Avenue Supermarts SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avenue Supermarts Bundle

Avenue Supermarts, operator of DMart, boasts formidable strengths in its efficient supply chain and value-driven pricing, giving it a significant competitive edge. However, understanding the nuances of its opportunities and the potential threats from evolving retail landscapes is crucial for informed decision-making.

Want the full story behind Avenue Supermarts' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

DMart's core strength is its Everyday Low Price (EDLP) strategy, which means consistently offering competitive prices without relying on frequent sales. This builds significant trust and loyalty, especially with price-conscious middle-income families in India.

This consistent value proposition drives repeat business and ensures high customer traffic in DMart stores. For example, in FY24, DMart reported a revenue of ₹46,300 crore, a testament to the effectiveness of its EDLP model in attracting and retaining a large customer base.

Avenue Supermarts, operating under the DMart brand, demonstrates remarkable strength in its supply chain and cost management. By directly sourcing a significant portion of its products from manufacturers, the company effectively bypasses intermediaries, leading to substantial cost savings. This direct sourcing strategy, coupled with owning a majority of its retail store properties, significantly reduces operational overheads and rental expenses.

These efficiencies translate directly into competitive pricing, a cornerstone of DMart's success. For instance, in the fiscal year 2024, DMart reported a revenue of ₹44,500 crore, showcasing its ability to attract a large customer base through its value proposition. This robust financial performance underscores the effectiveness of its lean operating model, allowing it to maintain healthy profit margins even with lower price points compared to rivals.

Avenue Supermarts, operating as DMart, benefits immensely from its strong store ownership model. By owning its properties, DMart significantly cuts down on recurring rental expenses, a major advantage in the real estate-heavy retail industry. This approach directly contributes to its reputation for maintaining low operating costs.

This strategic choice to own rather than lease provides long-term stability and a sustainable competitive edge. As of the first quarter of fiscal year 2025 (ending June 30, 2024), DMart's owned and leased store portfolio stood at 345 stores, with a substantial 300 of these being owned properties, highlighting their commitment to this asset-light strategy.

Strategic Cluster-Based Expansion

Avenue Supermarts, operating as DMart, excels through its strategic cluster-based expansion. This approach prioritizes deepening market penetration in established regions such as Maharashtra, Gujarat, Karnataka, and Andhra Pradesh before aggressively entering new territories. This focus allows DMart to optimize its supply chain and operational efficiencies, building a strong, dense customer base within these clusters.

This methodical expansion has proven highly effective. For the fiscal year ending March 31, 2024, DMart reported a robust revenue growth of 24.9% to ₹46,394.6 crore. The company's ability to leverage existing infrastructure and brand recognition within these clusters directly contributes to its consistent financial performance and market dominance in its chosen areas.

- Deep Market Penetration: DMart's cluster strategy allows for greater density in existing markets, enhancing customer accessibility and loyalty.

- Operational Efficiency: By concentrating on specific regions, DMart optimizes its supply chain, logistics, and inventory management, leading to cost savings.

- Leveraging Existing Networks: Expansion within clusters benefits from established distribution channels and brand familiarity, reducing the cost and time of market entry.

- Strong Financial Performance: This strategy underpins DMart's consistent revenue growth, as evidenced by its FY24 performance, demonstrating the financial viability of its expansion model.

Robust Financial Health and Profitability

Avenue Supermarts, operating as DMart, showcases remarkable financial resilience. Despite a highly competitive retail landscape, the company consistently reports strong revenue growth. For the fiscal year ending March 31, 2024, DMart's revenue from operations surged by 18.09% to ₹46,307.92 crore, a testament to its effective business model.

DMart's profitability remains a key strength, even with its commitment to everyday low prices. This is underscored by its healthy profit margins, which are a direct result of exceptional operational efficiency and cost management. The company's ability to translate sales into substantial profits highlights its mastery of the retail business.

Further bolstering its financial standing is DMart's robust cash flow generation and a notably debt-free balance sheet. This strong financial foundation provides significant flexibility for future expansion and investment, allowing DMart to weather economic fluctuations and pursue growth opportunities without the burden of heavy interest payments.

