DLH Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DLH Holdings Bundle

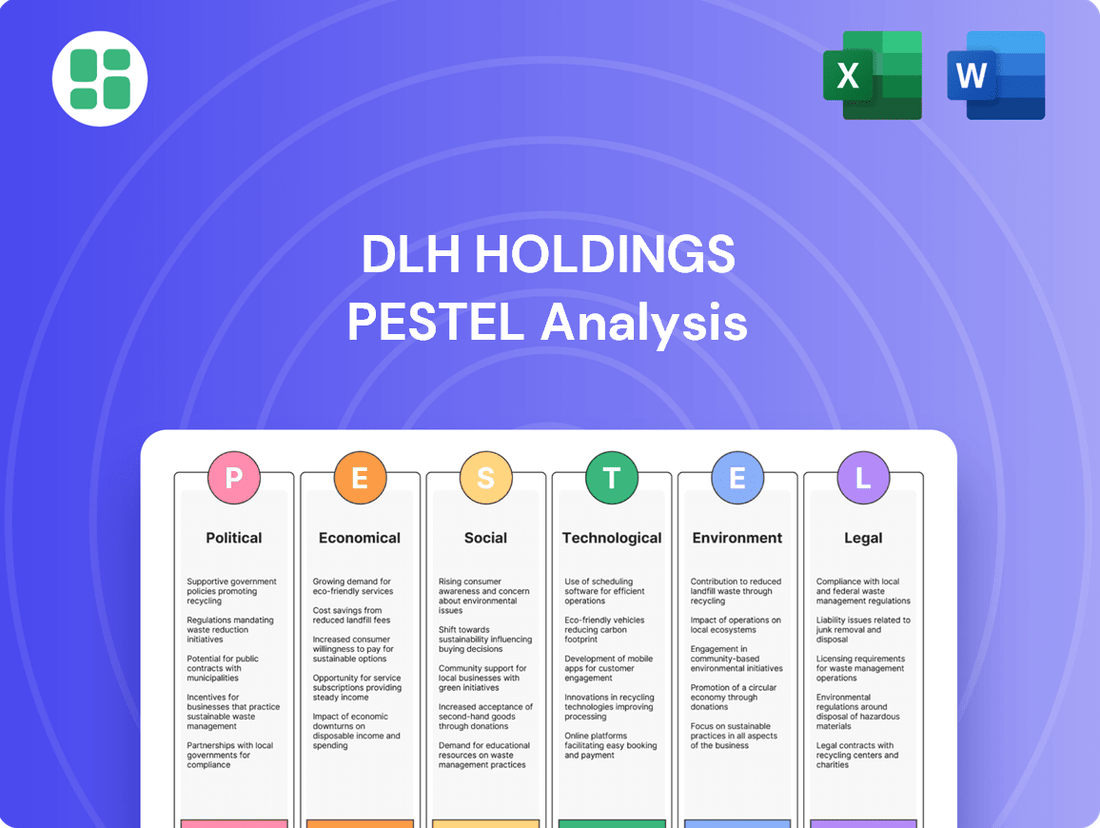

Uncover the critical political, economic, social, technological, legal, and environmental factors influencing DLH Holdings' trajectory. This comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and anticipate future challenges. Gain a strategic advantage by understanding these external forces—download the full report now.

Political factors

DLH Holdings Corp.'s revenue is intrinsically tied to government spending, with significant reliance on contracts from the Department of Health and Human Services and the Department of Defense. Changes in federal budget allocations for public health, defense, and IT modernization directly influence the company's financial performance and expansion prospects.

The proposed U.S. federal budget for fiscal year 2025 signals a strategic increase in investments toward cybersecurity and digital transformation initiatives. This projected spending aligns favorably with DLH's core service portfolio, suggesting potential for enhanced contract opportunities and revenue growth in these key areas.

Changes in federal healthcare policies, particularly those affecting Medicare and Medicaid, directly influence demand for DLH's services. For example, the Centers for Medicare & Medicaid Services (CMS) projected Medicare spending to reach $1.1 trillion in 2024, a figure that could be impacted by policy adjustments. These shifts can redefine contract scopes and create new opportunities or challenges for companies like DLH that support public health programs.

Defense strategy shifts also play a crucial role, altering the technological and service requirements for the Department of Defense. The U.S. defense budget for fiscal year 2025 is anticipated to be substantial, with specific allocations for modernization and innovation. DLH's ability to adapt its offerings to evolving defense priorities, such as cybersecurity or advanced analytics, will be key to its performance in this sector.

