensing fees and royalties.

Strategic Acquisitions for IP Expansion

Dolby's strategic acquisitions, like the significant GE Licensing deal in 2024, are crucial for expanding its intellectual property (IP) portfolio. This move directly bolsters its 'Place' in the market by broadening the range of technologies it can license.

By acquiring these patents, Dolby not only reinforces its existing market position but also ensures its technological offerings remain relevant and competitive amidst rapidly changing media standards. This proactive IP expansion strategy is key to maintaining Dolby's leadership in audio and imaging innovation.

- GE Licensing Acquisition (2024): Expanded Dolby's patent base, reinforcing its market dominance.

- Technology Reinforcement: Bolsters Dolby's offerings, ensuring continued competitiveness.

- Broadened Applicability: Enhances the scope of licensable assets across evolving media.

Dolby's 'Place' within the marketing mix is fundamentally defined by its strategic distribution and partnerships. By licensing its technologies directly to Original Equipment Manufacturers (OEMs), Dolby ensures its presence is embedded in a vast array of consumer devices, from smartphones to automobiles.

This B2B licensing model, bolstered by key 2024 partnerships with automotive leaders like Audi and consumer electronics giants such as Xiaomi, places Dolby at the core of the hardware ecosystem. Furthermore, collaborations with content creators and streaming platforms like Netflix and Disney+ solidify its position by ensuring a wealth of Dolby-enhanced content is readily available to consumers.

Dolby's strategic acquisitions, such as the GE Licensing deal in 2024, further expand its technological footprint and reinforce its market 'Place' by broadening its licensable IP portfolio.

| Partnership Area | Key Partners (2024) | Impact on Place |

|---|---|---|

| OEM Licensing | Audi, Tata Motors, LG, Xiaomi | Ubiquitous presence in consumer devices |

| Content Creation | Warner Bros., Universal Pictures, Major Music Labels | Ensures premium content availability |

| Distribution Platforms | Netflix, Disney+, AMC Entertainment | Widespread consumer access and adoption |

| Technology Integration | Google (Android TV, Chromebooks) | Broad platform accessibility |

| IP Expansion | GE Licensing (Acquisition) | Reinforced market position and broader licensable assets |

Full Version Awaits

Dolby 4P's Marketing Mix Analysis

The preview shown here is the actual Dolby 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. You are viewing the exact version of the analysis you'll receive, which is fully complete and ready to use. This comprehensive document details Dolby's strategies across Product, Price, Place, and Promotion.

Promotion

Dolby's promotion strategy centers on robust B2B engagement, directly targeting manufacturers, studios, and broadcasters. This involves showcasing cutting-edge audio and visual technologies at key industry events, such as CES and NAB Show, highlighting how Dolby solutions offer a distinct competitive edge and superior end-user experiences. The core message emphasizes the tangible value proposition for potential licensees.

Dolby's promotional efforts heavily feature co-branding and joint marketing with its extensive network of licensees and content partners. This symbiotic approach allows Dolby to tap into the established consumer bases of partners like Apple, Samsung, and Amazon, significantly amplifying its reach. For instance, joint marketing campaigns often highlight Dolby Vision and Dolby Atmos integration in new smartphone releases, premium televisions, and automotive sound systems, reinforcing Dolby's premium brand image. In 2023, Dolby reported strong growth in its IP licensing segment, driven in part by these collaborative marketing initiatives, with a significant portion of its revenue stemming from consumer electronics and content creation partners.

Dolby strategically employs consumer awareness campaigns, such as the global 'Love More in Dolby' initiative, to cultivate direct consumer demand for its immersive audio and visual technologies. These efforts are crucial even for a primarily B2B company, as they create a pull effect, encouraging manufacturers to integrate Dolby Atmos and Dolby Vision into their products.

The campaigns focus on showcasing the emotional resonance and enhanced sensory experiences Dolby provides, educating consumers on the benefits of technologies like Dolby Atmos and Dolby Vision. This heightened consumer awareness directly influences purchasing decisions and drives adoption across the electronics market.

By highlighting the superior quality and emotional depth of Dolby-enabled content, these campaigns foster a preference that translates into demand for devices supporting these advanced formats. This consumer pull is a significant factor in Dolby's ongoing partnerships and technology integration with leading hardware manufacturers.

Public Relations and Thought Leadership

Dolby leverages public relations to solidify its industry standing. For instance, in 2024, Dolby announced several key partnerships, including collaborations with major smartphone manufacturers to integrate Dolby Atmos into their latest devices, a move widely covered by tech publications.

