DLH Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DLH Holdings Bundle

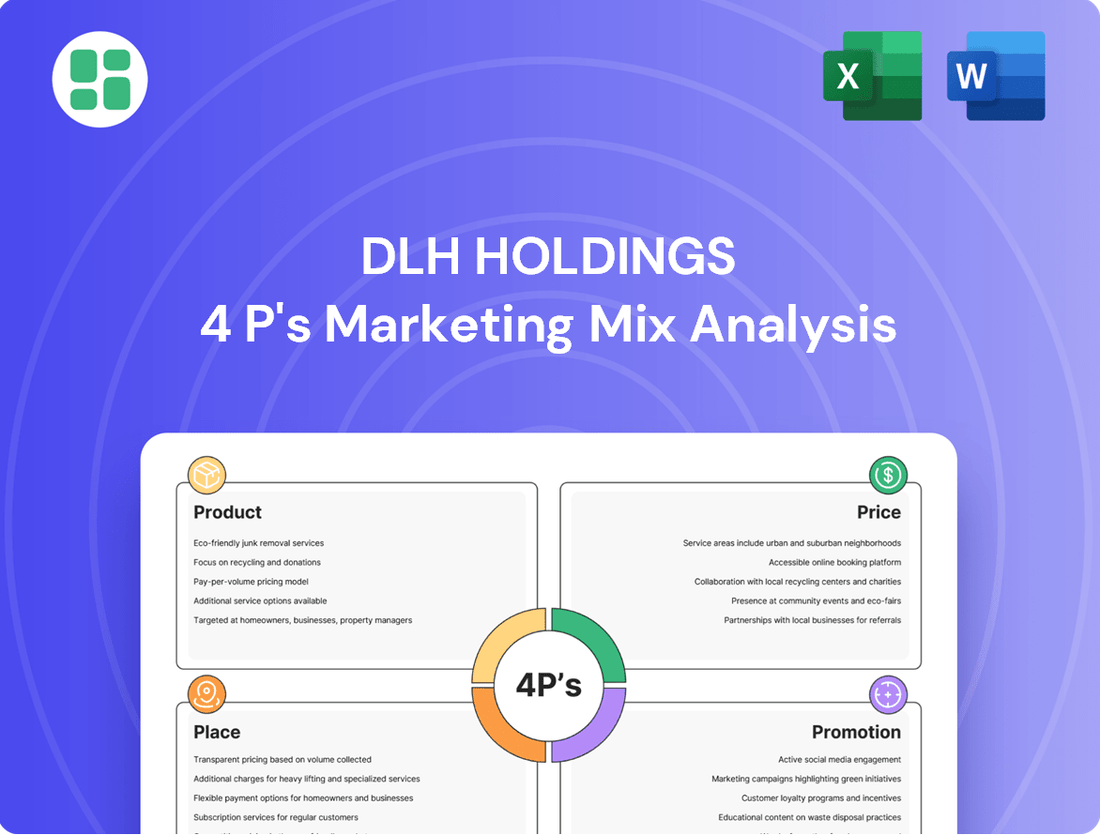

DLH Holdings strategically leverages its product offerings, competitive pricing, targeted distribution channels, and impactful promotional campaigns to capture market share. Understanding how these elements intertwine is crucial for anyone looking to replicate their success.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering DLH Holdings' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

DLH Holdings Corp. delivers a comprehensive suite of technology solutions for health and human services, specializing in digital transformation, AI, and cloud applications for federal agencies. Their offerings are designed to enhance public health initiatives and streamline critical government operations.

In 2024, DLH Holdings actively pursued contracts in areas like health IT modernization and data analytics, aiming to leverage AI and machine learning to improve service delivery. The company's focus on federal health programs positions it to capitalize on increasing government investments in technology for better citizen outcomes.

DLH Holdings offers comprehensive research and development (R&D) support, a crucial element of their marketing mix. This includes vital services like clinical trials research, epidemiology studies, and general scientific research, underpinning their value proposition.

Their R&D capabilities are particularly evident in their work with the Department of Defense (DoD). For instance, DLH supports critical areas such as medical simulation technology, infectious disease research, and advancements in battlefield healthcare. This demonstrates a direct application of their R&D support in high-impact sectors.

