Transocean SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Transocean Bundle

Transocean's SWOT analysis reveals a powerful fleet and experienced workforce as key strengths, but also highlights the industry's cyclical nature and intense competition as significant threats. Understanding these dynamics is crucial for navigating the offshore drilling market.

Want the full story behind Transocean's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Transocean stands out as a dominant force in ultra-deepwater and harsh environment drilling, boasting one of the most advanced and adaptable floating offshore drilling fleets globally. This strategic focus on technically demanding projects allows them to secure premium dayrates, as fewer companies possess the specialized capabilities to undertake such operations.

Their fleet comprises state-of-the-art drillships and semi-submersibles, engineered to perform effectively in extreme conditions and deep-sea environments. As of the first quarter of 2024, Transocean's backlog stood at an impressive $9.1 billion, underscoring the sustained demand for their high-specification services.

Transocean benefits from a robust contract backlog, offering considerable revenue visibility and operational stability. As of July 16, 2025, this backlog stood at approximately $7.2 billion, following a figure of $8.3 billion reported on February 12, 2025. This substantial backlog underscores a strong pipeline of secured work and reflects sustained customer confidence in Transocean's services.

Transocean stands out with its advanced technological capabilities, demonstrated by the industry's first two 20K subsea completions in 2024, achieved with their eighth-generation drillships. This pioneering spirit is further supported by their integration of sophisticated digital monitoring systems and real-time data analytics, which significantly boost operational efficiency and safety protocols.

Robust Safety and Operational Performance

Transocean's unwavering commitment to safety is a significant strength, evidenced by a remarkable 99.87% safety performance rating in 2023 and their best-ever occupational and process safety performance in 2024. This dedication extends to environmental stewardship, with zero major environmental incidents recorded in 2023. Their operational excellence is further highlighted by a strong focus on reliability, achieving a 96.6% revenue efficiency in Q2 2025, demonstrating their capacity to execute complex projects with both safety and effectiveness.

- Safety Performance: 99.87% in 2023, best-ever in 2024.

- Environmental Record: Zero major incidents in 2023.

- Operational Reliability: 96.6% revenue efficiency in Q2 2025.

Global Presence and Strategic Client Relationships

Transocean boasts a significant global operational footprint, enabling it to serve major oil and gas clients across key energy-producing regions. This includes operations in areas like the U.S. Gulf of Mexico, Norway, Australia, India, and Brazil, demonstrating a broad geographic reach.

The company's strength lies in its ability to cultivate and maintain long-term, strategic relationships with industry leaders. Securing multi-year contracts and extensions with prominent clients such as Reliance Industries and Equinor underscores a deep level of trust and a proven track record of reliable service delivery.

This extensive global presence serves as a crucial buffer against localized market downturns, diversifying Transocean's revenue streams. For instance, in 2023, the company reported that its backlog of contracted revenue stood at approximately $8.4 billion, a substantial portion of which is derived from these global, long-term agreements.

- Global Operations: Serves major clients in the U.S. Gulf of Mexico, Norway, Australia, India, and Brazil.

- Key Client Relationships: Holds multi-year contracts and extensions with companies like Reliance Industries and Equinor.

- Revenue Diversification: Mitigates regional market risks through a wide geographic spread of operations.

- Contract Backlog: As of late 2023, Transocean's contracted revenue backlog was around $8.4 billion, reflecting the value of these relationships.

Transocean's primary strength is its leading position in ultra-deepwater and harsh environment drilling, supported by a highly advanced and adaptable floating offshore fleet. This specialization allows them to command premium dayrates due to the high technical barriers to entry for competitors.

The company demonstrates technological leadership, evidenced by achieving the industry's first two 20K subsea completions in 2024 with their eighth-generation drillships. Their operational reliability is also a key asset, achieving a 96.6% revenue efficiency in Q2 2025.

Transocean maintains a significant global operational footprint across key energy regions, which diversifies revenue and mitigates localized market risks. This is further bolstered by strong, long-term relationships with major clients like Reliance Industries and Equinor, securing substantial contract backlogs.

Their commitment to safety and environmental stewardship is a core strength, demonstrated by a 99.87% safety performance in 2023 and zero major environmental incidents that year, alongside their best-ever occupational and process safety performance in 2024.

| Strength | Description | Supporting Data |

|---|---|---|

| Fleet Specialization | Dominance in ultra-deepwater and harsh environments | Advanced drillships and semi-submersibles |

| Technological Prowess | Industry-first 20K subsea completions in 2024 | Eighth-generation drillships |

| Operational Reliability | High revenue efficiency | 96.6% in Q2 2025 |

| Safety & Environment | Exceptional safety and environmental record | 99.87% safety in 2023, zero major environmental incidents in 2023, best-ever safety performance in 2024 |

What is included in the product

Delivers a strategic overview of Transocean’s internal and external business factors, highlighting its fleet capabilities and market position.

