Avenue Supermarts PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avenue Supermarts Bundle

Navigate the dynamic retail landscape with our PESTLE analysis of Avenue Supermarts. Understand how political stability, economic growth, evolving social trends, technological advancements, environmental regulations, and legal frameworks are shaping its operational success. Equip yourself with critical insights to anticipate market shifts and capitalize on emerging opportunities. Download the full PESTLE analysis now for a strategic advantage.

Political factors

The Indian government's stance on Foreign Direct Investment (FDI) in multi-brand retail significantly shapes the competitive arena for domestic retailers like Avenue Supermarts. For instance, the FDI policy, which allows up to 100% FDI in single-brand retail and up to 51% in multi-brand retail with certain conditions, directly impacts how global players can enter and compete in the Indian market, influencing Avenue Supermarts' strategic planning.

Any shifts in these FDI regulations, whether towards greater liberalization or stricter controls, could materially alter Avenue Supermarts' market position and future expansion prospects. For example, a move towards greater liberalization might intensify competition, while increased restrictions could provide domestic players with a more protected growth environment.

Furthermore, government programs aimed at bolstering domestic manufacturing and strengthening local supply chains present a dual-edged sword for Avenue Supermarts. These initiatives can offer opportunities for more cost-effective sourcing and improved product availability, but they may also introduce complexities in supplier management and adherence to evolving local content requirements.

The Goods and Services Tax (GST) in India has simplified indirect taxes, but shifts in tax rates for different goods, such as the recent 18% GST on certain food items, can impact DMart's pricing and profit margins. Stability in these policies is vital for Avenue Supermarts' long-term planning.

Changes to corporate tax rates, like the reduction to 22% (or 15% for new manufacturing units under specific conditions), directly influence Avenue Supermarts' net earnings and investment capacity. For instance, a stable tax environment encourages capital expenditure, which is essential for DMart's expansion plans.

The Indian government has been actively pursuing reforms to enhance the ease of doing business, a move that significantly impacts retail expansion. These initiatives, focusing on simplifying licensing, permits, and regulatory compliance, directly benefit companies like Avenue Supermarts (DMart) by streamlining their operational processes.

For DMart, reduced bureaucratic hurdles translate into faster store rollout plans and improved operational efficiency. For instance, the World Bank's Ease of Doing Business report for 2019 ranked India 63rd out of 190 economies, a substantial jump from its previous position, indicating progress in this area.

Conversely, any deceleration or reversal in these reformist policies could pose a challenge to DMart's growth trajectory. Such a scenario might lead to increased operational costs and slower expansion, impacting the company's ability to capitalize on market opportunities.

Political Stability and Consumer Confidence

India's political stability is a cornerstone for consumer confidence, directly impacting spending on essentials and discretionary items sold by Avenue Supermarts (DMart). A predictable political landscape fosters economic growth, encouraging consumers to spend more freely. For instance, a stable government often translates to policies that support retail sector expansion, benefiting DMart's revenue streams.

Political uncertainty, however, can create a ripple effect of reduced consumer optimism. This sentiment can lead to decreased sales volumes as households become more cautious with their expenditure. In 2024, ongoing election cycles in various Indian states, while a normal part of the democratic process, can introduce temporary periods of cautious consumer behavior, potentially affecting short-term sales performance for retailers like DMart.

- Political Stability: India's generally stable democratic framework supports consistent economic policy, crucial for retail sector growth.

- Consumer Confidence: A stable political environment directly boosts consumer confidence, leading to increased spending at retailers like DMart.

- Economic Impact: Political predictability encourages investment and economic activity, positively influencing DMart's sales volumes.

- Risk Factors: Social unrest or significant policy shifts due to political instability can negatively impact consumer sentiment and retail sales.

Regulations on E-commerce and Omnichannel Retail

The Indian government is actively shaping the e-commerce landscape through new regulations. These include measures focused on data privacy, bolstering consumer rights, and ensuring fair competition. For Avenue Supermarts, as it builds out its omnichannel strategy, staying compliant with these evolving rules is paramount.

The Digital Personal Data Protection Act, 2023, for instance, imposes strict guidelines on how companies collect, process, and store customer data, impacting DMart's online operations and customer relationship management. Furthermore, proposed amendments to consumer protection laws could introduce more stringent requirements for online marketplaces and sellers, affecting DMart's direct-to-consumer efforts.

Future policy decisions regarding the integration of online and offline retail channels will significantly influence DMart's digital expansion plans. Such policies could dictate how DMart leverages its physical store network to support its e-commerce growth, impacting its market penetration and overall customer engagement strategy.

- Data Privacy Compliance: Adherence to the Digital Personal Data Protection Act, 2023, is crucial for DMart's customer data handling.

- Consumer Protection: Evolving consumer protection laws may necessitate adjustments in DMart's online sales practices and return policies.

- Fair Trade Practices: Government scrutiny on fair trade in e-commerce impacts DMart's pricing strategies and vendor relationships.

- Omnichannel Regulation: Future policies on online-offline integration will shape DMart's investment in and execution of its digital transformation.

