Transocean PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Transocean Bundle

Navigate the complex external environment impacting Transocean with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping the offshore drilling industry. Gain a strategic advantage by anticipating market shifts and identifying opportunities. Purchase the full report now for actionable insights to inform your decisions.

Political factors

Global geopolitical stability is a critical factor for Transocean, directly impacting its offshore drilling operations. Regions with political unrest or ongoing conflicts pose significant risks, potentially disrupting supply chains and increasing operational hazards. For instance, the ongoing geopolitical tensions in Eastern Europe have led to increased energy security concerns, influencing demand and investment in offshore exploration in certain areas.

Government energy policies significantly shape the demand for offshore drilling services. For instance, the 2024 European Union's Green Deal aims to reduce emissions by 55% by 2030, potentially curbing investment in new fossil fuel projects. Conversely, some nations continue to offer subsidies for oil and gas production, as seen with continued support in certain Middle Eastern countries, which can sustain demand for drilling. Transocean must navigate these diverging policy landscapes, adapting its strategies to capitalize on regions with supportive policies for hydrocarbon exploration while preparing for potential contractions in others.

Trade agreements and diplomatic ties between oil-producing and consuming countries significantly influence global energy markets and, by extension, the demand for hydrocarbon exploration. For instance, the USMCA agreement, which came into effect in 2020, continues to shape trade flows within North America, impacting regional energy dynamics.

Tariffs, sanctions, or trade disputes can disrupt the supply of oil and gas, directly affecting commodity prices and the investment appetite of exploration and production (E&P) companies for new offshore projects. The ongoing trade tensions between major economies, such as those between the US and China, can create volatility in energy markets, impacting companies like Transocean.

Transocean's extensive global footprint means its operations are inherently sensitive to these cross-border economic and political shifts. For example, geopolitical events in the Middle East or Europe can swiftly alter crude oil prices, affecting Transocean's backlog and future contract opportunities as companies reassess their capital expenditure plans.

Regulatory Frameworks and Permitting

The regulatory landscape for offshore drilling significantly impacts Transocean's operations, with varying stringency across different jurisdictions. For instance, in 2024, the U.S. Bureau of Ocean Energy Management (BOEM) continued to enforce robust environmental reviews and safety protocols for offshore leasing and drilling, potentially extending permitting timelines. Conversely, some emerging markets might offer streamlined processes, but often with less predictable enforcement of standards.

Securing drilling permits involves navigating a complex web of environmental impact assessments, stringent safety regulations, and local content mandates, which differ substantially from one nation's waters to another. In 2024, countries like Brazil and Norway maintained rigorous requirements, demanding extensive documentation on environmental protection and local employment. These diverse requirements directly influence project costs and the feasibility of undertaking new contracts.

- Jurisdictional Variability: Regulatory frameworks for offshore operations, such as those enforced by the Norwegian Petroleum Directorate or the U.S. EPA, present varying levels of complexity and cost.

- Permitting Hurdles: Obtaining permits for drilling in 2024, for example, in the Gulf of Mexico or the North Sea, requires adherence to distinct environmental, safety, and local content rules.

- Impact on Timelines: Delays in permit approvals, a common occurrence in 2024 due to heightened environmental scrutiny in many regions, can significantly extend project schedules and increase operational expenses for Transocean.

- Contract Execution: Changes in permitting processes, whether becoming more or less stringent, directly affect Transocean's ability to secure and efficiently execute contracts globally.

Nationalization Risks and Resource Control

Some nations are increasingly looking to exert more authority over their valuable natural resources. This can translate into a higher likelihood of nationalizing assets or imposing stricter operating conditions on companies from other countries. For Transocean, this political risk directly affects the long-term stability of its contracts and the overall safety of its investments in specific territories.

Transocean needs to carefully evaluate and develop strategies to lessen these sovereign risks. This is crucial when considering new ventures or continuing existing operations in diverse global markets. For instance, in 2024, countries like Venezuela continued to signal a desire for greater state control over their oil and gas sectors, posing potential challenges for international service providers.

The potential for governments to revise fiscal terms or ownership structures can significantly alter the profitability and operational landscape. This necessitates robust due diligence and contingency planning. By 2025, geopolitical shifts could further amplify these nationalization trends in resource-rich regions.

- Sovereign Risk Assessment: Transocean must continuously monitor and analyze the political stability and resource control policies of countries where it operates.

- Contractual Safeguards: Incorporating clauses that protect against adverse governmental actions, such as nationalization or unfavorable regulatory changes, is vital.

- Diversification Strategy: Spreading operations across various geographical regions can mitigate the impact of localized political risks.

