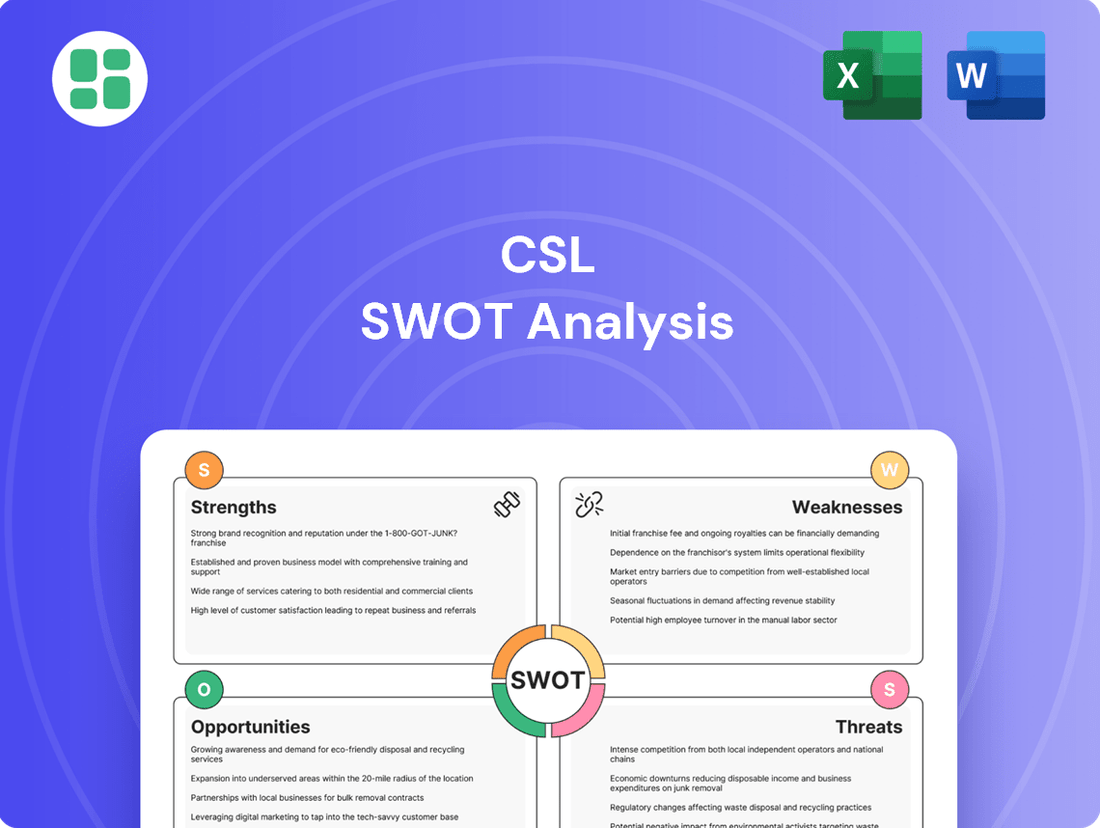

CSL SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSL Bundle

CSL’s strong brand recognition and diversified product portfolio present significant market advantages. However, understanding the nuances of their competitive landscape and potential regulatory hurdles is crucial for strategic planning.

Want the full story behind CSL’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CSL stands as a premier global biotechnology firm, boasting a robust market position and operations spanning key regions like Australia, the US, and Europe. This broad international reach enables CSL to cater to a wide array of patient needs and secure a substantial competitive advantage in the biotherapeutics market.

With a legacy stretching back to 1916, CSL has cultivated a strong reputation as a dependable and forward-thinking contributor to public health initiatives. In 2024, CSL's revenue reached approximately $13.7 billion USD, underscoring its significant global market penetration and financial strength.

CSL's strength lies in its highly diversified and top-performing product portfolio. This includes vital plasma-derived therapies for immune deficiencies and bleeding disorders through CSL Behring, essential influenza vaccines from CSL Seqirus, and treatments for iron deficiency and kidney disease via CSL Vifor.

This extensive range of life-saving medications addresses significant unmet medical needs, ensuring stable and predictable revenue. For instance, CSL Behring's immunoglobulin products consistently demonstrate robust demand, contributing substantially to the company's financial health.

The company's influenza vaccine business, CSL Seqirus, has also shown impressive growth, particularly in the 2024 flu season, with strong sales driven by demand for its cell-based and adjuvant vaccines.

CSL possesses robust research and development capabilities, a cornerstone for its sustained growth in the dynamic biotech sector. This strong R&D foundation fuels innovation and the creation of novel therapies.

