DLH Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DLH Holdings Bundle

DLH Holdings operates within a dynamic landscape shaped by the bargaining power of buyers and the intensity of rivalry among existing competitors. Understanding these forces is crucial for strategic planning.

The full Porter's Five Forces Analysis provides a comprehensive deep dive into DLH Holdings's market, revealing the true impact of supplier power and the threat of new entrants. Unlock actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

DLH Holdings Corp. depends on a highly specialized workforce, boasting over 3,000 employees with critical skills in data analytics, systems engineering, and public health, many of whom possess necessary government clearances. This reliance on a niche talent pool significantly influences the bargaining power of suppliers of such expertise.

The broader procurement landscape is currently experiencing shifts in talent availability, with projections indicating a potential scarcity of younger professionals entering specialized fields. This dynamic could amplify the bargaining power of experienced individuals or the organizations that effectively recruit and retain them, potentially impacting DLH Holdings' labor costs and project timelines.

Proprietary software and technology vendors hold significant bargaining power when DLH Holdings relies on their specialized, advanced solutions like AI and cloud-based platforms. The healthcare IT sector's strong shift towards cloud offerings, a market projected to reach over $100 billion globally by 2025, amplifies this dependence. This reliance means vendors offering unique, integral technologies can dictate terms, impacting DLH's costs and operational flexibility.

For intricate government projects, DLH Holdings often relies on specialized subcontractors possessing unique skills. These niche providers can wield significant bargaining power, especially when their expertise is difficult to replicate or when they are critical to fulfilling contract requirements.

Recent government directives, such as those aimed at increasing subcontracting opportunities for small businesses, could further bolster the negotiating leverage of these specialized firms. For instance, in 2024, small businesses continued to be a focus for federal contracting, potentially allowing niche subcontractors to secure more favorable payment terms and pricing.

Data Providers and Information Services

As a company offering data analytics services, DLH Holdings relies heavily on obtaining comprehensive datasets and information from various providers. The bargaining power of these suppliers can significantly impact DLH's operational costs and strategic flexibility.

The federal health sector, a key market for DLH, places a strong emphasis on standardization, advanced analytics, and interoperability for managing big data. This environment means that suppliers offering unique, proprietary, or critically important data sources could wield considerable influence over DLH. For instance, if a particular data provider holds exclusive rights to a dataset crucial for federal health analytics, they might be able to command higher prices or impose stricter terms. In 2024, the federal government continued its push for data modernization, with initiatives like the President's Management Agenda focusing on improving data governance and accessibility across agencies, potentially shifting the power dynamic for data providers.

- Data Dependency: DLH's core business model is built upon the acquisition and analysis of data, making reliable access to high-quality information a fundamental requirement.

- Federal Health Sector Trends: The increasing demand for standardization, analytics, and interoperability in federal health data suggests that providers of specialized or essential data sets possess leverage.

- Potential for Price Increases: Suppliers of unique or critical data could leverage their position to negotiate higher fees, impacting DLH's cost structure.

- Strategic Importance of Data Sources: The exclusivity or indispensability of certain data sources can grant suppliers significant bargaining power, influencing DLH's ability to innovate and compete.

Government Regulations and Compliance Standards

The government contracting sector, where DLH Holdings operates, is heavily influenced by stringent and ever-changing regulations. This creates significant leverage for suppliers who provide essential compliance tools, cybersecurity solutions, and expert regulatory advice. For instance, the Cybersecurity Maturity Model Certification (CMMC) framework, which became mandatory for many Department of Defense contractors, necessitates specialized software and consulting services, giving those providers increased bargaining power.

DLH's reliance on these specialized suppliers to meet complex government mandates, such as those related to data security and operational compliance, means these vendors are critical to the company's ability to secure and maintain contracts. Failure to comply can result in severe penalties or contract termination, underscoring the indispensable nature of these suppliers' offerings.

- Regulatory Dependence: DLH's adherence to government mandates like CMMC elevates the importance of suppliers offering compliance solutions.

- Cybersecurity Imperatives: The increasing focus on cybersecurity in government contracts strengthens the position of vendors providing advanced security tools and services.

- Supplier Leverage: The critical nature of these specialized services grants suppliers enhanced bargaining power in negotiations with companies like DLH.