- Stakeholder Engagement: Building strong relationships with host governments and local communities can help foster a more stable operating environment.

Government energy policies continue to be a major driver for Transocean, with differing approaches to fossil fuel development. For example, the Biden administration's commitment to offshore wind in the U.S. by 2030, while not directly impacting oil and gas drilling, signals a broader energy transition that could influence future demand for specialized offshore services. Conversely, many nations in the Middle East, such as Saudi Arabia, maintain strong support for oil production, ensuring continued demand for offshore exploration and drilling services in 2024 and beyond.

Geopolitical stability remains paramount, as conflicts or unrest can disrupt global energy supplies and investment. For instance, the ongoing tensions in Eastern Europe have heightened energy security concerns, leading to increased exploration activity in some regions as countries seek to diversify supply. This dynamic directly impacts Transocean's contract opportunities and operational planning.

Trade agreements and diplomatic relations between energy producers and consumers significantly influence market dynamics. The USMCA, for example, continues to shape North American energy flows, affecting regional demand for offshore services. Meanwhile, ongoing trade disputes between major economies can create price volatility, impacting the capital expenditure decisions of exploration and production companies and, consequently, Transocean's backlog.

What is included in the product

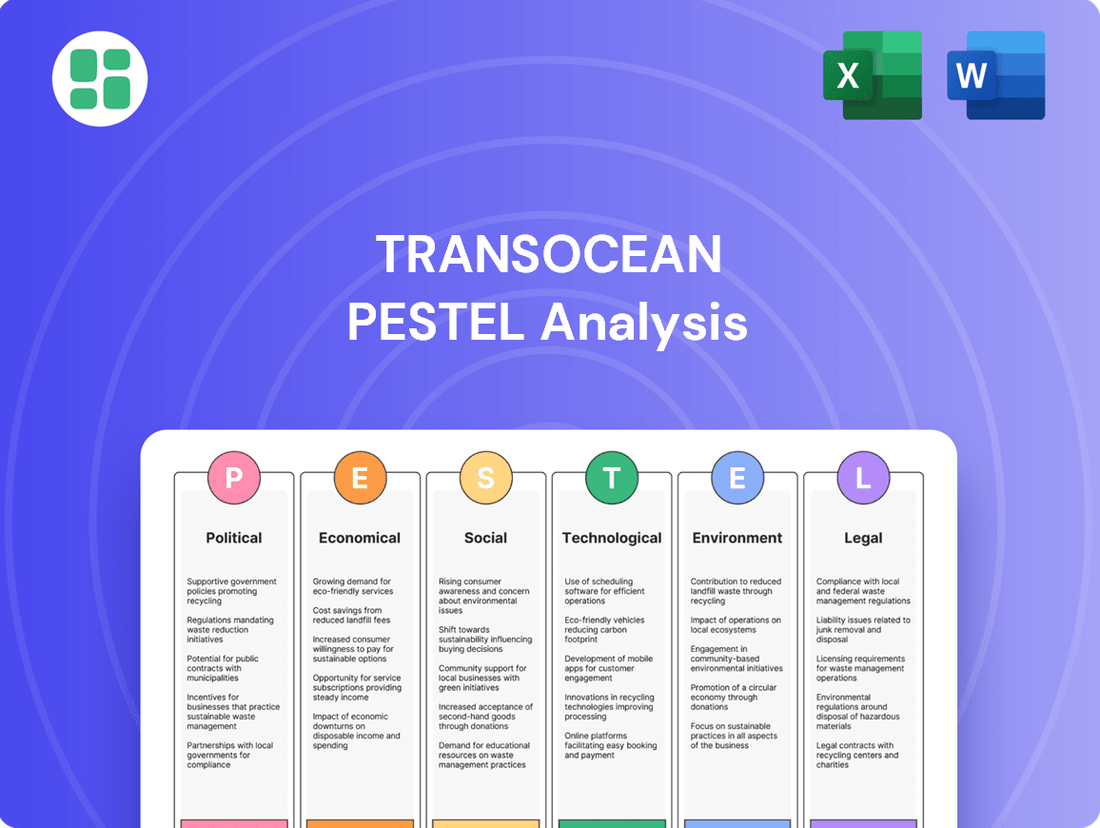

This Transocean PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the offshore drilling giant, offering a comprehensive view of its operating landscape.

Provides a clear, actionable framework for identifying and mitigating external risks, thereby reducing anxiety and uncertainty in strategic decision-making.

