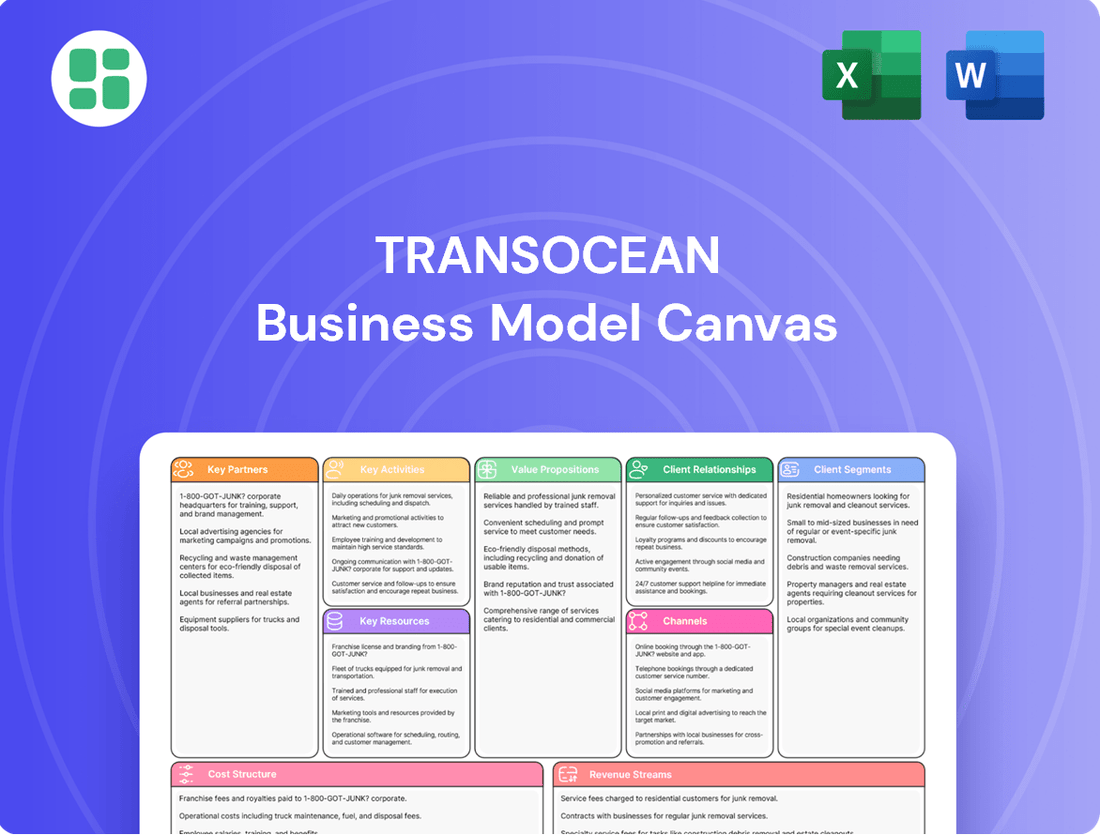

Transocean Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Transocean Bundle

Unlock the full strategic blueprint behind Transocean's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Transocean's key partnerships are with major integrated energy companies, national oil companies, and independent exploration and production (E&P) firms across the globe. These relationships are vital, as these entities represent Transocean's primary clientele, directly contracting its offshore drilling services. For instance, in 2023, Transocean secured significant contracts with companies like Equinor and Chevron, reinforcing its customer base.

The company's business model heavily relies on securing long-term contracts with these E&P partners. These agreements are not just revenue generators but are critical for ensuring consistent cash flow and maintaining high utilization rates for Transocean's advanced offshore drilling fleet. Strong, enduring relationships built on trust and performance are therefore paramount to its operational success and financial stability.

Transocean relies heavily on equipment and technology suppliers to maintain its cutting-edge fleet. These collaborations are crucial for securing high-specification drilling equipment, advanced subsea technologies, and sophisticated automation systems necessary for deepwater and harsh environment operations. For instance, in 2024, Transocean continued to invest in upgrading its fleet, emphasizing partnerships with key technology providers to integrate the latest advancements.

Transocean collaborates with a network of offshore service providers, encompassing crucial areas like well services, logistics, and specialized technical support. These partnerships are fundamental to managing the intricate demands of offshore drilling operations.

These strategic alliances are designed to optimize complex offshore projects, ensuring seamless execution and significantly reducing operational disruptions. For instance, in 2024, efficient logistics and specialized support are critical for maintaining Transocean's high revenue efficiency, which directly impacts profitability.

Financial Institutions and Investors

Transocean's relationships with financial institutions and investors are the bedrock of its operational and strategic capabilities. These entities, including major banks and investment firms, are crucial for securing the substantial capital needed for fleet modernization and the construction of new, advanced offshore drilling rigs. For instance, in 2024, Transocean successfully renegotiated its revolving credit facilities, demonstrating ongoing access to essential liquidity. This access allows the company to manage its debt obligations effectively and maintain the financial flexibility required to navigate the cyclical nature of the offshore drilling market.

These vital partnerships directly fuel Transocean's ability to invest in cutting-edge technology and expand its fleet. By securing financing, Transocean can undertake significant capital expenditures, such as the delivery of its new ultra-deepwater drillship, the *Discoverer Deepwater Titan*, which entered service in 2023. This strategic investment in advanced assets is paramount for maintaining a competitive edge and pursuing lucrative contract opportunities in the global energy sector.

- Access to Capital: Essential for funding new rig construction and major fleet upgrades, ensuring Transocean remains technologically advanced.

