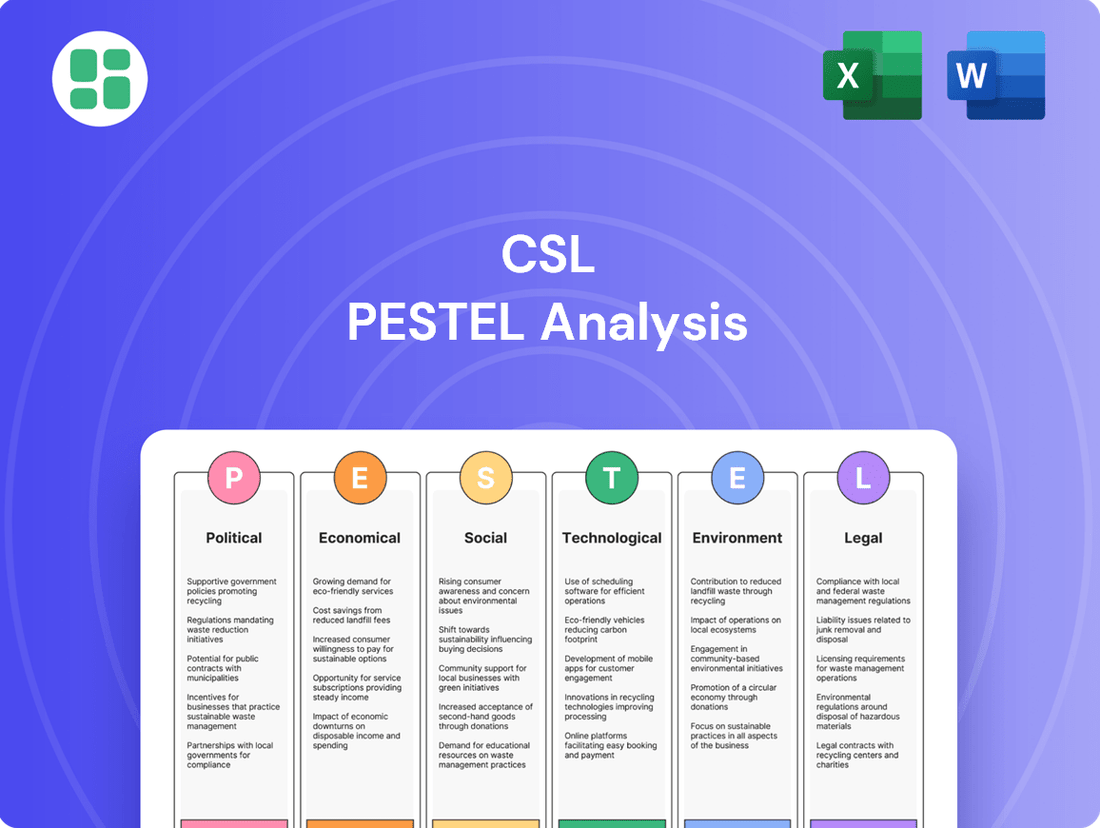

CSL PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSL Bundle

Uncover the critical external factors shaping CSL's future with our comprehensive PESTLE analysis. From evolving regulations to technological advancements, understand the forces driving change in the biopharmaceutical landscape. Gain a strategic advantage by downloading the full report and arming yourself with actionable intelligence.

Political factors

Government healthcare policies, like the Inflation Reduction Act (IRA) in the U.S., which permits Medicare to negotiate drug prices, introduce significant uncertainty for companies such as CSL. This regulatory shift can directly impact investment decisions within the biopharmaceutical sector by altering future revenue streams and profitability. For instance, the IRA's provisions are projected to affect the U.S. pharmaceutical market by potentially reducing the prices of certain high-cost drugs, a factor CSL must strategically account for in its long-term planning.

These policies, while designed to lower patient costs, compel companies like CSL to undertake strategic adjustments to their business models and R&D investment strategies. The anticipation of upcoming policy announcements concerning drug pricing further heightens the need for proactive industry responses and adaptive investment approaches. The biopharmaceutical industry is closely monitoring these developments, as they could reshape market dynamics and the overall investment landscape for the foreseeable future.

Regulatory frameworks governing the biotechnology and pharmaceutical sectors are in constant flux globally, impacting everything from initial clinical trials to final market approval. In 2024 and looking ahead to 2025, significant attention is being paid to how evolving regulations in key markets such as the United States, the European Union, the United Kingdom, and various Asian nations will shape drug development pipelines and market access strategies.