Economic factors

Global oil and gas prices are a critical economic factor for Transocean. Fluctuations directly affect the profitability of offshore exploration and production, which in turn influences the demand for their drilling services. When oil prices are high, companies tend to invest more in finding new reserves, boosting Transocean's business. Conversely, sustained low prices can lead to project postponements or cancellations, impacting revenue and rig utilization rates.

Looking ahead to 2025, the offshore drilling market is showing signs of a slight cooldown after a period of consistent growth. Dayrates, a key metric for drilling companies, are anticipated to experience only modest increases on average this year. This suggests a more balanced supply and demand dynamic compared to the preceding years, potentially impacting Transocean's pricing power.

The overall health of the global economy directly impacts energy consumption, which in turn shapes the long-term demand for oil and gas. A strong global economy generally translates to higher energy needs and greater investment in new energy sources, which is a positive signal for companies like Transocean involved in offshore drilling.

Indeed, the offshore drilling market is anticipated to see significant expansion, with forecasts indicating a compound annual growth rate (CAGR) of 8.2% between 2024 and 2029. This growth is largely fueled by the increasing global demand for both natural gas and oil.

The investment decisions of exploration and production (E&P) companies in offshore projects are a direct driver for Transocean's contract pipeline. These E&P firms' capital expenditure (CapEx) plans, particularly for new drilling campaigns, are heavily influenced by the outlook for commodity prices, their available financial liquidity, and their policies regarding shareholder returns. For instance, many E&P companies have signaled a commitment to capital discipline, meaning they are prioritizing efficient operations and returns over aggressive expansion, which directly impacts the demand for offshore rigs.

Interest Rates and Access to Capital

Interest rate fluctuations directly influence Transocean's financial flexibility. Higher rates increase the cost of borrowing for essential fleet upgrades and new vessel construction, potentially squeezing profit margins. For instance, a rise in benchmark rates could make refinancing existing debt more expensive, impacting the company's ability to manage its substantial debt obligations.

Access to capital at reasonable costs is paramount for Transocean, given its capital-intensive operations. The company's strategic focus on deleveraging highlights this need; Transocean aims to repay over $700 million of its debt in 2025. This proactive debt reduction strategy is designed to improve its financial standing and ensure it can secure necessary funding for future projects and operational needs.

- Impact on Borrowing Costs: Changes in interest rates directly affect the cost of Transocean's debt, influencing profitability and investment capacity.

- Capital Expenditure Funding: Affordable capital is essential for funding significant expenditures like fleet modernization and newbuild projects.

- Debt Management Strategy: Transocean's commitment to reducing its debt, with a target of over $700 million in repayments for 2025, underscores the importance of accessible and cost-effective financing.

- Financial Health: The company's ability to access capital and manage its debt load is critical for maintaining a strong balance sheet and operational resilience.

Day Rates and Rig Utilization

Transocean's revenue and profitability are directly tied to the day rates it can secure for its drilling rigs and how often those rigs are in operation. When utilization is high and day rates are strong, especially for its specialized ultra-deepwater and harsh environment units, it signals a robust market for offshore drilling services.

In 2024, Transocean successfully landed new contracts at rates that set industry benchmarks. Looking ahead to 2025, the company anticipates an impressive active fleet utilization rate of 96%, underscoring strong demand for its services.

- 2024 Contract Wins: Transocean secured new contracts at industry-leading day rates, demonstrating market strength.

- 2025 Utilization Forecast: The company expects its active fleet utilization to reach 96% in 2025.

- Market Health Indicator: High utilization and strong day rates, particularly for specialized rigs, reflect a healthy offshore drilling market.

The offshore drilling sector is poised for substantial growth, with projections indicating a compound annual growth rate of 8.2% from 2024 to 2029, driven by increasing global demand for oil and natural gas.

Transocean's financial health is directly linked to its ability to manage debt and access capital, with a stated goal of repaying over $700 million in debt during 2025. This focus on deleveraging is crucial for funding fleet upgrades and maintaining operational resilience in a capital-intensive industry.

The company's performance is also heavily influenced by global economic conditions, which dictate energy consumption and investment in new exploration projects, directly impacting the demand for Transocean's services.

| Economic Factor | Impact on Transocean | 2024/2025 Data/Outlook |

|---|---|---|

| Oil & Gas Prices | Influences E&P investment and demand for drilling services. | High prices generally boost demand; sustained low prices can hinder it. |

| Global Economic Growth | Drives energy consumption and investment in exploration. | Strong global economy translates to higher energy needs. |

| Interest Rates | Affects borrowing costs for fleet upgrades and debt management. | Higher rates increase financing costs; Transocean aims to repay over $700 million in debt in 2025. |

| Market Demand & Day Rates | Determines rig utilization and revenue. | Offshore drilling market CAGR of 8.2% (2024-2029); Transocean anticipates 96% fleet utilization in 2025. |

What You See Is What You Get

Transocean PESTLE Analysis

The preview shown here is the exact Transocean PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis covers all essential political, economic, social, technological, legal, and environmental factors impacting Transocean. You can be confident that the detailed insights and strategic overview you see are precisely what you'll gain immediate access to.