Government policies on Foreign Direct Investment (FDI) in multi-brand retail, such as the 51% cap, directly influence competition for Avenue Supermarts. The ongoing reforms aimed at improving the ease of doing business, evidenced by India's improved ranking in the World Bank's Ease of Doing Business report, streamline operations for retailers like DMart, facilitating faster store expansion.

Political stability is a key driver of consumer confidence, which in turn impacts spending on goods sold by Avenue Supermarts. For instance, election cycles in 2024 can introduce temporary consumer caution, potentially affecting short-term sales performance.

The government's regulatory approach to e-commerce, including the Digital Personal Data Protection Act, 2023, necessitates compliance from Avenue Supermarts as it develops its omnichannel strategy. Future policies on online-offline integration will shape DMart's digital transformation investments.

| Policy Area | Impact on Avenue Supermarts (DMart) | Relevant Data/Fact (2024-2025 Context) |

|---|---|---|

| FDI in Retail | Shapes competitive landscape and market entry for global players. | 51% cap on multi-brand retail FDI continues to provide a buffer for domestic players. |

| Ease of Doing Business | Streamlines operations, reduces bureaucratic hurdles for expansion. | Continued government focus on reducing compliance burdens for retail sector growth. |

| Political Stability | Influences consumer confidence and spending patterns. | Anticipated general elections in India in 2024 may lead to cautious consumer sentiment in the short term. |

| E-commerce Regulation | Impacts omnichannel strategy and data handling. | Digital Personal Data Protection Act, 2023, mandates strict data privacy compliance for online operations. |

What is included in the product

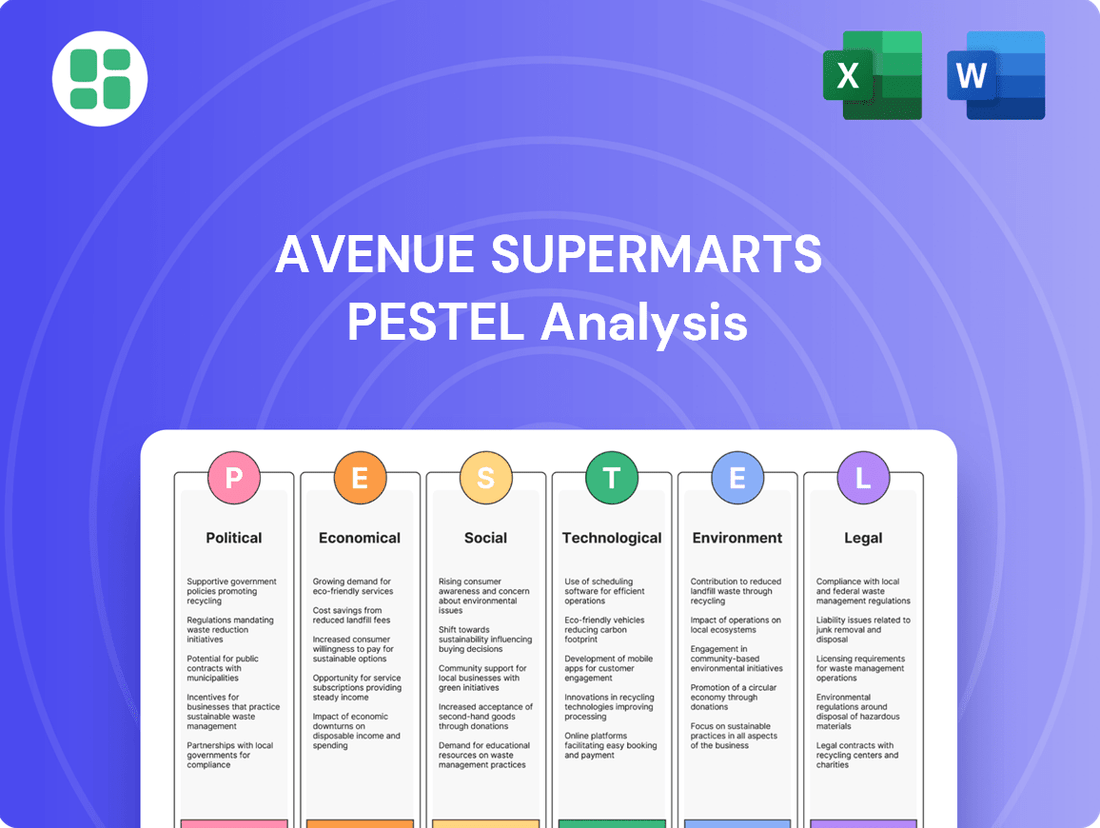

This PESTLE analysis for Avenue Supermarts examines how political, economic, social, technological, environmental, and legal factors influence its operations and strategy.

It provides a comprehensive overview of the external forces shaping Avenue Supermarts's market landscape, enabling informed strategic decision-making.

Avenue Supermarts' PESTLE analysis offers a clear, summarized version of external factors, simplifying discussions on market positioning and mitigating risks for strategic planning.

Economic factors

High inflation in India, especially for everyday necessities, directly impacts the spending capacity of middle-class households, who are DMart's primary customers. For instance, India's retail inflation stood at 4.83% in April 2024, a slight increase from the previous month, primarily driven by food prices. This persistent rise in costs can force consumers to reduce spending on non-essential items, potentially affecting DMart's sales volumes despite its value-driven approach.

