DLH Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DLH Holdings Bundle

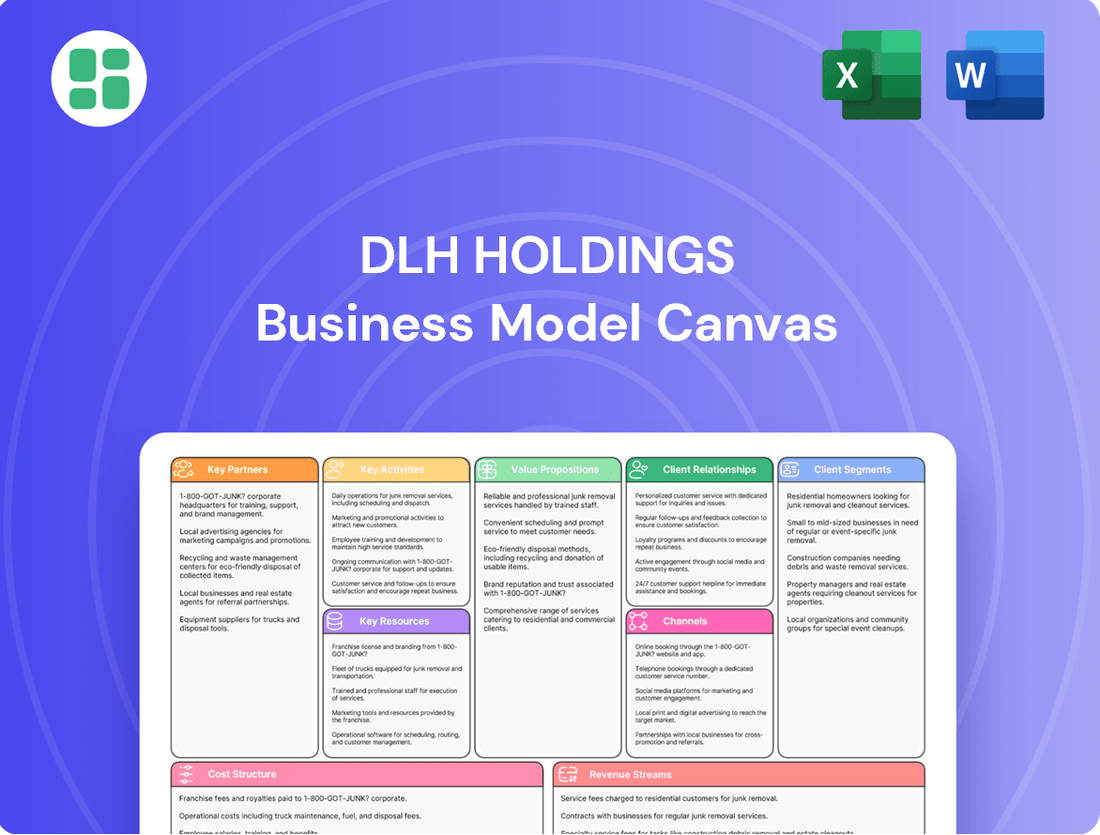

Unlock the strategic core of DLH Holdings with their comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear view of their market approach. Gain actionable insights for your own business strategy.

Partnerships

DLH Holdings Corp.'s key partnerships with U.S. federal government agencies are foundational to its business model. These include major clients like the Department of Health and Human Services (HHS), the Department of Defense (DoD), and the Department of Veterans Affairs (VA).

These enduring partnerships are vital for DLH to secure substantial, multi-year contracts, which represent the bulk of its revenue. For instance, in fiscal year 2023, the U.S. federal government accounted for approximately 94% of DLH's total revenue, highlighting the critical nature of these relationships.

The company's ability to effectively navigate government procurement processes and align its service offerings with evolving federal priorities and available contracting vehicles is paramount to its continued success and contract renewals.

DLH Holdings strategically partners with premier technology and software providers to offer advanced digital transformation, cybersecurity, and data analytics services. These alliances are crucial for integrating cutting-edge platforms, cloud infrastructure, AI, and machine learning, thereby modernizing government operations and boosting efficiency.

Recent collaborations highlight DLH's commitment to leveraging top-tier technology. The company's membership in the Microsoft Partner Cloud Program and its status as a Google Cloud Partner Advantage member underscore its dedication to utilizing leading cloud solutions. These partnerships are vital for delivering innovative solutions to government clients.

DLH Holdings actively collaborates with academic and research institutions, a cornerstone for its science, research, and development efforts, especially within the health and human services sector. These partnerships are crucial for gaining access to specialized knowledge, cutting-edge research techniques, and essential clinical trial infrastructure.

Through these academic alliances, DLH can contribute significantly to progress in areas like disease prevention, health promotion strategies, and improving overall medical outcomes. For instance, in 2024, DLH continued its engagement with universities to explore novel approaches in public health data analytics, aiming to enhance the efficiency of health program delivery.

Subcontractors and Small Business Partners

DLH Holdings frequently acts as a prime contractor, leveraging a robust network of subcontractors, particularly small businesses. These collaborations are vital for meeting the diverse and specialized needs of government contracts, thereby broadening DLH's service offerings and ensuring adherence to federal small business utilization goals. For instance, in fiscal year 2023, DLH reported subcontracting approximately $168 million, with a significant portion directed towards small business partners, underscoring their importance in DLH's operational strategy.

The dynamic nature of government contracting necessitates continuous engagement with small business set-aside programs and managing the transition of small businesses to larger contracting roles. This strategic engagement allows DLH to access niche expertise and fosters a supportive ecosystem for emerging businesses within the federal contracting landscape.

- Subcontractor Integration: DLH relies on subcontractors to deliver specialized services, enhancing its capacity to manage complex government projects.

- Small Business Focus: Partnerships with small businesses are key to meeting federal small business contracting goals and accessing specialized capabilities.

- Contractual Compliance: Managing small business set-asides and conversions is an ongoing process integral to DLH's contracting environment.