DLH Holdings' reliance on a highly specialized workforce, particularly in data analytics and public health, grants significant bargaining power to suppliers of this niche talent. The federal health sector's demand for advanced analytics and data interoperability further empowers data providers who hold essential, exclusive datasets. This dynamic can lead to increased costs and reduced operational flexibility for DLH.

| Supplier Type | Bargaining Power Factor | Impact on DLH Holdings |

|---|---|---|

| Specialized Workforce | Niche skill requirements, government clearances | Potential for higher labor costs, talent acquisition challenges |

| Data Providers | Exclusivity of critical datasets, federal data modernization initiatives | Increased data acquisition costs, potential limitations on data utilization |

| Proprietary Software/Tech Vendors | Advanced AI, cloud platforms, healthcare IT sector growth | Higher licensing fees, dependence on vendor roadmaps |

| Specialized Subcontractors | Unique skills for government projects, small business contracting focus (2024) | Negotiation leverage on pricing and terms for niche services |

| Compliance/Cybersecurity Solutions | Stringent government regulations (e.g., CMMC), data security imperatives | Increased costs for essential compliance tools and services |

What is included in the product

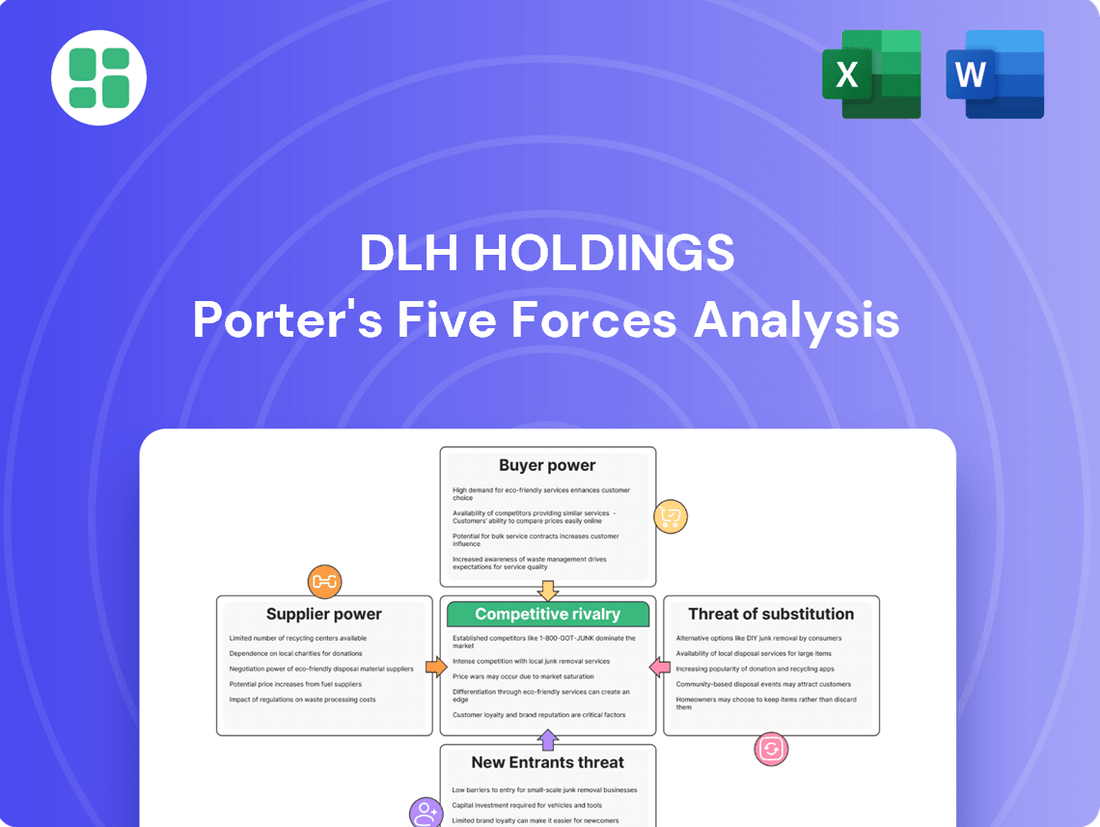

DLH Holdings' Porter's Five Forces analysis reveals the competitive intensity within its industry, assessing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly identify and mitigate competitive threats with a dynamic, interactive Porter's Five Forces model, allowing for proactive strategic adjustments.