- Consistent Revenue Growth: Reported revenue from operations of ₹46,307.92 crore for FY24, an 18.09% increase year-on-year.

- Healthy Profitability: Maintains strong profit margins, demonstrating operational excellence despite a low-price strategy.

- Debt-Free Status: Operates with a clean balance sheet, free from significant long-term debt, enhancing financial flexibility.

- Strong Cash Flows: Generates consistent and healthy cash flows, supporting operational needs and expansion plans.

DMart's core strength lies in its Everyday Low Price (EDLP) strategy, which fosters significant customer loyalty by consistently offering value without relying on frequent promotions. This approach drives high footfall and repeat purchases, as demonstrated by its FY24 revenue of ₹46,300 crore.

The company's operational efficiency is a major advantage, achieved through direct sourcing and owning a majority of its store properties. This reduces intermediary costs and rental expenses, allowing DMart to maintain competitive pricing and healthy profit margins. For FY24, revenue reached ₹44,500 crore, reflecting the success of this lean model.

DMart's strategic cluster-based expansion deepens market penetration in existing regions before entering new ones. This focus optimizes supply chains and leverages brand familiarity, leading to cost-effective growth. The company's revenue grew by 24.9% to ₹46,394.6 crore in FY24, highlighting the effectiveness of this methodical approach.

Financially, DMart exhibits strong resilience with consistent revenue growth, reporting ₹46,307.92 crore in FY24 (an 18.09% increase). Its debt-free status and strong cash flow generation provide financial flexibility for future expansion and investment.

| Metric | FY24 (₹ Crore) | FY23 (₹ Crore) | Year-on-Year Growth |

|---|---|---|---|

| Revenue from Operations | 46,307.92 | 39,203.00 | 18.09% |

| Profit After Tax | 2,523.26 | 2,378.37 | 6.09% |

| Number of Stores (as of March 31, 2024) | 324 | 302 | 7.28% |

What is included in the product

Delivers a strategic overview of Avenue Supermarts’s internal and external business factors, highlighting its strong brand, efficient operations, and expansion potential against competitive pressures and evolving consumer preferences.

Offers a clear, actionable SWOT breakdown for Avenue Supermarts, pinpointing areas to leverage strengths and mitigate weaknesses for improved operational efficiency.

Weaknesses

Historically, Avenue Supermarts (DMart) has maintained a comparatively limited online presence. Its e-commerce initiative, DMart Ready, has largely concentrated on a click-and-collect model, with fewer resources dedicated to widespread home delivery services compared to its digitally native competitors.

While DMart is actively working to bolster its digital capabilities and integrate its online and offline operations, this gradual approach to omnichannel expansion represents a potential weakness. The Indian retail sector is rapidly digitizing, and a slower adoption of robust online delivery infrastructure could hinder DMart's ability to capture a larger share of the growing online grocery market, which saw significant growth in 2024.

Avenue Supermarts, operating under the DMart brand, has historically pursued a measured approach to store expansion. While this strategy prioritizes profitability and operational efficiency, it means DMart's growth in store count has been slower compared to some more aggressive retail players. For instance, in FY24, DMart added 226 stores, bringing their total to 345, a significant increase but still a more deliberate pace than some competitors might adopt for rapid market penetration.

This cautious expansion, though financially sound, could potentially result in missed opportunities to capture market share in emerging or underpenetrated geographies. While DMart has plans to accelerate its store additions in the coming years, the current pace means that in certain regions, competitors might establish a stronger foothold first, potentially impacting DMart's long-term market dominance in those specific areas.

Avenue Supermarts, operating as DMart, exhibits a notable geographical concentration in its store network, with a substantial presence in Western and Southern India. Maharashtra and Gujarat, in particular, host a significant portion of its retail footprint.

This heavy reliance on specific regions limits DMart's overall pan-India reach. It also exposes the company to risks associated with localized economic slowdowns or increased competition within these core markets, leaving vast areas of Northern and Eastern India largely unpenetrated.

