Transocean Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Transocean Bundle

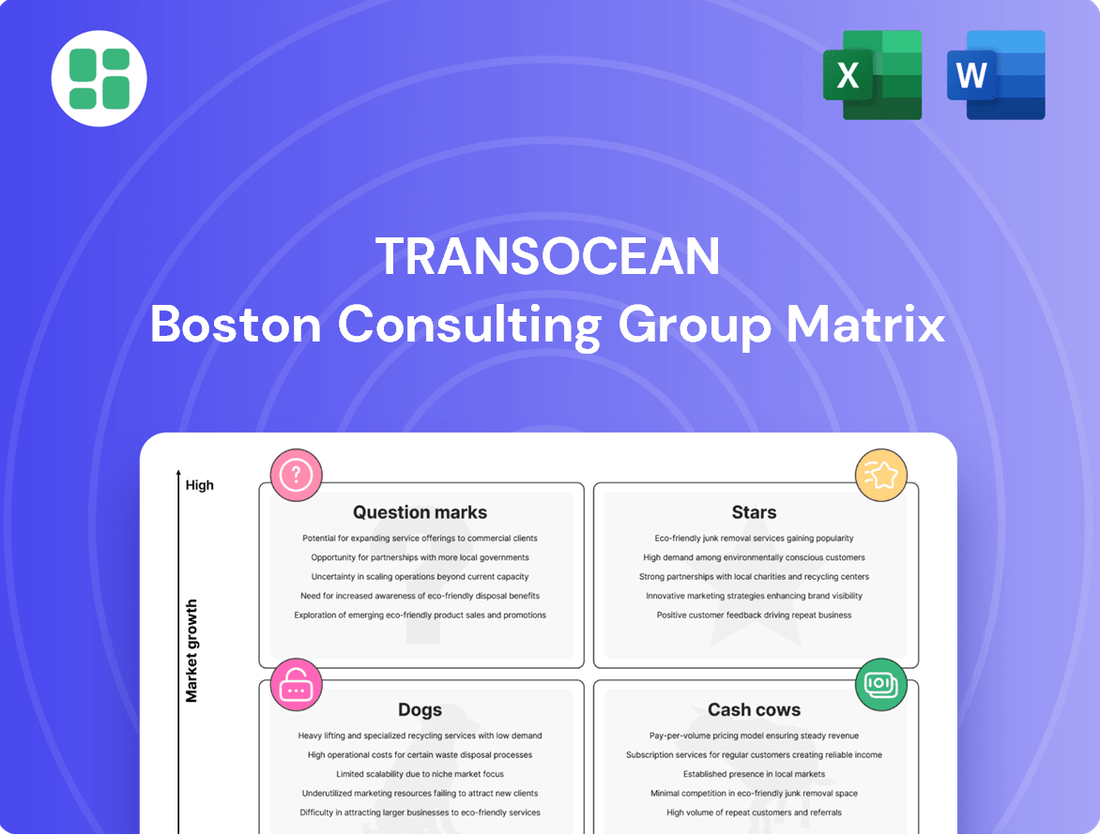

Curious about Transocean's strategic product portfolio? This glimpse into their BCG Matrix reveals the essential categories: Stars, Cash Cows, Dogs, and Question Marks. To truly understand how to leverage these insights for your own business, you need the complete picture.

Purchase the full Transocean BCG Matrix to unlock detailed quadrant analysis, actionable recommendations, and a clear roadmap for optimizing your investments and product development. Don't just see the categories; understand the strategy behind them.

Gain a competitive edge by acquiring the complete BCG Matrix report. It provides the in-depth data and strategic takeaways necessary to navigate market dynamics and make informed decisions, transforming potential into profit.

Stars

Transocean's eighth-generation ultra-deepwater drillships, including the Deepwater Titan and Deepwater Atlas, are at the forefront of offshore drilling innovation. These vessels are engineered for the harshest ultra-deepwater conditions, enabling them to secure premium day rates in a market experiencing limited availability of high-specification rigs.

These advanced drillships boast superior operational capabilities, making them the preferred choice for major oil and gas firms undertaking significant, long-term projects. For instance, Transocean reported that its ultra-deepwater floaters, which include these advanced drillships, achieved an average utilization rate of 97% in the first quarter of 2024, reflecting strong demand.