The proposed reorganization of the U.S. Department of Health and Human Services in 2025 is a significant political factor that could reshape program focus and funding streams. Such structural changes often lead to adjustments in how government contracts are awarded and managed, potentially impacting DLH's existing contracts and future business development efforts within the health sector.

Federal procurement regulations are a significant political factor for DLH Holdings. Executive orders aimed at increasing small business set-asides or unbundling large contracts can directly impact DLH's access to and retention of substantial government business. For instance, a prior administration's push to unbundle contracts, as noted by DLH, can fragment service delivery and hinder the integrated solutions the company provides.

Political Stability and Government Shutdowns

Political stability is a significant concern for DLH Holdings, particularly given its reliance on government contracts. Uncertainty surrounding legislative processes can directly impact the company's revenue streams and project timelines. For instance, the risk of government shutdowns, which have occurred periodically, can lead to significant disruptions.

The 2024 fiscal year saw continued budget negotiations, and the potential for continuing resolutions rather than full appropriations bills creates an environment of uncertainty for federal contractors like DLH. This can delay contract awards and funding disbursements, directly affecting operational continuity and financial planning. The Congressional Budget Office projected that federal spending could be impacted by such delays.

- Government shutdowns can halt contract processing and payments, directly impacting DLH's cash flow.

- Delays in appropriations bills for fiscal year 2025 could extend uncertainty for federal IT and healthcare services sectors where DLH operates.

- A prolonged period of political gridlock in Washington D.C. might slow down the awarding of new contracts, a key growth driver for DLH.

- Changes in administration or legislative priorities following elections can also introduce political risk, potentially altering contract landscapes.

International Relations and National Security Focus

Geopolitical events and the U.S. government's heightened focus on national security are directly impacting defense spending. This trend is particularly beneficial for companies like DLH Holdings, which specialize in advanced technology and cybersecurity solutions. For instance, the U.S. Department of Defense's budget for fiscal year 2024 included significant allocations towards modernization and cybersecurity initiatives, reflecting this strategic pivot. DLH's expertise in these critical areas positions it to capitalize on this increased demand.

The escalating landscape of cyber threats and the continuous evolution of defense strategies are causing a redirection of government contracts. These shifts are increasingly favoring firms possessing specialized engineering and robust cyber capabilities. DLH Holdings, with its demonstrated strengths in these domains, is well-positioned for substantial growth as these market dynamics unfold. The company's ability to provide tailored solutions for complex defense needs is a key differentiator.

- Defense Spending Growth: U.S. defense spending is projected to remain robust, with a particular emphasis on technology and cybersecurity.

- Cybersecurity Imperative: Increased cyber threats necessitate advanced solutions, a core area of DLH's expertise.

- Contract Reallocation: Government contracts are increasingly being awarded to firms with specialized engineering and cyber capabilities.

- DLH's Strategic Advantage: The company's focus aligns with current national security priorities, creating a favorable growth environment.

Government budget priorities significantly shape DLH Holdings' revenue streams, with federal spending on health and defense being paramount. The U.S. federal budget for fiscal year 2025 indicates increased investment in cybersecurity and digital transformation, areas where DLH excels, suggesting amplified contract prospects.

Policy shifts within agencies like the Centers for Medicare & Medicaid Services (CMS) directly influence demand for DLH's health IT services; CMS projected Medicare spending to reach $1.1 trillion in 2024, highlighting the scale of potential impacts from policy adjustments.

Evolving defense strategies and national security concerns are driving substantial U.S. defense spending, particularly in technology and cybersecurity, areas where DLH's specialized capabilities offer a competitive edge.

Political stability and efficient procurement processes are critical for DLH, as government shutdowns or delays in appropriations for fiscal year 2025 can disrupt contract awards and payments, impacting cash flow and operational continuity.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting DLH Holdings, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within DLH Holdings' operating landscape.

DLH Holdings' PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by enabling quick referencing during meetings and presentations.

Economic factors

The escalating U.S. federal budget deficit and national debt, projected to exceed $34 trillion by early 2024, can exert pressure on government spending. This could lead to potential budget cuts or slower growth in discretionary spending sectors, even as areas like defense and health IT see increases.

While DLH Holdings benefits from growth in defense and health IT, broader fiscal constraints stemming from the national debt could still affect the availability of funds for specific government programs or contracts. For instance, the Congressional Budget Office (CBO) projects deficits to remain above $1 trillion annually for the next decade, underscoring the persistent fiscal challenges.