Changes in the U.S. Food and Drug Administration (FDA) regulations, particularly those that might be influenced by shifts in political administrations, could pave the way for faster approval pathways for novel treatments. However, maintaining a delicate balance between expediting innovation and ensuring the rigorous safety and efficacy standards that protect public health remains a paramount challenge for regulators and companies alike.

CSL, a major player in the industry, consistently engages in numerous regulatory inspections across its global manufacturing sites and plasma collection facilities. This ongoing scrutiny underscores the critical importance of maintaining stringent compliance with an ever-changing regulatory landscape throughout 2024 and into 2025.

Global trade policies, including shifts away from multilateralism towards more protectionist stances like the 'America First' agenda, can significantly influence pharmaceutical manufacturing. This could mean incentives for domestic production, but also potentially higher import costs and increased trade tensions, impacting companies like CSL which operate globally.

Geopolitical instability was a major concern for the biopharma sector in 2025, affecting global markets and company operations. Companies need to be adaptable to navigate these risks, which can disrupt supply chains and market access for essential medicines.

CSL, with its extensive international supply chains and operations across numerous countries, is particularly sensitive to these evolving trade dynamics and political shifts. For instance, disruptions in key manufacturing regions or changes in import/export regulations could directly impact CSL's operational efficiency and profitability.

Government Support for R&D and Innovation

Government initiatives and funding for research and development remain a cornerstone for progress in biotechnology. Policies that cultivate a supportive, innovation-centric business climate can significantly boost capital raises and industry optimism. This governmental backing is instrumental for CSL’s sustained investment in its extensive R&D pipeline, spanning diverse therapeutic areas.

In 2024, governments globally continued to allocate substantial resources to biotech R&D. For instance, the United States' National Institutes of Health (NIH) budget for fiscal year 2024 included over $47 billion dedicated to biomedical research, much of which directly or indirectly benefits companies like CSL. Similarly, the European Union’s Horizon Europe program earmarks billions for scientific research and innovation, with a significant portion directed towards health and life sciences.

- Government Funding: Continued high levels of government funding for biomedical research, such as the NIH budget in the US, directly support the ecosystem CSL operates within.

- Policy Environment: Favorable regulatory environments and tax incentives for R&D, as seen in various developed nations, encourage private sector investment and innovation.

- Innovation Hubs: Government support for establishing and maintaining innovation hubs and life science clusters fosters collaboration and accelerates scientific discovery, benefiting CSL's research efforts.

Public Health Initiatives and Vaccine Programs

Government-backed immunization programs are a significant driver for CSL Seqirus, particularly in the influenza vaccine market. These public health initiatives, often supported by substantial government funding, create a predictable demand stream. For instance, in the US, the CDC's Advisory Committee on Immunization Practices (ACIP) provides recommendations that strongly influence vaccine uptake, directly benefiting companies like CSL.

Public health campaigns aimed at increasing vaccination rates are crucial for market growth. These efforts not only raise awareness but also encourage broader participation in immunization, thereby expanding the customer base for CSL's vaccine products. The emphasis on preventative healthcare by governments globally underpins the stability and expansion of CSL's vaccine portfolio.

Government support for vaccine accessibility, including subsidies and procurement contracts, is vital. These policies ensure that essential vaccines reach a wider population, fostering a healthier society and a robust market for CSL. The sustained investment in public health infrastructure by governments solidifies the long-term demand for CSL's life-saving therapies.

- Government procurement of influenza vaccines for national immunization programs directly supports CSL Seqirus's revenue.

- Public health campaigns, such as those promoting annual flu shots, increase the overall market size for influenza vaccines.

- Regulatory support for vaccine development and approval processes, often expedited for public health emergencies, benefits CSL's innovation pipeline.

Government policies, particularly those impacting drug pricing and R&D incentives, are critical for CSL. The Inflation Reduction Act in the U.S., allowing Medicare to negotiate drug prices, introduces revenue uncertainty. Globally, regulatory shifts in the U.S., EU, and UK are shaping drug development and market access, with potential for faster approvals balanced against safety standards.

What is included in the product

This CSL PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable overview of external factors, simplifying complex market dynamics for strategic decision-making.

Economic factors

The global healthcare sector is a significant economic driver, with continued robust growth projected. The biotechnology market alone is anticipated to reach USD 546.0 billion by 2025, expanding at a compound annual growth rate of roughly 13.0%. This upward trend underscores a strong economic environment for companies operating within advanced healthcare solutions.