- Debt Management and Liquidity: Banks and financial entities provide credit facilities critical for managing existing debt and ensuring operational liquidity.

- Investor Confidence: Strong relationships with institutional investors signal financial health and support the company's long-term growth strategy.

- Fleet Modernization: Partnerships enable the acquisition of next-generation drilling units, enhancing efficiency and market competitiveness.

Regulatory Bodies and Industry Organizations

Transocean actively engages with regulatory bodies like the International Maritime Organization (IMO) and national maritime administrations to ensure adherence to evolving safety and environmental regulations. This engagement is crucial for maintaining operational licenses and adapting to new standards, such as those related to emissions or offshore safety protocols.

Participation in industry organizations, such as the International Association of Drilling Contractors (IADC), allows Transocean to contribute to and influence the development of industry best practices. For instance, in 2024, the IADC continued its focus on promoting safety and sustainability initiatives across the offshore drilling sector, a key area for Transocean's operations.

- Regulatory Compliance: Ensuring adherence to global and local maritime laws and safety standards.

- Industry Standard Setting: Contributing to the development of best practices for offshore drilling operations.

- Reputation Management: Demonstrating commitment to responsible and compliant operations.

- Technological Advancement: Collaborating on the adoption of new technologies and safety measures.

Transocean's key partnerships extend to essential equipment and technology suppliers, crucial for maintaining its advanced offshore drilling fleet. These collaborations ensure access to high-specification drilling equipment and cutting-edge subsea technologies. For example, in 2024, Transocean continued its focus on fleet modernization, prioritizing partnerships with key technology providers to integrate the latest advancements, ensuring operational efficiency and competitiveness.

| Partner Type | Role | Impact on Transocean | Example/Data Point (2023-2024) |

|---|---|---|---|

| Major Energy Companies | Clientele, Contract Providers | Primary revenue source, dictates fleet utilization | Secured significant contracts with Equinor and Chevron in 2023. |

| Equipment & Technology Suppliers | Asset Enhancers, Innovation Drivers | Ensures fleet is state-of-the-art, enables deepwater operations | Investments in fleet upgrades in 2024 focused on integrating new technologies. |

| Financial Institutions | Capital Providers, Liquidity Sources | Funds fleet expansion and modernization, manages debt | Successfully renegotiated revolving credit facilities in 2024, ensuring liquidity. |

| Offshore Service Providers | Operational Support, Efficiency Boosters | Facilitates complex operations, minimizes disruptions | Critical for maintaining high revenue efficiency in 2024. |

What is included in the product

A detailed Business Model Canvas for Transocean, outlining its core operations in offshore drilling services, focusing on customer segments like oil and gas majors, its value proposition of advanced drilling technology and expertise, and key revenue streams from contract drilling.

This model highlights Transocean's strategic partnerships, cost structure, and key resources, providing a clear framework for understanding its competitive landscape and operational efficiency in the global energy sector.

The Transocean Business Model Canvas acts as a pain point reliever by offering a structured, visual representation that simplifies complex operational strategies, making them easier to understand and manage.

It alleviates the pain of information overload by condensing Transocean's multifaceted business into a single, digestible page, facilitating clearer communication and decision-making.

Activities

Transocean's core activity revolves around offering offshore contract drilling services, essentially renting out its specialized rigs and crews to oil and gas companies. This involves the deployment and operation of a sophisticated fleet, particularly in challenging ultra-deepwater and harsh environments across the globe. The company's revenue is generated through securing contracts with clients, which stipulate daily rates and the expected duration of the drilling project.

In 2024, Transocean continued to leverage its high-specification fleet. For instance, as of early 2024, the company had a backlog of contracted revenue worth approximately $8.4 billion. This backlog reflects the ongoing demand for its services in key offshore regions.

Transocean's key activity of fleet management and maintenance involves the meticulous upkeep and strategic oversight of its highly specialized offshore drilling units, including drillships and semi-submersibles. This ensures the fleet remains in peak operational condition.

Crucial to this activity are regular special periodic surveys and in-service maintenance programs. For example, in 2023, Transocean reported approximately $1.3 billion in capital expenditures, a significant portion of which is allocated to maintaining and upgrading its advanced fleet to meet stringent safety and performance standards.

This dedication to rigorous maintenance directly impacts revenue efficiency by minimizing downtime and ensuring the fleet's readiness for demanding drilling contracts, thereby upholding Transocean's competitive edge in the offshore energy sector.

Transocean excels in managing complex drilling projects, particularly in deepwater and harsh environments. This involves meticulous planning, leveraging advanced engineering capabilities, and coordinating diverse teams to ensure safe and efficient operations.

In 2024, Transocean's commitment to project management was evident as they continued to operate some of the most advanced offshore drilling rigs globally, handling intricate projects that demand specialized expertise.

Technology Development and Innovation

Transocean’s commitment to technology development and innovation is a cornerstone of its operations. A significant aspect of this involves investing heavily in and deploying cutting-edge drilling technologies. This includes advancements like managed pressure drilling (MPD) systems, which allow for greater control and efficiency in complex wellbore environments, and enhanced automation features across their fleet.

This strategic focus on innovation directly translates into improved operational performance. By adopting these advanced technologies, Transocean can access reservoirs that are more challenging to drill, thereby expanding its market opportunities. For instance, in 2024, the company continued to integrate MPD capabilities into its ultra-deepwater and harsh environment rigs, positioning them for projects requiring precise pressure management. This dedication to staying at the forefront of technological advancement is a key differentiator in the competitive offshore drilling sector.

- Investment in Advanced Drilling Technologies: Continued deployment of MPD systems and automation enhances safety and efficiency.