Pressure on Margins from Competition and Inflation

Avenue Supermarts, operating as DMart, faces significant pressure on its profit margins. The retail sector is highly competitive, with the rise of quick commerce and established large retailers intensifying this rivalry. This dynamic, combined with persistent inflationary pressures, has resulted in a noticeable softening of DMart's operating and net profit margins.

Maintaining competitive pricing is crucial for DMart, especially in a high-inflationary economic climate. However, this strategy directly strains profitability, particularly within the lower-margin Fast-Moving Consumer Goods (FMCG) segment, which forms a substantial part of its sales. For instance, during the third quarter of fiscal year 2024, DMart reported a net profit of ₹6.01 billion, a slight increase from ₹5.81 billion in the same period last year, but the operating profit margin saw a dip, reflecting these margin pressures.

- Intense Competition: Increased presence of quick commerce and other large retailers puts pressure on DMart's pricing strategies.

- Inflationary Impact: Rising costs due to inflation squeeze profitability, especially in high-volume, low-margin categories like FMCG.

- Margin Softening: Evidence suggests a trend of softening operating and net profit margins due to these combined factors.

- Pricing Dilemma: Balancing competitive pricing with the need to cover increased operational costs remains a key challenge.

Dependence on Physical Store Footfall

Avenue Supermarts, operating as DMart, faces a significant weakness in its heavy reliance on physical store footfall. This traditional brick-and-mortar model, while successful in driving value-conscious customers, could be challenged by the accelerating shift towards digital commerce and quick commerce solutions.

The company's strategy of offering low prices and a wide assortment in its stores is a strong draw, but a substantial change in consumer shopping habits could directly impact its core sales channels. For instance, while DMart reported a 36% year-on-year revenue growth to ₹46,385 crore for the fiscal year ending March 31, 2024, this growth is still largely tied to its physical presence.

- Store Footfall Dependency: DMart's business model is intrinsically linked to customers visiting its physical stores, making it susceptible to disruptions affecting in-person shopping.

- Digital Shift Vulnerability: A prolonged or rapid consumer migration to online platforms and rapid delivery services could erode DMart's traditional sales base.

- Competitive Landscape: Emerging online grocery players and quick commerce platforms offer convenience that DMart's current model may not fully match.

- Evolving Consumer Behavior: As consumers increasingly prioritize online convenience and speed, DMart's reliance on physical stores presents a potential strategic disadvantage.

DMart's limited online presence, primarily focused on a click-and-collect model via DMart Ready, lags behind digitally native competitors with robust home delivery. This slower adoption of comprehensive e-commerce infrastructure, especially in a rapidly digitizing Indian retail market, could hinder its ability to capture a larger share of the growing online grocery segment, which saw significant expansion in 2024.

The company's historically measured store expansion, while prioritizing profitability, means its growth in store count is slower than some aggressive players. Although DMart added 226 stores in FY24 to reach 345, this deliberate pace might lead to missed opportunities in underpenetrated geographies, allowing competitors to establish stronger footholds first.

A significant weakness lies in DMart's heavy reliance on physical store footfall. This traditional model, successful with value-conscious shoppers, faces challenges from the accelerating shift to digital and quick commerce, potentially impacting its core sales despite a 36% revenue growth to ₹46,385 crore in FY24, which remains largely tied to its physical presence.

DMart faces intense competition and inflationary pressures that are softening its profit margins. The need to maintain competitive pricing, particularly in the low-margin FMCG sector, strains profitability. For instance, in Q3 FY24, while net profit rose slightly to ₹6.01 billion, operating profit margins showed a dip, reflecting these pressures.