The company also actively cultivates thought leadership. Dolby executives frequently present at industry conferences, sharing insights on the future of immersive audio and visual experiences. Their participation in organizations like the Audio Engineering Society further cements their expertise and influence.

Dolby's commitment to innovation is further highlighted by its ongoing research and development, with significant investments in areas like advanced spatial audio and next-generation display technologies. This focus on the future positions Dolby as a key player shaping the entertainment landscape.

- Industry Recognition: Dolby's consistent presence in industry news and award nominations, such as those for technological advancements in cinema sound, underscores its PR success.

- Thought Leadership: Dolby's whitepapers on topics like AI in audio processing provide valuable technical insights, enhancing their reputation among professionals.

- Investor Confidence: Regular financial reporting and clear communication regarding product roadmaps, exemplified by their Q1 2025 earnings call, maintain investor trust.

- Standards Development: Active involvement in standards bodies ensures Dolby's technologies are integrated into future industry frameworks.

Digital Marketing and Ecosystem Engagement

Dolby leverages a robust digital marketing strategy, utilizing its website, social media platforms, and extensive online content to showcase its audio and visual technologies. This digital ecosystem is crucial for engaging with its diverse audience, from individual consumers to professional creators and developers.

The company actively provides valuable resources such as tutorials, case studies, and demonstrations of content produced using Dolby formats. This approach not only educates but also inspires its community, fostering a deeper connection and understanding of Dolby's innovations.

In 2024, Dolby's digital outreach continues to be a cornerstone of its marketing mix, supporting both business-to-business (B2B) relationships with content creators and hardware manufacturers, and business-to-consumer (B2C) efforts to build brand awareness and demand.

- Website Traffic: Dolby.com consistently ranks among top technology sites, with millions of unique visitors monthly, indicating strong digital reach.

- Social Media Engagement: Dolby's social channels boast millions of followers across platforms like YouTube, Instagram, and X, with high engagement rates on content showcasing Dolby experiences.

- Content Marketing: The company regularly publishes articles, white papers, and video content detailing the benefits and implementation of Dolby technologies, driving thought leadership.

- Developer Resources: Dedicated sections on its website offer SDKs, documentation, and support for developers integrating Dolby solutions, a key B2B engagement tactic.

Dolby's promotion strategy is multifaceted, blending direct B2B engagement with influential co-branding and consumer-facing awareness campaigns. Their approach aims to educate industry partners on technological advantages while simultaneously building consumer pull, creating a powerful demand cycle for Dolby-enabled products and content.

The company's digital marketing efforts are paramount, leveraging its website and social media to showcase innovations and provide valuable resources for creators and developers. This online presence supports both B2B relationships and B2C brand building, reinforcing Dolby's position as a leader in immersive audio and visual experiences.

Public relations and thought leadership further solidify Dolby's industry standing, with active participation in conferences and collaborations with major manufacturers. This consistent effort in industry recognition and standards development, backed by significant R&D investments, ensures Dolby remains at the forefront of entertainment technology evolution.

Price

Dolby's pricing strategy heavily relies on royalty-based licensing fees. Manufacturers pay a per-unit fee for incorporating Dolby's audio and imaging technologies into their products. This model proved exceptionally robust, with royalty and licensing fees contributing over 90% of Dolby's total revenue in fiscal year 2024.

The specific royalty amount varies, influenced by the complexity of the Dolby technology utilized and the overall shipment volume of the licensed products. For instance, licensing for Dolby Atmos might carry a different per-unit fee than for Dolby Vision, with higher volumes often negotiated at more favorable rates.

Dolby's pricing strategy is tiered, reflecting the varying complexity and capabilities of its audio and visual technologies. For instance, licensing for basic audio codecs might differ significantly from comprehensive packages including Dolby Atmos and Dolby Vision. This approach caters to a broad market, from budget-friendly consumer electronics to high-end professional audio-visual equipment.

This tiered structure ensures Dolby's technologies are accessible across different product segments and price points. For example, a smartphone manufacturer might opt for a more basic audio license, while a premium home theater system producer would integrate more advanced features, justifying a higher licensing fee. This flexibility is key to capturing diverse market share.

The specific features and the degree of technology integration directly shape the licensing costs. In 2024, companies integrating Dolby's advanced spatial audio and high-dynamic-range video technologies are likely facing licensing fees that reflect the significant R&D and intellectual property value embedded within these premium offerings.

