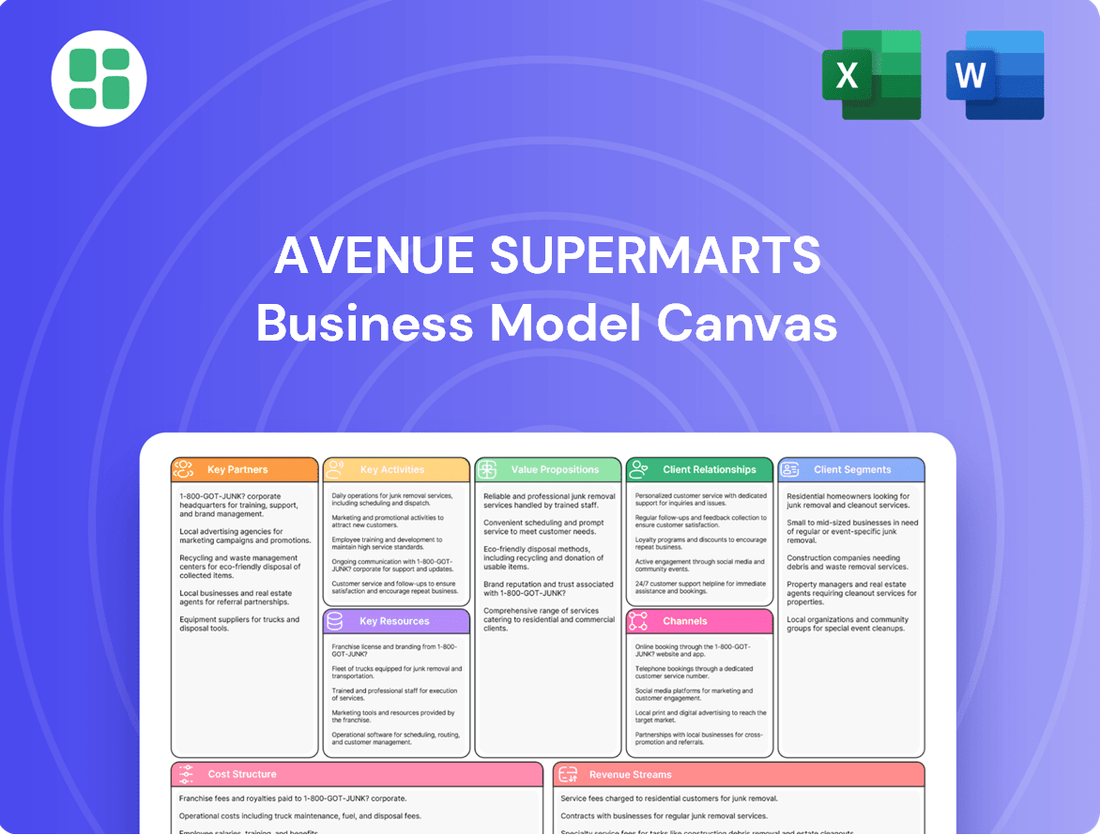

Avenue Supermarts Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avenue Supermarts Bundle

Unlock the core strategies behind Avenue Supermarts's retail dominance with our comprehensive Business Model Canvas. Discover how they efficiently manage costs, attract a vast customer base, and build strong supplier relationships to consistently deliver value. This detailed breakdown is essential for anyone looking to understand their operational excellence.

Partnerships

Avenue Supermarts, operating as DMart, cultivates direct relationships with a wide array of suppliers and manufacturers. This approach bypasses intermediaries, leading to substantial savings in procurement costs. For instance, DMart's focus on bulk purchasing from these partners allows them to negotiate favorable terms, directly contributing to their ability to offer products at competitive prices. These enduring partnerships are foundational for maintaining a steady flow of goods and securing advantageous pricing, a key element in their low-cost strategy.

Avenue Supermarts, operating as DMart, relies heavily on logistics and transportation providers to maintain its efficient supply chain. These partners are crucial for moving products from distribution centers to its over 340 stores, as of early 2024. This network ensures DMart's ability to achieve its high inventory turnover, a cornerstone of its cost-effective operating model.

The efficiency of these logistics partners directly impacts DMart's ability to keep shelves stocked and minimize costs. For instance, in FY23, DMart reported a revenue of INR 42,840 crore, underscoring the sheer volume of goods that must be moved reliably. Any disruption or inefficiency in transportation can significantly affect product availability and, consequently, customer satisfaction and profitability.

Avenue Supermarts, the operator of DMart, strategically partners with real estate developers and landlords to secure prime locations for its stores. This collaboration is crucial for their cluster-based expansion strategy, enabling efficient market penetration. For instance, in the fiscal year ending March 31, 2024, DMart continued its aggressive store opening drive, adding 224 new stores, bringing their total store count to 3446, many of which are likely secured through such partnerships.

Technology and IT Service Providers

Avenue Supermarts, operating as DMart, relies heavily on technology and IT service providers to maintain its vast retail network. These partnerships are crucial for the seamless functioning of its point-of-sale (POS) systems, sophisticated inventory management, and robust enterprise resource planning (ERP) solutions. For instance, in FY24, DMart continued to invest in technology to enhance operational efficiency across its growing store count.

These collaborations are instrumental in ensuring smooth store operations, enabling advanced data analytics for better decision-making, and supporting the infrastructure for its digital initiatives like DMart Ready. The company's commitment to leveraging technology is evident in its continuous upgrades to these systems, aiming to provide a consistent and efficient customer experience. In 2024, DMart's focus on supply chain optimization through technology was a key driver of its competitive edge.

- POS System Integration: Partnerships ensure reliable and fast transaction processing at checkout.

- Inventory Management Software: Collaboration with providers to implement and maintain real-time stock tracking, reducing stockouts and overstocking.

- ERP System Support: Essential for integrating various business functions like finance, HR, and supply chain, with IT providers offering ongoing maintenance and upgrades.