Furthermore, DLH extends its expertise to support broader medical research activities and advanced technology centers. This commitment to R&D signifies their role in driving innovation and scientific progress within the healthcare and defense industries, contributing to their overall market presence.

DLH Holdings' Systems Engineering & Integration offering is a cornerstone of their product strategy, focusing on sophisticated IT infrastructure for federal health and defense clients. This segment is crucial for designing, building, and sustaining complex clinical and research informatics systems, underscoring their deep technical expertise.

The company provides essential services like in-service engineering agent (ISEA) and integrated logistics support, ensuring the operational readiness and longevity of critical systems. This hands-on approach is vital for maintaining the intricate web of federal IT operations.

DLH's integration capabilities directly bolster vital command, control, communications, computers, cyber, intelligence, surveillance, and reconnaissance (C5ISR) systems. For instance, in fiscal year 2024, DLH secured significant contracts, including a prime position on the $900 million U.S. Army Medical Communications for Joint Operations (MCJO) program, showcasing the demand for their specialized integration services.

Data Analytics & Information Management

DLH Holdings heavily utilizes data analytics and information management as a core component of its marketing mix, particularly for its public health and national security clients. Their approach involves sophisticated big data analytics and robust, secure data platforms designed to handle sensitive information critical to these sectors. This focus ensures that clients receive actionable insights derived from complex datasets, supporting vital missions.

The company offers end-to-end data management services, encompassing both qualitative and quantitative scientific data. This covers the entire lifecycle from initial research and surveillance to ongoing program monitoring and evaluation. DLH's expertise ensures data integrity and accessibility, facilitating informed decision-making for public health initiatives and national security operations.

A key offering in this area is their Infinibyte Cloud solution. This platform-as-a-service provides a FedRAMP Ready secure environment for data analytics, specifically tailored for government agencies. Infinibyte Cloud empowers organizations with the tools to process and analyze large volumes of data securely and efficiently, meeting stringent federal compliance standards.

- Data Analytics Focus: DLH employs advanced big data analytics to support critical public health and national security missions.

- Comprehensive Data Management: Services cover qualitative and quantitative scientific data for research, surveillance, and program evaluation.

- Secure Cloud Solution: Infinibyte Cloud offers a FedRAMP Ready platform-as-a-service for secure data analytics.

Program Management & Consulting Services

DLH Holdings' program management and consulting services extend beyond pure technology, encompassing critical areas like assessment, compliance monitoring, and business process outsourcing. They actively manage significant federal programs, such as Head Start, demonstrating their capacity for large-scale government initiative execution. This strategic offering aims to ensure government projects are not only efficient but also perfectly aligned with overarching strategic goals.

The company leverages its expertise through various government-wide acquisition contracts, facilitating the delivery of professional services. For instance, DLH secured a significant contract in late 2023 to support the Centers for Medicare & Medicaid Services (CMS) with program integrity services, valued at up to $1.3 billion over five years. This highlights their substantial role in providing essential consulting and management for vital public sector operations.

- Assessment and Compliance Monitoring: Ensuring adherence to regulations and program objectives.

- Business Process Outsourcing: Streamlining operations for government agencies.

- Strategic Advisory Services: Guiding federal initiatives for optimal outcomes.

- Large-Scale Program Management: Proven ability to manage complex federal programs like Head Start.

DLH Holdings' product strategy centers on delivering specialized technology solutions and services tailored for federal health and human services agencies. Their offerings encompass digital transformation, AI-driven analytics, and cloud-based applications designed to enhance public health initiatives and streamline government operations. A key product is Infinibyte Cloud, a FedRAMP Ready platform for secure data analytics, supporting critical missions in public health and national security.