Inflationary pressures can significantly increase DLH Holdings' operating expenses, particularly for labor and raw materials. This could squeeze profit margins on existing fixed-price contracts, as the company may not be able to pass on these increased costs immediately. For instance, if the US CPI inflation rate remains elevated, as it has been in recent periods, DLH might face higher input costs throughout 2024 and into 2025.

Rising interest rates directly impact DLH's cost of borrowing, affecting its ability to finance new projects or manage existing debt. Higher rates mean increased interest payments, potentially reducing net income and impacting the company's financial flexibility for strategic investments or acquisitions. As central banks continue to adjust monetary policy, DLH must carefully consider its debt structure and financing costs in the evolving economic landscape.

The pace of U.S. economic expansion directly impacts the federal budget, influencing the total value of government contracts up for grabs. DLH Holdings' financial performance is closely linked to this federal spending, especially within its key health and human services and defense segments.

Anticipated needs for IT modernization in these sectors suggest a continued demand for DLH's services. For instance, in fiscal year 2023, U.S. federal government contracting spending reached over $700 billion, highlighting the significant market DLH operates within.

Competition in Government Contracting

DLH Holdings navigates a highly competitive federal contracting landscape. This environment is characterized by intense pricing pressures and a significant number of both small and large businesses vying for contract awards, directly impacting DLH's profitability and revenue streams.

A notable trend influencing DLH is the government's increasing emphasis on set-aside contracts specifically for small businesses. This strategic shift has, in certain segments, contributed to revenue declines for DLH as larger companies are naturally excluded from these opportunities.

- Intense Competition: The federal contracting market is crowded, with numerous players competing for limited government budgets.

- Pricing Pressures: Fierce competition often leads to downward pressure on pricing, affecting profit margins for contractors like DLH.

- Small Business Set-Asides: Government policy prioritizes small businesses, creating challenges for larger firms by limiting their access to certain contracts.

- Market Dynamics: DLH must continually adapt its strategy to account for evolving government procurement preferences and the competitive intensity.

Healthcare Spending Trends

National health expenditure in the United States is projected to see robust growth, with estimates suggesting it will reach $7.7 trillion by 2031, up from $4.5 trillion in 2022. This significant increase, driven by factors like an aging population and advancements in medical technology, directly translates to sustained demand for healthcare services and related solutions.

This upward trend in healthcare spending signals a favorable environment for companies like DLH Holdings, which specializes in health and human services. The continued expansion of the healthcare market indicates a persistent need for the types of solutions DLH offers, even as the landscape of insurance coverage evolves.

- Projected growth: National health expenditure expected to reach $7.7 trillion by 2031.

- Key drivers: Aging population, increased utilization of services, and technological advancements.

- Impact on DLH: Sustained demand for health and human services solutions.

- Market resilience: Continued spending growth supports DLH's business model despite potential insurance shifts.

The U.S. federal government's fiscal health, marked by a substantial national debt exceeding $34 trillion by early 2024, directly influences its spending capacity. This fiscal pressure could result in tighter budgets for certain government programs, potentially impacting contract awards, even as specific sectors like defense and health IT continue to see investment. The Congressional Budget Office anticipates deficits to remain above $1 trillion annually for the foreseeable future, highlighting ongoing fiscal challenges that DLH Holdings must navigate.

Same Document Delivered

DLH Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of DLH Holdings details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping DLH Holdings' market landscape.

Sociological factors

Societal health challenges, like the rising prevalence of chronic diseases and the ongoing need for robust emergency preparedness, directly shape government spending and regulatory priorities. DLH Holdings, operating in this space, finds its solutions in demand as public health initiatives aim to tackle issues such as obesity, diabetes, and mental health concerns, which continue to be significant burdens on healthcare systems.

National health objectives, exemplified by the Healthy People 2030 initiative, underscore a societal push towards improving health outcomes and reducing health disparities. This framework, which sets ambitious goals for areas like cancer prevention, improving maternal health, and increasing access to healthcare, guides federal funding and program development, creating opportunities for companies like DLH that support public health efforts.

The United States is experiencing a significant demographic shift with its population aging, which directly fuels the demand for healthcare services. This trend is particularly impactful for companies like DLH Holdings, as it drives a greater need for telehealth solutions and innovative health technologies designed to support an older demographic. For instance, the U.S. Census Bureau projected that by 2034, older adults (65 years and over) will outnumber younger people for the first time in history, highlighting the scale of this demographic change.