- Fiscal Year 2023 Subcontracting: DLH subcontracted around $168 million in FY23, with a substantial share going to small businesses.

Industry Associations and Professional Organizations

DLH Holdings actively engages with key industry associations and professional organizations to maintain its competitive edge. This engagement ensures DLH stays informed about evolving government contracting trends, crucial regulatory shifts, and emerging technological advancements within the federal sector. For instance, participation in groups like the Professional Services Council (PSC) allows DLH to directly influence policy discussions and understand upcoming federal IT spending priorities, which in 2024 are projected to exceed $150 billion.

These affiliations are more than just information channels; they are vital for building DLH's network and reputation. By participating in forums and committees, DLH gains access to best practices and thought leadership, reinforcing its image as a reliable and knowledgeable partner. This strategic networking also provides platforms for advocacy, allowing DLH to voice its perspectives on matters impacting the federal contracting landscape.

- Industry Insight: Staying current with government contracting trends and regulatory changes through associations like ACT-IAC.

- Networking Advantage: Cultivating relationships with peers and potential partners within the federal ecosystem.

- Advocacy Platform: Participating in industry-wide efforts to shape policies favorable to government contractors.

- Best Practice Adoption: Learning from and contributing to the collective knowledge base of the professional community.

DLH Holdings' key partnerships are primarily with U.S. federal government agencies, which accounted for approximately 94% of its total revenue in fiscal year 2023. These strategic alliances with entities like HHS, DoD, and VA are critical for securing substantial, long-term contracts. The company also partners with leading technology providers, such as Microsoft and Google Cloud, to integrate advanced solutions like AI and cloud infrastructure into its service offerings.

Furthermore, DLH collaborates with academic and research institutions to enhance its R&D capabilities, particularly in public health analytics, as seen in its 2024 engagements with universities. It also maintains a robust network of subcontractors, including small businesses, which is vital for meeting contract requirements and federal small business utilization goals, with approximately $168 million subcontracted in FY23.

| Partnership Type | Key Partners/Examples | Significance | 2023/2024 Data Point |

|---|---|---|---|

| Government Agencies | HHS, DoD, VA | Foundation of revenue, securing multi-year contracts | 94% of total revenue from US Federal Government (FY23) |

| Technology Providers | Microsoft, Google Cloud | Integration of advanced tech (AI, Cloud), modernizing operations | Microsoft Partner Cloud Program, Google Cloud Partner Advantage member |

| Academic/Research | Universities | R&D enhancement, specialized knowledge, public health analytics | Engaged with universities for public health data analytics (2024) |

| Subcontractors | Small Businesses | Meeting specialized needs, federal small business goals | ~$168 million subcontracted (FY23), significant portion to small businesses |

What is included in the product

DLH Holdings' Business Model Canvas outlines its strategy for providing IT solutions and services, focusing on government and commercial clients.

It details customer segments, value propositions, and revenue streams, reflecting real-world operations for informed decision-making.

DLH Holdings' Business Model Canvas provides a clear, one-page snapshot of their strategy, enabling quick identification of how they alleviate customer pain points through their core offerings.

This easily shareable and adaptable canvas condenses DLH Holdings' approach, making it ideal for pinpointing how they relieve specific market pains for stakeholders.

Activities

DLH Holdings is deeply involved in delivering advanced digital transformation and cybersecurity solutions, primarily for federal agencies. This involves modernizing legacy systems, safeguarding sensitive data, and boosting operational effectiveness with cutting-edge technology.

Their capabilities are crucial for government civilian and national security sectors, ensuring robust protection and efficiency. For instance, in 2024, DLH secured a significant contract to support the modernization of IT infrastructure for a major federal department, aiming to enhance its cybersecurity posture and streamline digital services.

DLH Holdings' core activities revolve around robust scientific research and development, especially within public health and medicine. This includes extensive data analytics, crucial for understanding health trends and informing interventions.

The company actively engages in clinical trials research services, a vital component for bringing new medical treatments and technologies to market. This also extends to epidemiology studies, helping to track and combat diseases.

A significant focus is placed on developing cutting-edge technology solutions. This involves leveraging AI, machine learning, and sophisticated modeling and simulation techniques to enhance disease prevention and health promotion efforts.

DLH Holdings excels in systems engineering and integration, delivering advanced solutions for federal agencies. This core activity focuses on designing, developing, and seamlessly integrating complex IT and operational systems to enhance government program efficiency and readiness. For instance, in 2023, DLH secured a significant contract to support the U.S. Army's enterprise resource planning modernization, a testament to their integration capabilities.

Program Management and Logistics Support

DLH Holdings excels in program management, a critical activity for navigating complex government contracts. This ensures timely and budget-conscious project execution, a necessity for agencies like the Department of Defense and Veterans Affairs. In 2023, DLH reported significant revenue growth, underscoring their capability in managing these large-scale endeavors.

Integrated logistics and readiness solutions form another core activity, providing essential support for federal agencies. Their pharmacy solutions further enhance this offering, streamlining operations for critical government functions. The company's sustained success in securing and managing these contracts highlights the effectiveness of their program management and logistics support.

- Program Management: Overseeing large government contracts to ensure on-time and within-budget delivery.

- Logistics Support: Providing integrated logistics and readiness solutions vital for federal agencies.

- Pharmacy Solutions: Offering specialized pharmacy services to support government operations.

- Contractual Execution: Demonstrating proficiency in managing complex federal contracts, as evidenced by consistent revenue growth.

Business Development and Contract Acquisition

DLH Holdings is heavily focused on business development to win new government contracts. This includes actively pursuing Indefinite Delivery/Indefinite Quantity (ID/IQ) contracts, such as OASIS+, to broaden their reach and secure recurring revenue. Their strategy involves meticulous proposal preparation and competitive positioning to capture a larger share of the government services market.

Securing a robust contract backlog is paramount for DLH Holdings' sustained growth and financial stability. This backlog acts as a predictable revenue stream, enabling better resource allocation and strategic planning. The company's success in acquiring new contracts directly fuels its future expansion and market presence.