Offers a clear, actionable framework to navigate industry volatility and capitalize on market opportunities.

Weaknesses

Transocean's earnings are closely tied to the unpredictable nature of oil and gas prices. When these prices swing, it directly affects how much oil companies spend on exploration and drilling, potentially causing delays or outright cancellations of projects, which in turn puts downward pressure on the rates Transocean can charge for its services.

While dayrates have shown strong recovery following the industry downturn, projections for 2025 suggest only a modest increase. This near-term outlook remains clouded by ongoing macroeconomic uncertainties and geopolitical tensions that can quickly disrupt the energy market.

Operating and maintaining a fleet of advanced offshore drilling rigs demands significant capital outlay and continuous upkeep. Transocean's first quarter of 2025 saw operating and maintenance expenses hit $618 million, with projections for the full year 2025 indicating these costs will fall between $2.3 billion and $2.4 billion.

This considerable cost structure can put pressure on profitability, particularly when rig utilization rates are low or when dayrates come under pressure in the market.

Transocean's substantial long-term debt remains a significant hurdle, impacting its financial flexibility and increasing interest expenses. Despite ongoing deleveraging efforts, including a stated aim to reduce debt by over $700 million in 2025, the sheer volume of outstanding obligations presents a challenge.

The company's Q2 2025 financial results underscored these balance sheet pressures, revealing a considerable GAAP net loss largely attributable to asset impairment charges, indicating persistent financial strain.

Fleet Utilization Challenges in Certain Segments

While Transocean's backlog for high-specification floaters remains robust, overall fleet utilization presents a hurdle. This is particularly true as global offshore rig demand is projected to decline through the remainder of 2025. As rigs complete their current contracts, the potential for lower overall utilization rates increases, impacting profitability.

- Active fleet utilization for high-spec ultra-deepwater and harsh environment floaters is near fully contracted for 2025.

- Global offshore rig demand is expected to trend downwards over the rest of 2025.

- Rigs rolling off contract could lead to lower overall utilization rates.

Environmental and Regulatory Risks

The offshore drilling sector is under increasing pressure from environmental regulations, which can significantly inflate operating expenses and create substantial liabilities in the event of spills or accidents. For instance, the International Maritime Organization's (IMO) 2020 sulfur cap, while not directly about drilling, signals a broader trend towards stricter environmental controls across maritime operations, impacting fuel costs and compliance for offshore vessels.

The global push for decarbonization and the broader energy transition poses a long-term threat, potentially altering policy landscapes and diminishing the demand for fossil fuel exploration and extraction. This shift is reflected in the growing investment in renewable energy sources, with global clean energy investment projected to reach $2 trillion annually by 2030, according to the International Energy Agency (IEA), diverting capital away from traditional oil and gas projects.

Specific initiatives, like the Biden administration's pause on new oil and gas leases on federal lands and waters, underscore the political headwinds. While Project 2025, a conservative policy agenda, advocates for expanded offshore drilling, it faces considerable opposition rooted in environmental protection concerns, highlighting a significant regulatory and public perception challenge.

- Increased Compliance Costs: Stricter environmental regulations necessitate higher spending on safety equipment, spill containment, and emissions control technologies.

- Potential for Fines and Liabilities: Environmental incidents can result in substantial fines and long-term remediation costs, impacting profitability.

- Regulatory Uncertainty: Evolving climate policies and energy transition goals create uncertainty regarding future project approvals and operational viability.

- Shifting Investor Sentiment: Growing investor focus on Environmental, Social, and Governance (ESG) factors can lead to reduced capital availability for fossil fuel projects.

Transocean's substantial debt burden remains a significant weakness, impacting financial flexibility. Despite efforts to reduce obligations, the company's Q2 2025 results highlighted balance sheet pressures, including a notable GAAP net loss attributed to asset impairment charges.

The company faces challenges with overall fleet utilization, as global offshore rig demand is projected to decline through the remainder of 2025. As contracts expire, lower utilization rates could negatively affect profitability.

