DLH Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DLH Holdings Bundle

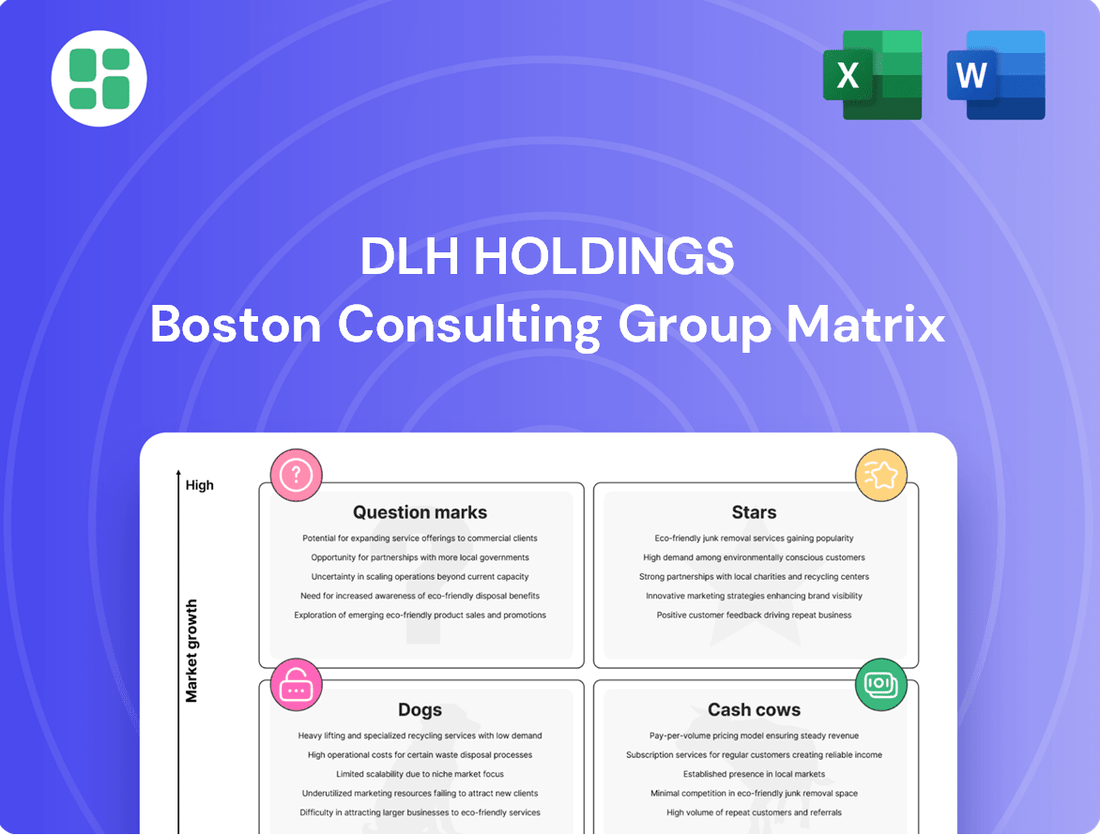

Curious about DLH Holdings' strategic product positioning? Our BCG Matrix preview offers a glimpse into their market performance, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock actionable insights and a clear roadmap for optimizing their portfolio, dive into the full BCG Matrix report.

Gain a competitive edge by understanding DLH Holdings' product landscape. The complete BCG Matrix provides a granular breakdown of each product's market share and growth rate, empowering you to make informed decisions. Purchase the full report for expert analysis and tailored strategic recommendations.

Don't miss out on the complete picture of DLH Holdings' strategic assets. Our full BCG Matrix report goes beyond the basics, offering detailed quadrant placements and data-driven insights to guide your investment and product development. Get your copy today and transform your strategic planning.

Stars

DLH Holdings Corp. is strategically positioned in the digital transformation and cybersecurity sector, serving critical government needs. This area is a significant growth driver, reflecting the ongoing modernization within federal civilian and national security agencies. The demand is robust, fueled by an increasing need to safeguard sensitive data against evolving cyber threats.