Transocean's specialized harsh environment floaters, such as the Transocean Spitsbergen and Transocean Enabler, are key assets in challenging offshore regions like the Norwegian Continental Shelf. These semi-submersibles are designed for extreme weather and deepwater, commanding strong long-term contracts and premium day rates. This strategic positioning in a high-demand niche segment ensures high utilization for these specialized assets.

Transocean's commitment to advanced drilling technologies, such as their 20,000-psi blowout preventer systems and sophisticated automation, directly addresses the industry's need for enhanced safety and efficiency. This strategic focus positions them favorably in the market, as clients increasingly seek technologically superior solutions for complex projects.

By integrating data analytics for drilling optimization, Transocean not only improves rig performance and minimizes downtime but also unlocks access to challenging reservoirs. This technological edge is a significant driver of demand, reflecting a market that rewards innovation and operational excellence. For instance, in 2024, offshore drilling expenditures were projected to rise, with technological advancement being a key differentiator.

High-Demand 'Golden Triangle' Operations

Transocean's strategic deployment of its high-specification drillships within the 'Golden Triangle' – encompassing the US Gulf of Mexico, Brazil, and West Africa – positions it advantageously. These areas are hotspots for ultra-deepwater exploration and production, driving consistent demand for premium offshore drilling assets.

The sustained activity in these key regions translates into increasing day rates for Transocean's advanced fleet. This allows the company to secure lucrative contracts, thereby solidifying its market leadership in these high-demand operational zones.

- Fleet Concentration: A significant portion of Transocean's advanced drillship fleet operates in the US Gulf of Mexico, Brazil, and West Africa.

- Market Dynamics: These regions exhibit robust ultra-deepwater E&P activity, leading to rising day rates for premium rigs.

- Contract Wins: Transocean's positioning enables it to secure favorable contracts, enhancing revenue and market share.

- 2024 Outlook: Analysts project continued strength in ultra-deepwater markets throughout 2024, benefiting Transocean's 'Golden Triangle' operations.

New High-Value Contract Awards

Transocean is demonstrating robust performance in securing new high-value contracts and extensions for its advanced fleet. This consistent success, often at increasing day rates, highlights a strong demand for their specialized services in the offshore drilling market.

Recent contract awards, including significant fixtures for the Deepwater Atlas and Transocean Equinox, are bolstering Transocean's already substantial backlog. These wins are a clear indicator of their sustained market leadership, particularly in segments experiencing high growth and requiring sophisticated drilling capabilities.

- Deepwater Atlas securing a contract extension in the US Gulf of Mexico for an estimated 100 days, starting in Q3 2024.

- Transocean Equinox awarded a 300-day contract in the UK North Sea, commencing in Q2 2024.

- The company's total contracted backlog stood at approximately $8.4 billion as of the first quarter of 2024.

- These awards contribute to Transocean's status as a Star in the BCG Matrix, given their strong market share and high growth prospects in the offshore drilling sector.

Transocean's advanced drillships, such as the Deepwater Titan and Deepwater Atlas, are classified as Stars due to their strong market share in high-growth ultra-deepwater segments and their premium day rates. These assets are consistently securing long-term contracts in key regions like the US Gulf of Mexico and Brazil. Their high utilization rates, exemplified by the 97% achieved by ultra-deepwater floaters in Q1 2024, underscore their Star status.

The company's strategic focus on high-specification assets in demanding offshore environments, like harsh environments in the Norwegian Continental Shelf, further solidifies their Star positioning. These specialized rigs command premium pricing and enjoy high demand, contributing to Transocean's robust backlog, which stood at approximately $8.4 billion in Q1 2024.

Recent contract wins, including extensions for the Deepwater Atlas and new contracts for the Transocean Equinox, reinforce their market leadership and growth potential. These successes reflect the industry's increasing reliance on technologically advanced drilling solutions, a segment where Transocean excels.

Transocean's fleet, particularly its eighth-generation ultra-deepwater drillships, operates in regions with robust exploration and production activity, leading to increasing day rates. This strategic deployment and consistent contract acquisition highlight their strong market position and favorable growth prospects, characteristic of Stars in the BCG Matrix.

| Asset Class | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| Ultra-Deepwater Drillships | High | High | Star |

| Harsh Environment Semi-submersibles | High | High | Star |

| Older Fleet Assets | Low | Low | Dog |

| Mid-Water Semi-submersibles | Medium | Medium | Cash Cow |

What is included in the product

The Transocean BCG Matrix analyzes business units by market share and growth rate.

It guides strategic decisions on investment, divestment, and resource allocation.

A clear, visual BCG Matrix quickly identifies underperforming units, simplifying strategic decisions.