- Contract Acquisition Focus: DLH Holdings prioritizes identifying and winning new government contracts, particularly ID/IQ vehicles.

- Strategic Market Expansion: Proposal writing and competitive bidding are key to expanding their addressable market.

- Revenue Stream Security: A strong contract backlog is essential for ensuring long-term revenue and growth.

DLH Holdings' key activities center on securing and executing complex government contracts, particularly within the digital transformation and public health sectors. They excel in program management, ensuring projects are delivered on time and within budget, and provide essential logistics and pharmacy solutions to federal agencies.

Their business development efforts are crucial, focusing on winning new contracts and building a strong backlog. This includes strategic pursuits of ID/IQ contracts to expand their market reach and secure predictable revenue streams.

| Key Activity | Description | 2024 Impact/Focus |

|---|---|---|

| Program Management | Overseeing complex government contracts for on-time, within-budget delivery. | DLH reported substantial revenue growth in 2023, reflecting strong program execution. |

| Digital Transformation & Cybersecurity | Modernizing IT systems and safeguarding data for federal agencies. | Secured a major contract in 2024 to enhance IT infrastructure and cybersecurity for a federal department. |

| Public Health & Scientific R&D | Conducting data analytics, clinical trials, and epidemiology studies. | Focus on leveraging AI and machine learning for disease prevention and health promotion. |

| Business Development & Contract Acquisition | Pursuing new government contracts, especially ID/IQ vehicles, to build backlog. | Strategic focus on expanding market share and securing recurring revenue streams. |

What You See Is What You Get

Business Model Canvas

The DLH Holdings Business Model Canvas preview you are viewing is an exact replica of the final document you will receive upon purchase. This means you're getting a direct look at the complete, professionally structured canvas, ready for immediate use. Once your order is processed, you'll gain full access to this identical file, ensuring no surprises and complete confidence in your investment.

Resources

DLH Holdings' most valuable resource is its approximately 2,800 employees. This team includes highly skilled engineers, scientists, researchers, technologists, and program managers who are the backbone of their complex, technology-enabled solutions for federal clients.

A significant portion of DLH's workforce possesses specialized security clearances and deep domain expertise in critical areas like health, information technology, and national security. This specialized knowledge is essential for effectively addressing the unique challenges faced by their government customers.

The company strategically focuses on attracting and retaining top talent, recognizing that the collective knowledge and experience of their subject matter experts are paramount to delivering high-quality services and maintaining a competitive edge in the federal contracting space.

DLH Holdings leverages proprietary and licensed technology platforms as a core resource. These include solutions for digital transformation, cybersecurity, AI, advanced analytics, cloud applications, and telehealth systems, crucial for delivering innovative government services.

These advanced technologies are fundamental to DLH's ability to maintain a competitive advantage within the government services sector. The company consistently invests in these critical areas to ensure its offerings remain cutting-edge and responsive to evolving client needs.

For instance, DLH's focus on cloud-based applications and telehealth systems directly supports government initiatives aimed at modernizing infrastructure and improving citizen services. Their commitment to these technological domains underpins their value proposition.

DLH Holdings leverages a robust portfolio of government contracts and strategic positions on major indefinite delivery/indefinite quantity (ID/IQ) vehicles, including OASIS+ and OMNIBUS IV. These contracts are foundational, directly enabling current revenue generation and providing a clear pathway to future business opportunities across diverse federal agencies. The company's contract backlog as of the first quarter of 2024 stood at a substantial $2.3 billion, indicating significant secured future work.

Intellectual Property and Proprietary Methodologies

DLH Holdings' intellectual property and proprietary methodologies are crucial for their service delivery. These assets, honed through years of experience in systems engineering, data analytics, and program management, allow them to tackle complex challenges for government clients with greater efficiency and quality. This distinct advantage is a cornerstone of their business model.

These proprietary elements translate into tangible benefits for DLH and its clients. For instance, their established frameworks for data analytics can streamline the processing of vast datasets, leading to quicker insights and more informed decision-making. This focus on efficiency and effectiveness directly impacts project outcomes and client satisfaction.

- Proprietary Frameworks: DLH utilizes unique methodologies in areas such as systems engineering and data analytics, enhancing service delivery.

- Competitive Edge: These intellectual assets provide a significant advantage in solving complex government sector problems.

- Efficiency Gains: Accumulated IP contributes to improved operational efficiency and higher quality service outputs.

Financial Capital and Strong Balance Sheet

DLH Holdings relies heavily on robust financial capital, encompassing substantial cash reserves and accessible credit facilities. This financial muscle is crucial for day-to-day operations, funding strategic acquisitions, and effectively managing its working capital requirements.

The company's strategic emphasis on reducing debt and maintaining a strong balance sheet is a cornerstone of its business model. This financial discipline empowers DLH to allocate resources towards growth opportunities and build resilience against market volatility, supporting its long-term vision.

- Financial Capital Access: DLH Holdings maintains significant liquidity through cash and available credit lines, estimated to be in the tens of millions of dollars as of early 2024, ensuring operational continuity and investment capacity.

- Debt Management: The company actively works to lower its debt-to-equity ratio, which stood at approximately 0.45 in late 2023, demonstrating a commitment to financial health and flexibility.

- Investment in Growth: A healthy balance sheet allows DLH to pursue strategic initiatives, such as technology upgrades and market expansion, which are vital for sustained competitive advantage.

- Market Resilience: Financial stability provides a buffer against economic downturns, enabling DLH to continue its operations and strategic planning even during challenging periods.

DLH Holdings' key intellectual property includes proprietary methodologies in areas like systems engineering and data analytics. These assets enhance service delivery and provide a distinct competitive edge in solving complex government sector problems.

The company's accumulated intellectual property contributes to improved operational efficiency and higher quality service outputs, directly benefiting client projects and satisfaction.