- DMart Ready Platform: Technology partners are vital for the development, scalability, and maintenance of DMart's e-commerce and online grocery delivery services.

Financial Institutions and Payment Partners

Avenue Supermarts, operating as DMart, relies heavily on its financial institutions and payment partners to ensure efficient customer transactions and robust financial operations. These partnerships are fundamental to the smooth functioning of its retail business.

DMart actively collaborates with leading banks and payment gateway providers. For instance, partnerships with institutions like HDFC Bank are leveraged to offer exclusive discounts and promotions to customers. This not only enhances customer value proposition but also streamlines the payment process, making it more convenient and secure.

- Financial Institution Collaboration: Partnerships with banks facilitate various financial services, including payment processing and potential co-branded loyalty programs.

- Payment Gateway Integration: Seamless integration with multiple payment gateways ensures that customers have a variety of secure and efficient payment options at checkout, both online and in-store.

- Promotional Tie-ups: Collaborations with financial partners, such as HDFC Bank, have historically led to attractive customer discounts, driving sales and customer loyalty. For example, in fiscal year 2024, DMart continued to explore such avenues to boost customer engagement.

Avenue Supermarts' key partnerships are critical for its low-cost, high-volume retail model. Direct relationships with suppliers and manufacturers are paramount, enabling bulk purchases and favorable pricing negotiations. Logistics and transportation providers are essential for maintaining DMart's efficient supply chain and high inventory turnover, ensuring products reach its rapidly expanding store network. Furthermore, collaborations with real estate developers secure prime locations for new stores, supporting their cluster-based expansion strategy.

| Partner Type | Role in DMart's Model | Impact/Example |

| Suppliers & Manufacturers | Direct sourcing, bulk purchasing | Cost savings, competitive pricing. FY23 Revenue: INR 42,840 crore indicates high volume. |

| Logistics & Transportation | Supply chain efficiency, inventory movement | High inventory turnover, product availability. Over 340 stores by early 2024. |

| Real Estate Developers | Store location acquisition | Cluster-based expansion. Added 224 stores in FY24, reaching 3446 total. |

| Technology & IT Service Providers | POS, Inventory, ERP systems, DMart Ready | Operational efficiency, data analytics. Continued tech investment in FY24. |

| Financial Institutions & Payment Partners | Transaction processing, customer promotions | Secure payments, customer loyalty. Tie-ups with banks like HDFC Bank for discounts. |

What is included in the product

Avenue Supermarts' Business Model Canvas focuses on delivering everyday low prices and a wide assortment of groceries and general merchandise to value-conscious Indian consumers through a network of strategically located, efficient hypermarkets.

This model emphasizes operational excellence, a lean cost structure, and strong supplier relationships to maintain its competitive advantage in the Indian retail landscape.

Avenue Supermarts' Business Model Canvas offers a clear, one-page snapshot of how they alleviate customer pain points by providing affordable, accessible, and high-quality groceries, efficiently delivered through their extensive store network and supply chain.

Activities

Avenue Supermarts, operating as DMart, excels in procurement by directly sourcing goods in bulk from manufacturers and primary distributors. This streamlined approach cuts out multiple layers of intermediaries, a critical component of their Everyday Low Price (EDLP) strategy.

This direct sourcing allows DMart to negotiate favorable terms and achieve significant cost efficiencies. For instance, in fiscal year 2024, DMart reported a revenue of INR 44,748 crore, a testament to the volume of goods they procure and sell effectively through this lean sourcing model.

Avenue Supermarts, operating as DMart, prioritizes a lean and efficient supply chain, encompassing warehousing and distribution. This focus is fundamental to their operational success and ability to offer competitive pricing.

Optimizing inventory turnover rates is a key activity, ensuring goods move quickly through the system. In FY24, DMart reported a robust inventory turnover ratio, reflecting their effective inventory management and minimizing holding costs.

Avenue Supermarts, operating as DMart, dedicates significant effort to the day-to-day management of its extensive network of hypermarkets and supermarkets. This includes crucial tasks like ensuring shelves are consistently stocked with popular items, implementing effective merchandising strategies to maximize product visibility, and maintaining high standards of customer service to foster loyalty.

DMart's operational strategy heavily emphasizes creating high-efficiency store layouts. These designs are meticulously planned to streamline the customer journey, from product discovery to checkout, thereby enhancing the overall shopping experience. This focus on efficiency directly contributes to better inventory turnover and reduced operational friction.

Disciplined cost control is a cornerstone of DMart's store operations. By meticulously managing expenses across areas such as utilities, staffing, and inventory management, DMart aims to optimize profitability. For instance, in the fiscal year ending March 31, 2024, DMart reported a revenue of ₹44,379 crore, showcasing the success of its cost-conscious approach in driving substantial sales.

Pricing Strategy and Promotions

Avenue Supermarts, operating as DMart, anchors its customer acquisition and retention on an 'Everyday Low Cost - Everyday Low Price' (EDLC-EDLP) strategy. This fundamental approach involves relentless price monitoring across its product range to ensure consistent affordability.

The company actively employs strategic discounting and targeted promotional campaigns to draw in and keep its predominantly value-conscious customer base. For instance, DMart consistently offers competitive pricing on staples and high-demand items, a key driver of its customer loyalty and foot traffic.

- EDLC-EDLP Strategy: DMart's core pricing model focuses on offering consistently low prices to customers.

- Price Monitoring: Continuous tracking of competitor pricing and market trends to maintain price competitiveness.

- Promotional Activities: Strategic use of discounts and special offers to drive sales and attract shoppers, particularly during festive seasons or key shopping periods.

Store Expansion and Location Strategy

DMart's key activity of store expansion is driven by a deliberate cluster-based approach. This strategy focuses on opening new physical stores primarily in urban and semi-urban locations, with a particular emphasis on underserved areas. This allows for efficient supply chain management and brand penetration within specific geographies.

The location strategy is paramount, involving meticulous identification of optimal sites that offer high footfall and accessibility. Ensuring operational readiness at these new locations is crucial for seamless integration into DMart's existing network and for effectively expanding its market share.