What You See Is What You Get

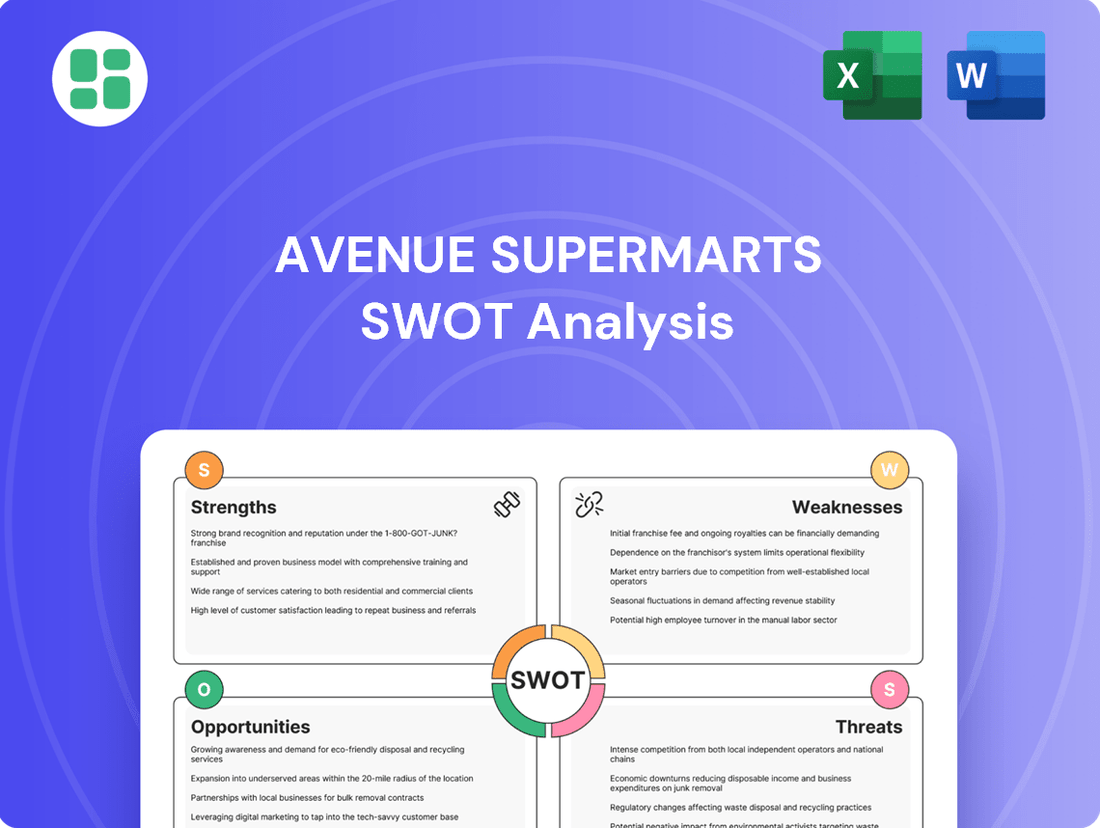

Avenue Supermarts SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear overview of Avenue Supermarts' Strengths, Weaknesses, Opportunities, and Threats.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain comprehensive insights into Avenue Supermarts' strategic positioning.

Opportunities

Avenue Supermarts, operating DMart, has a significant opportunity to tap into the vast, underserved markets of Tier II and Tier III cities in India. These regions are witnessing accelerated urbanization and a noticeable increase in disposable incomes, creating a fertile ground for DMart's value-driven retail proposition.

The growing middle class in these emerging urban centers aligns perfectly with DMart's cost-conscious operating model. For instance, by Q3 FY24, DMart had already established a strong foothold with 341 stores, and further expansion into these smaller cities promises substantial market share capture and revenue growth.

Avenue Supermarts has a significant opportunity to bolster its omnichannel and e-commerce capabilities. Further investment in and enhancement of its DMart Ready service, alongside a refined overall omnichannel strategy, can unlock substantial growth.

By focusing on improving the online ordering experience and expediting delivery times, DMart can better align with changing consumer expectations. This integration of online and offline channels is crucial for competing effectively against established e-commerce and quick commerce players.

For instance, DMart Ready's expansion into new cities and its growing order volumes in existing ones demonstrate the potential. As of early 2024, DMart Ready has been steadily increasing its reach, indicating a positive market response to their online grocery offerings.

Avenue Supermarts has a prime opportunity to boost its profitability by expanding its private label offerings across more product categories, from everyday essentials to personal care items. This strategic move is particularly appealing because private labels generally carry higher profit margins than established national brands.