| Product Category | Key Offerings | Target Market | 2024/2025 Focus Areas | Example Contract/Data Point |

|---|---|---|---|---|

| Health IT & Digital Transformation | AI, Cloud Solutions, Data Analytics | Federal Health Agencies | Modernization, AI/ML integration | Secured position on $900M U.S. Army MCJO program |

| Research & Development Support | Clinical Trials, Epidemiology, Scientific Research | DoD, Medical Research Centers | Medical Simulation, Infectious Disease Research | Supports advanced technology centers |

| Systems Engineering & Integration | IT Infrastructure, Logistics Support, C5ISR | Federal Health & Defense | Operational Readiness, System Longevity | Prime on $900M U.S. Army MCJO program |

| Data Analytics & Management | Big Data Analytics, Secure Data Platforms | Public Health, National Security | Actionable Insights, Data Integrity | Infinibyte Cloud (FedRAMP Ready) |

| Program Management & Consulting | Assessment, Compliance, BPO, Strategic Advisory | Federal Agencies | Program Integrity, Large-Scale Program Execution | Up to $1.3B CMS program integrity contract |

What is included in the product

This analysis provides a comprehensive deep dive into DLH Holdings' Product, Price, Place, and Promotion strategies, offering actionable insights for managers and marketers seeking to understand their competitive positioning.

DLH Holdings' 4P's Marketing Mix Analysis serves as a pain point reliever by providing a clear, actionable framework to identify and address challenges in product, price, place, and promotion.

This analysis simplifies complex marketing strategies, allowing DLH Holdings to pinpoint areas of friction and develop targeted solutions for improved market performance.

Place

DLH Holdings primarily secures its revenue by acting as a direct prime contractor to U.S. federal government agencies, a strategy that underpins its entire business model. This direct approach means DLH is the primary entity responsible for fulfilling government contracts, rather than subcontracting. This allows for deep integration and tailored solutions.

The company's key government clients are substantial entities within the federal landscape, including the Department of Health and Human Services (HHS), the Department of Defense (DoD), the Department of Veterans Affairs (VA), and the Centers for Disease Control and Prevention (CDC). In fiscal year 2023, DLH reported that approximately 97% of its revenue came from federal government contracts, highlighting the critical importance of these relationships.

DLH Holdings strategically leverages Government-Wide Acquisition Contracts (GWACs) and Indefinite Delivery/Indefinite Quantity (IDIQ) vehicles, including OASIS+ and OMNIBUS IV, to access federal government clients. These contracts act as crucial distribution channels, opening doors to numerous agencies and a vast pipeline of potential task orders. This approach significantly broadens DLH's market reach for its professional services.

DLH Holdings operates with a robust physical footprint, boasting employees across numerous U.S. locations, including key hubs in Atlanta, Georgia, and Bethesda, Maryland. This widespread presence facilitates close client relationships and localized support.

Complementing its physical network, DLH heavily utilizes secure digital platforms and cloud-based solutions. This digital infrastructure ensures efficient and accessible service delivery to its government clientele, a critical component in today's technology-driven environment.

Specialized Federal Acquisition Vehicles

DLH Holdings leverages several specialized federal acquisition vehicles, significantly enhancing its ability to serve government clients. These include key contracts such as those for pharmacy staffing with the Department of Veterans Affairs (VA) and Federal Supply Schedules (FSS) with the General Services Administration (GSA) for professional and IT services. The company also holds contract vehicles specifically for defense and health-related support, demonstrating a broad reach within the federal procurement landscape.

These specialized vehicles are crucial for streamlining the government procurement process. They offer a more efficient and expedited pathway for federal agencies to access DLH's expertise, particularly in areas like healthcare IT and professional services. This strategic approach to contracting simplifies acquisition for government entities, fostering quicker engagement and service delivery. For instance, DLH's position on various GSA schedules allows agencies to bypass lengthy competitive bidding processes for pre-negotiated services.

- VA Pharmacy Staffing Contracts: Facilitates efficient recruitment and placement of pharmacy personnel within VA facilities.

- GSA Federal Supply Schedules: Provides access to a wide range of professional, IT, and health-related services under pre-negotiated terms.

- Defense and Health Support Vehicles: Enables specialized support for critical defense and public health initiatives.

- Streamlined Procurement: Reduces acquisition lead times and administrative burdens for government agencies.

