Avenue Supermarts Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avenue Supermarts Bundle

Avenue Supermarts, through its astute 4Ps strategy, has carved a significant niche in the Indian retail landscape. Their product assortment focuses on everyday essentials, offering a wide variety of private label brands alongside national ones, all at competitive price points. This strategic approach to product and price, combined with their expansive and accessible store network (Place), forms the bedrock of their customer loyalty.

The real magic, however, lies in how Avenue Supermarts leverages its promotional activities to reinforce its value proposition. From in-store displays to targeted digital campaigns, their communication consistently emphasizes affordability and quality, driving footfall and repeat purchases. Want to understand the intricate details of how they achieve this marketing mastery?

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Avenue Supermarts. Ideal for business professionals, students, and consultants looking for strategic insights into one of India's retail giants.

Product

DMart's diverse assortment is a cornerstone of its strategy, offering everything from groceries and home essentials to apparel and general merchandise. This broad product mix positions DMart as a convenient one-stop shop for everyday household needs, catering to a wide spectrum of customer preferences and requirements.

The company effectively segments its vast product range into three core categories: Food, Non-foods, and General Merchandise & Apparel. This structured approach ensures a comprehensive offering that addresses various consumer demands under one roof, enhancing the overall shopping experience.

For the fiscal year ending March 31, 2024, Avenue Supermarts reported a significant increase in its product offerings, with sales from its Food segment contributing approximately 60% to its total revenue. This highlights the strong customer reliance on DMart for their daily food and grocery needs, further solidifying its one-stop-shop appeal.

DMart's product strategy is laser-focused on delivering value, concentrating on essential, high-demand FMCG and household goods. This deliberate curation ensures rapid inventory turnover, a cornerstone of their Everyday Low Price (EDLP) model, minimizing the risk of carrying slow-moving stock.

The company's product assortment is meticulously tailored to the preferences of middle-income Indian families, who consistently seek a balance of affordability and dependable quality. This approach directly addresses their core purchasing priorities.

For instance, in fiscal year 2024, DMart reported a robust revenue of INR 46,300 crore, a testament to the effectiveness of their value-driven product strategy in resonating with a broad customer base.

DMart heavily relies on its private label offerings, including brands like D Mart Minimax, D Mart Premia, D Homes, and Dutch Harbour. These in-house brands are a cornerstone of their strategy, enabling direct sourcing and significant cost savings.

This cost efficiency allows DMart to pass savings onto consumers, offering products at highly competitive prices. In the fiscal year 2023-2024, private label penetration continued to be a key driver for margin enhancement and customer loyalty.

The company is strategically growing its private label range, particularly in high-demand home and personal care segments. This expansion aims to further bolster profit margins and provide a unique value proposition to its customer base.

Quality and Packaging

Avenue Supermarts, operating under the DMart banner, balances its core strategy of affordability with a steadfast commitment to product quality. While the focus is on value, customers can expect goods that meet a satisfactory standard. For instance, in FY24, DMart reported a revenue of ₹46,300 crore, demonstrating the scale at which they deliver these quality-conscious, value-driven products.

Transparency is a hallmark of DMart's in-store experience. Products are consistently displayed with clear pricing, explicitly showing actual discounts and offer prices. This approach empowers customers to make informed purchasing decisions, reinforcing trust and value perception. This clarity is crucial in a competitive retail landscape where price sensitivity is high.

DMart's packaging strategy prioritizes functionality over premium aesthetics, aligning with its cost-conscious model. The emphasis is on protecting the product and ensuring it reaches the customer in good condition, rather than on elaborate branding or materials. This pragmatic approach allows DMart to maintain competitive pricing across its extensive product range, which saw a growth in its store count to over 340 by the end of FY24.

- Quality Assurance: DMart ensures products meet a satisfactory quality standard, even while emphasizing affordability.

- Price Transparency: Clear display of discounts and offer prices builds customer trust and aids purchasing decisions.

- Functional Packaging: Packaging is designed for utility and product protection, supporting the company's low-cost model.

- Scale of Operations: In FY24, with revenues exceeding ₹46,300 crore and over 340 stores, DMart effectively delivers value across a wide customer base.

Customer-Centric Mix

Avenue Supermarts, operating under the DMart brand, continuously refines its product mix to align with evolving customer needs and market trends. This ensures their offerings remain highly relevant and appealing to their core demographic of budget-conscious shoppers.