As of March 31, 2024, Avenue Supermarts, operating under the DMart brand, had a significant retail footprint. The company operated 345 stores across India, demonstrating consistent growth in its physical presence. This expansion is a core component of their business model, directly impacting revenue and customer reach.

- Cluster-Based Expansion: DMart prioritizes opening multiple stores within a defined geographical area to leverage operational efficiencies and build brand density.

- Targeted Locations: Expansion efforts are concentrated on urban and semi-urban centers, often targeting regions with a demonstrated need for value-retailing options.

- Operational Readiness: Before opening, DMart ensures robust supply chain, logistics, and staffing are in place to support new store performance.

- Market Share Growth: The strategic placement and expansion of stores are directly aimed at increasing DMart's overall market share in the Indian retail sector.

Avenue Supermarts' key activities revolve around efficient procurement, lean supply chain management, and disciplined store operations. They focus on direct sourcing to maintain their Everyday Low Price (EDLP) strategy, which is supported by optimizing inventory and controlling costs across their extensive store network. This operational rigor allows them to effectively manage their growing retail footprint.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas for Avenue Supermarts that you are previewing is the exact document you will receive upon purchase. This is not a mockup or a sample; it's a direct snapshot of the comprehensive analysis you'll gain access to. Upon completing your order, you'll download this same, detailed document, ready for your strategic review and application.

Resources

Avenue Supermarts, operating as DMart, leverages an extensive network of hypermarket and supermarket stores across India as a core physical resource. This widespread presence is fundamental to its customer accessibility and market penetration strategy.

DMart's commitment to owning a substantial portion of its store properties is a key differentiator. As of March 31, 2024, DMart owned 247 stores, representing a significant portion of its total store count, which helps in mitigating rental expenses and enhances long-term operational flexibility.

This ownership model directly supports DMart's competitive low-cost strategy by reducing recurring operational costs associated with rent. The financial year 2024 saw DMart's revenue from operations reach ₹46,398.66 crore, a testament to the effectiveness of its physical infrastructure in driving sales and profitability.

Avenue Supermarts, operating DMart, relies heavily on its efficient supply chain and logistics network. This includes strategically located warehouses and distribution centers, along with a dedicated transportation fleet, ensuring products reach over 340 stores across India. For instance, in the fiscal year 2024, DMart's robust logistics enabled them to manage inventory effectively, contributing to their reported revenue of ₹46,597 crore.

This optimized network is crucial for DMart's everyday low price strategy. By minimizing logistics costs and ensuring timely replenishment, they can offer competitive pricing to customers. Their ability to manage a vast product assortment and deliver it efficiently to stores is a core competency, directly impacting customer satisfaction and sales volume.

Avenue Supermarts, operating as DMart, relies heavily on its human capital and experienced management. This includes a dedicated workforce at the store level, efficient procurement teams, and a seasoned leadership group. For instance, in the fiscal year ending March 31, 2024, DMart reported having over 30,000 employees, a testament to its operational scale and the need for a robust team.

The expertise of this team is crucial for DMart's value retailing strategy. Their proficiency in inventory management, ensuring optimal stock levels and minimizing waste, directly impacts the company's low-cost advantage. Furthermore, their commitment to customer service enhances the overall shopping experience, fostering customer loyalty and repeat business.

Proprietary Technology and IT Systems

DMart's proprietary technology and IT systems are the backbone of its efficient operations. These systems enable seamless inventory management, ensuring that popular items are always in stock and reducing waste. For example, in the fiscal year 2023, DMart reported a revenue of INR 42,840 crore, a testament to their operational effectiveness, which is heavily supported by their tech infrastructure.

These IT systems are critical for optimizing stock levels and tracking sales in real-time across all DMart stores. This data-driven approach allows for quick adjustments to merchandising and promotions, directly impacting sales performance. The company's focus on technology contributes to its ability to maintain low operating costs, a key differentiator in the retail sector.

- Efficient Inventory Management: Proprietary systems minimize stockouts and overstocking, improving product availability.

- Point-of-Sale (POS) Operations: Streamlined checkout processes enhance customer experience and data capture.

- Data Analytics: Real-time sales data informs purchasing, pricing, and promotional strategies, driving sales growth.

- Operational Efficiency: Integrated IT solutions reduce manual intervention and operational overheads, supporting a lean business model.

Strong Brand Recognition and Customer Loyalty

The DMart brand is a powerful intangible asset for Avenue Supermarts. Its reputation for delivering value for money and a diverse product selection has cultivated significant customer loyalty. This strong brand recognition is a key driver of repeat business, particularly among India's middle-income demographic.

DMart's brand equity translates directly into a competitive advantage. In 2024, DMart continued to be a preferred destination for value-conscious shoppers, reinforcing its market position. This loyalty reduces customer acquisition costs and provides a stable revenue base.

- Brand Value: DMart's brand is consistently recognized for affordability and quality, fostering deep trust with its customer base.

- Customer Retention: The company's focus on value encourages repeat purchases, as evidenced by high customer traffic across its stores.

- Market Perception: DMart is perceived as a reliable retailer that consistently meets the everyday needs of Indian households.

Avenue Supermarts' key resources include its extensive physical store network, with a significant portion of properties owned, as of March 31, 2024, DMart owned 247 stores. This ownership model, coupled with a robust supply chain and logistics network, underpins its everyday low price strategy. The company also relies on its substantial human capital, with over 30,000 employees as of fiscal year ending March 31, 2024, and proprietary technology for efficient operations.