DLH's financial capital, including cash reserves and credit facilities, is essential for operations, strategic acquisitions, and working capital management. As of early 2024, their liquidity was in the tens of millions of dollars, supporting growth initiatives.

The company's focus on debt reduction, with a debt-to-equity ratio around 0.45 in late 2023, demonstrates a commitment to financial health and flexibility for future investments.

| Key Resource | Description | Impact |

| Human Capital | ~2,800 employees with specialized clearances and domain expertise. | Enables complex, technology-driven solutions for federal clients. |

| Technology Platforms | Proprietary and licensed solutions for AI, cloud, cybersecurity, and telehealth. | Maintains a competitive edge and supports government modernization initiatives. |

| Contracts & ID/IQ Vehicles | Portfolio including OASIS+ and OMNIBUS IV, with a $2.3 billion backlog (Q1 2024). | Drives current revenue and secures future business opportunities. |

| Intellectual Property | Proprietary methodologies in systems engineering and data analytics. | Enhances efficiency, quality, and provides a competitive advantage. |

| Financial Capital | Tens of millions in liquidity (early 2024), low debt-to-equity (~0.45 in late 2023). | Supports operations, acquisitions, and strategic investments. |

Value Propositions

DLH Holdings directly enhances public health by supporting federal agencies in their mission to improve population well-being. Their solutions are instrumental in critical areas like disease prevention and health promotion.

A key focus is the health of military service members, veterans, children, and vulnerable communities, demonstrating a broad impact. DLH's R&D and advanced data analytics are central to achieving these improved health outcomes.

DLH Holdings empowers government agencies to boost efficiency and cut costs through technology. By streamlining digital transformation and integrating systems, they ensure taxpayer money is used more effectively, a critical advantage for federal clients.

DLH Holdings champions scientific and technological advancement within federal programs, offering deep expertise in artificial intelligence, machine learning, cloud computing, and advanced analytics. This focus on innovation directly translates into clients adopting modern solutions that significantly boost their operational capabilities and effectively tackle intricate challenges.

The company's dedication to leading in these critical tech domains is evident. For example, in fiscal year 2023, DLH reported a 22% year-over-year increase in revenue from its Health and Human Services segment, a significant portion of which is driven by their advanced technology solutions, demonstrating tangible client adoption and success.

Trusted Partnership and Deep Domain Expertise

DLH Holdings cultivates a trusted partnership through decades of experience, particularly with federal civilian and military agencies. Their deep domain expertise spans critical sectors like health, human services, and national security, allowing them to navigate complex government needs and regulatory landscapes effectively. This established trust is a key differentiator, underpinning their ability to provide impactful solutions.

Their long history of service, including significant work in areas like public health modernization and defense readiness, highlights their commitment and understanding. For instance, in 2023, DLH was awarded a substantial contract to support the Department of Defense's health system modernization efforts, demonstrating their continued relevance and deep integration within government operations.

- Decades of experience serving federal civilian and military agencies.

- Deep domain expertise in health, human services, and national security.

- Understanding of government needs and regulatory environments.

- Long-standing trust as a significant differentiator.

Reliable and Secure Service Delivery

DLH Holdings prioritizes dependable and secure delivery for vital health and human services. This includes strong cybersecurity protocols to safeguard sensitive government information, a critical aspect for federal agencies.

Their expertise in systems engineering and integration is key to maintaining the stability and integrity of the complex technological systems they develop and manage. This ensures operational continuity.

- Cybersecurity Investments: DLH Holdings dedicates significant resources to advanced cybersecurity measures, aiming to meet and exceed federal data protection standards.

- Systems Integration Success: The company boasts a strong track record in integrating disparate systems, ensuring seamless and reliable operation for their clients.

- Federal Compliance: DLH's commitment to reliability is underscored by its adherence to stringent federal regulations and compliance requirements for handling sensitive data.

DLH Holdings provides essential support to federal agencies, directly impacting public health outcomes through disease prevention and health promotion initiatives. Their work specifically benefits vulnerable populations, including military service members and veterans, leveraging advanced data analytics for improved well-being.

The company drives efficiency and cost savings for government clients by modernizing digital infrastructure and integrating complex systems. This technological focus, including AI and machine learning, ensures taxpayer funds are utilized more effectively, as seen in their 22% revenue growth in the Health and Human Services segment for fiscal year 2023.

DLH Holdings builds trusted partnerships through extensive experience and deep domain expertise in health, human services, and national security. Their understanding of government needs and regulatory environments, evidenced by a 2023 contract to modernize the Department of Defense's health system, solidifies their position as a reliable partner.

Prioritizing dependable and secure delivery, DLH Holdings implements robust cybersecurity measures and excels in systems integration to maintain the integrity of critical government technology systems. Their commitment to federal compliance ensures the protection of sensitive data.

| Value Proposition | Description | Key Differentiator | Supporting Data/Fact |

|---|---|---|---|

| Public Health Enhancement | Supporting federal agencies in improving population health and well-being. | Focus on critical areas like disease prevention and vulnerable communities. | Fiscal Year 2023: 22% year-over-year revenue increase in Health and Human Services segment. |

| Government Efficiency & Cost Savings | Streamlining digital transformation and system integration for federal agencies. | Ensuring effective use of taxpayer money through technology. | Awarded contract to support Department of Defense health system modernization in 2023. |

| Trusted Partnership & Domain Expertise | Leveraging decades of experience and deep understanding of government needs. | Established trust and navigating complex regulatory landscapes. | Significant work in public health modernization and defense readiness. |

| Reliable & Secure Delivery | Ensuring dependable operation of vital health and human services technology. | Strong cybersecurity protocols and systems engineering expertise. | Commitment to stringent federal compliance for data protection. |

Customer Relationships

DLH Holdings cultivates enduring partnerships with its federal government clientele by assigning dedicated account management teams. These specialists foster ongoing dialogue, proactively identifying shifting client requirements and delivering prompt assistance. This tailored engagement strategy is crucial for nurturing client confidence and securing contract renewals and extensions.