DMart's deep understanding of consumer behavior is evident in its product selection, which consistently prioritizes items that resonate with value-seeking customers. For example, in the fiscal year ending March 31, 2024, DMart reported a revenue of ₹44,903 crore, demonstrating the success of their customer-centric product strategy.

- Product Assortment: DMart focuses on everyday essentials and value-for-money private label brands, which constituted a significant portion of their sales in FY24.

- Customer Preferences: The retailer actively monitors sales data to identify fast-moving items and adjust inventory, stocking products that address immediate consumer demands.

- Market Responsiveness: By staying attuned to local tastes and preferences, DMart ensures its product mix caters to the specific needs of the communities it serves.

- Loyalty Building: This tailored approach fosters strong customer loyalty and encourages repeat purchases, a key driver of DMart's sustained market position.

DMart's product strategy centers on providing value through a curated assortment of essential goods and a strong emphasis on private labels. This approach ensures high inventory turnover and competitive pricing, directly appealing to their target demographic of middle-income Indian families.

The company's private label brands, such as D Mart Minimax and D Homes, are crucial for cost savings and margin enhancement, with continued strategic expansion in high-demand segments like home and personal care.

DMart's commitment to price transparency, with clearly displayed discounts, builds customer trust and reinforces its value proposition, a strategy that contributed to its reported revenue of ₹46,300 crore for FY24.

The retailer's product selection is deeply informed by consumer behavior, prioritizing fast-moving items and adapting inventory to meet immediate demands, which has been a key factor in building customer loyalty.

| Product Category | FY24 Revenue Contribution (Approx.) | Key Strategy |

|---|---|---|

| Food | 60% | High demand essentials, driving daily traffic |

| Non-foods | N/A | Complementary household needs |

| General Merchandise & Apparel | N/A | Value-driven assortment for broader appeal |

| Private Labels | Significant contributor to margins | Cost savings, direct sourcing, brand loyalty |

What is included in the product

This analysis delves into Avenue Supermarts's (DMart) 4Ps, showcasing how their focus on everyday low prices (Price), extensive store network (Place), curated product assortment (Product), and minimal promotional spending (Promotion) creates a powerful value proposition for the Indian consumer.

Avenue Supermarts' 4P analysis effectively addresses customer pain points by offering accessible pricing and a wide product range, alleviating concerns about affordability and product availability.

Place

Avenue Supermarts, through its DMart brand, boasts an extensive retail network across India, strategically focusing on high-footfall locations. As of June 2025, DMart operates an impressive 424 stores, a testament to its aggressive expansion strategy. This widespread physical presence, particularly strong in states like Maharashtra, Gujarat, Telangana, Andhra Pradesh, and Karnataka, ensures broad market penetration and customer accessibility.

Avenue Supermarts, operating under the DMart banner, meticulously chooses store sites, prioritizing densely populated residential zones and suburban areas. This strategy is geared towards conveniently serving middle-income families, a core demographic.

Their cluster-based expansion model is a key driver for market penetration and operational efficiency in target regions. For instance, as of March 31, 2024, DMart operated 341 stores across India, with a significant concentration in Western India, reflecting this strategic placement.

Beyond major metropolitan centers, DMart is actively expanding its footprint into smaller towns. This approach broadens their market reach and taps into underserved populations, contributing to their overall growth trajectory.

Avenue Supermarts, operating under the DMart brand, strategically prioritizes owning its store properties. This approach is fundamental to its Everyday Low Cost (EDLC) model, as it significantly reduces long-term operational expenses by eliminating rental outgoings. For instance, as of March 31, 2024, DMart owned a substantial portion of its store locations, a key factor in maintaining its cost advantage.

Efficient Supply Chain and Inventory Management

Avenue Supermarts, operating as DMart, leverages an exceptionally efficient supply chain and inventory management system as a cornerstone of its marketing mix. This focus ensures product availability at the right time and place for its customers. For instance, DMart's direct sourcing strategy, bypassing multiple intermediaries, significantly cuts costs and secures a consistent supply of goods. This approach was evident in their fiscal year 2024 performance, where their robust inventory turnover ratio contributed to their operational efficiency.

DMart's commitment to optimizing logistics is further demonstrated through its strong vendor relationships. This allows for better negotiation power and a more reliable flow of products from manufacturers to stores. The result is a minimized risk of stockouts, a critical factor in maintaining customer satisfaction and driving sales volume. In FY24, DMart reported a significant increase in store count, underscoring the effectiveness of their supply chain in supporting expansion.