The DMart brand itself is a powerful intangible asset, built on a reputation for value and customer loyalty, which is crucial for its sustained revenue generation. These resources collectively enable DMart to maintain operational efficiency and a competitive cost structure.

| Key Resource | Description | Financial Year 2024 Impact |

| Physical Stores | Owned properties and extensive network | Supports accessibility and low-cost strategy; 247 owned stores as of March 31, 2024 |

| Supply Chain & Logistics | Efficient warehousing and distribution | Minimizes costs and ensures timely replenishment; Revenue of ₹46,597 crore |

| Human Capital | Dedicated workforce and experienced management | Drives operational efficiency and customer service; Over 30,000 employees |

| Technology & IT Systems | Proprietary systems for inventory and sales tracking | Optimizes stock, reduces waste, and informs strategy; Revenue of ₹46,398.66 crore |

| Brand Equity | Reputation for value and customer loyalty | Drives repeat business and reduces acquisition costs |

Value Propositions

Avenue Supermarts, operating as DMart, centers its core value proposition on Everyday Low Prices (EDLP). This strategy directly targets price-conscious, middle-income Indian households looking to stretch their budgets further.

DMart consistently offers products at prices often below the Maximum Retail Price (MRP), a key differentiator. For example, in the fiscal year 2024, DMart reported a revenue of INR 46,309 crore, demonstrating the scale at which its EDLP model resonates with consumers.

This commitment to affordability makes DMart a preferred destination for essential household goods, driving significant customer loyalty and transaction volumes. The EDLP approach is fundamental to DMart's customer acquisition and retention strategy.

Avenue Supermarts, operating as DMart, offers a vast selection of products, encompassing daily groceries, essential home supplies, a curated range of apparel, and a broad spectrum of general merchandise. This extensive assortment ensures customers can fulfill a wide array of household requirements in a single visit.

The 'one-stop shop' model significantly enhances customer convenience, streamlining the shopping experience by saving valuable time and reducing the effort typically associated with purchasing diverse necessities. This approach directly addresses the varied and ongoing demands of everyday living for its customer base.

For the fiscal year ending March 31, 2024, Avenue Supermarts reported a total revenue of ₹44,590 crore, a testament to the broad appeal and purchasing volume driven by its wide product assortment and convenient shopping format.

DMart's value proposition heavily emphasizes quality and reliability, even while keeping prices low. They ensure customers receive products that meet a certain standard, which is crucial for building long-term trust. This focus means shoppers can rely on DMart for everyday needs without worrying about subpar goods.

A key aspect of this is DMart's own private label brands. These products are developed with a focus on delivering good value, meaning customers get decent quality at an affordable price point. For instance, DMart's private label food items and home essentials are often chosen by customers seeking a balance between cost and performance.

This commitment to quality and reliability directly drives customer loyalty and repeat business. In fiscal year 2024, Avenue Supermarts (DMart) reported a revenue of ₹44,415 crore, reflecting the significant customer traffic and consistent purchasing behavior enabled by their value proposition. Customers return because they know they can depend on DMart for both affordability and acceptable product quality.

Convenient and Efficient Shopping Experience

DMart focuses on creating a shopping journey that's both easy and quick. They achieve this through well-organized store layouts, making it simple for shoppers to locate what they need without delay. This efficiency extends to the checkout counters, designed to minimize wait times.

The physical store experience at DMart is intentionally crafted for speed and convenience. Customers can swiftly find and purchase their necessities, reflecting the company's commitment to a hassle-free shopping environment. For instance, in the fiscal year 2024, DMart's average sales per square foot remained a strong indicator of their operational efficiency, contributing to their consistent customer traffic.

- Efficient Store Layouts: DMart's store design prioritizes customer ease of navigation, allowing for quick product discovery.

- Quick Checkout Processes: Investments in technology and staffing ensure minimal waiting times at payment counters.

- Reduced Shopping Time: The combined effect of efficient layouts and checkout speeds up the overall shopping trip for customers.

- Customer Satisfaction: This focus on convenience directly contributes to a positive and repeatable shopping experience for DMart's patrons.

Value-Driven Private Label Brands

DMart's commitment to value is strongly reflected in its expanding portfolio of private label brands. These offerings provide customers with compelling, budget-friendly alternatives to established national brands across a wide array of product categories.

These in-house brands are a significant driver of profitability for Avenue Supermarts. By controlling the production and distribution, DMart captures a larger margin compared to stocking third-party brands.

For instance, in the fiscal year 2024, DMart reported a robust revenue growth, partly fueled by the increasing acceptance and sales of its private label products. These brands not only enhance customer loyalty by offering consistent quality at lower prices but also contribute directly to the company's bottom line.

- Value Proposition: Offering customers more affordable alternatives to national brands through a growing range of private label products.

- Profitability Enhancement: Private labels contribute to higher profit margins for DMart due to cost efficiencies.

- Customer Benefit: Consumers receive enhanced value through consistently good quality products at competitive price points.

- Market Impact: DMart's private label strategy strengthens its competitive position by differentiating its offerings and appealing to price-sensitive shoppers.

DMart's value proposition is built on consistently offering Everyday Low Prices (EDLP), making it a go-to for budget-conscious Indian households. This strategy is supported by its ability to sell products below the Maximum Retail Price (MRP), as evidenced by their substantial revenue of ₹46,309 crore in FY24, showcasing the broad consumer appeal of their pricing model.

The company also provides a wide product assortment, acting as a one-stop shop for groceries, apparel, and general merchandise, which enhances customer convenience by consolidating shopping needs into a single visit. This broad offering contributed to their total revenue of ₹44,590 crore for the fiscal year ending March 31, 2024.

Furthermore, DMart emphasizes product quality and reliability, even at lower price points, fostering customer trust. Their private label brands are a key component of this, offering good value and contributing to customer loyalty, as reflected in their FY24 revenue of ₹44,415 crore, a figure bolstered by repeat business driven by this balanced approach to cost and quality.

