CSL Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSL Bundle

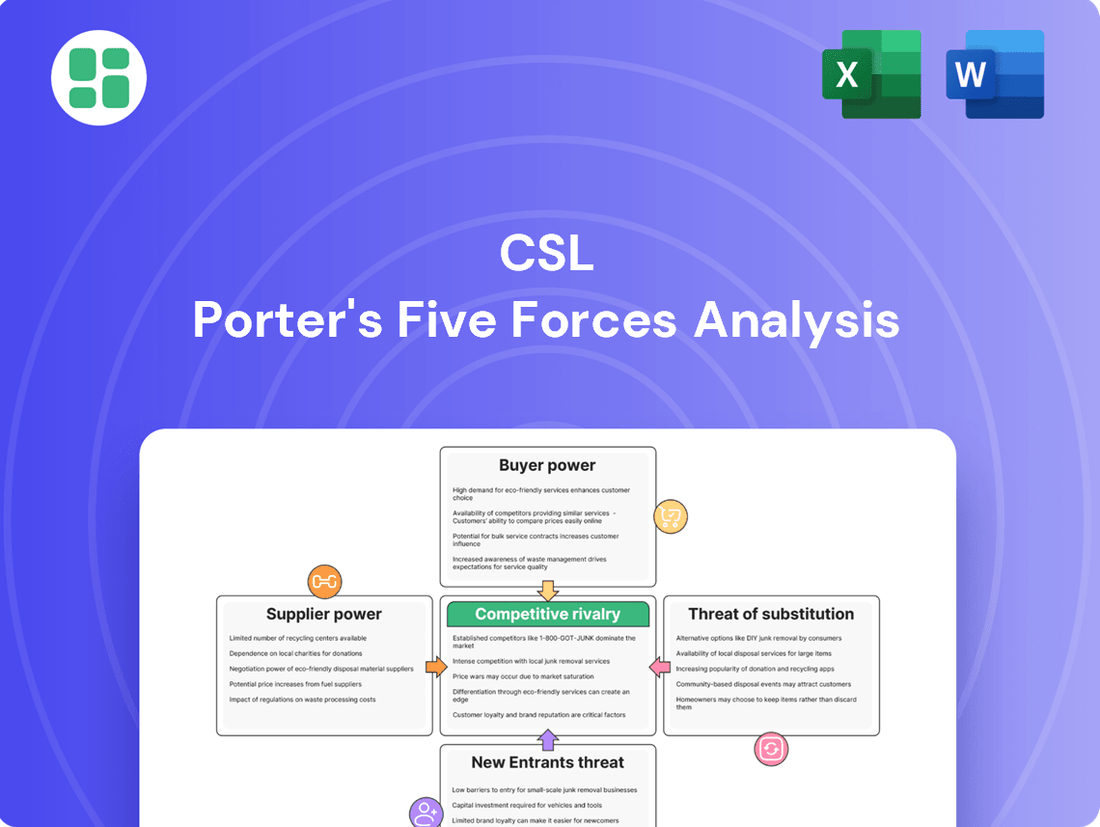

CSL's competitive landscape is shaped by five key forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping CSL’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CSL's dependence on human plasma, a raw material concentrated in a few countries like the United States, grants suppliers significant bargaining power. This concentration means that a limited number of plasma collection centers and even donors can influence CSL's production by controlling availability. In 2023, the US continued to be a dominant source, underscoring the strategic importance of managing these concentrated supply channels.

The plasma collection industry presents significant barriers to new entrants, primarily due to the immense capital required to establish and operate collection centers. These costs are amplified by rigorous regulatory compliance and the intricate logistics of managing a cold chain for biological materials. For instance, establishing a new plasma center can cost upwards of $10 million, a substantial hurdle that naturally limits competition.

These high entry barriers directly enhance the bargaining power of existing plasma suppliers. With fewer new centers able to enter the market, established players face less pressure on pricing and supply. This dynamic allows them to command more favorable terms from plasma product manufacturers.

CSL, recognizing this, has strategically invested in its own plasma collection infrastructure. By owning a significant global network of plasma collection centers, CSL effectively internalizes a portion of its supply chain. This vertical integration helps to mitigate the external bargaining power of independent suppliers, providing greater control over its raw material sourcing and costs.