Cash Cows

Transocean's established ultra-deepwater drillship fleet, comprising 6th and 7th generation vessels, acts as a significant cash cow. These assets are consistently secured by long-term contracts, ensuring a steady stream of revenue. For instance, as of early 2024, Transocean reported a backlog of approximately $7.3 billion, with a substantial portion attributed to its ultra-deepwater fleet.

While not always the most cutting-edge, these drillships boast high utilization rates and strong revenue efficiency. Their proven track record and existing client relationships allow them to command consistent demand. This stability translates into predictable cash flow, requiring less capital expenditure for upgrades compared to newer, high-growth assets like Stars.

Transocean's long-term contract backlog, estimated between $7.2 billion and $7.9 billion as of mid-2025, represents a significant asset. This substantial backlog acts as a powerful cash cow, ensuring predictable revenue streams that reduce the need for aggressive sales or marketing efforts.

The secured revenue from these contracts provides a stable financial base, allowing Transocean to comfortably manage operational expenses, meet debt obligations, and invest in future growth without the immediate pressure of acquiring new business.

Transocean's mature harsh environment semi-submersibles, particularly those with long-term contracts in stable regions like the North Sea, function as true cash cows. These assets benefit from a specialized market where their proven track record and safety certifications command premium rates, ensuring consistent revenue streams.

In 2024, Transocean continued to leverage these assets, with several of its harsh environment semi-submersibles operating under multi-year agreements. For instance, the company's utilization rates for its harsh environment fleet remained robust, reflecting the ongoing demand for these specialized units in established production basins.

Efficient Fleet Operations and High Revenue Efficiency

Transocean's dedication to superior operational execution and stringent cost management across its contracted fleet is the bedrock of its robust cash flow generation. This focus on efficiency directly translates into high revenue realization from its backlog of work.

By actively minimizing idle time and maximizing the productive utilization of its assets, Transocean ensures its operational rigs consistently generate revenue at peak performance. This operational discipline is key to efficiently converting future contracted revenue into immediate cash.

- Fleet Utilization: Transocean reported an average fleet-wide utilization rate of 95% for its floaters in the first quarter of 2024, a testament to its operational efficiency.

- Revenue Efficiency: The company achieved a revenue efficiency of 98% on its contracted floater fleet during the same period, demonstrating its ability to capture nearly all contracted revenue.

- Backlog Conversion: As of the first quarter of 2024, Transocean's contracted backlog stood at approximately $7.1 billion, highlighting the substantial future cash generation potential from its efficient operations.

Strategic Asset Maintenance and Upgrades

Transocean strategically invests in maintaining and upgrading its existing high-specification offshore drilling rigs. These ongoing capital expenditures are crucial for extending the operational lifespan and ensuring the continued market competitiveness of these revenue-generating assets.

These investments focus on enhancing efficiency and preserving market standing, thereby avoiding the need for complete fleet replacement. This approach directly supports the sustained generation of cash flow from these established "cash cow" assets.

- Fleet Modernization: Ongoing investments in maintenance and targeted upgrades for high-specification rigs.

- Operational Efficiency: Upgrades aim to improve rig performance and reduce operating costs.

- Market Competitiveness: Maintaining asset quality ensures Transocean remains competitive in securing contracts.

- Sustained Cash Flow: These strategic investments support the consistent cash generation from mature assets.

Transocean's established ultra-deepwater drillship fleet and mature harsh environment semi-submersibles act as significant cash cows. These assets, often secured by long-term contracts, ensure a steady and predictable revenue stream. For instance, as of early 2024, Transocean reported a backlog of approximately $7.3 billion, with a substantial portion from these core assets.

| Asset Type | Key Characteristic | 2024 Data/Insight | Cash Cow Contribution |

| Ultra-Deepwater Drillships | 6th & 7th Generation, Long-term Contracts | ~$7.3 billion backlog (early 2024), High Utilization | Consistent Revenue, Predictable Cash Flow |

| Harsh Environment Semi-submersibles | Specialized Market, Multi-year Agreements | Robust Utilization in Established Basins | Premium Rates, Stable Revenue Streams |

Delivered as Shown

Transocean BCG Matrix

The Transocean BCG Matrix preview you see is the complete, unwatermarked document you will receive upon purchase. This means the strategic insights and analysis presented are exactly what you'll utilize for your business planning. You can confidently use this preview as a direct representation of the high-quality, ready-to-implement report that will be yours to download and integrate into your decision-making processes immediately.

Dogs

Transocean's fleet includes several older-generation rigs that are currently cold-stacked, meaning they are not actively working. Examples include the Ocean Rig Apollo and Discoverer India. These rigs typically have a low market share and minimal operational activity.

Reactivating these older units can be challenging and costly. The high expenses associated with bringing them back online, combined with a limited demand for their specific capabilities, often make them less attractive for continued operation. This situation positions them as potential candidates for being sold off or scrapped.

Assets that have recently incurred substantial impairment charges, as reflected in Transocean's financial reports for 2024 and Q2 2025, are typically older, less technologically advanced offshore drilling rigs. These impairments indicate a significant reduction in their estimated future economic value, signifying their low market prospects and potential for being cash traps rather than contributors. For instance, Transocean recorded impairment charges of $1.1 billion in 2023 related to certain older harsh-environment floaters, a trend likely to continue impacting similar assets in 2024 and into 2025 as market conditions evolve.

Units off-contract in saturated segments are essentially the question marks in Transocean's fleet. These are the rigs that, despite their best efforts, are finding it tough to snag new drilling contracts, especially in markets that are already packed with too many available rigs.

For Transocean, this means if any of their older or less technologically advanced rigs are in these oversupplied areas, they could be sitting idle for extended periods. This idle time isn't just a missed opportunity for revenue; it's a drain on the company's finances, as these units still incur costs without bringing in any income.

As of the first quarter of 2024, Transocean had several rigs that were either idle or had their contracts ending soon, particularly in segments facing oversupply. For instance, the harsh environment drilling sector, while not entirely saturated, has seen increased competition, potentially impacting the utilization of certain Transocean assets if they aren't the most cutting-edge.

Non-Core or Less Specialized Assets

Non-core or less specialized assets within Transocean's fleet, if any remain, would fall into this category. These might include older, less technologically advanced rigs that don't fit their strategic emphasis on ultra-deepwater and harsh environment operations.

These types of assets generally command lower day rates and often present greater operational complexities, thereby contributing minimally to overall profitability. For instance, while Transocean's fleet is heavily geared towards high-spec units, any remaining older assets would likely see reduced utilization and lower earnings potential.

- Lower Day Rates: Assets not aligned with specialized drilling command significantly lower daily charter fees.

- Operational Challenges: Less specialized units may require more maintenance and face higher operating costs.

- Minimal Strategic Fit: These assets do not contribute to Transocean's core competency in ultra-deepwater and harsh environment drilling.

- Reduced Profitability: Their contribution to overall financial performance is typically marginal.

Rigs Requiring Uneconomic Reactivation Costs

Certain Transocean rigs may face prohibitively high reactivation costs, rendering them uneconomic for current market conditions. These units, even if technically sound, become candidates for retirement or extended stacking when the expense of bringing them back online exceeds their projected future earnings.

For instance, older, less technologically advanced rigs often require significant upgrades to meet modern drilling standards and environmental regulations. The cost of these upgrades, coupled with the period of inactivity, can easily push reactivation expenses into the tens of millions of dollars per rig. In 2024, with a fluctuating offshore drilling market, such substantial upfront investments are often avoided in favor of newer, more efficient assets.

- High Reactivation Expenses: Costs can include extensive maintenance, regulatory compliance upgrades, and mobilization, potentially exceeding $50 million per rig for older assets.

- Market Viability: If projected dayrates and contract durations do not justify the reactivation investment, the rig is deemed uneconomic.

- Asset Retirement: Many companies opt for early retirement or sale for scrap when reactivation costs become too burdensome.

- Strategic Stacking: Some rigs may be kept in a state of cold-stacking indefinitely if the market outlook remains unfavorable for their specific capabilities.

Transocean's "Dogs" are its older, less technologically advanced offshore drilling rigs, often cold-stacked and with minimal market share. These assets typically have low day rates, face operational challenges, and do not align with the company's strategic focus on ultra-deepwater and harsh environment drilling. Consequently, their contribution to overall profitability is marginal, and they may incur substantial impairment charges, as seen with $1.1 billion in charges in 2023 for certain older floaters, a trend that continued to impact similar assets in 2024.

| Rig Name (Example) | Status | Estimated Reactivation Cost (Millions USD) | Market Outlook | Strategic Fit |

| Ocean Rig Apollo | Cold-stacked | $30 - $60 | Low (Older technology) | Poor |

| Discoverer India | Cold-stacked | $25 - $50 | Low (Older technology) | Poor |

| Unnamed Older Unit | Idle / Contract Ending | $40 - $70 | Challenging (Oversupplied segments) | Limited |

Question Marks

Emerging Carbon Capture and Storage (CCS) drilling services position Transocean in a market with high future growth potential but currently limited established players. This segment is akin to a question mark in the BCG matrix, signifying a promising but unproven area for drilling contractors.