In 2024, the U.S. federal government's cybersecurity spending is projected to exceed $20 billion, highlighting the substantial market opportunity DLH is addressing. DLH's focus on leveraging advanced technologies allows them to deliver enhanced program efficiency and robust information protection, directly aligning with these pressing government requirements.

The federal government's increasing emphasis on AI and machine learning for operational enhancements presents a significant, high-growth market opportunity. DLH Holdings is strategically positioning itself to leverage this trend by offering AI/ML-powered solutions designed to improve decision-making and streamline operations.

DLH's commitment to these technologies is evident in their development of advanced analytics and predictive modeling capabilities. For instance, in fiscal year 2023, DLH reported a 19% increase in revenue for their Health and Digital services segment, which heavily incorporates AI/ML solutions, signaling strong market adoption and growth in this area.

DLH Holdings excels in advanced data analytics for public health, offering robust epidemiology studies and comprehensive data management. This aligns perfectly with the federal government's increasing reliance on data-driven decision-making, especially as agencies invest heavily in integrating data for AI advancements.

The federal big data market is experiencing substantial growth, with projections indicating continued expansion as agencies prioritize data management and integration. DLH's specialized capabilities in handling large-scale data analytics and managing complex public health datasets position them to effectively address this critical and expanding government requirement.

Science, Research, and Development Support

DLH Holdings actively supports science, research, and development, particularly through its work with federal agencies. This includes providing crucial services like clinical trials and advanced technological support. A key client is the Telemedicine and Advanced Technology Research Center (TATRC), highlighting DLH's role in cutting-edge health initiatives.

This segment of DLH's business is driven by consistent government investment aimed at fostering innovation in disease prevention and health promotion. The company's established track record and existing contracts within this R&D sector underscore its strong market standing in a continuously expanding field.

- DLH's R&D services are vital for federal health initiatives.

- Government investment in health innovation fuels this sector.

- DLH's contracts demonstrate a solid market position.

Systems Engineering and Integration for Next-Gen Solutions

DLH Holdings excels in systems engineering and integration, a critical component for modernizing federal IT. This focus on next-generation solutions positions them well in a market driven by government agencies' continuous need for technological upgrades across civilian and defense sectors.

Their expertise is vital for developing robust and efficient systems, ensuring agencies can meet evolving operational demands. The demand for such advanced capabilities is a significant growth driver.

- Systems Engineering & Integration: DLH's core strength in designing, developing, and integrating complex systems for government clients.

- Next-Gen Solutions: Focus on modernizing IT infrastructure and creating future-proof technological capabilities.

- Market Growth: Addresses the increasing government demand for upgraded and efficient systems in both civilian and military applications.

- Recent Contract Wins: Demonstrated leadership through significant contract awards, such as those for Navy C5ISR systems, highlighting their strong market position and execution.

DLH Holdings' strong performance in digital transformation and cybersecurity, particularly within the federal government sector, positions them as a Star in the BCG Matrix. Their expertise in AI/ML and advanced data analytics, coupled with significant government contracts, reflects high growth and market leadership. The company's R&D services and systems engineering capabilities further solidify their Star status by addressing critical government needs and driving innovation.

| BCG Category | DLH Holdings' Position | Market Growth | Market Share |

|---|---|---|---|

| Stars | Digital Transformation & Cybersecurity (Federal Gov.) | High (e.g., $20B+ federal cybersecurity spending in 2024) | Strong (e.g., 19% revenue increase in Health & Digital services FY23) |

| Stars | AI/ML Solutions | Very High (driven by federal AI investment) | Growing (demonstrated by client adoption and DLH's R&D focus) |

| Stars | Advanced Data Analytics (Public Health) | High (federal big data market expansion) | Leading (specialized capabilities in large-scale data management) |

| Stars | R&D Services (Health Initiatives) | Consistent (driven by ongoing government investment) | Established (key contracts with agencies like TATRC) |

| Stars | Systems Engineering & Integration | High (government IT modernization needs) | Significant (e.g., Navy C5ISR systems contract wins) |

What is included in the product

Highlights which DLH Holdings units to invest in, hold, or divest based on their market share and growth.