Plasma collection and fractionation operate under intense regulatory oversight, demanding strict quality control and safety protocols. Suppliers must comply with stringent standards set by agencies such as the FDA and EMA, which inherently elevates their operational expenses and complexity. This regulatory landscape can directly translate to higher costs for CSL, as suppliers pass on these compliance burdens.

Specialized Equipment and Consumables

The production of biotherapies, such as plasma fractionation and vaccine manufacturing, relies heavily on highly specialized equipment, reagents, and consumables. These niche products often face limited competition among suppliers.

This lack of widespread competition grants these specialized suppliers significant leverage over companies like CSL. CSL's reliance on a select few vendors for critical components can directly impact pricing structures and the overall stability of its supply chain for essential operational inputs.

- Limited Supplier Competition: The biopharmaceutical sector's need for highly specific manufacturing inputs means suppliers often operate in niche markets with few direct competitors.

- Supplier Leverage: This scarcity of alternatives empowers specialized suppliers to command higher prices and dictate terms, impacting CSL's cost of goods sold.

- Supply Chain Vulnerability: Dependence on a small number of providers for critical materials, like specialized bioreactor components or unique cell culture media, creates a potential vulnerability for CSL's production continuity.

- Impact on Pricing: For instance, a single supplier of a proprietary filtration membrane essential for plasma fractionation could significantly influence CSL's input costs, especially if that supplier raises prices without readily available substitutes.

Labor Costs and Donor Compensation

The cost of skilled labor in plasma collection centers, along with donor compensation, directly influences the price of raw plasma for CSL. These expenses are a significant component of CSL's cost of goods sold.

For instance, in 2024, the demand for skilled phlebotomists and center staff remained robust, potentially leading to increased wage pressures. Similarly, donor incentives, a key factor in plasma supply, can fluctuate based on market conditions and CSL's competitive strategies.

- Skilled Labor Costs: CSL's operational expenses are heavily tied to the wages paid to qualified personnel managing plasma collection, testing, and processing.

- Donor Compensation: The financial incentives offered to plasma donors are a direct cost that impacts the overall cost of raw plasma acquisition.

- Market Dynamics: Fluctuations in labor availability and donor participation rates, influenced by economic factors and competitor actions, can significantly alter CSL's input costs.

- Cost Management: Effective donor recruitment and retention programs are essential for CSL to maintain a stable and competitive cost structure for its plasma-derived therapies.

CSL's reliance on plasma, a concentrated resource, gives suppliers considerable power. The limited number of collection centers, particularly in the US which remains a primary source, means these entities can dictate terms. In 2024, the ongoing demand for plasma further solidified this supplier leverage, impacting CSL's raw material costs.

High barriers to entry in plasma collection, often exceeding $10 million per center due to regulatory and logistical complexities, restrict new competition. This scarcity of alternatives empowers existing suppliers, allowing them to negotiate more favorable pricing and supply agreements with CSL, as fewer new players can challenge their market position.

The specialized nature of inputs for biotherapies, such as unique reagents or bioreactor components, means suppliers often operate in niche markets with few alternatives. This limited competition grants these specialized vendors significant leverage over CSL, enabling them to command higher prices and potentially create supply chain vulnerabilities.

| Factor | Impact on CSL | 2024 Data/Trend |

|---|---|---|

| Plasma Concentration | High supplier bargaining power due to limited sources | US remains dominant; strong demand for plasma |

| Entry Barriers | Favors existing suppliers, limiting price pressure | Capital costs >$10M per center; stringent regulations |

| Specialized Inputs | Limited competition grants suppliers pricing power | Niche reagents and equipment face few alternatives |

| Labor & Donor Costs | Directly impacts raw plasma price | Robust demand for skilled labor; donor incentives fluctuate |

What is included in the product

This analysis dissects the competitive forces impacting CSL, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

CSL's customer base for its plasma-derived therapies is largely comprised of hospitals, clinics, and broader healthcare systems. These entities often procure CSL's products through larger purchasing groups or national health bidding processes. While these significant buyers can indeed influence pricing, the critical, life-saving nature of many of CSL's specialized treatments, like immunoglobulins for rare immune disorders, substantially reduces price sensitivity and the ability for any single customer to easily switch to alternatives.