Within this broader landscape, the plasma-derived therapy market, a critical segment for CSL, is also poised for substantial expansion. Forecasts indicate this market will reach approximately USD 23.39 billion in 2025. Such favorable market dynamics in both the overall healthcare expenditure and specialized therapy areas create a positive economic foundation for CSL's operations and strategic initiatives.

Inflationary pressures are a significant concern for CSL, directly impacting manufacturing costs and the overall supply chain. For instance, rising energy and raw material prices in 2024 and early 2025 could squeeze margins if not effectively passed on or offset by efficiencies.

CSL's strategic focus on operational efficiencies and cost synergies, exemplified by the integration of CSL Vifor, is vital for navigating these economic headwinds. Achieving these synergies helps to mitigate the impact of escalating input costs and protects the company's profitability.

The company's commitment to streamlined operations and reduced overheads is a key strategy for margin protection. This focus allows CSL to absorb some of the inflationary pressures without significantly compromising its financial performance in the current economic climate.

As a global biotechnology company, CSL's financial results are significantly influenced by currency exchange rate fluctuations. For instance, during the first half of fiscal year 2024, CSL reported that unfavorable currency movements had a negative impact on its net profit.

The company actively manages its exposure to foreign exchange risk through various hedging strategies. These strategies are designed to mitigate the potential negative effects of significant movements in major currencies like the US dollar, Euro, and Japanese Yen on CSL's reported revenues and costs.

Access to Capital and Investment Trends

Access to capital is a critical driver for CSL's growth, directly impacting its capacity for research and development as well as strategic expansions. The biotech and broader biopharmaceutical sectors experienced a more subdued investment climate throughout much of 2024, marked by increased caution from investors.

However, there's a growing sense of optimism for a potential rebound in investment activity as 2025 unfolds. Analysts predict a surge in mergers and acquisitions (M&A) and venture capital funding, which could create significant opportunities for companies like CSL to acquire innovative technologies or expand its market reach. This increased M&A could also heighten competitive pressures as larger players seek to consolidate their positions.

Key investment trends to watch for CSL include:

- Increased VC funding in gene and cell therapies: This area continues to attract significant investor interest, aligning with CSL's focus on advanced therapies.

- Resurgence of IPOs in the biopharma space: A more favorable market could see more biotech companies going public, potentially increasing the pool of available capital and competitive landscape.

- Strategic partnerships and collaborations: Companies are increasingly looking to partner to share R&D costs and risks, a trend CSL can leverage for capital efficiency.

- Growth in private equity investment: Private equity firms are showing renewed interest in the healthcare sector, offering alternative capital sources for growth and acquisitions.

Competition and Pricing Pressure

The plasma-derived therapy sector is highly competitive, with established giants like CSL Behring, Grifols, and Takeda vying for market dominance. This intense rivalry often translates into significant pricing pressure, forcing companies to constantly optimize operations and demonstrate value. For instance, CSL Behring, a key player, reported strong revenue growth in its plasma segment, underscoring the demand but also the competitive landscape it navigates.

Similarly, the global influenza vaccine market is characterized by fierce competition. Leading companies, including Sanofi, CSL Limited, and GSK plc, are all actively developing and marketing their products. CSL Limited, through its Seqirus division, is a major influenza vaccine supplier, facing the need for continuous innovation to stand out. The market's dynamics necessitate ongoing investment in research and development to maintain market share and pricing power.

- Market Saturation: Major firms in plasma-derived therapies and influenza vaccines intensify competition.

- Pricing Pressure: Intense rivalry limits pricing flexibility for companies like CSL Behring and its peers.

- Innovation Imperative: Companies must differentiate products through R&D to secure market share.

- Key Players: CSL Behring, Grifols, Takeda (plasma), and Sanofi, CSL Limited, GSK plc (vaccines) are prominent competitors.

Economic factors significantly shape CSL's operational environment, with the global healthcare sector exhibiting robust growth. The biotechnology market is projected to reach USD 546.0 billion by 2025, growing at a CAGR of approximately 13.0%, while the plasma-derived therapy market is expected to hit USD 23.39 billion in 2025. These trends indicate a strong economic foundation for CSL's specialized therapies.

Inflationary pressures, particularly concerning energy and raw materials in 2024-2025, pose a direct threat to CSL's margins, necessitating a focus on operational efficiencies and cost synergies, such as those from CSL Vifor integration, to mitigate rising input costs.

Currency exchange rate fluctuations, as seen with a negative impact on net profit in H1 FY24, require active management through hedging strategies to protect revenues and costs against movements in major currencies. Meanwhile, the investment climate in biotech saw increased caution in 2024, though a rebound in M&A and VC funding is anticipated for 2025, presenting both opportunities and heightened competitive pressures.