This increasing demand creates substantial long-term opportunities for DLH. Government agencies, facing the challenge of efficiently managing healthcare for a growing senior population, are actively seeking advanced technological and service solutions. DLH is well-positioned to capitalize on this by offering its expertise in areas like health IT modernization and program management, which are crucial for supporting the healthcare needs of older Americans.

The availability of a skilled workforce, especially in tech-focused fields like data analytics and cybersecurity, is a major driver for DLH. As of 2024, the demand for these specialized skills continues to outpace supply, creating a competitive hiring landscape.

Educational trends and vocational training programs directly impact DLH's talent pipeline. For instance, the increasing emphasis on STEM education and the growth of cybersecurity bootcamps in 2024 are positive indicators for talent acquisition in these critical areas.

The attractiveness of government contracting careers plays a significant role in DLH's ability to recruit and retain talent. Many professionals are drawn to the stability and mission-driven nature of public sector work, a trend that remained strong through 2024.

Social Determinants of Health Focus

The increasing focus on social determinants of health (SDOH) by policymakers is reshaping public health strategies, moving beyond just medical treatments to encompass factors like housing, education, and economic stability. This shift presents a significant opportunity for companies like DLH Holdings, whose expertise in data analytics and program management can be instrumental in developing and executing these expanded public health initiatives. For instance, DLH's capabilities can help government agencies identify populations most affected by SDOH and design targeted interventions.

DLH's role in managing complex government health programs, such as those administered by the Centers for Medicare & Medicaid Services (CMS) or the Department of Health and Human Services (HHS), positions them well to capitalize on this trend. By leveraging their data analytics, DLH can help measure the impact of SDOH interventions and optimize program delivery. The Biden-Harris administration, for example, has made addressing SDOH a priority, allocating significant resources to initiatives that tackle health disparities rooted in social and economic conditions. In 2024, federal spending on public health programs is projected to continue its upward trajectory, with a notable portion earmarked for addressing social determinants.

- Growing SDOH Focus: Public health policy is increasingly incorporating social determinants of health, expanding government program scope beyond clinical care.

- DLH's Role: DLH's data analytics and program management are crucial for supporting initiatives that address these broader health factors.

- Government Investment: Federal agencies are prioritizing SDOH, with significant resource allocation in 2024 for programs tackling health disparities.

- Data-Driven Solutions: DLH can leverage its expertise to identify at-risk populations and measure the effectiveness of SDOH interventions.

Telehealth Adoption and Acceptance

Societal acceptance of telehealth has surged, driven by convenience and necessity. By early 2024, a significant portion of the population had utilized telehealth services, with ongoing demand for remote healthcare options. This societal shift directly benefits DLH Holdings, as their expertise in digital health solutions and advanced technology services aligns perfectly with this growing trend.

DLH's involvement in critical initiatives such as the Telemedicine and Advanced Technology Research Center (TATRC) underscores their commitment to this evolving healthcare landscape. TATRC's work, often funded by government grants, focuses on advancing medical capabilities through technology, directly mirroring the increasing societal embrace of digital health.

The impact on DLH is clear:

- Increased Demand for Digital Health: Growing patient comfort with virtual consultations fuels demand for the digital health platforms and services DLH provides.

- Government Support for Innovation: Projects like TATRC, often backed by substantial government funding, create opportunities for DLH to showcase and implement its advanced technological solutions.

- Workforce Adaptation: The societal acceptance of remote work and digital tools extends to healthcare professionals, creating a more receptive environment for telehealth integration, a key area for DLH.

The aging U.S. population is a significant demographic driver for DLH Holdings, increasing demand for healthcare services. By 2034, older adults will outnumber younger individuals for the first time, according to U.S. Census Bureau projections, creating substantial long-term opportunities for companies like DLH that offer health IT modernization and program management to support senior care.

Societal health challenges, such as chronic diseases and the need for emergency preparedness, directly influence government spending and regulatory priorities, aligning with DLH's mission to support public health initiatives. National health objectives, like Healthy People 2030, further guide federal funding towards improving health outcomes and reducing disparities, creating a favorable market for DLH's solutions.

The growing societal acceptance of telehealth, evident by widespread adoption by early 2024, directly benefits DLH's digital health and technology services. Government-backed initiatives like TATRC, which advance medical capabilities through technology, further underscore this trend and provide platforms for DLH's innovative solutions.