By increasing the penetration of its own brands, DMart can directly improve its gross margins. For instance, in FY24, DMart's private label penetration stood at approximately 8.5% of total revenue. An increase in this figure, even by a few percentage points, could translate into substantial profit growth, while still allowing the company to offer competitive pricing to its value-conscious customer base.

Leveraging Data Analytics for Personalized Offers

Leveraging advanced data analytics offers Avenue Supermarts (DMart) a significant opportunity to deeply understand its customers. By analyzing purchasing patterns and preferences, DMart can move beyond generic promotions to highly personalized offers. This data-driven approach can significantly boost customer engagement and loyalty.

This personalization translates directly into tangible business benefits. For instance, by understanding which products are frequently bought together or which promotions resonate most with specific customer segments, DMart can optimize its inventory management, reducing waste and ensuring popular items are always in stock. This also allows for tailored product assortments in individual stores, catering to local demand more effectively.

The impact on sales and operational efficiency is substantial. In 2024, retail sectors that effectively implemented personalized marketing saw an average increase in conversion rates by 10-15% compared to those using broader strategies. For DMart, this could mean millions in additional revenue and improved profit margins through smarter inventory and targeted marketing spend.

- Enhanced Customer Insights: Deeper understanding of individual shopping habits and preferences.

- Personalized Promotions: Tailored offers and discounts to specific customer segments, increasing relevance and uptake.

- Optimized Inventory: Reduced stockouts and overstock by forecasting demand more accurately based on purchasing data.

- Improved Sales & Efficiency: Direct correlation between personalized marketing and increased customer spending and operational streamlining.

Growth in Organized Retail Sector

The Indian retail landscape is undergoing a significant transformation, with a noticeable migration from traditional, unorganized outlets to more structured, organized retail formats. This shift is particularly evident in the staples and Fast-Moving Consumer Goods (FMCG) segments. The organized retail market in India was estimated to be around USD 110 billion in 2023 and is projected to reach USD 200 billion by 2027, indicating a robust growth trajectory.

Avenue Supermarts, operating under the popular DMart brand, is strategically positioned to capitalize on this evolving consumer preference. As a leader in the value-driven organized retail space, DMart’s business model, which focuses on everyday low prices and efficient supply chain management, resonates well with the Indian consumer seeking affordability and quality. This allows DMart to capture an increasing share of the expanding organized retail market.

- Projected Growth: The organized staples and FMCG retail market in India is expected to see substantial growth, driven by changing consumer habits and increasing urbanization.

- DMart's Advantage: DMart's established presence and focus on value offerings place it in a prime position to benefit from this market expansion.

- Market Share Potential: The ongoing shift towards organized retail presents a significant opportunity for DMart to further increase its market share.

Avenue Supermarts can significantly enhance its profitability by expanding its private label offerings. This strategy, which saw an 8.5% penetration in FY24, offers higher margins compared to national brands. Increasing this penetration can directly boost gross margins, even while maintaining competitive pricing for value-conscious shoppers.

Leveraging data analytics presents a key opportunity for DMart to gain deeper customer insights. By analyzing purchasing patterns, DMart can implement personalized promotions, boosting customer engagement and loyalty. This data-driven approach can improve conversion rates by an estimated 10-15%, leading to increased sales and operational efficiency.

The ongoing shift towards organized retail in India, particularly in staples and FMCG, offers Avenue Supermarts a substantial growth avenue. The organized retail market, projected to grow from USD 110 billion in 2023 to USD 200 billion by 2027, provides a fertile ground for DMart's value-driven model to capture increased market share.

Threats

The retail landscape is fiercely competitive, with e-commerce giants like Amazon and Flipkart significantly expanding their reach. These platforms offer a vast product selection and often aggressive pricing, directly challenging traditional brick-and-mortar retailers. In the fiscal year 2023-24, e-commerce sales in India were projected to reach over $80 billion, highlighting the scale of this digital shift.

Furthermore, the rise of quick commerce, exemplified by players like Blinkit and Zepto, introduces a new dimension of competition focused on ultra-fast delivery. These services cater to the growing consumer demand for immediate gratification, particularly in urban centers, and could potentially siphon off market share from established players like Avenue Supermarts, especially for convenience-driven purchases.

