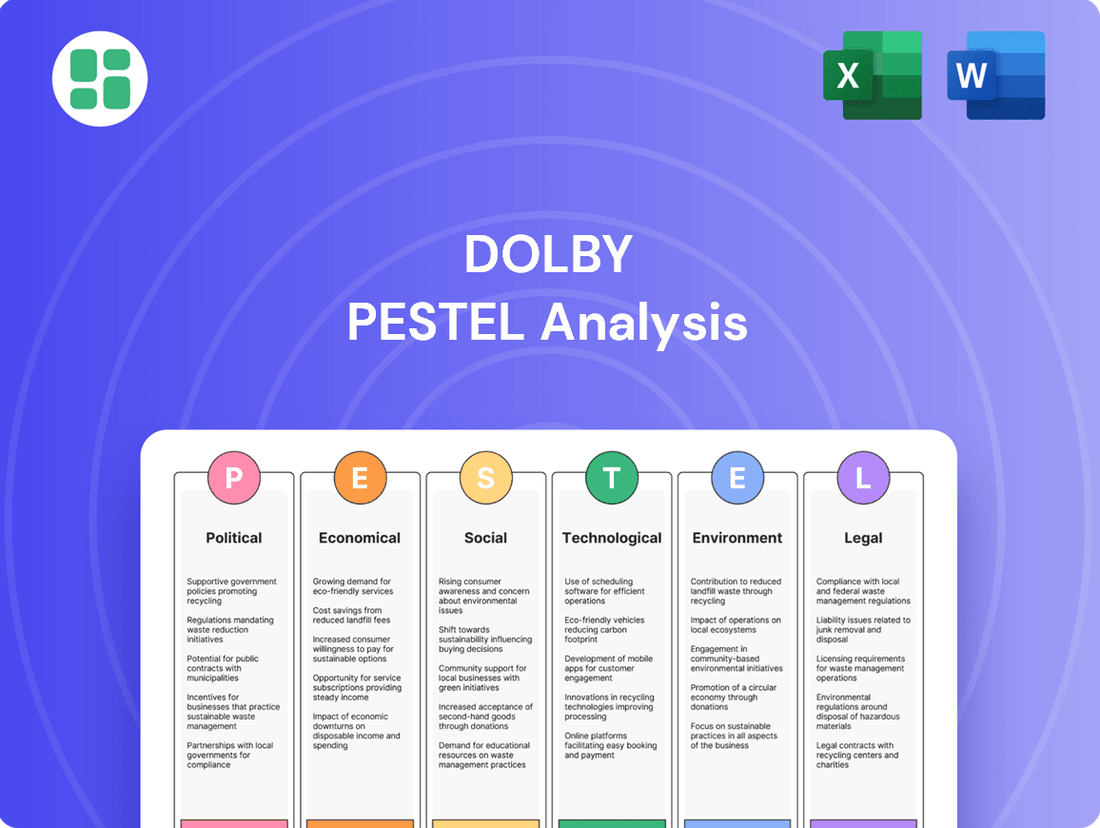

Dolby PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dolby Bundle

Unlock the secrets of Dolby's market position with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are shaping Dolby's future, from the rise of AI in audio to evolving consumer privacy regulations. Gain a critical edge in your strategic planning and investment decisions. Download the full PESTLE analysis now for actionable insights that will empower your business.

Political factors

Global trade policies, including potential tariffs and trade restrictions, directly influence Dolby's international licensing agreements and the supply chains of device manufacturers incorporating their technologies. For example, ongoing U.S.-China trade tensions can affect the sourcing of essential components and the overall cost of consumer electronics, impacting Dolby's partners. As of late 2024, many companies are actively re-evaluating their sourcing strategies to buffer against potential impacts from increasing tariffs on imported goods.

Geopolitical instability, such as regional conflicts, directly impacts global supply chains critical for the consumer electronics industry. For instance, the ongoing tensions in Eastern Europe and the Middle East in 2024 and into 2025 have led to increased shipping costs and potential component shortages, affecting manufacturers who integrate Dolby's audio and visual technologies. Businesses must prioritize supply chain resilience and proactive risk management to mitigate these disruptions.

Governments globally are tightening their grip on technology, with new rules emerging for content distribution, digital platforms, and how different technologies must work together. This means Dolby's advanced audio and visual tech might face new integration requirements across various entertainment and communication services.