Customers Bargaining Power

DLH Holdings' customer base is heavily concentrated among a few major federal government agencies, primarily the Department of Health and Human Services (HHS) and the Department of Defense (DoD). This consolidation means these large entities hold significant sway in negotiations, giving them considerable bargaining power over DLH.

In 2023, DLH reported that approximately 56% of its revenue came from contracts with HHS and DoD. This reliance on a small number of powerful clients amplifies their ability to dictate terms, influence pricing, and demand specific service levels, thereby increasing DLH's vulnerability to customer leverage.

DLH Holdings provides essential services that significantly impact public health and operational effectiveness for government clients. However, these clients, particularly government agencies, are characterized by rigorous and often lengthy procurement processes. This structured approach allows them to meticulously evaluate service providers and negotiate terms that align with specific public service mandates and budgetary constraints.

The government's ability to dictate terms is further evidenced by initiatives like the TRICARE T-5 contracts, slated to commence in 2025. These contracts are specifically designed to elevate healthcare delivery, improve quality metrics, and broaden access to medical services. This focus on demonstrable outcomes empowers government customers to demand high standards and favorable terms from their contractors, including DLH.

Long-term government contracts, like those DLH Holdings secures, can foster stability but also grant customers significant leverage. These multi-year agreements mean clients can exert continuous oversight and use the prospect of future contract renewals to their advantage. For example, DLH's OASIS+ contract, a significant win, includes a five-year base with a potential five-year extension, giving the government considerable influence over the long haul.

Internal Capabilities and Alternatives

Government agencies, as DLH Holdings' customers, can exert significant bargaining power if they develop or possess internal capabilities to perform services DLH offers. This potential for insourcing or developing in-house expertise directly challenges DLH's market position. For instance, a government agency might invest in its own data analytics or IT support infrastructure, reducing its reliance on external contractors.

The government's ongoing emphasis on achieving greater efficiency and securing the best value for taxpayer money intensifies competition among service providers like DLH. This competitive landscape naturally empowers customers, as they can more readily compare offerings and negotiate terms, knowing that alternative solutions exist. In 2024, the U.S. federal government continued its focus on cost-saving measures across various departments, impacting contract negotiations.

- Internal Capabilities: Government agencies may build or acquire in-house skills for functions traditionally outsourced to companies like DLH.

- Insourcing Potential: The possibility of bringing certain contracted services back under direct government management increases customer leverage.

- Efficiency Drive: A government-wide push for operational efficiency and cost-effectiveness encourages agencies to explore all viable service delivery options.

- Competitive Environment: Heightened competition among government contractors, driven by the demand for value, amplifies the bargaining power of federal agencies.

Price Sensitivity and Budget Constraints

Customers, particularly government entities, exhibit significant price sensitivity due to budget constraints and political pressures. This forces a strong emphasis on cost-effectiveness in procurement decisions.

DLH Holdings' financial performance in 2024 reflects this reality, with revenue declines partially attributed to 'small business conversions' and 'program timing.' These factors highlight the government's capacity to unbundle contracts and actively seek more efficient solutions, directly impacting DLH's revenue streams.

- Government procurement is highly sensitive to cost-effectiveness.

- DLH Holdings experienced revenue declines in 2024 due to factors like small business conversions.

- Program timing shifts also contributed to revenue fluctuations, demonstrating customer control over project timelines.

- The ability to unbundle contracts empowers government customers to negotiate better terms and seek specialized, potentially lower-cost providers.

DLH Holdings faces substantial bargaining power from its key government clients, such as HHS and DoD, which accounted for approximately 56% of its revenue in 2023. This concentration means these large entities can significantly influence pricing and service terms, especially given their rigorous procurement processes and focus on value for taxpayer money.