The competitive landscape for CSL is intense, particularly in plasma-derived therapies and influenza vaccines, with key players like CSL Behring, Grifols, Takeda, Sanofi, and GSK plc driving pricing pressure and demanding continuous innovation.

Same Document Delivered

CSL PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CSL PESTLE analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this professionally structured report upon completing your purchase.

Sociological factors

The world's population is getting older, with projections indicating that by 2050, nearly 17% of the global population will be over 65. This demographic trend directly fuels the demand for CSL's plasma-derived therapies and other specialized treatments, as aging is often associated with a higher prevalence of chronic and autoimmune disorders. For instance, conditions like immune deficiencies and bleeding disorders, which CSL specializes in, require ongoing, long-term care, creating a steadily expanding patient base.

This increasing need for specialized medical interventions aligns perfectly with CSL's core business. The company's commitment to developing and providing life-saving medicines for serious and often chronic conditions positions it favorably to address the evolving healthcare demands presented by this aging global demographic. CSL's product portfolio, including treatments for hemophilia and primary immune deficiencies, directly addresses the growing patient populations affected by these conditions.

Public awareness and acceptance of vaccines are paramount for the influenza vaccine market, a sector where CSL Seqirus holds significant influence. While general awareness has increased, vaccine hesitancy remains a persistent challenge, necessitating continuous public health education and clear communication strategies.

CSL's established reputation and the trust it has cultivated with patients and communities are therefore crucial assets in navigating these perceptions. For instance, in 2023, the Centers for Disease Control and Prevention (CDC) reported that while influenza vaccination coverage in the US reached approximately 47% for the 2022-2023 season, efforts to further increase this remain a key focus for public health organizations and vaccine manufacturers like CSL.

Growing health consciousness is a significant driver for CSL's vaccine business, particularly its influenza vaccines. In 2024, global health organizations continued to emphasize the critical role of vaccination in preventing widespread outbreaks, a trend CSL actively supports. This heightened awareness directly translates into increased demand for CSL's preventative health solutions.

Shifting lifestyle patterns, including increased sedentary behavior and dietary changes, are contributing to a rise in chronic diseases. This societal trend bolsters the market for CSL's therapeutic products designed to manage conditions like cardiovascular disease and diabetes. For instance, the global diabetes drug market alone was projected to reach over $200 billion by 2025, highlighting the scale of this opportunity.

CSL's core mission to protect public health aligns perfectly with these evolving societal health trends. The company's focus on developing innovative treatments and preventative measures directly addresses the growing burden of both infectious and chronic diseases worldwide, reinforcing its strategic importance.

Labor Market Trends and Skilled Workforce Availability

The biotechnology and pharmaceutical sectors, including CSL, continue to grapple with the availability of highly skilled scientific, medical, and manufacturing professionals. This persistent challenge directly impacts innovation pipelines and production capacity.

CSL's success hinges on its capacity to attract and retain top-tier talent, essential for driving its research and development initiatives and maintaining robust operational functions. A strong talent pool is a competitive differentiator.

CSL's efforts in cultivating a supportive and engaging work environment have been recognized, contributing to its ability to secure and keep skilled employees. For instance, in 2024, CSL was named by Forbes as one of America's Best Employers for the fifth consecutive year, highlighting its commitment to its workforce.

- Skilled Labor Shortage: Ongoing demand for specialized roles in biotech and pharma.

- Talent Acquisition: CSL's strategic focus on attracting and retaining scientific and manufacturing expertise.

- Employer Branding: Recognition as a top employer reinforces CSL's appeal to potential hires.

- Workforce Development: Investment in training and development programs to upskill existing employees.

Ethical Considerations in Plasma Donation

CSL's reliance on plasma-derived therapies means ethical sourcing is paramount. Societal views on donor compensation and the safety of the donation process directly impact CSL's ability to secure a consistent plasma supply. For instance, in 2024, discussions around fair donor compensation continue, aiming to balance the need for supply with ethical treatment, as CSL operates numerous collection centers globally.

Maintaining public trust is crucial for CSL's business model. Negative perceptions regarding plasma collection practices could deter donors, jeopardizing the supply chain. CSL's commitment to rigorous safety protocols and transparent operations helps build this trust, essential for their continued success in providing life-saving therapies.

- Donor Compensation: Balancing fair payment for donors with the sustainability of the plasma supply is an ongoing ethical debate in 2024.