Sociological factors

Public perception of fossil fuels is undergoing a significant shift, largely driven by growing concerns about climate change. This evolving societal attitude directly impacts investment decisions and political backing for activities like offshore drilling, which is central to Transocean's operations. As public demand for renewable energy sources and broader decarbonization efforts intensifies, companies like Transocean face increasing scrutiny regarding their long-term social license to operate.

The offshore drilling sector, including companies like Transocean, grapples with an aging workforce, with many experienced professionals nearing retirement. This demographic shift necessitates a focus on knowledge transfer and the recruitment of a new generation of workers. The industry requires specialized skills in areas like advanced drilling technologies and digitalization, creating a significant skills gap that needs addressing through targeted training and development programs.

Attracting and retaining skilled personnel is paramount for maintaining operational efficiency and upholding stringent safety standards in this cyclical industry. For instance, in 2024, the global offshore drilling market is projected to grow, increasing the demand for qualified professionals across technical disciplines, from rig engineers to data analysts.

This dynamic environment presents substantial career opportunities. Transocean, as a major player, actively seeks both seasoned professionals with deep industry knowledge and ambitious newcomers eager to develop expertise in cutting-edge offshore drilling techniques.

Societal expectations for robust safety protocols in hazardous sectors like offshore drilling are increasingly high. A significant safety lapse can irreparably harm a company's public image, invite stricter governmental oversight, and escalate operational expenses.

Transocean prioritizes safe, dependable, and efficient operations, demonstrating this commitment by achieving its strongest occupational and process safety performance to date in 2024. This focus is crucial for maintaining stakeholder trust and operational continuity.

Corporate Social Responsibility (CSR)

The increasing global focus on Corporate Social Responsibility (CSR) pressures companies like Transocean to actively engage in ethical business practices, community support, and environmental protection that go beyond legal requirements. For Transocean, a strong CSR program is crucial for maintaining a favorable public perception and attracting investors who prioritize sustainability, particularly as the energy sector navigates the transition towards cleaner sources. This includes exploring opportunities to integrate with renewable energy projects, a trend gaining significant traction in the 2024-2025 period.

Transocean's commitment to CSR can be seen in its sustainability reporting, which increasingly details its efforts in areas such as reducing emissions and improving safety standards. For instance, in its 2023 sustainability report, the company highlighted its progress in lowering its Scope 1 and Scope 2 greenhouse gas emissions intensity. This focus on tangible environmental improvements is directly linked to investor confidence; a 2024 report by Morgan Stanley indicated that companies with robust ESG (Environmental, Social, and Governance) performance often see lower costs of capital.

- Growing Stakeholder Expectations: Investors, customers, and employees are increasingly demanding that corporations demonstrate a genuine commitment to social and environmental well-being, not just profit.

- Reputational Risk and Opportunity: A strong CSR record can enhance brand loyalty and attract talent, while a poor one can lead to boycotts and negative publicity, impacting market share and investor relations.

- Integration with Renewable Energy: As the energy landscape shifts, companies like Transocean are exploring how their expertise and assets can be leveraged in the development and maintenance of offshore renewable energy infrastructure, such as wind farms.

- ESG Investment Trends: The global sustainable investment market reached an estimated $37.8 trillion in early 2024, underscoring the financial imperative for companies to align their operations with ESG principles.

Local Community Relations

Transocean's commitment to local community relations is crucial for its global operations. For instance, in 2024, the company continued its focus on community engagement programs, particularly in regions where it undertakes significant offshore drilling projects. These initiatives often involve local hiring, procurement from local suppliers, and investments in community development projects, such as education or infrastructure improvements.

Maintaining positive relationships helps Transocean secure its social license to operate, which is vital for project continuity and avoiding delays. In 2025, the company is expected to further enhance its stakeholder engagement strategies, ensuring that its activities align with community expectations and contribute positively to local economies. This proactive approach mitigates risks and fosters a collaborative environment.

- Social License: Positive community relations are essential for obtaining and maintaining the social license to operate in diverse international jurisdictions.

- Economic Contribution: Transocean's operations in 2024 and projected for 2025 include significant local economic contributions through employment and local procurement.

- Impact Mitigation: The company actively addresses and mitigates potential environmental and social impacts, a key factor in community acceptance.