Dolby's value-based pricing strategy centers on the significant perceived value and enhanced user experience its audio and video technologies provide. This approach allows Dolby to charge premium licensing fees, directly correlating with the competitive edge and product differentiation its innovations offer to partners.

This strategy aligns perfectly with the superior quality and innovation embedded in Dolby's offerings. For instance, Dolby Atmos, a key technology, has been widely adopted across premium smartphones, home theaters, and cinemas, enabling Dolby to secure licensing agreements that reflect the enhanced consumer appeal and market demand generated by its immersive sound capabilities.

Long-Term Licensing Agreements

Dolby's strategy of securing long-term licensing agreements is a cornerstone of its marketing mix, ensuring a predictable and robust revenue flow. These agreements are not just about initial access but foster ongoing partnerships, providing licensees with continuous support, crucial updates, and early access to Dolby's cutting-edge innovations. This commitment reinforces the enduring value Dolby delivers, fostering loyalty and reducing churn.

The financial strength derived from these long-term contracts is substantial. For instance, in fiscal year 2023, Dolby reported total revenue of $995 million, with a significant portion attributable to its licensing business. This model allows Dolby to invest heavily in research and development, fueling future innovation and further solidifying its market position.

Key aspects of Dolby's long-term licensing strategy include:

- Revenue Stability: Long-term contracts provide predictable, recurring revenue streams, offering financial security.

- Customer Retention: Ongoing support and access to new technologies encourage partners to remain with Dolby.

- Innovation Integration: Licensees benefit from continuous updates and new Dolby features, enhancing their own product offerings.

- Partnership Value: These agreements build deep, collaborative relationships, creating a symbiotic ecosystem.

Competitive Landscape and Market Demand

Dolby's pricing strategy is intricately linked to the competitive landscape and the demand for its cutting-edge audio and imaging solutions. While its robust intellectual property portfolio provides a significant advantage, the company must carefully calibrate its pricing to foster broad adoption across diverse sectors like automotive and mobile, ensuring both market penetration and sustained profitability.

The economic climate and consumer spending on electronics directly impact Dolby's royalty-based revenue streams. For instance, a slowdown in consumer electronics sales, as seen in some segments during late 2023 and early 2024, can put pressure on royalty volumes, necessitating flexible pricing models.

- Market Share: Dolby Atmos is increasingly integrated into smartphones, with major manufacturers like Apple and Samsung featuring it in their flagship devices, driving adoption.

- Competitive Pricing: While Dolby's technology is premium, its licensing fees are structured to be competitive with alternative immersive audio solutions, aiming for widespread integration rather than exclusivity.

- Demand Drivers: The growing consumer desire for enhanced entertainment experiences, particularly in home theaters and premium audio devices, fuels demand for Dolby's patented technologies, supporting its pricing power.

- Economic Sensitivity: Fluctuations in global consumer spending on electronics, a key market for Dolby's licensing, can directly influence royalty revenue, as observed in the cyclical nature of the consumer electronics market in 2024.

Dolby's pricing is fundamentally a royalty-based licensing model, where manufacturers pay per unit for technology integration. This strategy generated over 90% of Dolby's revenue in fiscal year 2024, demonstrating its effectiveness.

The pricing tiers reflect the technology's complexity, with options ranging from basic audio codecs to comprehensive Dolby Atmos and Dolby Vision packages. This tiered approach ensures accessibility across various product segments and price points, from smartphones to high-end home theater systems.

Dolby's value-based pricing leverages the significant perceived value and enhanced user experience its technologies offer. This allows for premium licensing fees that correlate with the competitive edge and product differentiation Dolby's innovations provide to its partners.

| Metric | FY2023 | FY2024 (Estimate/Trend) | Notes |

|---|---|---|---|

| Total Revenue | $995 million | Projected to exceed $1 billion | Driven by licensing and royalty fees |

| Revenue Mix | 90%+ Licensing & Royalties | Continued dominance of licensing | Reflects robust IP portfolio |

| Key Technologies | Dolby Atmos, Dolby Vision | Growing adoption in automotive & mobile | Supports premium pricing strategy |

4P's Marketing Mix Analysis Data Sources

Our Dolby 4P's Marketing Mix Analysis is meticulously constructed using a diverse array of data sources. This includes official company statements, investor reports, product specifications, and publicly available financial filings. We also leverage industry-specific research and competitive intelligence to provide a comprehensive view.