The increasing focus on social determinants of health (SDOH) by policymakers is reshaping public health strategies, creating opportunities for DLH's data analytics and program management expertise. Federal agencies are prioritizing SDOH, with significant resource allocation in 2024 for programs tackling health disparities, a key area where DLH can provide data-driven solutions.

| Sociological Factor | Impact on DLH Holdings | Supporting Data/Trend (2024/2025) |

| Aging Population | Increased demand for healthcare services and specialized health IT solutions. | By 2034, older adults (65+) will outnumber younger people for the first time. (U.S. Census Bureau) |

| Public Health Focus (SDOH) | Opportunities for data analytics and program management in broader health initiatives. | Federal agencies prioritizing SDOH with significant resource allocation in 2024. |

| Telehealth Acceptance | Growth in demand for digital health platforms and remote healthcare services. | Widespread adoption of telehealth services by early 2024, with continued demand. |

| Skilled Workforce Demand | Crucial for talent acquisition in tech-focused roles like data analytics and cybersecurity. | Demand for specialized tech skills continues to outpace supply in 2024. |

Technological factors

DLH Holdings is deeply embedded in the federal government's push for digital transformation, with AI and machine learning forming the backbone of its service delivery. These technologies are critical for improving public health initiatives and streamlining agency operations, reflecting a significant trend in government modernization efforts. For instance, DLH's work often involves implementing AI-driven analytics to process vast datasets for agencies like the Centers for Disease Control and Prevention (CDC), enhancing disease surveillance and response capabilities.

The increasing sophistication of cyber threats presents a substantial opportunity for DLH Holdings, as government agencies require advanced cybersecurity and digital transformation services to protect sensitive data. The White House's proposed budget for fiscal year 2025 signals a heightened focus on healthcare cybersecurity, allocating substantial resources that directly align with DLH's core competencies and market position.

The sheer volume and intricacy of government data are escalating, making robust data analytics and big data management essential. DLH Holdings excels in these areas, offering solutions that enable data-driven decision-making, particularly within health and human services sectors. For instance, the U.S. government is projected to spend over $200 billion on IT modernization in 2024, a significant portion of which will be allocated to data management and analytics to improve service delivery and efficiency.

Systems Engineering and Integration Innovations

Continuous innovation in systems engineering and integration is paramount for DLH to effectively deliver sophisticated technology solutions to its federal clientele. This involves everything from managing extensive IT infrastructures to developing specialized defense applications. The ability to seamlessly integrate diverse systems ensures DLH can meet the complex demands of government projects.

DLH's strategic positioning is further bolstered by its recent OASIS+ contract award. This significant achievement empowers the company to provide a broad spectrum of complex professional services and cutting-edge capabilities. The OASIS+ contract is expected to be a key driver for future growth, allowing DLH to expand its service offerings and secure larger, more impactful projects.

Key aspects of DLH's systems engineering and integration advancements include:

- Agile Development Methodologies: DLH increasingly leverages agile approaches to accelerate the delivery of adaptable and responsive technology solutions, ensuring client needs are met efficiently.

- Cloud Integration Expertise: The company is expanding its capabilities in integrating diverse systems with cloud environments, a critical requirement for modern federal IT modernization efforts.

- Cybersecurity Integration: DLH places a strong emphasis on embedding robust cybersecurity measures throughout the systems engineering lifecycle, protecting sensitive government data.

Telehealth and Advanced Health Technologies

The continuous evolution of telehealth and advanced health technologies, including remote patient monitoring and comprehensive digital health platforms, presents a significant and expanding market opportunity for DLH Holdings. These technological advancements are reshaping healthcare delivery, creating a demand for the specialized services DLH offers.

DLH's direct involvement with the Telemedicine and Advanced Technology Research Center (TATRC) underscores its active participation and strategic positioning within this burgeoning sector. This collaboration highlights the company's commitment to leveraging and contributing to cutting-edge health technology solutions.

- Telehealth Market Growth: The global telehealth market was valued at approximately USD 143.5 billion in 2023 and is projected to reach USD 455.5 billion by 2030, growing at a CAGR of 17.8% during this period.

- Digital Health Adoption: Digital health technologies are increasingly integrated into patient care pathways, with a notable surge in remote monitoring solutions for chronic disease management.

- DLH's TATRC Partnership: DLH's work with TATRC focuses on advancing medical technologies for the U.S. military and other government agencies, directly benefiting from and contributing to the development of these advanced health solutions.