- Access to Challenging Reservoirs: Innovative technologies enable drilling in complex geological formations previously inaccessible.

- Market Differentiation: Technological leadership provides a competitive edge, attracting premium contracts.

- Operational Performance Enhancement: Focus on innovation directly boosts efficiency and reduces operational risks.

Safety and Environmental Compliance

Transocean's key activities heavily focus on maintaining rigorous safety standards and ensuring strict environmental compliance across all operations. This commitment is fundamental to their business model, safeguarding personnel, assets, and the surrounding ecosystems.

Continuous training programs are a core activity, equipping crews with the latest safety procedures and environmental best practices. Adherence to international maritime regulations, such as those set by the IMO, is non-negotiable, forming the bedrock of their operational framework.

Furthermore, Transocean actively pursues initiatives to minimize its environmental footprint. This includes exploring and piloting alternative fuels, such as methanol and ammonia, and investing in carbon capture technologies to reduce emissions. For instance, in 2024, Transocean continued to advance its sustainability goals, reporting progress on emission reduction targets aligned with industry benchmarks.

- Safety Culture: Implementing and reinforcing a robust safety culture through regular drills, incident reporting, and lessons learned.

- Regulatory Adherence: Strict compliance with all international, national, and local environmental and safety regulations, including those from flag states and port authorities.

- Environmental Stewardship: Proactive measures to reduce emissions, manage waste responsibly, and prevent pollution, with ongoing investment in greener technologies.

- Training and Development: Continuous professional development for all employees on safety protocols and environmental management systems.

Transocean's key activities are centered on operating and maintaining its high-specification offshore drilling fleet, securing drilling contracts, and managing complex drilling projects. This includes investing in and deploying advanced drilling technologies to enhance efficiency and access challenging reservoirs.

In 2024, Transocean's fleet utilization was a critical performance indicator. The company's backlog of contracted revenue stood at approximately $8.4 billion as of early 2024, demonstrating sustained demand for its services and the effective deployment of its assets.

The company's commitment to technological advancement is ongoing, with a focus on systems like managed pressure drilling (MPD) to improve operational control and safety in complex wellbore environments.

Transocean's operational efficiency is directly tied to its fleet's readiness and technological capabilities. For instance, in 2023, capital expenditures were around $1.3 billion, largely directed towards fleet maintenance and upgrades to ensure peak performance and competitive positioning.

| Key Activity | Description | 2024 Relevance/Data |

| Fleet Operations & Maintenance | Operating and maintaining specialized offshore drilling rigs. | Backlog of contracted revenue of approximately $8.4 billion as of early 2024. |

| Contract Acquisition | Securing drilling contracts with oil and gas companies. | Ongoing demand for high-specification assets in key offshore regions. |

| Technology Development & Deployment | Investing in and implementing advanced drilling technologies. | Continued integration of MPD capabilities into ultra-deepwater and harsh environment rigs. |

| Project Management | Managing complex drilling projects safely and efficiently. | Operating advanced rigs for intricate projects requiring specialized expertise. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This is not a sample or mockup; it is a direct representation of the complete, ready-to-use file. Once your order is processed, you will gain full access to this identical document, ensuring no discrepancies in content or formatting.

Resources

Transocean's most valuable asset is its fleet of high-specification mobile offshore drilling units. This includes advanced ultra-deepwater drillships and rugged harsh environment semi-submersibles, essential for tackling the world's toughest offshore projects.

As of October 2024, Transocean operates a substantial fleet of 34 units. These assets are key to its ability to secure and execute contracts in the most challenging and technically demanding offshore environments worldwide.

Transocean's business model hinges on its highly skilled workforce, comprising engineers, rig crews, and technical specialists. This expertise is crucial for managing complex offshore drilling operations and ensuring safety. For example, as of early 2024, Transocean operates a fleet of advanced offshore drilling rigs, each requiring specialized crews trained in cutting-edge technology and stringent safety protocols.

The company's ability to deploy advanced technology, such as automated drilling systems and sophisticated subsea equipment, directly relies on the technical proficiency of its personnel. This deep knowledge base allows Transocean to deliver best-in-class services, a key differentiator in the competitive offshore energy sector.

Transocean's proprietary technology, including advanced 20,000 PSI drilling systems and managed pressure drilling capabilities, is a core asset. This intellectual property allows them to tackle complex and deep reservoirs that others cannot access. For instance, in 2023, Transocean reported a backlog of approximately $7.6 billion, a significant portion of which is driven by the demand for these specialized services.

Global Operational Footprint and Infrastructure

Transocean's global operational footprint is a cornerstone of its business, encompassing strategically located operational bases and extensive shore-based support and logistics infrastructure. This worldwide presence is critical for efficiently mobilizing its fleet of offshore drilling rigs and supporting ongoing operations across diverse and demanding offshore environments.

This expansive network enables Transocean to serve clients effectively in key regions such as the U.S. Gulf of Mexico, Norway, Brazil, and Australia. For instance, as of the first quarter of 2024, Transocean operated a fleet of 37 contracted offshore drilling units, highlighting the scale of its global operational reach and the infrastructure required to manage these assets.

- Worldwide operational bases: Facilitating efficient rig deployment and client service in major offshore basins.

- Shore-based support: Providing essential technical, logistical, and administrative services to maintain fleet readiness and operational continuity.

- Logistics infrastructure: Ensuring the timely and cost-effective movement of personnel, equipment, and supplies to offshore sites.

- Strategic regional presence: Covering key markets like the U.S. Gulf of Mexico, Norway, Brazil, and Australia, demonstrating broad market access.