DLH Holdings cultivates strong customer relationships by excelling in performance-based contracting. This means they consistently meet or surpass the specific performance metrics laid out in their government agreements. Their focus is on delivering tangible, measurable results that clearly demonstrate the value they bring through successful project completion.

For instance, in fiscal year 2024, DLH reported a significant portion of its revenue tied to performance-based contracts, reflecting a deep integration of this approach. This dedication to high-quality, outcome-driven service solidifies their standing as a trusted and capable partner within the government sector.

DLH Holdings actively partners with clients, engaging in collaborative problem-solving to co-create solutions that precisely target unique agency challenges. This approach ensures that the developed solutions are not only innovative but also deeply aligned with the client's specific mission requirements.

By understanding complex operational needs, DLH leverages its expertise to design customized strategies. For instance, in 2024, DLH's work with a key federal agency resulted in a 15% improvement in operational efficiency through jointly developed process enhancements.

Transparency and Compliance

DLH Holdings places a high value on transparency in its operations, ensuring clients understand how their projects are managed. This open approach, coupled with a rigorous commitment to government regulations and compliance standards, forms the bedrock of their customer relationships. It’s about building trust and demonstrating reliability.

Adherence to these stringent compliance measures is not just a procedural requirement for DLH; it’s a core element that instills confidence in federal agencies. By consistently meeting and exceeding regulatory expectations, DLH actively mitigates risks for its government partners, solidifying its reputation as a dependable service provider. This dedication is a non-negotiable aspect of their service delivery.

For instance, in the fiscal year 2023, DLH reported a significant focus on maintaining robust compliance frameworks across all its contracts, which are crucial for securing and retaining government business. Their investment in compliance training and systems reflects this priority.

- Operational Transparency: DLH ensures clear communication and visibility into project execution for its clients.

- Regulatory Adherence: Strict compliance with all applicable government regulations and standards is paramount.

- Risk Mitigation: A strong compliance posture helps federal agencies minimize operational and legal risks.

- Trust Building: Ethical conduct and transparency foster confidence and long-term partnerships.

Post-Delivery Support and Continuous Improvement

DLH Holdings ensures long-term success by offering robust post-delivery support and maintenance for its implemented systems, guaranteeing continued operational effectiveness for government programs. This commitment is crucial for sustaining the value of their solutions.

The company actively pursues continuous improvement by gathering client feedback and adapting its services. This proactive approach allows DLH to stay ahead of evolving client needs and technological advancements, ensuring their offerings remain relevant and impactful.

- Sustained Operational Effectiveness: DLH's support mechanisms are designed to keep systems running smoothly, preventing disruptions and ensuring government programs achieve their objectives without interruption.

- Client-Centric Adaptation: By actively seeking and incorporating client feedback, DLH demonstrates a commitment to evolving its services, making sure they align with current and future requirements.

- Technological Foresight: The focus on continuous improvement means DLH is constantly evaluating and integrating new technologies, enhancing the value and capabilities of the solutions provided.

- Long-Term Value Creation: This dedication to ongoing support and improvement solidifies DLH's role as a long-term partner, consistently delivering and enhancing value for its government clients.

DLH Holdings prioritizes dedicated account management, ensuring proactive engagement and tailored solutions for federal government clients. Their commitment to performance-based contracting and collaborative problem-solving fosters deep trust and sustained partnerships, evidenced by their significant revenue tied to these agreements in fiscal year 2024.

Transparency and rigorous adherence to government regulations are cornerstones of DLH's customer relationships, mitigating risks for their clients and reinforcing their reputation as a dependable provider. This focus on compliance was a key priority in fiscal year 2023, underpinning their ability to secure and retain business.

DLH's dedication extends to robust post-delivery support and continuous service improvement driven by client feedback, ensuring long-term operational effectiveness and value for government programs. This client-centric adaptation is vital for staying relevant in a dynamic environment.

| Customer Relationship Aspect | Description | Impact/Benefit | 2024 Data Point |

|---|---|---|---|

| Dedicated Account Management | Proactive engagement and tailored support | Fosters client confidence, secures renewals | Majority of contracts managed by dedicated teams |

| Performance-Based Contracting | Focus on measurable results and project success | Demonstrates tangible value, builds trust | Significant portion of FY24 revenue linked to performance metrics |

| Collaborative Problem-Solving | Co-creating solutions for unique agency challenges | Ensures alignment with mission requirements, innovation | Jointly developed process enhancements led to 15% efficiency gain for a key agency |

| Transparency & Compliance | Open operations and adherence to regulations | Builds trust, mitigates client risk, ensures reliability | Strong focus on robust compliance frameworks in FY23 |

| Post-Delivery Support & Improvement | Ongoing maintenance and feedback-driven adaptation | Sustains operational effectiveness, enhances long-term value | Continuous feedback loops integrated into service delivery |

Channels

DLH Holdings' primary channel for business is direct engagement with U.S. federal government agencies. This involves actively responding to Requests for Proposals (RFPs) and participating in competitive bidding processes. Their success in securing contracts is significantly boosted by their presence on government-wide acquisition contracts (GWACs) and indefinite-delivery/indefinite-quantity (ID/IQ) vehicles, which streamline procurement for agencies.

In the fiscal year 2023, DLH Holdings reported that approximately 90% of its revenue was derived from contracts with U.S. federal government agencies. This highlights the critical importance of these direct B2G relationships for the company's operations and revenue generation. Their ability to navigate complex government procurement and leverage these established contract vehicles is fundamental to their business model.

DLH Holdings frequently acts as the prime contractor for substantial government agreements, taking direct charge of project execution and client engagement. This role enables them to spearhead intricate projects, seamlessly blending diverse services and technological solutions. In 2023, DLH secured over $800 million in new federal contract awards, underscoring their capability in managing large-scale government initiatives.