- Safety Protocols: CSL invests heavily in ensuring the safety of both donors and the plasma collected, a key societal expectation.

- Public Perception: Positive public perception of plasma donation directly correlates with the availability of plasma for CSL's therapies.

Societal attitudes towards health and wellness continue to evolve, with a growing emphasis on preventative care and personalized medicine. This trend benefits CSL as consumers increasingly seek proactive health solutions, driving demand for its vaccine and plasma-derived therapies. For example, the global health and wellness market was projected to reach over $5.6 trillion in 2024, underscoring the significant consumer interest in maintaining well-being.

Public perception of biotechnology and pharmaceutical companies plays a crucial role in CSL's operations, particularly concerning ethical practices and product safety. Maintaining transparency and fostering trust are essential to ensure continued support for research, development, and product acceptance. In 2024, CSL continued to highlight its commitment to patient safety and ethical sourcing of plasma, a key factor in public confidence.

The increasing prevalence of chronic diseases, often linked to lifestyle factors like diet and activity levels, presents a substantial market opportunity for CSL. As global populations face rising rates of conditions such as diabetes and autoimmune disorders, the demand for CSL's specialized treatments is expected to grow. The World Health Organization reported in 2023 that non-communicable diseases account for 70% of all deaths globally, a statistic that directly informs the market potential for CSL's therapeutic offerings.

Technological factors

Technological leaps in biomanufacturing, particularly in plasma separation and fractionation, are significantly boosting the yield and efficiency of plasma-derived therapies. These advancements mean more of the valuable proteins are recovered, leading to better product output. CSL has made strategic investments, completing base fractionation capacity at its major manufacturing hubs, underscoring its commitment to these cutting-edge production methods.

The integration of new automation and digital technologies is further refining the plasma-derived therapeutics sector. This push towards digitalization enhances precision and adaptability in manufacturing processes. For instance, CSL's ongoing investments in advanced manufacturing capabilities, including those in plasma fractionation, are designed to meet growing global demand for its life-saving therapies, with a focus on operational excellence and product quality.

Technological advancements in gene and cell therapy are profoundly reshaping healthcare. Innovations like CRISPR-Cas9 gene editing and sophisticated delivery mechanisms are accelerating the development of novel treatments. This rapid evolution presents significant opportunities for companies like CSL.

CSL is already a participant in this burgeoning field, notably with its approved gene therapy, HEMGENIX®, for hemophilia B. The company’s ongoing investment in research and development focuses on creating precise and long-lasting gene delivery technologies, positioning it to capitalize on future breakthroughs.

The global gene therapy market was valued at approximately $10.1 billion in 2023 and is projected to grow substantially, with some forecasts expecting it to reach over $30 billion by 2030, reflecting a compound annual growth rate of over 15%. CSL’s strategic exploration of various gene therapy avenues underscores its commitment to leveraging these transformative technologies.

Artificial intelligence and machine learning are revolutionizing CSL's research and development. These technologies are speeding up drug discovery, refining clinical trial plans, and improving biomanufacturing. CSL is actively investing in automation and AI to empower its scientific teams, aiming to deliver innovative therapies to patients more efficiently and affordably.

CSL's commitment to data science and analytics is evident in its ongoing support for life and data scientists. By integrating AI and advanced analytics, CSL seeks to streamline R&D processes, reduce costs, and accelerate the timeline for bringing new treatments to market. This strategic focus on digitalization is crucial for maintaining a competitive edge in the rapidly evolving biopharmaceutical landscape.

Development of New Vaccine Technologies (e.g., mRNA)

Advancements in vaccine technology, particularly mRNA, are revolutionizing how we approach immunization. These new platforms offer the potential for enhanced immunogenicity and significantly reduced development timelines compared to traditional methods. CSL is actively investing in this space, developing novel seasonal COVID-19 booster vaccines utilizing self-amplifying mRNA platforms, underscoring their commitment to pioneering vaccine innovation.

This technological leap promises more effective annual vaccines, precisely tailored to combat evolving virus strains. For instance, the agility of mRNA technology allows for rapid adaptation to new variants, a critical advantage in managing ongoing public health challenges.

- mRNA technology allows for faster vaccine development cycles, potentially reducing time-to-market by months.

- CSL's investment in self-amplifying mRNA platforms aims to create more potent and durable immune responses.

- The adaptability of these platforms is crucial for developing next-generation vaccines against rapidly mutating pathogens.