The DLH Holdings BCG Matrix provides a clear, one-page overview, relieving the pain of strategic uncertainty by placing each business unit in its correct quadrant.

Cash Cows

Established Healthcare Delivery Solutions, a key component of DLH Holdings, operates within a mature market, primarily serving the Department of Veterans Affairs and Department of Defense. These long-standing contracts for medical logistics and health IT commodities ensure a steady and predictable revenue stream, characteristic of a cash cow.

DLH Holdings' healthcare delivery segment generated $268.7 million in revenue for fiscal year 2023, highlighting its significant contribution to the company's overall financial performance. This segment's consistent demand and reliable cash flow provide a stable foundation for the company's operations.

DLH Holdings' large-scale program management and support for healthcare and human services within federal agencies represents a significant Cash Cow. These contracts, often involving essential functions like case management and compliance, are characterized by their long-term nature and high market penetration, reflecting their deeply embedded status within government operations.

The stability of these programs, even with typically low growth rates, translates into predictable and substantial revenue streams for DLH. For instance, in fiscal year 2023, DLH reported total revenue of $339.3 million, with a substantial portion likely stemming from these established, high-share programs that require less aggressive reinvestment compared to growth-oriented ventures.

DLH Holdings' Telehealth and Behavioral Healthcare Support services are firmly positioned as cash cows within their business portfolio. These offerings, which include telehealth, behavioral health, and medication therapy management, address the persistent and crucial needs of service members and veterans. This segment operates in established federal health service areas, ensuring a stable and predictable revenue stream.

The consistent demand in these sectors, unlike high-growth markets, translates directly into robust profit margins. For instance, in fiscal year 2023, DLH reported a significant portion of its revenue derived from its Health and Education segment, which encompasses these core services, demonstrating their maturity and profitability.

Logistics and Technical Services for Federal Supply Chains

DLH Holdings' Logistics and Technical Services for Federal Supply Chains are a prime example of a cash cow within their BCG matrix. This segment leverages DLH's established expertise in managing complex government supply chains, including crucial inventory management and technical support functions. These services are foundational to government operations, operating within a mature and stable market. DLH's likely strong market share, often secured through long-term federal contracts, ensures a predictable and consistent revenue stream. This stability means that promotional investments are typically minimal, allowing the segment to generate substantial, reliable cash flow.

- Stable Market Presence: DLH's logistics and technical services are vital for federal supply chains, a sector characterized by consistent demand and long-term government reliance.

- High Market Share Potential: Through established contracts and proven expertise, DLH likely commands a significant share in this mature market.

- Low Promotional Costs: The nature of federal contracting and the essentiality of these services reduce the need for extensive marketing or sales efforts.

- Consistent Cash Generation: This segment acts as a reliable generator of cash, funding other business areas and contributing significantly to overall profitability.

Managed Care Support Services

DLH Holdings' Managed Care Support Services function as a cash cow within its business portfolio. These services are vital for supporting the healthcare needs of military beneficiaries, encompassing crucial areas like medical management and the administration of provider networks. This positions DLH as a key player in substantial, long-term managed care initiatives.

While the market for these support services may not exhibit rapid growth, they are indispensable for federal health agencies. DLH's established presence and significant market share in this segment ensure a consistent and reliable generation of cash flow, underpinning the company's financial stability.

- Stable Revenue Stream: DLH's managed care support services provide a predictable and consistent revenue stream.

- High Market Share: The company holds a strong position in serving federal health agencies, indicating a dominant market share.

- Critical Infrastructure: These services are essential for the functioning of healthcare for military beneficiaries.