For patients and healthcare providers, switching from an established, effective biotherapy to an alternative can involve significant clinical, logistical, and administrative hurdles. This complexity inherently limits their ability to easily shift to competitors, thereby reducing their bargaining power.

Once a patient is stabilized on a particular CSL product, the risks associated with changing treatment can be high, including potential efficacy loss or adverse reactions. This clinical inertia is a powerful factor that keeps customers locked in, diminishing their leverage.

This is particularly true for chronic conditions like hemophilia or primary immunodeficiencies, which require lifelong treatment. For instance, CSL's hemophilia treatments are critical for patient well-being, making frequent or arbitrary changes unfeasible and reinforcing customer loyalty.

Government health agencies and private insurers act as significant indirect customers, wielding considerable influence over pricing and market access through their reimbursement policies and formulary decisions. These entities are increasingly prioritizing cost-effectiveness and value-based care models, which naturally translates into downward pressure on pharmaceutical prices.

CSL must adeptly navigate these intricate reimbursement frameworks to secure widespread patient access to its therapies and sustain profitability. This is particularly crucial in major markets such as the United States and Europe, where reimbursement policies significantly shape market dynamics. For instance, in 2023, the Inflation Reduction Act in the US began its process of allowing Medicare to negotiate prices for certain high-cost drugs, a trend that could impact CSL's revenue streams for eligible products.

Demand Driven by Disease Prevalence

The demand for CSL's products is significantly influenced by the growing prevalence of chronic and rare diseases, including immune deficiencies, bleeding disorders, and kidney diseases. This fundamental medical necessity translates into demand that is relatively inelastic for CSL's critical therapies, thereby reducing the bargaining power of its customers.

The increasing global burden of these health conditions guarantees a sustained need for CSL's specialized treatments.

- Growing Disease Prevalence: The World Health Organization (WHO) reported in 2024 that the global prevalence of chronic diseases continues to rise, impacting millions worldwide.

- Inelastic Demand: For essential treatments like those CSL provides, patient and healthcare provider reliance often outweighs price sensitivity, limiting customer ability to negotiate lower prices.

- Consistent Need: The long-term nature of conditions like hemophilia and primary immune deficiencies ensures a steady demand for CSL's plasma-derived therapies and recombinant products.

Competition in Specific Segments like Vaccines

In specialized markets such as influenza vaccines, where CSL Seqirus operates, the bargaining power of customers can be significant. Governments and large public health organizations often act as major purchasers, engaging in competitive bidding processes for substantial volumes. This dynamic grants them considerable leverage.

The influenza vaccine sector features a number of prominent global suppliers, offering customers a degree of choice and further amplifying their bargaining power. CSL Seqirus, therefore, faces pressure to differentiate itself not just on price, but also on crucial aspects like vaccine efficacy, the breadth of influenza strains covered, and the dependability of its supply chain to win these vital contracts.

- Customer Concentration: In the influenza vaccine market, large governmental and public health entities represent concentrated customer bases.

- Competitive Tendering: These large buyers frequently utilize competitive tendering, which inherently increases their bargaining power.

- Market Competition: The presence of multiple global players in the influenza vaccine space gives customers alternatives.

- Differentiation Factors: CSL Seqirus must compete on efficacy, strain coverage, and supply reliability to secure contracts.

CSL's customer bargaining power is generally low due to the critical, life-saving nature of its plasma-derived therapies and the high switching costs for patients and healthcare providers. While large purchasers and payers like government agencies exert some influence through reimbursement, the inelastic demand for essential treatments and the complexity of switching therapies significantly limits customer leverage. This is particularly evident for chronic conditions requiring lifelong treatment, where patient well-being dictates treatment continuity.