DLH Holdings leverages advanced technologies like AI and machine learning to support federal digital transformation, particularly in public health. The company's expertise in data analytics and big data management is crucial as government IT modernization spending in 2024 is projected to exceed $200 billion, with a significant portion dedicated to these areas.

The company's systems engineering and integration capabilities are enhanced by agile development and cloud integration, addressing the growing need for robust cybersecurity solutions. The U.S. government's focus on healthcare cybersecurity, as indicated by fiscal year 2025 budget proposals, directly benefits DLH's service offerings.

DLH is also capitalizing on the telehealth and digital health boom, with the global telehealth market expected to reach $455.5 billion by 2030. Their collaboration with TATRC positions them at the forefront of medical technology advancements for government agencies.

Legal factors

DLH Holdings operates within a demanding landscape shaped by government contracting laws. Adherence to the Federal Acquisition Regulation (FAR) and specific agency directives is paramount, influencing everything from contract bidding to ongoing performance and compliance. Failure to navigate these intricate rules can significantly jeopardize a company's ability to secure and fulfill government work.

DLH Holdings operates within the health and human services sector, making strict adherence to data privacy regulations like HIPAA paramount. These laws govern the handling, storage, and security of sensitive patient information, with non-compliance carrying significant penalties. For instance, HIPAA fines can range from $100 to $50,000 per violation, with annual maximums reaching $1.5 million for identical violations.

DLH Holdings must diligently protect its intellectual property, particularly its technology-enabled solutions and proprietary systems. This is crucial for maintaining a competitive edge and safeguarding its innovative research and development efforts. For instance, in 2023, the IT services sector saw significant investment in R&D, underscoring the value of IP.

Navigating the complexities of intellectual property clauses within government contracts is a key legal factor for DLH. These contracts often dictate ownership and usage rights of developed technologies, requiring careful review and negotiation to ensure DLH's interests are protected. The US government's spending on IT services reached an estimated $130 billion in 2024, highlighting the prevalence of such contracts.

Labor and Employment Laws

As a significant employer, DLH Holdings is bound by a comprehensive suite of labor and employment laws. These regulations cover crucial areas such as equitable hiring processes, minimum wage requirements, employee benefits administration, and the maintenance of a safe working environment. For instance, in 2024, the U.S. Department of Labor continued to emphasize enforcement of wage and hour laws, with over $260 million recovered for more than 230,000 workers in fiscal year 2023 alone, highlighting the potential financial implications of non-compliance.

These legal obligations directly shape DLH's human resource strategies and contribute to its overall operational expenses. Adherence to these laws, including those mandated by the Occupational Safety and Health Administration (OSHA), requires ongoing investment in training, policy development, and compliance monitoring. The increasing focus on fair labor practices and worker protections, as seen in proposed federal legislation and state-level initiatives throughout 2024 and into 2025, means DLH must remain agile in its HR management.

- Fair Hiring Practices: Ensuring non-discriminatory recruitment and selection processes.

- Wage and Hour Laws: Compliance with minimum wage, overtime, and equal pay regulations.

- Employee Benefits: Adherence to laws governing health insurance, retirement plans, and paid leave.

- Workplace Safety: Meeting OSHA standards and other safety regulations to prevent accidents and injuries.

Ethical and Compliance Standards

DLH Holdings, as a government contractor, navigates a complex landscape of ethical and compliance standards. These are not mere suggestions but stringent requirements crucial for its operations, particularly concerning anti-corruption, conflict of interest, and cybersecurity mandates. Failure to adhere can lead to severe repercussions.

Maintaining a strong compliance program is paramount for DLH. This proactive approach is essential to not only avoid significant penalties and fines but also to preserve its eligibility for lucrative federal contracts. In 2023, for example, government contractors faced an average of $2.5 million in fines for compliance violations, underscoring the financial risks involved.

- Anti-Corruption: DLH must adhere to regulations like the Foreign Corrupt Practices Act (FCPA), ensuring no bribery or unethical inducements are involved in securing or maintaining business.

- Conflict of Interest: Strict policies are in place to prevent situations where personal interests could improperly influence professional judgment or company decisions, especially when dealing with government agencies.

- Cybersecurity Mandates: With increasing digital threats, DLH is bound by specific cybersecurity standards, such as the NIST Cybersecurity Framework, to protect sensitive government data. Non-compliance in this area can result in contract termination and significant reputational damage.

