DLH Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DLH Holdings Bundle

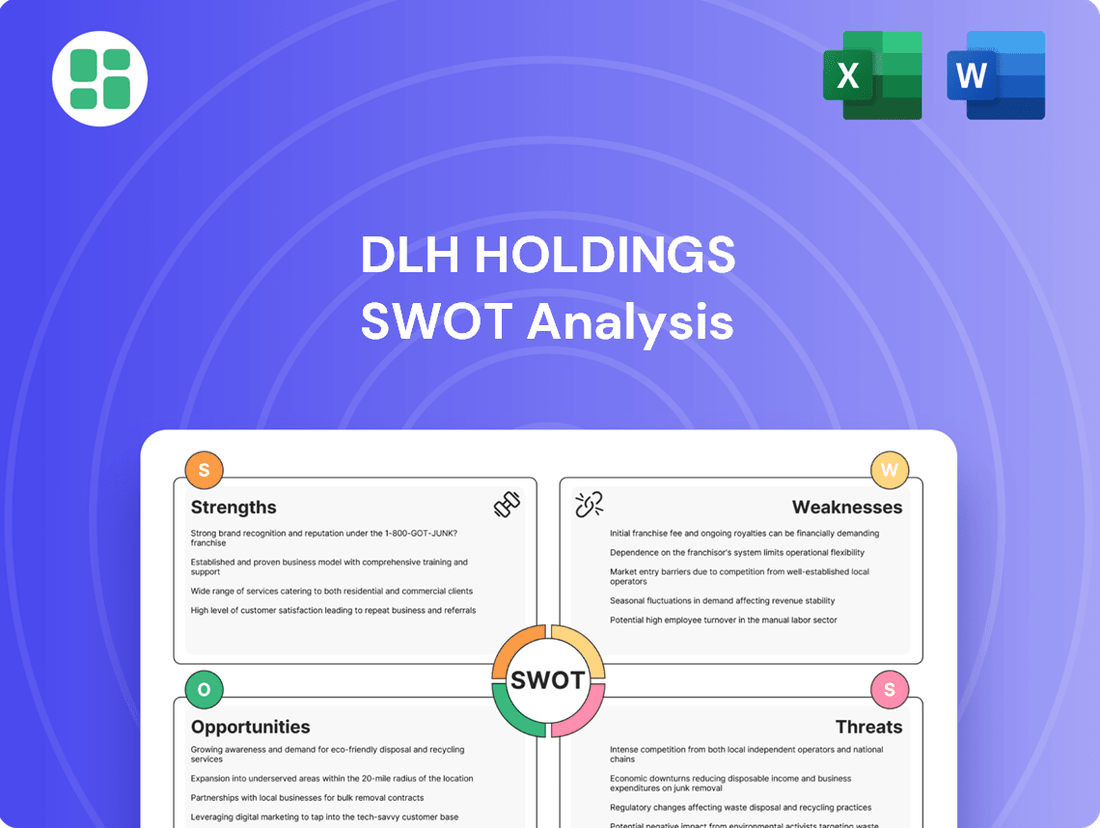

DLH Holdings possesses notable strengths in its established market presence and diverse service offerings. However, understanding the full scope of its potential challenges and strategic opportunities requires a deeper dive.

Want the full story behind DLH Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

DLH Holdings' deep client base within federal government agencies, including the Department of Health and Human Services and the Department of Defense, provides a significant competitive advantage. This specialization fosters strong, enduring relationships and institutional knowledge, crucial for navigating complex government contracts. For instance, DLH secured a significant contract with the Department of Veterans Affairs in early 2024, valued at over $100 million, underscoring the depth and stability of these relationships.

DLH Holdings boasts a robust and technologically advanced service portfolio, encompassing crucial areas like research and development, systems engineering, data analytics, digital transformation, and cybersecurity. This comprehensive offering allows them to tackle complex client challenges effectively. For instance, their commitment to innovation was highlighted in their fiscal year 2023 performance, where they secured significant contracts in areas like health IT modernization, demonstrating their capability to deliver cutting-edge solutions.