In the influenza vaccine market, however, customer bargaining power is more pronounced. Concentrated buyers like governments and public health organizations utilize competitive bidding, and the presence of multiple global suppliers allows for greater customer choice, necessitating CSL Seqirus to compete on factors beyond price, such as efficacy and supply reliability.

| Customer Type | Bargaining Power | Key Factors |

| Hospitals/Clinics (Plasma Therapies) | Low | Critical need, high switching costs, clinical inertia, inelastic demand. |

| Government/Insurers (Payers) | Moderate | Reimbursement policies, formulary decisions, focus on cost-effectiveness. US Medicare drug price negotiation (IRA) impacts pricing. |

| Governments/Public Health (Vaccines) | High | Customer concentration, competitive tendering, multiple suppliers, price sensitivity. |

Full Version Awaits

CSL Porter's Five Forces Analysis

This preview showcases the comprehensive CSL Porter's Five Forces Analysis, offering an in-depth examination of competitive pressures within the industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after completing your purchase, ensuring no surprises.

Rivalry Among Competitors

The plasma-derived therapies sector is a concentrated market, primarily steered by a handful of major companies such as CSL Behring, Grifols, Takeda, and Octapharma. These entities engage in fierce competition, focusing on expanding their product offerings, strengthening their worldwide distribution channels, increasing manufacturing output, and driving innovation.

Competition is particularly sharp among these established players, who vie for market share through product differentiation and operational efficiency. For instance, CSL Behring, a leader in the field, reported strong revenue growth in its plasma-derived therapies segment, underscoring the dynamic nature of this competitive landscape.

While the substantial capital needed for plasma fractionation facilities and the rigorous regulatory framework present significant hurdles for new entrants, the existing market participants operate in a highly competitive oligopoly. This intense rivalry ensures continuous pressure on pricing, product development, and market access strategies.

Competitive rivalry in the biotherapeutics sector, particularly for companies like CSL, is intensely fueled by ongoing research and development aimed at discovering and bringing to market new and enhanced treatments. CSL's commitment to R&D, evidenced by its substantial investment, is a key factor in its ability to broaden its product offerings and pioneer novel therapies.

The race to innovate is paramount, with the successful development and market introduction of new drug candidates and advanced gene therapies capable of significantly altering existing market positions. For instance, CSL's significant R&D expenditure in 2023, amounting to approximately AUD 1.1 billion, underscores the industry's reliance on pipeline innovation to secure future growth and competitive advantage.

CSL faces intense competitive rivalry as companies aggressively expand into new geographic markets. This is particularly evident in emerging economies where healthcare demand is rising. For instance, in 2024, many pharmaceutical and biotech firms announced significant investments in expanding their operations and distribution networks in Southeast Asia and parts of Africa, aiming to tap into growing patient bases.

This geographic push intensifies competition as players vie for market share by establishing a presence in these lucrative regions. Companies are actively pursuing mergers, acquisitions, and strategic partnerships to accelerate their global footprint and gain access to new patient populations, thereby heightening the rivalry among established and emerging players.

Product Differentiation and Specialization

CSL differentiates its plasma-derived products through unique features, administration methods, and robust clinical data. Its strategic focus on specialized biotherapies for rare and serious conditions provides a degree of separation from competitors. However, rivals are also actively pursuing advancements in formulation to offer superior or more convenient treatment options.

The competitive landscape in areas like hemophilia highlights this dynamic. For example, the introduction of less frequent dosing regimens by competitors directly challenges CSL's market position by offering patients greater convenience, potentially impacting CSL's market share in this segment.

- Product Features: CSL emphasizes specific attributes of its therapies, such as purity or efficacy profiles, to stand out.

- Administration Methods: Innovations in how products are delivered, like subcutaneous versus intravenous options, are key differentiators.

- Clinical Evidence: Strong clinical trial results and real-world data are crucial for validating product superiority and gaining physician trust.

Consolidation and Strategic Alliances

The biotechnology and pharmaceutical sectors are characterized by significant consolidation and the formation of strategic alliances. Companies actively pursue mergers and acquisitions (M&A) to bolster market share, acquire innovative technologies, and optimize their operational structures.

These strategic moves frequently redefine the competitive arena. For instance, Grifols' acquisition of Biotest significantly altered the landscape for plasma-derived medicines. In 2023 alone, the healthcare sector saw substantial M&A activity, with deal values reaching hundreds of billions of dollars globally, indicating a strong trend towards industry consolidation.

- Market Consolidation: Companies merge or acquire rivals to gain economies of scale and broader market access.

- Technological Advancement: Alliances are formed to share R&D costs and accelerate the development of novel therapies.

- Supply Chain Optimization: Acquisitions can streamline manufacturing and distribution networks for greater efficiency.

- Increased R&D Spending: In 2024, pharmaceutical R&D spending is projected to exceed $250 billion globally, with consolidation often fueling these investments.

The plasma-derived therapies market is dominated by a few key players, leading to intense competition. Companies like CSL Behring, Grifols, and Takeda are constantly innovating and expanding their global reach to capture market share. This rivalry is driven by significant R&D investments, with CSL alone spending around AUD 1.1 billion in 2023 to develop new treatments.

New entrants face high barriers due to the substantial capital required for plasma fractionation facilities and stringent regulatory approvals. Despite these challenges, the existing oligopoly ensures continuous pressure on pricing and product development, as companies strive to differentiate through features like advanced administration methods and robust clinical data.

Strategic alliances and mergers, such as Grifols' acquisition of Biotest, are reshaping the competitive landscape. In 2023, healthcare M&A activity reached hundreds of billions of dollars globally, underscoring the trend towards consolidation aimed at achieving economies of scale and accelerating technological advancement.

| Company | 2023 R&D Spend (Approx.) | Key Competitive Strategy |

|---|---|---|

| CSL Behring | AUD 1.1 billion | Pipeline innovation, specialized biotherapies |

| Grifols | N/A (Acquisition of Biotest) | Market consolidation, expanding plasma supply |

| Takeda | N/A | Global expansion, diverse therapeutic areas |

SSubstitutes Threaten

The most significant threat of substitution for CSL's plasma-derived therapies arises from recombinant products. These are synthetically engineered alternatives, distinct from those derived from human plasma.

While recombinant therapies can carry a higher price tag, they present compelling advantages like a more reliable and consistent supply chain, coupled with a reduced risk profile concerning the transmission of blood-borne pathogens. This makes them an attractive alternative for many patients and healthcare providers.

In the specific market of hemophilia treatment, recombinant products have seen a notable increase in adoption, directly supplanting plasma-derived therapies. This trend poses a clear and present danger to CSL's established market share in this critical therapeutic area.

Advanced therapies like gene and cell therapies are emerging as significant substitutes for certain chronic conditions currently managed with plasma-derived products. These innovative treatments aim for cures, not just symptom management, potentially altering the long-term demand for traditional therapies.

CSL is actively investing in gene therapy research, as demonstrated by its significant R&D expenditure, to remain competitive in this evolving landscape. For instance, CSL Behring's pipeline includes gene therapy candidates for hemophilia, a condition historically reliant on plasma-derived clotting factors.

For certain medical conditions, small molecule drugs or other biologics not derived from plasma can act as substitutes for CSL's products. This means patients might have alternative treatment options available.

While CSL focuses on intricate biotherapies, the pharmaceutical sector is always bringing forth new treatments. These innovations can potentially lessen the demand for specific plasma-derived therapies.

The constant drive for new drug discoveries across the entire industry presents a persistent risk of substitution. For example, in 2024, the global pharmaceutical market saw significant investment in novel drug modalities, including advanced small molecule inhibitors and gene therapies, which could impact the market share of established biologics.

Preventive Measures and Lifestyle Changes

While not a direct substitute for many of CSL's specialized therapies, advancements in preventive medicine and diagnostics represent a potential threat. For example, improved public health initiatives and widespread vaccination programs could reduce the incidence of diseases like influenza, impacting demand for CSL's influenza vaccines. In 2023, global influenza vaccine market was valued at approximately USD 10.5 billion, and a significant drop in demand due to prevention could affect revenue.

However, for many of CSL's core products, particularly those treating rare and chronic genetic disorders, readily available or effective substitutes are scarce. The complexity and specificity of these conditions mean that alternative treatments are often limited or non-existent, mitigating the threat of substitution in these critical areas.

Lifestyle interventions and early diagnostic tools can also play a role. Better public awareness and access to screenings might lead to earlier detection and management of certain conditions, potentially altering the treatment pathway. For instance, improved management of autoimmune diseases through lifestyle changes could theoretically reduce reliance on some biologic therapies, though CSL's focus on plasma-derived therapies and biologics for rare diseases remains a strong differentiator.