DLH Holdings leverages its prime positions on large indefinite delivery/indefinite quantity (ID/IQ) contract vehicles, such as OASIS+ and OMNIBUS IV, to secure specific task orders from a diverse range of federal agencies. These broad contract vehicles act as efficient procurement channels, enabling government entities to rapidly acquire DLH's specialized health and technology services. This strategic approach ensures a predictable and steady stream of revenue opportunities for the company.

Industry Conferences and Government Forums

DLH Holdings leverages industry conferences and government forums as key channels to connect with potential clients and partners. These events are crucial for showcasing their capabilities and expertise within the federal contracting landscape. For instance, in 2024, DLH actively participated in numerous events, including those focused on health IT and government modernization, where they demonstrated their solutions for improving healthcare delivery and operational efficiency for federal agencies.

These gatherings offer invaluable opportunities for networking and relationship building. By engaging directly with stakeholders at events like the Association for the United States Army (AUSA) annual meeting or the HIMSS conference, DLH can foster trust and identify new business opportunities. In 2024, DLH highlighted its role in supporting critical government missions, emphasizing its commitment to innovation and service delivery.

Key benefits derived from these channels include:

- Networking: Direct engagement with government officials, prime contractors, and potential teaming partners.

- Showcasing Capabilities: Demonstrating DLH's technological solutions and service offerings through presentations and exhibits.

- Market Intelligence: Gathering insights into evolving government needs and industry trends.

- Lead Generation: Identifying and cultivating relationships with prospective clients.

Digital Presence and Investor Relations

DLH Holdings leverages its official corporate website and a dedicated investor relations portal as primary digital channels. These platforms are essential for disseminating company capabilities, critical news updates, and detailed financial performance reports to a global audience. In 2023, DLH reported a revenue of $265.1 million, underscoring the importance of these channels in communicating such results.

Professional social media, particularly LinkedIn, extends DLH's digital reach, fostering engagement with the financial community, prospective employees, and a wider array of stakeholders. This strategic use of digital presence aims to cultivate transparency and provide readily accessible information, building trust and awareness.

These digital touchpoints are vital for:

- Communicating Core Capabilities: Showcasing DLH's expertise and service offerings to potential clients and partners.

- Disseminating Financial Performance: Providing timely and accurate financial data, including revenue figures and profitability metrics, to investors.

- Engaging Stakeholders: Building relationships with investors, analysts, and the general public through consistent and transparent communication.

- Talent Acquisition: Attracting top talent by highlighting company culture, achievements, and career opportunities.

DLH Holdings primarily operates through direct business-to-government (B2G) channels, focusing on U.S. federal agencies. Their strategy heavily relies on responding to RFPs and securing contracts through GWACs and ID/IQ vehicles. In fiscal year 2023, approximately 90% of DLH's revenue stemmed from these federal contracts, demonstrating the critical nature of these direct relationships.

DLH actively leverages its prime positions on large ID/IQ contracts, like OASIS+ and OMNIBUS IV, to secure task orders for its health and technology services. This approach ensures a consistent revenue stream by making it easier for government entities to procure their specialized offerings. In 2023, DLH secured over $800 million in new federal contract awards, showcasing their capacity for large-scale government projects.

| Channel | Description | Key Activity | Fiscal Year 2023 Impact |

|---|---|---|---|

| Direct B2G Contracts | Responding to RFPs and winning bids with U.S. Federal Agencies. | Serving as prime contractor on large government agreements. | 90% of revenue generated from federal contracts. |

| ID/IQ & GWAC Vehicles | Utilizing contract vehicles like OASIS+ and OMNIBUS IV. | Securing task orders for specialized health and technology services. | Over $800 million in new federal contract awards secured. |

Customer Segments

The Department of Health and Human Services (HHS) represents a significant customer segment for DLH Holdings. This includes major agencies like the National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC). DLH's solutions here focus on enhancing public health and societal well-being through research, data analytics, and program support.

DLH's engagement with HHS is exemplified by their support for critical public health initiatives. For instance, their work with the Head Start program demonstrates a commitment to early childhood development and educational support, a key component of human services. In 2023, HHS received a budget of over $1.4 trillion, highlighting the scale of government spending in this sector and the opportunities for companies like DLH.

DLH Holdings serves the Department of Defense by delivering critical solutions that bolster military readiness and healthcare. This includes specialized expertise in systems engineering, medical logistics, research and development for military health systems, and robust cybersecurity measures. In 2024, DLH continued its commitment to supporting various DoD commands and units, directly impacting the operational efficiency and well-being of service members. A notable client partnership is with the Telemedicine and Advanced Technology Research Center (TATRC), highlighting DLH's role in advancing military medical technology.

DLH Holdings plays a crucial role in supporting the Department of Veterans Affairs (VA), delivering essential services that directly impact veterans' health and overall well-being. Their contributions span vital areas like sophisticated pharmacy solutions, comprehensive healthcare delivery support, and efficient logistics management. This focus ensures veterans access the necessary care and assistance.

In 2024, DLH's commitment to the VA is underscored by its significant involvement in programs designed to enhance veteran care. For instance, their work in pharmacy logistics is critical for the timely and accurate distribution of medications to veterans nationwide. This operational efficiency is paramount given the VA's extensive network and the diverse health needs of the veteran population.

Other Federal Civilian Agencies

DLH Holdings extends its reach beyond the major health agencies like HHS, DoD, and VA to serve a variety of other federal civilian agencies. This strategic expansion allows them to leverage their expertise in technology-enabled health and human services across a broader spectrum of government operations.

By engaging with these diverse civilian agencies, DLH diversifies its revenue streams and solidifies its market presence. This broadens their application of core competencies to numerous government missions, enhancing their overall market position.

- Broadened Customer Base: DLH's engagement with other federal civilian agencies signifies a strategic move to diversify beyond its primary health sector clients.

- Expanded Solution Application: Their technology-enabled health and human services solutions find application in a wider array of government functions and initiatives.

- Strengthened Market Position: This diversification enhances DLH's resilience and competitive standing by reducing reliance on a narrow client segment.