Increasingly stringent environmental regulations impose higher operating expenses and create potential liabilities for Transocean. Regulatory uncertainty and shifting investor sentiment towards ESG factors also pose long-term risks to capital availability and project viability.

Preview the Actual Deliverable

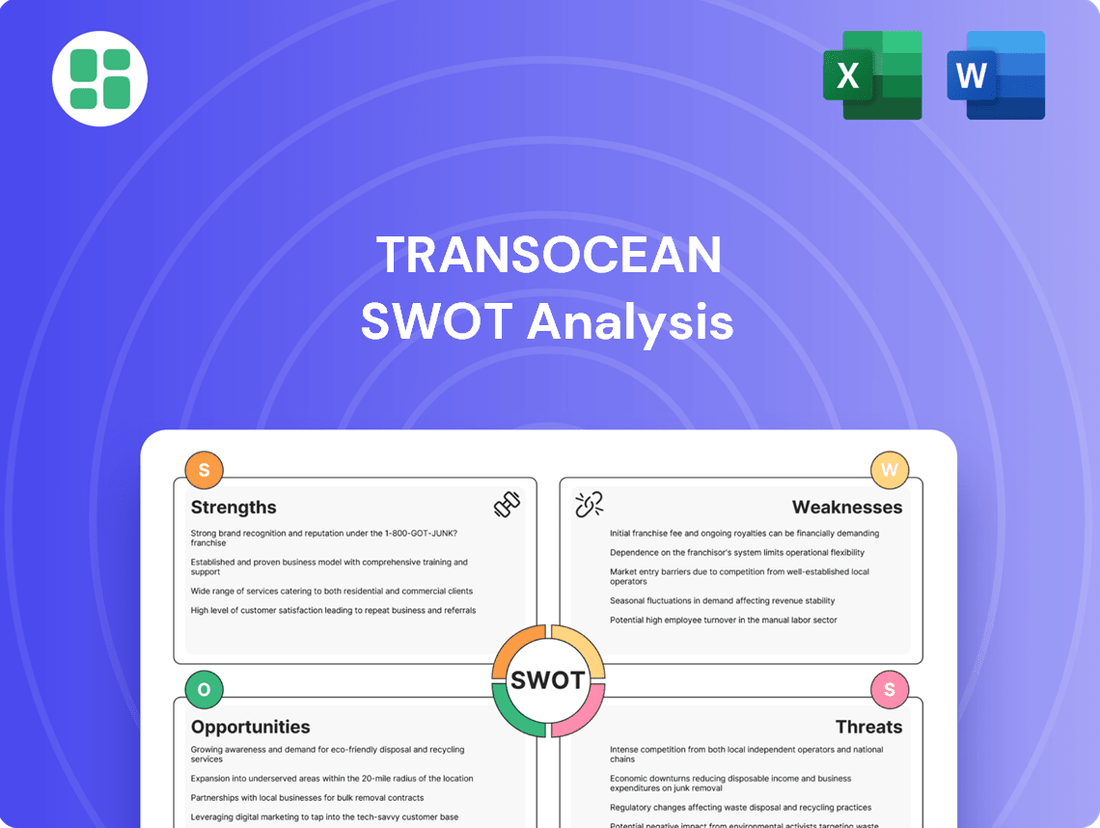

Transocean SWOT Analysis

The file shown below is not a sample—it’s the real Transocean SWOT analysis you'll download post-purchase, in full detail. You'll get the complete, expertly crafted document without any alterations from this preview. This ensures you receive the exact professional analysis you're evaluating.

Opportunities

The global offshore drilling market is set for robust growth, with projections indicating a CAGR of 8.07% between 2025 and 2034. This expansion is fueled by an increasing worldwide appetite for natural gas and oil.

Transocean's expertise in deepwater and ultra-deepwater exploration positions it favorably to capitalize on this trend. As onshore reserves dwindle, the industry is increasingly turning to deeper ocean frontiers for new resource discovery.

This strategic focus on challenging environments plays directly into Transocean's strengths, offering significant opportunities to deploy its advanced fleet and technological capabilities.

Ongoing technological advancements in drilling, automation, and digitalization offer significant opportunities for Transocean to boost efficiency and reduce risks. By embracing these innovations, the company can improve safety and unlock access to more challenging reserves, thereby strengthening its client value proposition. Transocean's commitment to innovation is evident in the 22 patents it secured in 2024.

New deepwater exploration frontiers are emerging, with areas like the Andaman Sea and India's Andhra coast showing potential, fueled by national energy security goals. These regions offer significant growth opportunities for offshore drilling contractors.