- Regulatory Scrutiny: The government contractor space is under constant scrutiny. DLH's commitment to ethical conduct and compliance directly impacts its ability to secure and retain contracts, with agencies like the Department of Justice actively pursuing violations.

DLH Holdings must navigate strict regulations governing government contracting, including the Federal Acquisition Regulation (FAR), which dictates bidding, performance, and compliance. Moreover, as a player in the health sector, HIPAA compliance is critical for handling sensitive patient data, with violations carrying substantial fines, potentially reaching $1.5 million annually per violation category as of 2023. Protecting its intellectual property, especially in a competitive IT services market that saw significant R&D investment in 2023, is also a legal imperative, particularly when intellectual property clauses in government contracts require careful negotiation.

Labor laws are a significant legal consideration for DLH Holdings, encompassing fair hiring, wage and hour compliance, benefits administration, and workplace safety. The U.S. Department of Labor's continued emphasis on enforcing wage and hour laws, recovering over $260 million for workers in FY2023, highlights the financial risks of non-compliance. Staying abreast of evolving labor practices, as seen in federal and state legislative trends through 2024-2025, is essential for HR management and operational costs.

Ethical conduct and compliance are non-negotiable for DLH Holdings as a government contractor, covering anti-corruption (e.g., FCPA), conflict of interest, and cybersecurity mandates. A robust compliance program, essential for avoiding penalties averaging $2.5 million for contractors in 2023, safeguards eligibility for federal contracts. Adherence to standards like the NIST Cybersecurity Framework is crucial for protecting government data, with breaches leading to contract termination and reputational damage.

| Legal Factor | Description | Relevance to DLH Holdings | Potential Impact of Non-Compliance | Example Data/Stat (2023-2025) |

|---|---|---|---|---|

| Government Contracting Laws | Regulations governing procurement, bidding, and performance. | Essential for securing and executing federal contracts. | Contract termination, debarment, financial penalties. | FAR adherence is mandatory; estimated $130 billion US government IT spending in 2024. |

| Data Privacy (HIPAA) | Rules for handling protected health information. | Critical for health and human services contracts. | Fines up to $1.5M annually per violation type. | HIPAA fines can reach $50,000 per violation. |

| Intellectual Property | Protection of proprietary technology and research. | Maintains competitive advantage and contract value. | Loss of competitive edge, legal disputes. | IT R&D investment was significant in 2023. |

| Labor & Employment Laws | Regulations on hiring, wages, benefits, and safety. | Impacts HR practices, operational costs, and employee relations. | Back wages, fines, lawsuits, reputational damage. | DOL recovered over $260M for workers in FY2023. |

| Ethical & Compliance Standards | Rules against corruption, conflicts of interest, cybersecurity. | Ensures integrity and eligibility for government work. | Fines, contract loss, reputational damage. | Contractors faced avg. $2.5M in compliance fines in 2023. |

Environmental factors

The growing importance of environmental, social, and governance (ESG) factors, particularly from government clients and stakeholders, is shaping DLH's approach to corporate responsibility. This focus means companies like DLH must demonstrate a commitment to sustainable practices and ethical operations to maintain and win business.

DLH has established a Corporate Social Responsibility (CSR) ecosystem that actively tracks its sustainability efforts. A key component of this is the monitoring of Scope 1 and Scope 2 greenhouse gas (GHG) emissions, providing measurable data on their environmental impact.

The increasing focus on climate change's public health consequences presents a significant opportunity for DLH. As governments and health organizations expand programs and research into environmental health risks, DLH can leverage its data analytics and scientific support capabilities. For instance, the World Health Organization (WHO) projects that climate change could cause an additional 250,000 deaths per year between 2030 and 2050 from malnutrition, malaria, diarrhea, and heat stress alone.

While DLH Holdings' core business isn't directly tied to environmental manufacturing, its role as a government contractor means it's indirectly influenced by regulations governing federal operations. For instance, government facilities DLH supports might face mandates for improved energy efficiency or stricter waste management protocols. In 2024, the U.S. government continued to emphasize sustainability, with agencies like the General Services Administration (GSA) setting targets for reducing greenhouse gas emissions from federal buildings, impacting operational requirements for contractors.

Resource Scarcity and Supply Chain Resilience

Resource scarcity and environmental disruptions pose significant risks to DLH's operations by potentially impacting the availability and cost of critical technology components. For instance, the ongoing global semiconductor shortage, which saw lead times extend significantly through 2023 and into early 2024, directly affects the integration of advanced hardware into DLH's health IT solutions.