- Direct Sourcing: DMart's strategy of procuring directly from manufacturers reduces costs by eliminating layers of distributors and wholesalers.

- Vendor Relationships: Cultivating strong ties with suppliers ensures preferential treatment and a consistent flow of inventory.

- Inventory Turnover: A high inventory turnover ratio, reported at approximately 12-15 times annually in recent years, indicates efficient stock management and reduced holding costs.

- Logistics Network: DMart's investment in a streamlined logistics network minimizes transit times and ensures product availability across its growing store footprint.

DMart Ready Online Presence

DMart Ready, Avenue Supermarts' online arm, offers convenient home delivery and pick-up points in select cities, complementing its vast network of physical stores. This dual approach caters to evolving consumer habits, with home delivery increasingly outperforming pick-up point collections. For instance, in the fiscal year ending March 2024, DMart Ready's contribution to Avenue Supermarts' overall revenue continued to grow, reflecting a strategic expansion into the digital space.

The company emphasizes value and convenience over speed, a strategy that resonates with its core customer base. DMart Ready's growth trajectory in FY2024 showcased a steady increase in order volumes, indicating successful adaptation to online grocery shopping trends. This multi-channel strategy is crucial for maintaining customer loyalty and expanding market reach.

- DMart Ready's FY2024 Performance: Avenue Supermarts reported a notable increase in online sales contribution, driven by DMart Ready's expansion.

- Channel Preference Shift: Home delivery orders are now surpassing pick-up point orders in many DMart Ready service areas.

- Strategic Focus: The company prioritizes delivering value and convenience, rather than competing on ultra-fast delivery times.

- Customer Reach: The online platform extends DMart's reach to customers who may not have easy access to physical stores.

DMart's strategic place in the market is defined by its extensive physical store network and a growing online presence. As of June 2025, the company operates 424 stores, primarily in densely populated middle-income residential areas and suburban locations, ensuring high footfall and accessibility.

This cluster-based expansion, with a strong presence in Western India as of March 2024 (341 stores), allows for operational efficiencies and deep market penetration. DMart's ownership of most store properties further solidifies its cost advantage, a key element of its place strategy.

The DMart Ready online platform complements this by offering home delivery and pick-up points, extending reach and catering to evolving consumer habits, with home delivery showing a stronger growth trend in FY2024.

| Metric | Value (as of June 2025) | Significance |

|---|---|---|

| Total Stores | 424 | Widespread market coverage and accessibility |

| Key Regions | Maharashtra, Gujarat, Telangana, Andhra Pradesh, Karnataka | Strong penetration in high-demand states |

| Store Ownership | Majority owned | Reduces operational costs, supports EDLC model |

| DMart Ready Growth | Increasing contribution to overall revenue (FY2024) | Expansion into digital channels, catering to online demand |