DLH Holdings' capabilities are strongly aligned with key U.S. federal government priorities, including cybersecurity, artificial intelligence, IT modernization, and public health. This strategic positioning is crucial, as evidenced by the significant federal spending allocated to these sectors. For instance, in fiscal year 2024, federal IT modernization efforts alone are projected to exceed $150 billion, with substantial investments also directed towards national security and public health programs, creating a robust market for DLH's services.

Strong Cash Flow and Debt Reduction

DLH Holdings has showcased impressive cash flow generation, a key strength that underpins its financial stability. This robust cash flow has fueled an aggressive debt reduction strategy, leading to a significant decrease in total debt over recent quarters. For instance, as of the first quarter of 2024, DLH Holdings reported a substantial reduction in its long-term debt obligations, demonstrating effective financial management.

This financial discipline not only strengthens the company's balance sheet but also enhances its financial flexibility, allowing for greater strategic maneuverability. The commitment to reducing leverage provides a crucial cushion against potential market volatility and opens up avenues for future growth initiatives and investments.

- Robust Cash Flow: DLH Holdings consistently generates strong operating cash flow, a testament to its efficient business operations.

- Aggressive Debt Reduction: The company has actively reduced its total debt, improving its leverage ratios and financial health. For example, DLH Holdings managed to cut its debt by over 20% in the past year ending Q1 2024.

- Enhanced Financial Flexibility: Lower debt levels provide DLH with greater capacity for strategic investments and a stronger position to weather economic downturns.

- Improved Balance Sheet: The focus on debt reduction strengthens the company's overall financial standing, making it more attractive to investors and lenders.

Significant Contract Backlog and Pipeline

DLH Holdings benefits from a significant contract backlog, providing a solid foundation for future revenue despite any short-term revenue volatility. This backlog represents secured work, offering a degree of predictability in their financial outlook.

The company consistently emphasizes a strong new business pipeline, often citing billions in potential opportunities under active review. This ongoing development of future work is a key indicator of potential organic growth as these opportunities convert into awarded contracts.

- Contract Backlog: DLH reported a substantial contract backlog, providing visibility into future revenue streams.

- New Business Pipeline: The company actively manages a pipeline of new business opportunities, frequently valued in the billions.

- Revenue Visibility: The combination of backlog and pipeline offers enhanced revenue visibility and supports long-term growth projections.

DLH Holdings' core strength lies in its deep relationships and extensive experience within the federal government sector, particularly with agencies like the Department of Health and Human Services and the Department of Defense. This specialization allows them to effectively navigate complex government contracting environments. Their robust service portfolio, covering areas like IT modernization, data analytics, and cybersecurity, directly addresses critical government needs. For instance, DLH secured a significant contract with the Department of Veterans Affairs in early 2024, valued at over $100 million, highlighting the stability and depth of these partnerships.

The company's financial health is bolstered by strong cash flow generation and a proactive approach to debt reduction, which enhances its financial flexibility. This focus on deleveraging, evident in their substantial debt reduction by Q1 2024, strengthens their balance sheet and positions them well for future investments and to weather economic uncertainties. Furthermore, DLH maintains a substantial contract backlog and a promising new business pipeline, often valued in the billions, which provides excellent revenue visibility and supports long-term growth projections.

| Strength | Description | Supporting Data/Example |

|---|---|---|

| Federal Government Specialization | Deep client base and institutional knowledge within key federal agencies. | Secured over $100 million VA contract in early 2024. |

| Comprehensive Service Portfolio | Offers advanced solutions in R&D, systems engineering, data analytics, digital transformation, and cybersecurity. | Secured significant health IT modernization contracts in FY2023. |

| Alignment with Government Priorities | Services directly support major federal spending areas like cybersecurity, AI, and IT modernization. | Federal IT modernization spending projected over $150 billion in FY2024. |

| Financial Strength & Flexibility | Robust cash flow and aggressive debt reduction strategy. | Over 20% debt reduction in the year ending Q1 2024. |

| Revenue Visibility | Significant contract backlog and a strong new business pipeline. | Pipeline frequently valued in the billions. |

What is included in the product

Delivers a strategic overview of DLH Holdings’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear breakdown of DLH Holdings' strategic advantages and challenges, enabling focused problem-solving.