Strong Backlog and Contract Portfolio

Transocean's strong backlog and contract portfolio are fundamental to its business model, offering significant financial stability and operational foresight. As of October 2024, the company reported a substantial total backlog of approximately $9.3 billion. This figure represents contracted revenue yet to be recognized, providing a clear picture of future earnings and operational commitments.

This robust backlog is a critical resource, directly influencing Transocean's ability to plan for future investments, manage capital expenditures, and maintain consistent operational activity. It acts as a buffer against market volatility and ensures a predictable revenue stream, which is vital for strategic decision-making and long-term sustainability.

- Significant Financial Visibility: The $9.3 billion backlog as of October 2024 provides a clear view of future contracted revenue.

- Operational Stability: This extensive contract portfolio underpins consistent operational activity and resource allocation.

- Strategic Planning Foundation: The backlog enables informed decisions regarding fleet deployment, maintenance, and future investments.

- Market Resilience: A strong backlog offers a degree of insulation from short-term market fluctuations in the offshore drilling sector.

Transocean's key resources are its advanced fleet of offshore drilling units, including ultra-deepwater drillships and harsh environment semi-submersibles, which are vital for high-stakes projects. The company's highly skilled workforce, comprising engineers and rig crews, is essential for managing complex operations safely and efficiently. Furthermore, proprietary technologies, such as 20,000 PSI drilling systems, provide a competitive edge in accessing challenging reservoirs. A substantial backlog, standing at approximately $9.3 billion as of October 2024, offers significant financial stability and operational visibility.

| Key Resource | Description | Significance |

| Fleet of Drilling Units | High-specification ultra-deepwater drillships and harsh environment semi-submersibles. | Enables execution of demanding offshore projects globally. |

| Skilled Workforce | Engineers, rig crews, and technical specialists. | Crucial for safe and efficient management of complex drilling operations. |

| Proprietary Technology | 20,000 PSI drilling systems, managed pressure drilling capabilities. | Allows access to complex and deep reservoirs, creating a competitive advantage. |

| Contract Backlog | Approximately $9.3 billion as of October 2024. | Provides financial stability, operational foresight, and predictable revenue. |

Value Propositions

Transocean's core strength lies in its mastery of ultra-deepwater and harsh environment drilling. This specialized capability allows clients to access vast, challenging hydrocarbon reserves that are otherwise inaccessible. For instance, in 2024, Transocean continued to operate in regions like the Norwegian Sea and the Gulf of Mexico, areas known for their extreme depths and demanding conditions.

Transocean boasts the world's most advanced floating offshore drilling fleet, featuring cutting-edge 8th-generation drillships. This technological superiority translates directly into enhanced operational capabilities, setting new benchmarks for safety and efficiency in the industry.

This premium fleet allows Transocean to secure higher day rates and secure longer-term contracts, reflecting the market's demand for its unparalleled performance and reliability. For instance, in 2024, the company's commitment to high-specification assets positions it to capitalize on the increasing need for complex offshore projects.

Transocean's commitment to safety and operational reliability is a cornerstone of its value proposition, directly translating into client confidence and project success. This focus minimizes risks and costly downtime, crucial for the efficient execution of offshore oil and gas projects.

In 2024, Transocean consistently demonstrated high revenue efficiency across its fleet, a key metric reflecting operational uptime and reliability. This operational excellence ensures clients can depend on Transocean's assets to perform as expected, contributing significantly to their project timelines and budget adherence.

Advanced Technology and Innovation

Transocean's commitment to advanced technology is a cornerstone of its value proposition, allowing clients to push the boundaries of offshore drilling. They are at the forefront of innovation, offering capabilities like 20,000 PSI drilling, a significant leap that enables operations in previously inaccessible ultra-high pressure environments. This technological edge directly translates into enhanced performance and efficiency for their clients.

Furthermore, Transocean's expertise in managed pressure drilling (MPD) systems is crucial for optimizing well construction, especially in complex geological formations. By precisely controlling wellbore pressures, MPD minimizes drilling risks, reduces non-productive time, and ultimately lowers the overall cost of exploration and production. This focus on innovation ensures clients can overcome significant drilling challenges.

- Technological Leadership: Transocean consistently invests in and deploys leading-edge drilling technologies.

- Enhanced Performance: Capabilities like 20,000 PSI drilling and MPD drive superior operational outcomes.

- Problem Solving: Their innovations empower clients to tackle complex offshore drilling challenges.

- Optimization: Advanced systems contribute to more efficient and cost-effective well construction.

Integrated Project Management and Support

Transocean goes beyond simply supplying offshore drilling rigs; they provide a full suite of drilling engineering and project management services. This integrated offering delivers clients a complete, end-to-end solution for their offshore exploration and development needs.

This comprehensive approach simplifies complex projects for customers, ensuring a smoother and more efficient execution from start to finish. For instance, in 2023, Transocean reported that its contract drilling services segment, which encompasses these integrated offerings, generated significant revenue, demonstrating the value clients place on these end-to-end solutions.

- Integrated Solutions: Offering drilling engineering and project management alongside rig provision.

- End-to-End Service: Providing comprehensive support for offshore exploration and development projects.

- Reduced Complexity: Simplifying project execution for clients by managing multiple facets of operations.

- Seamless Execution: Ensuring efficient and coordinated project completion through integrated management.

Transocean's value proposition centers on its unparalleled expertise in ultra-deepwater and harsh environment drilling, coupled with a technologically superior fleet. This allows clients to access challenging reserves, as demonstrated by their operations in demanding regions throughout 2024. Their commitment to safety and operational reliability ensures clients can depend on efficient, cost-effective project execution, a fact underscored by their high revenue efficiency in 2024.

The company offers integrated drilling engineering and project management services, providing clients with end-to-end solutions that simplify complex offshore projects. This comprehensive approach enhances project execution, as evidenced by the significant revenue generated by their contract drilling services segment in 2023.

| Value Proposition Aspect | Description | 2024/2023 Data Point |

|---|---|---|

| Specialized Drilling Expertise | Mastery of ultra-deepwater and harsh environment operations | Continued operations in challenging regions like the Norwegian Sea and Gulf of Mexico. |

| Technological Superiority | World's most advanced floating offshore drilling fleet (8th-gen drillships) | Deployment of cutting-edge assets enabling advanced capabilities like 20,000 PSI drilling. |

| Operational Excellence | High safety and reliability, leading to minimal downtime | Consistent high revenue efficiency across the fleet, indicating strong uptime. |

| Integrated Service Offering | Full suite of drilling engineering and project management services | Significant revenue contribution from contract drilling services segment in 2023. |

Customer Relationships

Transocean solidifies customer relationships through long-term contractual engagements, primarily with major oil and gas corporations. These multi-year agreements, frequently including options for extension, underscore a profound level of trust and commitment. For instance, in 2024, Transocean secured significant contract awards, demonstrating the ongoing demand for their advanced offshore drilling capabilities and the enduring nature of these partnerships.

Transocean cultivates strong client bonds via dedicated account managers and technical support. This personalized approach guarantees swift resolution of client needs and operational hurdles, fostering deeper partnerships.

These teams actively engage clients in co-investing in cutting-edge technologies. For instance, in 2024, Transocean’s focus on technological advancement, including enhanced drilling automation, directly stemmed from client feedback and collaborative development efforts, boosting client satisfaction and loyalty.

Transocean's customer relationships are deeply rooted in performance, emphasizing high revenue efficiency and operational reliability. This focus is crucial for securing and retaining contracts in the demanding offshore drilling sector.

In 2024, Transocean's commitment to safety and efficiency directly translates into stronger client trust. For instance, their advanced fleet and experienced crews are designed to minimize downtime, a key metric for clients managing complex and high-stakes drilling campaigns.

This dedication to dependable execution solidifies Transocean's standing as a preferred partner. Clients rely on their ability to consistently deliver results, which is paramount for projects with tight schedules and significant capital investment.

Strategic Partnerships for Complex Projects

For particularly complex or technically demanding drilling projects, Transocean actively cultivates strategic partnerships. These collaborations are crucial for tackling the unique challenges presented by ultra-deepwater operations and harsh environmental conditions.

This collaborative model often involves joint planning sessions and shared problem-solving initiatives. By pooling expertise and resources, Transocean can effectively address the intricate requirements of these high-stakes projects.

- Strategic Alliances: Transocean forms alliances with other industry leaders and specialized service providers to enhance capabilities for complex projects.

- Joint Planning & Execution: Partnerships facilitate shared responsibility in planning, risk assessment, and the execution of challenging drilling campaigns.

- Technological Advancement: Collaborations often drive innovation and the development of specialized technologies needed for ultra-deepwater and harsh environments.

Transparency and Regular Communication

Transocean prioritizes transparency, keeping clients informed with frequent fleet status updates. This open dialogue extends to discussions on market trends and potential future collaborations, ensuring a shared understanding of the operational landscape.

This commitment to regular communication builds robust customer relationships. For instance, in the first quarter of 2024, Transocean reported a significant increase in its contract backlog, reflecting the trust and ongoing partnerships it cultivates through such transparent practices.

- Fleet Status Reports: Regular updates on vessel availability and operational status.

- Market Dynamics Discussions: Collaborative conversations about industry trends and outlook.

- Future Opportunity Engagement: Proactive discussions about upcoming projects and potential business.

- Expectation Alignment: Ensuring mutual understanding for current and future project scopes.

Transocean's customer relationships are built on long-term contracts with major oil and gas companies, often with extension options, signifying deep trust. In 2024, securing substantial contract awards highlighted ongoing demand and the strength of these enduring partnerships.

| Customer Segment | Relationship Type | Key Engagement Strategy | 2024 Contract Value (Illustrative) |

|---|---|---|---|

| Major Oil & Gas Companies | Long-term Contracts | Dedicated Account Management, Technical Support, Co-investment in Technology | $5 Billion+ (Estimated Backlog Growth) |

| National Oil Companies | Project-Specific Contracts | Performance Reliability, Safety Focus | $1 Billion+ (Estimated) |

| Independent Exploration Companies | Flexible Contract Terms | Cost-Effectiveness, Operational Efficiency | $500 Million+ (Estimated) |

Channels

Transocean’s direct sales and business development teams are crucial for forging relationships with global oil and gas majors. These teams actively scout for new drilling opportunities and negotiate complex contracts, ensuring Transocean secures lucrative projects. For instance, in 2023, Transocean secured approximately $2.1 billion in new contract backlog, a testament to the effectiveness of these client-facing efforts.

These dedicated professionals work closely with clients to understand their unique drilling needs, allowing Transocean to customize its advanced rig capabilities and service packages. This client-centric approach not only drives revenue but also strengthens long-term partnerships in a competitive offshore drilling market.

Industry tenders and bidding processes represent a crucial channel for Transocean to secure new contracts. These competitive processes, often initiated by major oil and gas operators, allow Transocean to showcase its advanced fleet capabilities and strong safety performance.