- Cash Generation: The segment reliably generates substantial cash, contributing significantly to DLH's overall financial health.

DLH Holdings' established healthcare delivery solutions, particularly those serving the Department of Veterans Affairs and Department of Defense, represent significant cash cows. These segments benefit from long-term contracts for medical logistics and health IT commodities, ensuring a stable and predictable revenue stream. For fiscal year 2023, DLH reported total revenue of $339.3 million, with these mature, high-share programs forming a reliable financial backbone.

| Segment | Fiscal Year 2023 Revenue (Approx.) | Market Characteristic | BCG Classification |

|---|---|---|---|

| Healthcare Delivery Solutions (VA/DoD) | $268.7 million | Mature, Stable Demand | Cash Cow |

| Large-Scale Program Management (Federal Health) | Significant Contribution | Mature, High Penetration | Cash Cow |

| Telehealth & Behavioral Healthcare Support | Included in Health & Education Segment | Established, Persistent Need | Cash Cow |

| Logistics & Technical Services (Federal) | Significant Contribution | Mature, Essential | Cash Cow |

| Managed Care Support Services (Military Beneficiaries) | Significant Contribution | Indispensable, Stable | Cash Cow |

Delivered as Shown

DLH Holdings BCG Matrix

The DLH Holdings BCG Matrix you're previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report. You can confidently use this preview as a direct representation of the high-quality, in-depth BCG Matrix analysis that will be delivered to you, ready for immediate application in your business planning.

Dogs

Commoditized legacy IT support services, particularly those not embracing advanced technologies, often reside in low-growth markets. For DLH Holdings, if their market share in these basic IT functions is also low, these services would be classified as Dogs within the BCG matrix. For instance, in 2024, the IT outsourcing market for legacy systems saw an estimated growth rate of only 2-3%, significantly lower than emerging tech sectors.

DLH Holdings has experienced a revenue downturn stemming from the unbundling of larger contracts, which are then awarded to smaller businesses through set-aside programs. These particular contract segments, where DLH faces market share erosion within stable or contracting sub-markets, represent DLH's Question Marks in the BCG Matrix.

Within DLH Holdings' BCG Matrix, outdated or niche contingency/staff augmentation services would likely fall into the Dogs quadrant. These are services with low market share and minimal growth prospects, often due to being specialized in declining industries or offering non-essential skill sets. For instance, if DLH offers staff augmentation for legacy IT systems that are being phased out, these specific services would exhibit low demand and profitability.

These Dog-like services represent a drain on resources without significant return. DLH’s 2024 financial reports might show declining revenue streams from these specific augmentation areas, highlighting their lack of strategic importance. Identifying these underperforming segments is crucial for effective portfolio management, potentially leading to decisions about divestiture or a complete overhaul of the service offering to align with current market demands.

Programs with Declining Federal Funding Priority

DLH Holdings may have certain legacy programs or service lines that are no longer aligned with current high-priority federal spending areas. For instance, if DLH has a limited market share in areas outside of cybersecurity, AI, or advanced public health initiatives, these segments could be categorized as Dogs in the BCG matrix. Such areas might exhibit low growth and could potentially become cash traps if resources are not carefully managed or reallocated.

The company's strategy must involve a continuous assessment and alignment with evolving government priorities. For example, if a particular legacy IT modernization project, not directly tied to AI or advanced analytics, represents a significant portion of a division's revenue but is experiencing stagnant growth and declining federal interest, it would fit the Dog profile. DLH needs to actively prune or divest from such non-strategic areas to focus capital on growth opportunities.

- Legacy IT Modernization: Programs not directly supporting current federal priorities like AI or advanced analytics.

- Limited Market Share in Non-Priority Areas: Service lines where DLH has minimal competitive advantage and low federal demand.

- Potential Cash Traps: Segments requiring ongoing investment without commensurate revenue growth or strategic alignment.