Government contractors like DLH are increasingly focused on supply chain resilience. The U.S. Department of Defense, a key client, emphasizes strategies to mitigate disruptions, including diversifying suppliers and increasing domestic production capabilities for essential technologies. This focus is driven by events like the COVID-19 pandemic, which highlighted vulnerabilities in extended global supply networks, leading to a projected 5% increase in supply chain risk management spending by federal agencies in 2024.

- Semiconductor Shortage Impact: Extended lead times for chips in 2023-2024 directly affect hardware integration for DLH.

- Government Focus on Resilience: U.S. government clients prioritize diversified suppliers and domestic production.

- Increased Risk Management Spending: Federal agencies anticipate a 5% rise in supply chain risk management in 2024.

- Environmental Disruption Risk: Extreme weather events can disrupt logistics and component manufacturing, impacting delivery schedules.

Natural Disaster Response and Preparedness

The increasing frequency and intensity of natural disasters, a trend often linked to environmental shifts, can significantly boost government expenditure on preparedness and response initiatives. This heightened focus creates a direct demand for DLH Holdings' expertise in areas such as emergency management and public health support. For instance, in 2024, federal agencies continued to allocate substantial resources towards disaster mitigation and recovery efforts, with FEMA alone managing billions in disaster relief funding.

DLH's capabilities are well-positioned to address the growing need for resilient infrastructure and effective public health responses during crises. The company's role in supporting government entities, particularly in health and human services, allows it to capitalize on increased spending related to climate resilience and disaster preparedness. A report from the National Oceanic and Atmospheric Administration (NOAA) in late 2024 highlighted a rise in billion-dollar weather and climate disasters across the United States.

- Increased Demand for Emergency Management: Growing natural disasters necessitate robust emergency response planning and execution, a core service area for DLH.

- Public Health Support Needs: Post-disaster scenarios often require significant public health interventions, aligning with DLH's health sector focus.

- Government Spending Trends: In 2024, federal agencies increased budgets for disaster preparedness and response, reflecting a commitment to address climate-related risks.

- Climate Impact Data: NOAA reported a significant number of costly weather and climate disasters in 2024, underscoring the ongoing need for DLH's specialized services.

DLH Holdings' environmental considerations are increasingly tied to government mandates and the growing emphasis on ESG. The company actively monitors its Scope 1 and 2 greenhouse gas emissions as part of its Corporate Social Responsibility efforts. This focus is critical as government clients, like those DLH serves, prioritize sustainability in their operations and contracting.

Climate change impacts present both opportunities and risks for DLH. Increased government spending on disaster preparedness and public health response, driven by more frequent extreme weather events, directly benefits DLH's service offerings. Conversely, resource scarcity and supply chain disruptions, exacerbated by environmental factors, can affect the availability and cost of technology components essential for DLH's solutions.

The U.S. government's commitment to sustainability, evident in initiatives like energy efficiency targets for federal buildings in 2024, influences DLH's operational support. Furthermore, the ongoing semiconductor shortage, impacting hardware integration through early 2024, highlights the vulnerability of technology supply chains to broader environmental and geopolitical factors.

DLH's strategic positioning allows it to leverage increased demand for resilience and public health support stemming from environmental challenges. The company's expertise in health IT and scientific support is vital as government agencies, such as FEMA, continue to allocate significant funds to disaster relief and mitigation efforts, a trend amplified by a rise in costly weather events reported by NOAA in late 2024.

| Environmental Factor | Impact on DLH | 2024/2025 Data/Trend |

|---|---|---|

| ESG Focus & Government Mandates | Requirement for sustainable practices, influencing contract wins. | Increasing scrutiny from government clients on ESG performance. |

| Climate Change & Public Health | Opportunity for health IT and scientific support services. | WHO projects significant deaths from climate change impacts; increased government funding for climate-related health programs. |

| Natural Disasters & Preparedness | Boosts demand for emergency management and public health support. | FEMA managing billions in disaster relief; NOAA reported a rise in billion-dollar weather disasters in 2024. |

| Resource Scarcity & Supply Chain | Risk to component availability and cost for technology solutions. | Semiconductor shortages extended lead times through early 2024; increased federal spending on supply chain risk management (projected 5% rise). |

PESTLE Analysis Data Sources

Our DLH Holdings PESTLE Analysis draws upon a robust foundation of official government publications, reputable financial news outlets, and leading industry research firms. This ensures that each factor, from regulatory changes to economic forecasts, is informed by current and credible information.