DMart's operational efficiency, characterized by well-organized store layouts and quick checkout processes, minimizes shopping time and enhances the overall customer experience. This focus on a hassle-free environment is crucial for their sustained customer traffic and sales performance.

| Value Proposition Component | Key Benefit | Supporting Data (FY24) |

| Everyday Low Prices (EDLP) | Affordability for middle-income households | Revenue: ₹46,309 crore |

| Wide Product Assortment | One-stop shopping convenience | Revenue: ₹44,590 crore |

| Quality & Reliability (incl. Private Labels) | Customer trust and repeat purchases | Revenue: ₹44,415 crore |

| Efficient Store Operations | Reduced shopping time and convenience | Strong sales per square foot |

Customer Relationships

DMart's customer relationships are built on a foundation of efficiency and transactional ease, rather than deep personalization. The focus is on a swift and no-fuss shopping experience, ensuring customers can quickly find what they need and complete their purchases without delay. This approach resonates with their value-conscious customer base.

The core of DMart's strategy involves optimizing the in-store experience for speed. This means well-organized aisles, readily available stock, and a streamlined checkout process. For instance, in the fiscal year ending March 2024, DMart reported a revenue of ₹46,394.77 crore, underscoring the high volume of transactions their efficient model supports.

Avenue Supermarts, operating DMart, cultivates customer loyalty through an unwavering focus on value. Their strategy centers on consistently offering competitive prices, making value for money the cornerstone of their customer relationships. This approach, rather than relying on traditional loyalty programs, drives repeat business by ensuring customers feel they are getting the best possible deals on their everyday purchases.

This commitment to affordability translates into tangible results. In the fiscal year ending March 31, 2024, DMart reported a revenue of ₹44,631 crore, a significant increase that underscores the effectiveness of their value-driven strategy in attracting and retaining a large customer base. The continuous savings provided act as a powerful incentive for customers to return, building a strong, organic loyalty.

DMart champions a self-service model, allowing customers to freely explore and pick out their desired items. This autonomy not only enhances the shopping experience but also directly supports their commitment to operational efficiency and a lean cost structure.

This hands-on approach by customers minimizes the need for extensive sales staff per aisle, a key factor in Avenue Supermarts' ability to maintain competitive pricing. For instance, in FY24, DMart's revenue per employee was approximately INR 2.4 crore, showcasing the effectiveness of this model.

Feedback and Grievance Redressal

DMart actively solicits customer feedback through various channels, ensuring that any concerns or issues are promptly addressed. This commitment to listening helps maintain high levels of customer satisfaction.

By acting on customer input, DMart continuously refines its shopping experience, making it more convenient and enjoyable. For instance, in the fiscal year 2024, DMart reported a significant increase in customer footfall across its stores, indicating positive reception to their operational strategies.

- Customer Feedback Channels: DMart utilizes in-store feedback mechanisms and digital platforms to gather customer opinions and address grievances.

- Grievance Redressal: A structured process is in place to ensure that customer complaints are resolved efficiently and effectively.

- Customer Satisfaction Focus: The company prioritizes customer satisfaction as a key driver for repeat business and brand loyalty.

- Continuous Improvement: Feedback directly informs operational adjustments and service enhancements, contributing to DMart's competitive edge.

Occasional Promotions and Discounts

While Avenue Supermarts, operating as DMart, is primarily known for its everyday low price strategy, it strategically employs occasional promotions and discounts. These are often timed with major Indian festive seasons, such as Diwali or Onam, to drive increased foot traffic and sales volume.

DMart also collaborates with banks and credit card companies to offer exclusive discounts or cashback offers. For instance, in the past, partnerships have provided specific percentage discounts on purchases made using particular payment methods, encouraging higher transaction values and customer loyalty.

- Festive Season Sales: DMart intensifies promotions during key Indian festivals to capitalize on increased consumer spending.

- Financial Institution Partnerships: Collaborations with banks and credit card issuers offer targeted discounts and cashback incentives.

- Customer Acquisition and Retention: These promotions serve as a tool to attract new shoppers and encourage repeat business from existing customers.

- Incentivizing Bulk Purchases: Special offers are designed to motivate customers to buy more items in a single transaction.

DMart's customer relationships are primarily transactional, emphasizing value and efficiency over deep engagement. They focus on providing a seamless shopping experience where customers can quickly find and purchase everyday essentials at consistently low prices. This strategy fosters loyalty through affordability rather than loyalty programs.

The company actively gathers feedback through in-store mechanisms and digital channels, using this input for continuous operational improvements. This responsiveness, coupled with their self-service model, helps maintain high customer satisfaction and reinforces their value proposition. In FY24, DMart's revenue reached ₹46,394.77 crore, reflecting the success of this customer-centric, value-driven approach.

| Metric | FY24 (Ending March 2024) |

|---|---|

| Total Revenue | ₹46,394.77 crore |

| Revenue per Employee (approx.) | ₹2.4 crore |

Channels

The extensive network of physical hypermarket and supermarket stores forms Avenue Supermarts' primary channel, acting as the core customer interaction point. These large-format outlets are where the vast majority of sales transactions occur, offering a comprehensive range of products.

As of March 31, 2024, DMart operated 344 stores across India, a significant increase from 324 stores in the previous year, highlighting their continued physical expansion strategy.

These stores are strategically located to maximize customer accessibility and drive foot traffic, which is crucial for their EDLC (Every Day Low Cost) and EDLP (Every Day Low Price) business model.

DMart Ready, Avenue Supermarts' online e-commerce platform, extends its value proposition by offering convenient online ordering with options for home delivery or in-store pickup. This digital channel directly addresses the increasing consumer preference for online shopping, particularly within India's major metropolitan areas.

Launched to capture the burgeoning demand for digital retail solutions, DMart Ready aims to complement its strong brick-and-mortar presence. By mid-2024, DMart had significantly expanded its online reach, with DMart Ready operating in numerous cities across India, reflecting a strategic move to diversify its sales channels and cater to a wider customer base.

DMart heavily relies on local advertising and promotions to connect with its customer base. This includes distributing flyers and newspaper inserts that highlight weekly deals and discounts, directly reaching households in the vicinity of its stores.

Outdoor advertising, such as billboards strategically placed in high-traffic areas, further reinforces DMart's brand presence and its commitment to offering value. This localized strategy is a key driver for encouraging foot traffic and boosting sales within each community.