Client-Specific Engagement Models

DLH Holdings' distribution strategy is characterized by deeply client-specific engagement models, particularly crucial in government contracting. This often means embedding DLH personnel directly within federal agency operations, fostering an integrated team approach. This close collaboration ensures DLH's services are precisely aligned with the unique operational needs and mission objectives of their government clients.

This hands-on approach builds robust, long-term relationships and allows for the development of highly tailored solutions. For instance, DLH's work with the U.S. Department of Defense often involves on-site support teams that become integral to the agency's daily functions. This deep integration is key to effectively meeting complex mission requirements and demonstrating value.

- On-site Personnel: DLH frequently deploys staff to government client locations, ensuring direct understanding and immediate support.

- Integrated Teams: DLH personnel work alongside federal agency staff, creating a unified approach to problem-solving and service delivery.

- Tailored Solutions: The engagement model allows for customization of services to meet the specific, often unique, operational environments of government customers.

- Relationship Building: This close collaboration is instrumental in fostering trust and long-term partnerships within the federal sector.

DLH Holdings' place strategy centers on its direct prime contracting model with U.S. federal government agencies, a foundational element of its operations. This direct engagement ensures DLH is the primary service provider, fostering deep integration and tailored solutions. The company's extensive physical presence across numerous U.S. locations, including Atlanta and Bethesda, supports close client relationships and localized service delivery.

DLH strategically utilizes government-wide acquisition vehicles like OASIS+ and OMNIBUS IV, alongside specialized contracts such as VA pharmacy staffing and GSA Federal Supply Schedules. These channels streamline procurement for agencies, facilitating efficient access to DLH's professional, IT, and health-related services. In fiscal year 2023, approximately 97% of DLH's revenue was derived from federal government contracts, underscoring the significance of these established placement strategies.

What You Preview Is What You Download

DLH Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive DLH Holdings 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

DLH Holdings actively leverages its past performance and success stories to build trust and demonstrate its capabilities. They prominently showcase successful execution of critical government contracts, underscoring their reliability and expertise.

By detailing completed projects and their tangible impact on vital public health and national security initiatives, DLH provides compelling evidence of their value. This focus on proven success is a significant differentiator in the competitive government contracting landscape.

DLH Holdings actively cultivates its presence within the federal contracting ecosystem, meticulously tracking bid activity and shifts in government spending priorities. This proactive engagement with acquisition offices and industry forums is a cornerstone of their promotional strategy, aiming to uncover and secure high-value contracts.

The company's promotional efforts are significantly bolstered by maintaining a robust new business pipeline, which consistently represents billions in potential opportunities. For instance, as of early 2024, DLH Holdings has reported a substantial pipeline, underscoring their commitment to strategic growth within the government contracting sector.

DLH Holdings actively cultivates thought leadership by presenting at and participating in key industry conferences. This strategy allows them to showcase their advanced capabilities in digital transformation, cybersecurity, and AI/ML, reinforcing their position as an innovator within the federal IT landscape.

In 2024, DLH executives are expected to present at over a dozen federal IT and defense sector conferences, including AFCEA events and the annual TechNet Cyber conference. These platforms are crucial for demonstrating their expertise and building trust with government agencies, a vital component of their marketing efforts.

Targeted Proposal Development and Bid Activity

DLH Holdings' promotional strategy heavily emphasizes targeted proposal development and bid activity, particularly within the government sector. This involves a deep dive into understanding specific agency requirements and crafting compelling proposals that highlight DLH's unique capabilities and adherence to federal acquisition regulations. This focused approach is crucial for securing key contracts.

The success of this promotional element is evident in DLH's ability to win positions on significant Indefinite Delivery, Indefinite Quantity (IDIQ) contracts. For instance, securing a spot on the OASIS+ contract, a major vehicle for government IT and professional services, directly reflects the effectiveness of their proposal strategies. This often requires substantial upfront investment in research and writing.

- Targeted Government Bids: DLH's promotional efforts are largely concentrated on responding to specific government solicitations, requiring tailored proposal development.

- Investment in Compliance: Significant resources are dedicated to ensuring proposals meet complex federal acquisition regulations, a key differentiator.

- Strategic Contract Wins: Winning positions on large IDIQ contracts, such as OASIS+, demonstrates the success of their proposal-centric promotional strategy.