These evolving policies directly shape the competitive environment for proprietary technologies like Dolby's, potentially affecting its market access and how easily its innovations can be adopted by partners. For instance, the European Union's Digital Markets Act, which came into effect in 2024, aims to ensure fairer competition on digital platforms, which could influence how Dolby's licensing models are applied.

Intellectual Property Enforcement

Dolby's revenue heavily relies on its ability to license patented technologies, making strong intellectual property (IP) enforcement a critical political factor. Weak IP protection in markets like China, where enforcement can be inconsistent, poses a significant risk to Dolby's licensing agreements and royalty collections. For instance, reports from the U.S. Chamber of Commerce's Global Innovation Policy Center in 2023 highlighted ongoing challenges in IP enforcement across several emerging economies, potentially impacting companies with similar licensing models.

The validity and enforcement of Dolby's patents directly influence its competitive edge and financial performance. Countries with robust legal systems that effectively protect patents and trademarks are vital for Dolby's sustained profitability. Conversely, jurisdictions with lax enforcement or frequent challenges to patent validity could diminish the value of Dolby's technological innovations and create an uneven playing field.

- IP Enforcement Landscape: The effectiveness of intellectual property (IP) enforcement varies significantly by country, directly impacting Dolby's licensing revenue.

- Market Risks: Weak IP protection in key markets, such as certain Asian countries, can undermine Dolby's revenue streams and competitive advantage by enabling unauthorized use of its technologies.

- Legal Frameworks: Maintaining strong and consistent legal frameworks for patents and trademarks globally is essential for Dolby, a company whose business model is built on technology licensing.

Political Influence on Consumer Spending

Government economic policies, including fiscal stimulus packages or austerity measures, significantly shape consumer spending habits. For Dolby, this translates directly into demand for its audio and imaging technologies embedded in consumer electronics and entertainment services. For instance, during periods of economic expansion supported by government spending, consumers are more likely to purchase high-end televisions, soundbars, and gaming consoles that leverage Dolby's advanced features.

Persistent inflation and economic uncertainty, often exacerbated by policy decisions, can create pressure on discretionary spending. Consumers may defer purchases of non-essential technology, such as premium home theater systems or immersive gaming setups, if their disposable income is squeezed. This trend was evident in late 2023 and early 2024, where inflation concerns led some analysts to project slower growth in consumer electronics sales.

- Government Stimulus Impact: Fiscal stimulus measures, like direct payments or tax credits, have historically boosted consumer spending on durable goods, including electronics.

- Inflationary Pressures: High inflation rates, as seen in many economies throughout 2023 and projected into 2024, can reduce the purchasing power for non-essential technology.

- Interest Rate Hikes: Central bank policies to combat inflation, such as interest rate increases, can make financing for larger electronics purchases more expensive, potentially dampening demand.

- Regulatory Environment: Government regulations concerning technology standards, content distribution, or data privacy can also indirectly influence the adoption and market penetration of Dolby's technologies.

Government regulations on technology standards and content distribution directly impact how Dolby's innovations are integrated into devices and services. For instance, the EU's Digital Markets Act, implemented in 2024, aims to foster competition and could influence Dolby's licensing models. These evolving policies shape market access and the ease with which Dolby's technologies are adopted by partners.

What is included in the product

This Dolby PESTLE analysis provides a comprehensive examination of how external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions impact the company's operations and strategic direction.

It offers actionable insights for stakeholders, enabling them to identify emerging threats and opportunities within Dolby's operating landscape.

A clear, actionable Dolby PESTLE analysis helps alleviate the pain of navigating complex external factors by providing a concise, categorized overview for strategic decision-making.

This analysis serves as a pain point reliever by offering a simplified, digestible framework that demystifies the external environment, enabling focused strategic planning.

Economic factors

The health of the global economy and how much consumers are willing and able to spend are crucial for Dolby's business. When economies are strong and people feel confident about their finances, they're more likely to buy new gadgets and enjoy entertainment, both of which are core to Dolby's offerings.

Looking ahead to 2025, the consumer technology sector is seeing a bit of cautious optimism. However, ongoing economic uncertainties and inflation are still making consumers think twice about their spending. This means companies like Dolby need to be mindful of how these factors might affect demand for their products and services.

Despite these pressures, there's a silver lining. Many consumers are on predictable tech upgrade cycles, meaning they tend to replace their devices every few years. This planned replacement activity is expected to provide a steady base of demand for various consumer electronics categories, which is good news for Dolby.

Inflationary pressures can significantly impact Dolby's business. For instance, rising costs in the tech sector, a key area for Dolby's manufacturing partners, could lead to increased production expenses. This, in turn, might affect the affordability of premium devices featuring Dolby's audio and visual technologies for consumers.