- Stakeholder Engagement: Enhanced stakeholder engagement in 2025 aims to strengthen partnerships and ensure mutual benefit with local communities.

Societal attitudes towards energy production are rapidly evolving, with a pronounced shift towards sustainability and environmental responsibility. This influences public support for offshore drilling, impacting Transocean's social license to operate. By 2024, investor and consumer demand for greener energy solutions is a significant factor shaping corporate strategies across the energy sector.

The industry faces a critical need to attract and retain a skilled workforce, addressing an aging demographic and a gap in specialized technical expertise. In 2024, the demand for offshore drilling professionals is projected to increase, highlighting the urgency for robust training and development initiatives to meet this growing need.

Corporate Social Responsibility (CSR) is no longer optional; it's a core expectation for companies like Transocean. Demonstrating a commitment to ethical practices and community well-being is vital for maintaining a positive reputation and attracting ESG-focused investments, a trend that gained significant momentum in 2024 and is expected to continue into 2025.

Strong community relations are fundamental to Transocean's global operations, ensuring project continuity and local acceptance. The company's ongoing engagement in 2024 and planned enhancements for 2025 aim to foster mutually beneficial relationships with local communities, reinforcing its social license to operate.

| Sociological Factor | Impact on Transocean | 2024/2025 Data/Trend |

| Public Perception of Fossil Fuels | Influences social license to operate and investment decisions. | Growing demand for renewable energy and decarbonization efforts impacting fossil fuel industry perception. |

| Workforce Demographics & Skills Gap | Affects operational efficiency, safety, and innovation. | Aging workforce and demand for specialized skills in digitalization and advanced technologies. Global offshore drilling market growth in 2024 increases demand for qualified professionals. |

| Corporate Social Responsibility (CSR) | Enhances brand reputation, attracts investors, and ensures stakeholder trust. | Increasing pressure for ethical practices, environmental protection, and community support. ESG investments reached $37.8 trillion in early 2024. |

| Community Relations | Crucial for securing social license to operate and project continuity. | Focus on local hiring, procurement, and community development projects. Enhanced stakeholder engagement planned for 2025 to strengthen partnerships. |

Technological factors

Continuous innovation in drilling technology is paramount for Transocean's competitive standing. Automation, digitalization, and improved well completion techniques are key drivers, allowing for more efficient, safer, and cost-effective operations, particularly in demanding ultra-deepwater and harsh environments.

The sector is actively embracing digital transformation, with technologies like digital twins and advanced seismic imaging becoming increasingly prevalent. These tools offer enhanced predictive capabilities and a clearer understanding of subsurface conditions, directly impacting operational planning and execution.

For instance, the increasing adoption of automated drilling systems can reduce personnel exposure in hazardous zones and improve consistency. While specific 2024/2025 figures for Transocean's technology investment are proprietary, the broader offshore drilling industry saw significant capital expenditure allocated towards technological upgrades in the lead-up to and throughout this period, reflecting the critical need for such advancements.

Transocean's technological edge in ultra-deepwater and harsh environments is paramount. This specialization demands cutting-edge, highly advanced rigs, acting as a significant competitive advantage by unlocking access to previously inaccessible hydrocarbon reserves. As of early 2024, Transocean's fleet boasts eighth-generation drillships, engineered for the extreme pressures of 20,000 psi wells, showcasing their commitment to technological superiority in the most challenging offshore conditions.

Transocean is heavily investing in automation and digitalization to boost its operations. For instance, the company has been integrating advanced drilling automation systems, aiming to cut down human error and increase precision. These advancements are crucial for optimizing drilling performance and enabling predictive maintenance, which was a key focus in their 2024 strategies.

The adoption of technologies like remote operations centers and digital twins is transforming the offshore drilling sector. By enabling remote oversight and creating virtual replicas of their assets, Transocean can enhance operational efficiency and significantly reduce downtime. This digital transformation is expected to lead to substantial cost savings and improved safety metrics throughout their fleet.

Subsea Technology Development

Innovations in subsea equipment and systems are vital for deepwater exploration, directly influencing the capabilities of drilling contractors like Transocean. These advancements enable more intricate well designs and boost resource extraction efficiency.

TechnipFMC, a key player, is actively developing subsea technologies aimed at optimizing offshore oil and gas production. Their efforts are geared towards enhancing operational performance and reducing costs in challenging environments.

The subsea sector is seeing significant investment, with companies focusing on automation and digitalization. For instance, the global subsea technology market was valued at approximately $15 billion in 2023 and is projected to grow, reflecting the increasing demand for sophisticated offshore solutions.

