Transocean Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Transocean Bundle

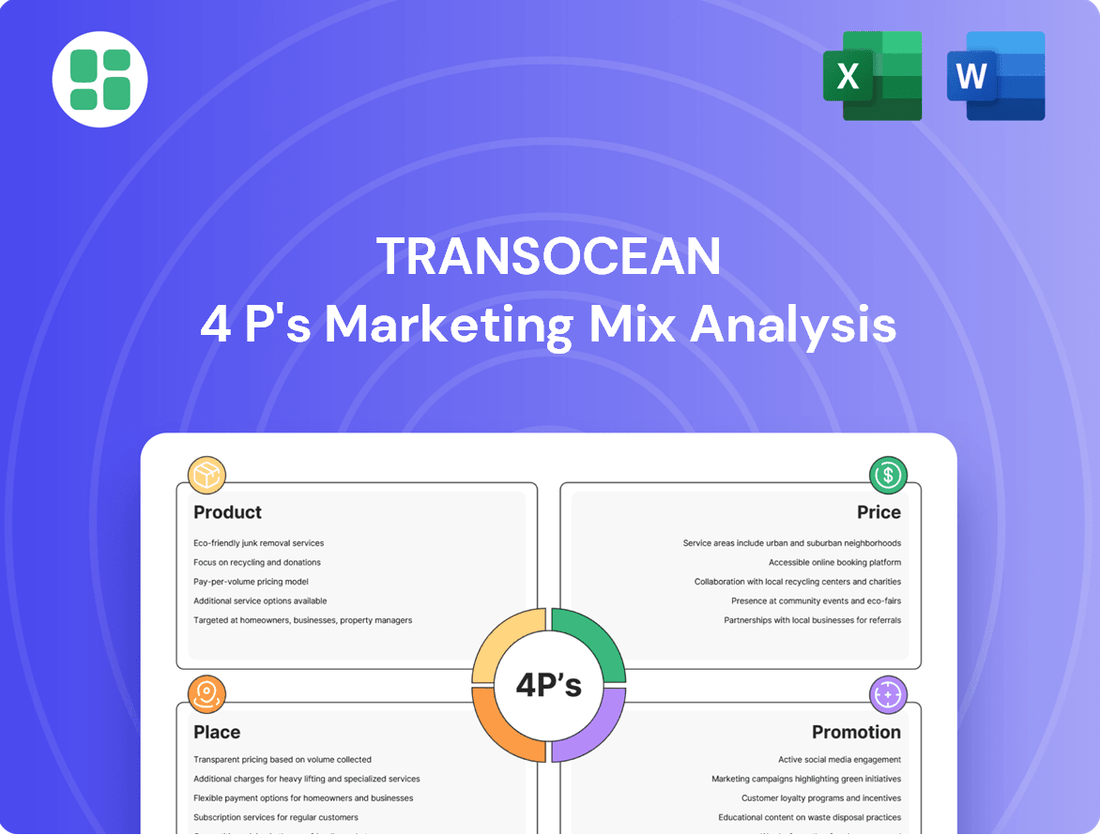

Uncover the strategic brilliance behind Transocean's market dominance. This analysis delves into their innovative product offerings, competitive pricing, extensive global reach, and impactful promotional campaigns.

Go beyond the surface and gain a comprehensive understanding of how Transocean leverages its Product, Price, Place, and Promotion strategies to secure its leadership position in the offshore drilling industry. This ready-to-use analysis is perfect for anyone seeking actionable insights.

Save valuable time and effort with this expertly crafted 4Ps Marketing Mix Analysis of Transocean. It provides a structured framework, real-world examples, and strategic recommendations that you can immediately apply to your own business planning or academic research.

Product

Transocean's high-specification mobile offshore drilling units, such as their advanced ultra-deepwater drillships and harsh environment semi-submersibles, are engineered for the most complex global offshore projects. These state-of-the-art assets are crucial for clients tackling technically demanding operations in challenging deepwater and harsh conditions. For instance, Transocean's fleet continues to secure significant contracts, with their 2024 backlog reflecting strong demand for these specialized units, demonstrating their competitive edge.

Transocean's core product is ultra-deepwater drilling services, enabling exploration and development in extreme ocean depths. This specialized offering caters to major oil and gas firms targeting vast offshore hydrocarbon reserves. In 2024, the demand for such services is expected to remain robust, driven by the need for new energy sources.

Transocean’s harsh environment drilling expertise is a cornerstone of its offering, particularly for operations in demanding offshore locations like the North Sea. This specialization allows them to tackle challenging weather and complex geological conditions, ensuring client projects proceed safely and efficiently. For instance, in 2024, Transocean continued to deploy its advanced fleet, including harsh environment-capable units, in regions known for their rigorous operational demands.