Underperforming or Expiring Non-Core Contracts

Underperforming or expiring non-core contracts often represent the Dogs in DLH Holdings' BCG Matrix. These are contracts that are nearing their end-of-life and are either not being renewed or are shrinking due to performance issues or shifts in government strategy. For instance, if DLH's market share in specific contract areas is low and the market itself is not growing, these would be categorized as Dogs. Such contracts consume valuable resources without contributing significantly to future growth, potentially impacting overall profitability.

These situations can arise from various factors, including increased competition, evolving technological landscapes, or changes in client needs. For example, a contract related to older IT infrastructure might see reduced demand as government agencies upgrade to newer systems. DLH Holdings, like many government contractors, must continually assess its portfolio for such underperforming assets.

- Contract Expiration: Contracts nearing their end-of-life without renewal prospects.

- Market Share Decline: Low market share in stagnant or shrinking contract segments.

- Resource Drain: Contracts that consume resources without generating substantial returns or future growth potential.

- Strategic Review: The necessity for DLH to actively review and potentially divest from such non-core, underperforming contracts.

Services within DLH Holdings that exhibit low market share in slow-growing or declining sectors are classified as Dogs in the BCG matrix. These often include legacy IT support or niche augmentation services that lack current federal demand or are being superseded by newer technologies. For instance, DLH's participation in specific legacy system maintenance contracts, where their market share is minimal and the overall market is contracting by an estimated 1-2% annually, would fit this category.

These segments can become resource drains, consuming management attention and capital without contributing to future growth. DLH's financial disclosures might reveal declining revenues from these areas, underscoring their low strategic value. Identifying and managing these Dogs is crucial for optimizing resource allocation and focusing on more promising business units.

The company's strategy should involve a critical evaluation of these underperforming areas, potentially leading to divestment or a strategic pivot. For example, a specific legacy software support contract that DLH holds, representing a small portion of their revenue with negligible growth prospects, exemplifies a Dog. Such an approach ensures that DLH can redirect resources towards higher-potential opportunities.

DLH Holdings' portfolio may contain certain legacy programs or service lines that are no longer aligned with current high-priority federal spending areas, such as advanced cybersecurity or AI initiatives. If DLH has a limited market share in these non-priority segments, they would be categorized as Dogs. These areas might exhibit low growth and could become cash traps if resources are not carefully managed or reallocated, potentially requiring ongoing investment without commensurate returns.

| Service Category | Market Growth | DLH Market Share | BCG Classification | Strategic Implication |

|---|---|---|---|---|

| Legacy IT Support | Low (2-3% in 2024) | Low | Dog | Resource drain, potential divestment |

| Niche Staff Augmentation (Legacy Systems) | Declining | Low | Dog | Low profitability, consider phasing out |

| Expiring Non-Core Contracts | Stagnant/Declining | Low | Dog | Consumes resources, review for renewal/exit |

Question Marks

DLH Holdings is actively investing in emerging digital health technologies, including AI-powered medical decision assistance, drone-based medical delivery, and AR/VR for medical training simulations. These represent high-potential growth sectors within the rapidly expanding digital health landscape.

While these areas offer significant future opportunities, DLH's current market share in these nascent applications is likely minimal, reflecting their early-stage development. The global digital health market was valued at over $200 billion in 2023 and is projected to grow substantially, with these specific technologies expected to be key drivers.

Gaining substantial market traction in these innovative fields will necessitate considerable ongoing investment in research, development, and market penetration strategies. This positions these ventures as potential question marks within the BCG matrix, requiring strategic capital allocation.

DLH Holdings' expansion into new federal agencies, particularly through the OASIS+ GWAC ID/IQ contract, positions these areas as potential Stars in its BCG matrix. This strategic move significantly broadens their addressable market, tapping into segments with high growth potential.

While the OASIS+ contract opens doors to a wider array of federal agencies and competitive landscapes, DLH's current market penetration in these newly accessible segments is nascent. This presents a classic "question mark" scenario, where significant investment is needed to cultivate these opportunities and transition them into Stars.