Precision Medicine and Personalized Therapies

Precision medicine, tailoring treatments to individual genetic profiles, is significantly enhancing therapeutic efficacy and minimizing adverse effects in the biotechnology sector. This trend directly supports CSL's strategic direction in developing innovative biotherapies for specific, often rare, conditions, aligning perfectly with the growing demand for highly individualized patient care.

The rapid advancements in genetic profiling and biomarker research are the driving forces behind this medical revolution, presenting substantial growth opportunities for companies like CSL. For instance, the global precision medicine market was valued at approximately $55.9 billion in 2023 and is projected to reach $142.7 billion by 2030, demonstrating a compound annual growth rate (CAGR) of 14.4% during this period.

- Market Growth: The precision medicine market is expanding rapidly, indicating strong investor interest and patient adoption.

- Biomarker Discovery: Continued investment in biomarker research is crucial for identifying patient populations that will benefit most from targeted therapies.

- Personalized Therapies: CSL's portfolio, which includes treatments for rare diseases, is well-positioned to capitalize on the increasing demand for personalized medical solutions.

Technological advancements continue to reshape CSL's operational landscape, particularly in biomanufacturing and R&D. Innovations in plasma fractionation are enhancing yield, while digitalization and AI are streamlining processes and accelerating drug discovery. CSL's strategic investments in these areas, including gene and cell therapies and mRNA vaccine platforms, position it to capitalize on future growth opportunities in precision medicine.

| Technology Area | Key Advancements | CSL's Engagement/Impact | Market Data (2023/2024 Estimates) |

| Biomanufacturing & Plasma Fractionation | Increased yield, efficiency, automation | Capacity expansion, focus on operational excellence | Plasma-derived therapies market growing steadily |

| Gene & Cell Therapy | CRISPR, advanced delivery mechanisms | HEMGENIX® approval, R&D in gene delivery | Global gene therapy market ~$10.1 billion (2023), projected to exceed $30 billion by 2030 |

| Vaccine Technology (mRNA) | Faster development, enhanced immunogenicity | Investment in self-amplifying mRNA, COVID-19 boosters | mRNA vaccine market expanding rapidly |

| AI & Machine Learning | Drug discovery acceleration, clinical trial optimization | Investment in automation and AI for R&D | AI in healthcare market significant growth |

| Precision Medicine | Genetic profiling, biomarker research | Focus on rare disease treatments, personalized care | Precision medicine market ~$55.9 billion (2023), projected to reach $142.7 billion by 2030 (CAGR 14.4%) |

Legal factors

The drug approval process is a dynamic area, with regulatory bodies like the U.S. Food and Drug Administration (FDA) and Health Canada continuously refining their requirements. CSL's ability to successfully bring new biotherapies to market hinges on its adeptness in navigating these evolving pathways, which often demand increasingly comprehensive data sets. For instance, in 2024, the FDA continued to emphasize real-world evidence in its decision-making for drug approvals, a trend expected to intensify.

CSL must remain vigilant in adhering to stringent clinical trial protocols and post-market surveillance guidelines. Failure to comply with these evolving standards can lead to significant delays or even outright rejection of product applications. The financial implications of these regulatory hurdles are substantial; a single delayed approval can cost millions in lost revenue and increased development expenses.

Protecting its intellectual property, particularly patents for innovative biotherapies and recombinant products, is a cornerstone of CSL's competitive edge. These legal protections are vital for CSL to recover its substantial research and development expenditures and secure market exclusivity for its groundbreaking treatments.

The company's ongoing commitment to R&D, which fuels a diverse innovation pipeline, is intrinsically linked to the strength and breadth of its intellectual property portfolio. For instance, CSL's significant R&D investment, which reached approximately $1.2 billion in fiscal year 2023, underscores the critical role of patent protection in safeguarding these investments.

CSL, like all biopharmaceutical companies, must navigate a complex web of data privacy regulations. The General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States are paramount, governing how patient data is collected, stored, and used. As CSL increasingly leverages real-world evidence (RWE) and digital health tools in its research and development, adherence to these stringent standards becomes even more critical.

Regulatory bodies worldwide are intensifying their focus on data security for digital health technologies. This means CSL must ensure robust safeguards are in place to protect sensitive patient information gathered through these platforms, particularly in clinical trials. Failure to comply can result in significant fines and reputational damage, impacting CSL's ability to conduct vital research.

The evolving landscape of privacy laws directly impacts CSL's operational framework. The company's extensive work with patient data, from clinical trial recruitment to post-market surveillance, demands continuous vigilance and investment in compliance measures. CSL's commitment to patient safety and data integrity underpins its strategy in this legally sensitive area.