Integrated Drilling Solutions

Integrated Drilling Solutions represent a significant evolution in Transocean's offering, moving beyond mere rig provision. This segment focuses on managing the entire well construction lifecycle, from initial planning through to completion. By bundling project management, engineering expertise, and specialized well services, Transocean aims to streamline operations and enhance efficiency for its clients in the oil and gas sector.

This integrated approach is designed to provide a more holistic and cost-effective solution for exploration and production companies. For instance, Transocean's commitment to innovation in this area is reflected in their ongoing investments in advanced drilling technologies and digital solutions. In 2024, the company continued to emphasize these integrated services as a key differentiator in a competitive market, aiming to secure longer-term contracts that leverage their full suite of capabilities.

- Project Management: Overseeing all phases of the drilling project.

- Engineering Support: Providing technical expertise and optimization.

- Specialized Well Services: Offering tailored solutions for complex well challenges.

- Efficiency Gains: Aiming to reduce downtime and improve overall well delivery.

Advanced Technology and Safety Standards

Transocean 4P leverages cutting-edge drilling technologies, including advanced systems for high-pressure, high-temperature (HPHT) wells, to enhance operational efficiency and capability. This focus on innovation directly supports their service quality, allowing them to tackle more demanding projects. Their commitment to advanced technology is a key differentiator in the competitive offshore drilling market.

Safety and environmental stewardship are paramount, with the company adhering to stringent protocols. This includes comprehensive risk management and continuous training programs to ensure the well-being of personnel and the protection of the marine environment. By maintaining these high standards, Transocean 4P builds trust and reliability with its clients.

The company's investment in advanced technology is evident in its fleet modernization efforts. For instance, as of late 2024, Transocean has continued to integrate newbuilds and upgrade existing assets with the latest drilling and safety equipment. This proactive approach ensures they remain at the forefront of industry capabilities.

- Technological Edge: Utilization of advanced drilling systems for HPHT environments.

- Safety First: Implementation of rigorous safety and environmental protocols.

- Fleet Modernization: Ongoing investment in upgrading and integrating new drilling technologies.

- Service Quality: Differentiation through superior operational capabilities and reliability.

Transocean's product offering centers on its high-specification offshore drilling fleet, comprising ultra-deepwater drillships and harsh environment semi-submersibles. These assets are designed for complex projects in challenging environments, a capability that continues to drive strong contract awards. The company's backlog as of late 2024 underscores the sustained demand for these specialized units, reflecting their critical role in global energy exploration and development.

| Product Category | Key Features | Market Demand Indicator (2024/2025) | Example Unit |

|---|---|---|---|

| Ultra-Deepwater Drilling Services | Exploration & development in extreme depths | Robust demand driven by new energy source needs | Drillships |

| Harsh Environment Drilling | Operations in challenging weather/geological conditions | Continued deployment in demanding regions like the North Sea | Harsh Environment Semi-submersibles |

| Integrated Drilling Solutions | Full well construction lifecycle management | Emphasis as a key differentiator, aiming for longer-term contracts | Bundled Project Management & Engineering |

What is included in the product

This analysis provides a comprehensive examination of Transocean's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights into their market positioning.

It is designed for professionals seeking a detailed understanding of Transocean's marketing mix, grounded in real-world practices and competitive landscapes.

Provides a clear, actionable framework to address market challenges, transforming complex marketing strategies into understandable solutions.

Simplifies the evaluation of Transocean's marketing efforts, pinpointing areas for improvement and alleviating the stress of strategic uncertainty.

Place

Transocean boasts a truly global operational footprint, strategically positioning its advanced fleet within key offshore oil and gas regions worldwide. This extensive network spans continents, ensuring proximity to major exploration and production hubs.

Their fleet is actively deployed in critical markets like the U.S. Gulf of Mexico, Brazil, the North Sea (including Norway), West Africa (Angola), and the Asia-Pacific region (Australia). This broad geographical coverage is crucial for servicing a diverse international clientele.

As of the first quarter of 2024, Transocean reported operating days across numerous regions, highlighting their active engagement in these vital basins. For instance, their ultra-deepwater floaters and harsh environment semi-submersibles are integral to projects in these high-demand areas, demonstrating their commitment to global service delivery.

Transocean’s primary go-to-market strategy involves securing direct contracts with major international and national oil and gas corporations. This approach bypasses intermediaries, allowing for direct negotiation and a clear understanding of client needs.

These agreements are typically long-term, often spanning multiple years and covering extensive drilling campaigns. For instance, in 2024, Transocean secured significant contract extensions and new awards valued in the billions, demonstrating the strength of these direct client relationships and the demand for its advanced offshore drilling fleet.

This direct engagement fosters a collaborative environment, enabling Transocean to tailor its services precisely to each client's unique project specifications and operational challenges. Such close partnerships are crucial for optimizing drilling efficiency and safety in complex offshore environments.

On-site rig deployment is the core of Transocean's physical offering. Their advanced offshore drilling units, like the ultra-deepwater Discoverer Origin, are transported and positioned directly at client-selected exploration or production sites. This tangible presence at the operational frontier is fundamental to delivering their high-specification drilling services.

Strategic Fleet Positioning

Transocean strategically positions its advanced fleet to align with anticipated market demand and secure contract awards, emphasizing operational efficiency. This proactive approach involves redeploying rigs across various global regions to enhance utilization rates and capitalize on emerging project opportunities. Effective fleet management is paramount for optimizing asset value and ensuring accessibility for clients.

As of early 2024, Transocean operates a diverse fleet, including ultra-deepwater and harsh environment drilling units. The company's fleet utilization is a key performance indicator, directly impacting revenue generation. For instance, in Q1 2024, Transocean reported a fleet-wide operational utilization of approximately 90% for its floaters, underscoring the success of its strategic positioning efforts.

- Fleet Optimization: Moving rigs to regions with higher day rates and longer contract durations.

- Market Responsiveness: Adapting fleet deployment to shifts in offshore drilling activity, such as increased demand in the Gulf of Mexico or the North Sea.

- Asset Modernization: Continually evaluating and upgrading the fleet to meet the evolving technical requirements of offshore projects.

- Contract Backlog: Leveraging its strategic positioning to maintain a robust contract backlog, providing revenue visibility. As of Q1 2024, Transocean's contracted backlog stood at over $6.7 billion.

Client Relationship Management

Client Relationship Management is crucial for Transocean, extending beyond mere contract fulfillment to encompass proactive engagement and support. This involves dedicated teams ensuring smooth project execution and addressing client needs throughout the long-cycle offshore drilling process. For instance, in 2024, Transocean's focus on client partnerships was evident in securing significant contracts, underscoring the value placed on sustained relationships within the industry.

Building and maintaining strong client relationships is paramount in the offshore drilling sector, where projects span years and require deep trust and collaboration. Transocean's approach includes:

- Dedicated Operational and Technical Support: Ensuring clients receive expert assistance and seamless service delivery throughout project lifecycles.

- Proactive Communication: Maintaining open lines of communication to anticipate and address client needs, fostering long-term partnerships.

- Customized Solutions: Tailoring services and support to meet the specific requirements of each client and project, enhancing satisfaction and retention.

- Long-Term Value Creation: Focusing on delivering consistent performance and reliability to build enduring trust and secure repeat business, a strategy that contributed to their robust backlog in early 2025.

Transocean's global presence is a cornerstone of its marketing strategy, ensuring its state-of-the-art fleet is strategically positioned in key offshore oil and gas basins. This widespread operational footprint allows them to serve major exploration and production hubs across continents, from the U.S. Gulf of Mexico to the Asia-Pacific region.

The company's fleet is actively deployed in high-demand areas such as Brazil, the North Sea, and West Africa, reflecting a deliberate placement to meet client needs and capitalize on market opportunities. This strategic positioning is crucial for maintaining proximity to their international clientele and ensuring efficient service delivery.

As of Q1 2024, Transocean's fleet utilization for floaters was approximately 90%, a testament to the effectiveness of their global deployment strategy. This high utilization rate underscores their ability to secure and maintain contracts in vital offshore drilling markets, supported by a contracted backlog exceeding $6.7 billion in early 2024.

Same Document Delivered

Transocean 4P's Marketing Mix Analysis

The preview shown here is the actual Transocean 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive report details Transocean's strategies across Product, Price, Place, and Promotion, offering valuable insights for your business. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use.

Promotion

Transocean's industry reputation is a cornerstone of its promotional strategy, built over decades as a global leader in offshore drilling. This long-standing presence translates into a robust track record of operational excellence and an unwavering commitment to safety, which are critical differentiators in securing new business.

The company's extensive experience in tackling highly complex deepwater and harsh environment projects is a significant promotional asset. For instance, in 2023, Transocean continued to demonstrate its capabilities by securing significant contract awards for its advanced ultra-deepwater floaters, reinforcing its position in challenging offshore regions.

This well-earned reputation directly contributes to securing new contracts and, crucially, maintaining the trust of its long-term clients. In the first quarter of 2024, Transocean reported a backlog of approximately $7.1 billion, a testament to the confidence clients place in their proven performance and specialized expertise.

