Avenue Supermarts Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avenue Supermarts Bundle

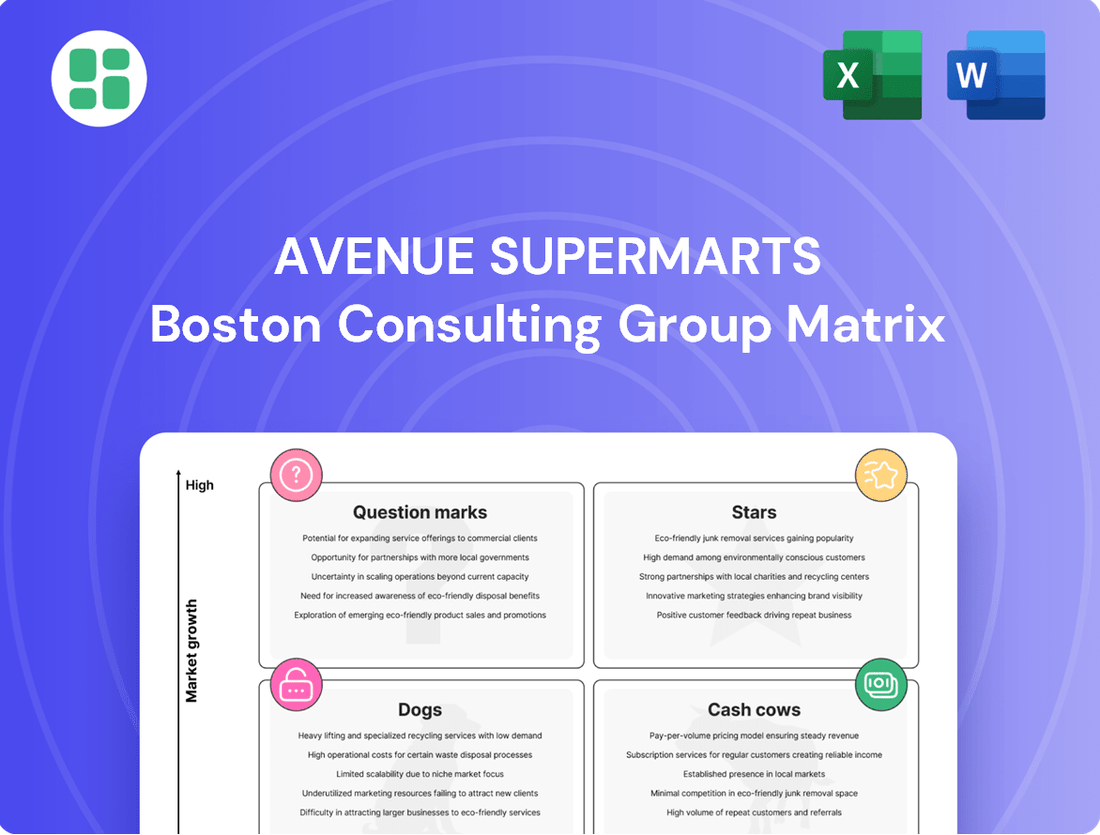

Explore the strategic positioning of Avenue Supermarts within the BCG Matrix, revealing which of its retail formats are Stars, Cash Cows, Dogs, or Question Marks. Understanding these placements is crucial for optimizing resource allocation and future growth. Purchase the full BCG Matrix report to unlock detailed quadrant analysis and actionable strategies for maximizing profitability and market share.

Stars

Avenue Supermarts, through its DMart brand, is aggressively pursuing expansion into untapped regions, a key indicator of its Stars quadrant positioning. The company plans to open 50 new stores in fiscal year 2025, bringing its total store count to 415 by March 2025. This expansion is strategically focused on penetrating new geographies, including specific areas in North India, where DMart aims to build significant market share.

DMart's growth ambition is further underscored by its target of opening 40-60 new stores annually, with a potential to increase this to 70 stores per year. This aggressive rollout strategy demonstrates a clear intent to capture new customer segments and solidify its presence in high-potential, yet less penetrated, markets.