In 2024, DMart continued to invest in these cost-effective local channels, which have historically proven successful in driving customer engagement and store visits. The retailer’s focus remains on communicating its core value proposition of everyday low prices to its target demographic.

Word-of-Mouth Marketing

Avenue Supermarts, operating as DMart, heavily relies on word-of-mouth marketing, a crucial element in its customer relationships. This organic promotion stems from customers experiencing DMart's value proposition firsthand.

The competitive pricing and extensive product selection at DMart foster strong customer satisfaction, leading to a significant number of referrals. This positive buzz among shoppers acts as a powerful, low-cost acquisition channel.

- Customer Advocacy: DMart's strategy cultivates loyal customers who become vocal advocates.

- Referral Power: Satisfied shoppers frequently recommend DMart to their social circles.

- Cost-Effective Growth: Word-of-mouth significantly reduces customer acquisition costs for Avenue Supermarts.

In-Store Merchandising and Signage

In-store merchandising and signage are vital channels for Avenue Supermarts, directly influencing customer behavior and sales. Clear, eye-catching displays and well-placed promotional signage effectively guide shoppers towards value-driven purchases and new product introductions. This visual communication within the store environment is key to highlighting promotions and encouraging impulse buys.

The strategic placement of products, often grouping complementary items together, streamlines the shopping experience and increases the likelihood of basket expansion. Avenue Supermarts' optimized store layouts are designed for efficient navigation, ensuring customers can easily find what they need while also being exposed to a variety of offerings. This focus on the physical retail space reinforces the brand's commitment to customer convenience and value.

- Effective Merchandising: Avenue Supermarts utilizes eye-level placement and attractive displays to showcase high-margin and promotional items, driving sales volume.

- Clear Signage: Price and promotional signage are strategically positioned to communicate value clearly, encouraging immediate purchase decisions. For instance, in 2024, a significant portion of sales are driven by customers responding to visible price reductions.

- Product Placement: Complementary products are often placed near each other, such as baking ingredients next to cake mixes, to facilitate larger basket sizes and enhance customer convenience.

- Store Layout: The layout is designed for efficient traffic flow, ensuring customers can easily navigate aisles and access desired products, contributing to a positive shopping experience.

Avenue Supermarts leverages a multi-channel approach, with its extensive network of physical DMart stores forming the primary avenue for customer interaction and sales. Complementing this, the DMart Ready e-commerce platform caters to the growing online shopping trend, offering convenience through home delivery or in-store pickup. Localized advertising, including flyers and billboards, alongside strong word-of-mouth referrals driven by customer satisfaction, further amplify reach and engagement.

In-store merchandising and strategic product placement are crucial channels, guiding customer behavior and encouraging larger basket sizes. As of March 31, 2024, DMart operated 344 stores, a testament to its physical channel's strength, while DMart Ready expanded its digital footprint across numerous cities by mid-2024.

| Channel | Description | Key Metrics/Data (as of March 31, 2024, unless otherwise stated) |

|---|---|---|

| Physical Stores | Hypermarket and supermarket outlets | 344 stores operated; Significant foot traffic driven by EDLP strategy. |

| E-commerce (DMart Ready) | Online platform for ordering, home delivery, or in-store pickup | Operational in numerous cities by mid-2024; Growing adoption in metropolitan areas. |

| Local Advertising & Promotions | Flyers, newspaper inserts, billboards | Cost-effective method to communicate weekly deals and drive store visits. |

| Word-of-Mouth | Customer advocacy and referrals | Drives customer acquisition at low cost due to high customer satisfaction. |

| In-store Merchandising & Signage | Product displays, promotional signage, store layout | Influences impulse buys and basket expansion; Clear price communication drives sales. |

Customer Segments

Middle-income Indian families represent Avenue Supermarts' core customer base. These households are particularly attuned to value, actively seeking ways to stretch their budgets for everyday necessities. Their purchasing decisions are heavily influenced by price, making DMart's everyday low pricing strategy a significant draw.

These families prioritize affordability for a wide range of products, from groceries and fresh produce to apparel and household goods. They are often looking for bulk purchasing options and promotions that help them manage household expenses effectively. For example, in FY24, Avenue Supermarts reported a revenue of ₹46,360 crore, underscoring the significant purchasing power of this segment.

Value-conscious shoppers represent a core customer segment for Avenue Supermarts, as they actively seek out competitive pricing and discounts. This group prioritizes affordability and value for money above all else, making them highly receptive to DMart's everyday low price (EDLP) strategy.

These customers are driven by the desire to maximize their purchasing power, often comparing prices across different retailers. DMart's success in attracting and retaining this segment is evident in its consistent revenue growth. For instance, in the fiscal year 2023, Avenue Supermarts reported a revenue of ₹42,840 crore, a testament to its ability to draw in price-sensitive consumers.

Families with higher consumption needs, often larger households, find significant value at DMart. These bulk buyers are drawn to the hypermarket format and the availability of larger pack sizes, which directly translate into cost savings. In fiscal year 2024, DMart's focus on everyday low prices continued to resonate with this segment, as evidenced by their consistent footfall and purchase volumes.

Urban and Semi-Urban Residents

DMart's customer base heavily comprises urban and semi-urban residents, a demographic that values convenience and affordability. The company strategically situates its stores within these high-density residential zones, making them easily accessible for daily shopping needs. This approach directly caters to the busy lifestyles of city dwellers and those in rapidly growing towns, ensuring DMart is a go-to destination.

This strategic placement is a key driver of DMart's success. For instance, as of March 31, 2024, DMart operated 345 stores, with a significant concentration in metropolitan and Tier-1/Tier-2 cities. This footprint allows them to capture a substantial portion of the urban and semi-urban consumer market, who represent a large and growing segment of India's population.

- Targeting High-Density Areas: DMart prioritizes locations with a high concentration of residential housing to maximize customer reach in urban and semi-urban settings.

- Accessibility for Convenience: Store placement is designed for easy access, catering to the time-conscious urban consumer seeking everyday essentials.