Government agencies' ability to unbundle contracts and their ongoing drive for efficiency, as seen in 2024 with factors like small business conversions impacting DLH's revenue, further amplifies customer leverage. The potential for these agencies to develop internal capabilities or insource services also acts as a significant check on DLH's pricing power.

| Customer Segment | Revenue Contribution (2023) | Key Bargaining Factors | Impact on DLH |

|---|---|---|---|

| Federal Government (HHS, DoD) | ~56% | Concentrated client base, rigorous procurement, cost-effectiveness focus, insourcing potential | High leverage on pricing, terms, and contract renewals |

| Other Government Agencies | ~44% | Budget constraints, competitive bidding, demand for specialized services | Moderate leverage, influenced by specific contract requirements |

Preview the Actual Deliverable

DLH Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for DLH Holdings, detailing the competitive landscape and industry dynamics. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within DLH Holdings' operating environment. You're looking at the actual document, offering a complete and ready-to-use analysis file that is precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

The federal government contracting market, especially for health and human services, is incredibly fragmented. This means there are many companies vying for the same business, ranging from massive prime contractors to smaller, specialized firms.

DLH Holdings operates within this competitive environment, where it's just one of many prime awardees on significant contract vehicles like OASIS+. This broad competitive landscape highlights the sheer number of players DLH must contend with to secure and maintain its contracts.

The competitive landscape for DLH Holdings is characterized by a bid and proposal intensive environment. Companies vie for contracts based on competitive pricing, demonstrated technical capabilities, and a track record of successful past performance. DLH's leadership has publicly stated their awareness of and efforts to adapt to evolving dynamics within this demanding sector.

DLH Holdings' success in the competitive government contracting landscape is significantly bolstered by its emphasis on past performance and deeply ingrained relationships. Companies like DLH, which have a history of successfully delivering for federal agencies, often possess a distinct advantage. Their established trust and proven capabilities make them a preferred choice for new contracts, reducing perceived risk for government clients.

DLH, for instance, highlights its decades of experience and enduring partnerships, a testament to its reliability and understanding of government needs. This history is not just anecdotal; it translates into tangible benefits. In 2023, DLH reported securing significant contract wins, underscoring the value of these long-standing relationships and a demonstrable track record of success in delivering complex solutions.

Specialization and Niche Focus

DLH Holdings operates in a competitive landscape where many rivals also concentrate on specific niches within the health and human services sector. This means companies like DLH often face intense rivalry from other specialized firms focusing on areas such as health information technology, clinical trial support, or even defense-related logistics.

This intense specialization can significantly heighten the competitive pressure within these particular market segments. For instance, in the health IT space, DLH might compete against companies that exclusively offer electronic health record solutions or data analytics platforms for healthcare providers. The year 2024 saw continued consolidation and strategic partnerships in these specialized areas, as companies sought to bolster their offerings and gain market share.

- Intensified Rivalry: Specialization leads to direct competition with similarly focused entities.

- Market Segment Pressure: Niche focus amplifies competition within those specific service areas.

- Industry Trends: 2024 marked a period of strategic alliances and acquisitions aimed at strengthening specialized capabilities.

Consolidation and M&A Activity

The government contracting sector, including companies like DLH Holdings, is characterized by significant consolidation. In 2024, this trend continues as firms aim for greater scale and broader service offerings. For instance, the U.S. federal IT services market saw numerous M&A deals in the preceding years, with many expected to continue into 2024, driven by the need to compete for larger, more complex government programs.

This M&A activity directly heightens competitive rivalry. As larger entities emerge through mergers, they often possess enhanced resources and broader contract portfolios, making it more challenging for smaller or less consolidated players to compete effectively. The pursuit of market share and key government contracts intensifies as the industry landscape shifts towards fewer, larger competitors.

- Increased Scale: Mergers allow companies to achieve greater operational efficiency and financial strength.

- Capability Expansion: Acquisitions enable companies to integrate new technologies or service lines, offering more comprehensive solutions.

- Contract Acquisition: Consolidation often involves the transfer of significant government contracts, altering the competitive dynamics.

- Rivalry Intensity: The presence of larger, more integrated competitors naturally raises the bar for market participation.

DLH Holdings faces intense competition within the federal government contracting space, particularly in health and human services. The market is highly fragmented, featuring numerous players ranging from large prime contractors to specialized niche firms, all vying for similar contracts. This dynamic necessitates a constant focus on competitive pricing, technical prowess, and a proven history of successful project execution.