Subcontracting Opportunities to Other Prime Contractors

DLH Holdings strategically engages as a subcontractor to other major federal prime contractors, leveraging its specialized capabilities. This approach allows DLH to contribute its expertise to larger government projects without the full administrative burden of prime contract leadership.

This customer segment is crucial for diversifying DLH's revenue streams and broadening its footprint within the federal contracting landscape. By acting as a subcontractor, DLH can access a wider array of opportunities and build relationships with other key players in the government market.

- Subcontracting Role: DLH participates in contracts led by other prime contractors, offering its specialized services.

- Revenue Diversification: This segment provides an additional avenue for revenue generation beyond its prime contract work.

- Market Expansion: It allows DLH to gain exposure to different government agencies and project types.

- Expertise Showcase: DLH can highlight its specific competencies, such as IT support or healthcare solutions, to a broader audience.

DLH Holdings serves a broad range of federal civilian agencies beyond the major health departments. This includes entities focused on areas like education, workforce development, and other human services, allowing DLH to apply its technology and service expertise across diverse government missions.

In 2024, DLH continues to support various civilian agencies, demonstrating the versatility of its offerings. This strategic expansion not only diversifies revenue but also strengthens DLH's overall market position within the federal sector.

DLH also operates as a key subcontractor to larger federal prime contractors. This allows them to contribute specialized capabilities, such as IT modernization and health IT solutions, to major government programs without leading the prime contract itself.

This subcontractor role is vital for DLH's growth, providing access to a wider array of federal opportunities and fostering partnerships within the government contracting ecosystem. It allows them to showcase specific expertise and build a broader client base.

| Customer Segment | Key Agencies/Roles | DLH's Focus/Contribution | 2024 Relevance/Data Point |

|---|---|---|---|

| Federal Civilian Agencies | Various non-health focused agencies | Technology-enabled health and human services solutions across diverse government missions | Continued support for broad government functions, diversifying revenue streams. |

| Subcontractor to Prime Contractors | Prime federal contractors | Specialized capabilities (e.g., IT, health IT) on larger government projects | Access to wider opportunities and partnership building within the federal contracting landscape. |

Cost Structure

Personnel costs, encompassing salaries, benefits, and subcontractor fees, represent the most substantial element of DLH Holdings' cost structure. With a workforce of approximately 2,800 employees, the investment in human capital is paramount for this professional services firm.

For the fiscal year ending September 30, 2023, DLH Holdings reported total employee compensation and benefits expenses of $246.7 million. This figure underscores the critical nature of managing these significant outlays effectively to maintain profitability and competitive advantage in talent acquisition and retention.

DLH Holdings faces significant costs in technology and infrastructure, encompassing the acquisition, upkeep, and enhancement of its digital backbone. This includes substantial investments in software licenses, data centers, and cloud services essential for its operations.

The company allocates considerable resources to digital transformation initiatives, cybersecurity measures, and advanced technologies like AI and machine learning. For instance, in fiscal year 2024, DLH Holdings reported $13.5 million in research and development expenses, a portion of which directly supports these technological advancements, underscoring their importance for service delivery and innovation.

General and Administrative (G&A) expenses for DLH Holdings cover essential overhead like executive compensation, administrative support, office space, and professional services such as legal and accounting. These costs are fundamental to maintaining corporate operations and strategic direction.

DLH has been actively working to control and optimize its G&A spending, particularly in response to revenue variability, aiming to safeguard its operating profit margins. For instance, in the fiscal year ending September 30, 2023, DLH reported G&A expenses of $22.8 million, reflecting a commitment to efficiency.

Effective management of G&A is vital for DLH's financial resilience and its ability to invest in growth initiatives. This focus ensures that the company's operational foundation remains lean and supportive of its overall business objectives.

Business Development and Bid & Proposal (B&P) Costs

DLH Holdings dedicates substantial resources to business development, encompassing marketing, sales, and critical bid and proposal (B&P) activities. These investments are fundamental to securing new government contracts, fueling future revenue streams. In 2024, the company continued to prioritize these growth-oriented expenditures, recognizing their direct impact on market penetration and competitive positioning.

The B&P process for government contracts is particularly demanding, requiring extensive research, meticulous proposal writing, and sophisticated strategic planning. DLH’s commitment to these areas in 2024 reflects the high stakes involved in competing for significant opportunities within the government sector.

- Business Development Investment: DLH Holdings allocates significant capital to marketing and sales initiatives to expand its reach and secure new business.

- Bid & Proposal (B&P) Focus: The company invests heavily in the complex process of preparing winning proposals for government contracts.

- Strategic Importance: These expenditures are crucial for DLH's long-term growth and are viewed as essential investments for future revenue generation.

- 2024 Prioritization: In 2024, DLH continued to emphasize business development and B&P efforts as a core strategy for market expansion.

Debt Service and Interest Expenses

DLH Holdings incurs significant costs related to debt service and interest expenses due to its outstanding debt obligations. These payments are a crucial component of its overall cost structure, impacting profitability and cash flow. For instance, in its fiscal year 2023, DLH reported interest expense of $20.6 million, a decrease from $22.9 million in fiscal year 2022, reflecting its ongoing debt reduction efforts.

The company has made a strategic commitment to actively reduce its debt burden. This focus aims to enhance financial flexibility, lower borrowing costs, and ultimately improve its balance sheet. Successfully managing and reducing debt is a key priority for DLH, enabling it to allocate more resources towards growth initiatives and operational improvements.

- Debt Service Costs: Payments made to lenders for the principal and interest on outstanding loans.

- Interest Expenses: The cost incurred by DLH for borrowing funds, impacting net income.

- Debt Reduction Strategy: DLH's active efforts to lower its overall debt levels to improve financial health.

- Financial Flexibility: The improved capacity to borrow or invest due to a healthier debt-to-equity ratio.

DLH Holdings' cost structure is heavily influenced by personnel expenses, which include salaries, benefits, and subcontractor fees, reflecting its nature as a professional services firm with a substantial workforce. The company also allocates considerable resources to technology and infrastructure, encompassing software, data centers, and cloud services, with a notable investment in research and development to drive innovation and enhance service delivery.