The U.S. Gulf of Mexico continues to be a vital market, while promising new ventures such as Namibia's Orange Basin are gaining traction. Transocean's established global footprint allows them to strategically enter and benefit from these developing offshore regions.

By expanding into these emerging markets, Transocean can diversify its operational base and tap into new revenue streams, solidifying its position in the evolving offshore energy landscape.

Potential for Offshore Wind and Renewable Energy Infrastructure

Transocean's extensive offshore infrastructure and deep expertise in marine operations present a significant opportunity to pivot into the burgeoning offshore wind energy sector. This transition aligns with the global push towards decarbonization and renewable energy sources.

The company's established capabilities in managing complex offshore projects, including deepwater operations and vessel management, are directly transferable to the construction and maintenance of offshore wind farms. This offers a pathway to diversify revenue streams beyond traditional oil and gas exploration.

Consider the following:

- Market Growth: The global offshore wind market is projected to see substantial growth, with the International Energy Agency (IEA) forecasting a tripling of offshore wind capacity by 2030.

- Infrastructure Synergy: Transocean's existing fleet, including specialized vessels, can be adapted for tasks such as turbine installation, foundation laying, and subsea cable deployment.

- New Revenue Streams: By securing contracts in the renewable energy sector, Transocean can tap into a new and expanding market, potentially offsetting cyclical downturns in the oil and gas industry.

- Expertise Leverage: The company's decades of experience in harsh offshore environments and complex logistical challenges provide a competitive edge in the demanding offshore wind construction phase.

Industry Consolidation and Market Tightening

The offshore drilling sector is undergoing significant consolidation, a trend that positions Transocean favorably by reducing competitive pressures. This strategic realignment allows larger, more efficient operators like Transocean to capture a greater share of the market.

A tightening market, especially for ultra-deepwater assets, is anticipated. Industry forecasts suggest utilization rates for these specialized fleets could surpass 90% by 2027, driving dayrates upward. This scenario directly benefits Transocean by enhancing its pricing power and securing more stable, long-term contracts.

- Reduced Competition: Industry consolidation streamlines the market, benefiting established players.

- Market Tightening: Utilization for ultra-deepwater fleets is projected to exceed 90% by 2027.

- Upward Dayrate Pressure: Increased demand for specialized rigs will likely lead to higher contract pricing.

- Enhanced Contract Security: Transocean can leverage market strength for more secure, lucrative agreements.

Transocean is well-positioned to benefit from the projected growth in the global offshore drilling market, with an estimated CAGR of 8.07% through 2034. The company's specialization in deepwater and ultra-deepwater operations aligns perfectly with the increasing industry focus on these challenging, yet resource-rich, frontiers. Furthermore, Transocean's proactive adoption of technological advancements, evidenced by its 22 patents in 2024, enhances its efficiency and competitive edge.

The company can also leverage its existing infrastructure and expertise to tap into the rapidly expanding offshore wind energy sector, a move supported by the International Energy Agency's forecast of a tripling in offshore wind capacity by 2030. Market consolidation within offshore drilling is also creating opportunities for Transocean to secure a larger market share and benefit from anticipated dayrate increases as utilization for ultra-deepwater fleets is expected to surpass 90% by 2027.

| Opportunity Area | Key Driver | Transocean's Advantage | Market Projection |

|---|---|---|---|

| Global Offshore Drilling Growth | Increasing demand for oil & gas | Expertise in deepwater/ultra-deepwater | CAGR of 8.07% (2025-2034) |

| Technological Advancement | Efficiency & risk reduction | 22 patents secured in 2024 | Improved operational performance |

| Offshore Wind Energy Transition | Decarbonization push | Existing offshore infrastructure & expertise | Tripling of capacity by 2030 (IEA) |

| Market Consolidation & Tightening | Reduced competition, increased demand | Leading ultra-deepwater fleet | >90% utilization by 2027 |

Threats

The persistent volatility of oil and gas prices presents a significant threat to Transocean. A sharp decline in crude oil prices, for instance, could directly impact exploration and production companies' spending, leading to fewer new drilling contracts and potentially forcing existing ones to be renegotiated unfavorably. This directly translates to reduced demand for Transocean's offshore drilling services.

Even with the current upswing in the market, the specter of macroeconomic uncertainty looms large. This uncertainty could lead to a softening of dayrates, meaning Transocean might earn less per day for its rigs, and could also cause companies to postpone crucial drilling activities, thereby deferring demand for Transocean's fleet.