The competitive landscape is further intensified by ongoing industry consolidation. In 2024, mergers and acquisitions continued to reshape the sector, creating larger, more resource-rich competitors. This trend means DLH must not only contend with established rivals but also with entities that have expanded their scale and service capabilities through strategic deals, thereby increasing the pressure to secure market share and key government programs.

DLH's strategy often leverages its decades of experience and established client relationships as key differentiators. This focus on past performance and trust is crucial in a bid-and-proposal-driven environment. For example, in 2023, the company reported significant contract wins, underscoring the value of its proven track record in delivering complex solutions to government agencies.

| Metric | DLH Holdings (Approx. 2023/2024) | Industry Trend |

|---|---|---|

| Number of Competitors | Hundreds (highly fragmented) | Consolidation increasing |

| Key Differentiators | Past Performance, Relationships, Specialization | Scale, Integrated Solutions, Technology |

| Contract Wins (Example) | Significant wins reported in 2023 | M&A activity impacting contract portfolios |

SSubstitutes Threaten

The threat of substitutes for DLH Holdings from internal government capabilities is a growing concern. As government agencies invest heavily in AI and IT modernization, they are increasingly building in-house expertise to perform tasks previously outsourced. For instance, the U.S. Department of Defense's push for digital transformation and the expansion of its internal software development teams directly reduce reliance on external contractors like DLH for certain technology services.

The growing availability of open-source software and public domain health data presents a significant threat of substitutes for companies like DLH Holdings. Government agencies, for instance, can leverage these resources to build in-house data analysis tools, bypassing the need for proprietary solutions from private sector providers. This trend democratizes access to sophisticated capabilities, offering a considerably more cost-effective alternative.

While DLH Holdings excels in specialized health and human services, the threat of substitutes arises from generic consulting and IT service providers. These firms can offer foundational IT support and management consulting, potentially at a lower cost, serving as an alternative for non-core functions.

For instance, the global IT services market was valued at approximately $1.3 trillion in 2023 and is projected to grow, indicating a large pool of providers capable of offering more commoditized services. This broad availability means clients might opt for these generalists for certain needs, bypassing DLH's specialized offerings.

Non-Technological or Manual Processes

In less complex or critical government functions, there's a persistent threat from non-technological or manual processes. These can serve as substitutes for DLH Holdings' advanced solutions, especially where the investment in sophisticated technology might not be justified by the complexity or criticality of the task. For instance, some administrative tasks or data entry might still be handled through paper-based systems or simpler, less integrated software. This is particularly relevant in areas where budget constraints are significant or where the pace of technological adoption is slower.

While the push for digital transformation is strong, a reversion to or continued reliance on simpler, manual methods can indeed act as a substitute. This is because these methods, while less efficient, often have lower upfront costs and require less specialized training. For example, a government department might choose to continue using spreadsheets for certain data analysis tasks rather than investing in DLH's more comprehensive analytics platforms if the immediate need is perceived as minimal. The overall government IT spending in the US was projected to reach $120 billion in 2024, but not all of this is allocated to advanced solutions, leaving room for these simpler alternatives.

- Lower Cost of Entry: Manual processes often bypass the significant capital expenditure associated with advanced technology solutions.

- Reduced Training Needs: Simpler methods typically require less specialized training for government staff compared to complex software.

- Flexibility in Less Critical Areas: For non-mission-critical functions, the perceived benefits of advanced technology may not outweigh the costs and complexities.

- Resistance to Change: In some government sectors, there can be inertia or resistance to adopting new, complex technological systems.

Alternative Funding Models and Partnerships

Government agencies are increasingly exploring alternative funding models to achieve public health outcomes. For instance, in 2024, federal agencies continued to leverage grants to non-profit organizations and academic institutions, providing direct support for research and service delivery. This trend offers a potential substitute for traditional contracting with companies like DLH Holdings.

Public-private partnerships (PPPs) also represent a significant substitute. These collaborations allow government entities to pool resources and expertise with private sector companies, potentially leading to more innovative and efficient solutions. For example, a 2024 initiative focused on improving vaccine distribution relied heavily on a PPP structure, bypassing traditional procurement processes.