- Preventive Medicine: Advances in public health and diagnostics can reduce disease incidence, impacting demand for CSL's vaccines and certain therapies.

- Rare Disease Focus: For many of CSL's core products treating rare and chronic conditions, effective substitutes are limited.

- Lifestyle Interventions: Early detection and lifestyle management of some diseases could alter treatment pathways, though CSL's specialized portfolio offers resilience.

Alternative Influenza Vaccine Technologies

The threat of substitutes in the influenza vaccine market is evolving. While CSL Seqirus currently utilizes established egg-based and cell-based technologies, newer platforms are gaining traction.

mRNA-based vaccines, for instance, present a significant potential substitute. These technologies offer advantages like faster development cycles and increased flexibility in vaccine formulation, which could challenge traditional methods. For example, by mid-2024, several companies were advancing mRNA influenza vaccine candidates through clinical trials, signaling a shift in production capabilities and potential market disruption.

These emerging technologies could offer improved speed to market and potentially broader or more adaptable protection against circulating influenza strains. This represents a growing substitution threat, as these platforms may eventually offer a more efficient or effective alternative to current vaccine offerings.

- Emerging mRNA Platforms: mRNA technology offers faster development and manufacturing compared to traditional methods.

- Flexibility and Speed: New vaccine technologies can adapt more quickly to changing influenza strains.

- Potential for Broader Protection: Some novel platforms aim to provide more comprehensive immunity against multiple influenza subtypes.

The threat of substitutes for CSL's plasma-derived therapies is multifaceted, with recombinant products posing a significant challenge, particularly in areas like hemophilia treatment where they offer consistent supply and reduced pathogen risk. Emerging gene and cell therapies also represent a long-term substitution threat, aiming for cures rather than symptom management.

While CSL is investing in these advanced therapies, other biologics and small molecule drugs can also serve as alternatives for certain conditions, highlighting the industry's continuous innovation. Furthermore, advancements in preventive medicine and diagnostics, although not direct substitutes for many rare disease treatments, could indirectly impact demand for CSL's products like influenza vaccines.

The influenza vaccine market, specifically, faces disruption from newer platforms like mRNA-based vaccines, which offer faster development and greater flexibility. By mid-2024, several companies were advancing mRNA influenza vaccine candidates, indicating a potential shift in production and market dynamics that could challenge CSL Seqirus's established technologies.

| Substitute Type | Key Advantages | Impact on CSL (Examples) | Market Trend (2024 Data) |

|---|---|---|---|

| Recombinant Products | Consistent supply, reduced pathogen risk | Supplanting plasma-derived therapies in hemophilia | Growing adoption in specialized therapeutic areas |

| Gene/Cell Therapies | Curative potential | CSL investing in pipeline candidates for hemophilia | Significant R&D focus across the industry |

| mRNA Vaccines | Faster development, flexibility | Potential challenge to traditional influenza vaccine platforms | Advancing clinical trials for influenza vaccines |

Entrants Threaten

The biotechnology and biopharmaceutical sectors, especially those focused on plasma fractionation and intricate biologics, demand substantial capital for research, development, extensive clinical trials, and state-of-the-art manufacturing. For instance, the average cost to bring a new drug to market in 2023 approached $2.6 billion, a figure that presents a significant hurdle.

This immense financial outlay acts as a powerful deterrent, effectively blocking most aspiring startups from entering the market. The sheer scale of investment needed to navigate regulatory pathways and establish production capabilities creates a formidable barrier to entry.

CSL, a leader in biotherapeutics, faces a significant threat from new entrants due to stringent regulatory hurdles. For instance, the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose exceptionally rigorous and time-consuming approval processes, particularly for innovative treatments like CSL's plasma-derived therapies and gene therapies.

These processes involve extensive clinical trials, comprehensive safety evaluations, and ongoing post-market surveillance, demanding substantial investment in both time and capital. This regulatory complexity, coupled with lengthy approval timelines, acts as a formidable barrier, effectively deterring many potential new competitors from entering the biopharmaceutical market.