Preview the Actual Deliverable

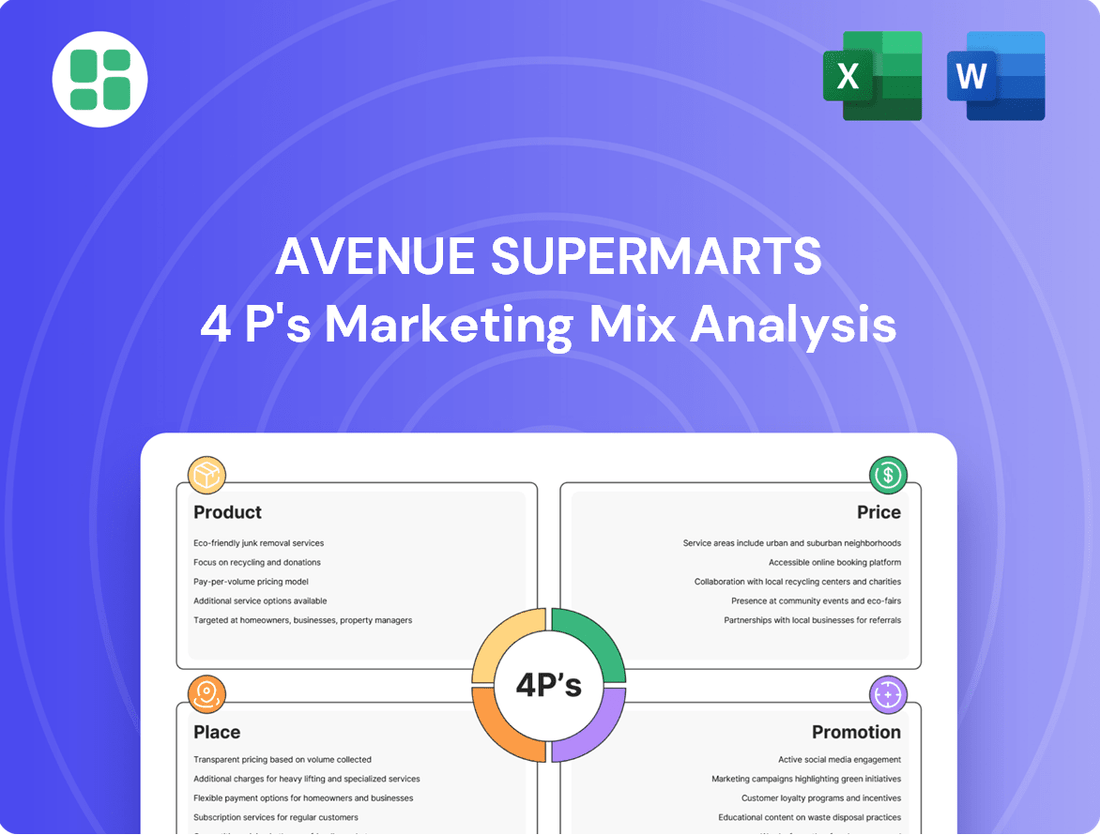

Avenue Supermarts 4P's Marketing Mix Analysis

The preview you see here is the exact Avenue Supermarts 4P's Marketing Mix Analysis document you'll receive instantly after purchase—no surprises. You're viewing the complete and final version, ready for immediate use. This isn't a sample; it's the actual content you'll get when you complete your order.

Promotion

DMart's core promotional strategy is its consistent communication of the Everyday Low Price (EDLP) model. This approach builds trust with shoppers by assuring them of competitive prices every single day, rather than relying on fleeting discounts. This commitment to affordability is central to DMart's brand, attracting a significant segment of price-sensitive customers.

By focusing on EDLP, DMart avoids the substantial costs associated with frequent promotional campaigns and extensive advertising. This allows them to maintain lower overheads, which in turn supports their ability to offer consistently low prices. For instance, in FY24, DMart reported a revenue of INR 46,300 crore, underscoring the success of their value-driven approach.

Avenue Supermarts, operating as DMart, distinguishes itself through a strategy of limited advertising and a strong emphasis on word-of-mouth. Unlike many retail giants that heavily invest in extensive advertising campaigns, DMart maintains a lean promotional budget. This approach allows them to translate cost savings directly into lower prices for consumers, a core tenet of their value proposition. For instance, in FY24, DMart's advertising and promotion expenses represented a mere 0.3% of their total revenue, a stark contrast to industry averages that can often exceed 2-3%.

DMart's promotional activities are primarily centered on enhancing the in-store experience and fostering positive customer interactions, which naturally generate word-of-mouth referrals. By consistently offering value and a pleasant shopping environment, they cultivate customer loyalty and encourage organic promotion. While traditional advertising channels like newspaper inserts and outdoor signage are utilized for specific offers and sales events, the bulk of their customer acquisition and retention relies on this organic growth driven by customer satisfaction.

DMart leverages in-store promotions and discounts as a key tactic within its marketing mix. They frequently run seasonal sales, festival-specific discounts, and targeted offers on particular items. For instance, during the festive season of Diwali 2024, DMart is expected to roll out attractive deals across various product categories to drive footfall and sales volume.

These promotions often take the form of percentage discounts on specific product lines or attractive deals like buy-one-get-one offers. Such initiatives are designed to encourage customers to make larger purchases and increase the perceived value of their shopping basket. For example, a 10% discount on home essentials or a 'buy 2, get 1 free' on select apparel items can significantly influence buying decisions.

Further enhancing these in-store offers, DMart often partners with leading banks to provide additional discounts or cashback for cardholders. This strategy not only drives sales but also fosters customer loyalty and attracts new shoppers. A campaign in early 2025 might feature a collaboration with a major bank, offering an extra 5% off on purchases exceeding a certain amount.

Customer Loyalty Programs

Avenue Supermarts, operating under the DMart brand, actively cultivates customer loyalty through well-designed reward programs. These initiatives are crucial for encouraging repeat purchases and building lasting relationships with their value-conscious customer base.