- Grant Funding: Government agencies may provide grants directly to non-profits and academic institutions, bypassing prime contractors.

- Public-Private Partnerships (PPPs): Collaborations between government and private entities can offer alternative service delivery mechanisms.

- In-House Capabilities: Government agencies might also build or expand their internal capabilities to perform services previously outsourced.

- Non-Traditional Procurement: Exploring new procurement methods that favor smaller, specialized providers or innovative solutions could shift market dynamics.

The threat of substitutes for DLH Holdings is multifaceted, encompassing both technological and process-oriented alternatives. Government agencies are increasingly developing in-house capabilities, particularly in AI and IT modernization, reducing their reliance on external contractors for core functions. For example, the U.S. Department of Defense's significant investments in digital transformation are expanding its internal software development teams, directly impacting the demand for outsourced technology services.

Open-source software and publicly available health data offer cost-effective substitutes, enabling government bodies to build their own data analysis tools. This trend democratizes advanced capabilities, presenting a more budget-friendly option than proprietary solutions. Furthermore, generic IT service providers and consulting firms can offer foundational support and management services at lower price points, acting as alternatives for DLH's less specialized offerings.

In simpler or less critical government functions, manual processes and less integrated systems remain viable substitutes for advanced technological solutions. These alternatives often come with lower upfront costs and reduced training requirements, making them attractive where budget constraints are a primary concern or technological adoption is slower. For instance, government departments might continue using spreadsheets for data analysis instead of investing in comprehensive analytics platforms if the immediate need is perceived as minimal.

The global IT services market, valued at approximately $1.3 trillion in 2023, highlights the broad availability of providers capable of offering commoditized services, potentially diverting clients from specialized providers like DLH for certain needs. Additionally, alternative funding models such as grants to non-profits and public-private partnerships (PPPs) are emerging as substitutes for traditional contracting, with initiatives in 2024 demonstrating a growing preference for these collaborative approaches in areas like public health outcomes and vaccine distribution.

| Threat of Substitute | Description | Example/Data Point |

|---|---|---|

| In-house Government Capabilities | Government agencies developing internal expertise for IT and AI modernization. | U.S. DoD's digital transformation and expanded internal software teams. |

| Open-Source Software & Public Data | Leveraging free resources to build internal data analysis tools. | Democratization of sophisticated capabilities, offering cost-effective alternatives. |

| Generic IT/Consulting Services | Broader market providers offering foundational IT support and management. | Global IT services market valued at ~$1.3 trillion in 2023, indicating ample commoditized service providers. |

| Manual Processes/Simpler Systems | Reliance on non-technological or basic digital methods for less critical tasks. | Continued use of spreadsheets for data analysis due to lower cost and training needs. |

| Alternative Funding Models | Grants to non-profits and public-private partnerships (PPPs) as alternatives to traditional contracts. | 2024 initiatives in public health and vaccine distribution utilizing PPP structures. |

Entrants Threaten

The threat of new entrants into the government contracting space, particularly for companies like DLH Holdings operating in health and defense, is considerably low. This is largely due to the substantial hurdles new companies must overcome.

Achieving the necessary security clearances for personnel and facilities is a time-consuming and rigorous process, often taking years. For instance, obtaining Top Secret clearances, a common requirement, involves extensive background checks and can be a significant deterrent. In 2024, the federal government continues to emphasize stringent security protocols, making it difficult for unproven entities to gain access.

Furthermore, navigating the complex web of federal regulations, such as the Federal Acquisition Regulation (FAR), demands specialized expertise and resources. The lengthy and often opaque government procurement process, which can involve extensive proposal writing and evaluation periods, also acts as a formidable barrier, discouraging less experienced or under-resourced competitors.

New entrants into the health and human services sector, like those DLH Holdings operates within, face a significant barrier due to the critical need for specialized expertise. This isn't just about general business acumen; it's about deep domain knowledge in areas such as public health, healthcare IT, and government contracting. For instance, understanding the intricacies of the TRICARE program or the Centers for Medicare & Medicaid Services (CMS) requires years of dedicated experience and a proven understanding of complex regulatory environments.