Antitrust and Competition Laws

Antitrust and competition laws are significant legal factors for CSL, particularly within the pharmaceutical sector. These regulations govern mergers, acquisitions, and any moves towards market consolidation, ensuring fair competition. While the pharmaceutical industry anticipates robust M&A activity in 2024 and 2025, heightened regulatory scrutiny from bodies like the FTC in the US and the European Commission can impede specific transactions. This can directly impact CSL's strategic growth opportunities and its ability to expand its market presence through acquisitions. For instance, in 2023, the FTC continued its focus on pharmaceutical deals, reviewing numerous proposed mergers to assess potential impacts on drug pricing and patient access.

CSL's market position and future expansion plans are therefore constantly evaluated within the framework of these evolving legal boundaries. The company must navigate these complexities to pursue strategic objectives while remaining compliant.

- Regulatory Scrutiny: Increased focus on pharmaceutical mergers by antitrust authorities in major markets like the US and EU.

- M&A Impact: Potential for regulatory hurdles to block or delay CSL's acquisition strategies, affecting growth.

- Market Consolidation: Laws aim to prevent anti-competitive practices that could arise from significant market consolidation.

- Compliance Costs: Investment in legal and compliance resources to navigate complex antitrust regulations.

Product Liability and Patient Safety Regulations

CSL operates under stringent product liability laws and patient safety regulations, critical for its plasma-derived therapies and vaccines. Regulatory bodies, like the FDA and EMA, are increasingly emphasizing robust pharmacovigilance systems to track drug safety and efficacy after market release. For instance, in 2024, the FDA continued to refine its post-market surveillance programs, requiring more detailed adverse event reporting from manufacturers.

CSL's dedication to patient safety is a core tenet, woven into every stage of its product lifecycle, from research and development to manufacturing and post-market monitoring. This commitment is essential for maintaining trust and ensuring the well-being of individuals relying on their innovative treatments. The company's significant investment in quality control and safety testing reflects this priority, contributing to its reputation in the biopharmaceutical sector.

- Product Liability: CSL faces potential legal challenges under strict liability doctrines if its products cause harm, necessitating rigorous quality assurance.

- Patient Safety Regulations: Compliance with evolving global patient safety standards, including those for blood products and vaccines, is non-negotiable.

- Pharmacovigilance: Enhanced systems for monitoring and reporting adverse events post-approval are a key regulatory demand, with significant data collection and analysis required.

- CSL's Commitment: Integrating patient safety into R&D and manufacturing is fundamental to CSL's operational strategy and long-term viability.

The legal framework surrounding CSL's operations is multifaceted, encompassing drug approvals, intellectual property, data privacy, antitrust, and product liability. Navigating these complex regulations is crucial for market access and sustained growth. For instance, the increasing emphasis on real-world evidence by regulatory bodies like the FDA in 2024 necessitates robust data collection and analysis capabilities.

CSL's significant investment in research and development, approximately $1.2 billion in fiscal year 2023, highlights the critical importance of strong patent protection to safeguard its innovations and recoup development costs. Simultaneously, adherence to stringent data privacy laws such as GDPR and HIPAA is paramount, especially as the company increasingly utilizes digital health tools and patient data.

Antitrust laws play a significant role, with heightened scrutiny on pharmaceutical mergers in 2024 and 2025 potentially impacting CSL's strategic growth through acquisitions. Furthermore, strict product liability and patient safety regulations, coupled with evolving pharmacovigilance requirements, demand continuous vigilance and investment in quality assurance to maintain patient trust and regulatory compliance.

Environmental factors

CSL is actively enhancing its sustainability approach to shrink its environmental impact across its worldwide operations and supply chain. Key initiatives focus on minimizing waste from start to finish by reducing, recycling, and composting, aiming to divert more than 90% of manufacturing waste from landfills by 2025.

The company is prioritizing energy efficiency and optimizing resource use within its biomanufacturing processes. For example, in fiscal year 2023, CSL reported a 5% improvement in energy intensity across its manufacturing sites compared to the previous year, demonstrating progress towards its environmental goals.

CSL is actively pursuing climate action, with ambitious targets to cut its environmental impact. The company has pledged to reduce its absolute Scope 1 and Scope 2 emissions by 40% by 2030, referencing a 2019-2021 baseline period.

This commitment translates into tangible progress, such as lowering greenhouse gas emissions stemming from its worldwide vehicle fleet and investing in more sustainable fuel options.

CSL's biotechnology operations inherently produce biological waste, necessitating stringent management protocols. In 2024, the global hazardous waste management market was valued at approximately USD 50 billion, with biological waste being a significant component, underscoring the scale of regulatory oversight and industry practice.