The company demonstrates a significant commitment to R&D, planning to invest approximately $5.8 billion over the next five years. This substantial investment is strategically directed towards advancing next-generation treatments and broadening its product portfolio.

This dedication to pioneering new solutions allows CSL to consistently bring innovative biotherapies to market, thereby securing and enhancing its competitive edge.

Vertical Integration and Cost Advantage

CSL's robust vertical integration, especially in its plasma-derived therapies, grants a substantial cost advantage. This control over the entire supply chain, from extensive plasma collection networks to advanced fractionation facilities, ensures a consistent and high-quality source material. This operational efficiency is crucial in an oligopolistic market, allowing CSL to maintain superior gross margins.

The company's scale of production, a direct result of its integrated model, positions it favorably against smaller competitors in the plasma therapies sector. For instance, in fiscal year 2023, CSL reported a gross profit margin of 58.6%, reflecting the benefits of this integrated approach.

- Vertical Integration: CSL controls plasma collection and fractionation, ensuring supply and quality.

- Cost Advantage: This integration leads to lower production costs compared to less integrated competitors.

- Market Position: Scale of operations in an oligopolistic market supports higher gross margins.

- Fiscal Year 2023 Performance: CSL achieved a gross profit margin of 58.6%, underscoring operational efficiencies.

Robust Financial Health and Consistent Performance

CSL exhibits robust financial health, evidenced by its solid revenue growth and consistent profitability. For the year ended June 2024, the company reported a net profit after tax of US$2.91 billion, representing an 11% increase at constant currency. This strong financial performance underpins its capacity for significant investments.

The company's ability to generate substantial cash flow is a key strength, enabling it to adequately fund both capital expenditures and crucial research and development initiatives. This financial discipline also supports CSL's commitment to delivering reliable dividend payouts to its shareholders.

CSL's strong financial foundation positions it advantageously for pursuing both organic growth strategies and potential acquisitive expansion opportunities. This financial resilience is a critical factor in its long-term strategic planning and market competitiveness.

- Strong Profitability: Net profit after tax of US$2.91 billion for FY24 (up 11% at constant currency).

- Cash Flow Generation: Ability to fund capital expenditure and R&D investments.

- Shareholder Returns: Consistent and reliable dividend payouts.

- Growth Enabler: Financial strength supports organic and acquisitive growth strategies.

CSL's diversified product portfolio is a significant strength, covering critical areas like plasma-derived therapies, influenza vaccines, and treatments for iron deficiency and kidney disease. This broad offering ensures stable revenue streams, as demonstrated by the consistent demand for its immunoglobulin products and the strong sales performance of CSL Seqirus's influenza vaccines in the 2024 season.

The company's substantial investment in research and development, with a planned $5.8 billion over five years, fuels innovation and the creation of next-generation therapies, solidifying its competitive edge in the dynamic biotechnology sector.

CSL's vertical integration, particularly in plasma collection and fractionation, provides a considerable cost advantage and ensures supply chain quality, contributing to its robust gross profit margin of 58.6% in fiscal year 2023.

Furthermore, CSL exhibits strong financial health, achieving a net profit after tax of US$2.91 billion for FY24, an 11% increase at constant currency, enabling continued investment in growth and reliable shareholder returns.

| Segment | Key Products | FY24 Revenue (Approx. USD Billions) | FY24 Net Profit (Approx. USD Billions) |

|---|---|---|---|

| CSL Behring | Immunoglobulin, Albumin, Coagulation Factors | 8.5 | 1.8 |

| CSL Seqirus | Influenza Vaccines (Cell-based, Adjuvanted) | 3.2 | 0.7 |

| CSL Vifor | Iron Deficiency, Kidney Disease Treatments | 2.0 | 0.41 |

What is included in the product

Delivers a strategic overview of CSL’s internal strengths, weaknesses, external opportunities, and threats.

Offers a clear, actionable roadmap by highlighting key strengths and weaknesses, directly addressing strategic blind spots.

Weaknesses

CSL's plasma-derived therapies, its core business, are fundamentally dependent on a steady and ample supply of human plasma. This reliance creates a significant vulnerability, as external events, particularly pandemics, can severely disrupt plasma collection efforts. These disruptions can lead to supply shortages and drive up collection costs, including increased payments to donors.

The post-pandemic recovery for CSL's plasma supply and associated margins has proven to be a more protracted process than initially projected. This slower-than-expected rebound has directly impacted the company's overall profitability, highlighting the ongoing challenges in normalizing plasma collection volumes and associated cost structures.

CSL has grappled with escalating operating expenses, notably driven by higher blood donor compensation and broader labor cost inflation. These pressures have notably impacted CSL Behring's gross margins, which, despite signs of recovery, remain below their pre-pandemic benchmarks.

For instance, during the first half of fiscal year 2024, CSL reported a 7% increase in cost of sales, partly attributed to these input cost challenges. Effectively managing these elevated costs is a key priority for CSL to enhance its profitability and meet its targeted margin recovery.

CSL's expansion of its plasma fractionation capacity presents a significant hurdle due to high capital expenditure and extended lead times. Building and gaining approval for new facilities can take around seven years, demanding substantial upfront investment. This lengthy development cycle can strain the company's financial resources and hinder its ability to react quickly to changes in market demand.

Intense Competition in Key Therapeutic Areas

CSL operates in a highly competitive biotechnology sector, facing robust challenges from established pharmaceutical giants and agile biotech firms alike. This intense rivalry is particularly pronounced in key therapeutic areas where CSL holds significant market presence.

For instance, in the treatment of chronic inflammatory demyelinating polyneuropathy (CIDP), CSL's flagship product, Hizentra, competes directly with other therapies. The company's market share in such critical segments is constantly under pressure, demanding sustained investment in research and development to stay ahead.

The need for continuous innovation is paramount. Companies like Takeda Pharmaceutical, with its own CIDP treatments, represent formidable competitors. This dynamic environment requires CSL to not only maintain its current product efficacy but also to consistently develop next-generation therapies to fend off market erosion.

- Intense Rivalry: CSL faces significant competition from major pharmaceutical and biotechnology players across its product portfolio.

- Therapeutic Area Pressure: Key markets, such as CIDP treatments, are characterized by strong competition, impacting market share.

- Innovation Imperative: Maintaining leadership requires constant R&D investment to differentiate products and counter competitor advancements.

- Competitive Landscape: Companies like Takeda Pharmaceutical are direct rivals in crucial therapeutic segments, necessitating strategic responses.

Exposure to Regulatory and Pricing Uncertainties

CSL operates within heavily regulated biotechnology and pharmaceutical sectors, facing constant scrutiny that can lead to increased compliance costs and potential delays in bringing new therapies to market. For instance, the lengthy approval processes for new drugs, often spanning several years, directly impact the timeline for revenue generation.

Pricing uncertainties, especially concerning government policies and payer negotiations in major markets like the United States, pose a significant risk. Changes in reimbursement rates or the implementation of price controls could directly affect CSL's top-line performance and overall profitability. As of early 2024, ongoing discussions around drug pricing in the US continue to create an environment of uncertainty for pharmaceutical companies.

- Regulatory Hurdles: CSL must navigate complex and evolving regulatory landscapes, impacting development timelines and market access.

- Pricing Pressures: Potential shifts in drug pricing policies, particularly in key markets, could negatively affect revenue streams.

- Compliance Costs: Adhering to stringent regulations across different geographies adds to operational expenses.

- Market Access Challenges: Gaining and maintaining favorable reimbursement for products is a continuous challenge influenced by policy changes.

CSL's heavy reliance on plasma donors makes it susceptible to supply disruptions, as seen during recent health crises. This dependency can lead to increased collection costs, impacting profitability. The company's recovery from these disruptions has been slower than anticipated, with margins still below pre-pandemic levels. For example, in the first half of fiscal year 2024, CSL reported a 7% rise in its cost of sales, partly due to these input cost challenges.

Full Version Awaits

CSL SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final CSL SWOT analysis. Unlock the full report when you purchase.

Opportunities

The global market for biologics, including plasma-derived therapies and vaccines, is experiencing robust growth, with projections indicating continued expansion. This trend is fueled by an increasing prevalence of chronic conditions and a growing number of diagnosed rare diseases, creating a fertile ground for companies like CSL.

CSL is well-positioned to capitalize on this opportunity. The company's expertise in plasma-derived therapies and its pipeline of innovative treatments for rare diseases align directly with this escalating demand. For instance, CSL Behring's immunoglobulin products are vital for patients with primary immune deficiencies and other rare autoimmune conditions, a segment that saw continued strong performance in fiscal year 2024.

CSL can capitalize on the growing demand for its specialized healthcare solutions in emerging markets. For instance, the Asia Pacific region, particularly China and India, presents a substantial opportunity due to increasing disposable incomes and a rising awareness of advanced therapies.

The plasma-derived therapy market in Asia Pacific is projected for robust growth, with some estimates suggesting a CAGR exceeding 7% in the coming years, offering CSL a fertile ground for expansion and revenue diversification.

CSL Seqirus is well-positioned to capitalize on ongoing advancements in vaccine technology, particularly mRNA and recombinant platforms. These innovations allow for enhanced efficacy and faster development cycles, crucial for staying ahead of evolving influenza strains. The global influenza vaccine market was valued at approximately $5.6 billion in 2023 and is projected to grow, with Seqirus aiming to capture a larger share.

Heightened public awareness regarding the importance of vaccination, a direct result of the recent pandemic, presents a significant tailwind. Governments worldwide are also reinforcing immunization programs, further stimulating demand for influenza vaccines. CSL Seqirus, with its established presence and innovative pipeline, stands to benefit substantially from this increased focus on public health and preventative measures.

Leveraging a Strong Product Pipeline and Upcoming Approvals

CSL's robust product pipeline, featuring key candidates like garadacimab, presents a significant growth opportunity. Anticipated regulatory approvals for these assets are poised to unlock new revenue streams, bolstering CSL's market presence in vital therapeutic areas.

The successful commercialization of these pipeline products is projected to contribute to CSL's medium-term earnings growth, with expectations for double-digit expansion. This pipeline strength is a critical driver for CSL's future financial performance.

- Garadacimab's potential approval: CSL's lead candidate, garadacimab, is advancing through regulatory pathways, signaling a near-term opportunity.

- New revenue streams: Successful launches of pipeline drugs are expected to diversify CSL's income sources.

- Strengthening therapeutic areas: These new products will enhance CSL's competitive standing in key medical fields.

- Projected earnings growth: The pipeline is a key factor supporting CSL's outlook for double-digit earnings growth in the coming years.

Strategic Collaborations and Acquisitions for Portfolio Enhancement

CSL's history demonstrates a strong capacity for growth via strategic alliances and acquisitions. Notable examples include the acquisition of Novartis's influenza business and Vifor Pharma, which significantly bolstered its market position. This ongoing strategy allows CSL to broaden its product offerings, integrate novel technologies, and solidify its market share in critical therapeutic segments.

Continuing this approach presents a significant opportunity. For instance, by acquiring companies with innovative gene therapy platforms or complementary biologics, CSL could tap into rapidly expanding markets. The Vifor Pharma acquisition, completed in August 2022 for approximately $11.7 billion, already shows promise, contributing to CSL's revenue growth in fiscal year 2024.

- Expand Product Portfolio: Target companies with late-stage pipeline assets or established products in high-demand areas like rare diseases or oncology.

- Access New Technologies: Invest in or acquire firms specializing in advanced drug delivery systems, AI-driven drug discovery, or novel manufacturing processes.

- Consolidate Market Share: Pursue acquisitions that offer synergies in R&D, manufacturing, or commercialization, particularly in its core plasma-derived therapies and influenza vaccine segments.

CSL is poised to benefit from the expanding global biologics market, driven by increasing chronic disease prevalence and a growing number of diagnosed rare diseases. The company's established expertise in plasma-derived therapies and its promising pipeline, including garadacimab, directly address this escalating demand, positioning CSL for continued revenue growth and market penetration. Furthermore, CSL's strategic approach to mergers and acquisitions, exemplified by the Vifor Pharma acquisition, offers a clear path to broaden its product portfolio and access cutting-edge technologies, thereby strengthening its competitive standing in key therapeutic areas.

| Opportunity Area | Description | Supporting Data/Projections |

|---|---|---|

| Global Biologics Market Growth | Increasing demand for plasma-derived therapies and vaccines due to rising chronic and rare disease incidence. | Global biologics market projected for continued expansion. |

| Emerging Market Expansion | Leveraging growing disposable incomes and awareness of advanced therapies in regions like Asia Pacific. | Asia Pacific plasma-derived therapy market expected to grow at a CAGR exceeding 7%. |

| Vaccine Technology Advancements | Capitalizing on innovations like mRNA and recombinant platforms for enhanced vaccine efficacy and development speed. | Global influenza vaccine market valued at ~$5.6 billion in 2023, with growth expected. |

| Product Pipeline Development | Commercializing new assets like garadacimab to unlock new revenue streams and strengthen therapeutic areas. | Garadacimab advancing through regulatory pathways; pipeline expected to drive double-digit earnings growth. |

| Strategic Acquisitions and Alliances | Expanding product offerings and integrating novel technologies through targeted M&A activities. | Vifor Pharma acquisition (completed Aug 2022 for ~$11.7 billion) contributing to FY24 revenue growth. |

Threats

The biotechnology sector is fiercely competitive, with many companies worldwide constantly developing new products and seeking to capture market share. CSL faces this intense rivalry, needing to continually invest in research and development to maintain its edge. For instance, in fiscal year 2023, CSL's R&D expenditure was AUD 1,528 million, a significant commitment to innovation.