Beyond theoretical knowledge, practical technical capabilities are paramount. Companies looking to compete must demonstrate proficiency in systems engineering, cybersecurity, and advanced data analytics to effectively manage and interpret health-related information. DLH, for example, highlights its expertise in areas like enterprise IT modernization and data-driven decision support, capabilities that are not easily replicated by newcomers without substantial prior investment in talent and technology. This technical depth is crucial for winning and executing contracts in this demanding field.

Furthermore, obtaining the necessary certifications and building a credible track record in this niche market demands considerable time and financial resources. Many government contracts, particularly those with agencies like the Department of Defense or the Department of Health and Human Services, require specific security clearances and adherence to stringent quality standards. For example, DLH Holdings has achieved various certifications and accreditations that underscore its commitment to quality and compliance, a process that can take years and significant capital outlay for any aspiring competitor.

The significant capital required for technology and infrastructure development presents a substantial barrier for new entrants. Building and maintaining sophisticated platforms, ensuring secure data infrastructure, and investing in R&D for cutting-edge solutions demand considerable financial resources. For instance, in 2024, the average R&D spending for major technology firms in the healthcare sector, a relevant comparison for DLH Holdings, reached billions of dollars, highlighting the scale of investment needed.

Importance of Established Relationships and Past Performance

Federal agencies prioritize established relationships and a proven track record, especially for mission-critical services. This inherent bias toward incumbency creates a significant barrier for new companies seeking prime contract awards.

DLH Holdings, for instance, benefits from deep-seated connections and a history of successful contract execution. In 2023, DLH reported a backlog of $1.3 billion, underscoring the value of its existing client relationships and past performance in securing future work.

New entrants often find it challenging to break into this market without:

- Forging strategic partnerships with established players.

- Acquiring companies with existing federal contracts and relationships.

- Demonstrating exceptional capabilities that outweigh the incumbency advantage.

The lengthy and rigorous qualification processes for federal contracts further solidify the advantage of incumbents, making the threat of new entrants relatively low in the short to medium term.

Risk Aversion of Government Customers

Government customers, by their nature, exhibit a significant degree of risk aversion. This means they typically favor working with established and proven contractors, prioritizing reliability and a track record of successful mission execution. This preference acts as a substantial barrier to entry for new companies looking to secure government contracts.

For new entrants, overcoming this inherent bias requires demonstrating exceptional capability, unwavering reliability, and a clear understanding of government procurement processes. Without a history of successful government projects, new firms face a steeper climb to gain trust and win bids.

- High Barrier to Entry: Government agencies' preference for established vendors creates a significant hurdle for new competitors.

- Demonstrated Reliability is Key: New entrants must prove their capability and reliability to overcome the inherent risk aversion of government clients.

- Focus on Proven Track Records: Agencies often prioritize contractors with a history of successful project delivery, making it difficult for newcomers to break in.

The threat of new entrants for DLH Holdings is significantly mitigated by high barriers to entry, including stringent security clearances, complex regulatory landscapes like the FAR, and the substantial capital required for technology and infrastructure. These factors, coupled with government agencies' preference for proven track records and established relationships, make it exceedingly difficult for newcomers to compete effectively in the health and human services contracting sector. DLH's substantial backlog of $1.3 billion as of 2023 further illustrates the advantage of incumbency.

| Barrier Type | Description | Impact on New Entrants | DLH Holdings Advantage |

|---|---|---|---|

| Security Clearances | Rigorous, time-consuming process for personnel and facilities. | Deters unproven entities; delays market entry. | Established clearance infrastructure and personnel. |

| Regulatory Complexity | Navigating federal regulations (e.g., FAR). | Requires specialized expertise and resources; lengthy procurement process. | Deep understanding and dedicated compliance teams. |

| Capital Investment | High costs for technology, infrastructure, and R&D. | Significant financial hurdle for new competitors. | Existing advanced platforms and ongoing R&D investment. |

| Incumbency & Relationships | Government preference for proven vendors and past performance. | New entrants struggle to gain trust and win bids. | Strong client relationships and a history of successful contract execution. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for DLH Holdings leverages comprehensive data from SEC filings, analyst reports, and industry-specific market research to assess competitive intensity.