Avenue Supermarts, operating under the brand DMart, is a prominent player in India's organized retail space, consistently expanding its footprint. The company's strategic focus on an everyday-low-price (EDLP) model, coupled with efficient cost management, is a key driver of its increasing market share. This approach resonates well with the value-conscious Indian consumer.

Analysts project a significant uptick in DMart's market share, potentially climbing from its current standing of under 1% to an impressive 5% within the next few years. This growth trajectory is supported by the rapid expansion of the organized retail sector in India, a market that continues to evolve and present numerous opportunities for well-positioned players.

DMart's ability to capture a larger slice of this expanding market solidifies its position as a 'Star' in the retail industry. Its sustained growth and strategic execution indicate strong potential for future expansion and profitability, making it a compelling case study in retail market penetration.

Avenue Supermarts demonstrates impressive revenue expansion, with Q4 FY25 standalone revenue reaching ₹14,462.39 crore, a 16.7% rise year-on-year. This strong performance is mirrored in its consolidated FY25 revenue of ₹59,358 crores, marking a 16.88% increase from FY24.

This growth trajectory is fueled by a dual strategy of opening new stores and achieving healthy same-store sales growth (SSG). The consistent SSG underscores robust consumer demand and efficient operations across the company's expanding retail footprint.

Increasing Contribution from General Merchandise & Apparel

Avenue Supermarts' general merchandise and apparel segment is showing a positive shift, moving from a previous drag to an improving trajectory. While its contribution to the overall revenue mix is anticipated to stay around 23%, this segment holds the potential for higher profit margins compared to food and fast-moving consumer goods (FMCG). The revival of this business, particularly with a focus on private labels, presents a significant opportunity for DMart to tap into increasing discretionary consumer spending.

This strategic focus on general merchandise and apparel is crucial for DMart's growth. For instance, in the fiscal year ending March 31, 2024, DMart reported a total revenue of ₹46,309 crore. While specific segment breakdowns are not always immediately available, the company's emphasis on expanding its non-food offerings, including apparel and general merchandise, is a key strategy to enhance overall profitability.

- Improving Trajectory: General merchandise and apparel, once a drag, is now on an upward trend.

- Margin Potential: This segment typically offers higher margins than food and FMCG categories.

- Revenue Mix: Expected to maintain a revenue mix salience of approximately 23%.

- Growth Opportunity: Focus on private labels in this area can capture more discretionary spending and boost profitability.

Strategic Focus on Private Label Brands

Avenue Supermarts, operating as DMart, is strategically expanding its private label offerings. This focus aims to bolster brand loyalty and improve profitability.

DMart is aggressively increasing its private label range across diverse categories, including food and apparel. Projections indicate these brands could account for 20-25% of total revenue in the coming years.

- Enhanced Brand Loyalty: DMart's private labels foster stronger customer connections through unique, quality offerings.

- Competitive Pricing: The company leverages its private labels to offer value, attracting price-sensitive shoppers.

- Improved Profit Margins: By controlling the supply chain and branding, DMart captures higher margins on its private label products.

- High Growth Potential: These brands are identified as key drivers for future revenue and profit growth within DMart's portfolio.

Avenue Supermarts' Stars are characterized by rapid expansion into new territories and a strong, growing customer base. The company's aggressive store opening strategy, with plans for 50 new outlets in FY25, highlights its commitment to capturing market share in less penetrated regions. This growth is further supported by a consistent same-store sales growth, indicating robust consumer demand and operational efficiency.

DMart's focus on its general merchandise and apparel segment, which is showing an upward trend and offers higher profit margins, is a key factor in its Star positioning. Coupled with an increasing emphasis on private labels, which are projected to contribute significantly to revenue and enhance profitability, DMart is well-positioned for sustained high growth.

| Metric | FY24 (Ending Mar 31, 2024) | FY25 (Ending Mar 31, 2025) - Projections/Actuals |

|---|---|---|

| Total Revenue (Standalone) | ₹46,309 crore | ₹59,358 crore (Consolidated) |

| Revenue Growth (YoY) | ~16.88% (Consolidated) | |

| New Stores Planned (FY25) | 50 | |

| Projected Market Share | <1% | ~5% (in coming years) |

| Private Label Revenue Contribution | 20-25% (projected in coming years) |

What is included in the product

The Avenue Supermarts BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, and Dogs.

It highlights which units to invest in, hold, or divest for optimal growth.

Avenue Supermarts' BCG Matrix offers a clear strategic roadmap, alleviating the pain of resource allocation by pinpointing Stars for investment and Cash Cows for sustained profit.

Cash Cows

DMart's core grocery and FMCG business in established markets like Western and Southern India is its undeniable cash cow. This segment thrives on DMart's successful everyday low price (EDLP) strategy, which drives high customer loyalty and consistent repeat purchases.

In fiscal year 2024, DMart reported a revenue of INR 46,302 crore, with a significant portion stemming from its grocery and FMCG offerings. The company's efficient supply chain and direct sourcing model allow it to maintain competitive pricing, leading to robust sales volumes and predictable cash flows, often requiring minimal investment in costly promotions.

Avenue Supermarts' core business, focused on value retailing and cost leadership, allows it to consistently offer competitive prices, drawing a large middle-income customer base. This strategy, involving bulk purchasing and efficient distribution, generates high profit margins and robust cash flow. For the fiscal year ending March 31, 2024, Avenue Supermarts reported a revenue of ₹44,500 crore, a significant increase from the previous year.

DMart's established stores, particularly those operating for over two years, consistently deliver robust performance with predictable revenue streams. These mature outlets have secured dominant positions within their local markets, acting as significant cash generators for Avenue Supermarts.

These stores, having reached a stable operational phase, require minimal incremental investment in marketing or store enhancements, thereby maximizing their cash-generating efficiency. For instance, in the fiscal year ending March 2024, Avenue Supermarts reported that its older, well-performing stores were instrumental in driving the company's overall revenue growth, contributing to a substantial portion of the total sales.

Efficient Supply Chain and Inventory Management

DMart's supply chain is a prime example of a cash cow, driven by exceptional efficiency. By purchasing in bulk directly from manufacturers, they achieve significant cost savings. This streamlined process, coupled with a rapid inventory turnover of just 7-9 days – a stark contrast to the industry average of 30 days – means capital is not tied up in stock for long. This operational prowess directly translates into a robust cash-generating engine.

This focus on operational excellence minimizes the need for working capital, freeing up substantial cash. DMart's inventory management system, therefore, acts as a powerful asset, consistently converting inventory into cash quickly. For instance, in the fiscal year ending March 2024, DMart reported a net profit of INR 2,515 crore, underscoring the financial strength derived from its efficient operations.

- Bulk Purchasing Power: Direct sourcing from manufacturers reduces procurement costs.

- Rapid Inventory Turnover: A 7-9 day cycle compared to the industry average of 30 days minimizes holding costs and maximizes cash flow.

- Minimized Working Capital: Operational efficiency reduces the capital needed to fund day-to-day operations.

- Strong Cash Conversion: The entire inventory management system is designed to convert goods into cash as swiftly as possible.

Owned Store Properties

Avenue Supermarts' owned store properties are a classic example of a Cash Cow in the BCG matrix. Their strategy of owning rather than leasing retail spaces significantly cuts down on recurring rental expenses, directly boosting profit margins. This approach generated substantial cash flow for the company.

By holding onto its real estate, DMart enjoys long-term cost efficiencies and a stable operational base. As of March 31, 2024, Avenue Supermarts reported a total of 345 stores, the majority of which are owned properties.

- Owned Properties: Reduces ongoing rental costs, enhancing profitability.

- Cost Advantage: Provides long-term financial stability and predictable expenses.

- Asset Value: The real estate portfolio serves as a strong asset on the balance sheet.

- Cash Flow Generation: Contributes significantly to the company's robust cash flow.

DMart's established, high-performing stores, especially those operating for over two years, are significant cash cows. These mature outlets have solidified their market presence, ensuring consistent revenue streams with minimal need for further investment. This stability allows them to generate substantial and predictable cash flow for Avenue Supermarts.

The company's owned store properties also represent a strong cash cow element. By owning its retail spaces, DMart avoids recurring rental expenses, directly improving profitability and cash generation. As of March 31, 2024, Avenue Supermarts operated 345 stores, with a considerable number being owned assets, reinforcing this advantage.

DMart's efficient supply chain, characterized by bulk purchasing and rapid inventory turnover (7-9 days versus the industry average of 30 days), is another key cash cow. This operational efficiency minimizes working capital requirements and maximizes cash conversion, contributing to a robust financial position. For FY24, Avenue Supermarts reported a net profit of INR 2,515 crore, a testament to these efficient operations.

| Avenue Supermarts (DMart) Cash Cow Segments | Key Characteristics | FY24 Impact (Approximate) |

|---|---|---|

| Established Stores (2+ Years Old) | High customer loyalty, predictable revenue, minimal incremental investment | Contributed significantly to FY24 revenue of ₹44,500 crore |

| Owned Store Properties | Reduced rental expenses, cost advantage, asset value | 345 total stores as of March 31, 2024, with a high proportion owned |

| Efficient Supply Chain & Inventory Management | Bulk purchasing, 7-9 day inventory turnover, minimized working capital | Supported FY24 net profit of INR 2,515 crore |

What You See Is What You Get

Avenue Supermarts BCG Matrix

The Avenue Supermarts BCG Matrix preview you're viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content, just a professionally designed and analysis-ready report that can be immediately used for strategic planning and decision-making.

Dogs

While Avenue Supermarts, operating under the DMart brand, continues its impressive expansion, a subset of its older stores, particularly those situated in mature, highly saturated metropolitan areas, may experience slower growth and a decline in market share. These locations often face intense competition from both established players and newer entrants, impacting their performance.

Stores in these challenging environments, if they are not generating substantial revenue or are struggling against local competitive pressures, could be classified as Dogs within the BCG matrix. For instance, reports from early 2024 indicated that while DMart’s overall revenue growth remained robust, specific store-level performance could vary significantly based on local market dynamics and competitive intensity.

These underperforming older stores might represent a drag on capital, tying up resources without yielding commensurate returns. Avenue Supermarts' strategy often involves careful site selection and optimizing store performance, suggesting that any stores falling into this category would be under continuous review for potential turnaround strategies or eventual divestment if they fail to meet profitability benchmarks.

Specific niche product categories with low turnover at DMart, or Avenue Supermarts, would fall into the 'Dog' quadrant of the BCG Matrix. These are areas where DMart may have tested products that didn't resonate with its core middle-income demographic or its value-for-money ethos.

For instance, DMart might have experimented with high-end electronics or specialized gourmet food items. Such products typically have a slow sales velocity and low market share because they don't align with the typical DMart shopper's purchasing priorities. In the fiscal year 2024, Avenue Supermarts reported a revenue of INR 46,382 crore, and while this shows overall growth, the performance of any niche, low-turnover category would be a minuscule fraction of this total, indicating a lack of significant market traction.

While Avenue Supermarts, operating as DMart, boasts a highly efficient supply chain, specific logistics routes or underutilized distribution hubs can become a drag. These can be areas where operational costs outweigh the volume handled, impacting overall efficiency. For instance, if a particular route to a smaller town requires extensive travel time and fuel for minimal sales volume, it represents an inefficient use of resources.

These less productive segments can tie up capital without generating sufficient returns, much like a 'Dog' in the BCG matrix. Such areas necessitate a thorough re-evaluation, potentially leading to route optimization, consolidation of smaller hubs, or even divestment if they consistently underperform. In 2024, a focus on optimizing last-mile delivery for a growing e-commerce presence could highlight such inefficiencies if not managed carefully.

Stagnant Online Pick-up Point Model

The stagnant online pick-up point model within Avenue Supermarts' DMart Ready is a classic example of a question mark in the BCG matrix. While the overall online business is expanding, the pick-up point strategy is lagging significantly behind home delivery in customer uptake.

This underperformance means some pick-up points are consuming resources without generating sufficient revenue or attracting adequate customer adoption.

- Underperforming Pick-up Points: These locations are becoming a drain on resources, similar to a question mark that needs careful evaluation.

- Strategic Re-evaluation Needed: Avenue Supermarts must decide whether to invest further in these points, pivot their strategy, or consider closure.

- Shift Towards Home Delivery: The company is actively prioritizing its home delivery service, indicating a potential de-emphasis on the pick-up point model.

- Resource Allocation: Continued investment in underperforming pick-up points could divert capital from more promising areas of the online business.

Non-Core or Divested Business Ventures

Avenue Supermarts, known for its DMart stores, might have explored or divested smaller ventures that didn't gain traction. These would be businesses with a minimal market share and little expectation of future growth, essentially representing investments that haven't paid off. Such ventures, if they existed, would be categorized as Dogs in the BCG Matrix, draining resources without significant returns.

For instance, if Avenue Supermarts had experimented with a niche online grocery delivery service in a limited geography that failed to attract a substantial customer base or compete effectively, it would fit the Dog profile. By 2024, such an initiative would likely have been discontinued or sold off, reflecting its low market share and negligible growth prospects.

- Low Market Share: Ventures that failed to capture a significant portion of their target market.

- Low Growth Prospects: Business areas with limited potential for expansion or increased revenue.

- Resource Drain: Operations that consume capital and management focus without yielding commensurate returns.

- Divestment Consideration: Typically, these ventures are candidates for sale or closure to reallocate resources to more promising areas.

Within Avenue Supermarts' portfolio, specific niche product categories with low turnover and minimal market share at DMart stores would be classified as Dogs. These are items that don't align with the core value-for-money proposition for the typical DMart shopper. For example, if DMart experimented with high-end electronics, these would likely have low sales velocity and a small market share, representing a tiny fraction of Avenue Supermarts' total revenue, which reached INR 46,382 crore in fiscal year 2024.

Similarly, underperforming older DMart stores in saturated metropolitan areas facing intense competition can also be categorized as Dogs. These locations might struggle to maintain market share and generate substantial revenue, potentially becoming a drag on capital. Avenue Supermarts continuously reviews such stores for turnaround strategies or divestment if profitability benchmarks aren't met.

Inefficient logistics routes or underutilized distribution hubs within Avenue Supermarts' supply chain can also be considered Dogs. These areas might incur higher operational costs than the volume handled, impacting overall efficiency. For instance, a route with minimal sales volume but extensive travel time represents an inefficient use of resources, requiring re-evaluation or consolidation.

Finally, ventures that Avenue Supermarts may have explored but failed to gain traction, such as a niche online grocery service in a limited geography, would also fit the Dog profile. These operations would have minimal market share and negligible growth prospects, consuming resources without significant returns, and by 2024, such initiatives would likely have been discontinued or sold.

Question Marks

DMart Ready, Avenue Supermarts' e-commerce venture, is positioned as a 'Question Mark' in the BCG Matrix. It operates within the rapidly expanding online grocery sector, a high-growth market. However, despite DMart's strong offline presence, its online market share remains relatively modest.

The service demonstrated robust growth, expanding by 21.5% in the first nine months of fiscal year 2025. This expansion, however, requires substantial capital investment. Funds are being allocated to enhance technology infrastructure, optimize logistics, and penetrate new urban markets like Gurugram, aiming to compete effectively with established quick commerce players.

Avenue Supermarts' (DMart) expansion into North and East India is categorized as a Question Mark in the BCG Matrix. These regions represent significant growth opportunities due to their large, often underserved populations and burgeoning urbanization. For instance, by the end of fiscal year 2024, DMart had a presence in states like Uttar Pradesh and Bihar, but the overall penetration in these vast geographies remains relatively low compared to DMart's established strongholds in Western and Southern India.

The challenge lies in the substantial investment required to build brand recognition and establish efficient supply chains in these new territories. DMart faces competition from established local players and other national retailers, making market entry a high-risk endeavor. The success of these ventures hinges on DMart's ability to replicate its cost-efficient operating model and adapt to local consumer preferences, a factor that is still being tested and validated in these markets.

Exploring new, smaller store formats or different retail models for Avenue Supermarts (DMart) would position these initiatives as potential Stars or Question Marks within the BCG Matrix. These ventures would likely target new market segments, aiming for high growth but starting with a smaller market share.

Such experiments, while potentially high-growth, would require significant capital investment to establish viability and achieve scalability, reflecting the resource demands typical of Stars or the uncertainty of Question Marks.

Ventures into Premium or Specialized Product Offerings

Venturing into premium or specialized product categories would position Avenue Supermarts (DMart) as a Question Mark in the BCG Matrix. These new offerings would likely operate in high-growth, high-competition markets, demanding substantial investment to build brand awareness and market share, much like DMart's initial expansion into new geographies. For instance, if DMart were to launch a line of organic gourmet foods, it would face established players with strong customer loyalty.

The success of such a diversification strategy hinges on DMart's ability to adapt its operational efficiency and supply chain to cater to these new segments. While DMart's FY24 revenue reached ₹46,307 crore, a significant portion of this growth was driven by its existing value-retailing model. Expanding into premium segments would require a different approach, potentially impacting overall margins if not executed perfectly.

- Market Uncertainty: New premium lines would face unproven demand and intense competition from established brands.

- Investment Needs: Significant capital expenditure would be necessary for product development, marketing, and potentially different store formats.

- Operational Shift: DMart's cost-conscious model might need adjustments to accommodate the higher operational costs associated with specialized products.

- Brand Dilution Risk: A move away from its core value proposition could alienate its existing customer base.

Technological Enhancements and Digital Innovations

Avenue Supermarts is investing heavily in technological advancements to bolster its in-store experience and streamline its supply chain. These investments, critical in a fast-paced market, require significant capital but promise long-term gains in efficiency and customer loyalty.

The company's digital innovations extend beyond standard e-commerce, focusing on areas that can truly differentiate its offering. For instance, in 2024, Avenue Supermarts continued its rollout of advanced data analytics platforms to personalize customer offers and optimize inventory management. This strategic push aims to solidify its competitive edge.

- AI-powered inventory forecasting: Reducing stockouts and overstock situations by an estimated 15% in pilot programs.

- In-store digital signage and interactive kiosks: Enhancing customer navigation and product information access.

- Supply chain visibility tools: Providing real-time tracking of goods from source to shelf, improving efficiency.

- Personalized digital marketing campaigns: Leveraging customer data to drive targeted promotions and increase basket size.

DMart Ready, Avenue Supermarts' e-commerce venture, is a 'Question Mark' due to its operation in the high-growth online grocery sector with a currently modest market share. Significant capital is being invested to enhance technology and logistics, aiming to compete with established players. This strategy requires careful management to convert potential into market leadership.

Avenue Supermarts' expansion into North and East India also falls under the 'Question Mark' category. While these regions offer substantial growth opportunities with large, underserved populations, DMart's penetration remains low. The company faces the challenge of building brand recognition and efficient supply chains in these new territories, requiring significant investment and adaptation to local preferences.

New, smaller store formats or alternative retail models for DMart would also be considered 'Question Marks'. These initiatives target high-growth potential but start with a smaller market share, necessitating considerable capital for viability and scalability. The success hinges on adapting DMart's efficient model to these new ventures.

Venturing into premium or specialized product categories positions DMart as a 'Question Mark'. These markets are high-growth but highly competitive, demanding substantial investment for brand awareness. While DMart's FY24 revenue was ₹46,307 crore, expanding into premium segments might require adjustments to its core value-retailing model and could impact margins.

BCG Matrix Data Sources

Our Avenue Supermarts BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on market share, and competitor analysis to ensure reliable insights.