CSL's robust intellectual property, including a vast patent portfolio covering manufacturing processes and therapeutic applications, acts as a significant barrier. For instance, in 2024, CSL continued to defend its intellectual property, as seen in ongoing patent litigation related to its plasma-derived therapies, which underscore the legal hurdles new entrants face.

Need for Specialized Expertise and Infrastructure

The significant need for specialized expertise and infrastructure acts as a substantial barrier to entry for new players in the biopharmaceutical sector. Developing, manufacturing, and distributing complex biotherapies and vaccines demand deep scientific, medical, and manufacturing knowledge, alongside a robust global supply chain and distribution network. For instance, the intricate processes involved in biologics manufacturing, such as cell culture and purification, require highly trained personnel and specialized facilities that are costly and time-consuming to establish.

Building these capabilities from the ground up presents a monumental challenge for any aspiring company. The pharmaceutical industry is also grappling with a talent shortage, particularly in critical STEM and digital roles, which further complicates the ability of new entrants to acquire the necessary human capital. In 2024, reports indicated a persistent gap in skilled professionals, especially those with experience in advanced bioprocessing and regulatory affairs, making it harder for newcomers to assemble competent teams.

- High Capital Investment: Establishing state-of-the-art manufacturing facilities for biologics can cost hundreds of millions to billions of dollars.

- Specialized Workforce Requirements: Accessing and retaining talent with expertise in areas like molecular biology, process engineering, and quality assurance is difficult and expensive.

- Regulatory Hurdles: Navigating complex and stringent regulatory pathways for drug approval requires significant expertise and resources, which new entrants may lack.

- Intellectual Property Landscape: A dense patent landscape in biopharmaceuticals can make it challenging for new companies to operate without infringing on existing intellectual property.

Brand Reputation and Established Relationships

CSL's formidable brand reputation, cultivated over decades, acts as a significant barrier to new entrants. This strong standing, particularly within the highly regulated and trust-dependent biotechnology sector, translates into deep-seated loyalty among healthcare providers and patients alike.

Established, long-standing relationships with key stakeholders, including hospitals, clinics, and physicians, further solidify CSL's market position. These entrenched connections are difficult and time-consuming for newcomers to replicate, requiring substantial investment in trust-building and network development.

For example, in 2024, CSL continued to leverage its established reputation in plasma-derived therapies, a market where patient confidence is paramount. New companies entering this space would need to demonstrate not only scientific efficacy but also an equivalent level of patient safety and ethical practice, a hurdle that takes years to clear.

- Brand Strength: CSL's global recognition and positive perception in the biotech industry deter new competitors.

- Provider Relationships: Existing ties with healthcare systems and medical professionals create a loyalty moat.

- Patient Trust: Decades of reliable product delivery have fostered significant patient confidence, a critical asset.

- Market Entry Cost: Replicating CSL's established credibility and relationships requires substantial time and resources for new entrants.

The threat of new entrants for CSL is generally low to moderate, primarily due to the substantial barriers to entry in the biopharmaceutical industry. High capital requirements for research, development, and manufacturing, estimated to be in the billions for a single drug, act as a significant deterrent. Furthermore, navigating stringent regulatory landscapes, like those enforced by the FDA and EMA, demands extensive expertise and resources, which new companies often lack. CSL's strong intellectual property portfolio and established brand reputation, built on decades of trust and provider relationships, also present formidable challenges for potential newcomers.

| Barrier to Entry | Impact on New Entrants | CSL's Advantage |

|---|---|---|

| Capital Investment | Extremely High (e.g., $2.6 billion avg. drug development cost in 2023) | Established financial resources and access to capital markets |

| Regulatory Hurdles | Complex, time-consuming, and costly approval processes | Extensive experience and dedicated regulatory affairs teams |

| Intellectual Property | Risk of patent infringement, costly litigation | Vast patent portfolio protecting core technologies and products |

| Specialized Expertise & Infrastructure | Need for highly skilled workforce and advanced facilities | Existing specialized workforce and global manufacturing network |

| Brand Reputation & Relationships | Difficulty in building trust and securing market access | Decades of established patient and healthcare provider trust |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of publicly available company filings, reputable industry research reports, and macroeconomic data from established financial databases. This comprehensive approach ensures a thorough understanding of competitive dynamics.