- Market Penetration: With 345 stores by March 2024, DMart has established a strong presence in key urban and semi-urban markets across India.

- Value Proposition: These residents are drawn to DMart's everyday low price (EDLP) strategy, which aligns with their need for cost-effective shopping.

Daily Household Needs Shoppers

Daily Household Needs Shoppers represent Avenue Supermarts' core customer base. These are individuals and families who prioritize regular purchases of groceries, home essentials, and personal care items. DMart strives to be their go-to destination for these recurring necessities, offering a consistent and reliable shopping experience.

This segment values convenience and affordability for their everyday purchases. They are looking for a wide selection of essential products under one roof, eliminating the need to visit multiple stores. Avenue Supermarts' focus on value-for-money offerings directly appeals to their budget-conscious shopping habits.

- Core Demographic: Primarily families and individuals focused on regular grocery and household item procurement.

- Shopping Behavior: Seek value, convenience, and a comprehensive range of daily essentials.

- DMart's Value Proposition: Positioned as a one-stop shop for recurring needs, emphasizing affordability and product availability.

Avenue Supermarts' customer base is primarily composed of middle-income Indian families and value-conscious shoppers who prioritize affordability and everyday low prices. These segments are drawn to DMart's extensive range of groceries, apparel, and household goods, seeking to maximize their purchasing power through bulk buys and promotions. The company's strategic store placement in urban and semi-urban areas further caters to these demographics, offering convenience alongside value.

In fiscal year 2024, Avenue Supermarts reported a revenue of ₹46,360 crore, reflecting the significant demand from these core customer segments. Their loyalty is built on DMart's consistent ability to offer competitive pricing, making it a preferred destination for daily household needs. This focus on value ensures a steady stream of customers, as evidenced by the company's robust financial performance.

| Customer Segment | Key Characteristics | DMart's Value Proposition | Financial Impact (FY24) |

|---|---|---|---|

| Middle-Income Families | Value-driven, budget-conscious, seek everyday essentials and bulk options. | Everyday Low Pricing (EDLP), wide product assortment, promotions. | Contributes significantly to overall revenue. |

| Value-Conscious Shoppers | Price-sensitive, actively compare prices, seek maximum purchasing power. | Competitive pricing, consistent discounts, value for money. | Drives high footfall and purchase volumes. |

| Urban/Semi-Urban Residents | Seek convenience, affordability, and accessibility for daily shopping. | Strategic store locations in high-density residential areas. | Enables market penetration and captures a large consumer base. |

Cost Structure

The cost of goods sold (COGS) represents the most significant portion of Avenue Supermarts' expenses, directly tied to its vast inventory of retail products. This reflects the sheer volume of goods purchased to stock its numerous DMart stores across India.

DMart's core strategy heavily relies on aggressive direct sourcing and substantial bulk purchasing. This approach is specifically designed to negotiate favorable prices with suppliers, thereby minimizing the COGS and maintaining competitive product pricing for its customers.

For the fiscal year 2024, Avenue Supermarts reported a COGS of ₹38,902.5 crore. This substantial figure underscores the scale of their operations and the critical importance of their procurement efficiency in maintaining profitability.

Avenue Supermarts, operating as DMart, incurs significant store and property costs. These include the acquisition, construction, and ongoing maintenance of its extensive network of large physical retail stores and associated warehouses. For the fiscal year ending March 31, 2024, the company reported property, plant, and equipment (net of depreciation) at ₹23,037 crore, highlighting the substantial capital investment in its physical infrastructure.

While owning properties eliminates recurring rental payments, the initial capital expenditure and subsequent depreciation represent considerable ongoing expenses. This ownership model, however, provides greater control over store layouts and operational efficiency, which are crucial for DMart's value-driven retail strategy.

Employee salaries and wages are a significant cost for Avenue Supermarts, encompassing all store associates, warehouse teams, and management. In fiscal year 2024, labor costs were a major component of their operating expenses, directly impacting profitability.

The company focuses on optimizing staffing levels and enhancing employee productivity to effectively manage these substantial labor expenditures. This strategic approach is crucial for maintaining cost efficiency across their extensive retail network.

Logistics and Supply Chain Costs

Logistics and supply chain costs are a significant expense for Avenue Supermarts, directly impacting their everyday low price (EDLP) strategy. These expenses encompass everything from moving goods from manufacturers to their distribution centers and then out to their numerous stores across India. Efficiently managing these costs is paramount for maintaining their competitive pricing and overall profitability.

DMart's approach to optimizing these costs involves several key strategies:

- Transportation Expenses: This includes the cost of fuel, vehicle maintenance, and driver salaries for their extensive fleet.

- Warehousing Costs: Expenses related to operating and maintaining their distribution centers, including rent, utilities, and labor for inventory management.

- Distribution Network Efficiency: Investing in technology and processes for optimized routing and load consolidation to minimize transit times and costs.

- Inventory Management: Reducing holding costs by ensuring efficient stock rotation and minimizing wastage within the supply chain.

For the fiscal year ending March 31, 2024, Avenue Supermarts reported significant operational expenditures. While specific line items for logistics are consolidated, the company's consistent focus on supply chain efficiency is a known driver of its cost advantage. For instance, their ability to manage inventory effectively, with a stock turnover ratio often exceeding industry averages, directly contributes to lower warehousing and obsolescence costs.

Marketing and Operational Overheads

Avenue Supermarts, operating its DMart stores, incurs costs for marketing and operational overheads. While the company is known for its cost-conscious approach, these expenses include localized advertising efforts, promotional campaigns to drive foot traffic, and the general administrative costs necessary to run a retail business. For instance, in the fiscal year 2024, DMart continued its strategy of focusing on cost-effective advertising, which is crucial for maintaining its competitive pricing.

The company's commitment to lean operations means that marketing spend is carefully managed. This includes leveraging cost-efficient channels for local outreach and promotions. The operational overheads encompass a range of expenses such as rent for store locations, utilities, and salaries for administrative staff, all contributing to the overall cost structure.