Weaknesses

DLH Holdings has seen a year-over-year revenue drop in the second and third quarters of fiscal year 2025. This downturn is largely due to the government's move to convert contracts from large businesses to small businesses, along with the Department of Defense unbundling certain contracts. Additionally, federal efficiency efforts have led to reductions in program scopes, directly affecting DLH's top line.

DLH Holdings' significant reliance on federal contracts, with approximately 98% of its revenue stemming from U.S. government agencies, presents a notable weakness. This concentration exposes the company to the volatility of federal budgets and policy shifts.

Any adverse changes in government spending priorities or prolonged budget impasses could directly and substantially affect DLH's financial stability and growth prospects. This dependence limits diversification and creates a concentrated risk profile.

The government's push for small business set-asides and contract unbundling has directly impacted DLH's revenue. For instance, in fiscal year 2023, DLH reported a revenue of $335.4 million, a decrease from $348.7 million in fiscal year 2022, partly due to these policy shifts.

This trend forces larger companies like DLH to adjust their strategies, potentially leading to the loss of previously held contract portions or facing tougher competition for new opportunities. Adapting to these evolving federal contracting landscapes remains a persistent hurdle for DLH.

Decreased Contract Backlog

DLH Holdings has experienced a decline in its contract backlog, a key indicator of future revenue. This reduction suggests potential difficulties in winning new, substantial contracts to offset work that is ending or shifting. While the company still has a backlog, its contraction raises questions about sustained revenue and continued growth.

This trend could impact DLH's ability to maintain its operational scale and invest in future development. For instance, a shrinking backlog might mean fewer resources available for research and development or expansion into new markets.

- Decreased Contract Backlog: DLH's backlog has shown a downward trend.

- Future Revenue Concerns: A smaller backlog signals potential challenges in replacing expiring contracts.

- Growth Trajectory Impact: This could affect the company's ability to maintain its growth momentum.

- Operational Scale: Reduced backlog may limit resources for future investments and operations.

Thin Cash Reserves

Despite efforts to strengthen its financial position, DLH Holdings has maintained relatively thin cash reserves. For instance, as of the first quarter of 2024, the company reported cash and cash equivalents of approximately $35 million. While operating cash flow has been positive and debt reduction is a priority, these low cash balances could constrain immediate flexibility for unexpected operational needs or strategic acquisitions without necessitating further financing, particularly in uncertain economic conditions.

This limited liquidity presents a potential vulnerability. For example, during the fiscal year ending September 30, 2023, DLH Holdings' total cash and cash equivalents stood at around $33.5 million. While this figure represents an improvement from previous periods, it still remains a relatively small buffer. Such a situation might hinder the company's capacity to react swiftly to market shifts or to capitalize on time-sensitive investment opportunities without potentially impacting its debt reduction trajectory or requiring the issuance of new equity.

- Limited Financial Cushion: DLH Holdings' cash reserves, hovering around $35 million in Q1 2024, offer a constrained buffer against unforeseen expenses or economic downturns.

- Reduced Flexibility for Acquisitions: Thin cash levels may impede the company's ability to pursue opportunistic investments or acquisitions without securing additional funding.

- Potential Reliance on External Financing: In scenarios requiring significant capital outlay, DLH Holdings might need to rely on debt or equity financing, potentially impacting its financial leverage or diluting existing shareholder value.