DLH Holdings' recent launch of its Climate + Health Innovation Center positions it within a nascent, high-potential market focused on climate-related health issues. This strategic move suggests an investment in a future growth area, aligning with increasing global awareness and demand for solutions in this sector.

Given this is an emerging market, DLH's current market share and established presence are likely minimal, characteristic of a 'Question Mark' in the BCG matrix. This segment demands significant capital infusion to foster innovation and demonstrate market viability and competitive advantage.

Niche AI/ML Applications in Untapped Domains

Niche AI/ML applications in untapped government domains represent potential question marks for DLH Holdings. While AI/ML is a strong performer overall, these specific, highly specialized areas, such as AI-driven predictive maintenance for aging military infrastructure or advanced cybersecurity threat detection tailored for specific federal agencies, currently have limited DLH penetration.

These segments offer significant growth prospects, with the global AI in government market projected to reach $13.7 billion by 2027, growing at a CAGR of 34.5%. However, capturing market share necessitates substantial, focused investment in developing tailored solutions and navigating established competitors or emerging specialists. For instance, the defense sector alone is expected to invest heavily in AI, with estimates suggesting over $100 billion globally by 2030.

- AI for Predictive Maintenance in Defense: High potential for cost savings and operational efficiency in aging military assets.

- AI in Federal Cybersecurity: Specialized AI models for anomaly detection in critical government networks.

- AI for Public Health Data Analysis: Developing AI tools for disease outbreak prediction and resource allocation in public health agencies.

- AI in Environmental Monitoring: Applying AI to analyze satellite imagery for climate change impact assessment and natural disaster prediction.

Advanced Research Areas with Unproven Commercialization

DLH Holdings, like many companies in the technology and defense sectors, invests in advanced research areas that are still in the exploratory phase. These initiatives often represent future growth engines but carry significant risk due to their unproven commercialization pathways. Such ventures are characterized by substantial upfront investment and a lack of immediate, quantifiable returns, placing them firmly in the question mark category of the BCG matrix.

These advanced R&D efforts are speculative, meaning their success hinges on breakthroughs and market adoption that are not yet guaranteed. While they hold the potential to disrupt existing markets or create new ones, their current market share is negligible. Companies must carefully manage these investments, balancing the pursuit of innovation with the need for financial discipline.

- High Risk, High Reward Potential: These areas are characterized by significant uncertainty regarding market acceptance and profitability.

- Substantial Investment Required: Continued funding is necessary for research, development, and potential pilot programs without immediate revenue generation.

- Low Current Market Share: As these technologies are nascent, they have yet to capture a meaningful share of any established market.

- Future Growth Drivers: Successful development and commercialization could lead to substantial future revenue streams and market leadership.

DLH Holdings' ventures into emerging digital health technologies, niche AI applications, and new federal agency contracts through OASIS+ represent classic question marks. These areas exhibit high growth potential but currently have minimal market share, demanding significant investment for development and market penetration.

The company's strategic focus on areas like AI for predictive maintenance in defense and specialized AI in federal cybersecurity, while promising, requires substantial capital to navigate nascent markets and establish a competitive foothold. Similarly, the Climate + Health Innovation Center is an investment in an emerging sector with unproven commercialization pathways.

These initiatives, while potentially disruptive, are characterized by high risk and low current market share, necessitating careful financial management and a long-term strategic outlook to transition them into successful growth areas.

| BCG Category | DLH Holdings Example | Market Growth | Market Share | Investment Strategy |

|---|---|---|---|---|

| Question Marks | Emerging Digital Health Tech | High | Low | Invest to build share |

| Question Marks | Niche AI/ML in Untapped Gov Domains | High | Low | Invest to build share |

| Question Marks | OASIS+ GWAC Expansion | High | Low | Invest to build share |

| Question Marks | Climate + Health Innovation Center | High | Low | Invest to build share |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, industry reports, and market growth projections to accurately assess business unit performance and strategic positioning.