- Advancements in robotic systems for subsea intervention are improving safety and efficiency.

- Development of high-pressure, high-temperature (HPHT) equipment is opening up new deepwater frontiers.

- Increased integration of AI and data analytics in subsea operations is enhancing predictive maintenance and performance monitoring.

Integration with Renewable Energy Technologies

Transocean's technological future may involve adapting its offshore drilling expertise to the growing renewable energy sector. This could include leveraging its capabilities for installing foundations for offshore wind farms or for geothermal energy projects. The company's deepwater and harsh environment experience is directly transferable to these emerging fields.

The offshore energy landscape is rapidly shifting, with increased focus on technologies like floating offshore wind and carbon capture and storage (CCS). Transocean's ability to operate in challenging offshore environments positions it to potentially play a role in the development and deployment of these cleaner energy solutions. For instance, the installation of massive floating wind turbines requires specialized offshore construction capabilities that Transocean possesses.

- Offshore Wind Growth: The global offshore wind market is projected for significant expansion, with an estimated 100 GW of new capacity expected to be installed by 2030, creating opportunities for specialized offshore construction and installation services.

- Carbon Capture and Storage (CCS): As CCS projects gain traction, the need for offshore drilling and injection expertise for CO2 sequestration is growing, a segment where Transocean could apply its existing skill sets.

- Technological Adaptation: Transocean's investment in advanced drilling technologies and its experience in complex subsea operations provide a strong foundation for adapting to the technological demands of renewable energy infrastructure installation.

Technological advancements are central to Transocean's strategy, particularly in ultra-deepwater and harsh environments. The company's fleet features eighth-generation drillships, designed for 20,000 psi wells, highlighting their commitment to cutting-edge capabilities as of early 2024. Investments in automation and digitalization, including advanced drilling systems and predictive maintenance, aim to enhance operational efficiency and safety, a key focus in their 2024 plans.

Legal factors

Transocean must navigate a complex web of environmental regulations, from emissions controls to waste disposal and the protection of marine life, all of which directly influence operational strategies and expenses. For instance, permits often mandate specific mitigation efforts for species like the North Atlantic right whale, impacting rig placement and operational windows.

Failure to comply with these stringent rules, such as those outlined by the Bureau of Ocean Energy Management (BOEM) in the US, can result in substantial fines and reputational damage, underscoring the critical importance of robust compliance programs.

Transocean's global operations mean it must navigate a complex web of international maritime laws, conventions like UNCLOS, and specific national regulations for shipping and offshore activities. Staying compliant is non-negotiable for legal operation and participation in global trade, ensuring smooth vessel movements and contract execution.

The regulatory landscape for offshore oil and gas investment is dynamic, with nations frequently updating their rules. For instance, as of early 2024, countries like Brazil and Norway continue to refine their offshore licensing terms and environmental regulations, impacting where and how Transocean can deploy its assets.

Transocean operates in an industry where stringent occupational health and safety (OHS) standards are paramount due to the inherent risks of offshore drilling. Compliance with these rigorous regulations is essential for preventing catastrophic accidents, safeguarding the well-being of its workforce, and mitigating significant legal liabilities and potential reputational harm.

These safety regulations are specifically designed to minimize the likelihood of dangerous incidents such as blowouts, protecting both personnel and the environment. For instance, in 2023, the offshore oil and gas industry reported a total recordable incident rate (TRIR) of 0.98 per 200,000 hours worked, highlighting the continuous focus on safety performance and the critical nature of adhering to OHS standards.

Contractual and Commercial Laws

Transocean's operations are heavily dependent on intricate drilling contracts with major oil and gas producers. These agreements are subject to a complex web of commercial and contractual laws across the many regions where Transocean operates. Navigating these legal frameworks, particularly clauses related to force majeure, liability allocation, and the mechanisms for resolving disputes, is critical for maintaining operational stability and financial predictability.

The company's ability to secure and execute these contracts directly impacts its financial health. As of April 2025, Transocean reported a substantial backlog of approximately $7.9 billion, underscoring the significance of these contractual relationships and the legal environments in which they are formed and enforced.

- Contractual Dependence: Transocean's revenue is generated through long-term contracts for its offshore drilling rigs.

- Jurisdictional Complexity: Operating globally means adhering to diverse legal systems governing commercial agreements.

- Risk Management: Understanding and managing contractual terms like force majeure and liability is paramount.

- Financial Backlog: A backlog of $7.9 billion as of April 2025 highlights the importance of robust contractual frameworks.