DMart's strategy of offering competitive prices helps cushion the blow of inflation. However, if inflation continues to climb, even DMart might face challenges in maintaining its price advantage without impacting margins. For example, the Food and Consumer Affairs Ministry reported that prices of essential vegetables like onions and tomatoes saw significant fluctuations in early 2024, directly impacting household budgets.

Therefore, closely tracking inflation rates is vital for Avenue Supermarts. This allows the company to make informed decisions regarding its pricing strategies and optimize its inventory to ensure it continues to offer value to its customers while managing its own operational costs effectively. Understanding these economic shifts is key to maintaining DMart's market position.

The growth in disposable income for Indian households is a significant driver for companies like Avenue Supermarts (DMart). As more money becomes available after essential expenses, consumers are more likely to spend on non-essential items.

This trend is particularly pronounced in the urban and semi-urban areas where DMart has a strong presence. For instance, India's per capita disposable income saw a notable increase in the fiscal year 2023-24, reaching approximately $2,800, up from around $2,500 in the previous year, according to various economic reports.

An uplift in disposable income directly translates to increased consumer spending power. This allows Indian families to expand their purchases beyond staple groceries, opting for general merchandise and apparel, which are key categories for DMart. Consequently, this boosts DMart's average basket size and revenue generated per customer.

Economic policies aimed at fostering income growth, such as tax reforms or initiatives that create more employment opportunities, are highly beneficial for DMart's business model. These policies create a more favorable environment for increased consumer expenditure.

India's overall economic growth is a critical driver for the retail sector, and consequently, for Avenue Supermarts (DMart). A strong GDP expansion fuels higher disposable incomes and boosts consumer confidence, directly benefiting retailers like DMart. For instance, India's GDP grew by an estimated 7.3% in the fiscal year 2023-24, indicating a healthy economic environment that supports increased consumer spending.

This robust economic expansion typically leads to better employment opportunities and wage growth, further empowering consumers to spend more on essential and discretionary goods. DMart, with its focus on value retailing, is well-positioned to capture this increased demand. The company's ability to expand its store network and cater to a growing customer base is intrinsically linked to the nation's economic vitality.

Conversely, any economic slowdown or recessionary pressures could present challenges for DMart. Reduced consumer spending power and lower market demand would directly impact sales volumes and profitability. While India has shown resilience, monitoring GDP growth trends and their impact on consumer behavior remains crucial for Avenue Supermarts' strategic planning.

Interest Rates and Access to Credit

Interest rates significantly influence Avenue Supermarts' (DMart) operational costs and expansion capabilities. For instance, the Reserve Bank of India (RBI) maintained its repo rate at 6.50% through its Monetary Policy Committee meetings in late 2023 and early 2024, impacting the cost of borrowing for DMart's capital-intensive expansion plans. Lower rates reduce the expense of financing new stores and inventory, potentially accelerating DMart's growth trajectory.

Access to credit also plays a role, though DMart's cash-and-carry model minimizes direct reliance on consumer credit for purchases. However, broader economic conditions where consumers have easier access to loans can indirectly support higher spending on essential goods. In India, while consumer credit growth has been robust, DMart's value-focused proposition often appeals across various economic segments.

- Interest Rate Impact: Prevailing interest rates directly affect DMart's cost of capital for expansion and operations.

- Expansion Financing: Lower interest rates make borrowing cheaper, facilitating faster store additions and infrastructure development.

- Consumer Spending: Affordable credit for consumers can indirectly boost overall spending, benefiting retailers.

- DMart's Model: DMart's cash-and-carry approach primarily relies on direct consumer purchases, mitigating direct impact of consumer credit availability on sales.

Consumer Spending Patterns

Indian consumer spending is increasingly shifting towards organized retail, with a growing preference for private labels and online shopping channels. Avenue Supermarts, operating under the DMart banner, benefits from this trend as its core strategy emphasizes providing value for daily household necessities, resonating with its target demographic's spending habits.

For instance, in the fiscal year 2024, DMart reported a revenue of ₹46,304 crore, showcasing strong consumer uptake. The company's success is intrinsically linked to its ability to cater to the evolving needs of the Indian middle class, who are actively seeking quality products at affordable prices.

However, shifts in consumer preferences, such as a rising demand for premium products or a greater emphasis on convenience-driven shopping experiences, necessitate adaptive strategies. DMart's consistent focus on everyday essentials and its EDLC (Every Day Low Cost) and EDLP (Every Day Low Price) model are key to navigating these changes.

- Organized Retail Growth: India's organized retail market is projected to reach $150 billion by 2025, up from $80 billion in 2020, indicating a significant shift from traditional trade.

- Private Label Penetration: Private labels in Indian supermarkets are expected to grow at a CAGR of 15-20%, capturing a larger share of consumer spending.

- E-commerce Influence: Online grocery sales in India are anticipated to reach $10.5 billion by 2025, highlighting the increasing digital adoption by consumers.

- DMart's Value Proposition: DMart's revenue growth of 24.5% in FY24 underscores the effectiveness of its value-driven approach in capturing consumer spending on essential goods.