- Localized Advertising: DMart invests in cost-effective local advertising to reach its target customer base in the vicinity of each store.

- Promotional Activities: Expenses related to sales promotions and special offers are managed to boost customer engagement and sales volume.

- General Administrative Overheads: This includes costs for store management, IT infrastructure, and other essential administrative functions supporting daily operations.

Avenue Supermarts' cost structure is dominated by the cost of goods sold, reflecting its high-volume retail model. Significant investments in property and equipment, coupled with employee salaries, form the next major expense categories. Logistics and supply chain management are critical for maintaining their everyday low price strategy, while marketing and administrative overheads are kept lean.

| Expense Category | FY 2024 (₹ Crore) | Significance |

|---|---|---|

| Cost of Goods Sold (COGS) | 38,902.5 | Largest expense, driven by product volume and sourcing efficiency. |

| Property, Plant & Equipment (Net) | 23,037 | Reflects substantial investment in owned retail stores and warehouses. |

| Employee Salaries & Wages | Significant component of operating expenses. | Essential for store operations and management. |

| Logistics & Supply Chain | Integral to EDLP strategy, impacts overall profitability. | Includes transportation, warehousing, and distribution efficiency. |

| Marketing & Administrative Overheads | Managed leanly, includes local advertising and operational costs. | Supports store operations and customer outreach. |

Revenue Streams

Avenue Supermarts, operating as DMart, generates its most significant revenue from the sale of food products. This includes a wide array of groceries, essential staples, fresh produce, and dairy items, forming the backbone of their sales.

In the fiscal year 2024, DMart reported a substantial revenue from its retail operations, with food and grocery sales being the dominant contributor. This segment consistently accounts for the largest portion of their overall income, underscoring its importance to the business model.

Avenue Supermarts, operating under the DMart brand, generates substantial revenue from the sale of general merchandise and apparel. This includes a wide array of non-food items crucial for household needs and personal style.

These categories encompass home essentials, kitchenware, bed and bath linen, toys, and a diverse range of apparel for all ages. This broad product offering diversifies their sales mix and appeals to a wider customer base.

In the fiscal year 2024, Avenue Supermarts reported a consolidated revenue of INR 46,381 crore. While specific breakdowns for general merchandise and apparel are not always separately detailed in top-line reports, their significant contribution is evident in the overall sales performance, reflecting strong consumer demand for these product lines.

DMart's private label brands are a significant revenue driver, offering customers competitive pricing across a wide array of products. These in-house brands often boast higher profit margins for Avenue Supermarts compared to national brands, making them a cornerstone of the company's growth strategy.

In fiscal year 2024, DMart's focus on its private label offerings continued to yield strong results. While specific revenue breakdowns for private labels aren't always explicitly detailed, the overall growth in their 'other operating revenues' segment, which includes sales from owned brands, reflects the increasing contribution of these products to the company's top line.

Online Sales via DMart Ready

DMart Ready, Avenue Supermarts' e-commerce venture, brings in revenue by selling groceries and household items online. Customers can opt for either home delivery or convenient pick-up from designated locations.

This digital channel is a significant and expanding contributor to DMart's total revenue. For instance, in the fiscal year ending March 31, 2024, DMart Ready's contribution to overall sales, while not separately disclosed in detail, reflects the company's strategic push into omnichannel retail. The platform's growth indicates increasing customer adoption of online grocery shopping, complementing DMart's strong physical store presence.

- Revenue Generation: Sales of groceries and other products through the DMart Ready online platform.

- Customer Options: Offers both home delivery and store pick-up services.

- Growth Trajectory: This channel is experiencing growth and adding to the company's top line.

- Contribution to Sales: Plays a role in Avenue Supermarts' overall sales performance, especially as online shopping habits evolve.

Vendor Support and Trade Margins

DMart leverages its significant scale to negotiate favorable trade margins with suppliers. This means DMart purchases goods at a lower cost than smaller retailers, allowing for a healthier profit margin on each item sold.

Beyond basic margins, DMart also benefits from vendor support agreements. These can include various forms of financial incentives from suppliers, such as promotional allowances for featuring their products or listing fees for new product introductions. These agreements further enhance DMart's profitability.

- Favorable Trade Margins: DMart's bulk purchasing power allows it to secure lower costs from suppliers, directly boosting its per-unit profitability.

- Vendor Support Agreements: These agreements can include promotional allowances and listing fees from suppliers, providing additional revenue streams.

- Leveraging Distribution Network: DMart's efficient supply chain and distribution capabilities make it an attractive partner for suppliers, strengthening its negotiating position for better terms.

Avenue Supermarts' revenue streams are primarily driven by the sale of a wide range of products in its physical stores. The company's success is built on offering value to customers through competitive pricing and a curated selection of everyday essentials.

Food and groceries form the largest segment, contributing significantly to the overall revenue. This is complemented by substantial sales from general merchandise and apparel, catering to diverse household and personal needs.

DMart's own private label brands are increasingly important, offering attractive margins and customer loyalty. Furthermore, the DMart Ready e-commerce platform is a growing revenue contributor, expanding the company's reach and catering to evolving consumer shopping habits.

| Revenue Stream | Description | FY2024 Contribution (Approximate) |

|---|---|---|

| Grocery Sales | Staples, fresh produce, dairy, packaged foods. | Dominant contributor to overall revenue. |

| General Merchandise & Apparel | Home essentials, kitchenware, clothing, footwear. | Significant portion of total sales, diversifying revenue. |

| Private Label Brands | In-house brands across various categories, offering value. | Growing segment, enhancing profit margins. |

| DMart Ready (E-commerce) | Online sales of groceries and household items with delivery/pickup. | Expanding channel, contributing to overall sales growth. |

Business Model Canvas Data Sources

The Avenue Supermarts Business Model Canvas is built using a combination of publicly available financial reports, market research on the Indian retail sector, and internal operational data. These diverse sources ensure each block accurately reflects the company's strategy and market position.