Anti-Corruption and Sanctions Laws

Operating globally means Transocean must navigate a complex web of anti-corruption and sanctions laws. This includes regulations like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, which carry significant penalties for violations. In 2023, the U.S. Department of Justice reported over $2.5 billion in FCPA enforcement actions, highlighting the serious financial and reputational risks involved.

Compliance is paramount, particularly when Transocean engages with state-owned entities or operates in regions with heightened political instability. Failure to adhere to these laws can result in substantial fines, debarment from contracts, and severe damage to the company's reputation. For instance, sanctions imposed by bodies like the United Nations or individual countries can restrict business dealings and require rigorous due diligence on all partners and jurisdictions.

- FCPA and UK Bribery Act Compliance: Transocean must maintain robust internal controls and training programs to prevent bribery and corruption.

- Sanctions Screening: Thoroughly vetting clients, suppliers, and operating locations against international sanctions lists is crucial.

- Risk Mitigation: Proactive legal counsel and compliance audits help identify and address potential violations before they escalate.

- Reputational Management: Demonstrating a strong commitment to ethical business practices protects Transocean's brand and stakeholder trust.

Transocean's global footprint necessitates strict adherence to international maritime laws and specific national regulations, ensuring legal operation and smooth contract execution. The company's substantial backlog of approximately $7.9 billion as of April 2025 underscores the critical importance of these contractual relationships and the legal frameworks governing them.

Navigating complex contractual terms, including force majeure and liability clauses, is essential for operational stability and financial predictability. Failure to comply with environmental regulations, such as those concerning emissions and marine life protection, can lead to significant fines and reputational damage.

The company must also meticulously follow anti-corruption laws like the FCPA and UK Bribery Act, with U.S. enforcement actions in 2023 exceeding $2.5 billion, highlighting the severe risks of non-compliance.

| Legal Factor | Description | Impact on Transocean | Relevant Data/Example |

| Environmental Regulations | Compliance with rules on emissions, waste, and marine life protection. | Influences operational strategies, expenses, and permits. | Permits may mandate specific mitigation for species like the North Atlantic right whale. |

| International Maritime Law | Adherence to global conventions and national shipping/offshore laws. | Ensures legal operation and participation in global trade. | UNCLOS (United Nations Convention on the Law of the Sea). |

| Contractual Law | Navigating complex drilling contracts and commercial agreements. | Critical for operational stability, financial predictability, and risk management. | Backlog of ~$7.9 billion as of April 2025 highlights contract significance. |

| Anti-Corruption & Sanctions | Compliance with laws like FCPA and UK Bribery Act, and sanctions lists. | Mitigates financial penalties, debarment, and reputational damage. | U.S. FCPA enforcement actions exceeded $2.5 billion in 2023. |

Environmental factors

Global initiatives like carbon pricing and stringent emissions reduction targets directly impact the long-term demand for fossil fuels, a core market for Transocean. For instance, the International Energy Agency (IEA) projects that under stated policies scenarios, oil demand could plateau around 2030, presenting a challenge for offshore drilling services.

Renewable energy mandates and the push for cleaner technologies are reshaping the energy landscape, potentially diverting investment from traditional offshore exploration. Project 2025's stated aims to expand offshore drilling are met with significant environmental concerns, highlighting the growing tension between energy production and climate change mitigation efforts.

The persistent risk of oil spills, especially in challenging deepwater and harsh offshore conditions, presents substantial environmental and reputational dangers for Transocean. The company's commitment to advanced prevention technologies and well-equipped emergency response teams is crucial for minimizing potential harm and adhering to stringent environmental mandates.

In 2024, the global offshore drilling industry continues to face intense scrutiny regarding environmental safety. Regulations are increasingly focused on preventing catastrophic events like blowouts, with significant financial penalties for non-compliance. For instance, the aftermath of incidents like the 2010 Deepwater Horizon spill, which cost BP billions, serves as a constant reminder of the severe consequences of inadequate safety measures.

Offshore drilling, a core activity for companies like Transocean, poses significant risks to marine biodiversity. The physical presence of rigs, operational noise, and potential discharges can disrupt delicate ocean ecosystems. For instance, seismic surveys used in exploration can negatively impact marine mammals, with studies indicating behavioral changes and potential hearing damage.

Environmental regulations are tightening globally, demanding more rigorous impact assessments and biodiversity offset strategies. This means companies must increasingly invest in mitigating their footprint and potentially restoring damaged habitats, adding to operational costs and complexity.

The entire lifecycle of offshore oil and gas extraction, from exploration to decommissioning, presents ongoing threats to marine life. Accidental spills, though infrequent, can have catastrophic consequences, as seen in past incidents that devastated coastal environments and marine populations, highlighting the inherent risks in the industry.