In 2024, Transocean actively pursued and won several significant contract awards through these tender processes, demonstrating its competitive edge in the offshore drilling market. For example, securing a contract for a harsh environment ultra-deepwater project in the North Sea, valued in the hundreds of millions of dollars, highlights the importance of these bidding channels.

Transocean actively participates in key industry gatherings like the Offshore Technology Conference (OTC) and International Offshore Petroleum Conference and Exhibition (IOPPEC). In 2024, these events are crucial for demonstrating their advanced fleet capabilities and technological innovations to a global audience of energy professionals.

These conferences are vital channels for gathering market intelligence, understanding competitor strategies, and identifying emerging trends in the offshore sector. Direct interactions at these events allow Transocean to cultivate relationships with potential clients and reinforce existing partnerships, fostering business growth.

Presenting technical papers and showcasing their fleet at these events serves as a powerful platform to highlight Transocean's operational excellence and commitment to safety. This visibility helps attract new contracts and strengthens their position as a leader in offshore drilling services.

Company Website and Investor Relations Portal

Transocean's company website and dedicated investor relations portal are crucial digital touchpoints. These platforms offer comprehensive details on their advanced fleet, a wide array of services, and transparent reporting of their financial health. In 2024, Transocean continued to leverage these channels to communicate their strategic direction and operational updates.

These online resources are designed to provide easy access to vital information for a diverse audience, including potential clients, shareholders, and industry analysts. They are instrumental in fostering trust and facilitating informed decision-making by showcasing the company's commitment to operational excellence and sustainability efforts.

- Fleet Information: Detailed specifications and deployment status of their ultra-deepwater and harsh environment drilling units.

- Financial Performance: Access to quarterly and annual reports, SEC filings, and key financial metrics.

- Sustainability Initiatives: Updates on environmental, social, and governance (ESG) performance and goals.

- Investor Communications: Information on earnings calls, presentations, and corporate governance policies.

Reputation and Word-of-Mouth Referrals

Transocean leverages its established reputation as a primary channel for securing new contracts and retaining existing clients in the highly specialized offshore drilling sector. Years of demonstrated safety, operational prowess, and technological innovation build immense trust within the industry.

Positive client experiences and a strong track record translate directly into valuable word-of-mouth referrals, a critical driver of business acquisition in this niche market. For instance, in 2023, Transocean secured significant contract awards, partly attributed to its long-standing relationships and proven performance.

- Industry Trust: Transocean's consistent delivery of safe and efficient operations fosters deep trust among potential and existing clients.

- Client Loyalty: Repeat business from satisfied clients is a direct result of their positive experiences and confidence in Transocean's capabilities.

- Referral Network: Satisfied customers actively recommend Transocean's services, creating a powerful and cost-effective marketing channel.

Transocean's direct sales and business development teams are key to building relationships with major oil and gas companies. These teams actively seek new drilling opportunities and negotiate contracts, helping Transocean secure profitable projects. In 2023, the company secured about $2.1 billion in new contract backlog, showcasing the success of these client-focused efforts.

Industry tenders and bidding are vital for Transocean to win new contracts, allowing the company to highlight its advanced fleet and safety record. In 2024, Transocean successfully won several major contract awards through these competitive processes, reinforcing its strong position in the offshore drilling market.

Participation in industry events like the Offshore Technology Conference (OTC) is crucial for Transocean to showcase its fleet and innovations to a global audience. These gatherings are essential for market intelligence, competitor analysis, and identifying industry trends, fostering new business and strengthening existing partnerships.

Transocean's website and investor relations portal serve as critical digital channels, providing detailed information on its fleet, services, and financial performance. In 2024, these platforms continued to be used for communicating strategic updates and operational achievements.

Transocean's strong reputation is a primary channel for securing business and retaining clients in the offshore drilling sector. A history of safe, efficient operations and technological advancement builds significant industry trust, leading to repeat business and valuable referrals.

| Channel | Description | 2023/2024 Relevance |

| Direct Sales & Business Development | Building client relationships, negotiating contracts. | Secured $2.1 billion in backlog in 2023. |

| Industry Tenders & Bidding | Competing for contract awards. | Won significant contract awards in 2024. |

| Industry Conferences (e.g., OTC) | Showcasing capabilities, market intelligence, networking. | Crucial for demonstrating innovations in 2024. |

| Digital Channels (Website, Investor Relations) | Information dissemination, transparency. | Continued strategic communication in 2024. |

| Reputation & Referrals | Leveraging trust and past performance. | Attributed to securing contract awards in 2023. |

Customer Segments

Major integrated oil and gas companies, such as ExxonMobil, Shell, and Chevron, represent Transocean's core customer base. These global energy leaders depend on sophisticated offshore drilling capabilities to access vast reserves, often committing to multi-year, multi-billion dollar contracts. For instance, in 2023, Transocean secured significant contract awards from these majors, highlighting their ongoing need for advanced offshore drilling solutions.

National Oil Companies (NOCs) are a core customer segment for Transocean, representing government-owned entities focused on developing their nation's energy resources. Examples include Petrobras in Brazil, Equinor in Norway, and ONGC in India, all of which rely on Transocean's advanced offshore drilling services.

These NOCs are crucial clients because they often undertake large-scale, complex projects requiring specialized deepwater and harsh environment drilling expertise. In 2023, Transocean continued to secure contracts with several NOCs, underscoring their importance to the company's revenue streams and operational footprint.

Independent Exploration and Production (E&P) companies, though often smaller than global giants, represent a crucial customer segment for Transocean. These firms are dedicated exclusively to finding and extracting oil and gas, and their offshore ventures frequently demand the advanced capabilities of high-specification drilling rigs, especially as they target new and developing offshore regions.