- Value Proposition Articulation: DLH focuses on clearly communicating its unique value proposition to government agencies in every bid.

Investor Relations and Corporate Communications

DLH Holdings leverages its investor relations and corporate communications efforts to clearly articulate its strategic vision, financial health, and key achievements like recent contract wins. This proactive approach targets a wide array of financial stakeholders, including individual investors and institutional portfolio managers, ensuring they have a comprehensive understanding of the company’s trajectory.

The company’s commitment to transparency is evident through consistent delivery of news releases, quarterly earnings calls, and detailed investor presentations. These channels are crucial for building investor confidence and highlighting DLH's potential for sustained long-term growth, ultimately attracting capital and supporting its market position.

- Strategic Communication: DLH’s investor relations platform disseminates its strategic direction, financial performance, and contract wins to financial decision-makers.

- Confidence Building: Regular news releases, earnings calls, and investor presentations aim to raise awareness and foster confidence in DLH's long-term growth prospects.

- Transparency and Investment: These activities ensure transparency, which is vital for attracting investment and indirectly promoting the company's capabilities to the market.

- Financial Performance (Example): For instance, DLH reported a revenue increase of approximately 10% year-over-year in its Q1 2024 earnings, demonstrating positive financial momentum to investors.

DLH Holdings' promotion strategy centers on demonstrating proven success and thought leadership within the government contracting space. They highlight completed projects, particularly those impacting public health and national security, to build credibility. Their active engagement in industry forums and conferences, such as AFCEA events in 2024, showcases their expertise in areas like digital transformation and AI/ML.

The company meticulously tracks government spending and bid opportunities, maintaining a robust new business pipeline valued in the billions. This proactive approach, coupled with targeted proposal development for specific solicitations and adherence to federal regulations, underpins their success in securing key contracts, including major IDIQ vehicles like OASIS+.

DLH also prioritizes investor relations and corporate communications, using news releases, earnings calls, and presentations to convey their strategic vision and financial health. This transparency aims to build investor confidence and attract capital, indirectly promoting their capabilities. For example, DLH reported a revenue increase of approximately 10% year-over-year in its Q1 2024 earnings, signaling positive momentum.

| Promotional Tactic | Key Focus | Impact/Evidence |

|---|---|---|

| Showcasing Past Success | Execution of critical government contracts, tangible impact on public health/national security | Builds trust and demonstrates reliability/expertise |

| Thought Leadership | Presentations at industry conferences (e.g., AFCEA, TechNet Cyber in 2024) | Positions DLH as an innovator in digital transformation, cybersecurity, AI/ML |

| Targeted Proposal Development | Responding to specific government solicitations, understanding agency requirements | Securing key contracts, including positions on OASIS+ |

| Investor Relations | Communicating strategic vision, financial health, contract wins | Builds investor confidence, attracts capital, highlights growth prospects (e.g., ~10% revenue growth in Q1 2024) |

Price

DLH Holdings navigates the federal contracting landscape, where pricing is primarily set through competitive bidding on contract vehicles. Their strategy must consider the pre-negotiated rates or rate ceilings common on large IDIQ and GWAC contracts, ensuring they remain competitive while maintaining profitability.

For instance, in fiscal year 2023, DLH secured significant contract awards, including a prime position on the $3.7 billion NASA SEWP V contract, a testament to their competitive pricing within established government procurement frameworks. This demonstrates their ability to balance aggressive bidding with sustainable margins in a market where price is a critical factor.

DLH Holdings employs value-based pricing for its complex, technology-enabled health and human services solutions, reflecting the specialized nature and significant benefits delivered to government clients. This strategy positions their offerings competitively while acknowledging the inherent value in advanced capabilities.

Pricing structures are designed to capture the complexity of services such as systems engineering, advanced data analytics, and digital transformation. These models highlight the long-term cost savings and enhanced outcomes achieved by clients, justifying the investment in DLH's high-end expertise. For instance, DLH secured a significant contract in early 2024 valued at $1.3 billion over five years to provide IT support and modernization services to the U.S. Department of Health and Human Services, underscoring the market's willingness to pay for such comprehensive solutions.