Waste Management and Pollution Control

Transocean, like all offshore drilling companies, faces significant environmental challenges in managing drilling waste, wastewater, and operational discharges. Responsible practices are crucial to minimize ecological footprints and maintain operational licenses. For instance, in 2023, the company reported managing substantial volumes of drilling fluids and cuttings across its global operations, adhering to strict disposal protocols in various jurisdictions.

Adherence to a complex web of international and national pollution control regulations is paramount. These regulations, such as those set by the International Maritime Organization (IMO) and regional bodies like the European Union, dictate discharge limits for oil, chemicals, and other pollutants. Non-compliance can lead to hefty fines and reputational damage, impacting Transocean's ability to secure new contracts.

The offshore industry is under increasing scrutiny regarding its environmental impact, particularly concerning greenhouse gas emissions and potential spills. This heightened awareness, amplified by climate change concerns, pressures companies like Transocean to invest in cleaner technologies and more efficient waste management systems. For example, advancements in cuttings treatment technologies aim to reduce the volume of material requiring offshore disposal, a key focus for the 2024-2025 period.

- Waste Management: Transocean employs advanced techniques for treating and disposing of drilling fluids and cuttings, aiming to meet or exceed regulatory standards in all operating regions.

- Pollution Control: Strict adherence to discharge permits for produced water and other operational effluents is a continuous effort, with ongoing monitoring and reporting.

- Regulatory Compliance: The company navigates a diverse and evolving regulatory landscape, ensuring all activities align with international conventions and national environmental laws.

- Environmental Scrutiny: Increased public and governmental focus on the environmental performance of offshore operations drives investment in sustainable practices and emission reduction strategies.

Resource Depletion and Energy Transition

The finite nature of hydrocarbon reserves, combined with the global drive for an energy transition, signals a move away from traditional fossil fuels. While Transocean's deepwater operations aim to unlock new reserves, the company must acknowledge the growing momentum towards sustainable energy. For instance, global investment in renewable energy sources reached an estimated $1.3 trillion in 2023, a significant increase from previous years, highlighting this shift.

This evolving landscape means the offshore energy sector is transforming into a more comprehensive ecosystem. Beyond oil and gas, this includes emerging areas like floating offshore wind and carbon capture and storage (CCS). By 2030, the global offshore wind market is projected to reach over $200 billion, indicating substantial growth opportunities outside of fossil fuels.

- Finite Hydrocarbon Reserves: Global proven oil reserves were estimated at around 1.7 trillion barrels in early 2024, but their long-term extraction is constrained.

- Energy Transition Investment: Renewable energy sources attracted significant global investment in 2023, underscoring the shift in capital allocation.

- Offshore Sector Diversification: The offshore energy market is expanding to include floating offshore wind and carbon capture technologies, creating new avenues for growth.

- Market Growth Projections: The offshore wind sector is expected to see substantial expansion, with market value projected to exceed $200 billion by 2030.

Stricter environmental regulations, including carbon pricing and emissions reduction targets, directly influence the demand for offshore drilling services. For example, the International Energy Agency projected in 2024 that under stated policies, oil demand might plateau around 2030, posing a challenge for Transocean's core market.

The increasing focus on preventing environmental incidents, such as oil spills, necessitates significant investment in safety and mitigation technologies. The industry remembers the immense costs and reputational damage from past events, like the 2010 Deepwater Horizon spill, which cost BP billions, underscoring the financial imperative for stringent safety protocols.

The global push for an energy transition and the finite nature of hydrocarbon reserves are reshaping the energy landscape, driving investment towards renewable sources. Global investment in renewables reached an estimated $1.3 trillion in 2023, signaling a significant shift in capital allocation away from traditional fossil fuels.

| Environmental Factor | Impact on Transocean | Data/Fact |

| Climate Change Initiatives | Reduced long-term demand for fossil fuels, increased operational costs due to compliance. | IEA projects oil demand plateauing around 2030 under stated policies. |

| Pollution Control Regulations | Need for advanced waste management and pollution prevention technologies, risk of fines for non-compliance. | IMO and regional bodies set strict discharge limits for pollutants. |

| Energy Transition | Shift in investment towards renewables, potential for diversification into areas like offshore wind and CCS. | Global renewable investment hit $1.3 trillion in 2023; offshore wind market projected to exceed $200 billion by 2030. |

PESTLE Analysis Data Sources

Our Transocean PESTLE Analysis is meticulously constructed using data from international maritime organizations, national regulatory bodies, and leading energy market intelligence firms. This ensures comprehensive coverage of political stability, economic forecasts, technological advancements, and environmental policies impacting offshore drilling.