Transocean's direct sales and business development strategy is crucial, focusing on building relationships with major oil and gas companies to secure long-term drilling contracts. This B2B approach necessitates a dedicated sales force skilled in complex negotiations.

In 2024, Transocean secured significant new contracts, demonstrating the effectiveness of its direct sales efforts. For instance, the company announced securing approximately $3.1 billion in new contract backlog in the first quarter of 2024, highlighting substantial business development wins.

Transocean prioritizes robust investor relations, consistently delivering timely financial reports, hosting earnings calls, and conducting investor presentations. This commitment to transparency is crucial for fostering investor confidence and shaping positive market perception, directly impacting capital attraction. For instance, in the first quarter of 2024, Transocean reported a net loss of $170 million, but highlighted a significant backlog of $8.9 billion, demonstrating operational strength despite short-term financial results.

Showcasing Advanced Technology and Safety

Transocean consistently emphasizes its dedication to cutting-edge drilling technology and paramount safety standards. This focus is a cornerstone of their marketing efforts, prominently featured in their corporate reports and presentations. For instance, in 2024, the company highlighted its continued investment in automated drilling systems, aiming to enhance efficiency and reduce human exposure in hazardous environments.

Their commitment to safety and environmental stewardship is not just a talking point; it's a demonstrable aspect of their operational capability. Transocean's safety performance metrics, often shared at industry forums, underscore their objective to maintain industry-leading standards. This approach reassures stakeholders of their responsible operational practices and technological prowess.

- Technological Advancement: Continued investment in automation and advanced drilling solutions.

- Safety Performance: Focus on reducing incidents and improving personnel safety metrics.

- Environmental Stewardship: Commitment to minimizing environmental impact through operational excellence.

- Industry Communication: Dissemination of achievements and commitments through corporate channels and forums.

Participation in Industry Conferences and Events

Transocean actively engages in key oil and gas industry gatherings like the Offshore Technology Conference (OTC) and International Petroleum Technology Conference (IPTC). These platforms are vital for demonstrating their advanced offshore drilling rig capabilities and innovative technologies. For instance, at OTC 2024, Transocean highlighted its ultra-deepwater and harsh-environment drilling expertise, attracting significant interest from major energy producers looking to secure high-specification assets for upcoming projects.

These conferences serve as crucial networking hubs, facilitating direct engagement with potential clients and industry partners. This direct interaction is instrumental in generating new business leads and reinforcing Transocean's brand as a leader in offshore drilling services. The ability to showcase their fleet, including their latest generation of harsh-environment semi-submersibles and ultra-deepwater drillships, directly to decision-makers is a powerful driver for securing future contracts.

- Fleet Showcase: Demonstrating capabilities of rigs like the Discoverer series and harsh-environment units.

- Technological Advancements: Presenting innovations in drilling efficiency, safety, and environmental performance.

- Client Engagement: Direct interaction with potential clients, fostering relationships and understanding market needs.

- Brand Visibility: Enhancing market presence and reinforcing Transocean's position as an industry leader.

Transocean's promotional efforts are deeply rooted in showcasing its technological leadership and unwavering commitment to safety and environmental stewardship. This is consistently communicated through corporate reports, investor presentations, and active participation in key industry forums.

The company leverages its robust backlog, which stood at approximately $8.9 billion as of the first quarter of 2024, as a testament to client confidence and its ability to secure substantial contracts, demonstrating the effectiveness of its B2B sales and relationship-building strategies.

Furthermore, Transocean actively engages with stakeholders at major industry events like the Offshore Technology Conference (OTC) in 2024, providing a platform to highlight its advanced ultra-deepwater and harsh-environment drilling capabilities, thereby reinforcing its brand as an industry leader.

| Promotional Element | Description | 2024 Data/Focus |

|---|---|---|

| Industry Reputation & Track Record | Leveraging decades of operational excellence and safety commitment. | Secured $3.1 billion in new contract backlog in Q1 2024. |

| Direct Sales & Business Development | Building relationships with major oil and gas companies. | Focus on securing long-term drilling contracts for high-specification assets. |

| Investor Relations & Transparency | Timely financial reporting and clear communication of performance. | Reported $8.9 billion backlog in Q1 2024, demonstrating operational strength. |

| Technology & Safety Emphasis | Highlighting investment in automation and safety metrics. | Continued investment in automated drilling systems for efficiency and safety. |

| Industry Event Participation | Showcasing fleet capabilities and innovations at conferences. | Highlighted ultra-deepwater and harsh-environment expertise at OTC 2024. |

Price

Transocean primarily prices its offshore drilling services through contract-based day rates. This model means clients pay a set fee each day for utilizing the company's rigs and the expertise that comes with them. The specific day rate is a dynamic figure, heavily influenced by the rig's capabilities, its technological sophistication, and the prevailing supply and demand in the offshore drilling market.