India's economic landscape presents a mixed bag for Avenue Supermarts (DMart). While robust GDP growth, projected at 7.3% for FY24, fuels consumer spending and disposable incomes, high inflation, hovering around 4.83% in April 2024, particularly in food prices, squeezes household budgets. This necessitates DMart's continued focus on value pricing to maintain its customer base amidst fluctuating essential goods costs.

Interest rates, maintained by the RBI at 6.50% through early 2024, influence DMart's expansion financing costs. Lower rates generally support capital-intensive growth, yet DMart's cash-and-carry model minimizes direct reliance on consumer credit. The overall trend of increasing disposable income, with per capita income rising to approximately $2,800 in FY24, directly benefits DMart by boosting spending power on its core offerings of groceries and general merchandise.

| Economic Factor | Data Point (2024/2025) | Impact on DMart |

| GDP Growth | Projected 7.3% for FY24 | Supports increased consumer spending and demand for DMart's products. |

| Retail Inflation | 4.83% in April 2024 | Puts pressure on household budgets, requiring DMart to maintain competitive pricing. |

| Interest Rate (Repo Rate) | 6.50% (maintained through early 2024) | Affects cost of capital for DMart's expansion plans. |

| Disposable Income | Approx. $2,800 per capita in FY24 | Increases consumer purchasing power, benefiting DMart's sales volumes. |

What You See Is What You Get

Avenue Supermarts PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Avenue Supermarts.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the political, economic, social, technological, legal, and environmental factors impacting Avenue Supermarts.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external environment of Avenue Supermarts.

Sociological factors

India's urbanization rate reached 36% in 2023, with projections indicating it will climb to 40% by 2030, fueling demand for organized retail. Avenue Supermarts, operating DMart, capitalizes on this by establishing a strong presence in high-density urban and peri-urban centers, aligning with the increasing concentration of consumers seeking convenience and value.

The demographic landscape is also evolving, with a significant portion of India's population falling within the 15-64 age bracket, representing the core working demographic. This segment, characterized by increasing disposable incomes and a preference for modern retail formats, directly benefits DMart's value-for-money proposition and its focus on essential household goods.

Indian consumers are increasingly prioritizing both affordability and ease when they shop. This means they want good deals, but they also want their shopping trips to be quick and hassle-free.

DMart's strategy is perfectly aligned with this, offering competitive prices and a wide range of products under one roof, making it a convenient one-stop destination for everyday needs.

The move from smaller, local kirana stores to larger, organized retail spaces is a significant societal shift in India, and DMart is well-positioned to capture this growing segment of shoppers. In FY24, DMart's revenue grew by 24.9% to ₹46,307 crore, showcasing the success of their model in attracting these evolving consumer preferences.

The shift towards nuclear families and smaller households in India, a trend observed across urban and semi-urban demographics, directly influences consumer purchasing habits. For instance, by 2024, the average household size in India was projected to be around 3.5 members, a decrease from previous decades, meaning less bulk buying and a greater need for convenience. This demographic evolution means Avenue Supermarts (DMart) benefits from its model that caters to frequent, smaller shopping trips, offering a wide product range suitable for these smaller units.

This sociological change necessitates that retailers like DMart adapt their product offerings and packaging. Smaller pack sizes and single-serving options are becoming increasingly important to meet the needs of smaller households, aligning with the observed preference for buying what is needed for a shorter period. Retailers who can effectively cater to these evolving family structures, perhaps through targeted promotions or product development, will likely see stronger customer loyalty.

Increasing Digital Literacy and Smartphone Penetration

The surge in digital literacy and smartphone ownership across India is fundamentally reshaping how consumers shop. By the end of 2024, it's estimated that over 60% of India's population will be internet users, with smartphones being the primary access point. This growing digital savviness means customers increasingly expect seamless online and offline experiences, pushing retailers like Avenue Supermarts (DMart) to adapt.

DMart's established strength in brick-and-mortar retail now faces the imperative to integrate digital touchpoints. This includes developing robust digital loyalty programs and exploring e-commerce avenues to connect with a tech-forward customer base. Furthermore, the rise of digital payments, with UPI transactions alone projected to reach over 200 billion by 2026, highlights the need for DMart to offer convenient and modern payment options.

- Digital Transformation: Over 650 million Indians are expected to be active internet users by mid-2025, with smartphones driving this growth.

- E-commerce Integration: The Indian e-commerce market is anticipated to hit $350 billion by 2028, indicating a significant opportunity for retailers with a digital presence.

- Digital Payments Adoption: Digital payment transactions in India are projected to exceed 100 billion annually by 2025, underscoring a consumer shift towards cashless methods.

Health and Wellness Trends

The increasing focus on health and wellness among Indian consumers is significantly shaping purchasing decisions. This shift is driving demand for organic, natural, and healthier food choices. For instance, the Indian organic food market was valued at approximately USD 1.7 billion in 2023 and is projected to grow considerably, indicating a strong consumer preference for such products.

To cater to these evolving preferences, Avenue Supermarts, operating as DMart, needs to strategically expand its product assortment. This includes incorporating a wider variety of organic produce, whole grains, and health-conscious packaged foods. Failing to adapt could lead to missed market opportunities as consumers actively seek out these healthier alternatives.