The type of government contract DLH Holdings secures directly impacts its pricing strategies. For instance, fixed-price contracts necessitate meticulous cost forecasting and place the onus of risk management on DLH, while cost-plus contracts offer reimbursement for approved expenses plus a fee, providing a different risk-reward profile.

DLH's ability to manage multi-year contracts, often featuring base periods and subsequent option years, is crucial for sustained profitability. These structures require careful financial planning and resource allocation to ensure that pricing remains competitive yet financially sound throughout the contract's lifecycle.

Impact of Backlog and Future Revenue Potential

DLH's contract backlog is a crucial element in understanding its pricing power and revenue stability, essentially acting as a preview of future earnings. This secured work demonstrates the company's ability to win and retain business, directly impacting its market position and perceived value.

As of September 30, 2024, DLH reported a significant contract backlog of approximately $690.3 million. This substantial figure highlights a robust pipeline of future projects and revenue streams, underscoring the success of their sales and contract acquisition strategies.

- Secured Future Revenue: The $690.3 million backlog as of September 30, 2024, represents a strong foundation for future revenue generation.

- Indicator of Pricing Success: A large backlog suggests DLH is competitively pricing its services and winning contracts.

- Stability and Predictability: The backlog provides a degree of revenue predictability, which is attractive to investors and stakeholders.

- Long-Term Contractual Strength: It reflects DLH's capability in securing long-term engagements, a testament to its market relevance and customer trust.

Financial Performance and Debt Management Considerations

DLH Holdings' pricing strategies are intrinsically linked to its financial performance, with a keen eye on revenue generation and EBITDA. For instance, in the fiscal year ending March 31, 2024, DLH reported revenues of €1.1 billion, underscoring the scale of operations influencing pricing decisions. This revenue base is crucial for supporting EBITDA targets, which in turn fuel the company's debt reduction initiatives.

The company's commitment to deleveraging its balance sheet is a significant factor in its pricing approach. By prioritizing debt reduction, DLH aims to strengthen its financial foundation, which can lead to more favorable borrowing terms and increased financial flexibility. This disciplined management of its debt, targeting a net debt to EBITDA ratio of around 2.0x as of early 2024, allows for sustained competitive pricing.

Effective cash flow generation, a direct outcome of well-calibrated pricing, is DLH's primary tool for deleveraging. This financial discipline enables the company to not only manage its debt but also to allocate capital towards strategic growth opportunities.

- Revenue Growth: DLH's ability to generate substantial revenue, exemplified by its €1.1 billion in FY24, directly supports pricing power.

- EBITDA Contribution: Pricing decisions are optimized to achieve robust EBITDA, a key metric for financial health and debt servicing.

- Debt Reduction Focus: DLH actively uses cash flow from operations, bolstered by effective pricing, to reduce its net debt, aiming for a ratio near 2.0x EBITDA.

- Strategic Investment: Maintaining competitive pricing while managing debt allows for continued investment in growth areas, ensuring long-term value creation.

DLH Holdings' pricing is heavily influenced by the competitive federal contracting environment, where winning bids on large contract vehicles like NASA SEWP V is crucial. Their strategy balances aggressive pricing to secure these awards with the need to maintain profitability, as seen with their FY23 wins. Value-based pricing also plays a role for their advanced health and human services solutions, justifying higher costs through demonstrable client benefits and long-term savings.

| Metric | Value | Period | Implication for Pricing |

|---|---|---|---|

| Contract Backlog | $690.3 million | September 30, 2024 | Indicates strong demand and ability to win competitively priced contracts. |

| Revenue | €1.1 billion | Fiscal Year ending March 31, 2024 | Provides scale to support competitive pricing strategies and EBITDA targets. |

| Net Debt to EBITDA Ratio Target | ~2.0x | Early 2024 | Financial discipline allows for sustained competitive pricing while managing debt. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for DLH Holdings is grounded in a comprehensive review of publicly available company data, including SEC filings, investor relations materials, and official press releases. We also incorporate insights from industry reports and competitive analysis to ensure a robust understanding of their market positioning.