Competitors such as Reliance Retail and Tata's Trent are aggressively expanding their footprint across India, intensifying competition in both brick-and-mortar and e-commerce channels. Reliance Retail, for instance, has been rapidly acquiring brands and opening new stores, aiming for broad market coverage.

These rivals possess substantial financial resources and a wide array of retail formats, from hypermarkets to specialty stores, which could pose a significant challenge to DMart's established market position and future growth plans. Reliance Retail's revenue in FY24 reached over ₹2.6 lakh crore, showcasing its immense scale.

Sustained high food inflation, a concern throughout 2024, directly impacts consumer purchasing power. For instance, food inflation in India remained elevated, exceeding 5% for much of the year, impacting household budgets. This economic slowdown forces consumers to prioritize essential goods, potentially reducing discretionary spending and creating a challenging environment for retailers like Avenue Supermarts.

This shift towards basic necessities puts additional pressure on DMart's margins. As input costs, including raw materials and logistics, continue to rise due to inflationary pressures, the company must balance maintaining its value proposition with absorbing these increased expenses. This delicate act is crucial for retaining its customer base in a price-sensitive market.

Supply Chain Disruptions and Logistics Challenges

Avenue Supermarts, operating as DMart, faces potential threats from supply chain disruptions. While their current model is efficient, unforeseen global events like the lingering effects of the COVID-19 pandemic or geopolitical tensions could disrupt product availability and inflate logistics expenses. For instance, global shipping costs saw significant volatility in 2023 and early 2024, impacting retail operations.

The increasing complexity of managing multi-channel operations, as DMart expands its reach, also poses a challenge. Ensuring consistent product flow across both physical stores and growing e-commerce platforms requires robust and adaptable logistics.

Furthermore, the sheer scale of managing an ever-expanding network of stores presents ongoing operational hurdles. Maintaining efficiency and controlling costs within this growth trajectory is a constant concern.

- Pandemic-related supply chain bottlenecks continued to affect global trade throughout 2023.

- Geopolitical events in 2024 have led to increased shipping insurance premiums and transit times.

- DMart's expansion into new regions necessitates navigating diverse logistical infrastructures and regulations.

Evolving Consumer Preferences and Technology Adoption

Consumer preferences in India are shifting rapidly, with a pronounced increase in the demand for integrated digital experiences and tailored services. For instance, the digital retail penetration in India was projected to reach approximately 35% by the end of 2024, highlighting this trend.

Avenue Supermarts, operating under the DMart banner, faces a significant threat if it cannot swiftly adapt to these evolving expectations and fully integrate new retail technologies. This lag could result in a diminished appeal to a crucial segment of its customer base, impacting market share.

- Digital Integration Gap: Failure to offer a seamless omnichannel experience, blending online and offline channels effectively, could alienate tech-savvy consumers.

- Personalization Deficit: Not leveraging data analytics to provide personalized offers and recommendations might put DMart at a disadvantage compared to competitors who excel in this area.

- Technology Adoption Lag: Slower adoption of innovations like AI-powered inventory management or advanced customer analytics could hinder operational efficiency and customer engagement.

Intensifying competition from both online retailers and aggressive brick-and-mortar expansion by rivals like Reliance Retail and Tata's Trent presents a significant threat. Reliance Retail's FY24 revenue exceeding ₹2.6 lakh crore underscores its formidable market presence.

Sustained high food inflation, with rates often above 5% in 2024, erodes consumer purchasing power, forcing a focus on essentials and potentially reducing discretionary spending, thereby pressuring DMart's margins.

The company must also contend with the ongoing threat of supply chain disruptions, exacerbated by geopolitical tensions and volatile global shipping costs seen through 2023 and early 2024, which can impact product availability and logistics expenses.

Failure to adapt to evolving consumer preferences for integrated digital experiences and personalized services, as evidenced by India's projected 35% digital retail penetration by end-2024, could lead to a diminished appeal among tech-savvy customers.

SWOT Analysis Data Sources

This Avenue Supermarts SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry analyses to ensure an accurate and insightful assessment.