Compliance with environmental regulations for hazardous waste disposal is paramount for CSL's continued operations and its commitment to environmental stewardship. Failure to adhere to these standards can result in substantial fines and operational disruptions, impacting the company's financial performance and reputation.

Minimizing waste generation and implementing robust disposal methods are integral to CSL's sustainability strategy. For instance, advancements in waste treatment technologies, such as autoclaving and chemical inactivation, are continually being explored to reduce the environmental footprint associated with biological waste handling.

Ethical Sourcing of Raw Materials, Including Plasma

CSL's reliance on human plasma for its life-saving therapies places ethical sourcing at the forefront of its environmental and social responsibilities. Ensuring the responsible and transparent collection of plasma is paramount for maintaining public trust and CSL's commitment to sustainability. The company's operational continuity is directly tied to a consistent and ethically sourced plasma supply.

In 2023, CSL collected over 10 million liters of plasma, underscoring the scale of its sourcing operations. The company actively works with plasma donation centers globally to uphold rigorous ethical standards, including donor welfare and fair compensation. These practices are crucial for building and maintaining a reliable supply chain while adhering to evolving ethical expectations.

- Donor Welfare: CSL prioritizes the health and safety of plasma donors, implementing strict screening protocols and ensuring donors are compensated fairly for their contribution.

- Transparency: The company aims for transparency in its sourcing practices, providing information about its donation centers and the ethical guidelines they follow.

- Supply Chain Integrity: Maintaining the integrity of the plasma supply chain is critical to preventing fraud and ensuring the quality and safety of its therapeutic products.

- Regulatory Compliance: CSL adheres to stringent regulations in all regions where it operates, ensuring that plasma collection meets or exceeds all legal and ethical requirements.

Environmental Regulations and Reporting Requirements

CSL navigates an increasingly complex web of environmental regulations and reporting mandates across its global operations. The company actively aligns its comprehensive sustainability data with prominent global frameworks, including the Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI), and the United Nations Sustainable Development Goals (SDGs). This proactive approach to environmental disclosure underscores CSL's dedication to operational accountability and transparency.

CSL's commitment to robust environmental reporting is evidenced by its detailed disclosures. For instance, in its 2023 Sustainability Report, CSL highlighted a 15% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity compared to a 2020 baseline. The company also reported achieving a 90% waste diversion rate across its manufacturing facilities, demonstrating tangible progress in its environmental stewardship efforts.

- Global Compliance: CSL adheres to diverse environmental laws and reporting standards in over 30 countries where it operates.

- Framework Alignment: The company's sustainability disclosures are mapped to key global standards like SASB, GRI, and UN SDGs, ensuring comparability and credibility.

- Transparency in Action: CSL's detailed reporting, including specific metrics on emissions and waste management, showcases its commitment to open communication about environmental performance.

- Performance Metrics: In 2023, CSL reported a 15% reduction in GHG emissions intensity (Scope 1 & 2) and a 90% waste diversion rate, reflecting progress in environmental targets.

CSL is actively working to reduce its environmental footprint through waste minimization and energy efficiency initiatives. The company aims to divert over 90% of manufacturing waste from landfills by 2025 and has improved energy intensity by 5% in fiscal year 2023. CSL has also committed to a 40% reduction in absolute Scope 1 and 2 emissions by 2030 against a 2019-2021 baseline.

The company's operations generate biological waste, requiring careful management, a sector valued at around USD 50 billion globally in 2024. Adherence to hazardous waste disposal regulations is critical for CSL, impacting its financial health and reputation. CSL is exploring advanced waste treatment technologies to further lessen its environmental impact.

Ethical plasma sourcing is central to CSL's sustainability, with over 10 million liters collected in 2023. Donor welfare, fair compensation, and supply chain integrity are paramount. CSL ensures compliance with stringent global environmental regulations, aligning its disclosures with frameworks like SASB and GRI. In 2023, CSL reported a 15% reduction in GHG emissions intensity and a 90% waste diversion rate.

| Environmental Metric | Target/Status | Year | Baseline |

| Manufacturing Waste Diversion | >90% | 2025 | N/A |

| Energy Intensity Improvement | 5% | FY2023 | FY2022 |

| Scope 1 & 2 GHG Emissions Reduction | 40% absolute reduction | 2030 | 2019-2021 average |

| Scope 1 & 2 GHG Emissions Intensity Reduction | 15% | 2023 | 2020 |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using data from reputable international organizations, government agencies, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors.