Transocean Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Transocean Bundle

Transocean's position in the ultra-deepwater drilling market is shaped by intense rivalry and the significant bargaining power of its major oil and gas clients. Understanding these forces is crucial for navigating the industry's cyclical nature and capital-intensive operations.

The complete report reveals the real forces shaping Transocean’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Transocean faces considerable bargaining power from specialized equipment and technology providers. These suppliers, often holding patents for unique drilling components and subsea systems, dictate terms due to their exclusive expertise. For instance, the intricate nature of advanced riser systems and dynamic positioning technology means few alternatives exist, allowing these providers to command premium pricing.

The demand for highly skilled labor and specialized crews in the offshore drilling sector, particularly for ultra-deepwater and harsh environment operations, remains strong. This robust demand for experienced drillers, engineers, and marine personnel creates a significant bargaining advantage for these workers.

The limited pool of individuals possessing the necessary certifications and experience for these complex operations directly translates into increased wage expectations and can constrain Transocean's leverage in negotiating labor costs. For instance, the average daily rate for a semi-submersible rig, heavily reliant on skilled crews, can range from $300,000 to $500,000 in 2024, reflecting the premium placed on operational expertise.

Transocean's reliance on specialized Maintenance, Repair, and Overhaul (MRO) services, often provided by original equipment manufacturers (OEMs) or certified specialists, significantly influences supplier bargaining power. The proprietary nature of many of its high-specification offshore drilling rig components means fewer alternative service providers exist, granting these specialized suppliers considerable leverage. For instance, in 2024, the complexity of maintaining advanced subsea drilling equipment necessitates deep technical expertise, limiting Transocean's ability to switch providers easily, thereby strengthening the MRO suppliers' negotiating position.

Shipyards and Fabrication Facilities

Transocean's reliance on a select group of global shipyards for major rig upgrades, life extensions, and new builds significantly influences the bargaining power of these suppliers. The limited number of facilities with the specialized capacity to handle such intricate offshore projects creates a bottleneck, directly benefiting the shipyards.

This scarcity translates into higher construction and upgrade costs for Transocean, as well as potentially longer lead times for project completion. For instance, the global shipbuilding market, particularly for specialized offshore vessels, has seen capacity constraints in recent years, a trend that has continued into 2024.

- Limited Global Capacity: The specialized nature of offshore drilling rig construction and maintenance means only a handful of shipyards worldwide possess the necessary infrastructure and expertise.

- Increased Project Costs: In 2024, the demand for shipyard services for offshore energy projects has remained strong, allowing these facilities to command premium pricing for their services.

- Extended Lead Times: Backlogs at major shipyards can push out project timelines, giving them more leverage in negotiations with clients like Transocean.

Logistics and Supply Chain for Remote Operations

Operating in remote deepwater and harsh environments, like those Transocean frequently navigates, demands a highly specialized and dependable logistics network. This includes everything from advanced vessels and helicopters to strategically located supply bases. The unique nature of these services often means there are fewer providers available.

This limited competition among logistics providers grants them significant bargaining power. For instance, in 2024, the cost of chartering specialized offshore support vessels saw an increase due to high demand and limited availability of certain vessel types, directly impacting operational expenses for companies like Transocean.

- Limited Provider Pool: The specialized nature of deepwater logistics restricts the number of companies capable of offering these services.

- High Operational Demands: The harsh environments and technical requirements increase the cost and complexity for logistics providers, justifying higher rates.

- Dependence on Reliability: Transocean's operations are critically dependent on the uninterrupted supply chain, making reliable logistics a non-negotiable, albeit costly, requirement.

Transocean's suppliers, particularly those providing highly specialized drilling equipment and technology, wield considerable bargaining power. This is due to the limited number of manufacturers holding patents for critical components like advanced riser systems and dynamic positioning technology, allowing them to command premium prices. The complexity of these systems means few viable alternatives exist for Transocean, strengthening supplier leverage in pricing and contract terms.

The demand for skilled labor in offshore drilling is robust, with experienced drillers and engineers being in high demand. This scarcity of qualified personnel gives workers significant bargaining power, leading to increased wage expectations. For example, in 2024, the daily rates for operating advanced offshore rigs reflect this premium on expertise, impacting labor costs for companies like Transocean.

Transocean's reliance on specialized Maintenance, Repair, and Overhaul (MRO) services for its high-specification rig components also empowers suppliers. The proprietary nature of many parts limits the pool of certified service providers, granting them leverage in negotiations. In 2024, the intricate maintenance needs of subsea drilling equipment necessitate specialized expertise, making it difficult for Transocean to switch providers easily.

A select group of global shipyards holds significant bargaining power over Transocean for major rig upgrades and new builds. Limited global capacity for specialized offshore vessel construction means these shipyards can dictate higher costs and longer lead times. This trend continued into 2024, with strong demand for shipyard services for offshore energy projects.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Transocean | 2024 Data/Trend |

|---|---|---|---|

| Specialized Equipment Manufacturers | Patented technology, limited alternatives, high R&D costs | Premium pricing, restricted negotiation flexibility | Continued high demand for advanced drilling components |

| Skilled Labor (Drillers, Engineers) | Scarcity of qualified personnel, high demand for expertise | Increased wage expectations, potential for higher operational costs | Strong demand for experienced offshore crews |

| MRO Service Providers | Proprietary component knowledge, limited certified providers | Higher service costs, dependence on specific suppliers | Complex maintenance requirements for advanced rigs |

| Shipyards (Major Upgrades/New Builds) | Limited global capacity, specialized infrastructure | Increased project costs, extended lead times | Capacity constraints and strong demand for offshore vessel construction |

What is included in the product

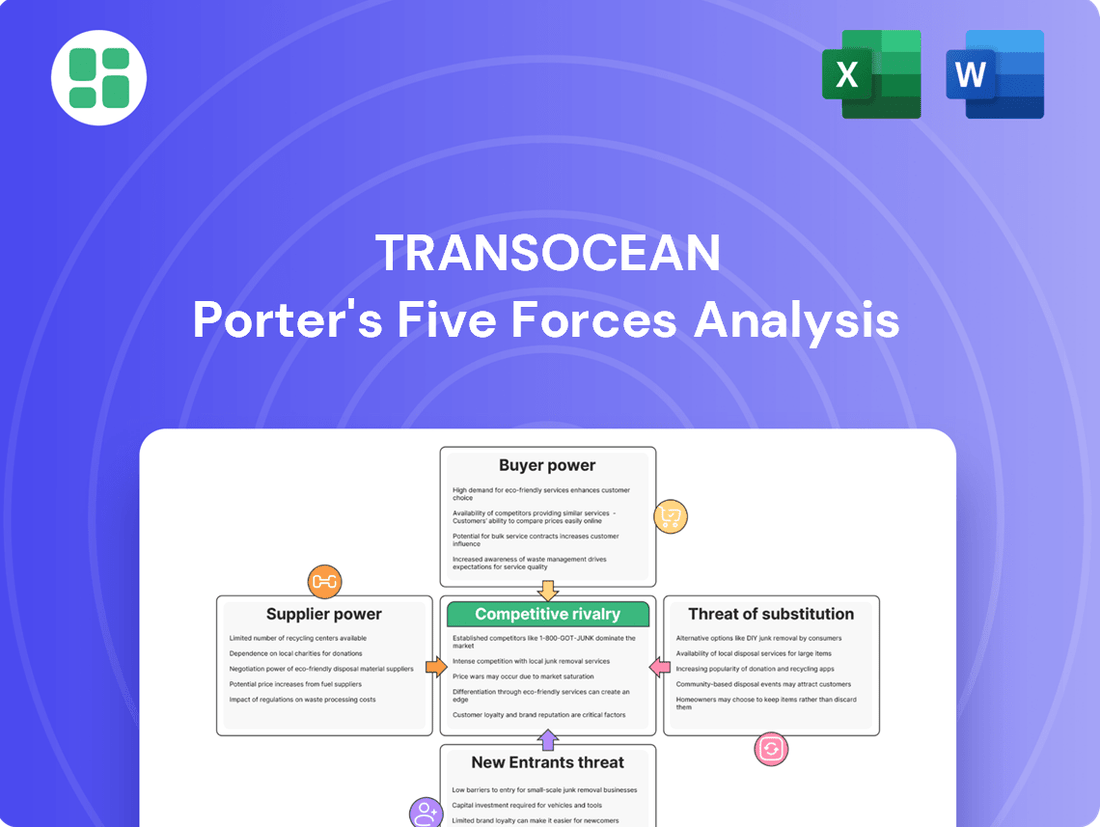

This Porter's Five Forces analysis for Transocean dissects the competitive intensity, buyer and supplier power, threat of new entrants, and availability of substitutes within the offshore drilling industry.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces chart, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Transocean's primary customers are major oil and gas companies, including international oil companies (IOCs) and national oil companies (NOCs). These entities possess substantial financial clout and extensive project pipelines, granting them considerable leverage.

The sheer scale of their drilling operations and the potential for awarding long-term, multi-year contracts amplify these customers' bargaining power. For instance, in 2023, the average day rate for ultra-deepwater drillships hovered around $400,000, a figure that large clients can negotiate down due to the volume of business they represent.

The market for ultra-deepwater and harsh environment drilling is a niche within the broader oil and gas industry, served by a select few major energy companies. This limited customer base, often comprised of highly sophisticated players like ExxonMobil, Shell, and BP, grants them significant bargaining power. For instance, in 2024, these major operators continue to be the primary drivers of demand for Transocean's most advanced rigs, enabling them to negotiate more favorable day rates and contract durations.

The offshore drilling sector's cyclical nature, driven by fluctuating oil prices and energy demand, often leads to periods of rig oversupply. For instance, in early 2024, the average day rate for ultra-deepwater drillships hovered around $300,000, but this figure can drop significantly during market downturns, impacting contractor profitability.

When oil prices are low and there's an abundance of available rigs, customers gain considerable leverage. They become acutely price-sensitive, demanding lower day rates and more flexible contract terms. This heightened sensitivity intensifies competition among drilling contractors, forcing them to accept less favorable deals to secure work.

Ability to Switch Contractors

Customers in the offshore drilling sector, while dealing with specialized services, often have a choice among several major high-specification drilling contractors. This competitive landscape allows them to shop around for the best deals.

Although changing drilling contractors can incur some costs, such as mobilization and initial setup, the market for modern, advanced rigs is robust. This availability of alternatives empowers customers to negotiate for more favorable pricing and service agreements, thereby increasing their bargaining power.

- Limited Number of Competitors: While there are several high-specification drilling contractors, the pool of companies capable of providing Transocean's advanced services is not vast, which can temper customer power.

- Switching Costs: Transitioning between drilling contractors involves significant logistical and financial hurdles, which can make customers hesitant to switch frequently.

- Rig Availability and Utilization: In 2024, the global offshore drilling rig utilization rate saw fluctuations, with periods of high demand for certain rig types impacting the ease with which customers could switch. For instance, ultra-deepwater rig utilization rates can influence a customer's ability to find immediate alternatives.

- Contractual Commitments: Long-term contracts often lock customers in, reducing their ability to switch without incurring penalties.

Long-Term Contracts with Performance Clauses

Transocean's long-term contracts, while seemingly advantageous, are often tempered by performance clauses and termination options. These provisions grant customers significant leverage, allowing them to renegotiate terms or exit agreements if market conditions deteriorate or if Transocean fails to meet agreed-upon performance benchmarks. This dynamic directly amplifies customer bargaining power.

For instance, a significant portion of Transocean's fleet operates under contracts that include dayrate adjustments tied to market indices or the ability for clients to terminate early under specific circumstances. This contractual flexibility empowers customers to exert pressure on pricing and service levels, especially during downturns in the offshore drilling market. In 2024, the offshore drilling sector experienced fluctuating dayrates, making these performance and termination clauses particularly relevant for customers seeking to manage costs and risk.

- Contractual Flexibility: Customers can leverage performance clauses to adjust contract terms or terminate early.

- Market Sensitivity: Dayrate adjustments linked to market conditions empower customers during price volatility.

- Risk Mitigation: Termination options allow clients to exit contracts if performance targets are missed or market conditions change unfavorably.

- Pricing Pressure: These clauses enable customers to negotiate better pricing, particularly in a buyer's market.

Transocean's customers, primarily large oil and gas companies, wield significant bargaining power due to their substantial financial resources and the concentrated nature of the ultra-deepwater drilling market.

In 2024, major operators like Shell and ExxonMobil, who are Transocean's key clients, continue to drive demand for high-specification rigs, allowing them to negotiate favorable terms. The availability of a limited number of advanced drilling contractors further strengthens their position.

The cyclical nature of the offshore drilling industry, marked by fluctuating oil prices and rig utilization rates, often tips the scales in favor of customers, especially during market downturns where they become more price-sensitive.

Contractual flexibility, including performance clauses and early termination options, empowers these customers to exert pressure on pricing and service levels, particularly when market conditions shift unfavorably.

| Customer Type | Bargaining Power Factors | Impact on Transocean |

|---|---|---|

| Major Oil Companies (IOCs/NOCs) | Financial clout, large project pipelines, volume of business | Ability to negotiate lower day rates and longer contract durations |

| Limited Customer Base | Concentrated market for specialized services | Customers can leverage competition among contractors |

| Market Cycles | Fluctuating oil prices, rig oversupply during downturns | Increased price sensitivity, demand for reduced rates |

| Contractual Terms | Performance clauses, early termination options | Leverage for renegotiation and risk mitigation |

Full Version Awaits

Transocean Porter's Five Forces Analysis

This preview displays the comprehensive Transocean Porter's Five Forces Analysis you will receive immediately upon purchase, ensuring full transparency. You're looking at the actual, professionally formatted document, meaning what you see is precisely what you'll get, ready for your strategic planning. No placeholders or sample content, just the complete analysis for your business insights after payment.

Rivalry Among Competitors

The ultra-deepwater and harsh environment drilling sector is a tight-knit arena, primarily steered by a handful of major global entities. Transocean stands alongside significant competitors like Valaris, Seadrill, and Diamond Offshore, forming a concentrated market structure.

This limited number of dominant players fuels a highly competitive landscape. These companies actively vie for the scarce, high-value contracts available in this specialized segment of the offshore drilling industry.

Transocean, like its peers, operates in an industry burdened by substantial fixed costs. The sheer expense of owning, maintaining, and crewing advanced offshore drilling rigs, estimated to be in the hundreds of millions of dollars per vessel, creates significant operational leverage. This means that once these high fixed costs are covered, additional revenue contributes disproportionately to profit. However, the flip side is intense pressure to secure contracts, as idle rigs continue to accrue substantial expenses, driving aggressive pricing strategies among competitors.

The offshore drilling sector is inherently cyclical, with demand heavily influenced by fluctuating oil prices and exploration budgets. This volatility leads to periods of significant oversupply in drilling rigs. For instance, in early 2024, the global offshore rig utilization rate hovered around 60-70%, a stark contrast to peak years, indicating a substantial number of idle or underutilized assets.

When an oversupply of rigs exists, competition among drilling contractors becomes fierce. Companies aggressively bid for contracts, often accepting lower day rates to keep their fleets active and cover operational costs. This intense rivalry can severely depress day rates, impacting profitability and making it challenging for even well-managed companies to maintain healthy margins.

Differentiation on Technology, Safety, and Efficiency

Competitive rivalry in the offshore drilling sector, including for companies like Transocean, extends far beyond mere price competition. It's heavily influenced by the technological sophistication of a company's fleet, its operational efficiency, and a demonstrably strong safety record. These factors are critical differentiators in securing lucrative contracts.

Transocean, for instance, emphasizes its high-specification rigs designed for challenging and complex drilling projects. This focus on advanced capabilities allows them to command premium rates and secure work in demanding environments. Their commitment to stringent safety and environmental standards is also a key selling point, reassuring clients of reliable and responsible operations.

- Technological Edge: Transocean's fleet includes advanced harsh-environment and ultra-deepwater rigs, such as the ultra-deepwater drillship *Discoverer India*, which is equipped for complex operations.

- Safety as a Differentiator: A strong safety culture and performance are paramount, as incidents can lead to significant financial and reputational damage.

- Operational Efficiency: Minimizing downtime and maximizing uptime through effective maintenance and operational planning are crucial for profitability and client satisfaction.

- Contract Wins: In 2024, Transocean secured new contracts and extensions valued at approximately $1.2 billion, underscoring the market's recognition of its technological and operational strengths.

High Exit Barriers

The specialized nature and immense capital investment required for ultra-deepwater drilling rigs create substantial exit barriers for companies like Transocean. These assets are highly specific and demand billions in upfront costs, making them incredibly difficult and expensive to sell or repurpose. For instance, a new ultra-deepwater drillship can cost upwards of $700 million to build.

These high exit barriers compel companies to remain in the market and continue competing, even when industry conditions are challenging or demand is low. This persistence, driven by the inability to easily divest costly assets, directly contributes to sustained, intense rivalry within the sector, impacting profitability and market dynamics for all players.

- Specialized Assets: Ultra-deepwater rigs are not easily transferable to other industries.

- Capital Intensity: The construction of these rigs involves massive financial outlays, often exceeding $500 million per unit.

- Market Persistence: Companies are forced to operate these assets rather than abandon them due to their illiquid nature.

- Sustained Rivalry: This inability to exit easily fuels continuous competition, even during industry downturns.

Competitive rivalry among offshore drilling giants like Transocean is intense, driven by a limited number of high-capacity players vying for scarce contracts. The significant capital expenditure required for these specialized assets, often exceeding $700 million per ultra-deepwater rig, creates high exit barriers, compelling companies to remain active and compete fiercely even during market downturns. This dynamic is further exacerbated by industry cyclicality and periods of rig oversupply, which can depress day rates. For example, in early 2024, global offshore rig utilization rates were around 60-70%, indicating substantial idle capacity and heightening competitive pressures.

| Competitor | Fleet Size (approx.) | Key Specialization | 2024 Contract Wins (approx.) |

|---|---|---|---|

| Transocean | 30+ | Ultra-deepwater, Harsh Environment | $1.2 billion |

| Valaris | 40+ | Ultra-deepwater, Shallow Water | Undisclosed |

| Seadrill | 20+ | Ultra-deepwater, Harsh Environment | Undisclosed |

| Diamond Offshore | 15+ | Ultra-deepwater | Undisclosed |

SSubstitutes Threaten

The threat of substitutes for Transocean's deepwater services is primarily influenced by the robust growth and increasing efficiency of onshore unconventional oil and gas production. Significant capital allocation towards shale oil and gas plays, for instance, can divert investment away from offshore exploration and development. In 2024, global investment in onshore unconventional resources continued to be substantial, with the U.S. shale sector alone producing over 13 million barrels of oil per day, demonstrating a consistent and cost-effective supply that can compete with offshore volumes.

Technological advancements in horizontal drilling and hydraulic fracturing have dramatically lowered the cost per barrel for onshore production. This efficiency makes unconventional resources a more attractive alternative, potentially reducing the market's perceived urgency for new, higher-cost offshore discoveries. The breakeven costs for many onshore shale wells in 2024 were often below those for deepwater projects, making them a more predictable and less risky investment for many energy companies.

For some oil and gas reserves, shallow water drilling or traditional offshore projects can be a more budget-friendly or less complex option compared to ultra-deepwater operations. These alternatives can capture exploration funds that might otherwise be allocated to deeper ventures.

In 2024, the cost of drilling in shallow waters can be significantly lower, often ranging from $20 million to $50 million per well, whereas ultra-deepwater wells can easily exceed $100 million. This cost differential makes shallow water a viable substitute for certain projects, impacting the demand for ultra-deepwater services.

The long-term shift towards renewable energy sources like solar and wind presents a significant threat to Transocean. As these alternatives become more cost-effective and widely adopted, the global demand for new hydrocarbon reserves could decrease substantially. This transition directly impacts the core business of offshore drilling companies by potentially reducing the need for exploration and development of oil and gas fields.

By 2024, renewable energy capacity continues its rapid expansion. For instance, global solar photovoltaic (PV) capacity is projected to reach over 1,500 GW by the end of 2024, a remarkable increase from previous years. Similarly, wind power installations are also seeing robust growth, contributing significantly to the global energy mix. This escalating presence of renewables directly challenges the long-term viability of traditional fossil fuel extraction, thereby posing a threat of substitution for services Transocean provides.

Enhanced Oil Recovery (EOR) and Existing Field Optimization

Technologies that enhance oil recovery from existing fields present a significant threat. These advancements can make it more appealing to maximize output from mature onshore and offshore assets rather than investing in new, potentially riskier exploration. For instance, in 2023, global EOR production accounted for approximately 10-15% of total oil output, demonstrating its substantial contribution.

The capital efficiency of optimizing existing fields through techniques like steam injection or chemical flooding can be a compelling alternative to the high upfront costs associated with developing new deepwater reserves. Companies might prioritize these less capital-intensive methods, thereby reducing demand for new drilling services. The global EOR market was valued at over $20 billion in 2023 and is projected to grow steadily.

- Reduced Demand for New Exploration: EOR technologies make existing fields more productive, lowering the urgency for costly new discoveries.

- Capital Efficiency: Optimizing mature assets is often more cost-effective than initiating high-risk deepwater projects.

- Market Size: The EOR market's significant and growing valuation underscores its impact on oilfield service demand.

Energy Efficiency and Demand Reduction

The push for energy efficiency and reduced consumption presents a significant threat of substitutes for Transocean. Global efforts to decarbonize, including widespread adoption of electric vehicles and advancements in renewable energy, are directly targeting traditional fossil fuel demand. For instance, by the end of 2023, the International Energy Agency reported that renewable energy sources accounted for over 30% of global electricity generation, a figure expected to climb. This shift diminishes the long-term need for offshore oil and gas exploration, which is Transocean's core business.

This trend directly impacts Transocean by potentially shrinking its addressable market. As countries and corporations commit to net-zero targets, the demand for new oil and gas projects, and consequently, the need for advanced drilling services like those provided by Transocean, is likely to decline. In 2024, many major economies continued to set ambitious emissions reduction goals, further accelerating this transition away from fossil fuels.

- Global renewable energy capacity is projected to grow by over 100% between 2023 and 2028, according to the IEA.

- The electric vehicle market saw a substantial increase in sales in 2023, exceeding 13 million units globally.

- Policies promoting energy efficiency are expected to reduce global energy demand growth by an estimated 15% by 2030.

The threat of substitutes for Transocean is multifaceted, encompassing alternative energy sources and more efficient extraction methods for existing reserves. Onshore unconventional production, particularly U.S. shale, continues to offer a cost-effective supply, with production exceeding 13 million barrels per day in 2024. This makes it a competitive alternative to higher-cost deepwater projects.

Technological advancements in onshore drilling have lowered breakeven costs, often below those of deepwater operations. Furthermore, shallow water drilling presents a less complex and more budget-friendly option, with well costs ranging from $20 million to $50 million, significantly less than the over $100 million for ultra-deepwater wells.

The accelerating growth of renewable energy, such as solar and wind, directly challenges the long-term demand for fossil fuels. Global solar capacity is projected to surpass 1,500 GW by the end of 2024, contributing to a broader energy transition that reduces the need for new offshore exploration.

Enhanced Oil Recovery (EOR) techniques, which boost output from existing fields, also act as a substitute. The EOR market, valued over $20 billion in 2023, offers capital efficiency by optimizing mature assets instead of investing in new, high-risk deepwater ventures.

| Substitute Type | Key Factor | 2024 Relevance/Data Point |

|---|---|---|

| Onshore Unconventional Production | Cost-effectiveness and efficiency | U.S. Shale production > 13 million bpd |

| Shallow Water Drilling | Lower cost and complexity | Well costs $20M-$50M vs. >$100M for ultra-deepwater |

| Renewable Energy | Long-term demand shift | Global Solar PV capacity > 1,500 GW projected |

| Enhanced Oil Recovery (EOR) | Maximizing existing reserves | EOR market valued >$20 billion in 2023 |

Entrants Threaten

The sheer cost of acquiring and maintaining modern offshore drilling assets presents a formidable barrier to entry. Building a single ultra-deepwater drillship or semi-submersible can easily surpass $1 billion, a staggering figure that deters many potential new players. This extreme capital intensity requires immense financial backing and a high tolerance for risk, effectively limiting the pool of new entrants to those with substantial resources.

Operating in ultra-deepwater environments, Transocean's core business, requires highly specialized and expensive technology, such as advanced drilling rigs and complex subsea equipment. For instance, a new ultra-deepwater drillship can cost upwards of $700 million to construct, a substantial barrier to entry. Furthermore, the intricate engineering and operational expertise needed to safely and effectively manage these operations are not easily replicated.

Stringent regulatory and environmental compliance acts as a significant barrier to new entrants in the offshore drilling sector. Companies looking to enter this market must navigate a complex web of international and national regulations governing safety, environmental protection, and operational standards. For instance, in 2024, the International Maritime Organization (IMO) continued to emphasize decarbonization efforts, requiring new vessels to meet stricter emissions standards, adding considerable upfront cost for any new entrant.

Achieving and maintaining compliance involves substantial investment in specialized equipment, advanced safety systems, and robust environmental management practices. Obtaining the necessary permits and certifications for offshore operations, especially in sensitive deepwater environments, can be a lengthy and costly process. This complexity deters many potential new players who may lack the capital and expertise to meet these demanding requirements.

Established Customer Relationships and Reputation

Major oil and gas companies, particularly those undertaking complex deepwater projects, place a significant premium on working with established drilling contractors like Transocean. This preference stems from a proven track record in safety, operational efficiency, and overall reliability, which are paramount in such high-stakes environments. For new entrants, cultivating the necessary trust and building the robust relationships required to secure these high-value contracts presents a formidable barrier.

Transocean's long-standing presence in the industry has allowed it to forge deep, often exclusive, relationships with key clients. These established connections are built on years of successful project execution and a consistent demonstration of capability. New companies would find it exceptionally difficult to replicate this level of client loyalty and access to lucrative opportunities, as clients are often reluctant to shift from proven partners to untested entities, especially when significant capital and operational risks are involved.

- Client Loyalty: Major oil and gas firms often prioritize contractors with a history of successful, safe, and efficient operations, making it hard for new entrants to break into the market.

- Reputational Barrier: Transocean's established reputation for reliability in deepwater drilling acts as a significant deterrent to new competitors seeking to gain client trust.

- Contractual Inertia: Existing long-term contracts and preferred supplier agreements create a sticky environment, making it challenging for new entrants to displace incumbents.

Limited Access to Financing and High Industry Volatility

The offshore drilling sector is inherently cyclical and demands significant capital investment, creating a substantial barrier for new companies seeking to enter the market. This capital intensity means that securing adequate financing is a major hurdle.

Lenders often hesitate to provide funding to new entrants without a proven track record of operations and a strong financial foundation. This caution is amplified by the industry's inherent volatility, where market downturns can severely impact profitability and debt repayment capabilities.

- Capital Intensity: Offshore drilling projects require billions of dollars in upfront investment for rig construction and technology.

- Financing Challenges: In 2024, the cost of capital for new, unproven ventures in volatile industries remains elevated.

- Industry Volatility: Fluctuations in oil prices directly impact demand for offshore drilling services, making it a risky proposition for lenders.

- Limited Track Record: New entrants lack the established operational history and financial stability that lenders prefer, further restricting access to crucial funding.

The threat of new entrants in the offshore drilling sector, particularly for ultra-deepwater operations like Transocean's, is significantly low due to immense capital requirements. Building a single advanced drillship can cost upwards of $700 million, a prohibitive sum for most potential competitors. This high capital intensity, coupled with the need for specialized technology and expertise, creates a substantial barrier.

New entrants face stringent regulatory hurdles and the challenge of establishing client trust. For instance, in 2024, evolving environmental standards, like those from the IMO, necessitate further investment in compliant technology. Furthermore, major oil companies prefer established contractors with proven safety records, making it difficult for newcomers to secure lucrative contracts.

Access to financing is also a major impediment. Lenders are cautious about funding unproven entities in a volatile industry, especially given the significant capital investment required. This financial risk, combined with the industry's cyclical nature and the need for a strong operational track record, further limits the threat of new market participants.

| Barrier Type | Description | Example/Data Point (2024) |

|---|---|---|

| Capital Intensity | High upfront investment for specialized assets. | Ultra-deepwater drillship cost: $700 million+ |

| Technology & Expertise | Requirement for advanced, complex equipment and skilled personnel. | Sophisticated subsea equipment and engineering know-how are critical. |

| Regulatory Compliance | Navigating complex international and national safety and environmental rules. | Stricter emissions standards for new vessels (IMO). |

| Client Relationships & Reputation | Need for proven track record and established trust with major oil companies. | Clients prioritize reliability and safety, favoring incumbents. |

| Financing & Industry Volatility | Difficulty in securing funding for new ventures in a cyclical market. | Elevated cost of capital for unproven entities in volatile sectors. |

Porter's Five Forces Analysis Data Sources

Our Transocean Porter's Five Forces analysis is built upon a robust foundation of data, including Transocean's annual reports and SEC filings, as well as industry-specific market research from firms like IHS Markit and Wood Mackenzie.