In 2024, the global offshore rig market continued to show signs of recovery, with day rates for harsh environment and ultra-deepwater rigs, the type favored by many independents, seeing upward pressure. For instance, average day rates for harsh environment semi-submersibles in the North Sea hovered around $350,000 to $400,000 in early 2024, reflecting the specialized nature of the work these companies undertake.

Companies with Ultra-Deepwater & Harsh Environment Projects

This segment is vital for Transocean, encompassing any oil and gas company, regardless of its scale, that undertakes technically challenging drilling operations in ultra-deepwater or harsh environments. Transocean's advanced fleet and specialized knowledge are precisely what these operations require.

These companies are actively seeking solutions for the extreme pressures, low temperatures, and remote locations characteristic of such projects. Transocean's ability to deploy and operate highly capable rigs in these demanding conditions makes it an indispensable partner.

- Targeted Operations: Focus on exploration and production companies with projects in water depths exceeding 5,000 feet and in regions with significant weather challenges.

- Technological Demand: Clients require advanced drilling technologies, including dynamic positioning, riserless drilling, and automated drilling systems.

- Risk Mitigation: Companies in this segment prioritize safety and operational efficiency, seeking partners with proven track records in complex environments.

- Market Context: As of early 2024, the global demand for ultra-deepwater drilling remains robust, driven by the need to access new reserves, with Transocean holding a significant share of the market for these specialized services.

Clients Requiring Advanced Drilling Technology

This client segment comprises companies undertaking complex offshore drilling projects that demand the most advanced technological solutions. These are operators pushing the envelope in deepwater and ultra-deepwater exploration, where conventional drilling methods are insufficient.

Transocean's strategic investments in capabilities like 20,000 PSI drilling systems and managed pressure drilling (MPD) directly address the needs of these sophisticated clients. For instance, the company's fleet includes advanced harsh environment semi-submersibles and drillships equipped for these high-specification operations, crucial for accessing challenging reservoirs.

Clients requiring these advanced drilling technologies are often involved in frontier exploration or development projects with significant technical hurdles. Their willingness to engage with Transocean stems from the company's demonstrated ability to deploy and operate these cutting-edge systems safely and efficiently, ensuring project success in demanding environments.

- Advanced Technology Needs: Clients specifically seek drilling solutions capable of handling extreme pressures, complex wellbore stability issues, and the need for precise pressure control, often found in ultra-deepwater or geologically challenging formations.

- Project Complexity: This segment includes operators engaged in frontier exploration, ultra-deepwater development, and projects requiring specialized drilling techniques like managed pressure drilling (MPD) or high-pressure/high-temperature (HPHT) environments.

- Strategic Partnerships: These clients value Transocean's commitment to technological innovation and its proven track record in deploying and operating advanced offshore drilling rigs, recognizing the critical role of technology in mitigating risk and maximizing recovery in their high-stakes projects.

Transocean's customer base is primarily composed of major integrated oil and gas companies, national oil companies (NOCs), and independent exploration and production (E&P) firms. These entities require specialized offshore drilling services, particularly for deepwater and harsh environment operations.

In 2023 and early 2024, Transocean continued to secure significant contracts with these clients, underscoring their reliance on advanced drilling capabilities. The demand for ultra-deepwater and harsh environment rigs remains robust, with day rates showing upward trends, reflecting the specialized nature of the services provided.

Clients are increasingly seeking advanced technological solutions, such as managed pressure drilling (MPD) and systems capable of handling extreme pressures, to mitigate risks and maximize recovery in challenging offshore projects.

| Customer Segment | Key Characteristics | 2024 Market Insight |

|---|---|---|

| Major Integrated Oil & Gas Companies | Global energy leaders needing sophisticated offshore drilling for vast reserves. | Continued demand for multi-year, multi-billion dollar contracts. |

| National Oil Companies (NOCs) | Government-owned entities developing national energy resources, undertaking large-scale projects. | Crucial clients for complex deepwater and harsh environment drilling expertise. |

| Independent E&P Companies | Focus exclusively on finding and extracting oil and gas, often in new offshore regions. | Day rates for specialized rigs favored by independents showed upward pressure in early 2024. |

Cost Structure

Operating and Maintenance (O&M) expenses are a substantial part of Transocean's cost structure, directly tied to keeping its advanced drilling rigs functional and efficient. These costs encompass everything from the salaries of the skilled crews to the fuel powering the vessels and essential supplies. For the second quarter of 2025, Transocean reported $599 million in O&M expenses, highlighting the significant investment required for daily operations and upkeep.

Personnel costs are a significant driver for Transocean, reflecting the need for highly skilled rig crews, engineers, and shore-based support staff. In 2023, Transocean reported total compensation and benefits expenses of approximately $2.3 billion, underscoring the substantial investment in its workforce.

Transocean heavily invests in its fleet, dedicating significant capital to maintain, upgrade, and reactivate its drilling units. This ensures all assets adhere to stringent industry specifications and the highest safety protocols.

For 2025, the company anticipates capital expenditures to be around $120 million. This figure encompasses essential customer-mandated upgrades and ongoing sustaining capital necessary for fleet readiness.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses are the backbone of Transocean's corporate operations, encompassing essential functions that keep the company running smoothly. These costs include the salaries of executive leadership, the support staff managing daily administrative tasks, the upkeep of office facilities, and crucial professional services like legal counsel and accounting oversight.

For the second quarter of 2025, Transocean reported G&A expenses totaling $49 million. This figure underscores the significant investment required to manage the administrative complexities inherent in supporting a vast, global fleet of offshore drilling rigs and a diverse workforce.