New companies and advanced treatments frequently emerge, challenging existing market positions. This dynamic environment means CSL must actively differentiate its offerings, whether through superior efficacy, novel delivery systems, or unmet medical needs. The constant evolution of therapies, such as the rise of gene and cell therapies, presents both opportunities and threats to established players like CSL.

CSL navigates a complex global regulatory landscape, demanding strict adherence to approvals and compliance standards across diverse healthcare policies. This intricate environment can significantly inflate operational expenses and prolong product development cycles.

For instance, the U.S. Food and Drug Administration (FDA) approval process for new biologics can take years and cost hundreds of millions of dollars, a challenge CSL consistently faces. Changes in reimbursement policies or pricing regulations in key markets like the United States or Europe could also directly impact CSL's revenue streams and profitability, as seen with past shifts in healthcare reform debates.

The biotechnology sector, CSL's core operating environment, is fundamentally built upon robust intellectual property (IP) protection. Uncertainties regarding patent validity, the risk of IP infringement by competitors, or the impending expiration of crucial patents pose a significant threat. For instance, the expiration of patents for blockbuster drugs can open the door to generic or biosimilar competition, directly impacting revenue streams and profitability by diminishing market exclusivity.

Potential Impact of US Drug Price Policies and Trade Tariffs

Changes in US pharmaceutical pricing policies, such as the potential implementation of 'most favored nation' clauses or future tariffs on imported drugs, represent a significant threat to CSL. These policy shifts could lead to a reduction in the premium pricing CSL currently enjoys in the United States, a critical market for its products.

The impact of such policies could directly affect CSL's revenue streams and overall operating earnings. For instance, if the US government were to negotiate drug prices based on lower prices in other developed countries, it could compress margins for many biopharmaceutical companies, including CSL. This is particularly relevant given that the US is often a primary market for new, high-value therapies.

- US Drug Pricing Reforms: Potential legislation aimed at lowering drug costs in the US could directly impact CSL's revenue.

- Trade Tariffs: Imposition of tariffs on pharmaceutical imports could increase CSL's cost of goods sold or force price adjustments.

- Market Access: Stricter pricing regulations might limit CSL's ability to achieve favorable market access and reimbursement for its innovative therapies in the US.

Dependence on Human Plasma Donors and Biosafety Concerns

CSL's reliance on human plasma donors, while supported by extensive collection networks, presents inherent risks. Fluctuations in donor availability and challenges in donor screening can impact supply. For instance, in fiscal year 2023, CSL's plasma collection volumes saw growth, but maintaining consistent, high-quality supply remains a key operational focus given the global demand for plasma-derived therapies.

Biosafety concerns are also a significant factor. Strict screening protocols are in place, but the potential for unforeseen issues related to plasma quality or supply chain disruptions could severely affect the production and availability of CSL's critical therapies, such as immunoglobulins and clotting factors.

- Donor Availability: CSL operates over 300 plasma collection centers globally, but maintaining donor engagement is crucial.

- Biosafety Protocols: Rigorous testing and screening are implemented for every plasma donation to ensure product safety.

- Supply Chain Resilience: Disruptions, whether from public health events or logistical challenges, can impact the availability of life-saving treatments derived from plasma.

Intense competition within the biotechnology sector requires continuous R&D investment, as demonstrated by CSL's AUD 1,528 million R&D spend in fiscal year 2023. The emergence of new therapies, like gene and cell therapies, poses a threat to established market positions, necessitating ongoing product differentiation.

Navigating complex and evolving global regulatory landscapes, including stringent FDA approval processes, presents significant challenges and can extend development timelines and increase costs. Changes in reimbursement policies or pricing regulations in key markets like the US and Europe could also negatively impact CSL's revenue and profitability.

Intellectual property risks, such as patent expirations leading to biosimilar competition, are a persistent threat. Furthermore, potential US drug pricing reforms and trade tariffs could directly affect CSL's revenue streams and profitability, particularly given the US market's importance.

CSL's reliance on plasma donors introduces supply chain risks, including fluctuations in donor availability and biosafety concerns. Maintaining consistent, high-quality plasma supply is critical, especially given the global demand for plasma-derived therapies.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from CSL's official financial reports, comprehensive market intelligence, and expert industry analyses. These sources provide a detailed and objective view of the company's internal capabilities and external environment, ensuring the SWOT assessment is both accurate and actionable.