This health-conscious trend isn't confined to food; it also impacts personal care and home products. Consumers are increasingly looking for sustainable, chemical-free, and ethically sourced items. DMart's ability to offer a broader range of eco-friendly and natural personal care items, cleaning supplies, and home goods will be crucial in meeting this growing demand and maintaining customer loyalty.

- Growing Health Consciousness: Indian consumers are prioritizing well-being, boosting demand for organic and natural products.

- Market Value: The Indian organic food market reached about USD 1.7 billion in 2023, highlighting a significant consumer shift.

- Product Assortment Adaptation: DMart must broaden its offerings to include more health-focused food and personal care items.

- Sustainability Demand: Consumer interest extends to sustainable and chemical-free personal care and home products.

Societal shifts in India are profoundly influencing retail. Urbanization continues to grow, with over 36% of the population living in cities as of 2023, a trend expected to reach 40% by 2030, driving demand for organized retail formats like DMart. This demographic shift, coupled with a growing preference for convenience and value, directly benefits DMart's strategy of offering a wide product range at competitive prices in accessible locations.

The Indian consumer base is increasingly digitally connected, with over 60% of the population anticipated to be internet users by the end of 2024, primarily via smartphones. This necessitates retailers like Avenue Supermarts to enhance their digital presence, integrating online and offline experiences to cater to tech-savvy shoppers and leveraging digital payment systems, which saw UPI transactions alone projected to exceed 200 billion by 2026.

A growing emphasis on health and wellness is also reshaping consumer choices, boosting demand for organic and natural products; the Indian organic food market was valued at approximately USD 1.7 billion in 2023. Avenue Supermarts must adapt by expanding its product assortment to include more health-conscious food, personal care, and home products to meet this evolving consumer preference for well-being and sustainability.

| Sociological Factor | Description | Impact on Avenue Supermarts (DMart) | Supporting Data (2023-2025 Projections) |

|---|---|---|---|

| Urbanization | Increasing concentration of population in urban areas. | Drives demand for organized retail, aligning with DMart's store placement strategy. | 36% urbanization in 2023, projected 40% by 2030. |

| Digital Penetration | Growing internet and smartphone usage. | Requires enhanced online presence and digital payment integration. | Over 60% internet users by end of 2024; UPI transactions >200 billion by 2026. |

| Health & Wellness Consciousness | Consumer preference for healthier, organic, and sustainable products. | Necessitates expansion of product offerings to include health-focused items. | Indian organic food market valued at USD 1.7 billion in 2023. |

Technological factors

The increasing use of digital payment methods, such as Unified Payments Interface (UPI), mobile wallets, and cards, is fundamentally reshaping retail. For Avenue Supermarts (DMart), this trend directly impacts customer experience and operational flow. By embracing these technologies, DMart can offer greater convenience and speed at checkout.

In India, digital payments have seen explosive growth. UPI transactions alone processed over 12 lakh crore rupees in the fiscal year 2023-24, showcasing a massive shift away from cash. DMart's integration with these systems allows for quicker checkouts, reducing queues and improving overall store efficiency, which is vital for their high-volume, value-focused model.

Further advancements in payment technology, like contactless payments and buy-now-pay-later options, are expected to continue. DMart's strategic adoption of these innovations will be key to maintaining its competitive edge and meeting evolving consumer expectations for seamless transactions.

Avenue Supermarts, operating as DMart, heavily relies on advanced supply chain management technologies to keep costs low. This includes sophisticated inventory tracking, automated warehousing, and smart route optimization software. These tools are fundamental to their cost-efficient operational model.

By ensuring efficient logistics, DMart guarantees product availability, minimizes waste, and slashes transportation expenses. This directly supports their core strategy of offering competitive prices and maintaining their strong value proposition for customers.

DMart continues to invest in these critical technologies. For instance, during the fiscal year ending March 31, 2024, the company reported a significant increase in its capital expenditure, with a substantial portion allocated to enhancing its warehousing and logistics infrastructure, reflecting this ongoing commitment.

Avenue Supermarts, operating as DMart, leverages advanced data analytics to refine its inventory management and promotional strategies. This technological adoption allows for a deep dive into consumer purchasing habits, enabling the company to precisely manage stock levels and craft targeted offers.

By meticulously analyzing sales figures, DMart can forecast demand with greater accuracy, thereby minimizing instances of stockouts and enhancing the personalization of customer interactions. This data-driven approach directly translates into boosted sales and a stronger base of loyal customers, a critical element for sustained competitive advantage in the retail sector.

E-commerce Integration and Omnichannel Strategy

Avenue Supermarts, known for its strong offline presence, is increasingly focused on integrating e-commerce. This is crucial as customer shopping habits evolve. By developing a robust omnichannel strategy, DMart can expand its reach and cater to convenience-seeking shoppers.

Technology is the backbone of this integration, enabling a smooth customer journey across online and offline touchpoints. This could involve services like click-and-collect or home delivery, ensuring DMart's value proposition remains intact while embracing digital channels. For instance, DMart's e-commerce platform, DMart Ready, saw significant growth, with online sales contributing a notable percentage to its overall revenue in recent fiscal years, reflecting the success of these technological integrations.