The accelerated global energy transition, driven by climate change concerns and policy shifts, presents a significant long-term threat to Transocean. A rapid move away from fossil fuels could drastically reduce the demand for offshore drilling services, impacting the company's core business. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that while oil and gas will remain crucial in the near term, the pace of renewable energy deployment is accelerating, potentially shortening the lifespan of hydrocarbon investments.

Stricter environmental regulations globally are a significant threat, potentially increasing Transocean's operational costs through compliance measures and investments in cleaner technologies. For instance, the International Maritime Organization's (IMO) 2020 sulfur cap, while implemented, continues to drive up fuel costs and necessitates ongoing adjustments.

Heightened public awareness and activism surrounding climate change are fueling strong opposition to new offshore drilling projects. This sentiment can translate into political pressure, leading to permitting challenges and even outright bans on exploration, as seen in various regions considering moratoria on deepwater drilling.

The risk of incidents like oil spills remains a critical threat, carrying the potential for severe financial penalties and long-term operational restrictions. Following the 2010 Deepwater Horizon incident, BP faced over $65 billion in costs, a stark reminder of the financial and reputational damage such events can inflict on offshore operators.

Intense Competition and Oversupply of Rigs

The offshore drilling sector, even with some recent consolidation, remains a fiercely competitive landscape. Transocean faces rivals like Valaris, Noble Corporation, and Seadrill, all actively pursuing limited contracts. This intense competition can drive down the dayrates operators are willing to pay for rig services.

A significant concern is the oversupply of drilling rigs, particularly in specific market segments. For instance, the jack-up rig market has seen substantial newbuild deliveries in recent years. If demand for offshore drilling doesn't grow sufficiently to absorb this excess capacity, it will likely lead to lower utilization rates for Transocean's fleet and continued pressure on dayrates.

- Competitive Landscape: Major players like Valaris, Noble Corporation, and Seadrill continue to vie for offshore drilling contracts, intensifying competition.

- Rig Oversupply: Certain rig segments, such as jack-ups, face an oversupply issue due to recent newbuild deliveries, potentially impacting utilization and dayrates.

- Dayrate Pressure: The combination of intense competition and rig oversupply exerts downward pressure on the dayrates Transocean can command for its services.

Geopolitical Instability and Operational Risks

Geopolitical tensions in key oil-producing regions present a significant threat to Transocean’s operations. Conflicts or political instability can disrupt exploration activities, impact the flow of oil, and create uncertainty regarding future contract awards. For instance, ongoing geopolitical shifts in the Middle East and parts of Africa, where many offshore projects are located, directly influence market sentiment and investment decisions by energy companies.

The inherent operational risks of deepwater drilling are also a major concern. These include the potential for technical failures in complex equipment, severe weather events that can halt operations, and unforeseen geological challenges encountered during drilling. Such incidents can lead to substantial financial losses due to downtime, costly repairs, and potential environmental liabilities. In 2023, the offshore drilling industry saw several instances of operational disruptions, underscoring the persistent nature of these risks.

- Geopolitical Disruptions: Tensions in oil-rich regions can halt exploration and affect contract awards.

- Operational Hazards: Deepwater drilling faces risks from technical failures, weather, and geological surprises.

- Financial Impact: Incidents can cause costly downtime, safety issues, and environmental damage, impacting profitability.

- Market Uncertainty: Geopolitical events contribute to volatility in oil prices and demand for offshore services.

The global energy transition poses a significant long-term threat as a rapid shift away from fossil fuels could reduce demand for offshore drilling. Furthermore, intense competition from rivals like Valaris and Noble Corporation, coupled with an oversupply of certain rig types, continues to pressure dayrates. Geopolitical instability in key oil-producing regions also creates market uncertainty and can disrupt contract awards, impacting Transocean's revenue streams.

| Threat Category | Specific Concern | Potential Impact |

|---|---|---|

| Market Dynamics | Energy Transition & Oil Price Volatility | Reduced demand for offshore drilling, lower dayrates. |

| Competition & Supply | Intense Rivalry & Rig Oversupply | Downward pressure on dayrates, lower utilization. |

| Geopolitical & Operational | Regional Instability & Drilling Risks | Contract disruptions, operational downtime, increased costs. |

SWOT Analysis Data Sources

This Transocean SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial filings, comprehensive market research reports, and insights from leading industry analysts. These sources provide a well-rounded view of Transocean's operational performance, competitive landscape, and future market potential.