In the current market, particularly for advanced, high-specification rigs, day rates have seen a significant uptick. For instance, recent contract awards for these premium assets have been reported in the range of $500,000 to $600,000 per day. This demonstrates the substantial value clients place on cutting-edge technology and operational efficiency in challenging offshore environments.

Transocean's pricing strategy heavily relies on long-term drilling contracts, a key element of its marketing mix. These agreements offer substantial revenue visibility and stability, crucial for an industry with high capital expenditure. The terms are meticulously negotiated, taking into account the project's length, technical demands, and anticipated market conditions.

This long-term contract structure is a significant differentiator for Transocean. By securing multi-year commitments, the company mitigates the volatility often associated with the offshore drilling sector. This approach allows for more predictable financial planning and operational execution.

As of July 2025, Transocean's robust backlog stood at approximately $7.2 billion. This figure underscores the company's success in securing future work through these long-term contracts, providing a solid foundation for its financial performance and strategic investments.

Transocean's pricing strategy is intrinsically linked to the advanced capabilities and rig specifications of its fleet. Units equipped for ultra-deepwater and harsh environments, particularly its cutting-edge eighth-generation drillships, command significantly higher day rates. This premium reflects their superior technology and capacity to operate in the most demanding offshore conditions, a key differentiator in securing lucrative contracts.

Negotiation Based on Project Complexity

Transocean's pricing for drilling services is highly adaptable, reflecting the intricate nature of offshore projects. The final cost is determined through negotiation, directly influenced by factors such as the technical demands, the operational site's remoteness, and the project's overall complexity. This bespoke approach ensures that clients are billed appropriately for the unique challenges and resources required.

Projects demanding specialized drilling equipment, operations in ultra-deepwater environments, or those situated in challenging geographical locations, such as the Arctic or remote offshore basins, naturally command higher rates. For instance, the average day rate for a harsh environment ultra-deepwater drillship in early 2024 hovered around $450,000 to $550,000, significantly higher than standard deepwater operations. This premium accounts for the increased operational risks, specialized personnel, and advanced technology necessary for such undertakings.

- Project Complexity: Factors like water depth, well design, and geological formations directly impact pricing.

- Geographical Location: Remote or harsh environments necessitate higher operational costs, reflected in day rates.

- Equipment Specialization: Use of advanced or bespoke drilling technology incurs additional charges.

- Market Demand: High demand for specific rig types in certain regions can also influence negotiation outcomes.

Market Demand and Competitive Landscape

Transocean's pricing strategy is deeply intertwined with the robust demand for offshore drilling services and the competitive environment. The market has seen a significant uptick in day rates, with many analysts projecting continued strength through 2025. Transocean is strategically positioning itself to capture these higher rates, capitalizing on its advanced fleet and substantial order backlog, which provides a degree of pricing power.

The company is actively avoiding the temptation of accepting below-market bids, demonstrating a commitment to securing premium pricing that reflects the value of its high-specification assets and operational expertise. This approach is crucial in a market where capacity is tightening.

- Market Demand: Offshore drilling demand is strong, driven by energy security concerns and a need to replenish reserves.

- Rising Day Rates: Average day rates for harsh-environment floaters were projected to average over $450,000 in late 2024, with potential for further increases.

- Fleet Premium: Transocean's modern, technologically advanced fleet allows it to command higher rates compared to older, less capable rigs.

- Backlog Strength: A significant backlog of contracted work provides revenue visibility and supports pricing negotiations for future contracts.

Transocean's pricing is primarily driven by day rates negotiated through long-term contracts, reflecting rig capabilities and market conditions. As of July 2025, the company's backlog of $7.2 billion highlights its success in securing future revenue, enabling strategic pricing power.

| Rig Type | Estimated Day Rate (USD) | Key Factors |

|---|---|---|

| Ultra-Deepwater Harsh Environment Drillship | $500,000 - $600,000+ | Advanced technology, harsh environment capability, project complexity |

| Harsh Environment Semi-submersible | $450,000 - $550,000+ | Operational efficiency, specific project demands, market demand |

4P's Marketing Mix Analysis Data Sources

Our Transocean 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, including SEC filings and investor presentations, alongside comprehensive industry reports and competitive intelligence. This ensures a robust understanding of Transocean's strategic positioning across Product, Price, Place, and Promotion.