- E-commerce Growth: DMart Ready's expansion into new cities and increased order volumes highlight the growing importance of online channels.

- Omnichannel Investment: Continued investment in technology is essential for seamless customer experiences between physical stores and digital platforms.

- Customer Convenience: Offering options like home delivery and click-and-collect directly addresses evolving consumer expectations for convenience.

- Data Analytics: Leveraging technology for data analytics can provide insights into customer behavior, optimizing inventory and marketing efforts across all channels.

In-store Technology for Customer Experience

Avenue Supermarts, operating DMart stores, is increasingly leveraging in-store technology to elevate the customer journey and streamline operations. Self-checkout kiosks are becoming more prevalent, aiming to reduce queue times, a common pain point for shoppers. Digital signage offers dynamic product displays and promotional information, enhancing engagement. The company is also exploring smart shopping cart technology, which could provide real-time inventory checks and personalized offers as customers browse.

These technological investments are designed to boost customer satisfaction and encourage loyalty. By reducing friction points like long waits and providing readily accessible product details, DMart aims to create a more convenient and pleasant shopping environment. For instance, a successful rollout of self-checkout can directly impact perceived wait times, a key metric in retail customer experience. DMart’s focus on efficiency through technology also supports their value-for-money proposition.

The retail landscape is constantly evolving, making continuous evaluation of emerging technologies crucial for maintaining a competitive edge. Avenue Supermarts' commitment to exploring and integrating new retail tech, such as AI-powered inventory management or enhanced data analytics for personalized marketing, will be key to future growth. This proactive approach ensures they can adapt to changing consumer expectations and operational demands.

- Self-Checkout Adoption: Increasing deployment of self-checkout kiosks to reduce customer wait times.

- Digital Signage: Utilizing digital screens for dynamic promotions and product information.

- Smart Shopping Carts: Exploring innovative cart technology for enhanced in-store navigation and personalized offers.

- Operational Efficiency: Technology integration focused on improving inventory management and checkout processes.

Technological advancements are pivotal for Avenue Supermarts' (DMart) operational efficiency and customer engagement. The widespread adoption of digital payment methods, like UPI, has streamlined transactions, with UPI processing over 12 lakh crore rupees in FY 2023-24, significantly reducing checkout times.

DMart's investment in advanced supply chain management technologies, including automated warehousing and smart route optimization, directly supports its low-cost model. This focus on logistics efficiency was reflected in increased capital expenditure for warehousing and logistics infrastructure in FY ending March 31, 2024.

The company leverages data analytics for precise inventory management and targeted promotions, enhancing customer loyalty. Furthermore, DMart's e-commerce platform, DMart Ready, has seen notable growth, with online sales contributing a significant portion to overall revenue, demonstrating successful integration of digital channels.

In-store technologies, such as self-checkout kiosks and digital signage, are being implemented to improve the customer experience and operational flow. DMart's commitment to exploring emerging retail technologies like AI-powered inventory management is crucial for maintaining its competitive edge in the dynamic retail sector.

Legal factors

Avenue Supermarts, operating its popular DMart stores, must meticulously follow the Food Safety and Standards Authority of India (FSSAI) regulations. These rules dictate everything from the quality and sourcing of food items to their proper packaging and labeling, ensuring consumer well-being.

Non-compliance can lead to severe consequences, including substantial fines and damage to the brand's hard-earned reputation. For instance, FSSAI can impose penalties up to ₹5 lakh for various violations, as outlined in the Food Safety and Standards Act, 2006. Avenue Supermarts’ commitment to rigorous internal checks and regular audits is therefore paramount to navigating these legal requirements effectively and maintaining operational continuity.

Avenue Supermarts, operating as DMart, faces a significant legal landscape governed by India's comprehensive labor laws. As a major employer, the company must strictly adhere to regulations concerning minimum wages, maximum working hours, employee benefits like provident fund and gratuity, and industrial dispute resolution mechanisms. For instance, the Code on Wages, 2019, aims to simplify wage and bonus payments, and its implementation could influence DMart's payroll structure and associated costs.

Compliance with these labor laws is not merely a legal obligation but a strategic imperative for DMart to ensure employee satisfaction, minimize the risk of costly litigation, and uphold its reputation for ethical business conduct. The company's ability to manage its vast workforce effectively hinges on its understanding and application of these regulations, impacting everything from recruitment to employee retention.

Potential shifts in India's labor codes, such as the ongoing consolidation of various labor laws into four broader codes, could directly affect DMart's operational expenses. For example, changes in regulations regarding contract labor or working conditions might necessitate adjustments in staffing models or compensation packages, potentially impacting the company's cost structure and profitability. The government's push for labor reforms aims to streamline compliance, but the actual impact on large retailers like DMart will depend on the specifics of the final rules and their implementation, with potential cost implications for 2024-2025.

The Consumer Protection Act in India places significant responsibility on retailers like Avenue Supermarts (DMart) for the quality and safety of the products they offer. This means DMart must rigorously ensure that all merchandise adheres to specified standards and is presented truthfully to consumers, safeguarding them against defective or misrepresented goods.