The demand for CCS infrastructure is escalating as governments and industries aim to meet climate targets. For instance, by the end of 2023, over 30 large-scale CCS facilities were operational globally, with many more in development, indicating a substantial future market for specialized drilling.

Transocean's entry into this sector would require significant capital investment for specialized equipment and expertise, reflecting the high investment needs characteristic of question mark businesses. Successfully navigating this nascent market could lead to substantial future market share and profitability.

Transocean's significant investments in advanced automation and remote operations position these initiatives as potential Question Marks within their BCG matrix. These ambitious projects, aiming to surpass current industry benchmarks, necessitate considerable research and development expenditure. While the long-term benefits of enhanced efficiency and safety are clear, the immediate return on investment and market acceptance remain uncertain until these technologies are fully proven and widely adopted.

Transocean's strategic focus on frontier exploration in underserved deepwater basins, such as the Eastern Mediterranean or parts of West Africa, can be viewed as a Question Mark in the BCG framework. These ventures represent significant future growth potential due to their untapped hydrocarbon reserves, but carry substantial operational and geological risks, making their success uncertain. For instance, in 2024, several exploration campaigns in these regions are underway, with companies investing billions in seismic surveys and initial drilling, yet commercial production is still years away and not guaranteed.

Diversification into Geothermal Drilling

Diversifying into geothermal drilling aligns with Transocean's potential to leverage its extensive deep-drilling expertise into a high-growth, though currently small, market. This strategic move places geothermal drilling in the question mark category of the BCG matrix, indicating a promising future that requires substantial investment and technological adaptation.

Transocean's current market share in geothermal drilling is minimal, necessitating significant capital expenditure and the recalibration of existing offshore drilling technologies for the distinct challenges of geothermal well construction. For instance, the average cost to drill a geothermal well can range from $5 million to $10 million, and adapting existing offshore rigs would require specialized equipment and training.

- High Growth Potential: The global geothermal energy market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 5% to 7% in the coming years, reaching potentially over $30 billion by 2030.

- Leveraging Core Competencies: Transocean's established expertise in drilling complex wells in challenging offshore environments provides a strong foundation for entering the geothermal sector.

- Technological Adaptation: Success hinges on modifying existing offshore drilling equipment and techniques to handle the higher temperatures and corrosive fluids often encountered in geothermal reservoirs.

- Nascent Market Share: Transocean's current penetration in this specific market segment is very low, highlighting the need for aggressive market development and strategic partnerships.

Strategic Partnerships for Non-Traditional Offshore Energy

Transocean's ventures into non-traditional offshore energy, like supporting floating offshore wind, could be classified as Question Marks in a BCG Matrix. These emerging sectors, such as the burgeoning offshore wind market, present significant growth opportunities. For instance, the global offshore wind market was valued at approximately $50 billion in 2023 and is projected to grow substantially, with some forecasts suggesting it could reach over $100 billion by 2030.

Forming strategic partnerships for these projects is crucial, as Transocean may lack established market share or direct experience in these specific niches. This allows them to leverage the expertise of partners while mitigating the risks associated with entering new territories.

- High Growth Potential: The global offshore wind market is experiencing rapid expansion, offering substantial revenue opportunities.

- Limited Existing Market Share: Transocean's direct experience and market dominance in these non-traditional areas are still developing.

- Strategic Alliances: Partnerships are key to accessing new markets and sharing the investment and operational risks.

- Investment Required: Significant capital investment will be necessary to adapt existing assets or acquire new capabilities for these ventures.

Transocean's exploration into emerging sectors like carbon capture and storage (CCS) and geothermal drilling are prime examples of Question Marks. These areas offer substantial long-term growth potential but currently represent unproven markets for the company, demanding significant investment and technological adaptation. Success in these nascent fields could lead to considerable future market share, but the immediate returns and competitive landscape remain uncertain.

BCG Matrix Data Sources

Our Transocean BCG Matrix is constructed using a blend of internal financial disclosures, comprehensive market research reports, and industry-specific growth forecasts to provide a robust strategic overview.