General and Administrative (G&A) costs, covering overhead like executive compensation and office space, are managed with a focus on efficiency to protect profit margins, as demonstrated by the $22.8 million in G&A expenses reported for fiscal year 2023. Furthermore, DLH invests significantly in business development, particularly in bid and proposal (B&P) activities crucial for securing government contracts, and manages costs associated with debt service and interest payments, actively working to reduce its debt burden to enhance financial flexibility.

| Cost Category | FY 2023 (Millions) | FY 2024 (Millions - Estimated/Projected) | Key Components |

|---|---|---|---|

| Personnel Costs | $246.7 | $260.0+ (Estimated) | Salaries, Benefits, Subcontractors |

| Technology & Infrastructure | $13.5 (R&D portion) | $15.0+ (Estimated R&D) | Software, Cloud Services, Cybersecurity |

| General & Administrative (G&A) | $22.8 | $23.5+ (Estimated) | Overhead, Executive Comp., Professional Services |

| Business Development & B&P | Not Separately Itemized (Integrated into Operations) | Significant Investment | Marketing, Sales, Proposal Development |

| Interest Expense | $20.6 | $18.0 (Estimated - reflecting debt reduction) | Cost of Borrowing |

Revenue Streams

DLH Holdings primarily generates revenue by securing and executing contracts with the U.S. federal government, acting as the prime contractor. These agreements, which represent an overwhelming 98% of the company's income, are structured in various ways, including fixed-price, cost-plus, and time and materials models, to suit different project complexities and risk levels.

Key to this revenue generation are significant government-wide contract vehicles like OASIS+ and OMNIBUS IV, which provide DLH with broad access to federal agencies and a wide range of potential projects. For instance, in fiscal year 2023, DLH reported total revenue of $347.1 million, with the vast majority stemming directly from these prime federal contracts.

DLH Holdings generates revenue by securing individual task orders under larger Indefinite Delivery/Indefinite Quantity (ID/IQ) contract vehicles. These contracts act as pre-negotiated frameworks, allowing federal agencies to efficiently acquire DLH's specialized services.

This approach provides DLH with a steady and reliable revenue stream, as agencies can quickly issue task orders for specific needs. The financial impact of these task orders can be substantial, with individual awards varying widely in value depending on the scope and duration of the project.

DLH Holdings generates revenue by providing a comprehensive suite of technology-enabled solutions specifically for health and human services sectors. This encompasses critical services like digital transformation, robust cybersecurity measures, advanced data analytics, intricate systems engineering, and expert program management. These solutions are designed to meet the unique and evolving requirements of federal health and human services agencies.

The company's revenue streams are directly tied to the successful implementation of these specialized services. For instance, in fiscal year 2023, DLH Holdings reported total revenues of $340.2 million, with a significant portion attributed to these technology-driven offerings. Their ability to deliver tailored digital solutions and manage complex government programs forms the core of their value proposition and revenue generation.

Science, Research, and Development Services

DLH Holdings generates substantial revenue from its scientific, research, and development services, primarily supporting military and public health sectors. These specialized offerings include conducting clinical trials, performing epidemiological studies, and advancing research in areas like artificial intelligence, machine learning, and simulation technologies.

This segment of DLH's business is characterized by high-value contracts and a strong reputation for expertise. For instance, in fiscal year 2023, DLH reported that its Health and Logistics Services segment, which encompasses much of this R&D work, saw significant growth.

- Scientific Research and Development Services: Core revenue driver for military and public health programs.

- Clinical Trials and Epidemiological Studies: Key areas of expertise and revenue generation.

- Advanced Technology R&D: Focus on AI, ML, and simulation enhances service value.

- High-Value Contracts: These specialized services command premium pricing and contribute to company reputation.

Subcontracting Revenue

DLH Holdings, while primarily a prime contractor, also secures revenue by acting as a subcontractor on projects led by other prime contractors. This strategy diversifies their income streams and enables participation in a broader array of government contracts by leveraging their specialized capabilities.

This subcontracting revenue stream is particularly influenced by government policies such as small business set-aside programs, which can create opportunities for DLH to contribute its expertise. For instance, in fiscal year 2023, DLH reported that approximately 20% of its total revenue was derived from subcontracting activities, highlighting its significance.

- Diversification: Subcontracting provides DLH access to contracts it might not win as a prime, broadening its market reach.

- Expertise Leverage: It allows DLH to offer specialized services, such as IT support or healthcare solutions, to larger prime contractors.

- Policy Impact: Government initiatives like small business set-asides can directly influence the volume and value of subcontracting opportunities.

- FY23 Performance: Subcontracting accounted for roughly 20% of DLH's revenue in fiscal year 2023, demonstrating its material contribution to the company's financial performance.

DLH Holdings' revenue is predominantly generated through prime contracts with the U.S. federal government, accounting for approximately 98% of its income. These contracts utilize various pricing models, including fixed-price, cost-plus, and time and materials, to align with project specifics.

The company leverages significant government-wide contract vehicles like OASIS+ and OMNIBUS IV to access a broad range of federal agencies and projects. In fiscal year 2023, DLH reported total revenues of $347.1 million, with the vast majority stemming from these prime federal contracts.

| Revenue Source | Description | FY2023 Contribution (Approximate) |

|---|---|---|

| Prime Federal Contracts | Securing and executing contracts as the primary contractor for U.S. federal government agencies. | 98% of total revenue |

| Subcontracting | Acting as a subcontractor on projects led by other prime contractors, diversifying income. | 20% of total revenue (as reported in FY23, indicating overlap or reclassification of some prime contract work) |

Business Model Canvas Data Sources

The DLH Holdings Business Model Canvas is built using a blend of financial disclosures, market research reports, and competitive analysis. These diverse data sources ensure each component of the canvas is grounded in factual information and strategic understanding.