Failure to comply with these regulations can result in serious repercussions, including a surge in consumer complaints, costly legal battles, and, critically, a severe erosion of brand trust and reputation. For instance, in 2023, the Consumer Protection Authority reported a 15% increase in product liability cases filed against retailers nationwide, highlighting the growing scrutiny.

Land Acquisition and Real Estate Regulations

Avenue Supermarts, operating as DMart, is deeply invested in expanding its retail footprint across India. This expansion is fundamentally tied to its ability to secure prime retail locations, whether through outright purchase or long-term leases. In fiscal year 2024, DMart continued its aggressive store opening strategy, adding 30 new stores, bringing its total to 344 stores. This growth is directly influenced by the intricate web of land acquisition laws, zoning ordinances, and diverse real estate policies that vary significantly from one Indian state to another. Any unforeseen hurdles or shifts in these legal frameworks can introduce considerable delays and inflate the capital expenditure associated with establishing new outlets, thereby potentially moderating the company's otherwise robust growth trajectory.

The company's strategic planning must therefore incorporate a thorough understanding and proactive management of these legal intricacies. For instance, changes in development rights or environmental clearances can directly impact project timelines and budgets. DMart's success in navigating these regulatory landscapes is a critical determinant of its ability to maintain its expansion momentum and capitalize on market opportunities.

- DMart's Store Network: As of March 31, 2024, DMart operated 344 stores across 14 states and 1 union territory in India.

- Expansion Pace: The company added 30 new stores during FY24, demonstrating a consistent expansion drive.

- Regulatory Impact: Delays in land acquisition or changes in zoning laws can directly affect the planned opening of new stores and associated costs.

- State-Specific Laws: Real estate regulations differ across Indian states, requiring tailored legal approaches for each new location.

Competition Law and Anti-trust Regulations

Avenue Supermarts, operating as DMart, navigates a highly competitive retail landscape in India. The company must adhere to the Indian Competition Act, 2002, which strictly prohibits anti-competitive practices such as forming cartels, abusing dominant market positions, or engaging in mergers that could substantially lessen competition. The Competition Commission of India (CCI) actively monitors market activities to ensure a level playing field for all businesses. For instance, the CCI has investigated various sectors for potential anti-competitive behavior, underscoring the importance of compliance for companies like Avenue Supermarts.

Failure to comply with these regulations can result in severe consequences. The CCI has the authority to impose significant penalties, which can include substantial fines, divestiture of assets, and even market access restrictions. Beyond financial penalties, such violations can also lead to considerable reputational damage, impacting customer trust and investor confidence. In 2023, the CCI continued its enforcement actions across multiple industries, reinforcing the need for robust compliance frameworks within retail operations.

Key considerations for Avenue Supermarts regarding competition law include:

- Adherence to fair pricing strategies: Avoiding predatory pricing or price-fixing arrangements.

- Preventing monopolistic practices: Ensuring market dominance is not leveraged to stifle smaller competitors.

- Transparency in business dealings: Maintaining open and fair relationships with suppliers and customers.

- Scrutiny of potential mergers and acquisitions: Ensuring any strategic growth initiatives do not violate anti-trust provisions.

Avenue Supermarts must navigate India's complex tax regime, including GST and corporate income tax. Changes in tax policies, such as potential adjustments to corporate tax rates or GST on specific goods, could directly impact DMart's profitability and pricing strategies. For example, the Union Budget 2024-25 might introduce amendments affecting retail businesses.

Compliance with tax laws is critical to avoid penalties and maintain financial stability. The company's effective tax rate in FY23 was approximately 28.5%, highlighting the significant financial implications of tax regulations. Proactive tax planning and adherence to evolving tax legislation are essential for Avenue Supermarts' sustained financial health and operational efficiency.

The company's adherence to intellectual property laws is crucial for protecting its brand, DMart, and its proprietary business processes. This includes safeguarding trademarks, copyrights, and any patented innovations. Infringement of these laws could lead to legal disputes and financial liabilities, impacting brand value and market position.

Environmental factors

India's heightened emphasis on environmental sustainability directly impacts retailers like Avenue Supermarts (DMart). This necessitates robust plastic waste management, including phasing out single-use plastics in packaging and encouraging reusable shopping bags. DMart's commitment to these practices is crucial for aligning with evolving consumer expectations and environmental regulations.

Compliance with India's Plastic Waste Management Rules, 2016 (amended in 2022), presents a significant regulatory and social imperative. These rules mandate Extended Producer Responsibility (EPR), requiring producers and importers to manage plastic waste generated from their products. For a large retailer like DMart, this translates to actively participating in collection and recycling systems for plastic packaging materials used in their supply chain.

The drive towards a circular economy further amplifies the need for effective plastic waste reduction. Initiatives promoting the use of recycled content in packaging and exploring biodegradable alternatives are becoming increasingly important. As of early 2024, India aims to significantly increase its plastic recycling rate, a target that DMart, as a major player, can contribute to through strategic partnerships and in-store collection programs.

DMart's extensive network of large retail stores and warehouses naturally leads to substantial energy consumption. This presents a significant environmental consideration for the company.