While overall inflation might be moderating, specific segments like Software as a Service (SaaS) continue to experience elevated inflation rates. This trend could influence Dolby's internal operational costs and potentially impact its software licensing agreements and revenue streams.

Given these economic conditions, tech companies, including Dolby, are being advised to focus on capital preservation and enhancing productivity. For example, in the US, the Consumer Price Index (CPI) saw a notable increase in early 2024, highlighting ongoing inflationary concerns across various sectors.

Currency exchange rates significantly impact Dolby's global operations. Fluctuations can directly affect revenue and profitability as the company licenses its technologies to manufacturers worldwide. For example, a strengthening U.S. dollar can make Dolby's offerings more costly for international partners, potentially slowing adoption rates.

Currency devaluation in emerging markets presents another challenge, as it can diminish the reported value of Dolby's earnings when converted back to U.S. dollars. In the first quarter of fiscal year 2024, Dolby reported revenue of $338 million, with a substantial portion likely influenced by these global currency dynamics.

Market Demand for Premium Audio/Visual

Dolby's financial health is intrinsically linked to consumer desire for superior audio and visual quality in everyday devices. This includes everything from the latest smartphones and high-definition televisions to sophisticated in-car entertainment systems.

The company's recent performance underscores this connection. Dolby reported robust growth in adoption for its immersive technologies, Dolby Atmos and Dolby Vision, across a wide array of content and hardware. This expansion is particularly notable in the automotive sector, signaling a growing demand for premium in-vehicle entertainment experiences.

This sustained market appetite for enhanced entertainment suggests a positive outlook for Dolby. Key indicators include:

- Growing adoption of Dolby Vision in streaming services and content production.

- Increased integration of Dolby Atmos in mobile devices, leading to higher attach rates.

- Significant expansion of Dolby technologies within the automotive industry, a key growth area.

Competition and Pricing Pressures

The audio and imaging technology sector is intensely competitive, with companies like DTS (now owned by Xperi) and newer entrants offering advanced audio solutions. This rivalry can put pressure on Dolby's licensing models, potentially impacting its revenue streams and market share as customers seek cost-effective alternatives. For instance, while Dolby's licensing revenue was strong in recent years, the ongoing need to innovate and maintain a competitive edge against these players is a constant factor.

Dolby's strategy involves continuous investment in research and development to maintain its technological leadership. By expanding its offerings, such as Dolby Vision and Dolby Atmos across more devices and content platforms, the company aims to solidify its position. This focus on enhancing capabilities and broadening market penetration is crucial for capturing growth in the dynamic digital entertainment space, especially as streaming services and immersive content continue to gain traction.

The pricing strategies of competitors directly influence Dolby's ability to command its current licensing fees. Aggressive pricing from rivals can force Dolby to re-evaluate its fee structures or offer more bundled solutions to retain its customer base. This dynamic is particularly relevant in the consumer electronics market, where price sensitivity plays a significant role in purchasing decisions.

- Competitive Landscape: Dolby faces competition from established players like Xperi (DTS) and emerging technologies in immersive audio and video.

- Pricing Pressures: Competitors' pricing strategies can influence Dolby's licensing fee structures and overall market share.

- Market Share Impact: Aggressive pricing or superior alternative technologies from rivals could erode Dolby's existing market share.

- Strategic Response: Dolby's focus on technological expansion and market reach is a direct response to competitive pressures and evolving digital entertainment trends.

Economic factors significantly shape Dolby's revenue, as consumer spending on electronics and entertainment is directly tied to economic health. While inflation can increase production costs for Dolby's partners and potentially affect consumer affordability, predictable tech upgrade cycles provide a baseline demand. For instance, the US CPI saw increases in early 2024, underscoring ongoing inflationary concerns that companies like Dolby must navigate.

Preview the Actual Deliverable

Dolby PESTLE Analysis

The preview you see here is the exact Dolby PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Dolby's business landscape.

Understand the external forces shaping Dolby's strategy and market position with this detailed and professionally structured report.

Sociological factors

Consumers are increasingly ditching traditional cable for digital and streaming options. In 2024, it's estimated that over 70% of U.S. households subscribe to at least one streaming service, a significant jump from just a decade ago. This shift directly benefits Dolby, as its audio and visual technologies are integral to the high-quality experience offered by these platforms and the devices used to access them.

While overall media consumption might seem fragmented, people are more deliberate about where they focus their attention. For instance, engagement with short-form video content on platforms like TikTok and Instagram Reels surged in 2024, with users spending an average of over 90 minutes per day on these apps. This intentional reallocation of attention means consumers are seeking out immersive and engaging content, a space where Dolby's innovations in sound and picture quality can truly shine.

Consumers are increasingly seeking out engaging, personalized entertainment, driving demand for technologies like virtual reality (VR), augmented reality (AR), and sophisticated audio systems. This shift is evident in everything from concerts to car interiors, creating a fertile ground for Dolby's immersive technologies.

Dolby's Atmos and Vision are perfectly positioned to capitalize on this trend, as they are key components in delivering the high-quality, interactive experiences consumers crave. The global immersive entertainment market is on a strong growth trajectory, with projections indicating it could reach hundreds of billions of dollars by 2030, underscoring the significant market opportunity for Dolby.

Content creators on platforms like YouTube and TikTok are increasingly adopting high-fidelity audio and video, directly boosting demand for Dolby's immersive sound technologies. By 2025, it's projected that over 70% of internet traffic will be video, with user-generated content forming a significant portion, often enhanced by creator-driven adoption of premium audio standards.

This trend means consumers are frequently exposed to and influenced by creator-led demonstrations of Dolby's capabilities, encouraging wider adoption of Dolby-enabled devices and content. The expansion of user-generated content recorded and shared in Dolby formats further solidifies Dolby's ecosystem and brand presence among a younger, digitally native audience.

Demographic Shifts and Tech Adoption

Demographic shifts significantly influence how Dolby's technologies are adopted and utilized. Younger generations, like Gen Z, are driving demand for digital content and are early adopters of new audio-visual experiences, with a notable preference for short-form video and immersive gaming environments. For example, a 2024 report indicated that over 70% of Gen Z consumers regularly use streaming services, a key area for Dolby's audio innovations.

Conversely, older demographics may still favor more traditional media consumption, presenting a challenge for Dolby to maintain relevance across all age segments. This requires a balanced approach to product development and marketing, ensuring that Dolby's advanced audio and visual solutions appeal to both tech-savvy youth and established consumer bases. Dolby's strategy must account for these differing media habits to maximize market penetration.

The varying rates of technology adoption across age groups also impact Dolby's market reach. While younger users readily embrace new devices and platforms that support high-fidelity audio, older users might be slower to upgrade. This necessitates Dolby's continued investment in backward compatibility and user-friendly interfaces to bridge this adoption gap.

- Gen Z's digital content consumption: Over 70% of Gen Z regularly use streaming services (2024 data).

- Media consumption divergence: Gen Z favors short-form video; older demographics engage with traditional media.

- Device category relevance: Dolby must ensure technologies are compatible with a wide range of devices favored by different age groups.

- Adoption rate impact: Slower tech adoption by older demographics requires Dolby to focus on user-friendly interfaces and backward compatibility.

Premiumization in Consumer Electronics

Consumers are increasingly prioritizing quality and advanced features, even when budgets are tight. This willingness to spend more on products that offer superior durability, performance, and a better user experience is a significant trend. For instance, the global premium smartphone market saw a value growth of 8% in 2024, demonstrating this consumer behavior.

This inclination towards premiumization directly benefits Dolby's business model. The company thrives by licensing its cutting-edge audio and imaging technologies, which are precisely the kinds of enhanced features consumers are seeking. These innovations allow manufacturers to justify higher price points for their devices, aligning perfectly with Dolby's strategy.

The overall growth in the consumer technology sector is heavily reliant on this premiumization trend. Companies that can successfully integrate innovative features that elevate the user experience are poised for greater value capture. In 2024, Dolby's licensing revenue saw a 6% increase, largely attributed to the adoption of its Dolby Vision and Dolby Atmos technologies in high-end televisions and mobile devices.

- Consumer Willingness to Pay: Consumers are actively seeking enhanced durability, performance, and user experience, even in challenging economic climates.

- Dolby's Strategic Alignment: This trend supports Dolby's licensing strategy for advanced audio and imaging technologies that command premium pricing.

- Value Driver in Tech: Innovative features are the key to value growth in consumer technology, enabling premiumization.

- Market Evidence: The premium smartphone segment's 8% value growth in 2024 and Dolby's 6% revenue increase in the same year highlight this trend.

Sociological factors highlight a significant shift in consumer behavior towards digital and immersive entertainment. The increasing reliance on streaming services, with over 70% of U.S. households subscribing in 2024, directly benefits Dolby as its technologies enhance these platforms. Furthermore, the growing engagement with short-form video, averaging over 90 minutes daily for some users in 2024, demonstrates a demand for captivating content where Dolby's innovations can excel.

Demographic trends, particularly the digital fluency of younger generations like Gen Z, are crucial. Over 70% of Gen Z regularly use streaming services, aligning with Dolby's target markets. However, differing media consumption habits across age groups, with older demographics still engaging with traditional media, necessitates Dolby's focus on user-friendly interfaces and backward compatibility to ensure broad market appeal.

Consumers are increasingly prioritizing quality and advanced features, a trend evidenced by the 8% value growth in the premium smartphone market in 2024. This willingness to invest in superior experiences directly supports Dolby's licensing model, as its advanced audio and imaging technologies enable manufacturers to justify higher price points. Dolby's own 6% revenue increase in 2024 reflects this successful alignment with consumer demand for premiumization.

Technological factors

Dolby is navigating significant opportunities and challenges stemming from advancements in Artificial Intelligence (AI) and Machine Learning (ML) within audio and imaging processing. These technologies are poised to elevate sound and picture quality, streamline content creation, and deliver highly personalized user experiences.

The company is actively investigating AI's role in refining its audio and video codec development and application. For instance, AI-powered upscaling techniques are becoming increasingly common, potentially allowing Dolby to offer enhanced viewing experiences even from lower-resolution source material. This could translate to increased adoption of Dolby Vision and Dolby Atmos in a wider range of content and devices.

The widespread rollout of 5G technology significantly boosts Dolby's offerings by enabling high-bandwidth, low-latency delivery of immersive audio and video experiences. This improved connectivity is crucial for mobile devices and streaming services, where Dolby's technologies are increasingly integrated.

Faster 5G speeds are making real-time interactive applications, such as multiplayer virtual reality gaming and virtual live events, more feasible and accessible to a broader audience. This expansion of virtual experiences directly leverages Dolby's advanced audio solutions.

Dolby is a key player in shaping the future of audio and video through its work on next-generation codecs. Technologies like AC4 are crucial for bringing advanced features, such as Dolby Atmos, to a wider audience and facilitating personalized soundscapes. This commitment to innovation keeps Dolby aligned with evolving industry standards and opens doors for new licensing revenue streams.

Cross-Platform Integration

Dolby's ability to seamlessly integrate its audio and visual technologies across a wide array of devices and platforms is a significant technological advantage. This cross-platform integration is key to its market penetration, extending from high-end cinema experiences to everyday mobile devices and even automotive systems.

Recent strategic partnerships highlight this success. For instance, Dolby's collaborations with major automotive manufacturers have seen its immersive audio solutions integrated into a growing number of new vehicle models released in 2024 and expected in 2025. Similarly, its ongoing relationships with consumer electronics giants continue to embed Dolby technologies into smart TVs, soundbars, and laptops, expanding its ecosystem reach.

- Growing Automotive Integration: Dolby's presence is expanding in the automotive sector, with its technologies featured in an increasing number of premium and mid-range vehicles launched in 2024.

- Consumer Electronics Penetration: Dolby Atmos and Dolby Vision are becoming standard features in many new smart TVs and streaming devices, enhancing home entertainment experiences.

- Mobile Device Adoption: The integration of Dolby technologies into smartphones and tablets continues to grow, offering consumers enhanced audio-visual quality on the go.

Competition from Open-Source and Alternative Technologies

The rise of open-source audio and video technologies presents a significant competitive challenge to Dolby's established licensing model. For instance, projects like FFmpeg and DaVinci Resolve offer robust, often free, alternatives for audio and video processing, directly impacting the demand for Dolby's proprietary solutions. This necessitates continuous innovation from Dolby to ensure its offerings provide demonstrably superior quality and user experience.

Dolby's competitive edge is further tested by alternative proprietary technologies that aim to replicate or surpass its audio and video enhancement capabilities. Companies are investing heavily in AI-driven audio upscaling and spatial audio solutions that could potentially erode Dolby's market share. For example, advancements in AI-based audio processing, as seen in some consumer electronics products released in 2024, offer increasingly sophisticated features without requiring Dolby's licensing fees.

- Open-Source Impact: Projects like the Alliance for Open Media's AV1 video codec offer royalty-free alternatives, directly challenging Dolby's revenue streams from video compression technologies.

- Proprietary Alternatives: Competitors are developing advanced spatial audio and AI-powered audio enhancement technologies that aim to match or exceed Dolby's performance, potentially reducing the perceived value of Dolby's licensing.