DMart's loyalty programs often feature tangible benefits like discounts or gift coupons, especially for customers making larger purchases. This strategy directly supports their core value proposition of offering affordable goods, making loyalty a financially rewarding choice for shoppers.

By engaging customers with these incentives, DMart not only drives sales but also enhances the overall shopping experience. This focus on customer engagement strengthens brand affinity, a key factor in maintaining market share in the competitive retail landscape.

- Customer Retention: DMart's loyalty programs are designed to keep customers coming back, a vital strategy for sustained growth.

- Value Alignment: Incentives like bulk purchase discounts reinforce DMart's commitment to providing everyday low prices.

- Brand Affinity: Engaging reward schemes foster a positive emotional connection, increasing customer preference for DMart over competitors.

- Data Insights: Loyalty programs provide valuable data on customer purchasing habits, enabling more targeted promotions and inventory management.

Digital Marketing and Online Branding

While DMart's core strength lies in its physical store presence, digital marketing and online branding are increasingly important for engaging its target audience and boosting brand awareness. The company analyzes market trends and customer preferences to craft targeted promotional campaigns, ensuring their digital efforts resonate with shoppers.

DMart Ready, the company's online grocery platform, acts as a key promotional channel. It effectively communicates product availability and pricing directly to digital consumers, offering a convenient way for customers to stay informed and make purchases. This digital touchpoint is crucial for reaching a wider demographic and catering to evolving shopping habits.

DMart's digital strategy focuses on providing value and convenience online, mirroring its in-store approach. For instance, during the fiscal year ending March 2024, DMart Ready expanded its reach, contributing to the overall customer engagement. While specific digital marketing spend figures are not always broken out, the company's continued investment in its online platform underscores its commitment to this aspect of the marketing mix.

- Digital Engagement: DMart utilizes digital channels to connect with customers, focusing on market trends and consumer preferences for targeted promotions.

- DMart Ready as a Platform: The online grocery service serves as a vital promotional tool, showcasing product availability and pricing to a digital audience.

- Brand Awareness: Online branding efforts are key to enhancing DMart's visibility and reinforcing its value proposition in the digital space.

- Evolving Consumer Habits: The company's digital presence acknowledges and adapts to the growing trend of online shopping and information seeking.

DMart's promotional strategy is characterized by its strong emphasis on Everyday Low Price (EDLP), minimizing traditional advertising to keep costs down. This focus on consistent affordability, rather than frequent sales, builds customer trust and loyalty. For example, in FY24, DMart's advertising and promotion expenses were only 0.3% of its INR 46,300 crore revenue, a testament to its lean approach.

In-store promotions, seasonal discounts, and bank tie-ups for additional offers are key tactics to drive footfall and basket size. Loyalty programs, offering tangible benefits like discounts for larger purchases, further reinforce DMart's value proposition and encourage repeat business. These programs also provide valuable customer data for more targeted marketing efforts.

The DMart Ready online platform serves as a crucial digital promotional channel, communicating product availability and pricing to a wider audience. This digital presence, while lean, is essential for adapting to evolving consumer habits and reinforcing the brand's value message in the online space.

Price

DMart's cornerstone pricing strategy is Everyday Low Price (EDLP). This means they consistently offer competitive prices on their goods every single day, frequently under the Maximum Retail Price (MRP). This approach is a significant draw for budget-conscious shoppers, particularly middle-income Indian households.

This EDLP model sets DMart apart from rivals who often depend on sporadic, deep promotional sales. For instance, as of early 2024, DMart's focus on EDLP contributed to its strong performance, with revenue for the fiscal year ending March 2024 reaching approximately ₹44,000 crore, showcasing the effectiveness of their consistent value proposition.

Avenue Supermarts, operating as DMart, achieves cost leadership by relentlessly focusing on operational efficiency. Their ability to offer consistently low prices stems from stringent cost controls, a highly efficient supply chain, and direct sourcing from manufacturers, cutting out middlemen and their associated markups.

This streamlined approach allows DMart to secure better terms with suppliers, with a significant portion of their inventory sourced directly. For instance, DMart's direct sourcing model in FY23 contributed to a healthy gross profit margin of 15.6%, demonstrating the financial benefit of bypassing intermediaries.

Furthermore, DMart's strategic decision to own a substantial portion of its store properties, rather than leasing, significantly reduces overheads. This ownership model, which saw their property, plant, and equipment increase by 18.5% to ₹26,730 crore in FY23, provides long-term cost advantages and stability, directly translating into savings passed on to the consumer.