There's growing pressure, both regulatory and societal, for businesses like DMart to curb their energy usage. This is driving adoption of energy-efficient technologies such as LED lighting and advanced HVAC systems across their facilities.

In India, where DMart operates, the renewable energy sector is expanding rapidly. For instance, by the end of 2023, India's installed solar power capacity reached over 70 GW, indicating a favorable environment for companies to explore solar power for their operations. Adopting such solutions could help DMart reduce its carbon footprint and potentially lower long-term energy expenses.

Consumers and regulators are increasingly pushing for sustainable sourcing, demanding ethical labor and eco-friendly production throughout the supply chain. DMart must ensure its suppliers, especially for agricultural goods and textiles, meet these standards to protect its brand and satisfy stakeholders. Transparency in the supply chain is now a critical expectation, with a growing number of consumers actively seeking information about product origins and production methods.

Carbon Footprint Reduction Goals

With increasing global concern over climate change, there's a significant push for companies to actively measure and reduce their carbon footprint. Avenue Supermarts (DMart) can address this by focusing on operational efficiencies like optimizing its supply chain logistics and implementing strategies to minimize food waste across its stores. Investing in more energy-efficient infrastructure, such as LED lighting and renewable energy sources for its facilities, will also be crucial.

Setting and transparently reporting on ambitious carbon emission reduction targets can significantly bolster DMart's corporate social responsibility (CSR) image. This focus on sustainability is increasingly important for attracting environmentally conscious consumers who are more likely to patronize businesses aligning with their values. Furthermore, it can appeal to a growing segment of investors who prioritize Environmental, Social, and Governance (ESG) factors in their investment decisions. For instance, many retail companies are setting targets; Walmart, a global competitor, aims for net-zero emissions across its value chain by 2040.

DMart's efforts in carbon footprint reduction could involve:

- Optimizing Logistics: Implementing route optimization software and exploring more fuel-efficient transportation methods for its extensive distribution network.

- Reducing Food Waste: Enhancing inventory management systems and partnering with food donation organizations to divert edible surplus food from landfills.

- Investing in Greener Infrastructure: Upgrading store lighting to LED, exploring solar panel installations on warehouses and retail outlets, and improving building insulation.

- Supply Chain Engagement: Collaborating with suppliers to encourage sustainable practices and reduce emissions throughout the value chain.

Water Management and Conservation

Water scarcity is a growing concern across India, impacting various sectors. Avenue Supermarts (DMart) acknowledges this, recognizing that its extensive network of stores and its supply chain, which includes agricultural produce, can exert pressure on local water resources.

DMart's commitment to sustainable practices includes focusing on water conservation. This involves implementing measures like rainwater harvesting systems at its facilities and promoting efficient water usage within its retail outlets and distribution centers. For instance, in fiscal year 2024, DMart continued its efforts to optimize water consumption across its operations, though specific consolidated figures for water saved are not publicly detailed.

These initiatives are crucial not only for reducing the company's environmental footprint but also for fostering positive community relations in the areas where it operates. By actively managing its water usage, DMart aims to contribute to the long-term availability of this vital resource.

- Water Scarcity Impact: Many regions in India face significant water shortages, affecting agriculture and daily life.

- DMart's Operational Link: DMart's retail operations and supply chain, including sourcing from agriculture, have a connection to local water usage.

- Conservation Efforts: The company focuses on implementing water-saving technologies like rainwater harvesting and efficient water management in its stores and warehouses.

- Sustainability Goal: These measures are vital for ensuring sustainable business practices and maintaining good relationships with local communities.

Environmental factors significantly influence Avenue Supermarts (DMart), particularly in India's evolving regulatory landscape. The nation's focus on sustainability mandates strict plastic waste management, including phasing out single-use plastics and promoting reusable bags, a direct challenge for DMart's packaging and operations.

DMart faces increasing pressure to reduce its carbon footprint, necessitating investments in energy efficiency and renewable sources. India's expanding solar capacity, exceeding 70 GW by late 2023, offers opportunities for DMart to adopt solar power, thereby lowering operational costs and environmental impact.

Water scarcity in India also impacts DMart's supply chain and operations. The company is implementing water conservation measures like rainwater harvesting and efficient water management across its facilities to mitigate this risk and foster positive community relations.

| Environmental Factor | Impact on DMart | DMart's Response/Strategy | Relevant Data/Trends (2023-2025) |

|---|---|---|---|

| Plastic Waste Management | Regulatory compliance, consumer expectations | Phasing out single-use plastics, promoting reusable bags | India's Plastic Waste Management Rules (amended 2022) |

| Energy Consumption & Carbon Footprint | Operational costs, CSR image, investor focus | Energy-efficient technologies (LEDs), exploring renewables | India's solar capacity > 70 GW (end 2023) |

| Water Scarcity | Supply chain stability, community relations | Rainwater harvesting, efficient water usage | Ongoing water stress in various Indian regions |

PESTLE Analysis Data Sources

Our PESTLE analysis for Avenue Supermarts is meticulously constructed using data from government reports, economic indicators, and retail industry publications. We incorporate regulatory updates, consumer spending trends, and technological advancements to provide a comprehensive overview.