- Innovation Imperative: Dolby's continued success hinges on its ability to consistently deliver groundbreaking technologies and maintain a clear performance advantage in areas like immersive audio and picture quality.

Technological advancements in AI and 5G are central to Dolby's strategy, enhancing its immersive audio and video experiences. AI is being integrated into codec development for better upscaling and personalized content, while 5G's high bandwidth and low latency are crucial for delivering these advanced features, particularly in mobile and streaming contexts.

Dolby's cross-platform integration across automotive, consumer electronics, and mobile devices is a key technological strength. For example, in 2024, Dolby's immersive audio solutions were integrated into a significant number of new vehicle models from major manufacturers, underscoring its expanding ecosystem reach.

The company faces competition from open-source alternatives like AV1 and proprietary AI-driven audio enhancements. This competitive landscape necessitates Dolby's continuous innovation to maintain its performance advantage and justify its licensing model, especially as competitors offer advanced features without licensing fees.

Legal factors

Dolby's core business hinges on its vast collection of patented technologies, making intellectual property rights paramount. Effective global enforcement is crucial to safeguard against unauthorized use and ensure consistent licensing revenue streams. For instance, in 2023, Dolby continued to actively manage its patent portfolio, which underpins its licensing agreements across various entertainment sectors.

Dolby's strong market presence in audio and imaging technologies means it operates under the watchful eye of antitrust regulators globally. For instance, in 2024, the European Commission continued its investigations into digital markets, including those where dominant technology firms set the rules. These laws are designed to ensure fair competition, and Dolby's licensing models, particularly its patent pools and royalty structures, are often scrutinized to prevent any potential monopolistic behavior.

Failure to comply with these stringent regulations can lead to significant penalties, including hefty fines and mandated changes to business practices. In 2025, ongoing enforcement actions by bodies like the U.S. Federal Trade Commission (FTC) against other tech giants highlight the increasing focus on maintaining competitive landscapes. For Dolby, this necessitates careful management of its intellectual property and licensing agreements to align with evolving legal interpretations and avoid costly legal battles that could disrupt its market position.

Dolby's reliance on user data for personalized experiences and service improvements means strict adherence to global data privacy laws like GDPR and CCPA is paramount. Failure to comply could result in significant fines, with GDPR penalties reaching up to 4% of global annual revenue or €20 million, whichever is higher. This necessitates robust data protection measures and transparency in how Dolby handles consumer information.

Licensing Agreement Complexity

Dolby's extensive network of licensing agreements, spanning thousands of manufacturers and content creators globally, presents significant legal complexity. Managing these contracts requires specialized legal teams adept at navigating diverse international contract laws and intellectual property regulations. For instance, as of late 2024, Dolby's licensing revenue, a direct outcome of these agreements, continued to be a substantial portion of its overall income, underscoring the critical nature of their legal framework.

The intricacies of intellectual property rights enforcement across different jurisdictions add another layer of challenge. Dolby must ensure its patents and technologies are protected and that licensees adhere to the terms of their agreements worldwide. This necessitates robust legal strategies for monitoring, compliance, and dispute resolution, especially given the varying legal interpretations of IP in markets like China and Europe.

- Global IP Protection: Dolby actively defends its intellectual property portfolio, which comprised over 13,000 granted patents and pending applications as of early 2025, across more than 60 countries.

- Contractual Nuances: Variations in international contract law require tailored agreement structures to ensure enforceability and clarity in regions with differing legal precedents.

- Regulatory Compliance: Adherence to evolving consumer protection laws and data privacy regulations (like GDPR and CCPA) in multiple territories adds to the legal management burden.

Product Liability and Consumer Protection Laws

Dolby's licensing model means it doesn't directly manufacture consumer electronics, but it can still be impacted by product liability and consumer protection laws. If a device incorporating Dolby's audio or visual technology malfunctions and causes harm or economic loss to a consumer, the end-product manufacturer would be primarily liable. However, regulatory scrutiny on product safety and performance standards, such as those enforced by the U.S. Consumer Product Safety Commission (CPSC), could indirectly affect Dolby by imposing stricter requirements on its licensees. For instance, in 2023, the CPSC recalled millions of electronic devices for fire and shock hazards, highlighting the stringent safety landscape.

These laws are designed to ensure products are safe and that consumers are treated fairly. For Dolby, this translates to ensuring its licensed technologies perform as advertised and do not contribute to product defects. While Dolby's core business is intellectual property, a pattern of failures in devices using its technology could lead to increased regulatory oversight or consumer backlash, impacting its brand and partnerships. For example, in 2024, several consumer electronics companies faced class-action lawsuits over alleged product defects, underscoring the potential reputational risks.

Key considerations for Dolby within this legal framework include:

- Compliance Assurance: Ensuring licensees adhere to all relevant consumer protection and product safety regulations for devices featuring Dolby technologies.

- Brand Reputation: Protecting its brand from negative associations that could arise from product failures or safety issues in licensed devices.

- Contractual Safeguards: Including clauses in licensing agreements that address product performance standards and liability, although ultimate responsibility often rests with the device manufacturer.

- Regulatory Trends: Monitoring evolving consumer protection laws globally, such as the EU's General Product Safety Regulation, which strengthens market surveillance and recall procedures for unsafe products.

Dolby's legal landscape is heavily shaped by intellectual property rights and global patent enforcement, a cornerstone of its business model. As of early 2025, Dolby maintained a robust portfolio exceeding 13,000 granted patents and pending applications across more than 60 countries, underscoring the critical need for vigilant protection. Navigating diverse international contract laws is also essential for its extensive network of licensing agreements, which generated substantial revenue in 2024, highlighting the importance of legally sound and enforceable contracts worldwide.

Antitrust and competition laws are significant legal factors for Dolby, given its dominant position in audio and imaging technologies. Regulators globally, such as the European Commission in 2024, actively scrutinize market practices to prevent monopolistic behavior, impacting Dolby's royalty structures and licensing models. Compliance with evolving consumer protection and data privacy laws, including GDPR and CCPA, is also paramount, with potential fines up to 4% of global annual revenue for non-compliance, as seen in ongoing enforcement actions by bodies like the FTC in 2025.

| Legal Factor | Description | Relevance to Dolby (2024-2025) |

| Intellectual Property Rights | Protection and enforcement of patents and proprietary technologies. | Dolby's core revenue driver; over 13,000 patents globally as of early 2025. |

| Antitrust & Competition Law | Ensuring fair market practices and preventing monopolistic behavior. | Scrutiny of licensing models by regulators like the European Commission in 2024. |

| Data Privacy & Consumer Protection | Compliance with regulations like GDPR and CCPA regarding user data. | Significant penalties for non-compliance; strict adherence required for brand trust. |

| Contract Law | Governing licensing agreements with thousands of global partners. | Essential for revenue generation and dispute resolution across diverse jurisdictions. |

Environmental factors

Growing global regulations on electronic waste, such as the EU's Waste Electrical and Electronic Equipment (WEEE) Directive, are increasing the burden on manufacturers. While Dolby itself doesn't produce hardware, these evolving e-waste rules mean its hardware partners must invest more in responsible disposal and recycling. For instance, by 2025, the EU aims for a 65% collection rate for WEEE, a significant operational challenge for device makers.

This indirect impact on Dolby's ecosystem is substantial. Increased compliance costs for device manufacturers could influence their willingness to adopt new technologies or their overall profitability, potentially affecting Dolby's licensing revenue. The push for circular economy principles in electronics, driven by these regulations, also encourages longer product lifecycles, which might slow the pace of new device sales where Dolby's latest innovations are typically introduced.

Growing pressure for sustainable supply chains, emphasizing ethical material sourcing and reduced carbon footprints in manufacturing, is increasingly influencing Dolby's partners. For instance, the global supply chain management market is projected to reach $30.7 billion by 2027, indicating a significant focus on efficiency and sustainability.

Dolby might experience indirect pressure to ensure its licensees uphold environmental standards. This could affect their sourcing decisions and operational costs, especially as consumers and regulators demand greater transparency regarding the environmental impact of electronic device production, a sector where Dolby's technologies are prevalent.

The energy consumption of devices is increasingly scrutinized as a significant environmental factor. As consumers and regulators prioritize sustainability, the power draw of electronics featuring Dolby's audio and imaging solutions directly impacts their marketability and compliance with evolving environmental standards.

Optimizing Dolby technologies for reduced energy consumption offers a competitive edge. For instance, advancements in power-efficient audio processing or display technologies can lead to longer battery life in portable devices and lower overall electricity usage, aligning with global energy efficiency directives and consumer demand for greener products.

Corporate Social Responsibility (CSR)

Growing stakeholder and consumer demand for corporate social responsibility significantly impacts Dolby's brand image and its ability to forge strategic alliances. Companies are increasingly scrutinized for their environmental footprint and ethical practices. For instance, in 2024, a significant majority of consumers indicated they would switch brands if a competitor demonstrated a stronger commitment to sustainability.

Dolby's approach to sustainability, even as a technology licensing firm, plays a crucial role in its investor relations and overall market perception. A strong CSR profile can attract environmentally conscious investors and enhance its standing in a competitive landscape. In early 2025, ESG (Environmental, Social, and Governance) funds saw continued inflows, highlighting this trend.

Key considerations for Dolby regarding CSR include:

- Environmental Stewardship: Highlighting efforts to reduce the environmental impact of its technologies and operations.

- Ethical Supply Chains: Ensuring responsible sourcing and fair labor practices throughout its value chain.

- Community Engagement: Investing in initiatives that benefit the communities where it operates and its technology is used.

- Transparency and Reporting: Openly communicating its CSR performance and goals to stakeholders.

Climate Change Impact on Operations

While Dolby's core business is software and licensing, climate change can indirectly disrupt operations. Extreme weather events, such as those increasingly impacting global supply chains, could affect the manufacturing capabilities of Dolby's hardware partners. For instance, disruptions in semiconductor production due to floods or extreme heat could delay the availability of devices that integrate Dolby technologies.

This necessitates resilience planning not just for Dolby, but across the broader tech ecosystem. Companies are increasingly factoring in climate-related risks to their supply chain continuity. A 2024 report indicated that over 60% of businesses surveyed had experienced supply chain disruptions attributed to climate change in the preceding year, highlighting the growing need for proactive adaptation strategies.

Furthermore, resource scarcity, another consequence of climate change, could impact the availability and cost of raw materials used in the production of electronic components. This could lead to increased costs for hardware manufacturers, potentially affecting their investment in new technologies that incorporate Dolby's innovations.

- Supply Chain Vulnerability: Extreme weather events in key manufacturing regions can disrupt production of audio and visual components.

- Resource Scarcity: Potential shortages of rare earth minerals or other materials essential for electronics could increase manufacturing costs.

- Ecosystem Resilience: Dolby's reliance on hardware partners means its operational continuity is linked to the climate resilience of the wider tech manufacturing sector.

- Increased Operational Costs: Indirect impacts from climate change could translate to higher component costs for hardware manufacturers, potentially affecting market adoption of new Dolby-enabled products.

Growing global regulations on electronic waste, such as the EU's WEEE Directive, are increasing the burden on hardware partners. By 2025, the EU aims for a 65% collection rate for WEEE, impacting device makers and indirectly Dolby's licensing revenue through increased compliance costs.

The push for circular economy principles encourages longer product lifecycles, potentially slowing the adoption of new Dolby-enabled devices. Increased scrutiny on energy consumption also means Dolby's technologies must be power-efficient to remain competitive and comply with evolving environmental standards.

Corporate social responsibility is a significant factor, with a majority of consumers in 2024 willing to switch brands for stronger sustainability commitments. ESG funds saw continued inflows in early 2025, underscoring the importance of Dolby's environmental stewardship and transparency for investors.

Climate change poses indirect operational risks through supply chain disruptions from extreme weather, affecting hardware partner production. Resource scarcity could also increase component costs for manufacturers, impacting the market adoption of new Dolby innovations.

| Environmental Factor | Impact on Dolby Ecosystem | Supporting Data/Trend (2024-2025) |

|---|---|---|

| E-waste Regulations | Increased compliance costs for hardware partners; potential slowdown in new device sales. | EU WEEE collection rate target of 65% by 2025. |

| Sustainable Supply Chains | Pressure on partners for ethical sourcing and reduced carbon footprint; potential impact on operational costs. | Global supply chain management market projected to reach $30.7 billion by 2027. |

| Energy Consumption | Need for power-efficient technologies to enhance marketability and compliance. | Growing consumer and regulatory demand for greener electronics. |

| Corporate Social Responsibility (CSR) | Enhances brand image and investor relations; attracts ESG-focused investment. | Majority of consumers in 2024 would switch brands for stronger sustainability; continued inflows into ESG funds in early 2025. |

| Climate Change Impacts | Supply chain disruptions; increased raw material costs for partners. | Over 60% of businesses surveyed in 2024 experienced climate-related supply chain disruptions. |

PESTLE Analysis Data Sources

Our Dolby PESTLE Analysis is grounded in a comprehensive review of official government publications, leading industry research reports, and reputable financial news outlets. This ensures that our insights into political, economic, social, technological, legal, and environmental factors impacting Dolby are accurate and current.