DMart's competitive pricing strategy firmly establishes it as a value retailer, a core element of its marketing mix. The company consistently offers affordable rates on a broad range of products, from daily groceries to home essentials and apparel. This focus on cost-efficiency makes DMart an attractive option for budget-conscious consumers.

This strategy directly appeals to a significant segment of the Indian market that prioritizes affordability. For instance, DMart’s average selling price per unit is considerably lower than many of its competitors, allowing it to capture market share. This commitment to low prices is a key differentiator in the highly competitive retail landscape.

Volume-Based Sales and Margins

Avenue Supermarts' low-price strategy is a cornerstone of its volume-driven model. By offering competitive pricing, the company incentivizes customers to purchase larger quantities, leading to high sales volumes and a quick turnover of inventory. This approach, while resulting in thinner margins on individual items, generates substantial overall revenue and healthy profitability through sheer scale.

This strategy is particularly effective during peak shopping periods. For instance, during the festive season of Diwali 2024, DMart is anticipated to see a significant uplift in sales as consumers are drawn to the value proposition for bulk purchases. This increased footfall and transaction volume directly translates to higher revenues for the company.

The impact of this volume-based sales approach can be seen in their financial performance. For the fiscal year ending March 31, 2024, Avenue Supermarts reported a revenue of ₹46,385 crore, a notable increase from ₹42,840 crore in the previous year. This growth underscores the success of their strategy in attracting and retaining a large customer base through attractive pricing.

- High Sales Volume: The low-price strategy directly fuels high transaction volumes.

- Inventory Turnover: Rapid inventory movement is a key operational benefit.

- Revenue Growth: Fiscal year 2024 revenue reached ₹46,385 crore, demonstrating scale.

- Festive Season Boost: Attractive pricing during festivals encourages bulk buying and revenue.

Impact of Competition and Market Dynamics

DMart's pricing strategy, centered on Every Day Low Price (EDLP), is significantly shaped by the competitive environment. This includes established organized retail players and the rapidly expanding quick commerce sector.

The intense discounting tactics employed by quick commerce rivals have prompted DMart to adapt. In response, DMart has strategically offered higher discounts on select products to defend its market share, demonstrating its agility in a dynamic retail landscape.

- Competitive Pressure: DMart faces competition from both traditional organized retailers and emerging quick commerce platforms, influencing its pricing decisions.

- EDLP Adaptation: While committed to its EDLP model, DMart has shown flexibility by increasing discounts in certain categories to counter aggressive competitor pricing.

- Market Share Defense: These tactical discounts are crucial for DMart to retain its customer base and market position amidst aggressive promotional activities by rivals.

DMart's pricing strategy is fundamentally about delivering consistent value through Everyday Low Price (EDLP). This approach ensures that customers can rely on competitive prices daily, rather than waiting for sales events, making it particularly appealing to the value-conscious Indian consumer base.

This EDLP model is supported by Avenue Supermarts' operational efficiencies, including direct sourcing and property ownership, which reduce costs. For example, in FY23, their property, plant, and equipment stood at ₹26,730 crore, reflecting a strategy that lowers long-term operating expenses.

The company's commitment to EDLP drives high sales volumes and rapid inventory turnover. This strategy proved effective in FY24, with Avenue Supermarts reporting revenues of ₹46,385 crore, an increase from ₹42,840 crore in the prior year, highlighting the success of their volume-driven model.

DMart's pricing also adapts to competitive pressures, such as those from quick commerce. While maintaining its EDLP core, DMart strategically offers increased discounts on select items to defend market share, showcasing its agility in the dynamic retail environment.

| Metric | FY23 | FY24 | Impact of Pricing Strategy |

| Revenue (₹ crore) | 42,840 | 46,385 | Demonstrates volume growth driven by EDLP |

| Property, Plant & Equipment (₹ crore) | 26,730 | N/A (18.5% increase FY23) | Lower overheads from property ownership support low prices |

| Gross Profit Margin (%) | 15.6 | N/A | Efficiency from direct sourcing enables competitive pricing |

4P's Marketing Mix Analysis Data Sources

Our Avenue Supermarts 4P's analysis is built on a foundation of verified data, including official company reports, investor relations materials, and detailed market intelligence. We meticulously examine their product assortment, pricing strategies, extensive store network, and diverse promotional activities to provide a comprehensive view.