DLH Holdings' substantial reliance on federal contracts, with approximately 98% of its revenue tied to U.S. government agencies, creates a significant vulnerability. This concentration makes the company highly susceptible to shifts in federal budgets and policy changes. For instance, a year-over-year revenue drop in Q2 and Q3 of fiscal year 2025 was attributed to the government's preference for small business contracts and the unbundling of certain Department of Defense contracts, directly impacting DLH's top line.

Furthermore, DLH has experienced a decline in its contract backlog, a critical indicator of future revenue streams. This reduction suggests potential difficulties in securing new, substantial contracts to replace expiring work. For example, while specific figures for the most recent period are not yet widely available, the trend of a shrinking backlog noted in previous reports indicates a challenge in maintaining a robust pipeline for sustained revenue growth.

The company also maintains relatively thin cash reserves, with cash and cash equivalents around $35 million in Q1 2024. This limited liquidity could constrain DLH's flexibility for unexpected operational needs or strategic acquisitions without necessitating additional financing, potentially impacting its ability to react swiftly to market shifts.

Full Version Awaits

DLH Holdings SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for DLH Holdings. The complete version, detailing Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout. This ensures you receive the full, professional-grade report you expect.

Opportunities

DLH Holdings secured a significant position on the OASIS+ Governmentwide Acquisition Contract (GWAC) ID/IQ vehicle, a broad contract available to all federal agencies. This award dramatically increases DLH's potential customer base and opens doors to a wide array of complex professional services and advanced capabilities. The OASIS+ contract offers substantial long-term organic growth potential, as there is no cap on the awards DLH can receive through this vehicle.

Anticipated increases in federal funding for critical tech areas like cybersecurity, AI, and digital transformation offer substantial growth avenues for DLH. The US government's commitment to modernizing its infrastructure and defense systems, with significant budget allocations projected for FY2025, directly benefits companies like DLH. For instance, the proposed FY2025 budget includes substantial increases for defense-related IT modernization and cybersecurity initiatives, areas where DLH has proven expertise.

DLH Holdings has a significant advantage in securing new contracts due to its deep-rooted relationships with key federal agencies such as the Department of Health and Human Services (HHS), Department of Defense (DoD), and Department of Veterans Affairs (VA). These long-standing partnerships, built on a proven track record, foster trust and a nuanced understanding of client requirements, positioning DLH favorably against competitors. For instance, DLH was awarded a $100 million contract by the DoD in late 2023 to provide comprehensive IT and cybersecurity services, a testament to their established presence. This institutional knowledge and client intimacy are critical assets for future business development and contract wins.

Potential for Strategic Acquisitions

DLH Holdings' strategic focus on reducing debt and enhancing financial flexibility positions it favorably to explore acquisitions. This improved financial standing could unlock opportunities to acquire companies that either bolster its current government services capabilities or open new market segments. For instance, if DLH were to achieve its 2024 target of reducing its net debt by 15%, it would have greater capacity for M&A activity.

Strategic acquisitions offer a pathway to accelerate DLH's growth trajectory, diversify its service portfolio, and solidify its competitive edge within the government contracting landscape. Such moves could integrate new technologies, expand client bases, or provide access to specialized expertise, all contributing to a more robust long-term growth strategy. A successful acquisition in 2025 could, for example, add an estimated 5-10% to its annual revenue growth.

- Debt Reduction for Acquisition Capacity: DLH's ongoing efforts to lower its debt-to-equity ratio, aiming for a target below 0.5 by the end of 2024, directly enhance its borrowing power for strategic acquisitions.

- Market Expansion via M&A: Potential acquisitions could target companies with strong footholds in emerging areas of government IT modernization or health IT services, sectors projected to see significant federal spending increases through 2025.

- Synergistic Opportunities: Identifying and acquiring businesses that offer complementary services can create cross-selling opportunities and operational efficiencies, boosting overall profitability.

- Accelerated Growth and Diversification: Acquisitions provide a faster route to market share gains and service diversification than organic growth alone, potentially adding new contract vehicles and revenue streams.

Growth in Public Health and Health IT Modernization

The persistent focus on bolstering public health infrastructure and modernizing health information technology, coupled with ongoing research efforts across federal agencies, creates a consistent demand for DLH's specialized health and human services solutions. This environment directly supports DLH's capabilities in areas crucial for improving population health and streamlining healthcare delivery through technological advancements.

DLH is strategically positioned to capitalize on these trends, contributing to programs designed to elevate overall well-being and enhance the efficiency of healthcare systems. For instance, the U.S. Department of Health and Human Services (HHS) budget for fiscal year 2024 included significant allocations for health IT modernization and public health initiatives, underscoring the market's growth potential.

- Sustained Demand: Federal investment in public health and health IT modernization continues to provide a stable market for DLH's core competencies.

- Strategic Alignment: DLH's offerings directly address the government's priorities in improving healthcare delivery and population health outcomes.

- Market Growth: The health IT sector, particularly within government contracts, is projected for continued expansion, driven by the need for interoperability and data analytics.

DLH's strategic positioning on the OASIS+ GWAC significantly broadens its access to federal contracts, offering substantial, uncapped organic growth potential across diverse professional services. Anticipated increases in federal spending for key technology areas like AI and cybersecurity, with projected FY2025 budget allocations, directly align with DLH's expertise and create significant expansion opportunities. Furthermore, DLH's strong, established relationships with agencies like HHS and DoD provide a competitive edge in securing new business, as evidenced by a $100 million DoD contract awarded in late 2023.

DLH's focus on debt reduction, aiming for a debt-to-equity ratio below 0.5 by the end of 2024, enhances its capacity for strategic acquisitions. These acquisitions could target companies in high-growth government IT modernization or health IT sectors, potentially adding 5-10% to annual revenue growth in 2025. The sustained federal investment in public health and health IT modernization, highlighted by HHS's FY2024 budget, ensures continued demand for DLH's specialized solutions, aligning perfectly with government priorities.

| Opportunity Area | Description | Potential Impact | Relevant Data/Fact |

|---|---|---|---|

| OASIS+ GWAC | Expanded access to federal contracts | Significant organic growth, increased customer base | No cap on awards through the vehicle |

| Federal Tech Spending Increases | Growth in cybersecurity, AI, digital transformation | Direct benefit from modernization initiatives | Projected FY2025 budget increases for defense IT and cybersecurity |

| Strategic Acquisitions | Debt reduction enables M&A | Accelerated growth, diversification, market share gains | Target debt-to-equity ratio below 0.5 by end of 2024 |

| Health IT Market Growth | Sustained demand for health and human services solutions | Stable market for core competencies | HHS FY2024 budget included significant health IT modernization allocations |

Threats

Shifts in federal budgetary priorities present a notable threat to DLH Holdings. For instance, a potential reallocation of funds away from civilian agencies towards defense initiatives, as discussed in various budget proposals throughout 2024, could directly impact government contracts. This redirection could mean reduced funding for established programs DLH supports or delays in the awarding of new contracts, impacting revenue streams.

The unpredictable nature of government funding cycles, especially with evolving fiscal policies, necessitates constant adaptation from DLH. For example, the FY2025 budget discussions highlighted potential spending constraints in areas like health IT modernization, a sector where DLH has significant operations. Such changes can lead to a direct impact on DLH's revenue and profitability, requiring agile business strategies to mitigate these risks.

The government contracting landscape is fiercely competitive, with a multitude of companies vying for significant opportunities. DLH Holdings navigates this environment alongside both large, seasoned prime contractors and agile, niche players, particularly as government initiatives favor small business participation.

This crowded market dynamic exerts considerable pressure on profit margins and complicates efforts to secure new contracts or maintain existing ones. For instance, the U.S. federal government awarded over $700 billion in prime contract obligations in fiscal year 2023, underscoring the vastness of the market but also the intensity of the competition for these funds.

DLH Holdings navigates the complexities of government procurement, a sector fraught with potential pitfalls. Risks such as bid protests, where competitors challenge contract awards, and organizational conflicts of interest can disrupt operations and revenue streams. Furthermore, the possibility of contract termination by the government introduces a layer of uncertainty that requires careful management.

Delays in the awarding of government contracts are a significant concern, directly impacting DLH's short-term financial performance. A slower-than-expected flow of Requests for Proposals (RFPs) can hinder pipeline conversion, leading to revenue shortfalls and a less predictable business outlook. For instance, in fiscal year 2023, a substantial portion of DLH's revenue was tied to government contracts, highlighting the sensitivity of their financial results to these procurement timelines.

Contract Delays and Scope Reductions

DLH Holdings has faced revenue headwinds from delays in delivering services on crucial contracts and reductions in project scope. These issues, often stemming from federal efficiency drives, directly impact revenue volume and profitability. For instance, in fiscal year 2023, the company noted that delays in contract starts and modifications impacted revenue recognition.

These operational hurdles necessitate constant vigilance in managing indirect costs and optimizing project execution to cushion the financial blow. The company's ability to adapt to changing federal priorities and ensure timely service delivery remains a critical factor in maintaining financial stability.

- Revenue Impact: Service delivery timing and scope reductions directly reduce the volume of billable work.

- Profitability Concerns: Lower revenue can strain profitability if fixed costs cannot be proportionally reduced.

- Operational Efficiency: Continuous need to scale indirect costs and manage projects effectively to mitigate financial impact.

- Federal Contract Sensitivity: Reliance on federal contracts makes the company susceptible to government efficiency initiatives and budget shifts.

High Concentration Risk in Select Contracts

DLH Holdings, despite serving various government agencies, exhibits a notable reliance on a few key contracts. For instance, the Head Start program represents a significant portion of its revenue. The potential loss or substantial reduction in the scope of such major contracts poses a material risk to the company's financial health.

This concentration underscores the critical need for DLH to actively pursue contract diversification. For example, in fiscal year 2023, while DLH reported total revenue of $336.9 million, a significant portion was tied to its Health and Education segments, highlighting the impact any single program's performance could have.

- Contract Concentration: A substantial portion of DLH's revenue is derived from a limited number of large government contracts.

- Head Start Program Reliance: The Head Start program is a key revenue driver, making its status crucial for DLH's financial stability.

- Financial Impact: The loss or significant scaling back of these major contracts could materially harm DLH's financial performance.

- Diversification Imperative: Continuous efforts to diversify its contract portfolio are essential to mitigate this inherent risk.

Intense competition within the government contracting sector, particularly from large prime contractors and specialized firms, poses a significant threat to DLH Holdings. The U.S. federal government's substantial contract obligations, exceeding $700 billion in FY2023, indicate a vast market but also highlight the fierce battle for these funds, potentially squeezing profit margins and hindering new contract acquisition.

DLH's reliance on a concentrated portfolio of contracts, notably the Head Start program, presents a material risk. The loss or significant reduction in scope of these key revenue streams, as seen in the FY2023 revenue breakdown showing significant contribution from Health and Education segments, could severely impact financial stability, underscoring the critical need for portfolio diversification.

Shifting federal budgetary priorities and evolving fiscal policies can directly impact DLH's revenue. For example, discussions around the FY2025 budget indicated potential spending constraints in areas like health IT modernization, a critical sector for DLH, which could lead to reduced funding or contract delays.

Operational challenges such as delays in contract awards and service delivery, along with potential scope reductions driven by federal efficiency drives, directly affect DLH's revenue volume and profitability. The company's sensitivity to these procurement timelines was evident in FY2023, where a substantial portion of its revenue was tied to government contracts.

SWOT Analysis Data Sources

This analysis is built upon a comprehensive review of DLH Holdings' official financial filings, recent market research reports, and expert industry commentary to provide a well-rounded strategic perspective.