- Executive Salaries

- Administrative Staff Costs

- Office and Facility Expenses

- Legal and Accounting Fees

Interest Expense and Debt Servicing

Given the capital-intensive nature of the drilling industry, interest expense on Transocean's substantial debt is a significant cost. For instance, in the first quarter of 2024, Transocean reported interest expense of $118 million.

The company actively focuses on reducing its total debt burden to minimize ongoing interest expenses and enhance its overall financial flexibility. This strategic approach aims to improve the company's balance sheet and operational resilience.

- Interest Expense (Q1 2024): $118 million

- Debt Reduction Strategy: Ongoing focus to minimize interest costs.

- Financial Impact: Reduced debt improves financial flexibility and operational capacity.

Transocean's cost structure is dominated by operating and maintenance expenses, which were $599 million in Q2 2025, and personnel costs, totaling approximately $2.3 billion in 2023. Capital expenditures for fleet maintenance and upgrades were projected at $120 million for 2025, with general and administrative expenses at $49 million in Q2 2025. Interest expense was a notable $118 million in Q1 2024, reflecting the company's debt.

| Cost Category | Q2 2025 | 2023 | Q1 2024 |

| Operating & Maintenance (O&M) | $599 million | ||

| Personnel Costs (Total Compensation & Benefits) | ~$2.3 billion | ||

| Capital Expenditures (Projected) | $120 million (2025 projection) | ||

| General & Administrative (G&A) | $49 million | ||

| Interest Expense | $118 million |

Revenue Streams

Transocean's core revenue generation hinges on contract drilling day rates, essentially charging clients for the use of its advanced offshore drilling rigs. These rates are dynamic, influenced heavily by the rig's capabilities, its technical specifications, and the length of the service contract. For instance, in 2024, high-specification ultra-deepwater drillships and harsh environment semi-submersibles are commanding substantial daily rates, often surpassing $450,000 to $500,000 per day for longer-term commitments.

Transocean's revenue model includes reimbursable revenues, where clients cover specific operational costs beyond the core drilling services. These reimbursements are crucial for projects requiring specialized logistics, equipment rentals, or other direct project outlays, ensuring Transocean is compensated for these additional expenses.

For instance, in 2024, Transocean continued to leverage this stream by passing on costs associated with complex offshore operations, such as advanced subsea equipment deployment and extended support vessel charters, directly to its clients.

Transocean benefits from ongoing revenue through contract extensions and options exercised by its existing client base. These extensions, frequently secured at attractive daily rates, bolster the company's backlog and ensure a consistent flow of income.

Mobilization and Demobilization Fees

Mobilization and demobilization fees are a key revenue stream for Transocean, particularly when their advanced drilling rigs are relocated to new operational sites or transition between client contracts. These charges are designed to offset the significant logistical expenses and downtime involved in moving these complex, high-value assets.

For instance, in 2024, the industry saw continued demand for efficient rig repositioning, directly impacting Transocean's ability to generate revenue from these services. The complexity and specialized nature of these moves mean that these fees are not trivial, reflecting the intricate planning and execution required.

- Cost Recovery: Fees cover expenses like towing, anchoring, and personnel deployment for rig moves.

- Downtime Compensation: Revenue accounts for the period the rig is not actively drilling during relocation.

- Contractual Agreements: These fees are typically stipulated within the drilling service contracts with clients.

- Asset Utilization: Maximizes revenue generation by ensuring rigs are efficiently deployed and compensated for transit.

Standby and Idle Rates

Transocean can generate revenue through standby and idle rates in certain contracts. This means they get paid even when their drilling rigs aren't actively drilling but are still under agreement and ready for deployment.

- Revenue Stability: These rates offer a predictable income stream, cushioning against periods of inactivity.

- Contractual Basis: Standby and idle rates are specifically defined within contractual agreements with clients.

- Operational Readiness: This revenue model compensates Transocean for maintaining its assets and personnel in a state of readiness.

For instance, during the first quarter of 2024, Transocean reported that standby revenue contributed to their overall financial performance, reflecting the application of these contractual clauses.

Transocean's primary revenue comes from day rates for its drilling rigs, which vary based on rig type and contract length. In 2024, high-spec ultra-deepwater rigs were fetching rates upwards of $500,000 per day. This core business is supplemented by reimbursable costs for specialized services and operational expenses incurred on behalf of clients.

Contract extensions and options provide a stable income stream, often at favorable rates, bolstering the company's backlog. Additionally, mobilization and demobilization fees are charged for relocating rigs, covering significant logistical costs and downtime. Standby and idle rates also contribute to revenue stability, compensating Transocean for maintaining operational readiness.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Contract Drilling Day Rates | Charging clients for rig usage based on daily rates. | High-spec rigs commanding over $500,000/day. |

| Reimbursable Revenues | Clients cover specific operational costs beyond drilling. | Includes costs for specialized equipment and logistics. |

| Contract Extensions/Options | Revenue from extending existing client contracts. | Secured at attractive daily rates, bolstering backlog. |

| Mobilization/Demobilization Fees | Charges for relocating rigs to new operational sites. | Offsets significant logistical expenses and downtime. |

| Standby/Idle Rates | Payment for rigs under contract but not actively drilling. | Provides predictable income and compensates for readiness. |

Business Model Canvas Data Sources

The Transocean Business Model Canvas is informed by a robust combination of financial disclosures, industry analyst reports, and internal operational data. These sources provide a comprehensive view of revenue streams, cost structures, and key activities within the offshore drilling sector.